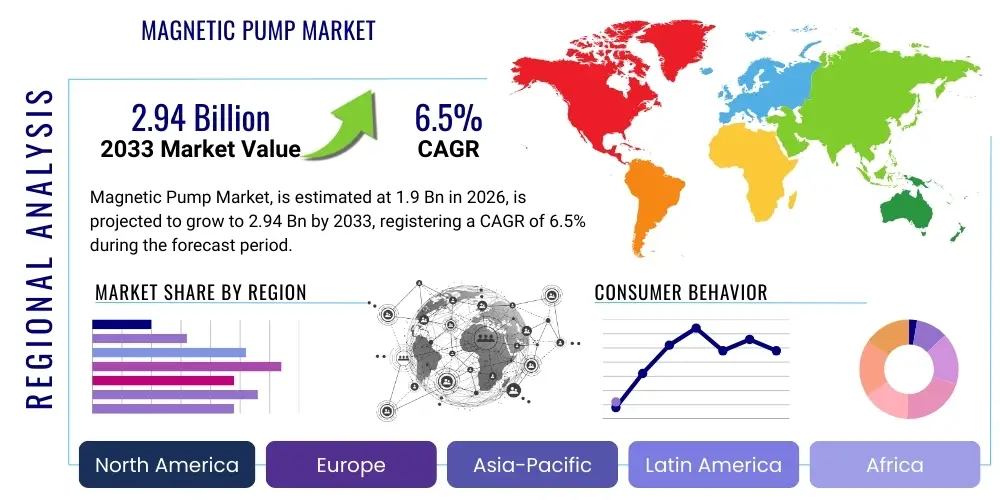

Magnetic Pump Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443356 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Magnetic Pump Market Size

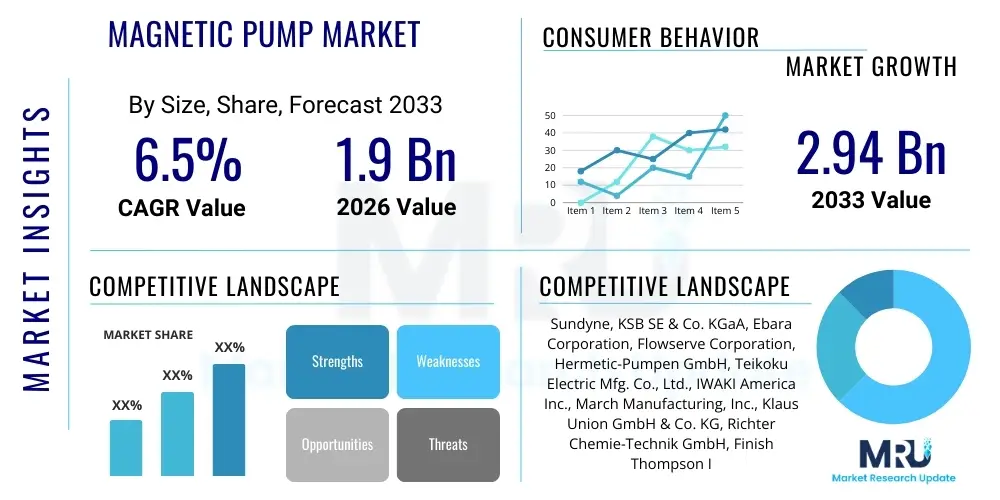

The Magnetic Pump Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $1.9 Billion in 2026 and is projected to reach $2.94 Billion by the end of the forecast period in 2033. This robust expansion is fueled by stringent industrial safety regulations across key regions, mandating the use of sealless pumping technologies to prevent leakage of hazardous, toxic, and corrosive media. Furthermore, the persistent demand from the chemical processing and pharmaceutical industries, which require absolute containment and zero contamination, significantly underpins this projected market valuation.

Magnetic Pump Market introduction

Magnetic pumps, often referred to as magnetically coupled pumps or mag drive pumps, represent a highly specialized category of centrifugal pumps distinguished by their sealless design, which eliminates the mechanical seal present in conventional pumps. The core operating principle involves transferring power from the motor to the impeller through magnetic forces, utilizing an inner magnetic rotor and an outer magnetic coupling separated by a hermetic containment shell or canned barrier. This design ensures that the pumped fluid is completely isolated from the atmosphere and the motor, achieving zero leakage, which is paramount when handling volatile organic compounds (VOCs), acids, caustics, or other environmentally hazardous and high-purity chemicals. Major applications span critical sectors including chemical synthesis, petrochemical refining, specialty gas handling, semiconductor manufacturing, and advanced pharmaceutical processing, where maintaining fluid integrity and operational safety are non-negotiable requirements.

Magnetic Pump Market Executive Summary

The global Magnetic Pump Market is experiencing significant upward business trends characterized by a foundational shift towards predictive maintenance and smart pumping solutions integrating IoT sensors for real-time monitoring of containment shell integrity and performance metrics. Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, driven by massive infrastructure investment in the Chinese and Indian chemical and petrochemical sectors, alongside escalating regulatory pressures in these emerging economies to adopt safer industrial practices. Segment trends show a clear preference for high-efficiency, corrosion-resistant materials such as fluoroplastics (PVDF, PTFE) and specialized alloys (Hastelloy, Titanium) in chemical and acid transfer applications, while sealless centrifugal magnetic pumps dominate the market share due to their widespread suitability across medium to high-flow processes, solidifying their role as indispensable equipment in handling critical industrial fluids.

AI Impact Analysis on Magnetic Pump Market

Analyzing common user inquiries reveals a strong focus on how Artificial Intelligence (AI) can revolutionize the reliability and maintenance cycles of magnetic pumps, specifically addressing concerns related to unexpected containment shell failure, dry run conditions, and bearing wear detection. Users are keenly interested in leveraging AI algorithms to predict failure points far in advance of traditional monitoring systems, optimizing inventory management for specialized spares, and fine-tuning operational parameters for maximum energy efficiency, particularly in highly variable flow environments. The key thematic concerns revolve around data privacy, the integration complexity of AI platforms with legacy industrial control systems (ICS), and the accuracy of machine learning models trained on highly complex fluid dynamics data.

The implementation of AI/ML technologies is moving beyond simple diagnostics into advanced operational control, establishing digital twins of high-value magnetic pump installations. These digital representations allow operators to simulate stress testing, material fatigue accumulation, and transient start-up/shut-down cycles without impacting the physical asset. Furthermore, AI is crucial in optimizing the magnetic coupling gap and analyzing eddy current losses, ensuring that the pump operates at its highest potential efficiency point, which is critical given the high energy consumption often associated with mag-drive systems due to inherent coupling inefficiencies. This intelligent monitoring capability enhances safety compliance and significantly extends the mean time between failures (MTBF).

Ultimately, the impact of AI in the magnetic pump sector is transformative, shifting the maintenance paradigm from reactive or time-based schedules to true condition-based monitoring (CBM). By processing vast datasets relating to vibration, temperature, pressure differentials, and motor current signature analysis (MCSA), AI models can identify subtle anomalies indicative of impending failure in expensive components like the inner rotor bearings or the containment shell. This predictive capability minimizes catastrophic failures, reduces costly unplanned downtime in critical processes, and dramatically improves the overall lifecycle cost of ownership (LCO) for high-specification magnetic pumps.

- AI-driven predictive maintenance scheduling to anticipate internal bearing or containment shell degradation.

- Optimization of energy consumption by analyzing flow dynamics and adjusting variable speed drives (VSD) in real time.

- Enhanced fault detection accuracy for dry run and cavitation through machine learning algorithms processing acoustic and vibration data.

- Creation of digital twins for simulating operational stress and optimizing component lifespan.

- Automated anomaly reporting and self-diagnostic capabilities integrated into industrial IoT (IIoT) platforms.

DRO & Impact Forces Of Magnetic Pump Market

The Magnetic Pump Market is shaped by a powerful interplay of drivers, restraints, and opportunities (DRO), collectively forming the impact forces that dictate its current trajectory and future expansion. The primary driver remains the indispensable need for absolute fluid containment, particularly in industries dealing with highly hazardous, corrosive, or expensive media where zero leakage is an environmental, safety, and economic imperative. Regulations such as those governing fugitive emissions (e.g., EPA standards or REACH in Europe) directly compel industries to replace traditional sealed pumps with sealless magnetic alternatives. Conversely, a significant restraint is the higher initial capital expenditure required for magnetic pumps compared to conventional sealed units, coupled with the complexity and cost associated with replacing specialized components like the containment shell or the inner magnetic assembly if damaged, requiring highly trained maintenance personnel and longer lead times for custom parts.

The opportunity landscape is expansive, centering on the rapid growth of the specialized chemicals, hydrogen generation, and electric vehicle (EV) battery manufacturing sectors. These emerging industries require the precise, contamination-free handling of highly specialized and often sensitive fluids, such as electrolytes, strong acids used in semiconductor etching, and refrigerants used in industrial cooling loops, all of which are ideal applications for magnetic drive technology. Furthermore, ongoing innovation focusing on material science—specifically developing advanced ceramics and specialized non-metallic containment materials—is actively addressing historical weaknesses related to dry running and thermal stress, thereby mitigating core restraints and expanding the operational envelope of these pumps into more demanding high-temperature and high-pressure applications.

The market impact forces are highly concentrated in the petrochemical and refining industries, where the risk and cost of leakage are astronomically high. Legislative drivers, such as API 685 (Sealless Centrifugal Pumps for Petroleum, Heavy Duty Chemical, and Gas Industry Services), standardize and enforce the robust design and application of these pumps, creating a continuous demand floor. The critical challenge posed by the impact forces is managing eddy current losses, which generate heat within the containment shell and require sophisticated cooling mechanisms or specialized materials to prevent overheating of the pumped medium or the pump components, continually pressuring manufacturers to improve efficiency and thermal management capabilities to maintain competitive viability.

Segmentation Analysis

The Magnetic Pump Market is meticulously segmented across several critical dimensions, enabling manufacturers and end-users to precisely align product specifications with unique operational requirements. The segmentation by type, specifically between sealless and sealed magnetic pumps (though sealed magnetic pumps are rare, representing hybrid designs), fundamentally categorizes the design principle, with sealless designs overwhelmingly dominating due to their zero-leakage advantage. Material segmentation is crucial, reflecting the corrosive nature of the handled fluids, dictating the use of materials ranging from robust metallic alloys like Stainless Steel and Hastelloy C-276 for high-pressure/high-temperature duties, to high-performance engineering plastics like Polypropylene (PP) and Polyvinylidene Fluoride (PVDF) for aggressive acids and specialized chemicals.

Segmentation by capacity or flow rate is essential for matching the pump to the application scale, differentiating between low-capacity metering pumps used in laboratories or small batch chemical dosing, medium-capacity units forming the workhorse of mainstream chemical processing, and high-capacity units employed in large-scale refinery transfer operations. Finally, the segmentation based on the end-user industry is perhaps the most defining, showcasing the market's reliance on sectors such as chemical processing (the largest consumer), pharmaceuticals (focused on high purity and CIP/SIP compatibility), oil and gas, and specialized water treatment applications requiring handling concentrated brine or hazardous treatment chemicals, demonstrating the market's widespread industrial penetration and specialized requirements.

- By Type: Sealless Magnetic Pumps, Sealed Magnetic Pumps (Hybrid/Specialty).

- By Material: Stainless Steel, Plastics (PP, PVDF, PFA), Alloys (Titanium, Hastelloy, Nickel), Ceramics/Composites.

- By Capacity: Low Capacity (up to 10 m³/h), Medium Capacity (10 m³/h to 100 m³/h), High Capacity (Above 100 m³/h).

- By End-User Industry: Chemical Processing, Oil & Gas (Midstream and Downstream), Pharmaceuticals & Biotechnology, Water and Wastewater Treatment, Food & Beverage, General Industry and Power Generation.

Value Chain Analysis For Magnetic Pump Market

The value chain for the Magnetic Pump Market initiates with highly specialized upstream activities centered on the procurement and processing of strategic raw materials, particularly high-grade ferrous metals for pump casings and frames, highly advanced magnetic materials (e.g., Neodymium Iron Boron or Samarium Cobalt) for the magnetic couplings, and performance engineering plastics (e.g., PVDF, PFA, PTFE) and specialized ceramics (e.g., Silicon Carbide or Alumina) for internal wetted parts, especially the containment shell and bearings. The upstream segment is characterized by high barriers to entry due to the stringent quality control required for magnetic components and non-metallic containment materials that must withstand aggressive chemical attack and high thermal stress. Ensuring a stable and quality supply of these niche components is vital for controlling manufacturing costs and maintaining the structural integrity required for zero-leakage operation.

Midstream activities involve precision manufacturing, sophisticated machining, and assembly, where core competencies lie in the design and engineering of the magnetic coupling to minimize eddy current losses and maximize torque transmission efficiency, along with ensuring the hermetic seal integrity of the containment shell. Manufacturers invest heavily in computer-aided design (CAD) and computational fluid dynamics (CFD) simulations to optimize flow path geometry, reduce cavitation risk, and ensure proper internal circulation for cooling the rear bearings. The midstream stage often includes extensive testing protocols to verify compliance with industry standards such as API 685, focusing on pressure ratings, performance curves, and material certifications, before the product is deemed market-ready.

Downstream deployment relies on a dual distribution channel: direct sales for highly customized or large-scale projects, and indirect channels leveraging specialized industrial distributors and technical representatives for general industrial applications, maintenance, repair, and overhaul (MRO) markets. Direct channels are preferred for industries like large petrochemical plants or nuclear facilities where engineering consultation and bespoke configurations are mandatory. Indirect channels provide geographical reach and localized technical support, crucial for servicing smaller chemical handlers or general manufacturing operations. Post-sales service, including spare parts supply for containment shells and bearing kits, forms a crucial and highly profitable part of the downstream value chain, necessitating a robust global logistical network to minimize client downtime.

Magnetic Pump Market Potential Customers

Potential customers for magnetic pumps are predominantly organizations operating in environments where fluid leakage poses unacceptable risks related to environmental damage, personnel safety, regulatory penalties, or product purity compromise. The chemical processing industry (CPI) represents the largest segment of end-users, requiring magnetic pumps for transfer, recirculation, and dosing applications involving aggressive acids (sulfuric, hydrochloric), highly reactive monomers, and toxic intermediates. These customers demand pumps made from highly corrosion-resistant materials such as PTFE-lined casings or specialized alloys to ensure operational lifespan and compliance with stringent process safety management (PSM) protocols, making zero-leakage technology a fundamental requirement rather than an optional feature.

Another major segment includes the pharmaceutical and biotechnology sectors, where the need for absolute sterility and prevention of cross-contamination is critical during the production of active pharmaceutical ingredients (APIs), sterile water for injection (WFI), and fermentation media. These customers prioritize materials that are inert, easy to sterilize (CIP/SIP compatible), and certified for sanitary applications, favoring specialized stainless steel or PFA-lined magnetic pumps used in closed-loop systems. The precision and reliability of magnetic pumps are leveraged in highly sensitive metering and transfer applications where even minor contamination can result in the loss of high-value product batches, justifying the initial investment cost.

The third significant customer base resides within the oil and gas sector, specifically in refining and downstream processing activities, where magnetic pumps handle volatile hydrocarbons, high-temperature thermal fluids, and toxic waste streams (e.g., sour water, heavy oils). These applications require high-pressure, heavy-duty metallic magnetic pumps compliant with API 685 standards, designed for continuous operation in explosive atmospheres. Furthermore, emerging customers are found in specialized environmental engineering firms and electronics manufacturing, particularly in semiconductor fabrication, where ultra-pure chemical delivery and handling of hazardous waste solvents necessitate the use of contamination-free, sealless pumping technology to maintain cleanroom standards and prevent etching defects on silicon wafers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.9 Billion |

| Market Forecast in 2033 | $2.94 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sundyne, KSB SE & Co. KGaA, Ebara Corporation, Flowserve Corporation, Hermetic-Pumpen GmbH, Teikoku Electric Mfg. Co., Ltd., IWAKI America Inc., March Manufacturing, Inc., Klaus Union GmbH & Co. KG, Richter Chemie-Technik GmbH, Finish Thompson Inc., Magnatex Pumps, Inc., Hayward Gordon, HCP Pump, Inc., DESMI A/S, Dover Corporation, Ruteck Pumpen, Tsurumi Pump, Yamada Corporation, Crane Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Magnetic Pump Market Key Technology Landscape

The technological landscape of the magnetic pump market is defined by continuous innovation across three primary areas: magnetic coupling technology, advanced material science, and integrated condition monitoring. In coupling technology, the focus is on optimizing magnetic torque transmission and reducing eddy current losses, which traditionally cause significant heat generation and subsequent energy inefficiency. Manufacturers are developing multi-pole magnet configurations and specialized shielding materials to minimize these losses, thereby increasing the permissible operating temperature and efficiency. This optimization is crucial for high-power, high-flow applications where efficiency gains translate directly into massive operational cost savings and extend the life of heat-sensitive components like PTFE linings and inner bearings, driving the adoption of increasingly sophisticated rare-earth magnet arrays.

Material science innovation centers heavily on developing superior materials for the critical containment shell and internal bearings, which are the most susceptible components to wear and failure. Advances in high-purity, reaction-bonded Silicon Carbide (SiC) ceramics have vastly improved bearing wear resistance, allowing magnetic pumps to reliably handle fluids with a higher solid content and operate under dry-running conditions for short periods without catastrophic failure—a historical weakness of the technology. Furthermore, the development of robust, thick-walled engineering plastics like PFA (Perfluoroalkoxy) liners bonded to metallic casings is enabling the handling of extremely corrosive media, such as concentrated hydrofluoric acid or chlorine-related compounds, at higher pressures and temperatures than previously feasible with standard plastic pump alternatives.

The integration of Industry 4.0 concepts, primarily through Industrial Internet of Things (IIoT) sensors and smart monitoring systems, represents the third major technological frontier. Modern magnetic pumps are increasingly equipped with embedded sensors for real-time monitoring of key performance indicators (KPIs) such as vibration signatures, containment shell temperature, internal pressure differential (to detect bearing wear or partial blockages), and motor current. This data is fed into cloud-based platforms utilizing edge computing and AI algorithms to provide predictive failure alerts and operational analytics, significantly reducing the risk of catastrophic sealless failure and enhancing overall process reliability, aligning the technology with the sophisticated demands of modern, automated industrial facilities seeking maximum asset utilization.

Regional Highlights

The market dynamics of magnetic pumps vary significantly across major geographical regions, influenced by localized industrial growth, regulatory frameworks, and maturity of existing infrastructure. North America, particularly the United States, represents a mature but consistently demanding market, driven by strict environmental protection agency (EPA) regulations governing hazardous chemical handling and fugitive emissions in the large-scale petrochemical, refining, and specialized fine chemical sectors. The focus here is on high-specification, API-compliant metallic magnetic pumps, and significant investment is seen in retrofitting older facilities with sealless technology to ensure long-term compliance and minimize potential environmental liability. Innovation adoption, particularly IIoT-enabled monitoring and predictive maintenance systems, is highest in this region, prioritizing operational efficiency alongside safety.

Europe stands out due to its leadership in environmental and safety regulation, notably through directives such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), which significantly pressures manufacturers across the chemical supply chain to adopt the safest available technology, thereby boosting the demand for magnetic pumps. Germany, France, and the UK are key markets, characterized by advanced pharmaceutical, specialty chemical, and water treatment industries. The regional demand heavily favors highly corrosion-resistant, often plastic or PFA-lined magnetic pumps, emphasizing both energy efficiency and conformity to ATEX directives for operations in potentially explosive atmospheres.

Asia Pacific (APAC) is currently the fastest-growing region, fueled by massive industrial expansion, especially in China, India, and Southeast Asian nations. The rapid establishment of new chemical parks, petrochemical complexes, and semiconductor fabrication facilities is generating colossal demand for new installations. While initial price sensitivity exists in some sub-markets, escalating environmental scrutiny from local governments and the drive for higher production output are compelling industries to choose reliable, leak-free magnetic pumping solutions, positioning APAC as the primary driver of global volume growth, particularly in the medium and high-capacity segments.

- North America: Mature market characterized by strict EPA regulations and high adoption rates of IIoT-integrated smart pumping solutions in petrochemical and refining sectors.

- Europe: Driven by stringent environmental policies (REACH, ATEX), favoring high-specification plastic and metallic pumps for specialty chemicals and pharmaceutical manufacturing.

- Asia Pacific (APAC): Highest growth rate globally due to rapid industrialization, expansion of the chemical processing infrastructure, and increasing regulatory enforcement in China and India.

- Middle East & Africa (MEA): Growing demand linked to greenfield investments in downstream oil and gas processing and water desalination projects, focusing on high-pressure and high-temperature applications.

- Latin America: Demand primarily stems from mining and large-scale commodity chemical production, showing a growing trend towards regulatory compliance and pump reliability enhancement.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Magnetic Pump Market.- Sundyne

- KSB SE & Co. KGaA

- Ebara Corporation

- Flowserve Corporation

- Hermetic-Pumpen GmbH

- Teikoku Electric Mfg. Co., Ltd.

- IWAKI America Inc.

- March Manufacturing, Inc.

- Klaus Union GmbH & Co. KG

- Richter Chemie-Technik GmbH

- Finish Thompson Inc.

- Magnatex Pumps, Inc.

- Hayward Gordon

- HCP Pump, Inc.

- DESMI A/S

- Dover Corporation (Blackmer/Maag Pump Systems)

- Ruteck Pumpen

- Tsurumi Pump

- Yamada Corporation

- Crane Co. (Pumps & Systems)

Frequently Asked Questions

Analyze common user questions about the Magnetic Pump market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a magnetic pump over a conventional pump?

The primary advantage is the sealless design, which utilizes magnetic coupling to transmit power without any mechanical connection penetrating the fluid containment area. This design eliminates the risk of leakage associated with mechanical seals, making magnetic pumps indispensable for handling hazardous, toxic, or highly valuable fluids.

In which industries are magnetic pumps most commonly used?

Magnetic pumps are predominantly used in the Chemical Processing Industry (CPI) for transferring acids and toxic intermediates, the Pharmaceutical sector for high-purity applications, and the Oil & Gas industry (downstream refining) for handling volatile hydrocarbons and thermal fluids, where zero leakage and safety compliance are critical.

What are the key failure points of a magnetic pump and how can they be mitigated?

The primary failure points include containment shell damage (due to pressure or thermal stress) and internal bearing wear (due to dry running or high loads). Mitigation involves installing smart monitoring systems (IIoT) to detect vibration and temperature anomalies, using advanced ceramic (SiC) bearings, and ensuring proper liquid circulation for cooling the inner components.

How do material advancements influence the magnetic pump market growth?

Advancements in material science, particularly the utilization of high-performance plastics like PVDF and PFA, and specialized corrosion-resistant alloys such as Hastelloy, allow magnetic pumps to handle increasingly aggressive chemicals and operate at higher temperatures and pressures, significantly expanding their operational envelope and driving market adoption in demanding applications.

What is the role of API 685 standards in defining magnetic pump quality?

API 685 (Sealless Centrifugal Pumps) is a crucial standard that defines stringent requirements for the design, testing, and performance of magnetic pumps specifically for heavy-duty service in the petroleum, chemical, and gas industries. Compliance ensures robust construction, reliability, and adherence to high safety benchmarks, heavily influencing procurement decisions in mission-critical applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Stainless Steel Magnetic Pump Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Magnetic Pump Market Statistics 2025 Analysis By Application (Oil and Gas, General Industry, Chemical, Food and Pharmaceutical), By Type (Rotating Shaft Magnetic Drive Pumps, Stationary Shaft Magnetic Drive Pumps), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- MRI-Compatible IV Infusion Pump Systems Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Non-magnetic Pump System, Magnetic Pump System with Shielding, Tubing and Disposables), By Application (Hospitals, Ambulatory Surgical Centres, Diagnostics and Imaging Centres), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager