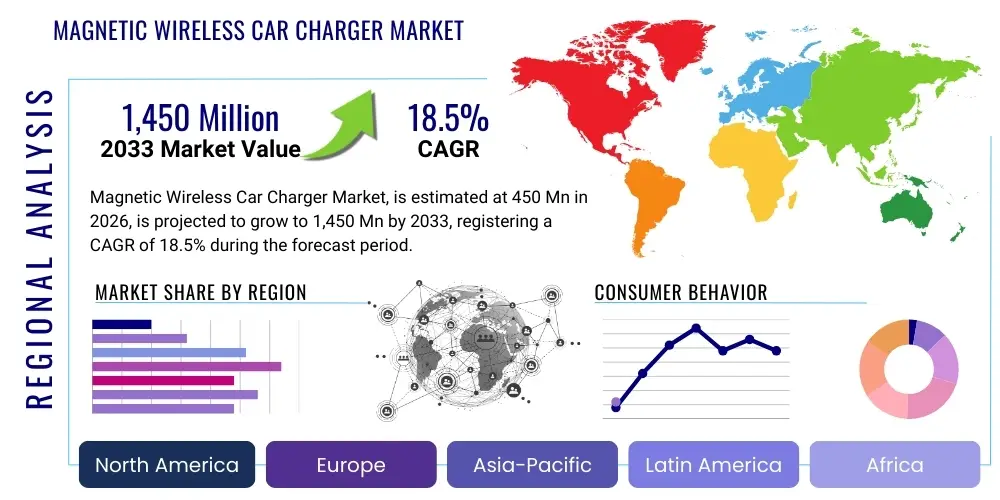

Magnetic Wireless Car Charger Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443193 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Magnetic Wireless Car Charger Market Size

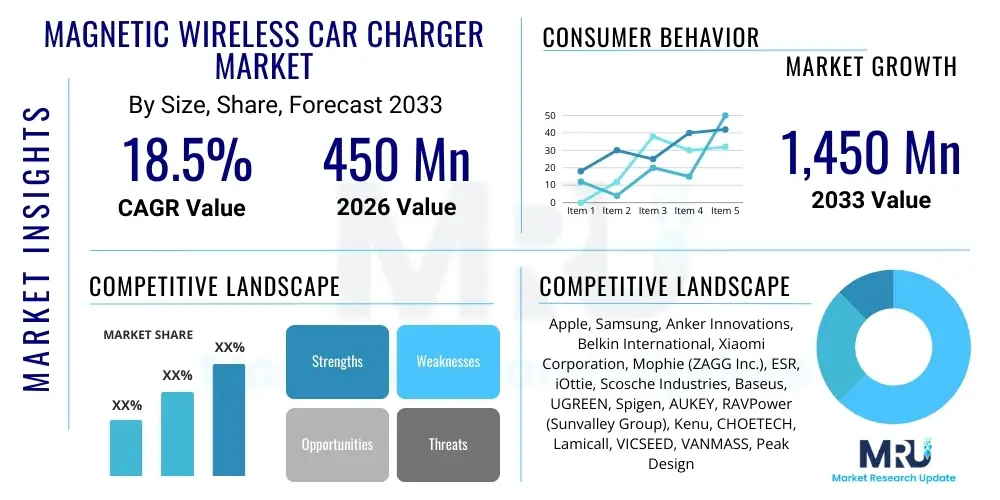

The Magnetic Wireless Car Charger Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 1,450 Million by the end of the forecast period in 2033.

The substantial growth trajectory is driven primarily by the rapid global adoption of smartphones equipped with magnetic charging capabilities, particularly following the introduction of Apple's MagSafe technology, which standardized magnetic attachment for accessories. Consumers increasingly demand seamless, clutter-free charging solutions in vehicles, replacing traditional cable connections. Furthermore, the proliferation of electric vehicles (EVs) and smart cars, which inherently integrate advanced technological accessories, provides a fertile ground for the expansion of magnetic wireless chargers. These devices offer superior safety and convenience by ensuring optimal coil alignment for efficient power transfer, mitigating common concerns associated with standard wireless charging pads.

Market expansion is also supported by continuous innovation in charger design, focusing on higher power output (15W and above), improved thermal management systems, and versatile mounting options compatible with various vehicle interiors. Geographically, high-income regions, including North America and Europe, lead adoption due to high consumer disposable income and mature aftermarket accessory ecosystems. However, emerging economies in the Asia Pacific are showing the fastest growth rate, fueled by rising vehicle ownership and local manufacturing competitiveness in electronic accessories. Strategic collaborations between automotive manufacturers and consumer electronics companies are expected to further institutionalize these charging methods within new vehicle models.

Magnetic Wireless Car Charger Market introduction

The Magnetic Wireless Car Charger Market encompasses devices designed to charge mobile phones within a vehicle environment using induction technology coupled with magnetic attachment mechanisms. These devices typically adhere to established wireless charging standards, predominantly the Qi standard, but leverage specialized magnetic arrays (such as those compatible with Apple’s MagSafe ecosystem or third-party magnetic rings) to secure the device optimally and ensure precise alignment of charging coils. This combination provides both the convenience of wireless power transfer and the stability required for mounting a smartphone securely during transit, improving usability for navigation and hands-free operation.

Major applications for magnetic wireless car chargers span across personal vehicles, commercial fleet operations, and ride-sharing services, where reliable power access is paramount. Benefits include enhanced safety by reducing driver distraction associated with plugging in cables, improved aesthetic appeal within the car cabin due to cable elimination, and superior charging efficiency compared to non-magnetic wireless pads that suffer from alignment issues. The market is currently undergoing a shift towards higher power outputs (15W fast charging) and integration into smart vehicle interfaces, making them essential accessories for the digitally connected driver.

Key driving factors accelerating market penetration include the ubiquitous presence of wireless charging in modern high-end and mid-range smartphones, consumer preference for sophisticated in-car technology, and the global regulatory push towards safer driving practices that encourage hands-free device operation. The introduction of standardized magnetic features by major smartphone manufacturers has significantly lowered consumer friction in adopting these magnetic mounting solutions, effectively converting a niche accessory into a mainstream necessity for vehicle owners globally.

Magnetic Wireless Car Charger Market Executive Summary

The Magnetic Wireless Car Charger Market is defined by robust technological convergence and strong consumer demand for integrated, efficient in-car solutions. Business trends highlight intense competition focusing on proprietary magnetic alignment technology, thermal efficiency, and multi-device charging capabilities. Key players are investing heavily in improving Foreign Object Detection (FOD) capabilities and ensuring compatibility across diverse smartphone models and mounting surfaces. Strategic partnerships with automotive OEMs are becoming a critical differentiator, moving these accessories from the aftermarket segment into factory-installed features. The market structure remains moderately fragmented, with large accessory conglomerates competing fiercely against specialized wireless charging startups, particularly those focused solely on the MagSafe ecosystem.

Regional trends indicate North America and Europe retaining leadership in terms of revenue, driven by high penetration rates of premium smartphones and strong purchasing power for automotive accessories. However, the Asia Pacific region, led by China and South Korea, is emerging as the primary manufacturing and innovation hub, dominating production volume and witnessing the fastest growth due to high rates of vehicle electrification and technological adoption among younger consumers. Latin America and the Middle East & Africa are nascent markets characterized by increasing urbanization and infrastructural development, presenting long-term opportunities for mass-market product variations and lower-cost alternatives.

Segmentation trends show a clear preference shift towards chargers offering 15W or higher power output, aligning with the fast-charging standards of modern flagship phones. The MagSafe compatible segment, while initially proprietary, is driving innovation across the entire market, influencing third-party manufacturers to adopt similar precision alignment technologies. Mounting type segmentation reveals that vent mounts remain popular for ease of installation, but dashboard mounts are gaining traction, especially in jurisdictions where windshield obstruction regulations are strict, and for users seeking a more stable, vibration-resistant setup, emphasizing product stability and ergonomic design in accessory development.

AI Impact Analysis on Magnetic Wireless Car Charger Market

User queries regarding AI's impact on magnetic wireless car chargers frequently revolve around concerns about personalized charging profiles, predictive thermal management, and seamless integration with vehicle infotainment systems driven by advanced algorithms. Consumers expect AI to not only optimize the charging speed based on battery health and ambient temperature but also to manage power distribution dynamically within the car's ecosystem, ensuring optimal performance without excessive drain on the vehicle's electrical system. The key themes summarized include the transition from simple power delivery to intelligent power management, focusing on maximizing efficiency and user experience through learned behaviors and real-time environmental adjustments. Users are specifically concerned about AI’s role in preventing device overheating during extended use (such as long navigation sessions) and its potential to facilitate predictive maintenance based on charging patterns.

- AI-driven optimization of charging curves based on real-time vehicle load and external temperature, maximizing battery lifespan.

- Predictive thermal management using machine learning algorithms to anticipate overheating issues and dynamically adjust power delivery.

- Integration with Vehicle Infotainment Systems (VIS) via AI to automate charging initiation and report diagnostics to the driver interface.

- Enhanced Foreign Object Detection (FOD) algorithms utilizing AI vision or sensor data fusion for superior safety and reliability.

- Personalized charging routines based on driver habits and commute patterns, ensuring the phone reaches optimal charge levels precisely when the driver exits the vehicle.

- Improved voice command integration for controlling charger functions within the smart cockpit environment.

DRO & Impact Forces Of Magnetic Wireless Car Charger Market

The Magnetic Wireless Car Charger Market is propelled by powerful consumer drivers, primarily centered on the inherent convenience and superior safety provided by magnetic alignment technology, which ensures single-handed mounting and immediate charging connection without fumbling for cables. This convenience factor is critical for minimizing driver distraction, aligning with global safety mandates. Furthermore, the rapid growth of the electric vehicle (EV) segment contributes significantly, as EV owners are early adopters of advanced in-car electronic accessories, seeking seamless technological integration throughout their driving experience. Opportunities lie in developing ultra-fast charging capabilities (e.g., beyond 15W) and integrating these chargers directly into advanced vehicle architectures, leveraging new materials for enhanced heat dissipation. The primary restraints facing the market include the relatively high initial cost compared to traditional wired chargers, potential issues related to heat generation during high-speed charging, and the existing fragmentation of magnetic standards (Qi vs. proprietary MagSafe), which complicates universal product compatibility. These internal market dynamics and external technological pressures dictate the trajectory of product development and consumer acceptance.

Segmentation Analysis

The Magnetic Wireless Car Charger Market is rigorously segmented based on essential product characteristics, technological standards, power output capabilities, and distribution channels, reflecting diverse consumer preferences and vehicle requirements. This segmentation allows manufacturers to target specific user groups, ranging from early technology adopters seeking maximum power and proprietary compatibility (e.g., MagSafe) to budget-conscious consumers prioritizing ease of use and lower power basic charging. Understanding these segments is vital for strategic pricing, product development lifecycle planning, and optimizing distribution strategies, ensuring products meet the specific regulatory and technical demands of regional markets. The continuous evolution of smartphone charging technology necessitates constant refinement of these segmentation criteria, particularly concerning wattage and material science used in magnetic housing.

- By Charging Standard:

- Qi Standard Compatible

- MagSafe Compatible/Proprietary

- By Power Output:

- Up to 7.5W

- 10W

- 15W and Above (Fast Charging)

- By Mounting Type:

- Air Vent Mount

- Dashboard/Adhesive Mount

- Windshield Mount

- CD Slot Mount

- By Sales Channel:

- Online Retail

- Offline Retail (Automotive Stores, Consumer Electronics Stores)

Value Chain Analysis For Magnetic Wireless Car Charger Market

The value chain for the Magnetic Wireless Car Charger Market begins with upstream activities involving the sourcing and refinement of crucial components, including advanced magnetic materials (e.g., Neodymium magnets), induction charging coils, semiconductor chips (for power management and rectification), and thermal dissipation materials (e.g., aluminum alloys or graphite sheets). Key upstream suppliers are located primarily in East Asia, specializing in high-precision electronics manufacturing and quality assurance for Qi-certified components. The quality and cost of these raw materials directly impact the final product performance, particularly concerning charging efficiency and heat management, which are critical consumer concerns. Innovation in this segment is centered on miniaturization and enhancing power conversion efficiency.

The midstream involves design, assembly, and branding. Manufacturers focus heavily on product design, aesthetics, and ergonomic compatibility with diverse vehicle interiors. Specialized processes include molding the housing, integrating the magnetic array with the charging coil, and ensuring robust fastening mechanisms for various vehicle mounts (vent, dashboard). Rigorous testing for electromagnetic interference (EMI), Foreign Object Detection (FOD), and thermal runaway protection is mandatory during this stage. Branding and intellectual property related to magnetic alignment and secure mounting mechanisms constitute significant competitive advantages in the midstream segment.

Downstream activities cover distribution channels, including direct sales via manufacturer websites, major e-commerce platforms (Amazon, eBay, etc.), and traditional offline retail channels such as automotive accessory stores and major consumer electronics chains. E-commerce platforms dominate the distribution landscape due to their ability to offer wide product catalogs and handle specialized shipping of electronic accessories. Indirect distribution through automotive dealerships and authorized resellers is also gaining importance, especially as these products transition into standard vehicle accessories rather than purely aftermarket purchases. Effective marketing, focused on safety, convenience, and charging speed, is crucial for market penetration at the downstream consumer level.

Magnetic Wireless Car Charger Market Potential Customers

The primary customer base for Magnetic Wireless Car Chargers includes digitally savvy vehicle owners who rely heavily on their smartphones for navigation, entertainment, and communication while driving. These are often early adopters of consumer electronics, prioritizing convenience, aesthetic integration, and high charging speeds. The strongest segment comprises owners of newer smartphones (particularly those compatible with MagSafe or similar magnetic systems) who seek to maintain the premium, cable-free experience of their devices even within the vehicle environment. This group is generally less price-sensitive and demands features like 15W fast charging and robust, vibration-resistant mounting systems.

A second major customer segment consists of frequent drivers, including gig economy workers (e.g., ride-share and delivery drivers) and commercial fleet operators. For this group, reliable, continuous charging is a functional necessity, ensuring that their device remains powered for long shifts involving navigation and communication. They prioritize durability, ease of use (single-handed operation), and high-reliability performance under constant use. Purchase decisions in this segment are often driven by total cost of ownership (TCO) and operational efficiency.

Furthermore, automotive enthusiasts and owners of Electric Vehicles (EVs) represent a high-potential segment. EV owners, in particular, are accustomed to incorporating cutting-edge technology into their vehicles and view integrated wireless charging solutions as a natural extension of the vehicle's smart cabin features. This segment often purchases through OEM channels or specialized high-end accessory retailers, valuing aesthetic matching with the vehicle interior and integration with proprietary vehicle software platforms. The growing trend toward minimalist vehicle interiors further reinforces the demand for aesthetically pleasing, invisible charging solutions that magnetic mounts provide.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 1,450 Million |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Apple, Samsung, Anker Innovations, Belkin International, Xiaomi Corporation, Mophie (ZAGG Inc.), ESR, iOttie, Scosche Industries, Baseus, UGREEN, Spigen, AUKEY, RAVPower (Sunvalley Group), Kenu, CHOETECH, Lamicall, VICSEED, VANMASS, Peak Design |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Magnetic Wireless Car Charger Market Key Technology Landscape

The technological landscape of the Magnetic Wireless Car Charger market is dominated by advancements in electromagnetic induction, magnetic alignment systems, and thermal management. The core technology relies on the established Qi wireless charging standard, maintained by the Wireless Power Consortium (WPC), but differentiation is achieved through precise magnetic component integration. The advent of MagSafe compatibility, characterized by a standardized ring of magnets, has significantly elevated the user experience by guaranteeing perfect coil alignment, which is crucial for maximizing charging efficiency and speed, particularly for 15W fast charging protocols. Manufacturers are continuously working on miniaturizing the power management circuitry while increasing its efficiency, reducing energy loss in the conversion process.

A key technological battleground is thermal regulation. High-speed charging generates significant heat, which can damage the smartphone battery or trigger safety shutdowns. Advanced magnetic wireless car chargers incorporate sophisticated heat dissipation technologies, including aluminum alloys, graphite films, and active cooling fans (micro-fans), to maintain optimal operating temperatures. Furthermore, the embedded electronics feature advanced safety protocols such as Foreign Object Detection (FOD), Over-Voltage Protection (OVP), and Over-Current Protection (OCP). These safety features are increasingly mandated by regulatory bodies and consumer expectations, driving up the complexity and technological sophistication of the power control chips used.

Integration technology is another significant area of development. The latest chargers feature seamless connectivity with the vehicle's electrical system, often drawing power via USB-C or directly hardwired for a clean installation. Furthermore, there is a push towards integrating Near Field Communication (NFC) or Bluetooth Low Energy (BLE) capabilities into the chargers. This allows the charger to communicate with the smartphone or the vehicle’s infotainment system, enabling features like automatic mounting detection, personalized charging settings, and real-time charging status display on the car dashboard. These smart features are essential for AEO and GEO strategy as they cater to user demand for highly integrated and intelligent vehicle accessories.

Regional Highlights

The global Magnetic Wireless Car Charger Market exhibits varied growth patterns influenced by regional smartphone penetration, regulatory environments, and vehicle ownership trends. North America leads the market in terms of premium product adoption and high average selling prices (ASP). The region benefits from a high concentration of tech-savvy consumers, robust e-commerce infrastructure, and high disposable income. Demand is strongly skewed towards MagSafe compatible 15W chargers, driven by the dominant market share of Apple products. Safety regulations encouraging hands-free device use also stimulate the need for reliable mounting and charging solutions, making this market mature but highly lucrative.

Europe represents a stable and high-growth market, characterized by stringent quality standards and a strong emphasis on sustainable and aesthetically pleasing design. Western European countries, particularly Germany, the UK, and France, show strong adoption rates, supported by a rapid transition toward electric vehicles and luxury car ownership. Regulatory compliance with EU directives on electronic safety and standardization is a key factor influencing product development here. Manufacturers must ensure their products adhere to rigorous environmental and electrical safety certifications to penetrate this sophisticated regional market effectively.

Asia Pacific (APAC) is the engine of volume growth and technological manufacturing. Led by China, South Korea, and Japan, APAC not only serves as the global manufacturing base but also as a massive consumer market. The competitive landscape is intense, favoring local brands offering high-quality products at competitive prices. The rapid adoption of EV technology, especially in China, and the sheer volume of new vehicles entering the market annually, ensure that APAC registers the highest Compound Annual Growth Rate (CAGR). Innovation in APAC often focuses on integrated vehicle accessories and multi-function chargers designed for various smartphone brands, reflecting the diverse mobile ecosystem.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets offering significant future potential. Growth in these regions is tied to increasing vehicle penetration, urbanization, and improving infrastructure. While price sensitivity is higher, the demand for basic, reliable wireless charging solutions is accelerating. Market entry strategies often focus on durable, lower-cost, Qi-certified products distributed through established local electronics retailers and automotive part suppliers, establishing a foundational market before introducing premium, high-speed magnetic options.

- North America: Dominates revenue share; high demand for 15W MagSafe compatible accessories; mature e-commerce and aftermarket ecosystem.

- Europe: Focus on premium design and quality certification; accelerated adoption driven by EV penetration; adherence to strict EU electronic standards.

- Asia Pacific (APAC): Fastest growth rate; global manufacturing hub; strong competition among local and international brands; high volume sales in China and India.

- Latin America (LATAM): Emerging market; growing vehicle ownership and smartphone penetration; demand driven by affordable, reliable Qi standard products.

- Middle East & Africa (MEA): Nascent growth tied to urbanization and infrastructure projects; potential in high-end accessory segment in Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Magnetic Wireless Car Charger Market.- Apple

- Samsung

- Anker Innovations

- Belkin International

- Xiaomi Corporation

- Mophie (ZAGG Inc.)

- ESR

- iOttie

- Scosche Industries

- Baseus

- UGREEN

- Spigen

- AUKEY

- RAVPower (Sunvalley Group)

- Kenu

- CHOETECH

- Lamicall

- VICSEED

- VANMASS

- Peak Design

Frequently Asked Questions

Analyze common user questions about the Magnetic Wireless Car Charger market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of a magnetic wireless car charger over a standard wireless charger?

The primary benefit is superior alignment and stability. Magnetic charging ensures the charging coils are perfectly aligned every time, maximizing charging efficiency (especially for fast charging like 15W) and preventing the phone from shifting or falling during vehicle movement, which is critical for safety and sustained charging.

Are magnetic wireless car chargers safe for my phone's battery life?

Yes, modern magnetic wireless chargers are designed with multiple safety features, including thermal management and intelligent power delivery systems. High-quality chargers are Qi-certified and include Over-Voltage Protection (OVP) and Foreign Object Detection (FOD) to ensure safe charging that minimizes heat and protects long-term battery health.

What is the difference between Qi and MagSafe compatibility in the market?

Qi is the universal inductive charging standard, governing power transfer. MagSafe compatibility refers to the specific magnetic ring design and proprietary communication protocol introduced by Apple, ensuring precise alignment and unlocking 15W fast charging for compatible iPhones. Many third-party chargers are Qi-certified but also incorporate magnets for MagSafe alignment.

What is the expected CAGR for the Magnetic Wireless Car Charger market between 2026 and 2033?

The Magnetic Wireless Car Charger Market is projected to experience a strong Compound Annual Growth Rate (CAGR) of 18.5% over the forecast period from 2026 to 2033, driven by increasing adoption of smart vehicles and demand for cable-free accessories.

Which mounting type is the most popular for magnetic car chargers?

Air vent mounts remain the most popular mounting type due to their ease of installation and ability to utilize the vehicle's HVAC system for passive cooling. However, dashboard/adhesive mounts are rapidly gaining preference for providing superior stability and compliance with local regulations against windshield obstruction.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager