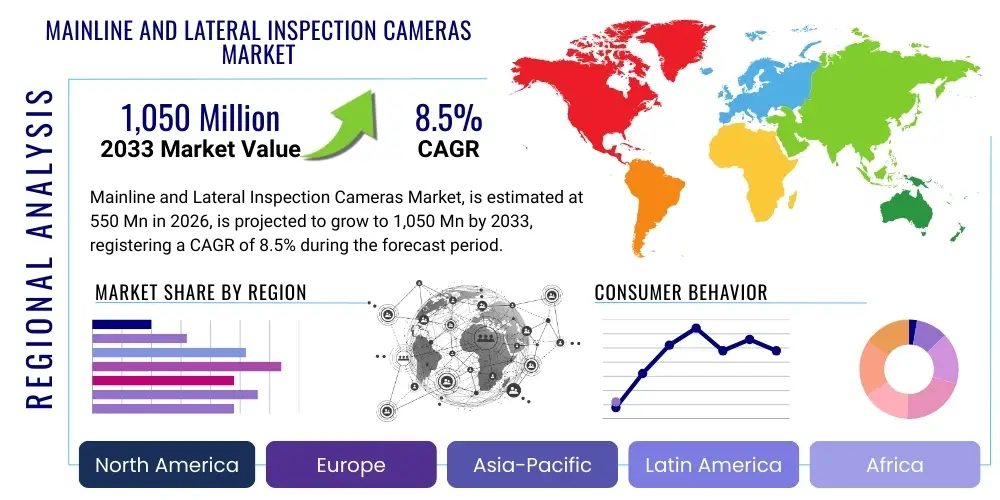

Mainline and Lateral Inspection Cameras Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442912 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Mainline and Lateral Inspection Cameras Market Size

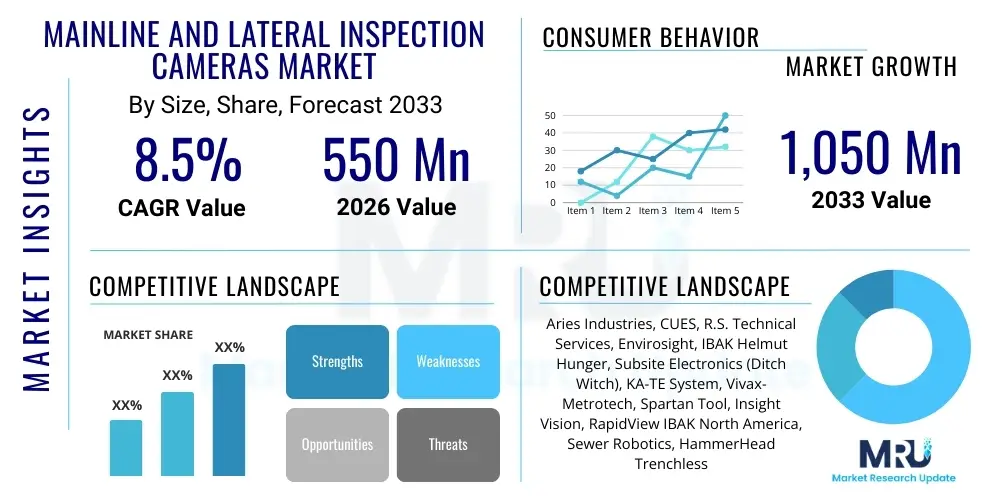

The Mainline and Lateral Inspection Cameras Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $550 Million in 2026 and is projected to reach $1,050 Million by the end of the forecast period in 2033.

Mainline and Lateral Inspection Cameras Market introduction

The Mainline and Lateral Inspection Cameras Market encompasses sophisticated robotic and push-rod camera systems specifically engineered for the non-destructive visual examination of subterranean piping infrastructure, primarily utilized in municipal sewer, stormwater, and industrial wastewater systems. These advanced inspection tools are critical for identifying structural defects, infiltration and inflow (I&I), blockages, root intrusion, and general deterioration without the need for costly and disruptive excavation. The equipment typically features high-resolution imaging sensors, powerful lighting, self-leveling capabilities, and robust construction designed to withstand harsh operating environments, providing essential data for infrastructure maintenance, planning, and capital improvement projects.

The primary function of mainline inspection cameras, often deployed via robotic crawlers, is to assess large-diameter pipes (typically 6 inches and above) that constitute the backbone of municipal utility networks. Lateral inspection cameras, conversely, are specialized systems designed to navigate the smaller-diameter pipes connecting properties to the main sewer line, a critical area often responsible for significant I&I issues. The integration of high-definition video feeds, digital recording capabilities, and precise distance measuring enables operators to accurately document the condition of aging infrastructure. This technology significantly improves asset management efficiency and regulatory compliance across public works departments globally, making it indispensable for preemptive fault detection and infrastructure longevity planning.

Key driving factors accelerating the adoption of this technology include the escalating global focus on aging water and wastewater infrastructure replacement and maintenance, stringent environmental regulations necessitating proactive leak detection, and the overall efficiency gains provided by trenchless technologies. The benefits extend beyond mere inspection, offering immediate actionable intelligence that aids in prioritizing repairs, optimizing budgetary allocations, and reducing public health and environmental risks associated with pipe failures. The market growth is also underpinned by continuous technological advancements, such as enhanced battery life, improved maneuverability in complex pipe geometries, and integration with Geographic Information Systems (GIS) for precise location mapping.

Mainline and Lateral Inspection Cameras Market Executive Summary

The Mainline and Lateral Inspection Cameras Market is poised for significant expansion, driven by global municipal investment in smart city infrastructure and mandated requirements for sewer condition assessments. Current business trends indicate a strong shift towards highly automated, battery-powered robotic crawlers equipped with multi-sensor platforms that go beyond visual inspection, incorporating laser profiling and sonar capabilities. Manufacturers are focusing heavily on developing modular systems that can adapt to various pipe diameters and materials, enhancing versatility and reducing the total cost of ownership for utility service providers. Furthermore, the emphasis on data integration with existing utility management software platforms is paramount, transforming raw video data into structured, decision-support assets, which is a key competitive differentiator in this technology-intensive sector.

Regionally, North America and Europe currently dominate the market, primarily due to well-established regulatory frameworks mandating periodic infrastructure inspections and the extensive presence of aging utility networks requiring urgent rehabilitation. However, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, fueled by rapid urbanization, significant government spending on new wastewater infrastructure projects, particularly in China and India, and increasing awareness regarding environmental protection. Latin America and the Middle East & Africa (MEA) are emerging markets, characterized by localized infrastructure modernization efforts and a gradual transition from reactive repair strategies to proactive predictive maintenance protocols, presenting substantial long-term growth opportunities for providers of robust, cost-effective inspection solutions.

Segment trends reveal that the robotic crawler segment, particularly those equipped for mainline inspection, commands the largest market share due to their applicability in large-scale municipal operations and their capability to cover long distances autonomously. Concurrently, the push camera segment remains crucial for residential and commercial lateral inspections, prized for its portability and ease of use in smaller, complex environments. In terms of technology, digital video recording and high-definition resolution are now baseline expectations, while the adoption of Artificial Intelligence (AI) and Machine Learning (ML) for automated defect recognition (ADR) is rapidly transitioning from a niche feature to a mandatory offering, driving significant capital expenditure across all major segments of the inspection camera value chain.

AI Impact Analysis on Mainline and Lateral Inspection Cameras Market

Common user questions regarding the impact of AI in the Mainline and Lateral Inspection Cameras Market center around three key themes: accuracy of Automated Defect Recognition (ADR), the requirement for standardized defect classification (e.g., NASSCO PACP), and the necessary computational power (edge vs. cloud processing). Users are primarily concerned with whether AI can reliably replace or significantly reduce the need for manual video review, thereby accelerating assessment times and minimizing human error. There is significant interest in how AI algorithms handle ambiguous defects, differentiate between minor wear and structural failure, and integrate seamlessly with existing utility GIS databases. Users also seek clarity on the initial investment and ongoing operational costs associated with implementing AI-powered inspection workflows, particularly regarding data storage requirements for vast amounts of high-resolution video footage necessary for ML model training and operation.

The primary concern, and thus the focus of AI development in this market, is achieving high precision and recall rates in defect identification. AI systems are being trained on millions of feet of inspected sewer footage to recognize standard defects like cracks, fractures, root intrusion, and pipe deformation according to established industry protocols (such as PACP in North America). This algorithmic assessment drastically reduces the time spent by engineers manually reviewing hours of video, allowing personnel to focus on high-level analysis and repair planning rather than routine defect logging. This efficiency gain is fundamentally transforming the operational economics of large-scale sewer infrastructure management programs.

Furthermore, the incorporation of AI facilitates predictive maintenance by identifying subtle trends and patterns in pipe deterioration that might be overlooked by human inspectors. By analyzing historical data and correlating it with environmental factors, AI models can forecast the likely time to failure for specific pipe segments, allowing utilities to move from purely reactive or scheduled maintenance to optimized, condition-based maintenance schedules. This predictive capability optimizes resource allocation, extends the lifespan of existing assets, and minimizes catastrophic failures, positioning AI as a central pillar in the evolution of smart water infrastructure management.

- Enhanced Automated Defect Recognition (ADR) for rapid, standardized defect classification (e.g., PACP/MACP codes).

- Reduced manual review time, increasing inspection throughput by up to 60-70%.

- Integration of machine learning for predictive maintenance modeling based on observed deterioration patterns.

- Real-time image enhancement and filtering to improve video clarity in challenging pipe environments.

- Improved data correlation with GIS systems, enabling immediate, geographically accurate reporting and repair prioritization.

- Development of edge computing capabilities within crawlers for immediate, in-situ analysis and feedback.

DRO & Impact Forces Of Mainline and Lateral Inspection Cameras Market

The Mainline and Lateral Inspection Cameras Market is primarily driven by critical infrastructure demands, specifically the need to address the widespread issue of aging sewer and water networks globally. Government mandates for preventative maintenance, coupled with public health concerns related to pipe failures and contamination, serve as powerful market accelerators. However, the market faces significant restraints, notably the high initial capital investment required for purchasing advanced robotic systems and the necessity for specialized operator training and maintenance protocols. Opportunities arise from technological convergence, particularly the integration of AI, IoT sensors, and advanced robotics, enabling more efficient and insightful inspections. The combined impact forces center on regulatory pressure and technological innovation pushing utilities toward non-destructive testing methodologies.

Drivers: A primary driver is the accelerating pace of infrastructure decay in developed nations. Many sewer systems constructed post-World War II have reached or exceeded their intended lifespan, necessitating continuous monitoring and rehabilitation. Furthermore, environmental regulations, especially those concerning stormwater runoff and minimizing non-point source pollution, compel municipal authorities to adopt precise inspection technologies to locate and eliminate sources of infiltration and inflow (I&I). The quantifiable cost savings associated with trenchless rehabilitation, which is dependent on accurate camera inspection data, further reinforces the demand across municipal and large industrial sectors seeking operational efficiency.

Restraints: The market’s growth is somewhat curtailed by the substantial procurement costs associated with advanced, self-propelled robotic crawlers and the ancillary specialized software platforms required for data processing and reporting. Additionally, the fragmented nature of legacy piping infrastructure—varying pipe materials, diameters, and installation standards—presents technical challenges that not all standard equipment can easily overcome. Training skilled personnel to operate, calibrate, and maintain these complex electromechanical systems represents a continuous operational challenge and cost barrier, particularly for smaller utility providers or regional contractors.

Opportunities: Significant market opportunities exist in the development of modular and interoperable camera systems that can easily integrate advanced sensors, such as laser profilers, sonar, and gas detection devices, within a single deployment platform. Emerging markets, particularly in Asia Pacific, represent untapped growth potential as these regions invest heavily in building out new, modern urban utility infrastructure. Moreover, the shift towards Software as a Service (SaaS) models for data management and AI-powered analysis reduces the upfront technological burden for customers and presents a recurrent revenue stream opportunity for solution providers.

Impact Forces: The overarching impact force is the necessity for infrastructure resilience. Regulatory bodies enforce strict compliance measures that demand verifiable documentation of pipe condition, directly translating to sustained demand for inspection equipment. Technological advancements, particularly miniaturization and battery technology improvements, enhance the efficiency and accessibility of inspection tools, allowing access to previously inaccessible or complex pipe geometries. The synergy between regulatory mandates (external pressure) and continuous technological innovation (internal market push) creates a robust environment for sustained market expansion, prioritizing high-precision, non-disruptive inspection methods.

Segmentation Analysis

The Mainline and Lateral Inspection Cameras Market is comprehensively segmented based on technology type, application environment, pipe diameter capability, and regional geography. This segmentation allows for targeted market strategies addressing the specific needs of diverse end-users, ranging from large municipal water authorities requiring highly automated robotic crawlers for primary sewer lines to small plumbing contractors utilizing flexible push-rod cameras for residential lateral assessments. Understanding the market dynamics within these segments is crucial, as demand varies significantly based on the scale of the infrastructure project and the required level of data precision, leading to distinct product development cycles and pricing strategies across the industry.

The segmentation by Type, specifically differentiating between Push Cameras and Robotic Crawlers, highlights the functional dichotomy in the market. Push cameras offer portability and cost-effectiveness for short runs and tight bends typical of laterals, while robotic crawlers are indispensable for long-distance mainline inspections, offering higher speed, remote control functionality, and the ability to carry auxiliary payloads (e.g., laser profilers). Application segmentation—Municipal, Industrial, and Residential—reflects the varying pipe complexity, regulatory requirements, and budgetary constraints of the end-users, with municipal applications representing the largest and most consistently growing consumer base globally due to the sheer volume of public infrastructure requiring inspection.

Furthermore, the segmentation by Pipe Diameter is critical, as camera systems are specialized to operate efficiently within narrow, medium, or large-diameter pipes, often requiring different illumination, articulation, and propulsion mechanisms. The trend toward modular design aims to bridge these diameter differences, allowing utilities to use fewer distinct pieces of equipment for a wider range of inspection tasks. The ongoing segmentation refinement emphasizes integration capabilities, such as the inclusion of sonar and laser profiling technologies for pipes with heavy debris or structural complexity, providing a holistic condition assessment beyond mere visual evidence.

- By Type:

- Push Cameras (Manual, highly flexible, used for laterals and smaller pipes)

- Self-Leveling Push Cameras (Enhanced visual stability)

- Robotic Crawlers (Self-propelled, high-range, used for mainlines)

- Zoom and Pan/Tilt Cameras (Integrated functionality on crawlers or standalone units)

- By Application:

- Municipal (Public sewer, stormwater, water distribution lines)

- Industrial (Process piping, chemical effluent lines, oil & gas pipelines)

- Residential and Commercial (Plumbing contractors, property management)

- By Pipe Diameter:

- Small Diameter (Under 6 inches)

- Medium Diameter (6 to 18 inches)

- Large Diameter (Above 18 inches)

- By Technology:

- Standard Definition (SD)

- High Definition (HD) and Ultra HD (4K)

- Multi-Sensor Integration (Laser Profiling, Sonar, Lidar)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Mainline and Lateral Inspection Cameras Market

The value chain for the Mainline and Lateral Inspection Cameras Market commences with upstream analysis, involving the sourcing and integration of high-precision electronic components, including imaging sensors (CMOS/CCD), specialized LED lighting, durable motors, complex cable assemblies (umbilical cords), and rugged, corrosion-resistant housing materials (often stainless steel and specialized polymers). Key upstream suppliers include component manufacturers specializing in high-resolution optics, miniature electromechanical systems, and advanced robotics controllers. Quality and supply chain reliability in this stage are critical, as the operational environment demands equipment capable of enduring extreme conditions such as high pressure, corrosive liquids, and physical abrasion.

Midstream activities are dominated by Original Equipment Manufacturers (OEMs) who design, assemble, and test the final camera systems and crawlers. This stage involves complex R&D focused on software development for camera control, data logging, and specialized features like self-leveling mechanisms, modular payload integration, and enhanced cable reel systems. Direct distribution channels are often favored, particularly for high-end robotic systems, where OEMs provide direct sales, implementation support, and intensive training to municipal utility customers. Indirect channels involve authorized dealers, specialized equipment distributors, and value-added resellers (VARs) who handle sales, regional support, and sometimes financing, especially to smaller contractors and international markets.

Downstream analysis focuses on the end-users: municipal utilities, industrial plant operators, and specialized inspection and cleaning contractors. The post-sales service component is a critical value driver, including continuous maintenance contracts, repair services, and software updates (especially for AI-enabled features). The ultimate value delivered lies in the transformation of inspection data into actionable intelligence through specialized reporting software that integrates with asset management systems (e.g., GIS). This comprehensive data lifecycle management, from image capture to repair prioritization, completes the value loop, ensuring the inspection equipment remains a profitable investment for the end-user throughout its operational lifespan.

Mainline and Lateral Inspection Cameras Market Potential Customers

The primary potential customers and end-users of Mainline and Lateral Inspection Cameras are entities responsible for the maintenance, repair, and planning of extensive subterranean piping infrastructure. These include municipal and governmental public works departments that manage large networks of sanitary sewers and stormwater drains, representing the largest market segment due to regulatory mandates for ongoing infrastructure assessment. The buying behavior of this segment is characterized by rigorous competitive tendering processes, long procurement cycles, and a strong preference for highly durable, modular systems offering comprehensive software integration and long-term support contracts, often prioritizing compliance with standards like NASSCO's Pipeline Assessment Certification Program (PACP).

Another significant customer base resides within the private sector, encompassing specialized trenchless technology contractors and professional plumbing service companies. These firms purchase inspection cameras to offer diagnostic services for residential and commercial property lateral lines, industrial process pipes, and internal building drain lines. Their purchasing criteria are often focused on portability, rapid deployment time, ease of use, and a lower total cost of ownership (TCO) compared to large municipal crawlers. These buyers often utilize push cameras and smaller, highly maneuverable robotic systems designed for accessing complex internal pipe geometries and typically rely on localized distributors for immediate sales and technical support.

Industrial customers, spanning sectors such as oil and gas, manufacturing, power generation, and chemical processing, also represent crucial potential buyers. These applications involve specialized needs, such as inspecting high-temperature lines, corrosive environments, or pipes containing hazardous materials. Their procurement decisions heavily weigh factors such as explosion-proof certification (e.g., ATEX or IECEx), material compatibility, and the ability of the system to integrate specific non-visual sensors (like sonar or specialized gauges). Investment here is driven by regulatory safety compliance, operational efficiency improvement, and minimizing downtime related to critical process pipe failures, demanding highly customized and robust camera solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $1,050 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aries Industries, CUES, R.S. Technical Services, Envirosight, IBAK Helmut Hunger, Subsite Electronics (Ditch Witch), KA-TE System, Vivax-Metrotech, Spartan Tool, Insight Vision, RapidView IBAK North America, Sewer Robotics, HammerHead Trenchless, Radiodetection (SPX Corporation), Rothenberger, MyTana, Kummert, Ratech Electronics, GSSI, Trelleborg Pipe Seals |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mainline and Lateral Inspection Cameras Market Key Technology Landscape

The technological landscape of the Mainline and Lateral Inspection Cameras Market is rapidly evolving, driven by the demand for higher resolution data, increased automation, and enhanced navigational capabilities in challenging environments. A fundamental technological trend is the transition from standard definition (SD) to high definition (HD) and ultra HD (4K) imaging sensors, significantly improving the clarity and detail required for accurate defect identification, particularly subtle cracks and material degradation. Furthermore, advanced lighting systems, utilizing high-output LED arrays, dynamically adjust illumination to compensate for different pipe materials and debris levels, ensuring consistent video quality throughout long inspection runs. The reliability and longevity of the umbilical cable systems are also critical, with advancements focusing on fiber optic integration for faster data transmission and enhanced tensile strength to prevent breakage in congested pipe networks.

The critical technological differentiation lies in the development of sophisticated robotic platforms. Modern crawlers utilize multi-axis articulation and advanced wheel designs (e.g., magnetically enhanced tracks or pressurized tires) to maintain stability and maneuverability in various pipe sizes and slopes, often incorporating self-leveling camera heads that ensure the video feed remains upright regardless of the crawler's orientation. Increasingly, these crawlers are equipped with modular tool interfaces, allowing them to carry supplementary payloads such as laser profilers, which generate precise 3D cross-sectional measurements of the pipe interior to quantify ovality, deformation, and accumulated debris. This multi-sensor approach moves beyond simple visual inspection to providing quantifiable structural assessment data.

The highest level of technological innovation is centered around data processing and Artificial Intelligence (AI). Automated Defect Recognition (ADR) software leverages deep learning algorithms to automatically analyze inspection footage, tagging defects based on industry standards like PACP. This not only dramatically speeds up the reporting process but also standardizes defect classification, minimizing subjectivity. Further integration involves sophisticated navigation and mapping technologies, where Inertial Measurement Units (IMUs) and specialized odometers work in conjunction with GIS software to accurately map the precise location of defects relative to ground-level infrastructure. The convergence of robust mechanics, high-fidelity sensing, and AI-driven analytics defines the leading edge of current market offerings.

Regional Highlights

North America maintains a dominant position in the Mainline and Lateral Inspection Cameras Market, largely attributable to the massive network of aging municipal infrastructure, particularly in the United States and Canada, coupled with stringent regulatory mandates concerning water quality and sewer system integrity (e.g., EPA mandates for CSO and SSO control). High investment capacity in technologically advanced solutions and the widespread adoption of standardized inspection protocols (such as NASSCO PACP) drive sustained demand for high-end robotic crawler systems and integrated data management software. The region is characterized by a mature market with high replacement rates and continuous technological upgrades among large municipal utilities and specialized infrastructure service providers.

Europe represents the second largest market, where demand is fueled by long-standing infrastructure, particularly in Western European nations, and a strong regulatory emphasis on environmental compliance and leakage reduction. European countries often lead in innovative trenchless rehabilitation methods, which inherently require high-precision inspection data. Germany, the UK, and France are key contributors, favoring robust, high-durability equipment that often complies with stringent local quality standards. The market here is slightly more fragmented regarding standardized reporting but shows a strong preference for hybrid systems combining visual inspection with ancillary technologies like sonar and laser profiling to address structural assessments comprehensively.

Asia Pacific (APAC) is projected to exhibit the highest growth rate during the forecast period. This rapid expansion is spurred by fast-paced urbanization and substantial public investment in new utility infrastructure in developing economies like China, India, and Southeast Asia. While initial adoption may favor more cost-effective push camera systems and lower-end robotic crawlers, the long-term trend indicates a rapid acceleration towards advanced, AI-enabled systems as new smart city projects mature. Governmental focus on controlling pollution and expanding municipal sanitation coverage acts as a fundamental catalyst for market penetration across the entire APAC region.

- North America: Market leader due to aging infrastructure, high regulatory pressure (EPA, NASSCO), and high technological adoption rates, particularly in robotic crawler systems and AI/GIS integration.

- Europe: Mature market focusing on environmental compliance, high-quality equipment, and trenchless technology implementation, with strong demand across Germany, UK, and Scandinavia.

- Asia Pacific (APAC): Fastest growing region, driven by rapid urbanization, major new infrastructure projects, and increasing government investment in public sanitation and water management systems.

- Latin America (LATAM): Emerging market characterized by increasing foreign investment in public services, leading to localized modernization efforts and growing adoption of cost-effective inspection solutions.

- Middle East & Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) states due to large-scale construction and smart city initiatives requiring new pipeline inspection capabilities, often prioritizing rugged, climate-resistant equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mainline and Lateral Inspection Cameras Market.- CUES Inc.

- Envirosight LLC

- IBAK Helmut Hunger GmbH & Co. KG

- Aries Industries, Inc.

- R.S. Technical Services, Inc. (RST)

- Subsite Electronics (Ditch Witch)

- Vivax-Metrotech Corporation

- Insight Vision Cameras

- RapidView IBAK North America

- Sewer Robotics

- HammerHead Trenchless

- Radiodetection (SPX Corporation)

- Rothenberger AG

- KA-TE System AG

- Kummert GmbH

- Ratech Electronics Ltd.

- Spartan Tool, LLC

- MyTana Manufacturing

- Geophysical Survey Systems, Inc. (GSSI)

- Trelleborg Pipe Seals

Frequently Asked Questions

Analyze common user questions about the Mainline and Lateral Inspection Cameras market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between mainline and lateral inspection cameras?

Mainline cameras are robust, self-propelled robotic crawlers designed for inspecting large-diameter pipes (typically 6 inches and up) over long distances within municipal systems. Lateral cameras, primarily push-rod systems, are smaller and highly flexible, optimized for accessing residential connections and smaller-diameter pipes with tight bends, often operating from the connection point to the main line.

How is Artificial Intelligence (AI) impacting sewer inspection reporting efficiency?

AI significantly impacts efficiency through Automated Defect Recognition (ADR). ADR software uses machine learning to analyze video footage in real-time or post-inspection, automatically identifying, tagging, and coding defects according to standards like PACP, drastically reducing the labor hours required for manual video review and accelerating the generation of final reports.

What are the key drivers for market growth in the Asia Pacific region (APAC)?

The key drivers in APAC are rapid urbanization, necessitating substantial investment in new wastewater and stormwater infrastructure, coupled with increasing governmental focus on environmental protection, leading to higher adoption rates of non-destructive inspection technologies for new construction validation and aging asset monitoring.

What critical technologies are being integrated beyond standard visual inspection?

Key critical technologies being integrated include laser profiling systems, which measure the pipe's internal geometry (ovality, deformation, debris accumulation) with millimeter accuracy, and sonar technology, which is utilized for assessing submerged or fully filled pipes, providing quantitative structural data beyond standard video.

What is NASSCO PACP, and why is it important for the inspection camera market?

NASSCO's Pipeline Assessment Certification Program (PACP) is the widely accepted standard for coding, classifying, and assessing the condition of wastewater collection systems in North America. Its importance lies in providing a standardized, consistent framework for inspection data, which is essential for ensuring comparability, accuracy, and efficient utilization of AI-driven ADR systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager