Malted Barley Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441247 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Malted Barley Market Size

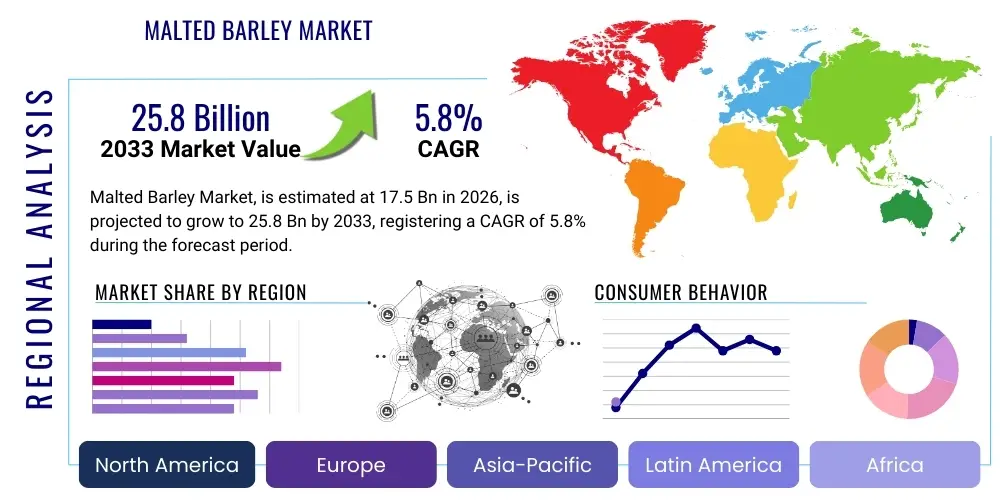

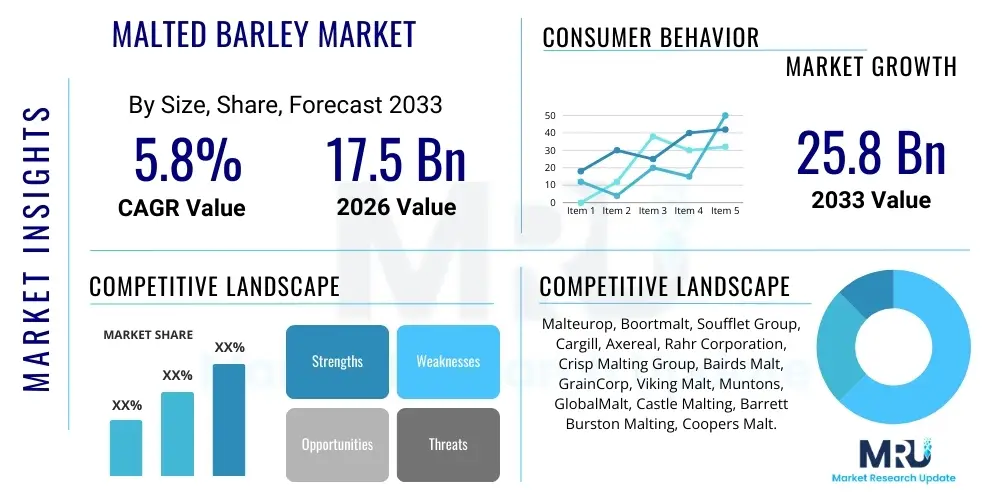

The Malted Barley Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 17.5 Billion in 2026 and is projected to reach USD 25.8 Billion by the end of the forecast period in 2033.

Malted Barley Market introduction

Malted barley represents barley grain that has undergone a controlled germination process, known as malting, which converts starches into fermentable sugars, modifies proteins, and creates flavor and color compounds essential for various industries. This process involves steeping the barley in water, allowing it to germinate, and then kiln-drying it to halt germination and achieve the desired moisture and color profile. The resulting product is critical to the brewing and distilling industries, serving as the primary source of fermentable carbohydrates and enzymes necessary for alcohol production. Beyond alcoholic beverages, malted barley is widely utilized in the food industry for baking, confectionery, and as a natural flavoring agent, demonstrating its fundamental importance in the global agricultural and food processing ecosystems.

The market expansion is heavily driven by the consistent and rising global demand for beer, particularly in emerging economies where disposable incomes are increasing and Western consumption patterns are being adopted. Furthermore, the craft brewing revolution across North America and Europe has significantly amplified the demand for specialized and high-quality specialty malts, driving innovation in malting techniques and raw material sourcing. The increasing consumer interest in natural, clean-label ingredients is also benefiting the market, as malted barley derivatives are often preferred over synthetic additives in food and beverage formulations. However, the market remains sensitive to fluctuations in barley harvest yields, climatic conditions, and regulatory changes concerning alcohol production and labeling.

Key applications of malted barley include the production of alcoholic beverages such as lagers, ales, and whiskeys, where it defines the character, body, and alcohol content of the final product. It is also used in non-alcoholic segments, including malted milk, breakfast cereals, and specialized animal feeds. The major benefits of malted barley include its high nutritional value, enzymatic activity that facilitates complex biochemical reactions, and its ability to impart desirable sensory characteristics such as sweetness, aroma, and color. Driving factors encompass population growth, urbanization leading to increased social consumption, technological advancements in malting equipment for enhanced efficiency, and continuous product diversification into niche markets like functional foods.

Malted Barley Market Executive Summary

The Malted Barley Market is characterized by robust growth underpinned by strong consumption trends in the global brewing sector and strategic expansion into functional food applications. Business trends indicate a movement toward consolidation, with major agricultural commodity firms and specialized maltsters engaging in cross-border acquisitions to secure raw material supplies and expand global production capacity, particularly in high-growth regions like Asia Pacific. Sustainability and traceability are becoming paramount business concerns, leading to investments in sustainable farming practices (e.g., lower water usage, reduced fertilizer reliance) and advanced supply chain management technologies to meet increasing consumer and regulatory scrutiny regarding product origin and environmental impact. Furthermore, there is a distinct trend towards product premiumization, where specialty malts (such as crystal, chocolate, and roasted malts) command higher margins due to their specific flavor profiles, catering directly to the demands of the craft brewing and high-end distilling segments.

Regionally, the market dynamics are highly heterogeneous. North America and Europe maintain dominance, driven by established brewing traditions and the vibrant craft beer scene, which demands high volumes of diverse malt varieties. However, the fastest growth trajectory is observed in the Asia Pacific (APAC) region, fueled primarily by China and India, where rising middle-class populations are driving per capita consumption of alcoholic beverages and processed foods. Investment is heavily concentrated in optimizing supply chains between key barley growing areas, such as Australia and parts of Eastern Europe, and the demanding processing hubs in East Asia. Conversely, regulatory hurdles and economic volatility in regions like Latin America and the Middle East pose moderating restraints, forcing companies to adopt highly customized market entry strategies that account for local taxation and cultural norms related to alcohol consumption.

Segmentation trends highlight the overwhelming dominance of the Brewing segment, which accounts for the largest share by application, demanding high volumes of standard pale malt. However, the Distilling segment is exhibiting accelerating growth, particularly due to the global resurgence in premium whiskey and craft spirits production, necessitating specific malting specifications like peated malt or single-origin varietals. By type, base malt remains the volume leader, but specialty malts are expanding rapidly in value share, reflecting the industry's shift towards product differentiation. Future growth is anticipated in the utilization of malt extracts in non-alcoholic beverages and functional foods, capitalizing on the increasing consumer preference for natural sweetness and nutritional enhancement, thus broadening the market's reliance beyond traditional fermentation industries.

AI Impact Analysis on Malted Barley Market

User inquiries regarding AI's influence on the Malted Barley Market predominantly revolve around optimizing agricultural yields, predicting market price volatility, and automating the complex malting process to ensure consistent quality. Key themes emerging from these questions concern the application of machine learning for precision agriculture in barley cultivation (e.g., optimizing irrigation and fertilizer application based on real-time climate data), the potential for AI-driven predictive maintenance in large-scale malting facilities to reduce downtime, and the use of sophisticated algorithms to model consumer preference for flavor profiles, linking specific barley strains and malting processes to desired product outcomes. Users are keen to understand how AI can mitigate the inherent risks associated with climate change and global supply chain disruptions, viewing it as a critical tool for improving efficiency and ensuring raw material security in a climate-sensitive industry.

The primary expectation is that AI will revolutionize the upstream segment of the value chain. Farmers are increasingly adopting satellite imagery and IoT sensors, analyzed by AI algorithms, to detect pest infestations, monitor soil health, and precisely time harvesting for maximum yield and optimal protein content, a crucial quality parameter for malting barley. Within the malting plant itself, machine learning is being integrated into steeping and kilning operations. For instance, predictive models can adjust temperature and humidity in real-time based on the enzymatic activity and moisture content measured by internal sensors, significantly reducing batch variability and minimizing energy consumption during the highly energy-intensive kilning stage. This technological adoption moves the industry towards 'smart malting,' promising unprecedented levels of product quality control and resource efficiency, which is critical for maintaining competitiveness in global commodity markets.

Furthermore, AI is extending its reach into demand forecasting and supply chain logistics. Sophisticated predictive analytics tools are being deployed to better anticipate demand from major brewing clients, factoring in seasonal trends, promotional activities, and macroeconomic indicators. This allows maltsters to optimize inventory levels, reduce wastage, and negotiate better procurement contracts for raw barley. The ability of AI to analyze vast datasets relating to global weather patterns, political stability, and transport logistics also enhances risk management capabilities, helping malt buyers secure resilient supply chains. Despite the benefits, concerns remain regarding the high initial investment costs for implementing AI infrastructure and the need for specialized data scientists and agronomists trained to manage these complex systems.

- AI-driven Precision Agriculture: Optimization of barley crop yields and quality parameters (protein, starch) using machine learning on sensor data and climate models.

- Automated Malting Process Control: Real-time adjustment of steeping, germination, and kilning parameters through algorithms to ensure consistent malt quality and energy efficiency.

- Predictive Maintenance: Use of AI to monitor machinery health in malting plants, minimizing operational downtime and reducing maintenance costs.

- Supply Chain Resilience: Advanced analytics for demand forecasting, logistics optimization, and risk assessment related to global barley sourcing and distribution.

- Flavor Profiling and R&D: Machine learning connecting specific raw barley genetics and malting regimes to desired sensory attributes in final beverages.

DRO & Impact Forces Of Malted Barley Market

The Malted Barley Market operates under a complex interplay of drivers, restraints, and opportunities that collectively shape its growth trajectory and competitive landscape. The primary driver remains the robust and resilient global demand from the brewing industry, which relies fundamentally on malted barley as its core ingredient; this stability is further amplified by the rapid expansion of the premium craft beer and artisanal distilling segments, demanding high-value specialty malts. Complementing this is the accelerating technological sophistication in malting processes, which enhances product quality, reduces energy consumption, and enables maltsters to customize products with greater precision, meeting increasingly stringent client specifications. However, the market faces significant restraints, chiefly climate variability, which directly impacts barley yield and quality, leading to price volatility and supply chain instability. Furthermore, intense competition from alternative fermentable ingredients, such as unmalted cereals, rice, and corn, particularly in high-volume, cost-sensitive brewing operations, continuously pressures malt pricing and market share.

Opportunities for market expansion are substantial, primarily focused on emerging geographical markets in Asia Pacific, where economic development and changing demographics are rapidly increasing the consumer base for alcoholic and processed malt-based foods. Product diversification offers another key avenue for growth; specifically, the utilization of malt extracts in the health and wellness sector, including sports nutrition, functional beverages, and natural sweeteners, aligns perfectly with global consumer trends prioritizing clean labels and natural ingredients. Strategic initiatives focused on sustainability, including the development of certified sustainable barley supply chains, offer competitive advantages by appealing to environmentally conscious corporate buyers and end consumers. The impact forces driving the market can be broadly categorized as economic leverage, technological diffusion, and regulatory frameworks. Economic leverage is strong, as the profitability of major brewers and distillers is inherently linked to malt cost and quality, making price stability and long-term contracts crucial market forces.

Technological impact forces involve continuous investment in high-throughput sorting, advanced kilning technology, and digital integration throughout the supply chain, enhancing operational efficiencies and traceability—forces essential for meeting modern regulatory and quality standards. Regulatory frameworks, particularly those governing alcohol content, taxation, and international trade tariffs, exert significant external pressure, dictating market access and profitability in various regions. Geopolitical instability and trade disputes, as seen in recent years affecting major commodity flows, serve as potent external impact forces that necessitate continuous recalibration of sourcing and distribution strategies. Ultimately, the market is defined by its necessity (in brewing) versus its vulnerability (to climate and commodity price swings), requiring strategic resilience and continuous innovation to sustain long-term growth.

Segmentation Analysis

The Malted Barley Market is segmented comprehensively based on several critical dimensions, including Type, Application, Source, and Form, allowing for granular analysis of market dynamics and targeted strategic planning. This segmentation structure reveals the diverse industrial utilization of the product, ranging from high-volume base malts used in global breweries to niche specialty malts serving artisanal distillers. The segmentation by application clearly demonstrates the overwhelming dependence on the alcoholic beverage industry, though diversification into food and feed sectors provides necessary market resilience. Analyzing the market through these segments helps identify high-growth pockets, such as the specialty malts segment within Type, which commands higher prices and exhibits faster growth than standard pale malts due to increasing demand for complex flavor profiles in premium beverages.

The segmentation by Source, primarily distinguishing between Winter Barley and Spring Barley, highlights important geographical and quality variances. Spring barley is often preferred for brewing due to its lower protein content and superior enzyme activity, while winter barley provides high yields and is frequently used for animal feed or standard malt applications. Understanding the geographical distribution and agricultural preferences linked to these sources is vital for supply chain management. Furthermore, the analysis of Form (Whole Grain, Malt Extracts, Malt Flour) reveals distinct consumption patterns and technological adoption levels; for instance, malt extracts are seeing increasing adoption in functional foods and industrial baking for their convenience and concentrated properties, driving innovation in extraction technologies.

This detailed segmentation not only serves to accurately map the current market structure but also provides a framework for forecasting future growth areas. For instance, the growth in the Distilling application segment is outpacing traditional mass-market brewing, indicating a shift in value proposition towards higher-quality, flavor-specific raw materials. Similarly, the growing trend toward non-alcoholic or low-alcohol beers globally suggests a future increase in demand for specialty malts that can provide complex flavor profiles without high fermentability. Effective strategic targeting requires manufacturers to tailor their product offerings and marketing efforts precisely to the needs of these distinct segments, optimizing production capabilities to handle the varied specifications demanded by each application area.

- By Type:

- Base Malt (Pale Malt, Pilsner Malt)

- Specialty Malt (Caramel/Crystal Malt, Roasted Malt, Chocolate Malt, Black Malt, Smoked Malt)

- By Application:

- Brewing Industry (Beer, Low/Non-Alcoholic Beer)

- Distilling Industry (Whiskey, Vodka, Gin)

- Food & Beverage Industry (Malted Milk, Baking, Confectionery, Cereals)

- Animal Feed

- By Source:

- Winter Barley

- Spring Barley

- By Form:

- Whole Grain Malt

- Malt Extracts (Liquid and Dry)

- Malt Flour

Value Chain Analysis For Malted Barley Market

The value chain for the Malted Barley Market begins firmly in the upstream segment with Raw Barley Production, where agricultural practices, seed selection (specifically focusing on malting quality varietals), and climate conditions dictate the quality and cost of the primary input. Farmers and large agricultural cooperatives manage the cultivation and harvesting, which is followed by initial grain cleaning and storage. Key upstream analysis focuses on securing consistent, high-protein/low-nitrogen barley, often requiring long-term contractual agreements between maltsters and farmers to stabilize supply and quality. Following agricultural procurement, the Malting Process itself forms the core transformational stage, involving the highly technical and controlled operations of steeping, germination, and kilning, where the raw grain is converted into the value-added product—malt. This stage is capital and energy-intensive, requiring specialized machinery and technical expertise to maximize enzyme activity and achieve specific flavor and color attributes demanded by downstream users.

The downstream analysis primarily centers on the major end-user industries: Brewing and Distilling. Maltsters distribute their product directly to large multinational beverage corporations or through regional distribution networks to smaller craft breweries and distilleries. Direct distribution channels are often preferred for major contracts to ensure quality control and timely delivery of large volumes of base malt. However, indirect channels, utilizing specialized food ingredient distributors and commodity traders, are critical for reaching smaller, geographically diverse clients and for supplying specialized malt extracts to the broader food and confectionery sectors. The effectiveness of the downstream segment hinges on maintaining strong, reliable relationships with major brewers, as their purchasing decisions significantly influence market volumes and pricing structures.

Distribution channels in the malted barley market are highly sophisticated, balancing the need for bulk commodity transport with the specialized handling required for premium products. Large-scale bulk handling facilities, involving rail, ocean freight, and specialized storage silos, are essential for distributing standard base malt globally, emphasizing logistical efficiency and cost minimization. For specialty malts and extracts, smaller, more agile distribution networks are utilized, often involving temperature-controlled or specialized packaging to preserve delicate flavors and textures. The dichotomy between direct distribution (for major contracts, ensuring quality and customized specifications) and indirect distribution (for market penetration and servicing smaller clients) defines the logistical framework of the industry, where digital platforms are increasingly used to manage complex global supply chains and improve traceability from farm to final consumer.

Malted Barley Market Potential Customers

The primary and largest category of potential customers for the Malted Barley Market resides within the Alcoholic Beverage Manufacturing industry, specifically global and regional breweries and distilleries. Breweries, ranging from multinational conglomerates producing mass-market lagers (e.g., Anheuser-Busch InBev, Heineken) to thousands of independent craft breweries, rely on malted barley as the fundamental source of fermentable sugars, body, and flavor for beer production. Distilleries, particularly those producing whiskey (scotch, bourbon, rye), constitute a critical customer base, demanding specific malting characteristics, such as high diastatic power or peat smoke infusion, to define the profile of their spirits. These customers require consistent quality, guaranteed supply volumes, and often customized specialty malts to differentiate their end products in highly competitive global markets.

A rapidly expanding segment of potential customers is found within the broader Food and Beverage Manufacturing sector. This includes producers of non-alcoholic beverages such as malted milk drinks, energy bars, breakfast cereals, and confectionery items. These customers utilize malted barley, often in the form of malt extracts or malt flour, as a natural sweetener, flavoring agent, coloring agent, and source of beneficial enzymes. The clean-label trend is driving demand from commercial bakeries and packaged food companies seeking natural alternatives to synthetic food additives and high-fructose corn syrup. Furthermore, the Pharmaceutical and Neutraceutical industries represent a niche but high-value customer group, using malt extracts as a base for flavor encapsulation or as a natural source of B vitamins and dietary fiber in health supplements.

Lastly, the Agricultural and Animal Feed industry constitutes a significant volume buyer, particularly for lower-grade or residual malted barley (malt sprouts) and specific high-protein winter barley malts. These products are incorporated into livestock feed formulations to enhance nutritional content, palatability, and digestibility, serving the poultry, swine, and cattle farming sectors. While this segment generally focuses on cost efficiency over specialty quality, it provides an essential outlet for non-brewing quality barley and contributes substantially to the overall market volume, ensuring minimal waste within the malt production cycle. Targeting these diverse end-users requires malt suppliers to maintain flexible production capabilities and a differentiated product portfolio.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 17.5 Billion |

| Market Forecast in 2033 | USD 25.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Malteurop, Boortmalt, Soufflet Group, Cargill, Axereal, Rahr Corporation, Crisp Malting Group, Bairds Malt, GrainCorp, Viking Malt, Muntons, GlobalMalt, Castle Malting, Barrett Burston Malting, Coopers Malt. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Malted Barley Market Key Technology Landscape

The technological landscape of the Malted Barley Market is centered around optimizing the core malting process (steeping, germination, and kilning) to enhance efficiency, reduce energy consumption, and ensure precise control over enzymatic and flavor development. Modern malting facilities increasingly utilize fully automated, large-scale germination and kilning systems, such as Saladin boxes or circular malting units, which allow for consistent aeration, temperature, and moisture management across massive batches, minimizing human error and maximizing throughput. Sensor technologies, including near-infrared (NIR) spectroscopy and advanced moisture probes, are deployed extensively to provide real-time data feedback on key parameters like starch conversion, protein modification, and color development, enabling immediate adjustment of process variables. This shift towards high-tech process control is essential for producing the highly specific specialty malts required by premium craft brewers and distillers, demanding precise and repeatable quality specifications batch after batch.

A significant area of technological investment is sustainability and resource efficiency, driven by increasing energy costs and environmental regulations. Innovations include the deployment of advanced heat recovery systems within kilns, capturing and reusing exhaust heat to pre-dry incoming air or heat water for the steeping process, thereby drastically reducing the natural gas consumption required for drying. Furthermore, water management technologies, such such as closed-loop systems and highly efficient steeping protocols, minimize water usage, which is a critical concern for agricultural processing facilities. The adoption of AI and machine learning, discussed previously, is fundamentally transforming plant management by integrating these sensors and automation systems into predictive models that optimize the entire operational flow, from raw material handling to final product packaging, thereby improving the overall environmental footprint of malt production.

Beyond the core malting process, the market is leveraging biotechnology and genetic research to enhance the raw material itself. Advanced breeding techniques, including marker-assisted selection (MAS) and genomic selection, are being used to develop new barley varietals that exhibit improved resilience to drought and disease while maintaining superior malting characteristics, such as low beta-glucan levels and specific protein profiles crucial for efficient brewing. Simultaneously, the extraction segment relies on highly efficient membrane filtration and vacuum evaporation technologies to produce clean, consistent malt extracts and syrups with specific sugar compositions, catering to the growing demand from the non-alcoholic beverage and functional food industries. These technological advancements collectively ensure that the industry remains capable of scaling production while consistently meeting the diverse and high-quality demands of its varied customer base.

Regional Highlights

- North America: The North American market is characterized by maturity in the overall beverage sector but explosive growth and premiumization within the craft brewing and distilling segments. The United States is the largest regional consumer, driving high demand for both standard base malts and a wide array of specialized malts (e.g., American Pale Malt, Rye Malt) required by thousands of independent brewers. Strong domestic barley production (especially in the Northern Plains) supports a robust local malting industry, although increasing reliance on specialty imported malts is also noted. Stringent quality standards and advanced logistics networks define the operational environment.

- Europe: Europe represents a traditional powerhouse in malt production and consumption, underpinned by long-established brewing cultures in Germany, the UK, and Belgium. Countries like France and the UK are major barley producers and exporters of malt. The market is defined by regulatory adherence (e.g., Reinheitsgebot in Germany impacting ingredient sourcing) and a focus on high-quality, regionally distinct malts (e.g., Maris Otter in the UK). While overall beer consumption growth is moderate, the high concentration of traditional distilleries (Scotch whisky) ensures consistent, high-value demand for specialized and often geographically protected malts. Sustainability initiatives and traceability mandates are significantly influencing sourcing strategies here.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, driven by massive consumption growth in China, India, and Southeast Asia, fueled by increasing urbanization and rising disposable incomes leading to higher per capita alcohol consumption. While local malt production capacity is expanding, the region remains a major net importer of high-quality malt, primarily sourced from Australia, Canada, and Europe. Investment is focused on establishing new malting facilities closer to major brewing hubs to reduce logistical costs and improve supply chain responsiveness. The demand is currently skewed toward high-volume base malts for mass-market lagers, but specialty malt demand is rising rapidly, particularly in urban centers.

- Latin America: This region presents a challenging yet high-potential market. Brazil and Mexico dominate consumption, driven by significant domestic beer production, largely controlled by a few multinational conglomerates. Market growth is sensitive to economic volatility and local regulatory environments concerning alcohol taxes and trade policies. The focus is primarily on cost-efficient, large-volume supply contracts for standard pale malt, with less immediate penetration of high-end specialty malts compared to North America or Europe, though the craft beer movement is slowly gaining traction in urban areas.

- Middle East and Africa (MEA): The MEA market is highly fragmented and culturally sensitive. While alcohol consumption is restricted in many Middle Eastern countries, there is significant growth in North Africa and South Africa. Malt demand is driven by the limited local brewing industries and, increasingly, by the food sector (malt extracts for confectionery and non-alcoholic malt beverages). Supply chains are often complex, relying heavily on imports, and growth remains dependent on stable political and economic conditions and adherence to diverse local religious and cultural constraints.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Malted Barley Market.- Malteurop

- Boortmalt

- Soufflet Group

- Cargill

- Axereal

- Rahr Corporation

- Crisp Malting Group

- Bairds Malt

- GrainCorp

- Viking Malt

- Muntons

- GlobalMalt

- Castle Malting

- Barrett Burston Malting

- Coopers Malt

- Heineken (Internal Malting Operations)

- Brewers Select

- Paul’s Malt

- Praag Malts

- The Swaen

Frequently Asked Questions

Analyze common user questions about the Malted Barley market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth trajectory of the Malted Barley Market?

The growth is primarily driven by the consistent global increase in demand for alcoholic beverages, particularly the robust expansion of the craft brewing and artisanal distilling sectors, which rely heavily on high-value specialty malts for unique flavor profiles.

How is climate change impacting the global supply chain for malted barley?

Climate change introduces significant volatility by causing unpredictable droughts or excessive rainfall, directly impacting the quality and yield of raw barley crops. This instability leads to higher commodity price fluctuations and necessitates strategic sourcing diversification by maltsters.

Which application segment holds the largest share in the Malted Barley Market?

The Brewing Industry remains the dominant application segment, accounting for the largest volume consumption of malted barley globally, utilizing both high-volume base malts and a wide variety of specialty malts for beer production.

What role does technology play in improving malt quality and production efficiency?

Advanced technologies, including AI-driven automation, real-time sensor monitoring (NIR spectroscopy), and highly efficient kilning processes, ensure precise control over enzyme activity, reduce energy consumption, and guarantee consistent, repeatable quality specifications across all malt batches.

Which geographical region is projected to exhibit the fastest growth for malted barley?

The Asia Pacific (APAC) region, driven by rapid urbanization and increased per capita consumption in major markets like China and India, is forecasted to show the highest Compound Annual Growth Rate (CAGR) due to expanding beverage manufacturing capacity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager