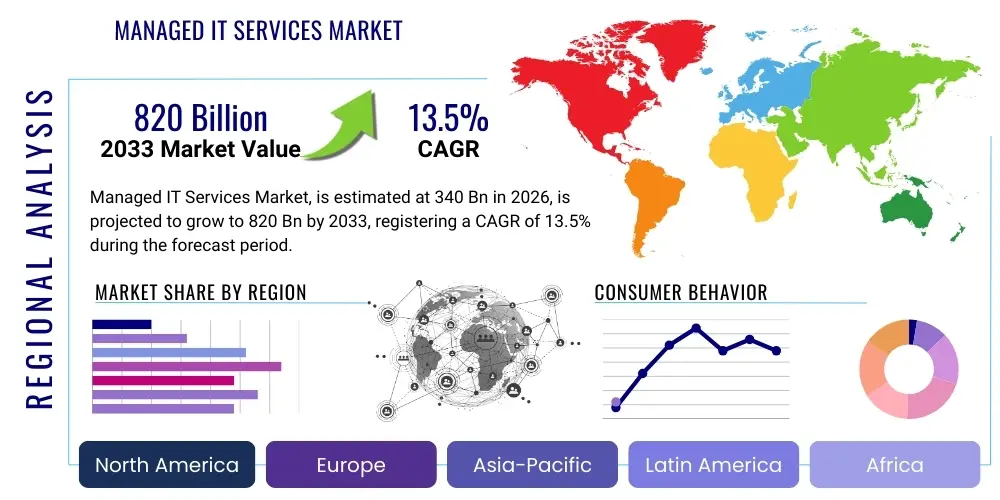

Managed IT Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441803 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Managed IT Services Market Size

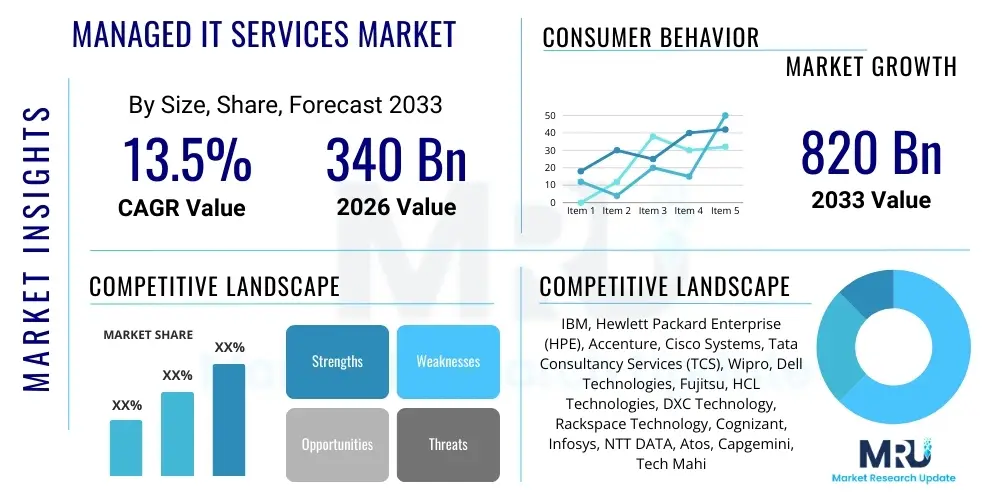

The Managed IT Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.5% between 2026 and 2033. The market is estimated at USD 340 Billion in 2026 and is projected to reach USD 820 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating complexity of IT infrastructure across small and medium-sized enterprises (SMEs) and large corporations, coupled with the critical requirement for robust cybersecurity solutions that mandate 24/7 expert management.

Market expansion is also heavily influenced by the accelerating shift towards cloud computing and hybrid IT environments. Organizations are increasingly relying on external expertise to manage these intricate, interconnected systems, thereby ensuring operational efficiency and compliance. Furthermore, the global shortage of skilled IT professionals specializing in cutting-edge technologies like advanced analytics and artificial intelligence integration is compelling businesses to outsource core IT management functions, solidifying the market's strong growth trajectory through the next decade.

Managed IT Services Market introduction

The Managed IT Services Market encompasses the outsourcing of specific or comprehensive IT responsibilities to a specialized third-party provider, known as a Managed Service Provider (MSP). These services typically span the entire IT landscape, including network monitoring, infrastructure management, data backup and recovery, security operations, and technical support. The primary product offering revolves around proactive management and maintenance, delivered either remotely or on a subscription basis, shifting the operational model from reactive break-fix to preventative care and continuous optimization. Major applications of Managed IT Services (MIS) include enhancing system uptime, streamlining business processes, and ensuring regulatory compliance, particularly in highly regulated sectors such as BFSI (Banking, Financial Services, and Insurance) and Healthcare.

Key benefits driving the adoption of Managed IT Services are predictable IT expenditure, reduced total cost of ownership (TCO) compared to maintaining large in-house IT teams, and access to specialized technological expertise that would otherwise be cost-prohibitive for many businesses, especially SMEs. Furthermore, by offloading routine infrastructure management, internal IT staff can focus on strategic, value-added initiatives critical for business innovation and growth. This strategic realignment is vital in the current digital economy where technological agility is paramount to competitive success.

Driving factors include the exponential growth in data volumes requiring sophisticated storage and management solutions, the mandatory need for robust defense against increasingly sophisticated cyber threats, and the widespread adoption of digital transformation initiatives across industries. The demand for scalable, flexible, and high-performance IT environments capable of supporting remote workforces and distributed operations continues to push organizations toward long-term MSP partnerships, fueling sustained market growth and innovation in service delivery models, such as AIOps and hybrid cloud management.

Managed IT Services Market Executive Summary

The Managed IT Services Market is undergoing rapid evolution, characterized by a major shift toward specialized, vertical-specific offerings and high-value services, predominantly managed security and cloud integration. Business trends indicate strong consolidation among smaller MSPs, driven by the necessity to acquire deep expertise in niche areas like advanced data analytics and compliance management, particularly concerning stringent regional regulations such as GDPR and CCPA. The move towards fixed-fee, outcome-based contracts, replacing traditional time-and-materials models, underscores the market’s focus on quantifiable performance and service delivery guarantees. Furthermore, the rising adoption of hybrid work models has accelerated demand for secure and seamless remote infrastructure access management, placing Managed Network Services and Unified Communications as a Service (UCaaS) at the forefront of market expansion.

Regionally, North America maintains its dominance due to early adoption of advanced technologies, the presence of major industry players, and high regulatory compliance needs in critical sectors like finance and pharmaceuticals. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by aggressive digital transformation strategies in emerging economies such as India, China, and Southeast Asian nations. European markets show stable growth, heavily influenced by robust data protection laws which necessitate comprehensive Managed Security Services (MSS). This diverse regional landscape reflects varying levels of IT maturity and regulatory compliance standards, influencing service demand and pricing structures across the globe.

Segment trends highlight Managed Security Services (MSS) as the fastest-growing segment, propelled by escalating ransomware attacks and the imperative for real-time threat detection and response capabilities that many organizations cannot sustain internally. Cloud Managed Services are also experiencing exponential demand, particularly those specializing in multi-cloud and hybrid environments, as enterprises seek optimization, cost management, and orchestration across various hyperscale cloud providers. Service providers are increasingly leveraging automation and Artificial Intelligence for IT Operations (AIOps) within their offerings to enhance efficiency, predictive maintenance, and scalability, signaling a technological pivot in service delivery models toward proactive and intelligent operations.

AI Impact Analysis on Managed IT Services Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Managed IT Services Market frequently center on themes of automation efficiency, the future role of IT staff, and the capability of AI to preemptively mitigate system failures. Users are primarily concerned about how AI, particularly through AIOps (AI for IT Operations), will transform monitoring, incident resolution, and predictive maintenance, seeking reassurance that these technologies will enhance, rather than replace, human analysts. Key expectations revolve around AI’s ability to handle massive data streams for advanced anomaly detection, improve the speed and accuracy of security incident responses, and provide highly personalized, scalable IT support without proportional increases in operational expenditure. The synthesis of these concerns highlights a desire for highly reliable, self-healing IT environments powered by AI, balanced against the need for transparent operational processes and skilled human oversight in complex decision-making.

AI is fundamentally reshaping the operational delivery model of Managed IT Services by introducing unprecedented levels of automation and predictive capability. AIOps platforms integrate machine learning algorithms to analyze historical performance data, alert correlation, and network traffic patterns, allowing MSPs to identify and resolve issues before they impact end-users. This shift from reactive troubleshooting to proactive intelligence significantly reduces downtime, enhances service quality, and optimizes resource utilization, thereby increasing the value proposition of outsourced IT management. Furthermore, AI-driven tools are being deployed in service desk functions through intelligent chatbots and self-service portals, automating common inquiries and freeing up specialized engineers for complex problem-solving.

The incorporation of AI into Managed IT Services also drastically strengthens the security posture. AI and machine learning are essential for processing the enormous volume of logs and alerts generated daily, effectively identifying subtle indicators of compromise (IoCs) that human analysts might miss. This enhanced capability is crucial in Managed Security Services, enabling providers to offer sophisticated threat hunting, behavioral analysis, and automated responses to zero-day attacks. While AI automates routine tasks, it elevates the role of the human IT professional, requiring deeper expertise in data science, ethical AI deployment, and complex system orchestration to manage these sophisticated tools effectively, ensuring AI acts as an augmentation tool rather than a wholesale replacement for human judgment.

- AI enables AIOps for predictive maintenance, drastically reducing system downtime.

- Machine learning enhances Managed Security Services (MSS) through superior anomaly detection and automated threat response.

- Automation streamlines routine IT tasks such as patch management and configuration, improving operational efficiency.

- AI-powered chatbots and virtual assistants enhance service desk functions, providing instant resolution for common user issues.

- Intelligent resource allocation and optimization across hybrid cloud environments improve cost efficiency for clients.

DRO & Impact Forces Of Managed IT Services Market

The Managed IT Services Market is subject to powerful driving forces stemming primarily from the unrelenting pace of digital transformation and the increasing complexity of modern IT environments. Key restraints involve persistent cybersecurity concerns related to handing over critical data control to third-party providers, alongside high initial setup and migration costs which can deter smaller enterprises. Significant opportunities lie in serving the growing Small and Medium Enterprise (SME) segment, which lacks the resources for in-house IT specialization, and in developing niche expertise in highly regulated sectors like financial technology (FinTech) and specialized healthcare IT compliance. These interwoven factors create a dynamic market environment where providers must balance innovation in service delivery (Drivers) with rigorous trust-building measures (Restraints) to capitalize on emerging market segments (Opportunities).

Drivers: The dominant driver remains the necessity for robust cybersecurity defenses against sophisticated, persistent threats, compelling organizations of all sizes to seek 24/7 monitoring and expert security management. The rapid adoption of cloud computing, encompassing multi-cloud and hybrid architectures, necessitates external expertise for seamless orchestration and governance. Furthermore, the global shortage of skilled talent in specialized areas like DevOps, cloud architecture, and zero-trust security architecture forces companies to outsource to MSPs to bridge the skills gap and maintain competitiveness. Cost efficiency and the shift from CapEx to OpEx models further accelerate adoption, making sophisticated IT infrastructure accessible to a broader range of organizations.

Restraints: Significant restraints include the inherent risk associated with data residency and vendor lock-in, where companies become overly reliant on a single provider for their critical operations. Regulatory compliance overheads, particularly across international borders, pose operational challenges that MSPs must continuously navigate, adding complexity and cost. Furthermore, some large enterprises exhibit reluctance to relinquish full control over their core IT assets, preferring partial outsourcing or co-managed models rather than complete reliance on a third party, thereby moderating the pace of full-scale market penetration in certain enterprise segments.

Opportunities and Impact Forces: Major opportunities reside in expanding specialized offerings for vertical markets, such as offering industry-specific compliance frameworks and customized application management. The development of advanced, AI-driven services (AIOps) provides a competitive edge, enabling MSPs to offer differentiated, high-value, proactive services. Impact forces are currently dominated by the accelerated adoption of remote and hybrid work models, which demand scalable, secure, and geographically agnostic network and device management. Economic pressure for optimization following global macroeconomic shifts also forces organizations to consolidate vendors and focus on services that deliver immediate cost savings and operational resilience, profoundly impacting service prioritization and contract negotiation.

Segmentation Analysis

The Managed IT Services market is primarily segmented based on Service Type, Deployment Mode, Organization Size, and End-User Vertical. Analyzing these segments reveals shifting market preferences, with Managed Security and Cloud Services exhibiting the strongest growth trajectory due to pervasive digital threats and the universal shift to cloud infrastructure. The shift toward subscription-based, recurring revenue models is solidifying across all service types, providing MSPs with predictable income streams and clients with fixed, manageable operating expenses. Organization size segmentation clearly shows that while large enterprises are the primary revenue contributors, the SME segment is the key driver of new volume and high-growth potential, often requiring comprehensive, bundled service packages to cover their entire IT stack from a single vendor.

The Service Type segment is crucial, illustrating where enterprises are prioritizing external investment. Managed Security is paramount, covering everything from threat detection and firewall management to identity and access management (IAM). Following closely is Managed Infrastructure and Managed Network Services, essential for ensuring the performance and resilience of hybrid cloud environments and supporting widespread geographical dispersion of operations. Deployment Mode differentiates between solutions hosted entirely on the provider's infrastructure (Cloud/Remote) versus solutions managed on the client's premises (On-premise/Co-managed), with cloud-based management rapidly becoming the default due to its inherent scalability and lower upfront capital expenditure requirements.

End-User vertical segmentation highlights sector-specific needs. BFSI requires stringent compliance management and ultra-low latency transaction processing, making Managed Compliance and Data Center Services vital. Healthcare demands adherence to regulations like HIPAA, driving demand for specialized Managed Security and Data Backup/Recovery. Retail and e-commerce are focused on seamless customer experience and scalable infrastructure to handle peak load times, emphasizing Managed Cloud and Network optimization services. Understanding these unique vertical requirements allows MSPs to tailor offerings and achieve greater market penetration and customer satisfaction within targeted industries.

- By Service Type:

- Managed Security Services (MSS)

- Managed Network Services (MNS)

- Managed Infrastructure Services (MIS)

- Managed Data Center Services

- Managed Communication Services

- Managed Mobility Services

- Managed Cloud Services (Public, Private, Hybrid)

- By Deployment Mode:

- On-Premise

- Cloud (Public, Private)

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By End-User Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecommunications

- Healthcare and Life Sciences

- Retail and Consumer Goods

- Manufacturing

- Government and Public Sector

- Energy and Utilities

Value Chain Analysis For Managed IT Services Market

The value chain for Managed IT Services commences with the upstream foundational layer, involving original equipment manufacturers (OEMs) and software vendors who supply the core hardware, networking equipment, cloud platforms (like AWS, Azure, GCP), and specialized software (Remote Monitoring and Management (RMM), Professional Services Automation (PSA)) essential for service delivery. These upstream relationships are critical, as the quality and integration capability of these foundational technologies directly determine the performance and reliability of the final managed service offering. MSPs must maintain robust partnerships and accreditation with these technology providers to ensure they are delivering the latest, most secure, and most efficient solutions, often negotiating favorable licensing terms that enhance their profit margins.

The midstream stage is the core service delivery, executed by the Managed Service Providers themselves. This stage involves complex service orchestration, integration, monitoring, and maintenance. MSPs add value by bundling disparate technologies into cohesive, single-point-of-contact services. This includes establishing secure network links, configuring security policies, deploying AIOps tools, and managing customer environments 24/7 through global security operations centers (SOCs) and network operations centers (NOCs). The efficiency of this middle layer—measured by incident response time, uptime guarantees, and cost-effectiveness—determines the competitiveness of the MSP in the market.

The downstream segment encompasses the distribution channels and end-users. Distribution channels are predominantly direct, where MSPs engage directly with Large Enterprises and SMEs through long-term service contracts. Indirect channels involve partnerships with IT consultancies, value-added resellers (VARs), and system integrators who may resell or co-manage specialized services, particularly to smaller clients who prefer localized support. The ultimate delivery is to the end-users across various sectors (BFSI, Healthcare, etc.). The effectiveness of the service is ultimately judged by the end-user’s ability to achieve their business outcomes, such as reduced operational costs, enhanced security, and improved business agility, thereby completing the value chain loop and driving contract renewals and expansion.

Managed IT Services Market Potential Customers

The primary customers for Managed IT Services are organizations across all industry verticals seeking to optimize their IT operations, minimize downtime, and strategically leverage technology without incurring the steep costs associated with maintaining large, specialized in-house teams. Potential customers are heavily concentrated within the Small and Medium-sized Enterprise (SME) segment, which often lacks the financial capacity or scale to hire dedicated security analysts, cloud architects, or advanced network specialists. For SMEs, Managed IT Services offer enterprise-grade capabilities at a predictable monthly operational cost, enabling them to compete effectively while maintaining stringent security and compliance standards.

However, Large Enterprises also represent significant potential customers, especially for specialized, high-value services such as Managed Security Services (MSS), Managed Cloud Orchestration, and co-managed environments. These large organizations often retain core IT functions but outsource complex, resource-intensive, or non-core operations, particularly those requiring 24/7 global coverage or specific, niche technical certifications. Sectors like BFSI and Healthcare are perpetual high-demand customers due to their intense need for data privacy, regulatory adherence (HIPAA, PCI DSS), and continuous operational resilience, driving demand for highly customized and audited MSP solutions.

Geographically, customers in high-growth regions like APAC are focused on rapid infrastructural build-out and cloud migration, seeking MSPs capable of facilitating fast, scalable deployment. In mature markets like North America and Western Europe, customers prioritize advanced security, regulatory compliance automation, and leveraging AIOps to refine existing complex architectures. The demand profile across the globe indicates that any organization undergoing digital transformation, struggling with IT talent acquisition, or facing increased pressure from cyber threats is a prime candidate for utilizing Managed IT Services, making the potential customer base exceptionally broad and diversified across economic sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 340 Billion |

| Market Forecast in 2033 | USD 820 Billion |

| Growth Rate | 13.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Hewlett Packard Enterprise (HPE), Accenture, Cisco Systems, Tata Consultancy Services (TCS), Wipro, Dell Technologies, Fujitsu, HCL Technologies, DXC Technology, Rackspace Technology, Cognizant, Infosys, NTT DATA, Atos, Capgemini, Tech Mahindra, CompuCom, Secureworks, Kaseya (Datto) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Managed IT Services Market Key Technology Landscape

The operational efficiency and service quality within the Managed IT Services market are fundamentally underpinned by a suite of sophisticated technological platforms, primarily focusing on automation and remote management capabilities. The core technological stack relies heavily on Remote Monitoring and Management (RMM) software, which allows MSPs to proactively monitor client endpoints, networks, and servers, performing maintenance and issuing patches remotely without requiring physical presence. Complementary to RMM are Professional Services Automation (PSA) tools, which manage the business side of service delivery, including client relationship management, billing, ticketing systems, and resource allocation. The integration and seamless interplay between RMM and PSA platforms are essential for maintaining high service levels and predictable profitability for the service provider.

Furthermore, the shift towards cloud and security specialization has necessitated the widespread adoption of advanced security technologies. Security Information and Event Management (SIEM) and Security Orchestration, Automation, and Response (SOAR) platforms form the backbone of modern Managed Security Services, enabling real-time threat correlation, automated containment, and rapid incident response across complex distributed environments. The trend towards Zero-Trust Architecture (ZTA) is highly influential, requiring MSPs to implement granular access controls and micro-segmentation capabilities, moving away from perimeter-based security models. This technological shift demands continuous investment in specialized training and advanced security certifications by MSP employees.

In terms of network management, Software-Defined Wide Area Networking (SD-WAN) and network virtualization are critical technologies managed by MSPs, enabling flexible, high-performance connectivity that is essential for supporting hybrid cloud deployments and geographically dispersed workforces. The emergence of AIOps—combining AI and machine learning with IT operations—is perhaps the most disruptive technological force. AIOps tools analyze vast operational data sets to predict failures, automate root cause analysis, and self-heal infrastructure components, allowing MSPs to offer true proactive service delivery that differentiates them from traditional providers and significantly enhances client uptime and operational resilience. The continuous integration of these complex, high-technology solutions defines the modern competitive landscape for Managed IT Services.

Regional Highlights

The Managed IT Services Market exhibits distinct characteristics and growth profiles across major global regions, influenced by varying levels of digital maturity, regulatory environments, and economic dynamism. North America, encompassing the United States and Canada, currently holds the largest market share. This dominance is attributable to the early and extensive adoption of cloud computing, the strong presence of major technology corporations and MSP headquarters, and the high demand for advanced Managed Security Services driven by stringent regulatory frameworks (e.g., HIPAA, SOC 2). The region's technological sophistication allows for rapid market penetration of cutting-edge solutions like AIOps and specialized multi-cloud management.

Europe represents a mature yet rapidly evolving market, primarily driven by regulatory compliance mandates such as GDPR, which necessitate robust data management and security services. Countries in Western Europe, particularly the UK, Germany, and France, are major adopters, focusing heavily on Managed Security and Managed Data Center services. Eastern Europe is experiencing accelerating growth as businesses modernize their IT infrastructure. The market dynamics here are characterized by strong regional provider consolidation and a focus on localized compliance expertise to meet the diverse legal requirements across the EU member states, ensuring cross-border operational consistency.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This exponential growth is spurred by massive governmental and private sector investments in digital infrastructure, urbanization, and the rapid uptake of public cloud services in emerging economies like India and Southeast Asia. The large SME base in APAC, previously underserved, is now actively seeking outsourced IT management to facilitate scalable growth and international competitiveness. While price sensitivity remains a factor, the urgent need for cybersecurity defenses and the adoption of remote work infrastructure are key market accelerators across the region.

- North America: Market leader; driven by high technological maturity, vast enterprise cloud adoption, and strict regulatory compliance requirements (especially in BFSI and Healthcare). Strong uptake of advanced cybersecurity and co-managed services.

- Europe: Stable and significant growth; heavily influenced by GDPR mandates for data protection and privacy, boosting demand for Managed Security and Compliance services. Focus on hybrid cloud models and IT environment optimization.

- Asia Pacific (APAC): Highest CAGR; propelled by aggressive digital transformation initiatives, increasing penetration of public cloud platforms, and expansion of the SME segment seeking outsourced IT capabilities in markets like China, India, and Japan.

- Latin America (LATAM): Emerging growth market; characterized by increasing infrastructure investment, particularly in Brazil and Mexico, focusing on managed infrastructure services and basic cybersecurity solutions to stabilize operations.

- Middle East and Africa (MEA): Growth driven by smart city projects and energy sector digitalization in the Gulf Cooperation Council (GCC) countries, focusing on Managed Data Center and specialized network services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Managed IT Services Market.- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- Accenture Plc

- Cisco Systems Inc.

- Tata Consultancy Services (TCS)

- Wipro Limited

- Dell Technologies Inc.

- Fujitsu Limited

- HCL Technologies Limited

- DXC Technology Company

- Rackspace Technology Inc.

- Cognizant Technology Solutions Corporation

- Infosys Limited

- NTT DATA Corporation

- Atos SE

- Capgemini SE

- Tech Mahindra Ltd.

- CompuCom Systems Inc.

- Secureworks Inc.

- Kaseya (Datto)

Frequently Asked Questions

Analyze common user questions about the Managed IT Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Managed IT Services Market?

The primary driver is the escalating complexity and frequency of advanced cyber threats, compelling organizations to outsource 24/7 security monitoring and incident response capabilities, specifically Managed Security Services (MSS), which are unaffordable to maintain in-house for most SMEs.

How does AI impact the operational delivery of Managed IT Services?

AI significantly impacts operations through AIOps, enabling proactive and predictive maintenance, automated system healing, and enhanced threat detection in security operations, thereby reducing operational expenditure and maximizing client system uptime.

Which segment of Managed IT Services is experiencing the fastest growth?

Managed Security Services (MSS) and Managed Cloud Services, particularly those focusing on hybrid and multi-cloud environments, are the fastest-growing segments due to the global imperative for robust digital defenses and flexible cloud architecture orchestration.

What are the main financial benefits of adopting Managed IT Services for SMEs?

SMEs benefit from converting large, unpredictable capital expenditures (CapEx) on infrastructure and specialized staff into predictable, scalable operational expenditures (OpEx), gaining access to expert IT talent and enterprise-grade technology otherwise out of reach.

What are the major restraint concerns related to utilizing a Managed Service Provider (MSP)?

Major restraints include concerns regarding data governance and sovereignty, potential vendor lock-in risk, and ensuring compliance with regional data regulations such as GDPR when sensitive information is managed by a third party.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager