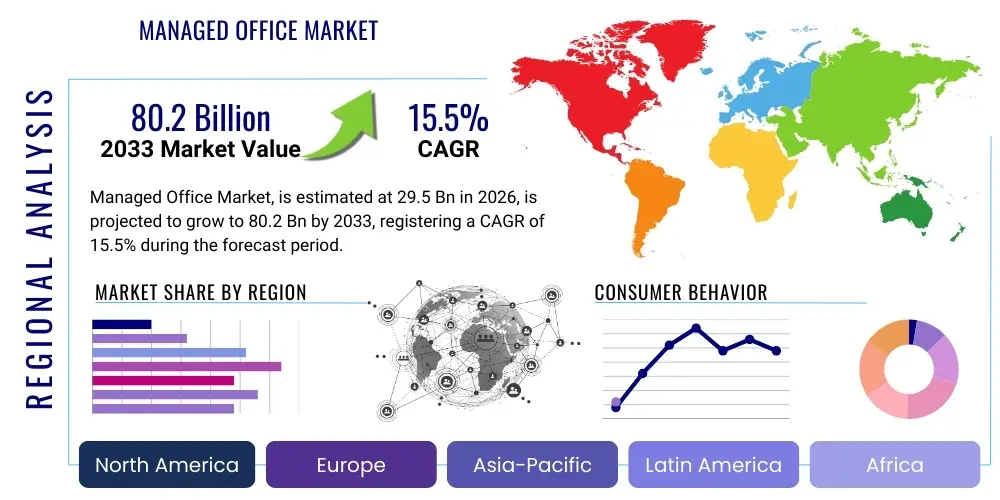

Managed Office Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441637 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Managed Office Market Size

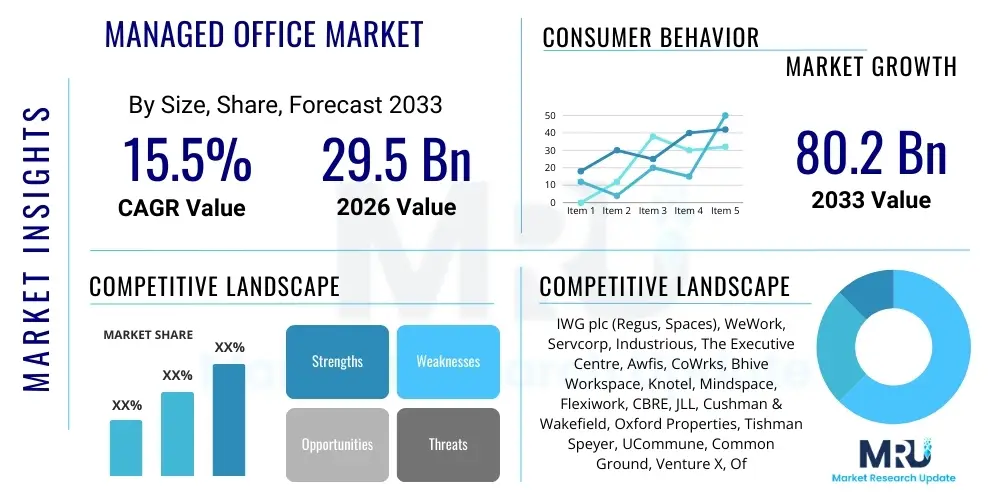

The Managed Office Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at $29.5 Billion in 2026 and is projected to reach $80.2 Billion by the end of the forecast period in 2033.

Managed Office Market introduction

The Managed Office Market encompasses flexible workspace solutions where a third-party provider takes responsibility for all aspects of office management, infrastructure, technology, and administration. Unlike traditional leased spaces or pure coworking models, managed offices offer fully customized, dedicated spaces tailored to the specific branding, layout, and technological needs of a single corporate client, often on medium to long-term contracts. This model provides the scalability and flexibility of coworking but with the privacy and personalization of a conventional office, significantly reducing capital expenditure and operational friction for the occupying organization. The primary offerings include fit-out management, furniture procurement, IT setup and maintenance, facilities management, and dedicated amenity provision.

Product demand is soaring across major metropolitan and tier-two cities, driven primarily by multinational corporations (MNCs) and large domestic enterprises seeking agility in their real estate portfolios. The concept emerged strongly post-pandemic as businesses realized the necessity of optimizing real estate costs while simultaneously providing high-quality, amenity-rich environments to attract and retain talent in hybrid work settings. Major applications span technology firms needing rapid deployment cycles, financial services requiring high security and compliance, and consulting agencies that experience fluctuating team sizes. Managed offices are essentially an outsourced real estate and facilities function, allowing core businesses to concentrate on their strategic priorities.

Key benefits driving market adoption include significant operational efficiencies, faster speed to market for new locations, and fixed, predictable operating expenses. Furthermore, the managed model inherently supports sustainability initiatives as providers often invest in shared, optimized infrastructure, contributing to lower per-capita environmental footprints for clients. The driving factors involve global economic uncertainty prompting cost-control measures, the increasing complexity of modern office technology (which providers manage seamlessly), and the pervasive shift towards hybrid work models that necessitate highly flexible, distributed, and premium office solutions for periodic team convergence. This structural shift underpins the robust projected CAGR for the forecast period.

- Market Intro: Provision of fully serviced, customized, dedicated office spaces managed by a third party for corporate clients.

- Product Description: Tailored office environments covering fit-outs, IT, facilities, and administration, offered under flexible contract terms.

- Major Applications: Technology (R&D centers, rapid scaling), BFSI (Secure operations), Professional Services (Flexible team deployment).

- Benefits: Reduced CAPEX, predictable OPEX, rapid scalability, high customization, and operational efficiency.

- Driving Factors: Hybrid work mandates, corporate demand for real estate flexibility, global economic volatility, and the need for premium, managed employee experiences.

Managed Office Market Executive Summary

The global Managed Office Market is experiencing unprecedented growth, positioned strategically at the intersection of enterprise real estate optimization and the future of work. Business trends indicate a decisive shift away from traditional long-term leases towards "Office-as-a-Service" (OaaS) models, driven by the desire for capital preservation and improved balance sheet flexibility. Large enterprises are increasingly signing portfolio-level deals with major managed space providers, securing consistent standards and management across multiple geographies. Technology integration, particularly focusing on smart building solutions, occupant experience platforms, and high-speed secure connectivity, remains a critical differentiating factor among competitors, transforming the office space from a static asset into a dynamic, performance-enhancing tool. Sustainability mandates and Environmental, Social, and Governance (ESG) reporting requirements are also influencing procurement, favoring providers who offer certified green buildings and optimized energy usage.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid urbanization, significant inward foreign direct investment (FDI), and the rapid expansion of technology and e-commerce giants, particularly in India, Southeast Asia, and Australia. North America and Europe, characterized by established real estate markets, are witnessing mature adoption driven by financial institutions and large consulting firms relocating or rightsizing their headquarters through managed solutions. The competitive landscape is consolidating, with major global real estate firms (Cushman & Wakefield, CBRE, JLL) increasingly partnering with or acquiring dedicated flexible space operators to offer comprehensive managed solutions, blurring the lines between traditional brokerage and OaaS provision. This consolidation ensures higher quality standards and greater capital backing for large-scale customization projects.

Segmentation trends highlight a strong demand surge for Enterprise Managed Offices (spaces exceeding 50,000 square feet), reflecting the growing comfort level of Fortune 500 companies in outsourcing their core workspace management. The IT & Telecom sector remains the dominant end-user vertical, although significant growth is observed in the BFSI and Healthcare sectors, driven by their stringent compliance and infrastructure requirements which managed providers can guarantee more efficiently than internal corporate facilities teams. Pricing models are evolving, moving from simple per-desk rates to complex risk-sharing or performance-based contracts, often incorporating tiered service levels for facilities and technology. This market evolution demonstrates a move toward higher value-add services, prioritizing end-user experience and operational uptime over mere square footage provision.

AI Impact Analysis on Managed Office Market

User queries regarding the impact of Artificial Intelligence (AI) on the Managed Office Market frequently revolve around automation of facility management tasks, the enhancement of employee experience, and the strategic implications for space utilization planning. Users are keen to understand how AI-powered platforms can optimize energy consumption, predict maintenance needs (preventive maintenance), and automate routine administrative functions like access control, visitor management, and concierge services. A significant area of concern and interest is the use of AI for real-time occupancy monitoring and spatial analytics, aiming to determine the true efficacy of hybrid working models and dynamically adjust services, such as HVAC and cleaning schedules, based on actual usage patterns. Expectations center on AI driving down operating costs for managed office providers while simultaneously delivering a hyper-personalized, seamless, and high-security working environment for corporate clients, establishing a clear competitive edge for early AI adopters in the OaaS sector.

AI's role transcends simple automation; it is fundamentally altering the design and operational blueprint of managed office spaces. Providers are leveraging machine learning algorithms fed by sensor data to create 'learning buildings' that anticipate user needs. For instance, AI algorithms can analyze meeting room booking patterns, catering requests, and internal movement data to optimize layouts before a space is even built, ensuring maximum flow and functional efficiency tailored to the client’s specific corporate culture. This predictive capability reduces wastage in fit-out costs and improves long-term asset performance. Furthermore, AI-driven cybersecurity measures are becoming standard, managing complex network traffic and providing dedicated, segregated IT infrastructure essential for regulated industries like finance and legal services operating within a flexible ecosystem. The integration of generative AI tools is also being explored to rapidly customize design visualizations and optimize contractual terms based on risk profiles, accelerating the sales and deployment cycle for new managed spaces.

- Predictive Maintenance: AI analyzing sensor data to anticipate equipment failures (HVAC, elevators) before they occur, maximizing uptime.

- Space Utilization Optimization: Machine learning used for real-time tracking of occupancy and adjusting environmental controls (lighting, temperature) based on actual demand, leading to significant energy savings.

- Enhanced Security and Access: AI-driven facial recognition, seamless access control, and automated anomaly detection in monitored areas.

- Personalized Workplace Experience: Using AI to tailor temperature zones, lighting levels, and even background noise to individual or team preferences.

- Automated Facilities Management (FM): Chatbots and virtual assistants handling tenant requests, reducing the need for human intervention in routine tasks.

- Design and Fit-out Acceleration: Generative AI assisting in rapidly creating optimized floor plans and visualizing customized branding elements.

DRO & Impact Forces Of Managed Office Market

The Managed Office Market is propelled by powerful market drivers, predominantly the pervasive corporate demand for flexible and scalable real estate solutions in an increasingly volatile global economy. The shift towards hybrid work necessitates decentralized, yet standardized, office footprints, which managed solutions are uniquely positioned to provide, bypassing the complexities of traditional lease negotiations and capital expenditures. This demand is further amplified by the competitive talent market, where high-quality, amenity-rich office environments are critical for employee recruitment and retention. Additionally, the increasing focus on sustainability and ESG compliance acts as a driver, compelling companies to partner with professional providers who can ensure buildings meet stringent environmental standards more easily than individual retrofitting efforts. These collective drivers place significant upward pressure on market growth and investment in new supply chains.

However, the market faces notable restraints, primarily related to the high initial capital investment required by providers to secure premium locations, execute bespoke fit-outs, and manage advanced technology infrastructure. Scaling these operations profitably across diverse regulatory and geographical landscapes presents logistical challenges. Moreover, client concerns regarding data security and corporate confidentiality remain a potential restraint, particularly in multi-tenant facilities, necessitating continuous investment in segregated IT networks and robust compliance protocols. Economic downturns, which might tempt companies to drastically reduce office footprints rather than optimize them, pose an external risk, although the inherent flexibility of managed offices often mitigates this risk by offering smaller, adaptable contracts compared to traditional leases. The long decision-making cycles within large enterprises also slow down the adoption curve initially.

The market opportunities are substantial, centered on the expansion into Tier 2 and Tier 3 cities, driven by the decentralization strategies of large corporations seeking access to diversified talent pools outside primary hubs. Further opportunities lie in the specialization of managed spaces for specific high-value sectors, such as highly secure labs for biotech or specialized editing suites for media companies, moving beyond generic office solutions. Key impact forces shaping the market include technological disruption, where superior smart building integration and cybersecurity capabilities are non-negotiable prerequisites. Regulatory shifts, particularly changes related to commercial real estate taxation or flexible labor laws, also significantly influence the operational viability and demand dynamics across regions. The overall impact force matrix suggests that drivers, particularly flexibility and operational efficiency, currently outweigh the restraints, supporting aggressive market expansion throughout the forecast period.

Segmentation Analysis

The Managed Office Market is comprehensively segmented based on the operational scale required (Type), the contractual structure and usage model (Occupancy), and the primary business activity of the client (Vertical). This segmentation allows providers to tailor their offerings—ranging from a few dedicated desks within a larger managed ecosystem to entire customized buildings—to precisely match the strategic needs and budgetary constraints of diverse corporate clientele. Analyzing these segments is crucial for understanding market dynamics, as different segments exhibit varying growth rates, price sensitivities, and infrastructural requirements, with enterprise solutions demanding higher levels of customization and security compared to those serving small and medium-sized enterprises (SMEs). The granularity of service offered is the key differentiator across these segments.

The segmentation by Type, specifically distinguishing between Enterprise Managed Offices (typically large, customized floors or entire buildings) and SME Managed Offices (often smaller, dedicated suites or shared facilities), reveals a high-value focus on the enterprise segment. Enterprises prioritize brand alignment, proprietary security, and advanced IT infrastructure, making them willing to commit to longer, high-value contracts. Conversely, the SME segment drives volume growth, seeking maximum flexibility and plug-and-play solutions with lower upfront commitment. The Occupancy segmentation further details how space is consumed, with dedicated private offices commanding the highest revenue share due to the persistent corporate need for privacy, while custom built-out spaces represent the future, offering complete design control to the client but requiring significant upfront capital commitment from the provider.

From a Vertical perspective, the market shows pronounced reliance on the high-growth IT & Telecom sector, which requires rapid scalability and specialized networking capabilities. However, the BFSI sector, driven by heightened regulatory scrutiny and the need for disaster recovery planning, is increasingly adopting managed solutions that guarantee robust business continuity and data compliance. The emerging growth in segments like Healthcare and E-commerce indicates that as core business operations become more complex and decentralized, the outsourcing of non-core real estate management becomes a fundamental operational necessity across all major economic sectors. Strategic investments must therefore target solutions capable of meeting specific vertical compliance requirements, such as HIPAA for healthcare or PCI DSS for financial services.

- By Type:

- Enterprise Managed Offices (Focus on 100+ seats, full customization, dedicated facilities)

- SME Managed Offices (Focus on 10-100 seats, standardized but private environments)

- By Occupancy:

- Dedicated Desks (Hybrid use within client's dedicated space)

- Private Offices (Standard secured suites for teams)

- Custom Built-out Spaces (Full design control, long-term commitment)

- By Vertical:

- IT & Telecom (Largest user base, driven by scalability)

- BFSI (High security, regulatory compliance focus)

- Consulting & Professional Services (Project-based, global mobility needs)

- E-commerce & Logistics (Rapid expansion into new distribution hubs)

- Healthcare and Life Sciences (Need for specialized, secure facilities)

- Others (Education, Non-Profit, Government Contractors)

Value Chain Analysis For Managed Office Market

The value chain of the Managed Office Market begins upstream with sourcing and acquisition, where providers interact with landowners, institutional investors, and traditional real estate developers to secure prime commercial properties, either through long-term leases or outright purchase. Critical upstream activities also involve financing for large-scale fit-outs and the procurement of high-grade construction materials, furniture, and IT infrastructure. Efficiency at this stage—particularly through bulk purchasing and strategic partnerships with global furniture manufacturers and technology vendors—directly influences the provider's ability to offer competitive pricing downstream while maintaining high-quality design standards. Success upstream requires strong capital reserves and expertise in large-scale property negotiation and development management.

Midstream activities form the core of the Managed Office offering and involve the design, construction management, technology implementation (including smart building systems and segregated networks), and the establishment of operational protocols, such as facilities management, security, and cleaning services. The value-add in the midstream is the transformation of raw space into a hyper-functional, branded corporate environment within an accelerated timeline (often much faster than a client could achieve internally). Provider expertise in navigating permits, managing complex subcontractor networks, and ensuring compliance with local regulations is paramount. The successful integration of technology platforms that allow clients to manage their space usage and amenities is a key midstream differentiator.

Downstream involves client acquisition, service delivery, and ongoing relationship management. Distribution channels are primarily direct, through dedicated enterprise sales teams that engage corporate real estate heads and HR departments, often leveraging existing relationships held by traditional real estate brokerage partners (indirect distribution). Direct channels ensure complex, custom requirements are accurately captured and implemented. The service delivery phase includes continuous maintenance, IT support, and dedicated community management—essential for maintaining high client satisfaction and ensuring contract renewal. The final value captured downstream is the recurring revenue stream generated by medium to long-term service contracts, sustained by exceptional operational performance and responsiveness to evolving client needs, particularly in maintaining high operational security and technological standards.

Managed Office Market Potential Customers

The primary potential customers and end-users of the Managed Office Market are large multinational corporations (MNCs) and fast-growing domestic enterprises that require significant flexibility and dedicated, high-quality workspaces without the burden of long-term capital commitment or complex facilities management. These customers are typically seeking to optimize their balance sheets, preferring OPEX over CAPEX models for real estate, and need rapid deployment capabilities in new markets or for temporary project teams. Potential customers also include organizations undergoing structural change, such as mergers or acquisitions, where real estate needs are highly volatile, or those implementing aggressive hybrid work policies that necessitate a network of smaller, strategically located hub offices that must maintain consistent corporate standards.

Within the largest customer segment, the BFSI sector represents a high-value customer base due to its critical demands for unparalleled security, network segregation, and compliance with financial regulations (e.g., SOX, GDPR). Managed Office providers capable of offering enterprise-grade, certified data centers and physically secured environments tailored to financial institutions find immense demand. Furthermore, the technology sector, encompassing software development, cloud services, and AI firms, consistently seeks managed solutions because of the need for specialized cooling, redundant power, and ultra-high-speed connectivity, coupled with the necessity of quickly scaling up or down project teams based on market cycles. These customers value the provider's ability to manage complex, non-core technical infrastructure flawlessly.

A rapidly expanding customer cohort includes medium-sized professional service firms (consulting, legal, accounting) and firms in the Healthcare/Life Sciences sector. Consulting firms use managed offices for client-facing project bases, requiring premium addresses and immediate setup capabilities globally. Healthcare and Life Sciences firms, including pharmaceutical companies and biotech startups, seek managed lab space or highly compliant administrative offices that adhere to strict health and safety standards. The attractiveness of the managed model to these varied customer profiles lies in the shift of risk and management complexity from the end-user organization to the specialized provider, enabling core business focus while guaranteeing a premium, controlled working environment that meets specific industry regulatory hurdles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $29.5 Billion |

| Market Forecast in 2033 | $80.2 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IWG plc (Regus, Spaces), WeWork, Servcorp, Industrious, The Executive Centre, Awfis, CoWrks, Bhive Workspace, Knotel, Mindspace, Flexiwork, CBRE, JLL, Cushman & Wakefield, Oxford Properties, Tishman Speyer, UCommune, Common Ground, Venture X, Office Evolution. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Managed Office Market Key Technology Landscape

The technological spine of the Managed Office Market is centered on creating intelligent, seamless, and highly secure working environments. This necessitates the deployment of advanced Internet of Things (IoT) sensors for continuous environmental monitoring (air quality, temperature, light), coupled with robust Building Management Systems (BMS) that use machine learning to automate climate control and energy consumption based on occupancy levels. Cybersecurity infrastructure is paramount, including segregated virtual private networks (VPNs) and dedicated fiber optic connections for each client to guarantee data isolation and high bandwidth, crucial for enterprise clients. Furthermore, mobile applications and proprietary software platforms are used for managing everything from room booking and amenity reservations to filing maintenance requests and controlling access via digital keys, simplifying the employee interaction with the physical workspace.

The rapid adoption of smart building technologies enables providers to collect vast amounts of data on spatial utilization, which is then analyzed using sophisticated analytics engines to inform operational decisions, such as cleaning frequency, staffing levels, and optimal office layout configuration for future clients. This data-driven approach allows managed office providers to offer performance guarantees related to efficiency and sustainability that traditional landlords cannot match. Integration capabilities are also critical; the managed office IT stack must seamlessly interface with the client’s existing enterprise resource planning (ERP) systems and internal HR software, ensuring smooth onboarding and off-boarding processes, especially for remote and hybrid teams accessing decentralized hub locations. This focus on seamless technological integration transforms the office space into a verifiable, measurable service.

Future technology trends point toward the widespread use of Digital Twins—virtual representations of the physical office space—used for real-time scenario planning, maintenance testing, and optimizing complex airflow or energy models before physical changes are implemented. The increased reliance on 5G and edge computing is improving the responsiveness of real-time sensor data, further enhancing the quality of service for applications like low-latency video conferencing and augmented reality (AR) used for remote collaboration. Investment in technologies that bolster physical security, such as sophisticated CCTV systems combined with AI-powered behavioral analysis and biometric access controls, remains a top priority, directly addressing the core concerns of large corporate customers regarding privacy and asset protection in flexible environments.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR, primarily driven by India, China, and Southeast Asia. This growth is underpinned by massive foreign investment, rapid urbanization, and a large population of digital-native companies that prioritize agility over fixed assets. Major cities like Bangalore, Mumbai, Singapore, and Sydney are seeing aggressive expansion from both international and domestic managed office providers. The high real estate costs and regulatory complexities in key APAC markets make the outsourced, managed model particularly attractive to multinational corporations seeking swift market entry or expansion without significant bureaucratic overhead. India’s market, in particular, is maturing rapidly, with major enterprises increasingly viewing managed offices as a long-term strategic real estate solution rather than a temporary fix.

- North America: This region holds a significant market share, characterized by mature adoption in technology, finance, and professional services sectors. Growth here is stable, driven mainly by the established trend of hybrid work and the need for decentralized satellite offices near suburban residential hubs. The market emphasizes high-end, premium managed solutions focused heavily on employee experience, amenities (wellness centers, specialized food and beverage), and sophisticated smart technology integration. Providers focus on securing long-term contracts (5-10 years) with Fortune 500 companies in primary markets such as New York, San Francisco, and Boston, prioritizing high-security standards and bespoke branding alignment.

- Europe: The European market, encompassing Western and Central Europe, shows robust demand, particularly in the UK, Germany, and France. Demand is fueled by regulatory harmonization within the EU, facilitating pan-European corporate portfolios managed centrally through a single provider. The European market places a strong emphasis on sustainability (Green Building certifications like BREEAM or LEED are highly valued) and adherence to stringent labor laws and data protection regulations (GDPR). London and Berlin remain key hubs, witnessing significant demand from high-growth tech startups and financial institutions seeking operational scalability and compliance reassurance through their managed office partners.

- Middle East and Africa (MEA): This region is an emerging high-potential market, largely concentrated in commercial hubs like Dubai, Riyadh, and Tel Aviv. Growth is driven by large-scale governmental diversification efforts away from oil economies, leading to the rapid establishment of technology parks and financial free zones. Managed offices are essential for rapidly establishing a presence for international firms entering these emerging markets. The primary focus for providers in MEA is on delivering ultra-luxury amenities, high-tech security, and rapid, turn-key solutions tailored to strict local business customs and high-net-worth client expectations.

- Latin America: The market in Latin America is developing steadily, with São Paulo, Mexico City, and Santiago leading the adoption. Economic volatility and currency fluctuations make the flexible, OPEX-focused nature of managed offices highly appealing to both local conglomerates and incoming MNCs. Challenges include varying real estate quality and infrastructure inconsistencies, meaning managed providers must invest heavily in guaranteed power backups and robust connectivity solutions to meet enterprise expectations. The market growth is primarily concentrated in the technology and shared services sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Managed Office Market.- IWG plc (Regus, Spaces)

- WeWork

- Servcorp

- Industrious

- The Executive Centre

- Awfis

- CoWrks

- Bhive Workspace

- Knotel

- Mindspace

- Flexiwork

- CBRE

- JLL

- Cushman & Wakefield

- Oxford Properties

- Tishman Speyer

- UCommune

- Common Ground

- Venture X

- Office Evolution

Frequently Asked Questions

Analyze common user questions about the Managed Office market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between a Managed Office and traditional coworking or serviced offices?

The primary distinction lies in customization, dedication, and operational scope. A Managed Office is a fully customized, branded, and dedicated space designed and operated solely for a single client, typically under medium- to long-term contracts (3-10 years). Coworking spaces are generally shared, non-customized, and used by multiple companies on flexible, short-term memberships. Managed solutions offer the full privacy, security, and IT segregation of a traditional office but without the capital risk and administrative burden, essentially functioning as outsourced real estate management for the client.

How does the Managed Office model support corporate ESG (Environmental, Social, and Governance) goals?

Managed Office providers inherently support ESG goals by aggregating demand and optimizing shared resources across their portfolios. Providers often invest in certified green buildings (LEED, BREEAM), implement advanced energy-efficient technologies (smart HVAC, renewable energy sourcing), and ensure sustainable material sourcing during fit-outs. By outsourcing real estate to specialized providers, corporations can rapidly reduce their operational carbon footprint and improve social metrics through enhanced amenities and wellness-focused designs without bearing the full capital cost of building or retrofitting sustainable infrastructure themselves. Providers also manage waste and recycling programs centrally.

What are the key technological security measures guaranteed by top Managed Office providers for enterprise clients?

Enterprise-grade security is a core offering, particularly in the BFSI and technology sectors. Key technological guarantees include segregated and dedicated IT infrastructure, meaning each client receives its own VLAN (Virtual Local Area Network) and secure firewall, preventing internal network access from other tenants. This is coupled with physical security layers such as dedicated, biometric or access-card controlled entrances to the client’s specific floor or suite, 24/7 CCTV monitoring with AI-driven anomaly detection, and adherence to global data compliance standards (e.g., ISO 27001 certification and GDPR compliance) managed by the provider’s IT team.

What impact has the global shift to hybrid work had on demand for Managed Offices?

The shift to hybrid work has significantly increased demand for Managed Offices, transforming them from a niche solution into a strategic necessity. Corporations are utilizing Managed Offices to establish decentralized, high-quality satellite hubs closer to employee populations, optimizing commute times and improving work-life balance. Furthermore, as headquarters shift from dense working environments to collaborative ‘destination centers,’ Managed Offices allow firms to secure high-quality, flexibly sized spaces optimized purely for team convergence, collaboration, and training, moving away from large, inefficient fixed desks, thus supporting the hub-and-spoke real estate strategy central to modern hybrid models.

Which geographical region is expected to lead market growth and why is its adoption accelerating?

The Asia Pacific (APAC) region, particularly driven by India and Southeast Asia, is projected to lead market growth with the highest CAGR. This acceleration is due to rapid economic expansion, massive influx of global technology and e-commerce companies seeking rapid scaling capabilities, and the inherent complexity of navigating local real estate markets. Managed Offices provide MNCs with a fast, standardized, and legally compliant pathway for market entry and scaling, offering superior infrastructure and facilities management compared to what is often available through traditional leasing in emerging APAC commercial centers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager