Mandrel Release Agents Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442503 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Mandrel Release Agents Market Size

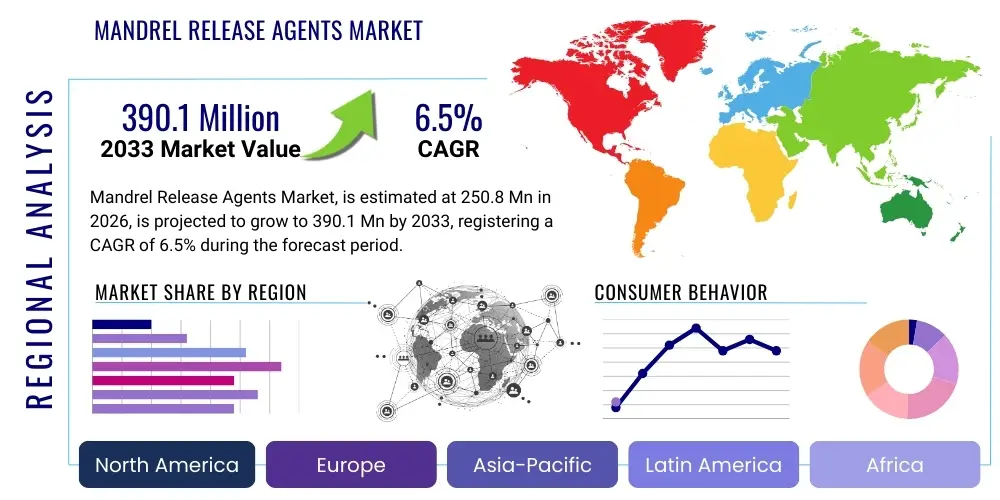

The Mandrel Release Agents Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 250.8 Million in 2026 and is projected to reach USD 390.1 Million by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the accelerating demand for high-performance composite materials across critical industrial sectors, notably aerospace, automotive, and infrastructure development, where precision molding and defect-free demolding processes are paramount. The reliability of mandrel release agents directly correlates with the efficiency and quality of composite component production, cementing their necessity in modern manufacturing chains.

The valuation reflects robust investment in advanced manufacturing techniques, particularly in areas requiring filament winding and pultrusion processes for producing seamless, cylindrical components like hoses and pipes. As regulatory standards push for lighter, yet stronger, materials—especially in electric vehicle (EV) construction and infrastructure rehabilitation—the reliance on sophisticated release agents that do not compromise the integrity or surface finish of the final product becomes a critical cost and performance differentiator. Geographically, growth is highly concentrated in regions experiencing rapid infrastructure expansion and technological uptake in composite fabrication, such as the Asia Pacific and North America.

Mandrel Release Agents Market introduction

Mandrel Release Agents are specialized chemical formulations applied to the surface of a mandrel (a core around which material is formed) to prevent adhesion between the mandrel and the formed composite component, ensuring smooth and non-destructive demolding. These agents are crucial in the manufacturing of rubber hoses, composite pipes, aerospace components, and various cylindrical or hollow molded parts using processes like winding, wrapping, or dipping. The primary benefits include increasing production throughput, extending the life of expensive mandrels, and achieving superior surface quality on the finished product, thereby minimizing rework and scrap rates. Market driving factors include the surging global automotive industry, particularly the demand for high-pressure hoses and fluid transfer systems, coupled with growing adoption of advanced composites in infrastructure projects requiring durable, corrosion-resistant piping. Furthermore, environmental regulations are spurring the development and adoption of solvent-free and water-based release agent formulations.

The product landscape spans various chemical bases, including silicone, fluoropolymer (PTFE), wax, and water-based dispersions, each selected based on the specific temperatures, materials, and complexity of the component being manufactured. For instance, high-temperature composite processing often necessitates fluoropolymer or silicone-based formulations due to their exceptional thermal stability and minimal transfer properties. Major applications are concentrated in the manufacturing of rubber hoses for automotive fluid systems, reinforced concrete pipes, and high-tech composite tubing used in oil & gas exploration and defense sectors. The function of these agents is not merely separation; they also serve to protect the mandrel surface from wear and chemical attack, ensuring long-term operational efficiency and precision.

Mandrel Release Agents Market Executive Summary

The Mandrel Release Agents Market is characterized by intense technological innovation, driven by the need for enhanced environmental compliance and superior demolding performance in high-stakes manufacturing environments. Key business trends include the shift toward concentrated, semi-permanent, and solvent-free formulations that offer better cost-in-use benefits and reduce Volatile Organic Compound (VOC) emissions, aligning with stringent global environmental standards. Regional trends show robust growth in the Asia Pacific, propelled by the massive expansion of automotive manufacturing bases in China and India, alongside significant investments in regional infrastructure development requiring composite pipes and specialized hoses. North America and Europe remain mature markets, focusing heavily on specialized, high-margin applications in aerospace and medical devices, driving demand for ultra-clean, non-transferring release systems. Segmentation trends indicate a pronounced shift toward polymer-based and water-based agents over traditional solvent-based systems, reflecting both technological advancement and regulatory pressure across all major end-use industries.

The competitive landscape is moderately fragmented, featuring global chemical giants alongside specialized niche producers focusing on specific material compatibility challenges. Strategic imperatives for leading market players involve optimizing distribution networks and expanding technical support services to address the complex and varied needs of composite manufacturers. Furthermore, the market structure is heavily influenced by the raw material supply chain, particularly the cost and availability of specialized silicone and fluoropolymer precursors. Success in this market is increasingly dependent on the ability to develop tailored solutions that integrate seamlessly into automated manufacturing processes, thereby offering measurable improvements in cycle time and reducing defect rates for highly critical components.

AI Impact Analysis on Mandrel Release Agents Market

User queries regarding AI’s impact on the Mandrel Release Agents Market primarily revolve around optimizing application processes, predicting coating failures, and developing novel formulations using machine learning (ML). Users are concerned with how AI can minimize waste, ensure uniform coating thickness in complex geometries, and automate quality control checks during the mandrel wrapping or winding process. Key expectations focus on AI-driven simulation tools for predicting the thermal and chemical interactions between the release agent, the composite material, and the mandrel surface, potentially reducing the extensive physical testing currently required during R&D. Furthermore, there is significant interest in using predictive maintenance algorithms to determine the optimal reapplication cycle for semi-permanent release coatings, thereby preventing premature failure and subsequent component adhesion, which is a major manufacturing bottleneck.

AI’s influence extends beyond process optimization into material informatics. ML models can analyze vast datasets of chemical structures and performance parameters to rapidly identify promising candidates for next-generation, high-temperature, or eco-friendly release agent formulations, significantly accelerating the innovation lifecycle. In manufacturing facilities, AI-powered vision systems are being deployed to monitor the application of the release agent, ensuring complete coverage and consistent film thickness, automatically flagging defects that human inspectors might miss. This integration of smart monitoring and predictive analytics elevates the quality and efficiency of composite production, transforming the application of these agents from a routine manual step into a precision-engineered process.

- AI-driven optimization of release agent application parameters (e.g., spray pattern, volume, drying time) to ensure uniformity.

- Machine Learning (ML) used for material informatics, accelerating the discovery of novel, high-performance, and sustainable chemical bases.

- Predictive maintenance algorithms for determining optimal reapplication cycles of semi-permanent release agents, extending mandrel lifespan.

- Integration of AI vision systems for automated quality control of coating thickness and surface integrity before composite layup.

- Simulation tools using AI to model complex thermal and chemical interactions, minimizing physical prototyping and failure rates.

DRO & Impact Forces Of Mandrel Release Agents Market

The Mandrel Release Agents market is primarily driven by the expanding adoption of composite materials across key industries and stringent quality requirements in precision manufacturing. Restraints include the high cost associated with advanced fluoropolymer and specialized silicone-based formulations, coupled with regulatory hurdles concerning VOC emissions, which challenge traditional solvent-based agents. Opportunities emerge from the growing trend of lightweighting in the automotive and aerospace sectors, increasing demand for highly durable, low-transfer, and semi-permanent systems. Impact forces manifest as the perpetual push-pull between the need for maximal release efficacy and the necessity of maintaining environmentally compliant, non-contaminating formulations that do not interfere with post-molding processes like painting or bonding. These dynamics dictate that successful market players must innovate towards water-based and bio-derived solutions while simultaneously enhancing performance in demanding high-heat and high-pressure applications.

Drivers: The dominant driver is the unprecedented growth in composite manufacturing, particularly filament winding for pipes and hoses used in water treatment, oil and gas, and automotive brake and fluid lines. The inherent difficulty of demolding complex composite shapes without specialized agents ensures consistent demand. Further impetus comes from the aerospace industry's shift towards larger, unitary composite structures, which require flawless release characteristics to meet rigorous safety and quality specifications. The increasing automation in composite production lines also favors reliable, consistent release systems that minimize downtime.

Restraints: Significant restraints include the volatile cost structure of key raw materials, especially high-grade silicones and advanced polymers, impacting the overall cost of the finished release agent. Furthermore, the global regulatory environment, particularly in Europe and North America, imposes strict limits on the use of solvent carriers due to VOC concerns (Volatile Organic Compounds), forcing manufacturers into expensive R&D for compliant alternatives. Technical challenges also exist in developing universal agents that perform consistently across diverse composite matrices (epoxy, vinyl ester, polyester) and high-temperature curing cycles.

Opportunities: Opportunities abound in the development of specialized, non-contaminating release agents optimized for sensitive applications, such as medical device manufacturing and advanced structural composites that require secondary bonding operations. The market for semi-permanent, high-cycle-life coatings represents a substantial growth area, offering manufacturers reduced application time and material usage. Furthermore, leveraging nanotechnology and specialized surface treatments to create ultra-low surface energy coatings promises superior performance and opens new avenues for customization in niche markets.

Segmentation Analysis

The Mandrel Release Agents market is comprehensively segmented based on its chemical composition (Type), the specific industrial application (End-Use Industry), and its physical form (Formulation), allowing for targeted product development and market strategy. The segmentation by type is crucial as it dictates the thermal stability, application method, and compatibility with the composite or rubber matrix. By end-use industry, the segmentation highlights the varied quality and volume requirements across sectors like automotive, aerospace, and construction. The ongoing shift is toward advanced, specialized agents within the high-performance segments, driven by regulatory demands for safer and more efficient manufacturing processes globally.

The complexity of composite manufacturing often necessitates a highly tailored approach to release agent selection, making detailed segmentation vital. For instance, the rubber hose segment demands agents that tolerate high-pressure steam curing, while aerospace composites require agents that ensure zero transfer to the final part surface. This diversity ensures that the market remains highly segmented, with manufacturers continually innovating to create hyper-specific solutions. Growth is expected to be highest in the PTFE and other fluoropolymer-based segments due to their inertness and excellent thermal resistance, crucial for modern, high-temperature composite curing processes.

- By Type:

- Silicone-Based

- Fluoropolymer (PTFE) Based

- Wax-Based

- Water-Based / Aqueous Dispersions

- Other Polymer & Proprietary Blends

- By Formulation:

- Solvent-Based

- Water-Based

- Semi-Permanent Coatings

- By End-Use Industry:

- Automotive (Hoses, Tubes)

- Aerospace & Defense (Composite Structures)

- Construction & Infrastructure (Piping, Composite Rebar)

- Industrial (Hydraulic & Pneumatic Hoses)

- Medical Devices

- Others (Marine, Energy)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Mandrel Release Agents Market

The value chain for Mandrel Release Agents begins with the Upstream Analysis, which focuses on the sourcing and processing of core raw materials such as specialized silicone polymers (polydimethylsiloxane), fluoropolymer resins, and various waxes and emulsifiers. The cost and quality of these chemical precursors are fundamental determinants of the final product's performance and market price. Key suppliers in this stage are major chemical producers and specialty polymer manufacturers. The midstream involves the formulation and compounding processes, where specialized chemical companies blend, disperse, and package these raw materials into application-specific release agents, often requiring highly specialized chemical engineering expertise to ensure thermal stability and optimal film formation.

The Downstream Analysis involves the distribution and application of the finished agents. Distribution channels are multifaceted, utilizing both Direct and Indirect methods. Direct sales are common for large-volume customers and complex industrial applications (e.g., Tier 1 automotive suppliers or aerospace manufacturers), allowing for technical consultation and tailored service. Indirect channels involve specialty chemical distributors and regional agents who manage inventory and provide localized support to smaller and medium-sized composite molders. Effective distribution is critical, as these products are often technical consumables requiring prompt delivery and detailed handling instructions. The final consumption occurs at the end-use manufacturing facility, where proper application techniques are essential for achieving the intended demolding performance and overall cost-efficiency.

Mandrel Release Agents Market Potential Customers

Potential customers for Mandrel Release Agents are primarily large-scale manufacturers engaged in the production of hollow, cylindrical, or complex composite/rubber components using mandrels. The End-User/Buyers of these products are concentrated within the automotive supply chain (manufacturers of fuel hoses, radiator hoses, and turbocharger pipes), demanding agents capable of high-temperature curing and repetitive use. Aerospace manufacturers constitute a highly lucrative customer base, requiring agents that deliver impeccable surface finish and ensure zero contamination for mission-critical structural components. Beyond these, industrial manufacturers of high-pressure hydraulic hoses, composite piping for water infrastructure, and pultrusion companies specializing in composite rods and profiles represent significant, volume-driven customer segments. The common thread among these buyers is the necessity for solutions that enhance operational efficiency, minimize component defects, and extend the serviceable life of expensive metallic or ceramic mandrels.

In addition to traditional industrial applications, emerging sectors like Electric Vehicle (EV) battery cooling systems and next-generation composite wind turbine blades are becoming pivotal customers. EV thermal management requires specialized hoses molded over complex mandrels, necessitating high-performance release agents tailored for fluoroelastomers and advanced plastics. Furthermore, companies involved in rehabilitating aging infrastructure using cured-in-place pipe (CIPP) technology also constitute potential customers, utilizing specialized release films or agents during the liner inversion process. The purchasing decision often rests not solely on price, but heavily on the agent’s reliability, technical support offered by the supplier, and verified certifications for use with specific composite chemistries and curing protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250.8 Million |

| Market Forecast in 2033 | USD 390.1 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chem-Trend, KLK Oleo, BASF SE, Dow Inc., Solvay S.A., Wacker Chemie AG, Momentive Performance Materials, Resbond, Freudenberg Chemical Specialties, Axel Plastics Research Laboratories, Marbocote Ltd., Stoner Inc., Rexco, PolyOne (Avient), Henkel AG & Co. KGaA, Miller-Stephenson Chemical Co., Inc., Daikin Industries, Ltd., Shin-Etsu Chemical Co., Ltd., Michelman, Inc., Specialty Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mandrel Release Agents Market Key Technology Landscape

The technological landscape of the Mandrel Release Agents market is defined by continuous innovation focused on achieving superior thermal stability, reduced transfer, and enhanced environmental safety. A significant trend involves the transition from traditional sacrificial (single-use) release agents to advanced semi-permanent coating technologies. These semi-permanent systems, often based on high-performance fluoropolymers or reactive silicone chemistries, utilize cross-linking mechanisms to chemically bond the release film to the mandrel surface, allowing for multiple demolding cycles without reapplication. This shift dramatically improves production efficiency and lowers overall material consumption, positioning semi-permanent technology as a key differentiator in precision composite manufacturing, particularly in aerospace and high-end automotive applications.

Another crucial technological development is the pervasive adoption of water-based (aqueous) release formulations. Driven by global mandates to limit VOC emissions and improve worker safety, these formulations utilize advanced emulsification and dispersion technologies to deliver high performance previously only achievable with solvent carriers. Furthermore, nanotechnology is beginning to influence the market, with research focused on incorporating specialized nanoparticles (such as PTFE micropowders or unique ceramic compounds) into release agent matrices. This inclusion aims to reduce surface energy further, increase resistance to abrasive wear during composite layup, and ensure non-stick performance even under extreme thermal cycling conditions typical of modern thermoset curing processes.

Finally, automated and precision application technologies are integral to the key technology landscape. Automated spray systems and robotic applicators ensure uniform film thickness and coverage, which is paramount for preventing "holidays" (areas missed by the agent) that lead to adhesion failures and costly component rejection. The development of quick-drying and thermally optimized formulations complements these automated systems, allowing manufacturers to maintain high production throughput. Future technological advancements will likely center on 'smart' release agents that can self-heal minor abrasions or indicate coating integrity status, integrating the agent even more closely with the digitalization of the manufacturing floor.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing region, fueled primarily by expansive growth in automotive production (especially in China, India, and Southeast Asia) and massive government investment in infrastructure projects, including wastewater and oil & gas piping, which rely heavily on composite solutions. The region is a major hub for rubber hose manufacturing, driving high volume demand for traditional and water-based mandrel release agents. Economic industrialization, coupled with lower manufacturing costs, makes APAC a critical consumption and production center.

- North America: North America is characterized by high demand for specialized, high-performance agents, driven by its dominant aerospace and defense sectors, which prioritize zero-defect demolding and non-contaminating formulations. The mature automotive sector, rapidly pivoting towards electric vehicle (EV) components, also demands sophisticated release systems for advanced material handling. Strict environmental regulations necessitate the widespread adoption of low-VOC and water-based products, positioning the region at the forefront of technological uptake.

- Europe: The European market is highly regulated, placing immense pressure on manufacturers to use environmentally sustainable, solvent-free solutions. Demand is strong from the advanced manufacturing sector, particularly in Germany and Italy, for high-end industrial machinery components, automotive systems, and specialized medical devices. Europe leads in the adoption of semi-permanent and high-efficiency release coatings to maximize production output under stringent quality assurance protocols.

- Latin America (LATAM): LATAM’s growth is moderate but steady, largely influenced by industrial recovery and localized infrastructure investments, particularly in Brazil and Mexico. Demand is concentrated in the general industrial manufacturing, construction, and localized automotive assembly sectors. Price sensitivity is higher here, leading to a strong demand for cost-effective, high-yield traditional release agents, though a gradual transition toward better performance agents is observed.

- Middle East and Africa (MEA): The MEA market is driven primarily by the oil & gas industry, which requires substantial quantities of composite pipes and high-pressure hoses for exploration and transportation infrastructure. This sector demands agents capable of withstanding extreme temperatures and harsh chemical environments. Investment in infrastructure and diversification efforts away from solely oil-dependent economies are also bolstering demand for construction-related composite materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mandrel Release Agents Market.- Chem-Trend

- KLK Oleo

- BASF SE

- Dow Inc.

- Solvay S.A.

- Wacker Chemie AG

- Momentive Performance Materials

- Resbond

- Freudenberg Chemical Specialties

- Axel Plastics Research Laboratories

- Marbocote Ltd.

- Stoner Inc.

- Rexco

- PolyOne (Avient)

- Henkel AG & Co. KGaA

- Miller-Stephenson Chemical Co., Inc.

- Daikin Industries, Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Michelman, Inc.

- Specialty Products

Frequently Asked Questions

Analyze common user questions about the Mandrel Release Agents market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are Mandrel Release Agents and why are they essential in manufacturing?

Mandrel Release Agents are specialized chemical coatings applied to a mandrel's surface to prevent the manufactured product (typically a composite pipe, hose, or rubber part) from sticking, ensuring easy and defect-free demolding. They are essential for maintaining production efficiency, protecting expensive tooling, and achieving the required surface finish on hollow or complex components.

What is the key difference between solvent-based and water-based mandrel release agents?

Solvent-based agents use chemical solvents as carriers, offering fast drying times and excellent film uniformity but releasing Volatile Organic Compounds (VOCs). Water-based agents use water as the carrier, offering environmental and safety benefits (low VOCs) and are rapidly becoming the preferred choice due to stringent regulatory pressures, despite requiring slightly longer drying times.

Which end-use industries are the primary drivers of demand for Mandrel Release Agents?

The primary drivers are the Automotive Industry (especially for manufacturing high-pressure fluid and air hoses), the Aerospace & Defense Sector (for complex composite structural components), and the Construction/Infrastructure industry (for composite and rubber piping systems).

How do semi-permanent release agents differ in function and application from sacrificial agents?

Sacrificial agents are consumed or removed during a single demolding cycle, requiring reapplication for every component. Semi-permanent agents form a durable, cross-linked film that adheres strongly to the mandrel, allowing for dozens or even hundreds of demolding cycles from a single application, significantly improving throughput and reducing material usage.

What role does fluoropolymer (PTFE) technology play in the Mandrel Release Agents market?

Fluoropolymer (PTFE) technology is critical for high-performance applications, particularly those involving extreme curing temperatures or aggressive chemical environments. PTFE-based agents offer exceptional thermal stability, superior non-stick properties, and extremely low transfer rates, making them ideal for high-precision aerospace and high-temperature composite molding.

END OF REPORT

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager