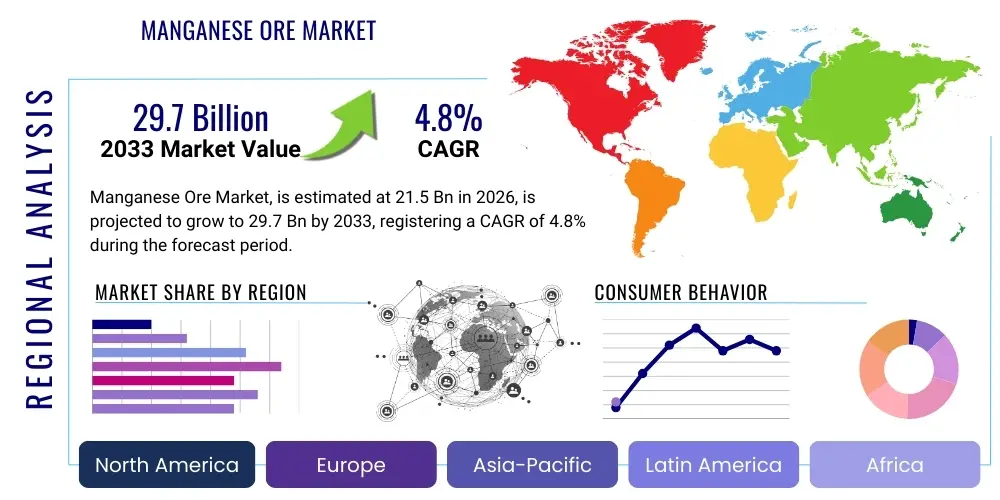

Manganese Ore Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443603 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Manganese Ore Market Size

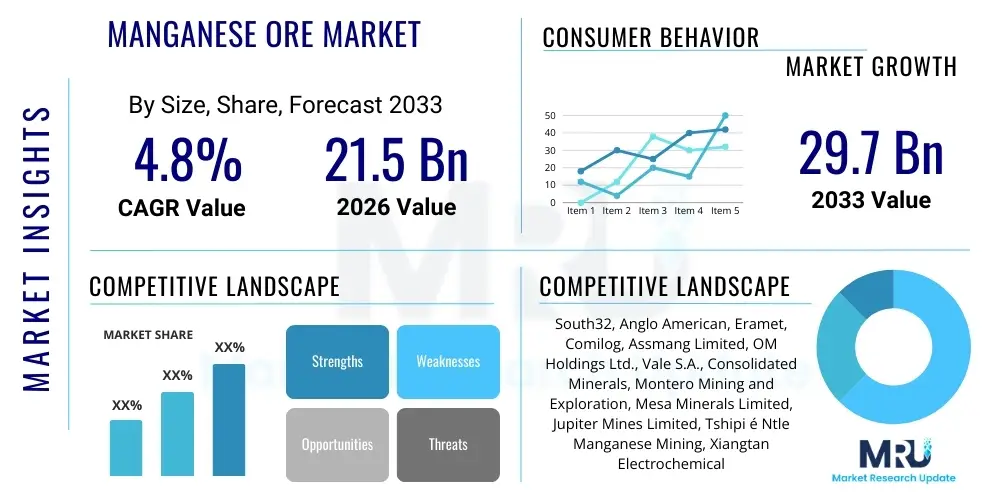

The Manganese Ore Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 21.5 billion in 2026 and is projected to reach USD 29.7 billion by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally underpinned by the sustained expansion of the global steel industry, which accounts for the vast majority of manganese consumption, alongside emerging, high-growth applications in electrochemical energy storage systems. Price volatility, supply chain resilience efforts, and increasing regulatory pressure regarding mining sustainability are critical factors shaping this market valuation throughout the forecast horizon.

Manganese Ore Market introduction

Manganese ore, primarily composed of manganese oxides, is a foundational industrial mineral critical to global manufacturing and modern infrastructure development. It serves predominantly as a vital raw material in the production of ferroalloys, such as ferromanganese and silicomanganese, which are indispensable components in steel manufacturing. Manganese imparts essential properties to steel, including enhanced strength, toughness, hardness, and resistance to corrosion and abrasion, making it non-substitutable in conventional steelmaking processes. The functionality of manganese extends beyond metallurgy, finding significant utility in the chemical sector for producing manganese dioxide (used in dry-cell batteries and fertilizers) and potassium permanganate (a powerful oxidizing agent).

The core application driving market demand remains its utilization in basic oxygen furnaces and electric arc furnaces globally, ensuring the quality and durability of structural and specialty steel. Furthermore, the market is experiencing a structural shift with the accelerated adoption of lithium-ion batteries and related energy storage solutions, where high-purity manganese is necessary for cathode materials like Lithium Manganese Oxide (LMO) and Nickel Manganese Cobalt (NMC). This diversification into high-technology applications is augmenting traditional demand patterns, providing a robust second pillar of growth and encouraging investment in higher-purity ore processing capabilities.

Key driving factors include unprecedented global urbanization and infrastructure spending, particularly across Asia Pacific nations, necessitating large volumes of steel. Benefits associated with manganese ore consumption include the operational efficiency it lends to steel production and its growing strategic importance in the energy transition narrative. However, the market remains highly concentrated geographically, subjecting global supply chains to geopolitical risks and localized operational disruptions, which necessitates strategic sourcing and inventory management for downstream consumers.

Manganese Ore Market Executive Summary

The Manganese Ore Market is characterized by robust demand stemming from traditional metallurgical applications, complemented by rapidly expanding high-purity requirements from the battery sector. Business trends indicate a movement towards vertical integration among major mining entities and ferroalloy producers to mitigate supply chain risks and stabilize pricing. Key players are increasingly investing in sophisticated processing technologies, such as hydrometallurgy and beneficiation techniques, aimed at upgrading lower-grade ores and meeting the stringent quality specifications required for battery-grade manganese, thereby establishing specialized, high-margin product streams alongside bulk commodities.

Regional trends highlight the dominance of the Asia Pacific (APAC) region, primarily due to China and India’s extensive steel production capabilities and massive infrastructural projects. While APAC remains the largest consumer, strategic mining activities are centered in South Africa, Australia, Gabon, and Brazil, creating complex intercontinental trade flows. North America and Europe, while having limited mining operations, are focusing heavily on developing domestic processing capabilities and establishing resilient supply chains for battery materials, often involving long-term off-take agreements with African or Australian producers, aligning with broader decarbonization and supply security policies.

Segment trends demonstrate the ferroalloy sector’s continued supremacy in volume consumption, particularly high-carbon ferromanganese (HC FeMn). However, the application segment for battery production is exhibiting the highest Compound Annual Growth Rate (CAGR), suggesting a future shift in market focus toward chemical processing and high-purity manganese sulfate (HPMSM). Within product type, high-grade ores (typically above 44% Mn content) command premium pricing due to superior processing efficiency and suitability for specialized applications, driving exploration efforts into rich deposits capable of sustaining high-quality output.

AI Impact Analysis on Manganese Ore Market

User inquiries regarding AI's influence on the Manganese Ore Market primarily center on how digitalization can enhance operational efficiency, improve geological modeling, and refine market forecasting amidst inherent commodity price volatility. Common questions address the role of predictive maintenance in mining equipment, the integration of machine learning (ML) for optimizing ore blending and processing yields, and how AI-driven analytics might stabilize or predict supply-demand imbalances, particularly concerning the nascent high-purity manganese segment. Users are concerned about implementing these capital-intensive technologies efficiently and the potential for AI-enabled systems to create a competitive advantage in cost-reduction and resource utilization.

AI and machine learning technologies are poised to revolutionize several critical facets of the manganese mining and processing lifecycle, ranging from initial exploration to final logistics. In exploration, deep learning algorithms analyze vast datasets—including geophysical surveys, satellite imagery, and drilling results—to identify new, economically viable ore deposits with greater accuracy and speed than traditional methods. Operationally, AI-powered systems monitor sensor data across crushers, beneficiation plants, and material handling systems to predict equipment failure, schedule preventative maintenance, and optimize energy consumption in energy-intensive processes like sintering and smelting, leading to substantial reductions in operational expenditure (OPEX) and improved uptime.

Furthermore, AI is instrumental in quality control and process optimization within processing plants. Machine vision systems can rapidly assess ore quality and particle size distribution, allowing for real-time adjustments in sorting and blending protocols to ensure consistent feed for ferroalloy furnaces or hydrometallurgical routes. This capability is especially critical for producing high-purity manganese required for battery applications, where minimal contaminants are tolerated. The integration of advanced analytics also aids in sophisticated market modeling, offering producers enhanced visibility into global steel output forecasts and electric vehicle (EV) battery material demand, enabling more strategic production planning and hedging decisions to manage price risk effectively.

- AI-driven geological modeling enhances accuracy in identifying high-grade manganese reserves.

- Predictive maintenance algorithms reduce downtime and operational costs of heavy mining machinery and processing equipment.

- Machine learning optimizes ore blending and beneficiation processes, improving yield and reducing waste material.

- AI analytics facilitate real-time quality control for battery-grade manganese production, meeting stringent purity requirements.

- Advanced forecasting models assist in managing price volatility and supply chain resilience based on global steel and EV demand.

DRO & Impact Forces Of Manganese Ore Market

The Manganese Ore Market is propelled by the robust and continuous demand from the global steel industry, which relies on manganese for its non-substitutable role as a deoxidizer and alloying agent. A significant driver is the accelerating penetration of Electric Vehicles (EVs) globally, fueling monumental growth in the demand for high-purity manganese derivatives for cathode materials, thus providing a high-value, high-growth segment outside of traditional metallurgy. Market opportunities are primarily concentrated around technological innovations aimed at sustainable and high-purity production, including developing economically viable methods for mining high-quality ore and enhancing recycling infrastructure for manganese-containing slag and spent batteries, addressing both resource constraints and environmental pressures.

Restraints in the market largely revolve around geographical concentration risks, with South Africa and Australia controlling a major portion of the world's high-quality ore supply, leading to potential supply chain bottlenecks influenced by geopolitical instability or labor disputes in these regions. The substantial capital expenditure required for developing new deep-sea or high-grade terrestrial mines, coupled with volatile commodity prices and the high energy consumption associated with ferroalloy production, act as financial restraints. Furthermore, increasing scrutiny regarding environmental, social, and governance (ESG) compliance is imposing stricter operational standards and higher compliance costs on mining companies.

The primary impact force shaping the market dynamics is the rapid energy transition, which is elevating manganese from a bulk commodity to a strategic battery metal. This shift is creating a dual market structure: a mature, high-volume market driven by steel, and an evolving, high-margin market driven by battery technology. This impact force compels established miners and new entrants to strategically adapt their resource extraction and processing focus, influencing long-term investment decisions toward specialized processing plants capable of meeting the rigorous demands of the battery supply chain and potentially altering the regional hierarchy of processing centers away from traditional ferroalloy hubs.

Segmentation Analysis

The Manganese Ore Market is rigorously segmented to provide granular insights into market dynamics, pricing structures, and technological requirements across various applications and product specifications. This detailed segmentation allows stakeholders to accurately gauge demand heterogeneity, enabling focused investment in specific mining grades or processing technologies. The primary basis for segmentation includes the grade of ore (defining its immediate applicability), the method of mining (impacting cost structure and environmental footprint), and the ultimate end-use application (determining the required level of purity and refinement). Analyzing these segments reveals shifting profit pools, particularly the increasing emphasis on high-purity manganese segments driven by non-metallurgical demand.

Segmentation by Product Type (Ore Grade) is critical as the manganese content dictates the suitability for ferroalloy production versus chemical applications; higher grades are often preferred for efficiency or required for battery applications, commanding a premium. Application segmentation clearly delineates the massive volume consumed by the ferroalloy sector from the rapidly growing, high-value demand in battery and chemical industries. Geographically, the market analysis is essential for identifying regions with high consumption (e.g., China for steel production) versus regions with high extraction activity (e.g., South Africa and Australia), highlighting crucial global trade corridors and the associated logistical challenges.

- By Product Type (Ore Grade):

- High-Grade Manganese Ore (typically >44% Mn)

- Medium-Grade Manganese Ore (30%–44% Mn)

- Low-Grade Manganese Ore (

- By Application:

- Ferroalloys (Ferromanganese, Silicomanganese)

- Battery Production (High-Purity Manganese Sulfate/Electrolytic Manganese Dioxide)

- Chemical Industry (Potassium Permanganate, Manganese Salts)

- Others (Agriculture, Water Treatment, Pigments)

- By Mining Type:

- Open Pit Mining

- Underground Mining

- Seabed Mining (Emerging)

Value Chain Analysis For Manganese Ore Market

The value chain for the Manganese Ore Market begins with complex upstream activities encompassing exploration, geological surveying, and mineral extraction. Upstream analysis focuses heavily on key mining jurisdictions—predominantly South Africa, Australia, Gabon, and Brazil—where large-scale open-pit and underground operations are utilized to extract the raw ore. Technological improvements in extraction efficiency and beneficiation (washing, crushing, screening, and heavy media separation) at this stage are crucial for determining the quality and cost base of the subsequent refined product. Success in the upstream segment relies heavily on securing mining licenses, managing high operational risks, and ensuring robust logistics infrastructure to transport the bulk commodity to major consuming ports.

The midstream sector involves processing the raw ore into marketable products, primarily ferroalloys (for metallurgy) or high-purity manganese chemicals (for batteries). Ferroalloy production is capital and energy-intensive, involving reduction in blast furnaces or electric submerged arc furnaces, typically located near cheap power sources (e.g., China, India, Russia, and South Africa). The midstream segment for high-purity manganese, a rapidly evolving field, involves sophisticated chemical refining, often hydrometallurgical, to produce high-purity manganese sulfate monohydrate (HPMSM) or electrolytic manganese metal (EMM). This stage adds significant value and requires high technological expertise to eliminate trace impurities detrimental to battery performance.

Downstream analysis centers on the distribution channels and end-user consumption. Direct sales are common for large volume contracts, particularly between major mining houses and integrated steel mills or large ferroalloy producers, ensuring long-term supply security. Indirect channels involve trading houses and specialized commodity brokers who manage complex international logistics, financing, and smaller volumes for diverse chemical and specialty applications. Ultimately, end-users are dominated by the global steel industry (around 90% consumption), with the remaining percentage absorbed by chemical manufacturers, battery producers, and agriculture. The emerging battery supply chain, characterized by rigorous quality checks and just-in-time delivery requirements, demands highly specialized distribution channels ensuring traceability and purity.

Manganese Ore Market Potential Customers

Potential customers for manganese ore and its derived products span across heavy industrial sectors and high-technology manufacturing environments, reflecting the mineral's dual strategic importance. The overwhelming majority of bulk purchasers are global integrated steel manufacturers and specialty steel producers. These entities require various grades of ferromanganese and silicomanganese as critical input materials for deoxidation, desulfurization, and alloying to meet specific mechanical properties for construction, automotive, and machinery applications. These customers seek long-term supply stability and competitive pricing due to the immense volumes consumed annually.

A rapidly expanding customer base is found within the battery supply chain, primarily cathode material manufacturers and precursor producers specializing in lithium-ion battery chemistries such as LMO and NMC. These customers demand extremely high-purity products, specifically High-Purity Manganese Sulfate Monohydrate (HPMSM) or Electrolytic Manganese Dioxide (EMD), and procurement is highly technical, focusing less on price and more on strict specifications, consistency, and verifiable ESG compliance. The rapid expansion of electric vehicle and grid storage manufacturing guarantees sustained growth in this premium customer segment.

Additional significant end-users include the chemical industry, notably manufacturers of potassium permanganate (used in water treatment and chemical synthesis), and the agricultural sector, which utilizes manganese compounds in fertilizers and animal feed supplements to correct nutrient deficiencies. These customers typically require specialized, chemically refined manganese products and often source through established chemical distributors or directly from specialized processing plants capable of producing non-metallurgical grades. The demand patterns from these sectors are steady, offering diversification away from the cyclical nature of the steel industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 21.5 billion |

| Market Forecast in 2033 | USD 29.7 billion |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | South32, Anglo American, Eramet, Comilog, Assmang Limited, OM Holdings Ltd., Vale S.A., Consolidated Minerals, Montero Mining and Exploration, Mesa Minerals Limited, Jupiter Mines Limited, Tshipi é Ntle Manganese Mining, Xiangtan Electrochemical Scientific Ltd., Guangxi Manganese Industry Group, and Nippon Denko Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Manganese Ore Market Key Technology Landscape

The technological landscape of the Manganese Ore Market is undergoing continuous refinement, driven primarily by the need to optimize efficiency in bulk processing and to meet the exacting purity demands of the battery industry. For bulk metallurgical grades, advancements focus on improving beneficiation techniques, such as Dense Media Separation (DMS) and magnetic separation, to maximize recovery rates from lower-grade ores and reduce waste. Furthermore, innovations in ferroalloy furnace design, including improved pre-treatment of feed material like sintering and pelletizing, aim to decrease energy consumption and minimize greenhouse gas emissions associated with the highly energy-intensive smelting process, enhancing the overall sustainability profile of standard manganese production.

The most transformative technological shifts are concentrated in the production of high-purity manganese products (HP Mn). Traditional electrolytic processes for producing EMM and EMD are being complemented, and sometimes superseded, by modern hydrometallurgical routes. These chemical processes involve leaching manganese ore with acids (e.g., sulfuric acid), followed by multiple stages of purification and solvent extraction to remove contaminants like iron, nickel, and cobalt down to parts-per-million levels. This precision chemistry is essential for battery material feedstock where impurities severely degrade performance and lifespan. Companies are heavily investing in proprietary leaching technologies and crystallization processes to enhance the yield and reduce the capital expenditure (CAPEX) associated with HPMSM production.

Additionally, the development of sustainable mining practices is heavily reliant on technological implementation. This includes utilizing advanced sensor-based sorting technologies to distinguish ore from waste rock underground, minimizing the amount of material hoisted and processed, thereby reducing energy use and environmental impact. Automated fleet management systems and the integration of digital twins for processing plants further enhance operational oversight and resource allocation. Future technological endeavors are expected to include efficient methods for recycling manganese from steel slag and end-of-life lithium-ion batteries, completing the circular economy model for this critical mineral.

Regional Highlights

Regional dynamics within the Manganese Ore Market reflect a distinct separation between major production centers and consumption hubs, dictated by resource availability, industrialization levels, and technological capacity. The global market is highly reliant on key mining regions, primarily South Africa, which possesses approximately 70-80% of the world’s high-grade manganese reserves, ensuring its position as the largest global exporter. This geographical concentration makes trade flows highly sensitive to policy changes, logistical efficiencies, and labor stability in Southern Africa. Conversely, the processing and manufacturing capabilities are largely centered in Asia Pacific, creating a robust, high-volume shipping corridor.

Asia Pacific (APAC) is undeniably the dominant consumer and processor, primarily driven by China and India. China alone accounts for the bulk of global steel production and is also the leading producer of ferroalloys and most high-purity manganese chemicals, necessitating massive imports of raw ore. The relentless demand for infrastructure development, coupled with aggressive expansion in the EV battery supply chain, solidifies APAC’s commanding market position. India is also seeing rapid growth in its domestic steel sector, contributing significantly to regional manganese consumption, leading to increased focus on both domestic mining and securing international supply agreements.

North America and Europe are characterized by their status as significant consumers of steel products and advanced battery materials, yet they possess minimal domestic manganese mining capacity. The strategic objective in these regions is focused on diversifying supply away from traditional sources and establishing secure, traceable supply chains for battery-grade manganese. Policy initiatives, such as the European Union’s Critical Raw Materials Act and similar US governmental programs, are actively encouraging investment in processing facilities, particularly for HPMSM, aiming to reduce dependence on external processors (mainly China) and enhance regional resilience in the energy transition materials market.

Latin America (LATAM), particularly Brazil, holds substantial reserves and operates large-scale mines that contribute significantly to global exports, primarily targeting North American and European ferroalloy producers. Middle East and Africa (MEA), dominated by South Africa, Gabon, and Ghana, are the undisputed leaders in raw ore extraction. South Africa’s position is critical, but the region is increasingly looking to move up the value chain by developing domestic ferroalloy smelting capacity and attracting foreign investment for high-purity chemical processing, challenging the historical model of exporting only raw or minimally processed ore.

- Asia Pacific (APAC): Largest consumer and processor; driven by massive steel production in China and India; rapid expansion of local EV battery manufacturing demanding high-purity materials.

- Middle East & Africa (MEA): Global leader in manganese ore reserves (South Africa); primary source of high-grade raw materials; strategic focus on value addition through domestic ferroalloy production.

- Europe: High demand for ferroalloys in specialty steel sectors; growing strategic imperative to localize high-purity manganese processing for the regional battery gigafactories; high dependency on imports.

- North America: Significant end-user market; increasing focus on securing resilient, traceable supply chains; limited domestic mining, driving investment in refining and recycling technologies.

- Latin America (LATAM): Brazil serves as a major exporter of manganese ore, supporting international supply chains for steel and chemical industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Manganese Ore Market.- South32

- Anglo American

- Eramet

- Comilog (Compagnie Minière de l'Ogooué)

- Assmang Limited

- OM Holdings Ltd.

- Vale S.A.

- Consolidated Minerals

- Montero Mining and Exploration

- Mesa Minerals Limited

- Jupiter Mines Limited

- Tshipi é Ntle Manganese Mining

- Xiangtan Electrochemical Scientific Ltd.

- Guangxi Manganese Industry Group

- Nippon Denko Co., Ltd.

- Glencore PLC

- African Rainbow Minerals (ARM)

- Manganex (Pty) Ltd

- Minas Rio (Iron Ore & Manganese)

- BHP Group (via historical associations and potential future interest)

Frequently Asked Questions

Analyze common user questions about the Manganese Ore market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for manganese ore?

The primary driver is the global steel industry, which uses manganese as an indispensable alloying agent and deoxidizer, accounting for approximately 90% of total consumption. Secondary, but rapidly growing, demand comes from the need for high-purity manganese in electric vehicle (EV) batteries.

How is the emerging battery market influencing the manganese ore value chain?

The battery market necessitates a shift towards high-purity manganese chemicals, such as HPMSM (High-Purity Manganese Sulfate Monohydrate), rather than raw ore or ferroalloys. This demands significant investment in complex, high-technology hydrometallurgical processing facilities, creating a distinct, high-value segment separate from the bulk commodity market.

Which regions dominate the global supply of high-grade manganese ore?

South Africa is the undisputed leader, holding the largest known reserves of high-grade manganese ore globally. Australia and Gabon are also critical supply regions, collectively ensuring that global supply remains geographically concentrated, leading to strategic sourcing challenges for consumers.

What is the difference between ferroalloy grade and battery grade manganese?

Ferroalloy grade manganese ore is used to produce ferromanganese or silicomanganese for steel, requiring high manganese content (typically 30-48%) but tolerating moderate impurities. Battery grade, conversely, demands extremely high purity (>99.9%), with impurities measured in parts-per-million (ppm), achieved only through advanced chemical refining processes.

What are the key sustainability challenges faced by the manganese mining sector?

Key challenges include managing the large environmental footprint of mining operations, reducing the high energy intensity and associated carbon emissions of ferroalloy production, and ensuring responsible sourcing concerning labor and community impacts, which collectively heighten the need for strict ESG compliance across the supply chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager