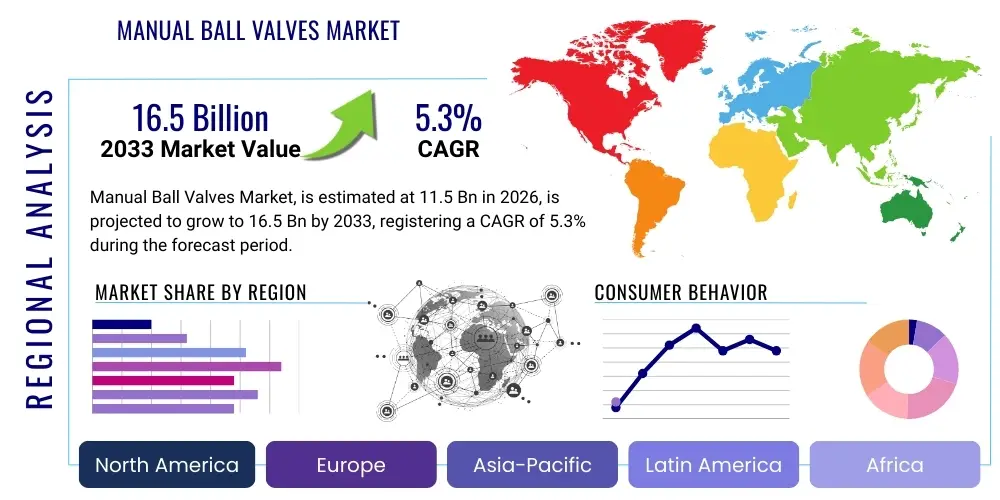

Manual Ball Valves Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441587 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Manual Ball Valves Market Size

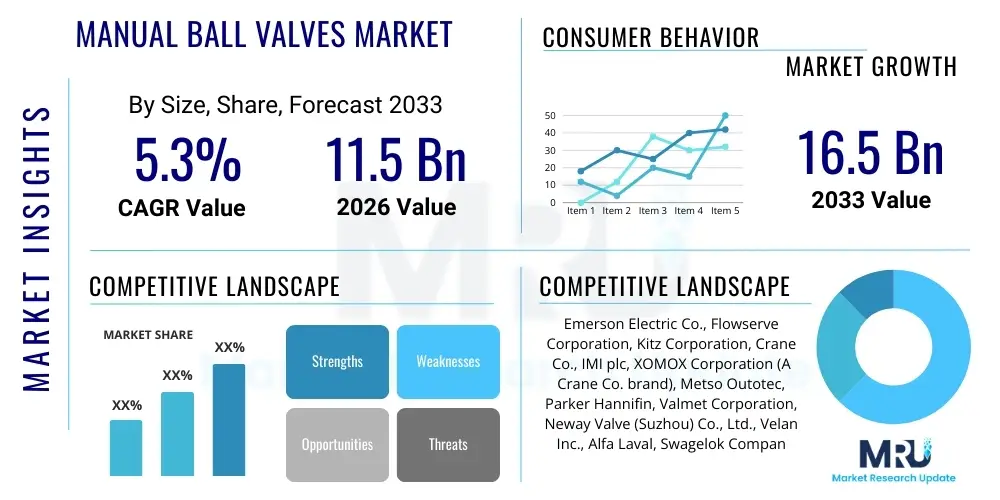

The Manual Ball Valves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.3% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 16.5 Billion by the end of the forecast period in 2033.

Manual Ball Valves Market introduction

The Manual Ball Valves Market encompasses a wide range of devices designed to control the flow of liquids or gases using a rotational ball having a bore through the center. These valves are fundamental components across numerous industrial and commercial systems due to their simple operation, reliability, cost-effectiveness, and excellent shut-off capabilities. They are predominantly used where quick shut-off is required and are favored over other valve types in applications demanding tight sealing and low maintenance. Key sectors driving demand include petrochemicals, oil and gas, water and wastewater treatment, power generation, and specialized applications in pharmaceuticals and food processing.

Manual ball valves are typically differentiated by their materials of construction, port size, pressure rating, and the type of end connections (e.g., flanged, threaded, welded). The product line includes standard two-way valves, multi-port valves, and specialized designs like cryogenic or high-temperature ball valves. A primary benefit of manual operation is the immediate control it offers without reliance on external power sources, making them critical safety components and preferred choices in less automated or remote installations. The increasing global focus on infrastructure development and the necessary maintenance of aging industrial assets are consistently reinforcing the utility and demand for robust manual ball valve solutions, ensuring their steady position in the fluid control landscape.

Manual Ball Valves Market Executive Summary

The Manual Ball Valves Market exhibits stable growth driven by global investments in industrial infrastructure and the essential need for reliable fluid control mechanisms across energy, chemical, and utility sectors. Business trends show a strong focus on developing materials that enhance corrosion resistance and withstand extreme pressures and temperatures, particularly within the upstream oil and gas sector and high-purity chemical processing. Manufacturers are increasingly integrating lightweight yet durable construction materials, such as specialized stainless steel alloys and high-performance polymers, to meet rigorous industry standards and minimize lifecycle costs. The competitive landscape is characterized by consolidation among major players seeking to broaden their product portfolios and geographical reach, while smaller manufacturers focus on niche applications requiring custom engineering and rapid turnaround.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid industrialization, urbanization, and substantial government spending on public infrastructure, including massive water supply projects and new power plants. North America and Europe maintain a mature market status, with demand primarily stemming from replacement cycles, stringent regulatory requirements favoring high-integrity valves, and expansion in specialized fields like natural gas distribution and advanced manufacturing. Segment trends indicate strong performance in the Trunnion-mounted segment, favored in large-diameter, high-pressure pipelines, while the application of exotic materials like titanium or hastelloy sees rising adoption in highly corrosive environments, thus commanding premium pricing and higher margins. Overall market buoyancy is underpinned by the irreplaceable function of manual isolation in process safety and operational efficiency.

AI Impact Analysis on Manual Ball Valves Market

User queries regarding the impact of Artificial Intelligence (AI) on the Manual Ball Valves Market primarily revolve around how traditional, purely mechanical components can interface with modern digital ecosystems. Users are concerned about whether AI integration will lead to the obsolescence of manual control and are seeking clarity on the role of predictive maintenance and smart monitoring in valve performance. Key themes highlight the shift towards "smart valves," which, while primarily actuated, utilize AI for analyzing operational data captured by associated sensors (vibration, temperature, pressure). Expectations center on AI enhancing the lifecycle management of manual valves by predicting failure points, optimizing preventative maintenance schedules, and ensuring compliance through automated data logging and anomaly detection, thereby extending the utility and reliability of existing manual installations rather than replacing them entirely.

While the operation of the manual ball valve itself remains mechanical—requiring human intervention for opening and closing—AI’s influence is profound in the surrounding operational environment. Advanced AI algorithms, particularly machine learning models, are being deployed to analyze vast datasets collected from flow meters and temperature sensors adjacent to manual valves. This allows facility operators to determine the optimal timing for manual valve maintenance, minimizing unexpected downtime. Furthermore, AI contributes significantly to supply chain efficiency, predicting demand fluctuations for specific valve types and optimizing inventory levels, which reduces lead times and improves market responsiveness. The integration is not about automating the 'manual' action, but rather digitizing the 'intelligence' surrounding the component's performance and maintenance requirements.

- AI-driven predictive maintenance scheduling enhances valve lifespan and reduces catastrophic failure rates.

- Automated data analytics improve inventory management and optimize the procurement cycles for replacement manual valves and associated components.

- AI monitoring systems detect performance deviations in processes controlled by manual valves, triggering alarms for human intervention.

- Machine learning assists in quality control during the manufacturing process, improving the consistency and integrity of valve components.

- AI optimizes material usage and reduces waste in the casting and machining of high-specification manual ball valve bodies.

DRO & Impact Forces Of Manual Ball Valves Market

The Manual Ball Valves Market is driven by consistent global capital expenditure in critical infrastructure, particularly in the energy sector and utility networks, where reliable isolation points are non-negotiable for safety and operation. Restraints largely involve volatility in the pricing of core raw materials such as steel and nickel, which directly impacts manufacturing costs and profit margins, alongside the increasing market penetration of automated valve systems in new, highly automated industrial installations. Significant opportunities exist in the refurbishment of aging infrastructure in developed economies and the adoption of specialized, high-integrity valves compliant with stringent environmental and safety regulations, such as those governing fugitive emissions in the oil and gas industry. These external and internal factors combine to create dynamic market forces that shape pricing power, innovation speed, and competitive strategies among market participants.

Drivers: A primary driver is the accelerating global pace of urbanization, necessitating substantial investments in water and wastewater management systems, which rely heavily on manual ball valves for distribution network control and emergency isolation. Furthermore, the robust growth in the global petrochemical and chemical processing industries, particularly in Asia, demands valves capable of handling corrosive media and extreme operating conditions. The inherent simplicity, low cost, and minimal maintenance required for manual ball valves compared to their automated counterparts ensure their continued preference in non-critical isolation services and backup systems. Regulations mandating specific safety standards in high-hazard environments, where a quick, positive shut-off is paramount, also sustain high demand.

Restraints: The market faces significant restraints from the continuous and often unpredictable fluctuations in the cost of metals like stainless steel (304, 316) and specialized alloys, which constitute the bulk of the valve weight and complexity. Another key restraint is the growing trend toward full process automation in advanced manufacturing and process industries (e.g., high-purity semiconductor manufacturing), which favors sophisticated actuated valves over manual operation for enhanced precision and remote control. Additionally, the lengthy qualification and certification processes required for manual valves used in highly regulated sectors (e.g., nuclear power, aerospace) pose barriers to entry and slow down product introduction cycles, limiting market fluidity.

Opportunities: Major opportunities lie in the replacement market, specifically targeting aging infrastructure in North America and Western Europe, where millions of valves are reaching the end of their design life and require modern, efficient replacements. Developing highly customized, application-specific manual ball valves, such as those designed for cryogenic services in LNG (Liquefied Natural Gas) transportation or high-pressure oxygen service, offers premium market expansion potential. The adoption of advanced coatings and sealing technologies to enhance performance in abrasive slurries or high-cycle applications presents another significant opportunity for specialized manufacturers to capture market share through superior product lifespan and reduced total cost of ownership (TCO).

Impact Forces: The most significant impact force is the macroeconomic environment, particularly global commodity pricing and industrial capital expenditure, which dictates investment in new plants and pipeline infrastructure. Regulatory pressures, especially those related to minimizing fugitive emissions (e.g., EPA standards, ISO 15848), force manufacturers to upgrade standard manual designs to include high-performance stem seals and packing arrangements, impacting both design complexity and unit cost. Technological innovation in sealing materials (e.g., PEEK, TFM) creates a competitive impact, pushing older, less reliable PTFE-seated valves out of demanding applications, while the growing industrial footprint of China and India exerts powerful regional market forces on pricing and volume distribution.

Segmentation Analysis

The Manual Ball Valves Market segmentation is crucial for understanding specific demand drivers and specialized application requirements across various industries. The market is primarily segmented based on the valve type (Floating Ball Valves, Trunnion Mounted Ball Valves), the material of construction (Stainless Steel, Cast Iron, Brass/Bronze, Exotic Alloys), and the end-user industry (Oil & Gas, Chemical & Petrochemical, Power Generation, Water & Wastewater, HVAC). Each segment possesses unique characteristics; for example, Trunnion valves dominate high-pressure applications, while stainless steel materials are standard across chemical processing due to corrosion resistance. Analyzing these segments helps identify high-growth niches, such as specialized valves for high-purity applications in pharmaceuticals or the emerging need for lightweight composite valves in marine applications.

The distinction between segment performance is strongly influenced by capital investment cycles within specific industries. The Oil & Gas segment often demands large-bore, high-pressure, and high-temperature manual ball valves, driving the Trunnion-mounted market. Conversely, the Water & Wastewater segment relies heavily on cost-effective Cast Iron or standard Stainless Steel valves for general purpose shut-off functions in non-critical environments. Manufacturers strategically tailor their production lines and distribution networks to cater to these divergent segment needs, ensuring compliance with varied international standards, such as API (American Petroleum Institute) for energy applications and ANSI (American National Standards Institute) for general industrial use, thereby maximizing their market relevance and penetration across different verticals.

- By Type:

- Floating Ball Valves

- Trunnion Mounted Ball Valves

- Segmented Ball Valves

- Multi-Port Ball Valves (3-way, 4-way)

- By Material:

- Stainless Steel (SS 304, 316)

- Cast Iron and Ductile Iron

- Carbon Steel

- Brass and Bronze

- Exotic Alloys (Hastelloy, Monel, Titanium)

- By End-User Industry:

- Oil and Gas (Upstream, Midstream, Downstream)

- Chemical and Petrochemical

- Water and Wastewater Treatment

- Power Generation (Thermal, Nuclear, Renewable)

- HVAC (Heating, Ventilation, and Air Conditioning)

- Pharmaceuticals and Food & Beverage

- Pulp and Paper

- By Size:

- Below 2 Inch

- 2 Inch to 6 Inch

- Above 6 Inch

Value Chain Analysis For Manual Ball Valves Market

The value chain for the Manual Ball Valves Market begins with the upstream procurement of raw materials, primarily specialized metal alloys and high-performance polymer sealing materials. This phase is characterized by high sensitivity to global commodity prices and reliance on certified foundries and metallurgical suppliers capable of meeting stringent industrial specifications, particularly concerning material traceability and non-destructive testing requirements. Efficiency at this stage is crucial, as raw material costs constitute a significant proportion of the final product expense. Key challenges include maintaining a diversified supply base to mitigate the risks associated with single-source reliance for high-grade alloys used in extreme pressure or temperature applications, while simultaneously ensuring material quality and adherence to global standards like ASTM and ASME.

The midstream phase involves manufacturing, including casting, forging, precision machining, assembly, and testing. This process is complex, requiring high capital investment in CNC machinery and rigorous quality control protocols (e.g., pressure testing, fugitive emission testing). Major manufacturers differentiate themselves here through technological expertise in design optimization, suchities like fire-safe certification (API 607), and achieving lean manufacturing efficiencies. The downstream phase focuses on distribution, where products move through direct sales channels to large Engineering, Procurement, and Construction (EPC) firms, or through indirect channels involving regional distributors, specialized stockists, and maintenance, repair, and overhaul (MRO) suppliers. Direct sales are preferred for large, customized project orders, while indirect channels serve standardized, high-volume replacement and maintenance demand, emphasizing localized technical support and rapid inventory availability.

The effectiveness of the distribution channel is a critical determinant of market success. Direct sales ensure deep customer engagement and better alignment with project specifications, but require substantial in-house sales engineering resources. Indirect distribution via third-party partners allows manufacturers to achieve broader market reach, particularly in geographically diverse regions like APAC, without excessive internal overhead. The choice of channel strategy must align with the product type; highly technical, specialized valves often necessitate direct interaction with end-users, while common, commodity-grade manual ball valves thrive in broad, stocking distributor networks. Both channels require effective supply chain management to minimize lead times and ensure the authenticity and quality of the final product delivered to the end-user facilities.

Manual Ball Valves Market Potential Customers

Potential customers for manual ball valves span the entire industrial infrastructure spectrum, with the primary end-users being operators of large-scale processing facilities, utility companies, and construction project managers. The most lucrative segment consists of Engineering, Procurement, and Construction (EPC) contractors executing major capital projects in the oil refining, chemical production, and power generation sectors, as they purchase valves in bulk based on detailed project specifications and regulatory compliance requirements. These buyers prioritize product certification (e.g., API, ISO), vendor reputation, and reliable delivery timelines, often requiring customized material compositions to handle specific process media. Their purchasing decisions are highly influenced by project budget constraints and long-term operational lifespan considerations.

Another significant customer base includes Maintenance, Repair, and Overhaul (MRO) departments within existing industrial plants, pipeline operators, and municipal water authorities. These customers drive consistent demand for standard, readily available manual ball valves for ongoing system upkeep, replacement of aging assets, and minor system modifications. Unlike EPCs, MRO buyers often prioritize rapid availability, competitive pricing, and compatibility with legacy systems. Additionally, original equipment manufacturers (OEMs) who integrate fluid control components into their machinery, such as pump skid manufacturers or HVAC system fabricators, represent a stable customer segment requiring medium-volume, standardized valve configurations. Understanding the technical needs and purchasing cycles of these diverse buyer groups is essential for effective market penetration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 16.5 Billion |

| Growth Rate | 5.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerson Electric Co., Flowserve Corporation, Kitz Corporation, Crane Co., IMI plc, XOMOX Corporation (A Crane Co. brand), Metso Outotec, Parker Hannifin, Valmet Corporation, Neway Valve (Suzhou) Co., Ltd., Velan Inc., Alfa Laval, Swagelok Company, Cameron (A Schlumberger Company), CIRCOR International, Inc., Apollo Valves, GWC Valve International Inc., Bray International, Inc., Samson AG, Spirax-Sarco Engineering plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Manual Ball Valves Market Key Technology Landscape

The technology landscape in the Manual Ball Valves Market is less about radical new inventions and more focused on continuous, incremental improvements in material science, sealing technology, and manufacturing precision to enhance operational safety and longevity. A primary technological focus is on reducing or eliminating fugitive emissions, which involves designing superior stem packing systems using high-performance materials like reinforced PTFE (Polytetrafluoroethylene) or graphite composite packing. Manufacturers are adopting advanced machining techniques, such as diamond-polished balls and seats, to achieve Class VI shutoff capabilities consistently, meeting stringent API 641 and ISO 15848 standards. These material and design advancements are crucial for high-pressure, high-temperature applications where leakage poses both an environmental and a safety risk, driving higher value for specialized valve designs over standard, commodity components.

Furthermore, technology related to material coatings and surface treatments is gaining prominence, particularly for applications involving abrasive media or corrosive chemicals. Techniques such as hard-facing (e.g., Tungsten Carbide) and specialized polymer coatings are applied to the ball and seating surfaces to extend the valve's service life significantly, especially in slurry handling or highly acidic environments within the mining and chemical industries. This enhancement minimizes the frequency of maintenance shutdowns and reduces the total cost of ownership for the end-user. The ongoing development of lightweight, high-strength composite materials for valve bodies, particularly for non-critical, low-pressure applications like water treatment and HVAC, aims to reduce installation complexity, transportation costs, and material consumption, presenting a sustainable technological shift in the segment.

Finally, manufacturing technologies centered on quality assurance and traceability are critical. The use of advanced computational fluid dynamics (CFD) software enables engineers to simulate flow characteristics and internal stress distribution during the design phase, leading to optimized flow paths and reduced pressure drop. Non-destructive testing (NDT) methods, including ultrasonic and radiographic inspection, are standard practices to ensure the integrity of castings and welds, particularly for critical service valves (e.g., nuclear or cryogenic). The increased adoption of 3D printing for rapid prototyping and the creation of highly complex internal geometries for specialized valves represents a frontier technology, allowing for faster customization and the efficient production of low-volume, high-specification components required by niche markets.

Regional Highlights

The global Manual Ball Valves Market exhibits distinct regional dynamics heavily influenced by local industrial maturity, regulatory environment, and infrastructure investment patterns. The Asia Pacific (APAC) region is currently the epicenter of market growth, driven by massive infrastructure expansion in countries like China, India, and Southeast Asian nations. Investments in new chemical plants, oil refineries, and large-scale urban water projects necessitate a high volume of general-purpose and specialized manual ball valves. The regional focus is often on achieving cost efficiency and scaling production volumes rapidly, although demand for high-integrity valves is rising due to increasing environmental awareness and adoption of Western safety standards in high-risk sectors.

North America and Europe represent mature markets characterized by stringent regulatory oversight, high operational safety standards, and demand driven predominantly by replacement, refurbishment, and capacity expansion in specialized sectors. In North America, the ongoing expansion of pipeline infrastructure for natural gas and crude oil, coupled with the need to modernize aging refining capacity, sustains demand for large-diameter, Trunnion-mounted valves compliant with API standards and fugitive emission mandates. European demand is equally strong in the chemical and pharmaceutical industries, where manual ball valves are critical for isolation and ensuring high purity, necessitating specialized materials and rigorous certification compliant with PED (Pressure Equipment Directive) and ATEX directives.

The Middle East and Africa (MEA) region is dominated by the oil and gas sector, where capital expenditure on upstream exploration, midstream transport, and downstream processing drives significant demand for high-pressure, high-temperature (HPHT) manual ball valves. Major national oil companies (NOCs) and international energy firms prioritize robust, reliable valves with fire-safe designs and proven track records in severe service conditions. Latin America, while smaller, shows variable growth, primarily tied to oil and mining projects in countries like Brazil and Mexico, creating focused demand for valves resistant to abrasive slurries and highly corrosive media found in mineral extraction processes, making material selection a paramount local requirement.

- Asia Pacific (APAC): Highest growth region driven by urbanization, industrialization, and massive investment in water treatment and chemical manufacturing facilities, with a strong focus on high-volume production and competitive pricing.

- North America: Market stability supported by rigorous safety regulations, pipeline expansion projects, and critical need for replacement of decades-old infrastructure, favoring high-integrity, fugitive-emission certified valves.

- Europe: Demand concentrated in high-value sectors such as chemical processing, pharmaceuticals, and power generation (including nuclear), with strong emphasis on conformity to regional directives like ATEX and PED.

- Middle East and Africa (MEA): Market concentration heavily skewed towards the oil and gas industry, demanding robust Trunnion-mounted ball valves for severe service applications and large-diameter pipelines.

- Latin America: Growth tied to commodity cycles, particularly mining and petrochemical exploration, requiring manual valves designed for abrasive and highly corrosive environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Manual Ball Valves Market.- Emerson Electric Co.

- Flowserve Corporation

- Kitz Corporation

- Crane Co.

- IMI plc

- XOMOX Corporation (A Crane Co. brand)

- Metso Outotec

- Parker Hannifin

- Valmet Corporation

- Neway Valve (Suzhou) Co., Ltd.

- Velan Inc.

- Alfa Laval

- Swagelok Company

- Cameron (A Schlumberger Company)

- CIRCOR International, Inc.

- Apollo Valves

- GWC Valve International Inc.

- Bray International, Inc.

- Samson AG

- Spirax-Sarco Engineering plc

Frequently Asked Questions

Analyze common user questions about the Manual Ball Valves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Floating and Trunnion Mounted Manual Ball Valves?

Floating ball valves are typically used for smaller sizes and lower pressure applications, relying on line pressure to push the ball against the downstream seat for sealing. Trunnion mounted ball valves utilize a mechanical anchor (trunnion) at the top and bottom of the ball to absorb axial forces, making them suitable for larger diameters, high-pressure, and high-temperature critical service applications where precise sealing and reduced torque are essential.

Which end-user segment drives the highest demand for Manual Ball Valves?

The Oil and Gas segment, encompassing upstream, midstream (pipeline), and downstream (refining) activities, drives the highest demand both in volume and value, due to the critical need for reliable isolation points, high operating pressures, and stringent safety standards requiring fire-safe and fugitive emission certified manual valves across exploration and processing infrastructure globally.

How do global regulations, such as fugitive emission standards, affect the Manual Ball Valves market?

Fugitive emission standards (like ISO 15848 and API 641) mandate rigorous testing and superior stem sealing designs, forcing manufacturers to innovate using advanced packing materials (e.g., graphite, specialized PTFE) and precise machining. This regulatory push increases the unit cost and technical complexity of valves, effectively driving up the market value of specialized, high-integrity manual ball valves, especially in mature markets like North America and Europe.

What are the key materials used for manufacturing Manual Ball Valves and how do they impact applications?

Common materials include Stainless Steel (for corrosion resistance in chemical/food processing), Carbon Steel (for high-pressure service in general industrial and oil & gas), and Brass/Bronze (for non-corrosive, low-pressure applications like HVAC and water). The material choice directly dictates the valve’s suitability for specific media, temperature, pressure rating, and overall lifespan, making it a crucial specification point for buyers.

Is the Manual Ball Valves market threatened by the increasing adoption of automated valve systems?

While automated (actuated) valves are dominating highly integrated, precise control applications, the manual segment remains stable and essential. Manual valves are irreplaceable for critical isolation, emergency shut-off, backup systems, and non-critical services where cost-effectiveness and simplicity are prioritized. Automation adoption primarily influences new plant builds, but the vast installed base and MRO segment consistently ensure strong demand for manual replacements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager