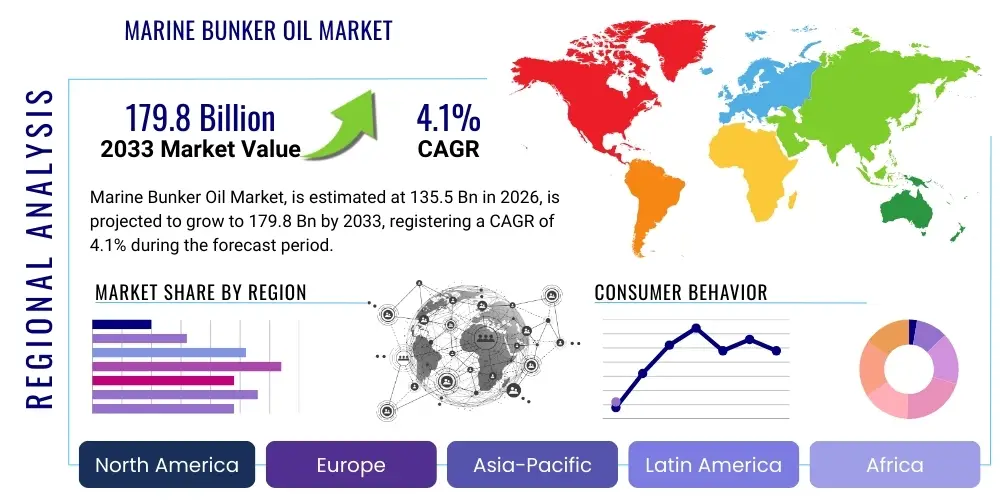

Marine Bunker Oil Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443606 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Marine Bunker Oil Market Size

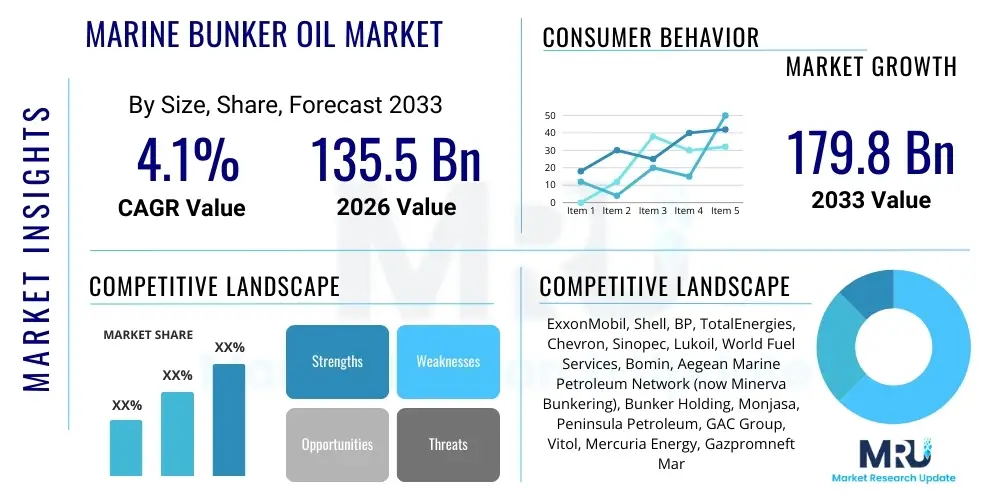

The Marine Bunker Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.1% between 2026 and 2033. The market is estimated at USD 135.5 Billion in 2026 and is projected to reach USD 179.8 Billion by the end of the forecast period in 2033.

Marine Bunker Oil Market introduction

The Marine Bunker Oil Market encompasses the supply and demand landscape for fuels utilized in maritime transportation, driving global trade and commerce. This essential market includes a diverse portfolio of fuel types, historically dominated by Heavy Fuel Oil (HFO), but increasingly transitioning toward Very Low Sulfur Fuel Oil (VLSFO), Marine Gas Oil (MGO), and alternative low-carbon fuels such as Liquefied Natural Gas (LNG), methanol, and eventually, ammonia. The core function of bunker oil is to power marine engines, ensuring the propulsion and operational integrity of vessels ranging from massive container ships and bulk carriers to specialized chemical tankers and cruise liners. Given the maritime sector's critical role in the global supply chain, the demand for bunker fuel is intrinsically linked to macroeconomic indicators, geopolitical stability, and global trade volumes.

Key benefits derived from marine bunker oil, particularly the compliant fuels mandated by the International Maritime Organization (IMO), include reduced sulfur oxide emissions (SOx), promoting better air quality in coastal and port areas, and enabling shipping lines to operate within stringent environmental regulatory frameworks. The transition towards lower sulfur content, necessitated by IMO 2020 regulations, has fundamentally reshaped the refining and supply infrastructure, demanding significant investment in desulfurization technologies both at refineries and onboard vessels (scrubbers). This regulatory environment is the primary driving factor dictating modern market dynamics, pushing the industry towards cleaner and more complex fuel chemistries.

Major applications of marine bunker oil span the entire spectrum of maritime activities, including international shipping, coastal trade, offshore support, and naval operations. The primary driving factors for market growth extend beyond regulatory compliance to include the sustained expansion of global seaborne trade, particularly in emerging economies of the Asia Pacific region, continuous technological advancements in engine efficiency, and the development of robust infrastructure for alternative bunker fuels (e.g., LNG bunkering hubs). However, the market faces significant challenges from fluctuating crude oil prices, the complexity and cost associated with developing low-carbon fuels, and the vast capital expenditure required to retrofit or build new vessels capable of utilizing these novel energy sources. The interplay between traditional fossil fuels and nascent alternative energy vectors defines the current competitive landscape.

Marine Bunker Oil Market Executive Summary

The Marine Bunker Oil Market is currently undergoing a structural transformation characterized by strict environmental compliance requirements and a burgeoning push toward decarbonization. Business trends emphasize dual-fuel engine technologies, significant infrastructure investment in VLSFO and MGO production, and strategic partnerships between energy majors and shipping lines to secure long-term compliant fuel supply. The necessity for reliable, quality-assured bunker supply has intensified due to the technical complexities introduced by blended VLSFOs and the growing global adoption of scrubbers to allow continued use of high sulfur fuel oil (HSFO) in certain trades. Forward-looking strategies increasingly focus on supply chain digitization for enhanced transparency and efficiency in bunkering operations.

Regional trends indicate that the Asia Pacific (APAC) region, driven by major bunkering hubs like Singapore, Zhoushan, and Fujairah, remains the largest and most dynamic market. Singapore, in particular, dominates the global physical supply landscape and is pioneering the adoption of alternative fuels, evidenced by its push towards LNG and bio-bunker capabilities. North America and Europe are characterized by tighter emissions control areas (ECAs) and relatively higher utilization of MGO and VLSFO, coupled with stronger governmental support for research and development into zero-emission fuels. The Middle East, leveraging its strategic position and crude oil production capacity, serves as a crucial transit and supply point, managing high volumes of traditional and compliant fuels.

Segmentation trends highlight the rapid expansion of the Low Sulfur and Ultra-Low Sulfur categories, primarily VLSFO and MGO, at the expense of traditional HFO, except among vessels equipped with exhaust gas cleaning systems (scrubbers). The fuel type segment sees LNG gaining considerable traction, especially for new builds and specific trade routes, driven by its immediate sulfur and NOx reduction capabilities, although methane slip remains a concern. Furthermore, the segmentation by vessel type reveals sustained, high-volume demand from container ships and bulk carriers—the backbone of global trade—while cruise ships, highly sensitive to public perception and environmental regulations, are aggressively adopting the cleanest available solutions, including shore power and LNG.

AI Impact Analysis on Marine Bunker Oil Market

User queries regarding the impact of Artificial Intelligence (AI) on the Marine Bunker Oil Market frequently revolve around optimizing fuel consumption, predicting price volatility, and enhancing regulatory compliance tracking. Key themes emerging from these questions include the viability of predictive analytics for global bunkering optimization (e.g., dynamic routing based on fuel availability and pricing), the role of machine learning in quality control and fraud detection in blended fuels, and how AI can assist in calculating and minimizing a vessel's Carbon Intensity Indicator (CII). Users are specifically concerned about the integration challenges of large-scale AI platforms with legacy operational technology (OT) systems onboard ships and at port terminals, seeking confirmation on ROI and scalability for small to medium-sized fleets. The overarching expectation is that AI will transition bunker purchasing from a reactive, transactional process to a proactive, highly optimized strategic function, reducing costs and significantly improving environmental performance metrics.

AI’s influence is profound across the entire bunker supply chain, starting from demand forecasting, which uses complex models integrating geopolitical data, trade flow predictions, and historical consumption patterns to anticipate localized demand shifts. This predictive capability allows bunker suppliers to manage inventories more efficiently and hedge against price risks, optimizing the deployment of bunker barges. Furthermore, AI-driven digital twin technologies are being utilized to simulate engine performance and fuel use under varying operational conditions, enabling masters and ship managers to determine the optimal speed and route profile that minimizes fuel burn while adhering to schedule, directly impacting consumption rates and procurement volumes.

Moreover, the application of AI extends into the critical area of fuel quality assurance and compliance management. Machine learning algorithms can analyze sensor data from fuel flow meters and engine combustion diagnostics in real-time to detect deviations in fuel quality, preventing engine damage and ensuring VLSFO blends remain stable and compliant with ISO standards. In terms of regulatory oversight, AI platforms are instrumental in automating the collection and reporting of data required for emissions regulations (e.g., EU MRV, IMO DCS, CII), reducing administrative burden and providing auditable trails for compliance purposes, thereby mitigating the risk of penalties associated with non-compliant operations. This data-driven approach fundamentally enhances operational efficiency and strategic decision-making in bunkering.

- AI-driven Predictive Maintenance: Utilizing sensor data to forecast engine maintenance needs, ensuring optimal fuel combustion efficiency and reducing unexpected downtime.

- Dynamic Fuel Price Prediction: Machine learning models analyzing global crude markets, geopolitical events, and logistical constraints to forecast localized bunker price fluctuations, optimizing procurement timing.

- Optimal Routing & Speed Calculation: AI algorithms determine the most fuel-efficient routes by factoring in weather conditions, hull resistance, draft, and compliant zone requirements (ECA/SECA).

- Automated Compliance Reporting (CII/DCS): Streamlining the collection, verification, and submission of mandatory environmental performance data, ensuring regulatory adherence.

- Enhanced Fuel Quality Monitoring: Real-time analysis of bunker fuel characteristics using machine learning to detect stability issues or non-compliance with sulfur content regulations.

DRO & Impact Forces Of Marine Bunker Oil Market

The Marine Bunker Oil market is intensely shaped by dynamic interactions among its Drivers, Restraints, and Opportunities, collectively forming powerful Impact Forces that dictate investment and strategic direction. The primary driving force remains the relentless global regulatory pressure, exemplified by the IMO's mandate for decarbonization and the establishment of the Carbon Intensity Indicator (CII) rating system, compelling the industry to adopt cleaner, higher-cost fuels. This regulatory push is compounded by the sustained growth in seaborne trade, which necessitates higher overall fuel volumes, especially from regions like Asia where manufacturing and export activities are expanding rapidly. Technological advancements in shipbuilding, specifically the proliferation of dual-fuel engines compatible with LNG, methanol, and future fuels, also drive market evolution by creating specialized demand segments and infrastructure requirements.

Conversely, significant restraints impede the market's trajectory, chiefly the extreme volatility in crude oil prices, which directly translates to unpredictable bunker costs, complicating long-term planning for shipping companies. Furthermore, the massive capital expenditure required for global infrastructure development needed to support alternative fuels (e.g., global methanol or ammonia bunkering networks) presents a major hurdle, especially for developing nations or smaller ports. The uncertainty surrounding the technical viability and regulatory framework for future zero-carbon fuels (such as ammonia's toxicity and energy density challenges) further acts as a restraint, leading to hesitant investment decisions known as the 'technology lock-in' risk among shipowners.

Despite these challenges, substantial opportunities exist, driven by the innovation required for the energy transition. The market presents opportunities for energy companies to establish early mover advantage in providing bio-bunkers (e.g., bio-MGO, bio-VLSFO) or synthetic fuels (e.g., e-Methanol) that offer immediate pathways to emissions reduction within existing regulatory frameworks. The increasing digitalization of the bunker supply chain, leveraging technologies like blockchain for transparency and AI for optimization, offers scope for efficiency gains and reduced transactional risks. The impact forces are thus dominated by the 'Energy Transition Imperative,' which forces stakeholders across the value chain—from refiners to end-users—to prioritize long-term sustainability and compliance over short-term cost minimization, fundamentally altering procurement strategies and infrastructure blueprints.

Segmentation Analysis

The Marine Bunker Oil Market is meticulously segmented based on key operational and technical characteristics, providing a granular view of market dynamics influenced by regulatory mandates and technological uptake. The segmentation primarily analyzes the market across Fuel Type, Sulfur Content, and Vessel Type, reflecting the complexity introduced by the IMO 2020 low-sulfur mandate and the subsequent drive toward decarbonization. Understanding these segments is crucial for stakeholders to tailor their product offerings, manage supply chain risks, and anticipate shifts in regional demand patterns. The ongoing introduction of new alternative fuels, such as methanol and LNG, continually reshapes the market share distribution among these established segments, indicating a profound shift away from purely petroleum-based dominance.

The segmentation by Fuel Type reveals the competitive landscape between traditional residual fuels and distillate fuels, alongside the emerging category of alternative low-carbon energy sources. Heavy Fuel Oil (HFO) remains relevant due to scrubber adoption but faces structural decline; Very Low Sulfur Fuel Oil (VLSFO) has become the contemporary standard for compliant operations, utilizing complex blends; and Marine Gas Oil (MGO) serves high-demand, high-regulation segments like passenger vessels and ECA zones. The segmentation by Sulfur Content (High, Low, Ultra-Low) is directly linked to geographic operating restrictions, with low and ultra-low sulfur fuels dominating ECAs and general global operations, while high sulfur fuel is concentrated in routes favoring scrubber investment.

Furthermore, segmentation by Vessel Type directly correlates fuel demand with trade activity and regulatory exposure. Container ships, characterized by fixed routes and intense operational requirements, are major consumers and early adopters of dual-fuel solutions. Bulk carriers and tankers, often operating on more flexible routes, represent significant volume demand and tend to favor established compliant fuels like VLSFO. Cruise ships, focused heavily on minimizing environmental impact and maximizing passenger comfort, prioritize the cleanest options, including MGO, shore power, and increasingly, LNG, thus driving specialized demand profiles in key coastal regions. This multi-dimensional segmentation allows for precise market forecasting and strategic resource allocation.

- Fuel Type:

- Heavy Fuel Oil (HFO)

- Very Low Sulfur Fuel Oil (VLSFO)

- Marine Gas Oil (MGO)

- Liquefied Natural Gas (LNG)

- Methanol/Ammonia/Bio-Bunkers

- Sulfur Content:

- High Sulfur Fuel Oil (HSFO, >0.5%)

- Low Sulfur Fuel Oil (LSFO, 0.1% to 0.5%)

- Ultra-Low Sulfur Fuel Oil (ULSFO, <0.1%)

- Vessel Type:

- Container Ships

- Tankers (Crude, Product, Chemical)

- Bulk Carriers

- Cruise and Ferry Ships

- General Cargo and Other Vessels

Value Chain Analysis For Marine Bunker Oil Market

The value chain of the Marine Bunker Oil Market is intricate, starting from the extraction of crude oil and extending through highly specialized distribution to the final consumer vessel. The upstream segment is dominated by major oil producers and refineries responsible for crude processing. Following the IMO 2020 mandate, the refining sector has undergone substantial reconfiguration, investing heavily in coking, hydrocracking, and desulfurization units to increase the yield of compliant fuels like VLSFO and MGO, shifting away from maximizing residual HFO. Refineries strategically located near major maritime trade routes, such as those in the Persian Gulf or Southeast Asia, hold a distinct advantage, influencing global pricing and supply stability. The efficiency and flexibility of these upstream operations in adapting to complex blending requirements directly influence the quality and availability of bunker fuels globally.

The midstream section involves transportation and storage, utilizing large crude carriers and product tankers to move refined fuels to regional storage hubs, which include major coastal terminals and floating storage units (FSUs) positioned near high-traffic ports. This stage is critical for inventory management and blending operations, where various low-sulfur components are mixed to create stable, compliant VLSFO blends. The distribution channel, the most visible downstream segment, involves specialized bunker suppliers, traders, and physical suppliers operating dedicated bunker barges. Distribution can be direct, where a major oil company sells fuel procured from its own refinery straight to a shipping line, or indirect, involving intermediaries (traders) who negotiate deals, manage logistics, and leverage market knowledge to connect buyers and physical suppliers globally, absorbing much of the price volatility risk.

Downstream analysis focuses on the final delivery and consumption. The delivery process often involves Ship-to-Ship (STS) transfers at anchorage or alongside the berth, requiring specialized equipment and strict adherence to safety protocols. End-users, the global fleet of commercial vessels, procure fuel based on voyage requirements, regulatory constraints (ECAs), and economic considerations. The shift towards alternative fuels introduces complexity in the distribution channel, requiring cryogenic storage and specialized transfer systems for LNG or highly controlled handling protocols for methanol and ammonia. The growing importance of digitalization in this segment, utilizing mass flow meters (MFMs) and electronic documentation, is focused on improving accuracy, reducing transactional fraud, and enhancing the transparency required for sustainability reporting.

Marine Bunker Oil Market Potential Customers

The primary customers in the Marine Bunker Oil Market are the owners and operators of the global fleet of commercial vessels, whose procurement decisions are driven by operational efficiency, regulatory compliance, and cost minimization. This diverse group is broadly categorized by the vessel type, reflecting differing fuel consumption patterns and risk profiles. Container shipping companies, operating on rigid schedules, represent high-volume, continuous demand, often engaging in long-term contracts for compliant fuels (VLSFO, LNG) to ensure supply security on major East-West and North-South trade lanes. Their purchasing strategy is highly centralized and sophisticated, integrating fuel hedging and consumption optimization technologies.

Another major customer segment includes owners of bulk carriers and oil/product tankers, which collectively account for the largest share of deadweight tonnage (DWT) globally. These vessels often operate on tramp trade routes, leading to more fragmented and opportunistic purchasing patterns, dictated by spot market pricing at various global ports. Many owners in this segment have invested in scrubbers, maintaining significant demand for cost-effective High Sulfur Fuel Oil (HSFO) on non-ECA routes, thus creating a stable demand base for the less expensive residual fuel, provided they can ensure global availability and regulatory acceptance of their scrubber technology.

Niche but high-value customer segments include cruise lines and naval forces. Cruise ship operators are extremely sensitive to environmental optics and operate extensively within strict Emission Control Areas (ECAs), leading them to favor Ultra-Low Sulfur Fuel Oil (ULSFO), MGO, or alternative zero-emission technologies like shore power connection capabilities and LNG. Their contracts typically prioritize quality and environmental certifications over purely minimizing cost per ton. Naval and coast guard fleets, while having smaller overall consumption volume compared to commercial shipping, demand highly specific fuel grades (often specialized F-76 diesel) with emphasis on guaranteed security of supply and compliance with military specifications rather than commercial pricing pressures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 135.5 Billion |

| Market Forecast in 2033 | USD 179.8 Billion |

| Growth Rate | 4.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ExxonMobil, Shell, BP, TotalEnergies, Chevron, Sinopec, Lukoil, World Fuel Services, Bomin, Aegean Marine Petroleum Network (now Minerva Bunkering), Bunker Holding, Monjasa, Peninsula Petroleum, GAC Group, Vitol, Mercuria Energy, Gazpromneft Marine Bunker, Chimbusco, Glencore, KPI OceanConnect. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Marine Bunker Oil Market Key Technology Landscape

The technology landscape governing the Marine Bunker Oil Market is centered on two critical areas: maximizing efficiency of traditional fuels and facilitating the adoption of cleaner energy sources. A pivotal technological shift has been the mandatory adoption of exhaust gas cleaning systems, commonly known as scrubbers, which allow vessels to continue burning lower-cost High Sulfur Fuel Oil (HSFO) while meeting air quality regulations. These systems, utilizing wet or dry scrubbing processes, neutralize sulfur oxides from engine exhaust, offering a pragmatic compliance bridge for older vessels or those with long service lives ahead. Simultaneously, engine manufacturers have rapidly developed high-efficiency two-stroke and four-stroke engines optimized specifically for Very Low Sulfur Fuel Oil (VLSFO) and Marine Gas Oil (MGO), ensuring stable combustion and maximizing fuel economy under varying loads, supported by advanced electronic control systems.

In parallel, the market is profoundly influenced by the necessary technologies to support alternative fuels. Liquefied Natural Gas (LNG) bunkering requires specialized cryogenic storage tanks (Type B, C, or membrane tanks) both onboard the vessel and at the bunkering terminal, along with sophisticated transfer systems to manage boil-off gas (BOG) and maintain ultra-low temperatures. This necessitates the development of robust, standardized BOG handling systems and reliquefication technologies on the ship. Looking forward, the emerging technologies for methanol and ammonia bunkering are focused heavily on safety. Methanol requires robust tank coatings and specialized handling due to its corrosive nature, while ammonia demands highly advanced safety protocols and sensor technology due to its toxicity and associated challenges in combustion efficiency and NOx reduction.

Digital technologies are also transforming the transactional and operational aspects of bunkering. The implementation of Mass Flow Meters (MFMs) has been a significant technological leap, particularly popularized in major hubs like Singapore, providing highly accurate, custody-transfer level measurement of delivered fuel volume, drastically reducing disputes related to quantity and enhancing trust between buyer and seller. Furthermore, the integration of IoT sensors, big data analytics, and blockchain technology is creating transparent digital platforms for fuel ordering, tracking, and compliance certification. These technologies improve supply chain visibility, optimize inventory management at terminals, and provide verifiable data trails essential for calculating and reporting a vessel's Carbon Intensity Indicator (CII) and overall environmental performance.

Regional Highlights

The regional dynamics of the Marine Bunker Oil Market are driven by trade flows, refining capacity, and the localized stringency of environmental regulations, creating distinct market characteristics across major continents.

- Asia Pacific (APAC): APAC is the epicenter of global bunkering activity, primarily driven by hubs like Singapore, which accounts for the largest physical volumes globally, and emerging centers in China (Zhoushan) and South Korea. The region benefits from robust refining capacity and acts as the world's manufacturing engine, generating immense demand for container shipping and bulk movements. APAC exhibits a strong balance between VLSFO consumption and emerging LNG adoption, particularly in China and Japan, supported by government initiatives to decarbonize domestic fleets and strategically positioned LNG import terminals.

- Europe: Europe is characterized by some of the world's strictest environmental regulations, encompassing multiple Emission Control Areas (ECAs) in the Baltic Sea, North Sea, and the English Channel. This regulatory environment mandates high penetration of Ultra-Low Sulfur Fuel Oil (ULSFO) and MGO. Europe is a leader in adopting alternative fuels; Rotterdam and other Northern European ports are pioneering the development of LNG and methanol bunkering infrastructure. The region prioritizes short-sea shipping sustainability and is aggressively pursuing carbon pricing mechanisms that directly impact bunker procurement decisions.

- North America: Driven by the North American ECA (extending 200 nautical miles from the coast), the market demands high compliance levels, leading to high consumption of MGO. The U.S. Gulf Coast, particularly Houston, is a major bunkering area, benefiting from strong domestic crude production and refining capabilities. Demand is significantly influenced by crude oil exports and domestic container traffic. There is increasing investment in LNG bunkering facilities, largely focused on vessels trading between the U.S. and Central/South America, leveraging extensive natural gas reserves.

- Middle East & Africa (MEA): The Middle East is crucial due to its strategic position on global trade routes (Suez Canal) and its immense refining output. Fujairah (UAE) is one of the world's leading bunkering ports, specializing in high-volume supply for vessels transiting between Asia and Europe. The market structure here is dominated by reliable supply of both HSFO (supported by high scrubber usage on transiting vessels) and VLSFO. Africa remains a developing market, highly sensitive to price, with bunkering activities concentrated in key ports like Durban and those along the West African coast supporting resource extraction.

- Latin America: This region presents localized demand patterns driven by commodity exports (e.g., Brazilian iron ore, Chilean copper) and transit traffic through the Panama Canal. Bunkering activity is focused near major shipping lanes. The adoption of alternative fuels is slower compared to Europe and APAC, largely due to infrastructure investment barriers, leading to a strong reliance on compliant petroleum fuels like VLSFO.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Marine Bunker Oil Market.- ExxonMobil

- Shell

- BP plc

- TotalEnergies SE

- Chevron Corporation

- Sinopec Group

- Lukoil

- World Fuel Services (WFS)

- Bomin (part of the Mabanaft Group)

- Minerva Bunkering (formerly Aegean Marine Petroleum Network)

- Bunker Holding Group

- Monjasa A/S

- Peninsula Petroleum

- GAC Group

- Vitol Group

- Mercuria Energy Group

- Gazpromneft Marine Bunker

- China Marine Bunker (Chimbusco)

- Glencore plc

- KPI OceanConnect

Frequently Asked Questions

Analyze common user questions about the Marine Bunker Oil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current transition in the Marine Bunker Oil Market?

The primary factor is regulatory mandate, specifically the International Maritime Organization's (IMO) drive towards decarbonization, culminating in the IMO 2020 low-sulfur mandate and the subsequent Carbon Intensity Indicator (CII) requirements. These regulations compel ship operators to switch from High Sulfur Fuel Oil (HSFO) to Very Low Sulfur Fuel Oil (VLSFO), Marine Gas Oil (MGO), or alternative, cleaner energy sources like LNG and methanol to reduce sulfur oxide (SOx) and greenhouse gas (GHG) emissions.

How has the IMO 2020 sulfur limit rule impacted the demand split between fuel types?

The IMO 2020 rule, limiting sulfur content to 0.5% globally (0.1% in Emission Control Areas), caused a massive shift in demand from traditional HSFO to VLSFO, which utilizes complex blending of low-sulfur residuals and distillates. While HSFO demand sharply declined, it stabilized due to widespread adoption of scrubbers (exhaust gas cleaning systems) by larger vessels, thereby creating a dual-fuel market structure where both compliant VLSFO/MGO and scrubber-enabled HSFO coexist.

What role does Liquefied Natural Gas (LNG) play in the future of marine bunkering?

LNG currently serves as the leading transitional fuel for deep-sea shipping, offering immediate compliance with sulfur and nitrogen oxide (NOx) regulations and significant reduction in carbon emissions compared to HFO. Its role is expanding through new vessel construction equipped with dual-fuel engines and continuous development of bunkering infrastructure in major ports worldwide, positioning it as a key decarbonization pathway until zero-carbon alternatives become commercially scalable.

What are the main technological challenges associated with alternative bunker fuels like ammonia and methanol?

For alternative fuels, key challenges include safety (ammonia's toxicity and corrosiveness), required engine modifications (both for ammonia and methanol), and energy density limitations, which necessitate larger fuel storage tanks onboard, impacting cargo capacity. Furthermore, significant investment is needed for shoreside infrastructure, supply chain standardization, and regulatory development to manage these complex fuels safely and efficiently on a global scale.

Why are Mass Flow Meters (MFMs) becoming standard technology in marine bunkering?

Mass Flow Meters (MFMs) provide highly accurate, verifiable, and continuous measurement of the quantity and density of delivered bunker fuel, reducing measurement errors inherent in traditional tank dipping methods. Their mandatory adoption in major hubs, such as Singapore, enhances supply chain transparency, minimizes disputes between buyers and sellers regarding delivered volume, and ultimately improves trust and efficiency in bunkering transactions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager