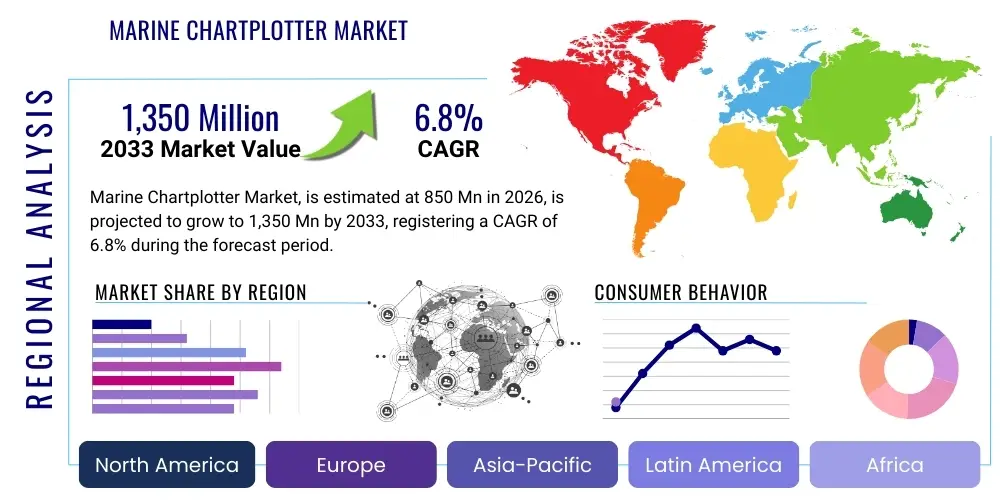

Marine Chartplotter Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443058 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Marine Chartplotter Market Size

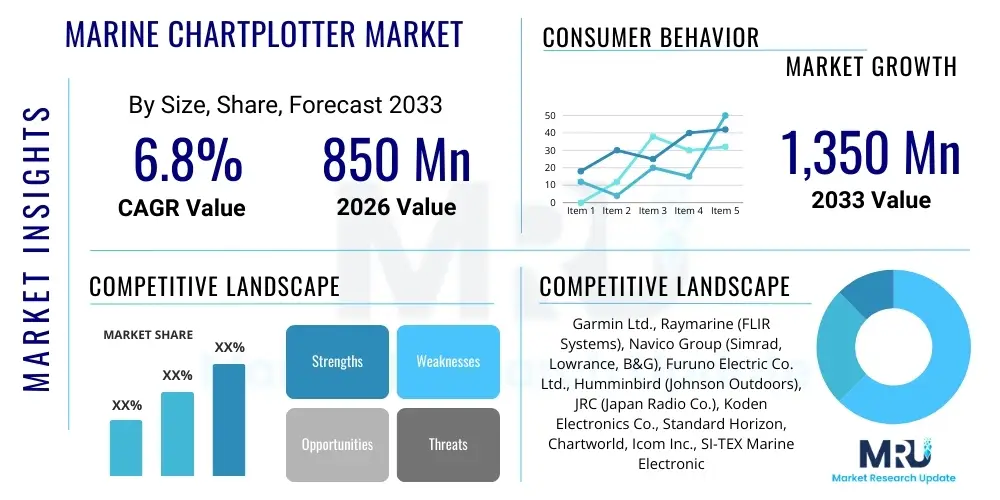

The Marine Chartplotter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $850 Million USD in 2026 and is projected to reach $1,350 Million USD by the end of the forecast period in 2033.

Marine Chartplotter Market introduction

The Marine Chartplotter Market encompasses navigation systems utilizing Global Positioning System (GPS) technology integrated with electronic navigational charts (ENCs) to display vessel position, track movements, and plan routes on water bodies. These devices are essential components of modern marine electronics, providing crucial situational awareness for various maritime activities, ranging from recreational boating and fishing to commercial shipping and governmental patrol operations. The core function of a chartplotter is to replace traditional paper charts by offering real-time, dynamic navigation data, often incorporating sophisticated features like sonar integration, radar overlays, and autopilot connectivity. Product offerings in this market vary significantly by display size, processing power, waterproofing standards, and network compatibility, catering to diverse end-user requirements and budgetary constraints. Technological advancements, particularly in high-definition displays and advanced sensor fusion, are continuously enhancing the usability and accuracy of these systems, driving market adoption across global maritime sectors. The reliability of navigation in challenging weather conditions and complex coastal waterways is fundamentally dependent on the performance of these digital charting solutions, making them a critical safety and efficiency tool.

Major applications for marine chartplotters span several key segments. In the leisure sector, chartplotters are standard equipment for cruising yachts, sailboats, and fishing boats, enabling safe passage, precise location targeting for angling, and seamless integration with entertainment systems. For commercial entities, including small-scale ferry operators, coastal transportation services, and commercial fishing fleets, chartplotters are vital for optimizing fuel consumption, adhering to regulated routes, and ensuring compliance with maritime safety standards. Furthermore, governmental and defense applications, such as coast guard operations, naval patrols, and search and rescue missions, rely on high-grade, ruggedized chartplotters capable of handling proprietary mapping data and integrating complex surveillance systems. The increasing digitalization of maritime administration and the mandatory requirement for electronic charting systems (ECS) on larger vessels further solidify the essential role of chartplotters in the global marine industry ecosystem. Chartplotters enhance operational efficiency by reducing manual navigational tasks and minimizing the risk of grounding or collisions, leading to direct economic benefits for users.

Key benefits driving the adoption of marine chartplotters include improved navigational accuracy, enhanced safety through real-time hazard alerts (e.g., shallow water, rocks), and seamless integration with other vital marine instrumentation like depth sounders, radar systems, and Automatic Identification System (AIS) transponders. Driving factors propelling market expansion include the sustained growth in recreational boating activities globally, driven by increasing disposable incomes in developed and emerging economies, and the continuous push for digitization in commercial maritime operations to meet international regulatory standards like those set by the International Maritime Organization (IMO). Technological innovation, such as the miniaturization of components, the rise of multi-function displays (MFDs) that consolidate various functionalities into a single unit, and the enhanced fidelity of electronic charts, also acts as a primary market driver. Additionally, the replacement cycle for older analog equipment with modern digital systems contributes significantly to market demand, ensuring a steady stream of revenue for manufacturers specializing in advanced marine navigation solutions.

Marine Chartplotter Market Executive Summary

The Marine Chartplotter Market is undergoing a rapid evolution characterized by significant technological integration, particularly the convergence of charting, radar, and sonar capabilities into unified Multi-Function Displays (MFDs). Business trends indicate a strong move toward subscription-based chart updates and cloud connectivity, enabling users to access real-time weather data, enhanced mapping features, and social boating insights. Key competitive strategies involve partnerships between hardware manufacturers and mapping providers to offer proprietary and differentiated charting experiences. Furthermore, the commercial sector demands systems with superior network robustness, redundancy, and integration with Vessel Monitoring Systems (VMS) and bridge management solutions, driving premium product development. The shift toward higher resolution displays and intuitive user interfaces (UI/UX) is a pervasive trend, mimicking consumer electronics standards to enhance ease of use for recreational boaters. Geopolitically, supply chain resilience, particularly regarding semiconductor components and display technology, remains a critical factor influencing production schedules and final product costs. Manufacturers are increasingly focusing on sustainability, offering energy-efficient systems that minimize power draw on small vessel battery banks, aligning with broader ecological concerns within the marine leisure sector.

Regionally, North America and Europe currently dominate the Marine Chartplotter Market, driven by high levels of recreational boating participation, stringent safety regulations mandating sophisticated navigation tools, and the early adoption of advanced marine technologies. The Asia Pacific (APAC) region, however, is projected to exhibit the highest growth rate during the forecast period. This accelerated growth is primarily attributed to the rapid expansion of commercial shipping fleets, significant investments in maritime infrastructure development, the modernization of domestic fishing fleets in countries like China, Japan, and South Korea, and the burgeoning interest in luxury yachting and recreational activities among the growing middle class. Latin America and the Middle East & Africa (MEA) represent emerging markets, where market penetration is gradually increasing, fueled by offshore oil and gas exploration activities requiring precise positioning and increasing governmental investment in coastal surveillance and maritime security applications. Differences in charting standards and regulatory requirements across regions necessitate localized product customization and distribution strategies, requiring manufacturers to maintain flexible product platforms.

Segmentation trends highlight the increasing dominance of Multi-Function Displays (MFDs) over dedicated chartplotters, especially in new vessel installations, due to their space-saving design and integrated functionalities. By component, the hardware segment, encompassing the display unit, GPS antenna, and associated processors, holds the largest market share, but the software and services segment, including cartography updates, cloud synchronization, and feature subscriptions, is growing faster, reflecting the recurring revenue potential. Based on application, the recreational segment remains the largest volume driver, characterized by sensitivity to pricing and user-friendly features, whereas the commercial and defense segments prioritize ruggedness, reliability, and advanced networking capabilities, often leading to higher average selling prices (ASPs). Furthermore, the trend toward fully networked systems utilizing Ethernet and proprietary protocols is enhancing data exchange speeds and system resilience, making seamless integration the benchmark for high-end market offerings. The demand for higher screen sizes, particularly 12 inches and above, is increasing as vessel sizes grow and bridge real estate allows for more comprehensive display arrangements.

AI Impact Analysis on Marine Chartplotter Market

User queries regarding AI's impact on marine chartplotters frequently center on the potential for autonomous navigation, predictive collision avoidance, and the integration of machine learning for optimized route planning based on historical data and real-time environmental factors. Users are concerned about the reliability and security of AI algorithms in mission-critical navigation scenarios and seek clarification on how AI will transition from merely assisting human operators to potentially replacing them in certain routine tasks. There is significant interest in how AI can process and synthesize massive amounts of sensor data (radar, sonar, weather, AIS) faster than human capacity, offering proactive hazard identification and dynamic adjustments to maintain optimal course and speed. The key themes revolve around enhanced safety, operational efficiency gains, reducing human error, and the necessary regulatory framework required for increasingly autonomous marine systems. Users expect AI to personalize the navigation experience and significantly improve fuel efficiency by calculating the most hydrodynamic routes based on currents and tide predictions.

- Enhanced Predictive Route Optimization: AI algorithms analyze historical voyage data, real-time currents, and weather forecasts to suggest optimal, fuel-efficient, and time-saving routes, minimizing human effort in planning.

- Advanced Collision Avoidance: Machine learning processes complex radar and AIS data to differentiate between clutter and genuine hazards (including rapidly maneuvering small craft), offering proactive warnings and recommended evasion maneuvers far superior to traditional proximity alarms.

- Automated Sonar Interpretation: AI improves the processing of fishfinder and bottom mapping sonar data, automatically identifying species, distinguishing bottom composition, and highlighting potential fishing hotspots, thereby increasing efficiency for commercial and recreational fishing.

- System Diagnostics and Predictive Maintenance: AI monitors the performance and health of the chartplotter and integrated sensors, predicting potential component failures before they occur, reducing downtime and ensuring navigational reliability.

- Autonomous Docking and Piloting Assistance: AI-enabled systems provide enhanced assistance for complex maneuvers like docking in tight spaces or maintaining precise position (dynamic positioning), significantly reducing the skill requirement for vessel operation.

- Personalized User Experience (UX): AI learns user preferences for chart display, data overlays, and frequently traveled areas, customizing the interface for quicker access to necessary functions.

- Cybersecurity and Data Integrity: AI models are increasingly used to detect anomalous network behavior and potential intrusions, securing the mission-critical navigation data against cyber threats.

DRO & Impact Forces Of Marine Chartplotter Market

The Marine Chartplotter Market is shaped by a confluence of powerful drivers, structural restraints, and emerging opportunities that dictate its growth trajectory and competitive landscape. The primary drivers include the escalating global focus on maritime safety and the imposition of stringent international regulations, such as those promoting the adoption of Electronic Chart Display and Information Systems (ECDIS) for larger commercial vessels, which indirectly drives demand for modern chartplotters in smaller commercial and governmental segments. Furthermore, the sustained innovation cycle leading to more feature-rich, integrated, and user-friendly devices, coupled with the rising disposable incomes globally that fuel recreational boating, provides continuous demand pressure. Technological advancements, particularly in sensor fusion—integrating radar, sonar, and thermal imaging data seamlessly onto the chart display—enhance the value proposition significantly. Opportunities arise from the rapidly expanding Asia Pacific maritime sector, the development of new functionalities such as augmented reality overlays on chart displays, and the integration of high-bandwidth satellite communication systems for global real-time chart updates and connectivity services. These forces collectively underscore a market moving toward higher integration and greater intelligence in navigation assistance.

Restraints, however, pose challenges to widespread market penetration. High initial acquisition costs, particularly for premium, multi-function display systems incorporating advanced radar and sonar technology, can deter small-scale recreational users and smaller commercial operators. Furthermore, the complexity associated with installing, networking, and maintaining sophisticated integrated marine electronic systems requires specialized technical expertise, which is not always readily available in remote or less developed maritime regions. A significant constraint involves the continuous cost and complexity of chart updating and licensing, which often requires proprietary software and potentially recurring fees, creating friction for users who prefer free or universally compatible mapping solutions. Data reliability and standardization across different manufacturers and regions present another challenge, impacting interoperability and system resilience. These restraints compel manufacturers to focus on modular, scalable designs and simplified user maintenance protocols to broaden their addressable market.

The core impact forces—market drivers, restraints, and opportunities—interact to determine the speed and direction of market growth. Technological superiority, driven by opportunities in AI and system integration, is forcing competitors to invest heavily in Research and Development (R&D) to maintain relevance. Regulatory compliance acts as a consistent upward pressure, ensuring a baseline level of technological sophistication is maintained across the commercial fleet. Conversely, pricing pressures in the high-volume recreational segment, influenced by restraints related to cost sensitivity, drive manufacturers to achieve economies of scale and optimize supply chains. The net impact suggests a bifurcation of the market: a high-end segment focused on complex, integrated, and expensive commercial/naval systems, and a high-volume segment focused on accessible, user-friendly MFDs for the leisure market, often utilizing simplified network protocols and relying heavily on intuitive touch interfaces. The successful navigation of these impact forces requires a balanced approach to innovation, pricing, and global regulatory adherence.

Segmentation Analysis

The Marine Chartplotter Market is comprehensively segmented based on product type, display size, application, and component, providing a granular view of market dynamics and end-user adoption patterns. Segmentation by product type reveals a shift from dedicated chartplotters, which perform a single primary function, toward integrated Multi-Function Displays (MFDs) that consolidate radar, sonar, engine monitoring, and charting onto a single networked screen, appealing strongly to both the recreational and commercial sectors seeking system simplification and space efficiency. Display size is a crucial factor, influencing price and suitability for different vessel types, with sizes ranging from small 5-inch units for kayaks and dinghies to large 16-inch and 24-inch displays preferred for yachts and commercial bridge systems, reflecting differing navigational requirements and viewing distances. Analyzing these segments helps stakeholders tailor product development and marketing efforts to specific demographic and operational needs, maximizing market penetration across diverse maritime activities.

- By Product Type:

- Dedicated Chartplotters

- Multi-Function Displays (MFDs)

- By Display Size:

- Below 7 Inches

- 7 to 12 Inches

- Above 12 Inches

- By Component:

- Hardware (Display Unit, Processor, GPS Receiver)

- Software and Services (Cartography, Updates, Licensing, Cloud Services)

- By Application:

- Recreational Boating (Fishing, Cruising, Sailing)

- Commercial Vessels (Fishing, Transport, Ferries)

- Defense and Government (Coast Guard, Navy, Scientific Research)

- By Technology:

- Traditional GPS Chartplotters

- Networked Systems (Ethernet/NMEA 2000 Integration)

- Integrated Digital Switching Systems

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Marine Chartplotter Market

The value chain for the Marine Chartplotter Market begins with upstream activities dominated by the sourcing of critical electronic components, including high-resolution liquid crystal displays (LCDs) or organic light-emitting diode (OLED) panels, semiconductor chips (microprocessors, memory), and specialized GPS/GNSS receiver modules. These raw material and component suppliers, often highly concentrated in Asia, exert moderate bargaining power due to the highly customized nature of marine-grade electronics which require specific ruggedization and water resistance standards. Key activities in this stage also involve the licensing and acquisition of global cartographic data, where specialized mapping companies and hydrographic offices play a crucial role. Manufacturing and assembly, the subsequent stage, involves integrating these components, ensuring rigorous testing for vibration, thermal stability, and ingress protection (IP) ratings, thereby defining the final product quality and durability. Successful upstream management is paramount for maintaining supply chain stability and controlling the ultimate cost structure, especially given the fluctuating global prices of semiconductors and display screens.

Midstream activities involve core innovation, system software development, and product differentiation. Manufacturers invest heavily in proprietary operating systems, user interfaces, and network protocols (such as Garmin’s Marine Network or Raymarine’s SeaTalk), which create ecosystem lock-in and provide a competitive edge. This stage also includes the packaging of complementary technologies, such as CHIRP sonar, high-definition radar, and autopilot integration, into unified MFD platforms. The downstream segment focuses primarily on distribution and sales. Distribution channels are varied, encompassing direct sales to major boat builders (Original Equipment Manufacturers - OEMs), indirect sales through a vast network of marine electronics dealers and specialized installers, and, increasingly, e-commerce platforms for spare parts and lower-end recreational units. OEMs represent a crucial channel, as the chartplotter is often factory-installed, providing large, guaranteed volumes. Specialized installers are essential for high-end systems requiring complex networking, calibration, and integration with existing vessel electronics.

Direct distribution, though less common for highly technical installations, is utilized by major brands for strategic accounts like large naval contracts or major commercial fleet modernization projects, allowing for greater control over pricing and service delivery. Indirect channels, primarily marine distributors and retailers (both brick-and-mortar and online), are critical for reaching the dispersed and geographically fragmented recreational market, providing local support, installation, and after-sales service. The final stage of the value chain involves after-sales support, encompassing warranty fulfillment, provision of technical documentation, and, critically, continuous software updates and cartography subscriptions. The recurring revenue generated through software and service subscriptions is becoming an increasingly important aspect of the value chain, shifting the focus from a one-time hardware sale to long-term customer engagement. Efficiency in the distribution and service network is key to maximizing customer satisfaction and capitalizing on replacement and upgrade cycles, sustaining market momentum.

Marine Chartplotter Market Potential Customers

The primary customer base for marine chartplotters is highly diverse, spanning three major sectors: recreational boaters, commercial maritime operators, and governmental/defense agencies, each with distinct requirements and purchasing criteria. Recreational boaters constitute the largest volume segment, including owners of small fishing boats, sailing yachts, powerboats, and personal watercraft. These buyers prioritize ease of use, screen clarity, integrated fishing technology (e.g., advanced sonar), and favorable pricing. They typically purchase through marine retailers and specialized installation shops, with purchasing decisions often influenced by peer reviews and brand reputation for user-friendliness and reliability. The growing trend of offshore angling and coastal cruising among affluent individuals worldwide further expands this customer segment, requiring MFDs with advanced weather routing and high-definition mapping capabilities.

Commercial maritime operators represent a high-value, high-requirement segment, including commercial fishing fleets, short-sea shippers, tugboat operators, passenger ferries, and offshore support vessels. For these users, reliability, compliance with international maritime standards (e.g., IMO, SOLAS), integration with mandatory systems (AIS, ECDIS surrogates), and robustness under continuous operational stress are non-negotiable criteria. Commercial vessels often require larger, redundant systems capable of seamless networking and data logging for operational audits. Purchasing decisions in this segment are highly influenced by total cost of ownership (TCO), long-term service contracts, and regulatory certifications. System integrators and original equipment manufacturers (OEMs) who supply these vessels form a critical conduit for market access in this sector.

The third major segment involves governmental and defense agencies, including coast guards, navies, border patrol units, and scientific research vessels. These customers demand the highest level of ruggedization, specialized military-grade components, secure communication capabilities, and the ability to handle highly classified or proprietary mapping data. Their procurement processes are often lengthy, governed by strict tendering and regulatory compliance procedures, prioritizing vendor security clearance and proven reliability in extreme environments. Defense contracts typically involve customized hardware and software solutions not available on the commercial market. The increasing need for maritime domain awareness and enhanced border security worldwide ensures sustained investment from this crucial, although specialized, customer group, driving demand for technologically advanced and highly secure chartplotter systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million USD |

| Market Forecast in 2033 | $1,350 Million USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Garmin Ltd., Raymarine (FLIR Systems), Navico Group (Simrad, Lowrance, B&G), Furuno Electric Co. Ltd., Humminbird (Johnson Outdoors), JRC (Japan Radio Co.), Koden Electronics Co., Standard Horizon, Chartworld, Icom Inc., SI-TEX Marine Electronics, Digital Yacht, Onwa Marine, ComNav Marine, Vesper Marine, Raytheon Anschütz, Sperry Marine, Transas, Saab, Rose Point Navigation Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Marine Chartplotter Market Key Technology Landscape

The technological landscape of the Marine Chartplotter Market is defined by the convergence of advanced sensor technologies, sophisticated network protocols, and high-performance computing capabilities aimed at enhancing situational awareness and ease of navigation. A key foundational technology is Global Navigation Satellite System (GNSS) receivers, which are increasingly multi-constellation capable (receiving signals from GPS, GLONASS, Galileo, and BeiDou) to ensure higher accuracy and reliability, particularly in congested or complex navigational environments where line-of-sight may be obstructed. Display technology has transitioned significantly, favoring high-brightness, sunlight-readable, and optically bonded touchscreens (capacitive sensing) that improve durability and user interaction, moving away from resistive screens. Processor technology, utilizing powerful multi-core processors, is essential for simultaneously running demanding applications like 3D chart rendering, high-speed radar overlays, and real-time sonar processing without system lag, enabling true multi-functionality within MFDs.

Integration technology, primarily facilitated by standardized marine communication networks such as NMEA 2000 and Ethernet (for high-bandwidth data like radar and video), allows chartplotters to act as the central hub for the entire vessel electronics system. NMEA 2000 provides a robust, standardized backbone for sharing smaller data packets, such as GPS position, depth, temperature, and engine telemetry, across different manufacturers' equipment. High-speed Ethernet networking is critical for integrating high-resolution data streams from solid-state radar systems, sophisticated imaging sonar (e.g., side imaging, down imaging, LiveSight), and digital switching systems (CZone, EmpirBus), enabling centralized control of vessel components from the chartplotter interface. The shift toward solid-state radar, replacing traditional magnetron-based pulse radar, offers instant-on capability, lower power consumption, and superior short-range target separation, which is crucial for collision avoidance in congested harbors.

Furthermore, the cartography and software segment employs vector chart technology, offering scalable and layered information, alongside Raster charts, which provide an exact image of traditional paper charts. Advanced technology platforms include satellite imagery overlays and high-definition bathymetric mapping (derived from high-frequency sonar) that provide highly detailed contours for fishing and seabed analysis. Cloud connectivity and Wi-Fi capability are now standard, enabling wireless software and chart updates, remote monitoring, and synchronization with mobile applications, extending the utility of the chartplotter beyond the helm. The rapid adoption of digital switching and control technologies allows chartplotters to manage lights, bilge pumps, and climate control, transforming them into comprehensive vessel management systems, thereby consolidating the technology footprint on the bridge and simplifying complex vessel operations through intuitive digital interfaces.

Regional Highlights

- North America: Dominant market share, driven by a high volume of recreational boating (particularly in the US and Canada) and extensive coastline infrastructure. Stringent safety regulations and high disposable income ensure high technological adoption rates and rapid market absorption of premium MFDs and integrated systems. The US recreational fishing sector is a major driver for advanced sonar-equipped chartplotters.

- Europe: Second-largest market, characterized by strong demand from yachting, sailing, and coastal commercial transport. Key markets like the UK, Germany, France, and Scandinavian countries exhibit high technological maturity. The implementation of EU maritime directives and continued investment in high-end leisure boating contribute significantly to consistent market growth and system upgrades.

- Asia Pacific (APAC): Fastest-growing region, fueled by massive investments in commercial shipping fleet expansion, port modernization, and increasing demand for navigation tools in emerging coastal nations like China, India, and Southeast Asia. The rise of a luxury boating culture in countries such as Australia and Japan also contributes to the recreational segment’s expansion.

- Latin America (LATAM): Emerging market with gradual growth driven by coastal fishing, maritime security needs, and offshore resource extraction activities, particularly in Brazil and Mexico. Market penetration is currently lower compared to North America and Europe, but governmental investment in patrol and monitoring vessels presents a key opportunity.

- Middle East & Africa (MEA): Growth concentrated around the Gulf Cooperation Council (GCC) nations due to strategic naval interests, commercial shipping lanes (Suez Canal proximity), and investments in luxury marine leisure facilities (e.g., UAE). Demand is primarily for high-reliability, rugged systems suitable for complex, high-traffic waterways and security applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Marine Chartplotter Market.- Garmin Ltd.

- Raymarine (FLIR Systems)

- Navico Group (Simrad, Lowrance, B&G)

- Furuno Electric Co. Ltd.

- Humminbird (Johnson Outdoors)

- JRC (Japan Radio Co.)

- Koden Electronics Co.

- Standard Horizon

- Chartworld

- Icom Inc.

- SI-TEX Marine Electronics

- Digital Yacht

- Onwa Marine

- ComNav Marine

- Vesper Marine

- Raytheon Anschütz

- Sperry Marine

- Transas

- Saab

- Rose Point Navigation Systems

Frequently Asked Questions

Analyze common user questions about the Marine Chartplotter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Marine Chartplotter Market?

The Marine Chartplotter Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% between the forecast period of 2026 and 2033, driven by advancements in MFD technology and increased recreational boating activity.

Which technology trend is most significantly impacting modern chartplotters?

The most significant technology trend is the integration of high-speed networking (Ethernet/NMEA 2000) and sophisticated sensor fusion, allowing Multi-Function Displays (MFDs) to seamlessly combine and overlay radar, sonar, and thermal imaging data onto electronic charts for enhanced situational awareness.

What is a Multi-Function Display (MFD) and why is it preferred over dedicated chartplotters?

An MFD is a unified display unit that consolidates the functions of a chartplotter, radar, depth sounder, and engine monitor into a single interface. It is preferred for its space efficiency, simplified networking, and ability to manage all vessel electronics from one central hub, offering better value and integration.

Which geographical region is expected to demonstrate the fastest growth in the market?

The Asia Pacific (APAC) region is anticipated to record the highest growth rate during the forecast period, primarily due to expanding commercial shipping fleets, significant investments in maritime infrastructure, and the growing luxury yachting sector in countries like China and South Korea.

How is Artificial Intelligence (AI) being utilized in marine chartplotters?

AI is increasingly utilized for advanced predictive route optimization based on real-time environmental data, sophisticated collision avoidance algorithms that interpret complex radar signatures, and automated processing of sonar data to identify fish and bottom composition, enhancing safety and operational efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager