Marine Hydraulic Pumps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443163 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Marine Hydraulic Pumps Market Size

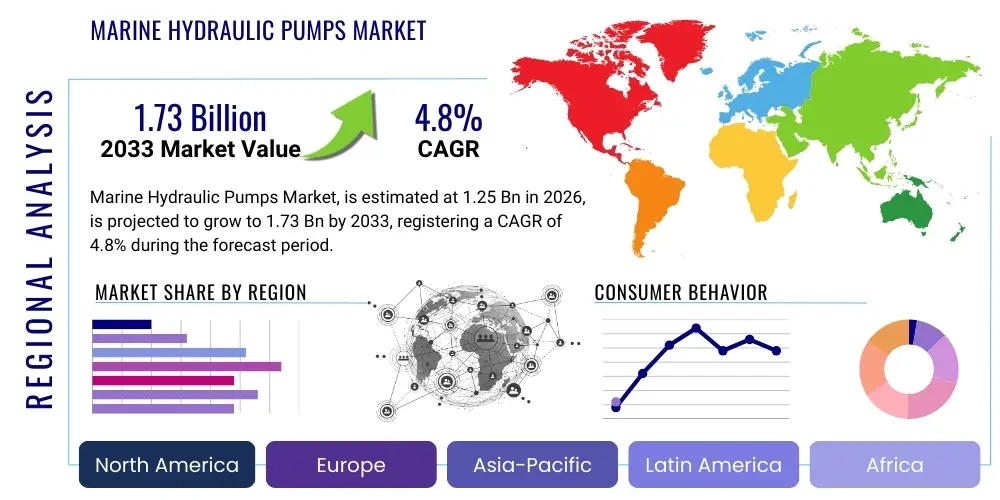

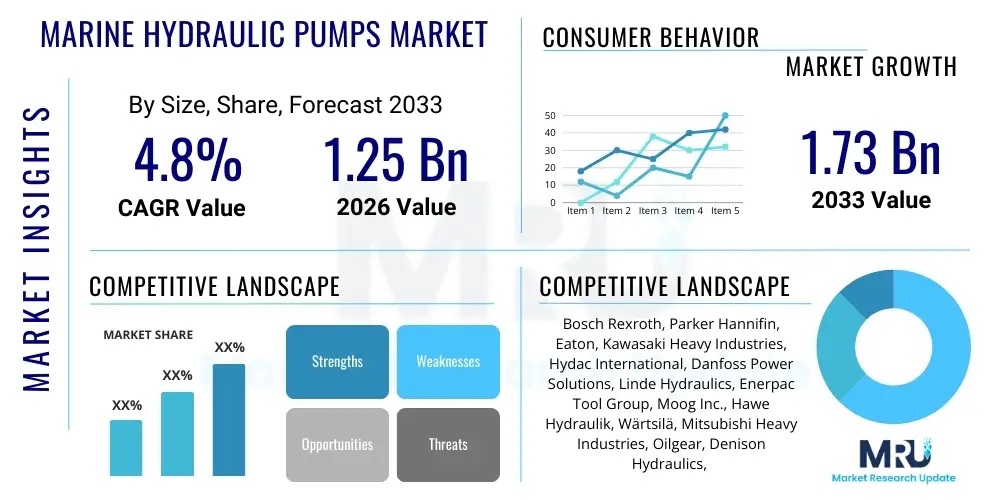

The Marine Hydraulic Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.73 Billion by the end of the forecast period in 2033.

Marine Hydraulic Pumps Market introduction

The Marine Hydraulic Pumps Market encompasses the manufacturing, distribution, and utilization of specialized fluid power components designed specifically for marine environments. These pumps are critical mechanical devices used to convert mechanical energy into hydraulic energy, enabling the efficient operation of various on-board machinery. The operating conditions in the marine sector, characterized by high salinity, extreme pressure fluctuations, and continuous operation requirements, necessitate pumps constructed from corrosion-resistant materials and robust designs, capable of maintaining high reliability and performance across diverse vessel types.

Products within this market range primarily include piston pumps, gear pumps, and vane pumps, each optimized for specific applications such as steering gear systems, cargo handling equipment, deck machinery, thrusters, and stabilization systems. The increasing complexity and automation levels of modern commercial vessels, coupled with rigorous safety standards imposed by international maritime organizations like the IMO (International Maritime Organization), drive the demand for high-performance and reliable hydraulic solutions. Furthermore, the longevity and maintenance predictability of these systems are paramount, influencing procurement decisions heavily towards established manufacturers providing comprehensive service networks.

Major applications of marine hydraulic pumps are centered around safety-critical functions and operational efficiency. Benefits derived from utilizing advanced hydraulic systems include superior power density, precise control over heavy loads, and inherent reliability compared to electric or pneumatic alternatives for certain high-torque operations. Key driving factors accelerating market expansion include the consistent growth of global trade necessitating larger fleets, the rapid expansion of offshore oil and gas exploration requiring specialized support vessels, and mandatory retrofitting initiatives aimed at improving vessel efficiency and adherence to environmental regulations.

Marine Hydraulic Pumps Market Executive Summary

The Marine Hydraulic Pumps Market demonstrates robust growth propelled by secular business trends, particularly the recovery in global shipbuilding activities and the increasing regulatory emphasis on vessel automation and energy efficiency. Strategic investments in digitalization and condition monitoring are reshaping traditional maintenance paradigms, moving towards predictive failure analysis, which increases the lifecycle value proposition of premium hydraulic systems. Geographically, the market exhibits dynamism, with Asia Pacific maintaining its dominance driven by massive shipbuilding capacity in countries like China, South Korea, and Japan, while North America and Europe focus intensely on naval modernization programs and specialized high-end vessel construction, such as cruise ships and advanced offshore platforms.

Segment trends indicate a strong preference for piston pumps in high-pressure, high-flow critical applications like steering gear and large crane operations due to their superior efficiency and durability. Simultaneously, the application segment focused on cargo handling and deck machinery, crucial for container ships and bulk carriers, represents the largest share of consumption, reflecting the sheer volume of global maritime logistics. Innovation is concentrated on developing pumps capable of operating with environmentally acceptable lubricants (EALs) and those that integrate seamlessly with hybrid propulsion systems, addressing both ecological compliance and fuel efficiency requirements simultaneously.

Regional dynamics highlight divergent investment focuses; while APAC remains volume-driven, European manufacturers prioritize technological leadership in complex variable displacement pumps and integrated hydraulic power units (HPUs) tailored for sophisticated naval and luxury vessels. Competitive intensity is high, characterized by a mix of global diversified industrial giants and specialized hydraulic component manufacturers. The overall outlook remains positive, underscored by the imperative for fleet renewal and the continuous need for reliable operational infrastructure across the diverse marine ecosystem.

AI Impact Analysis on Marine Hydraulic Pumps Market

Common user inquiries regarding AI’s influence on the Marine Hydraulic Pumps Market typically center on three core themes: predictive maintenance effectiveness, optimization of pump operation efficiency, and the role of AI in hydraulic system design and diagnostics. Users frequently ask how AI-driven algorithms can forecast imminent pump failures with greater accuracy than traditional sensor monitoring, thereby minimizing catastrophic downtime in critical marine operations. There is also significant interest in using machine learning to analyze hydraulic fluid conditions and operational telemetry in real-time to adjust pump settings dynamically, ensuring maximum energy efficiency and reducing parasitic losses, which is crucial for meeting stringent fuel consumption targets. Furthermore, system integrators are keen to understand how AI tools can streamline the complex configuration of hydraulic circuits for highly customized vessel platforms.

The primary impact of AI adoption is manifesting through the integration of digital twins and sophisticated sensor arrays linked to cloud-based analytical platforms. These systems collect granular data on pressure, temperature, vibration, and fluid contamination, feeding it into algorithms trained to detect subtle anomalies indicative of wear or impending failure in hydraulic pumps. This shift from calendar-based maintenance to condition-based maintenance significantly extends the operational lifespan of the pumps, reducing total cost of ownership (TCO) for ship operators. However, the requirement for seamless data connectivity in isolated marine environments remains a key implementation challenge that is currently being addressed through edge computing solutions and optimized data transmission protocols.

Ultimately, the influence of AI will result in more resilient, efficient, and intelligent hydraulic systems. While the fundamental mechanical design of the hydraulic pump remains relatively unchanged, AI is optimizing the peripheral systems—including cooling loops, filtration units, and control logic—that govern pump operation. This intelligent optimization ensures that marine hydraulic pumps are utilized within their optimal performance envelope, drastically improving reliability, which is the most valued characteristic in the marine sector where unscheduled equipment failure can lead to substantial financial losses and safety hazards.

- AI-enabled Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data (vibration, pressure, temperature) and predict component degradation in marine hydraulic pumps, significantly reducing unexpected downtime and enabling just-in-time repairs.

- Optimized Power Management: AI systems dynamically adjusting pump output and flow rates based on real-time operational demands (e.g., cargo load, sea state), leading to measurable reductions in auxiliary power consumption and fuel usage.

- Digital Twin Development: Creation of virtual models of hydraulic systems that allow for simulation and testing of different operational scenarios, accelerating the design phase and ensuring optimal system configuration before physical deployment.

- Autonomous Fault Diagnosis: Machine learning models automating the identification and classification of complex hydraulic system faults, providing faster root-cause analysis and accelerating resolution times for technical crews.

- Supply Chain Optimization: Using AI to forecast demand for specific pump spare parts based on vessel usage patterns and age profiles, improving inventory management for both manufacturers and fleet operators.

DRO & Impact Forces Of Marine Hydraulic Pumps Market

The market for marine hydraulic pumps is shaped by a confluence of driving factors, restrictive regulatory hurdles, and emerging opportunities. Key drivers include the revitalization of global trade routes and the subsequent demand for new, larger commercial vessels, alongside sustained governmental expenditure on naval fleet modernization programs. The inherent reliability and high power-to-weight ratio of hydraulic systems continue to position them as the preferred technology for heavy-duty marine applications, especially crucial operations like rudder control and anchor handling. Furthermore, the necessity for compliance with stringent environmental mandates, such as the International Maritime Organization's (IMO) directives aimed at reducing greenhouse gas emissions and pollution, compels ship operators to invest in newer, more efficient hydraulic pump technologies that minimize energy waste.

However, the market faces significant restraints. The high initial capital cost associated with installing sophisticated, corrosion-resistant hydraulic systems, especially compared to electric alternatives in lower-power applications, presents a hurdle for smaller operators or retrofit projects with constrained budgets. Furthermore, the specialized nature of hydraulic fluids and the environmental risks associated with leakage require rigorous maintenance protocols and compliance, adding complexity and operational costs. Economic volatility, particularly fluctuations in shipbuilding output tied to global commodity prices and trade disputes, introduces cyclical instability that can dampen investment in new marine equipment.

Opportunities for growth are substantial, primarily driven by the transition towards greener shipping solutions. The development of advanced variable speed pumps integrated with electric motor controls offers significant potential for energy savings. Moreover, the burgeoning offshore renewable energy sector, specifically the installation and maintenance of offshore wind farms, requires specialized jack-up vessels and platforms heavily dependent on high-power, reliable hydraulic systems for stability and operational maneuvers. The increasing adoption of digital solutions, including IoT integration and condition monitoring systems, creates new avenues for manufacturers to offer high-margin, value-added services focused on predictive maintenance and remote diagnostics, thus cementing their long-term customer relationships and market position. These factors collectively define the trajectory of market development.

Segmentation Analysis

The Marine Hydraulic Pumps Market segmentation provides a granular view of market dynamics based on pump type, application area, vessel type, and operational pressure range. This structure allows stakeholders to accurately gauge demand pockets and align product development strategies with specific industry requirements. The performance characteristics demanded by steering systems, which require precise control and safety redundancy, differ significantly from those needed for rugged, continuous-duty cargo pumps, necessitating diverse hydraulic pump technologies optimized for each segment. Detailed analysis of these segments highlights where volume growth intersects with technological complexity.

- By Product Type:

- Piston Pumps (Axial Piston, Radial Piston)

- Gear Pumps (Internal Gear, External Gear)

- Vane Pumps (Fixed Displacement, Variable Displacement)

- Screw Pumps

- By Application:

- Steering Systems (Rudder Control)

- Cargo Handling Equipment (Cranes, Hoists)

- Deck Machinery (Winches, Capstans, Mooring Systems)

- Propulsion Control Systems

- Stabilization Systems (Fin Stabilizers)

- Thrusters and Dynamic Positioning (DP) Systems

- By Vessel Type:

- Commercial Vessels (Tankers, Bulk Carriers, Container Ships)

- Naval and Military Vessels

- Passenger and Cruise Ships

- Offshore Support Vessels (OSV) and Drilling Rigs

- Fishing Vessels and Small Crafts

- By Pressure Range:

- Low Pressure (Up to 100 bar)

- Medium Pressure (100–250 bar)

- High Pressure (Above 250 bar)

Value Chain Analysis For Marine Hydraulic Pumps Market

The value chain for the Marine Hydraulic Pumps Market begins with upstream activities involving raw material procurement, focusing primarily on high-grade specialized steel alloys, non-ferrous metals (like bronze and aluminum), and advanced sealing materials essential for maintaining corrosion resistance and high-pressure integrity in harsh marine environments. Key suppliers include specialized metal foundries and precision component manufacturers. The manufacturing stage is capital-intensive and requires high precision machining, stringent quality control, and certified assembly processes, often demanding compliance with classification society standards (e.g., DNV, ABS, Lloyd’s Register). Research and Development play a crucial role upstream, focusing on improving pump efficiency, reducing noise pollution, and integrating smart monitoring capabilities into the physical pump design.

Downstream activities center on distribution, system integration, and end-user deployment. Marine hydraulic pumps are rarely sold as standalone components; instead, they are integrated into complex Hydraulic Power Units (HPUs) or complete systems by specialized system integrators who customize the solution for a specific vessel application (e.g., a specific winch drive or steering mechanism). Distribution channels are highly structured and rely heavily on technical distributors and certified service partners capable of providing local support, installation expertise, and post-sales maintenance services. This high dependence on technical support means the distinction between direct sales (often to major shipyards or naval programs) and indirect sales (through regional distributors and system integrators) is critical.

Direct channels are typically utilized for large, high-value contracts with major global shipyards or naval defense contractors where customized design and long-term support agreements are negotiated directly with the OEM (Original Equipment Manufacturer). Indirect channels, leveraging extensive distributor networks, are vital for accessing smaller regional shipyards, retrofit markets, and maintenance/repair/overhaul (MRO) operations. The effectiveness of the after-sales service network—including spare parts availability, rapid repair capabilities, and certified technicians—is a decisive factor in customer choice, defining the final stage of the value chain and significantly impacting long-term profitability for manufacturers in the marine sector.

Marine Hydraulic Pumps Market Potential Customers

Potential customers and end-users of marine hydraulic pumps are segmented primarily by their operational focus and vessel ownership. The largest single group of customers comprises global shipbuilding yards (e.g., Hyundai Heavy Industries, Samsung Heavy Industries, CSSC) which integrate these pumps into new vessel constructions. These shipyards act as primary buyers, adhering strictly to specification requirements dictated by ship designers and eventual vessel owners. The specification process is rigorous, often requiring pumps to be type-approved by major maritime classification societies to ensure safety and compliance throughout the vessel’s expected life cycle, making brand reputation and certification status highly valuable procurement criteria.

Vessel owners and operators, including major container shipping lines (e.g., Maersk, MSC), bulk carrier operators, and specialized offshore drilling companies, represent the secondary, yet highly consistent, customer base through the aftermarket and MRO segment. These customers require replacement pumps, spare parts, and upgrade solutions to maintain their existing fleets. Their purchasing decisions are strongly influenced by reliability metrics, efficiency gains (to reduce fuel consumption), and the global availability of maintenance services, favoring suppliers with comprehensive worldwide service networks capable of deploying specialized technicians rapidly to vessels operating across international waters.

Furthermore, government agencies and naval forces constitute a strategic, high-value customer segment. Naval contracts demand extremely customized, robust, and often shock-proof hydraulic systems for mission-critical applications like weapon systems, sensor deployment, and complex steering/stabilization gear. Procurement processes for naval vessels are characterized by long lead times, stringent security requirements, and an emphasis on domestic or allied supplier chains. Specialized segments, such as ferry operators, luxury yacht builders, and offshore renewable energy companies (owning installation vessels), also form specific niche markets requiring hydraulic pumps tailored to high cycle rates, aesthetic integration, or specialized dynamic positioning capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.73 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Rexroth, Parker Hannifin, Eaton, Kawasaki Heavy Industries, Hydac International, Danfoss Power Solutions, Linde Hydraulics, Enerpac Tool Group, Moog Inc., Hawe Hydraulik, Wärtsilä, Mitsubishi Heavy Industries, Oilgear, Denison Hydraulics, J.P. Sauer & Sohn, Rotork, Atos S.p.A., Hubei Machinery & Electric, Viking Pump, Sunfab Hydraulics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Marine Hydraulic Pumps Market Key Technology Landscape

The technological landscape of the Marine Hydraulic Pumps Market is characterized by a drive towards enhanced efficiency, digitalization, and environmental compliance. Variable displacement piston pump technology, particularly the swashplate design, remains dominant in high-pressure marine applications due to its superior efficiency control. Modern advancements focus on integrating electronic controls that allow for instantaneous adjustment of pump flow and pressure based on real-time system demands, moving beyond purely mechanical or basic servo controls. This technological refinement significantly reduces auxiliary engine load and optimizes fuel consumption, directly addressing operational cost pressures faced by ship owners in a fuel-price sensitive environment. The incorporation of advanced materials, such as specialized ceramics and composites, in pump internals is also gaining traction, offering improved resistance to cavitation and erosion caused by contaminated or EAL fluids, thus extending the mean time between failures (MTBF) under aggressive operating conditions.

A critical technological evolution is the development and adoption of smart hydraulics, involving the integration of sensors (pressure, temperature, flow, particle counting) directly into the pump housing and associated power units. These sensors facilitate continuous condition monitoring, allowing for predictive maintenance strategies supported by cloud connectivity and edge computing capabilities. The standardization of communication protocols, such as OPC UA, enables seamless data exchange between the Hydraulic Power Unit (HPU) and the vessel's centralized control and monitoring systems (SCADA/IAS). Furthermore, noise and vibration reduction technologies are increasingly vital, especially in passenger ships and naval vessels, leading to the design of specific low-noise pump casings and damping mounts that comply with stringent noise pollution regulations.

Another significant area of innovation revolves around the implementation of environmentally acceptable lubricants (EALs). While EALs offer ecological benefits, they often possess different viscosity and lubrication properties compared to traditional mineral oils, posing challenges to pump efficiency and seal life. Manufacturers are responding by engineering pumps specifically rated and optimized for EALs, using compatible seals and redesigning internal clearances to maintain performance integrity. Lastly, the convergence of hydraulic power with electric drives—leading to hybrid systems where an electric motor drives a variable pump—is essential for vessels utilizing battery or alternative power sources, necessitating hydraulic pumps that can interface efficiently with DC grids and transient power supply conditions.

Regional Highlights

The regional analysis of the Marine Hydraulic Pumps Market reveals a distinct dichotomy in market maturity and growth drivers across major geographies. Asia Pacific (APAC) currently holds the dominant market share, primarily driven by the massive concentration of global shipbuilding activities, particularly in China, South Korea, and Japan. These nations are responsible for constructing the vast majority of commercial vessels, including mega-container ships and LNG carriers, which require extensive hydraulic systems for cargo handling, steering, and emergency operations. Rapid industrialization and government support for domestic maritime industries further solidify APAC's position, focusing heavily on volume production and competitive pricing for standardized hydraulic components.

Europe represents the second largest market, characterized by its focus on high-value, specialized vessel segments such as cruise liners, high-tech research vessels, and advanced naval platforms. European manufacturers and shipyards emphasize cutting-edge technology, including integrated, energy-efficient, and low-noise hydraulic solutions. Countries like Germany, Norway, and Italy lead in technological innovation, driving the adoption of complex variable displacement pumps and prioritizing adherence to strict environmental regulations, particularly concerning EAL usage and noise emissions. The strong presence of major hydraulic component suppliers and system integrators ensures a high level of market competition and innovation within the region.

North America maintains a stable market presence, largely propelled by ongoing naval modernization programs and the robust requirements of the offshore oil and gas industry, especially in the Gulf of Mexico. The demand here is centered on highly rugged, reliable, and certified hydraulic systems capable of enduring harsh operational environments associated with deep-sea drilling and specialized support vessels. While shipbuilding capacity is smaller than in APAC, the complexity and stringent performance specifications for U.S. Navy vessels ensure high average selling prices (ASPs) for specialized hydraulic pumps and related power units. The rest of the world (Latin America, Middle East, and Africa) shows nascent growth tied to localized port development projects and regional naval defense expenditures, though they remain heavily reliant on imported technology and aftermarket services from established European and Asian suppliers.

- Asia Pacific (APAC): Dominant market share due to large-scale shipbuilding in China, South Korea, and Japan; high demand for commercial vessel applications (cargo handling); focus on cost-efficiency and volume production.

- Europe: High-value market segment focusing on technological superiority; strong demand from cruise ship building, naval platforms, and offshore wind installation vessels; regulatory pressure drives innovation in EAL compatibility and energy efficiency.

- North America: Stable demand driven by significant naval modernization budgets and the specialized needs of the offshore energy sector; emphasis on robustness, system redundancy, and high performance specifications.

- Middle East & Africa (MEA): Growth potential linked to regional naval expansion and infrastructure investments in port facilities and oil/gas terminals, often sourcing high-end technology from European OEMs.

- Latin America: Smaller market share, characterized by reliance on imported vessels and equipment; localized growth opportunities exist in maintenance and overhaul (MRO) services for existing fleets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Marine Hydraulic Pumps Market.- Bosch Rexroth

- Parker Hannifin

- Eaton

- Kawasaki Heavy Industries

- Hydac International

- Danfoss Power Solutions

- Linde Hydraulics

- Enerpac Tool Group

- Moog Inc.

- Hawe Hydraulik

- Wärtsilä

- Mitsubishi Heavy Industries

- Oilgear

- Denison Hydraulics (now part of Parker)

- J.P. Sauer & Sohn

- Rotork

- Atos S.p.A.

- Hubei Machinery & Electric

- Viking Pump

- Sunfab Hydraulics

Frequently Asked Questions

Analyze common user questions about the Marine Hydraulic Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the Marine Hydraulic Pumps Market?

The primary driver is the consistent recovery and expansion of global commercial shipbuilding, coupled with stringent international maritime regulations (IMO mandates) requiring vessels to adopt more energy-efficient and reliable hydraulic systems for critical operations like steering and cargo handling, thereby necessitating upgrades and new installations across the global fleet.

How do environmental regulations impact the design requirements for marine hydraulic pumps?

Environmental regulations significantly influence design by mandating the use of environmentally acceptable lubricants (EALs) in specific operational areas. This necessitates manufacturers to redesign seals and internal components to ensure compatibility, prevent leakage, and maintain performance integrity when operating with lower lubricity EAL fluids, pushing R&D towards specialized materials and optimized pump clearances.

Which type of hydraulic pump dominates high-pressure marine applications and why?

Axial piston pumps, particularly those with variable displacement capabilities, dominate high-pressure marine applications such as steering gear and heavy deck machinery. This dominance is due to their inherent efficiency at high pressures, excellent power-to-weight ratio, and precise controllability over flow rate and pressure, crucial for safety-critical marine functions.

What role does Asia Pacific play in the global Marine Hydraulic Pumps Market?

Asia Pacific is the key regional market leader, primarily because countries like China, South Korea, and Japan host the world’s largest shipbuilding yards. This concentration of new vessel construction drives the highest volume demand for both standard and custom-engineered marine hydraulic pumps used in commercial ship applications, including tankers and container vessels.

How is AI transforming maintenance strategies for marine hydraulic systems?

AI is transforming maintenance by enabling predictive failure analysis through real-time data monitoring (vibration, pressure, temperature). Machine learning algorithms process this telemetry to anticipate component degradation, allowing operators to shift from fixed calendar-based maintenance schedules to highly accurate condition-based maintenance, minimizing costly unscheduled downtime and optimizing operational lifecycles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager