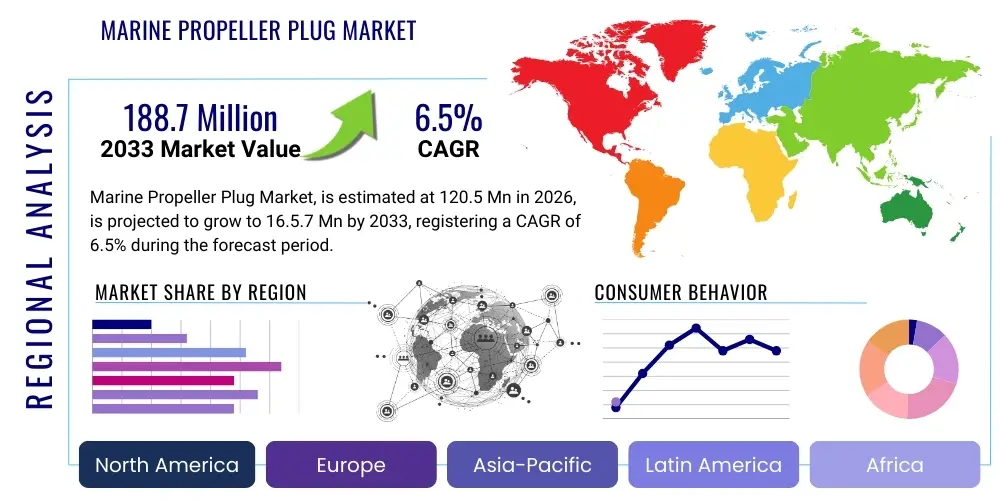

Marine Propeller Plug Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442892 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Marine Propeller Plug Market Size

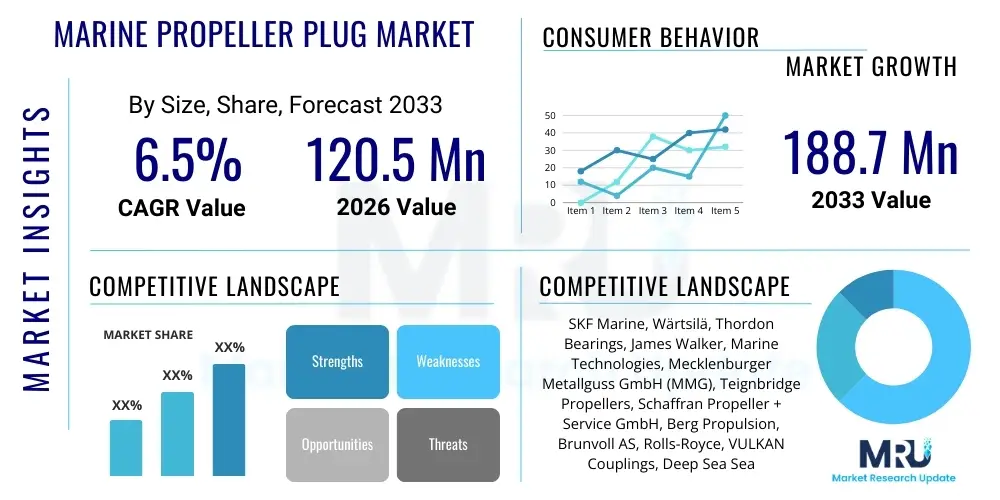

The Marine Propeller Plug Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 120.5 Million in 2026 and is projected to reach USD 188.7 Million by the end of the forecast period in 2033.

Marine Propeller Plug Market introduction

The Marine Propeller Plug Market is defined by the manufacturing, distribution, and utilization of highly specialized sealing devices designed for temporary or long-term isolation of propeller shafts and stern tubes within marine vessels. These components are indispensable tools in the realm of preventative and scheduled marine maintenance, serving the crucial function of creating a robust water-tight barrier at the hull penetration point, typically allowing for the inspection, repair, or replacement of stern tube seals and bearings without the necessity of relocating the vessel to a costly dry-dock facility. The application spectrum is broad, covering virtually every type of sea-going vessel, from small recreational craft to the largest ultra-large container vessels (ULCVs) and naval frigates. Product complexity varies significantly based on propeller type—fixed pitch, controllable pitch, or specialized azimuth thrusters—each requiring unique plug geometries and material specifications to ensure reliable pressure retention and dimensional stability in harsh marine operational environments.

The inherent value proposition of modern propeller plugs lies in their ability to minimize operational expenditure (OPEX) by dramatically reducing vessel downtime. A standard dry-docking procedure for seal replacement can take several days and incur substantial fees, whereas an afloat repair utilizing a high-quality, certified propeller plug can often be completed in a fraction of the time, leading to significant competitive advantages for fleet operators. The products themselves must demonstrate exceptional engineering integrity, capable of withstanding significant hydrostatic pressure, torsional stresses exerted by the shaft assembly, and corrosive exposure to seawater and lubricants. Consequently, the development of specialized materials, including advanced fiber-reinforced composites and proprietary high-density elastomers, is a major focus area for market participants, aiming to deliver plugs that are lighter, easier to handle, and possess greater longevity than previous generations of predominantly metallic solutions. The adoption of these advanced materials is directly linked to the increasing stringency of classification society rules regarding underwater sealing reliability.

Driving factors for the market expansion are multifaceted. Firstly, the continuous growth of global maritime trade and the associated expansion of the world fleet necessitate ongoing maintenance cycles. Secondly, the escalating regulatory pressure from the International Maritime Organization (IMO), particularly the emphasis on pollution control (MARPOL Annex I) to prevent leakage of stern tube lubricating oil into the ocean, mandates more frequent and reliable seal monitoring, which in turn necessitates the deployment of reliable plugs for inspection access. Thirdly, the pervasive industry trend toward Condition-Based Monitoring (CBM) systems for propulsion components dictates that operators shift from arbitrary maintenance schedules to diagnostic-driven intervention, maximizing the operational life of seals and demanding ready availability of reliable plugs for swift, targeted repairs. The integration of propeller plugs into complex underwater inspection protocols, often involving Remotely Operated Vehicles (ROVs), further underscores their importance in modern fleet management strategies, ensuring operational continuity and compliance across global jurisdictions.

Marine Propeller Plug Market Executive Summary

The Marine Propeller Plug Market is currently navigating a growth trajectory driven by the dual forces of global fleet modernization and enhanced maritime regulatory oversight. Business trends indicate a marked shift towards standardization of plug designs where possible, alongside increased demand for bespoke solutions catering to complex podded propulsion systems and large-diameter shafts found in Post-Panamax and Ultra-Large Container Vessels (ULCVs). Manufacturers are increasingly integrating digitalization into their offerings, not only in terms of supply chain tracking but also in providing digital twin models and augmented reality instructions for complex underwater installations. The competitive landscape is characterized by a mix of specialized marine component manufacturers and large engineering conglomerates, with successful strategies focusing on achieving certifications from key classification societies (DNV, ABS, Lloyd’s Register) and building strong service networks to support the crucial aftermarket segment, which accounts for the majority of recurring revenue and provides insulation against cyclical shipbuilding downturns.

Regionally, the market is decisively bifurcated between high-volume manufacturing and fleet maintenance hubs. Asia Pacific (APAC) stands out as the primary market driver, underpinned by its dominance in global shipbuilding output and a vast, increasingly sophisticated regional fleet requiring consistent maintenance. North America and Europe, while slower in terms of new build volume, command high-value market shares, driven by demand for specialized, high-performance plugs for naval and specialized offshore segments, where reliability and material quality are non-negotiable and cost sensitivity is lower. Emerging markets in Latin America and MEA are seeing substantial infrastructure investment focused on oil and gas exports and trade logistics, creating opportunities for entry-level and standard-sized plugs. Localized port regulations and the availability of specialized diving resources significantly influence regional product adoption, favoring suppliers who can provide immediate logistical support and certified installation services.

Segmentation trends reveal robust growth in the Polymer/Composite Material segment, capitalizing on the need for lighter components that mitigate corrosion risks and simplify handling for underwater teams. Although Fixed Pitch Propellers (FPP) currently hold the largest volume share due to the global prevalence in standard merchant fleets, the Controllable Pitch Propeller (CPP) and Azimuth Thruster segments are experiencing accelerated revenue growth, reflecting the trend towards more complex, efficient propulsion systems in new builds, which demand precision-engineered, higher-margin plugs. The Aftermarket Replacement sector remains paramount, fueled by the mandatory five-year survey cycles and the necessity to address unpredictable operational failures. Forward-looking strategies focus on product differentiation through enhanced anti-fouling coatings and modular designs that facilitate easier field repair and maintenance, thereby securing long-term service contracts with major fleet owners and MRO entities globally.

AI Impact Analysis on Marine Propeller Plug Market

The influence of Artificial Intelligence (AI) on the Marine Propeller Plug Market is primarily indirect but profoundly impacts the underlying maintenance planning and logistical infrastructure that dictates plug utilization. User concerns frequently concentrate on the integration of AI-powered diagnostic tools with existing vessel systems, seeking assurance that these new technologies will accurately predict stern tube seal failure with sufficient lead time to schedule plug installation efficiently. Common questions delve into the capability of AI to manage and optimize inventories of various plug sizes across global service centers, minimizing the high cost associated with warehousing critical spare parts. The core expectation is that AI will institutionalize Condition-Based Maintenance (CBM), moving the industry away from traditional time-based maintenance intervals, thus making the deployment of propeller plugs a precision-timed, rather than prophylactic, event.

AI’s primary leverage point is within the realm of prognostics and health management (PHM) for propulsion systems. By continuously analyzing sensor data streams—including shaft vibration spectra, lubricant analysis results (particle count, moisture levels), and stern tube bearing temperatures—AI algorithms can detect subtle anomalies indicative of seal wear or damage far earlier than human technicians. This predictive capability translates directly into highly optimized maintenance windows. Instead of defaulting to dry-docking, vessel managers, guided by AI predictions, can confidently deploy propeller plugs for targeted afloat repairs, maximizing the operational cycle between major service intervals. This shift demands a high level of reliability and certification for the plug itself, as its performance is now linked to a complex, data-driven decision process, elevating quality standards across the manufacturing sector.

Beyond diagnostics, AI streamlines the global supply chain essential for supporting the plug market. For MRO providers managing multiple fleets worldwide, AI utilizes machine learning to forecast regional demand fluctuations, taking into account vessel routing, regulatory inspection calendars, and historical failure rates specific to different plug materials and sizes. This optimization minimizes inventory carrying costs while ensuring mission-critical components are available near major shipping lanes or port clusters. Furthermore, in the design phase, Generative AI is being explored to optimize the complex geometry of plugs for specialized propulsion units (e.g., azimuth thrusters), suggesting novel, lighter, and more efficient designs that maintain structural integrity under extreme hydrostatic and operational loads, thereby enhancing product performance and reducing manufacturing waste.

- AI-driven Predictive Maintenance: Enhancing the accuracy of stern tube seal failure prediction, optimizing the timing for propeller plug deployment for inspection and replacement.

- Automated Diagnostics: Using machine learning models to interpret complex vibration and lubricant analysis data to confirm the necessity and scope of a repair requiring a plug.

- Optimized Spare Parts Logistics: AI forecasting global replacement demand based on fleet profiles and operational data, improving inventory management and reducing lead times for MRO centers.

- Digital Twin Integration: Utilizing AI to run virtual simulations of plug installation and removal processes, training technicians and validating structural integrity under simulated conditions.

- Enhanced Manufacturing Quality Control: Implementing computer vision systems powered by AI for automated dimensional inspection of plugs during fabrication, ensuring adherence to strict geometric tolerances.

DRO & Impact Forces Of Marine Propeller Plug Market

The Marine Propeller Plug Market dynamic is fundamentally influenced by robust Drivers, critical Restraints, promising Opportunities, and pervasive Impact Forces. Key drivers include the overwhelming global reliance on maritime transport, which mandates continuous maintenance of the expanding commercial fleet, ensuring a steady baseline demand for maintenance tools. Foremost among the drivers is the increasing stringency of environmental regulations, particularly the IMO's requirements concerning the prevention of oil pollution from stern tube systems. This legislative framework compels ship owners to invest in reliable, certified components and proactive maintenance strategies that frequently involve the use of propeller plugs for inspection and seal replacement, thereby sustaining high-quality product demand irrespective of short-term economic fluctuations. Furthermore, the operational cost benefits derived from utilizing plugs for afloat maintenance, circumventing expensive and time-consuming dry-docking, provide a powerful economic incentive for adoption across all vessel segments.

However, the market faces several restraining factors that temper growth. The high cost associated with custom-engineered, large-diameter plugs required for modern mega-vessels (ULCVs, large cruise ships) presents a significant barrier to entry for smaller operators or maintenance service providers. A critical restraint lies in the technical complexity and specialized skill set required for the underwater installation and removal of these plugs. This process often necessitates highly trained diving teams or specialized Remotely Operated Vehicles (ROVs), whose availability and operational costs are substantial, especially in remote ports, limiting the speed and accessibility of afloat repair services. Furthermore, the long replacement cycle of propeller plugs, driven by their inherent durability and the typical 5-year classification survey cycle for stern tube seals, means that the new build market provides only an initial boost, requiring manufacturers to heavily rely on capturing aftermarket service contracts for sustained revenue.

Opportunities for future expansion are substantial, particularly in technological innovation and new market segments. The growing trend towards "green shipping" creates an opportunity for manufacturers to develop propeller plugs compatible with new, environmentally acceptable lubricants (EALs), which often possess different chemical properties that necessitate specific plug materials to maintain seal integrity. Furthermore, the burgeoning demand from the recreational boating and smaller coastal vessel sector, often overlooked by major marine engineering firms, offers a high-volume, albeit lower-margin, opportunity for standardized, easy-to-install plugs. The greatest long-term opportunity lies in the integration of smart technology; designing plugs with embedded passive sensors or RFID technology to streamline inspection verification and maintenance logging, moving the product from a purely mechanical component to a 'smart maintenance enabler'. Impact forces, such as global trade policy shifts and geopolitical tensions affecting major shipping routes, can influence fleet deployment and maintenance scheduling, indirectly affecting short-term demand variability, while the steady advancement of specialized underwater robotics improves the feasibility and safety of plug deployment, acting as a positive, facilitating force.

Segmentation Analysis

Segmentation analysis of the Marine Propeller Plug Market reveals a highly specialized structure, crucial for deciphering demand patterns across different vessel types and operational requirements. The segmentation by Propeller Type—Fixed Pitch Propellers (FPP) versus Controllable Pitch Propellers (CPP) and Azimuth Thrusters—is essential, as FPP systems, being the industry standard for general cargo and smaller vessels, generate the largest volume requirement for standardized plugs. Conversely, CPP and Azimuth systems, typically found in large, technologically advanced vessels like offshore support vessels (OSVs) and naval ships, require highly customized, precision-engineered plugs, leading to a higher average selling price (ASP) and greater revenue contribution per unit despite lower volume. Understanding this dual market structure is paramount for manufacturers allocating R&D resources toward either mass production efficiency or bespoke engineering capabilities.

Material segmentation provides insight into the technological direction of the industry, with the traditional dominance of Metallic Plugs (e.g., bronze or steel) being challenged by advanced Polymer/Composite solutions. Composite plugs offer substantial benefits, including inherent corrosion resistance, reduced weight (simplifying handling for diving teams), and often quicker turnaround times for custom fabrication. This shift is driven by sustainability goals and the need for components compatible with modern, non-petroleum-based lubricants (EALs). Furthermore, the application split between New Shipbuilding and Aftermarket Replacement clearly delineates the market drivers. While new build demand is cyclical and tied directly to global economic health and order books, the Aftermarket segment provides consistent, resilient demand necessary for market stability, driven by mandatory vessel surveys and the operational necessity to conduct unplanned repairs, which requires global distribution agility.

The segmentation by Vessel Type further refines targeting. Commercial Vessels (tankers, carriers) represent the core market volume and drive demand for durable, standardized large plugs. The Offshore Support Vessel (OSV) sector demands specialized plugs for dynamic positioning systems, often requiring compatibility with retractable thrusters, introducing unique engineering challenges. Naval vessels represent a distinct niche with extremely high-security and technical specifications, requiring plugs certified to strict military standards. Analyzing these segments allows manufacturers to tailor their marketing, certification efforts, and inventory management, recognizing that a small recreational boat repair facility requires a standardized, off-the-shelf product, while a major international shipping firm requires global, certified MRO service support integrated with plug supply.

- By Propeller Type:

- Fixed Pitch Propellers (FPP)

- Controllable Pitch Propellers (CPP)

- Azimuth Thrusters

- Podded Propulsion Systems

- By Material Type:

- Metallic Plugs (Steel, Aluminum, Bronze)

- Polymer/Composite Plugs (High-density Polyethylene, Specialized Elastomers)

- Rubber Plugs (Custom Molded)

- By Application:

- New Shipbuilding

- Aftermarket Replacement & Maintenance

- By Vessel Type:

- Commercial Vessels (Tankers, Bulk Carriers, Container Ships)

- Offshore Support Vessels (OSVs)

- Naval and Military Vessels

- Passenger and Ferry Vessels

- Recreational and Small Vessels

Value Chain Analysis For Marine Propeller Plug Market

The intricate value chain of the Marine Propeller Plug Market starts with the rigorous selection and sourcing of materials in the Upstream segment. Given the extreme operational requirements—exposure to high pressure, continuous shear stress, chemical interaction with various lubricants, and potential biofouling—material integrity is non-negotiable. Suppliers must provide materials that meet stringent maritime specifications (e.g., specific grades of stainless steel, nickel-aluminum bronze alloys, or specialty HNBR/Viton elastomers). This phase involves complex supply agreements with specialty chemical companies and metallurgical firms to ensure traceability and consistent quality required for Classification Society certification. For composite plugs, raw material processing includes advanced compounding and reinforcement technologies, focusing on achieving optimal stiffness-to-weight ratios and mitigating water absorption risks, which can compromise the plug's critical dimensions.

The Midstream component encompasses the core manufacturing process, characterized by high-precision engineering. For metallic plugs, this involves complex casting, forging, and multi-axis CNC machining to achieve micro-level surface finish and exacting geometric tolerances crucial for effective sealing. Polymer plugs rely on specialized injection molding and compression molding techniques under highly controlled environments. Quality control is a major bottleneck, requiring non-destructive testing (NDT), hydrostatic pressure testing, and dimensional validation against Classification Society drawings. Crucially, successful manufacturers must maintain deep in-house engineering capabilities to handle the frequent requests for bespoke designs tailored to unique vessel stern gear configurations, which often differ significantly across different shipyards and propulsion system manufacturers. Standardization efforts are ongoing but complex due to the legacy nature of many existing fleets.

The Downstream segment, covering distribution and service, is highly critical. The industry utilizes both Direct and Indirect distribution channels. Direct sales are typically preferred for large new build projects or high-value, long-term fleet service agreements with major shipping lines. These direct relationships allow manufacturers to provide technical support and customized logistical planning. The indirect channel, however, dominates the expansive aftermarket. This channel involves a global network of specialized maritime distributors, MRO (Maintenance, Repair, and Overhaul) service centers, and appointed agents located strategically near major ports (e.g., Rotterdam, Singapore, Shanghai). Effective downstream management requires sophisticated inventory planning to anticipate global maintenance peaks and the capability to rapidly ship mission-critical, large components via specialized logistics providers, minimizing the vessel’s time spent waiting for parts. Certification status and the ability to provide installation support services are key competitive differentiators within this distribution network, ensuring compliance and reliability for the end-user.

Marine Propeller Plug Market Potential Customers

The primary purchasing entities and End-Users of the Marine Propeller Plug Market are segmented across various operational categories within the global maritime ecosystem. The most significant customer base comprises the Technical Management Departments of large International Shipping Companies that operate massive fleets of commercial vessels, including VLCCs, Capesize bulk carriers, and Post-Panamax container ships. These customers are driven by the necessity of regulatory compliance (Class Surveys) and the optimization of operational efficiency. Their purchasing decisions are highly influenced by product certification, proven reliability over long service intervals, global technical support availability, and the plug’s demonstrated capacity to reduce the frequency and duration of dry-docking events. Procurement for these large operators is centralized, focusing on establishing long-term, high-volume supply contracts.

The second major cohort of potential customers consists of Global Shipyards and specialized Third-Party MRO Service Providers. Shipyards are the initial consumers, integrating plugs into new vessel construction specifications, requiring guaranteed compatibility with stern tube specifications from manufacturers like Wärtsilä or SKF. MRO providers, ranging from large, multinational marine repair firms to smaller, regional dry-dock facilities, are the cornerstone of the aftermarket. They stock, install, and service the plugs during scheduled or emergency repairs. For this customer group, key purchasing criteria include ease of handling, robustness against repeated use, rapid delivery times, and comprehensive training and support from the plug manufacturer. Their demand is highly inelastic for emergency repair situations, prioritizing immediate availability above all else to minimize vessel lay-up time.

Further specialized segments include Governmental and Naval Fleets, requiring plugs that adhere to stringent military specifications for extreme durability, often involving specialized materials and complex sealing mechanisms for silent operation or enhanced shock resistance. Additionally, the Offshore and Energy sector, encompassing owners of FPSOs, drilling rigs, and advanced Offshore Support Vessels (OSVs), requires plugs tailored for challenging operational profiles, often involving dynamic positioning (DP) thruster systems. These customers prioritize robustness and specialized design features for quick deployment in often volatile sea conditions. Finally, the growing population of Private Yacht Owners and smaller Coastal Transport Operators form the base of the retail aftermarket, where price sensitivity is higher, and demand favors standardized, readily available components distributed through marine retail channels and local repair shops.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 120.5 Million |

| Market Forecast in 2033 | USD 188.7 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SKF Marine, Wärtsilä, Thordon Bearings, James Walker, Marine Technologies, Mecklenburger Metallguss GmbH (MMG), Teignbridge Propellers, Schaffran Propeller + Service GmbH, Berg Propulsion, Brunvoll AS, Rolls-Royce, VULKAN Couplings, Deep Sea Seals Ltd., Trelleborg Marine and Infrastructure, KEMEL Co., Ltd., Chesterton, Sealite, Riverhawk Company, Hydro Seals, JRC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Marine Propeller Plug Market Key Technology Landscape

The key technology landscape within the Marine Propeller Plug Market is defined by continuous improvement in material science, precision manufacturing, and installation methodologies designed to enhance sealing reliability and operational turnaround time. A critical technological evolution is the reliance on advanced composites, particularly fiber-reinforced polymers (FRP) and proprietary thermoplastic elastomers, replacing heavier, corrosion-prone metallic plugs. These materials are chosen not only for their superior resistance to galvanic corrosion and weight reduction but also for their mechanical properties, such as low water absorption and stable coefficient of thermal expansion, which guarantee a consistent seal integrity across fluctuating seawater temperatures and pressures. Manufacturers leverage sophisticated material testing facilities to ensure components remain robust after prolonged exposure to biofouling agents and chemically active environmentally acceptable lubricants (EALs).

Precision engineering and manufacturing tolerance control are fundamental technology drivers. Modern plugs must interface seamlessly with sophisticated stern tube assemblies, often requiring tolerances measured in micrometers. Key technologies employed include 5-axis CNC machining for complex metallic components and high-pressure vacuum casting for large-format composite pieces, ensuring perfect symmetry and surface finish necessary to interface correctly with sensitive stern tube sealing interfaces. Design optimization utilizes computational fluid dynamics (CFD) and Finite Element Analysis (FEA) to model the hydrostatic pressure distribution on the plug face, optimizing internal reinforcement structures and material thickness to maximize safety factors while minimizing overall weight and material cost, adhering rigorously to design standards set by classification societies.

Installation technology represents another major area of innovation. Traditional plug installation often requires highly specialized, time-consuming diving operations. New technological advancements focus on Modular and Quick-Deployment Systems. These include hydraulically activated plugs that expand to secure and seal the opening remotely or specialized plug-handling tools compatible with advanced Remotely Operated Vehicles (ROVs). This shift reduces the dependence on divers in hazardous environments and significantly accelerates the maintenance cycle. Furthermore, the integration of passive smart technology, such as embedded ultrasonic sensors or pressure-sensitive foils, allows maintenance engineers to verify the seating and sealing pressure of the plug remotely before commencing work, adding a layer of crucial safety assurance and streamlining the certification handover process after the afloat repair is completed, representing the convergence of digital technology with purely mechanical components.

Regional Highlights

The strategic importance of the Asia Pacific (APAC) region cannot be overstated in the Marine Propeller Plug Market, serving as both the epicenter of global manufacturing and a major demand hub. Countries like China, South Korea, and Japan command over 70% of the world's new shipbuilding capacity, generating massive initial equipment demand for plugs. Furthermore, the high volume of traffic flowing through critical Asian maritime routes and major ports (Singapore, Shanghai, Busan) ensures that the aftermarket for maintenance and repair services is exceptionally vigorous. The operational environment in this region often involves challenging conditions, such as high biofouling rates and fluctuating temperatures, driving localized demand for materials and coatings specifically engineered for these requirements. The region's focus on expanding its domestic commercial fleets and maintaining naval dominance guarantees sustained, long-term market growth.

Europe holds a dominant position in the high-end, specialized segment of the market. European ship owners, driven by demanding environmental legislation and a focus on high-efficiency operations (e.g., luxury cruise, advanced ferries, renewable energy service vessels), prioritize plugs with superior materials, advanced certifications, and robust design reliability. European manufacturers, particularly in Germany and Scandinavia, are leaders in developing composite and quick-deployment plug technology, serving a market that is less price-sensitive and highly focused on minimizing operational risks and maximizing lifecycle value. The existence of robust regulatory bodies and world-class MRO facilities in key maritime centers like the Netherlands and the UK ensures that Europe remains a critical innovation and high-margin service market.

North America’s market is characterized by stability and specialized requirements. Demand is predominantly driven by the requirements of the United States Coast Guard (USCG) and the US Navy (USN), which require specialized plugs meeting rigorous military standards, often focusing on reliability under extreme operational stress. The large recreational boating market along the coasts and Great Lakes also generates high volume for standardized, smaller-diameter plugs. In contrast, the Middle East and Africa (MEA) market is exhibiting rapid expansion, intrinsically linked to offshore oil and gas operations and the strategic development of major container terminals (e.g., Jebel Ali, Port Said). This growth requires specialized plugs for OSVs and large tanker fleets, presenting opportunities for manufacturers to secure supply contracts tied to long-term regional infrastructure projects. Latin America’s market is slower but steady, primarily focused on maintaining fleets supporting commodity exports (Brazil, Chile) and requiring reliable, cost-effective plug solutions for essential fleet upkeep.

- Asia Pacific (APAC): Market leader due to massive shipbuilding volume and extensive commercial fleet operations; key drivers are new builds and large aftermarket component replacement.

- Europe: Focus on high-specification, premium plugs for specialized vessels (cruise, naval); strong market for advanced composite materials and environmental compliance solutions.

- North America: Stable demand driven by naval maintenance, strict regulatory compliance (USCG), and the large recreational marine sector.

- Middle East & Africa (MEA): Emerging high-growth market linked to offshore energy expansion and development of strategic maritime logistics hubs demanding OSV and tanker plugs.

- Latin America: Steady market relying on standardized plug solutions for maintaining commodity transport fleets, with growth tied to investment in port infrastructure modernization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Marine Propeller Plug Market.- SKF Marine

- Wärtsilä

- Thordon Bearings

- James Walker

- Marine Technologies

- Mecklenburger Metallguss GmbH (MMG)

- Teignbridge Propellers

- Schaffran Propeller + Service GmbH

- Berg Propulsion

- Brunvoll AS

- Rolls-Royce

- VULKAN Couplings

- Deep Sea Seals Ltd.

- Trelleborg Marine and Infrastructure

- KEMEL Co., Ltd.

- Chesterton

- Sealite

- Riverhawk Company

- Hydro Seals

- JRC

Frequently Asked Questions

Analyze common user questions about the Marine Propeller Plug market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Marine Propeller Plug?

The primary function of a marine propeller plug is to provide a reliable seal to the stern tube or propeller hub opening when the propeller shaft is removed or when maintenance is required on stern tube seals, bearings, or associated components. This allows essential repairs or inspections to be conducted without the necessity of dry-docking the vessel, significantly reducing operational downtime and costs. Plugs are certified by classification societies to maintain a watertight seal against hydrostatic pressure.

Which materials are most commonly used in the manufacture of Marine Propeller Plugs?

Marine propeller plugs are commonly manufactured using high-grade materials to ensure durability in harsh marine environments. The dominant material types include specialized polymers and composites (preferred for weight and corrosion resistance), corrosion-resistant metallic alloys (such as stainless steel or naval bronze for high-stress applications), and high-performance, custom-molded rubber/elastomers for sealing components. The trend favors composites for easier handling and improved longevity against corrosion and biofouling.

How do stringent environmental regulations impact the Marine Propeller Plug Market?

Strict environmental regulations, notably those from the IMO concerning oil pollution (MARPOL), significantly impact the market by driving demand for highly reliable, certified plugs. Operators seek plugs that guarantee zero leakage during maintenance procedures involving stern tube oil. This regulatory push forces manufacturers toward advanced material science and precision engineering to ensure components are compatible with environmentally acceptable lubricants (EALs) and prevent environmental contamination, elevating quality standards across the board.

What is the difference in demand between Fixed Pitch Propeller (FPP) and Controllable Pitch Propeller (CPP) plugs?

Fixed Pitch Propeller (FPP) plugs account for higher volume demand due to the massive installed base of FPP systems globally in standard merchant fleets. However, Controllable Pitch Propeller (CPP) plugs and plugs for Azimuth Thrusters represent a higher value segment with complex engineering requirements. This high-value segment is projected to show faster growth due to the increasing adoption of efficient CPP systems in modern, large-scale commercial and specialized vessels requiring precise variable pitch functionality.

How does predictive maintenance technology affect the market for propeller plugs?

Predictive maintenance systems, often utilizing AI and sensor data, optimize the scheduling of stern tube inspections. Instead of routine, time-based maintenance, plugs are deployed only when predictive analytics indicate seal degradation or imminent failure. This increases the utilization efficiency of maintenance teams and plugs, emphasizing the demand for quick-installation, highly reliable plug designs that support minimized intervention periods and maximize vessel operational uptime between scheduled maintenance events.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager