Mask Inspection Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442899 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Mask Inspection Equipment Market Size

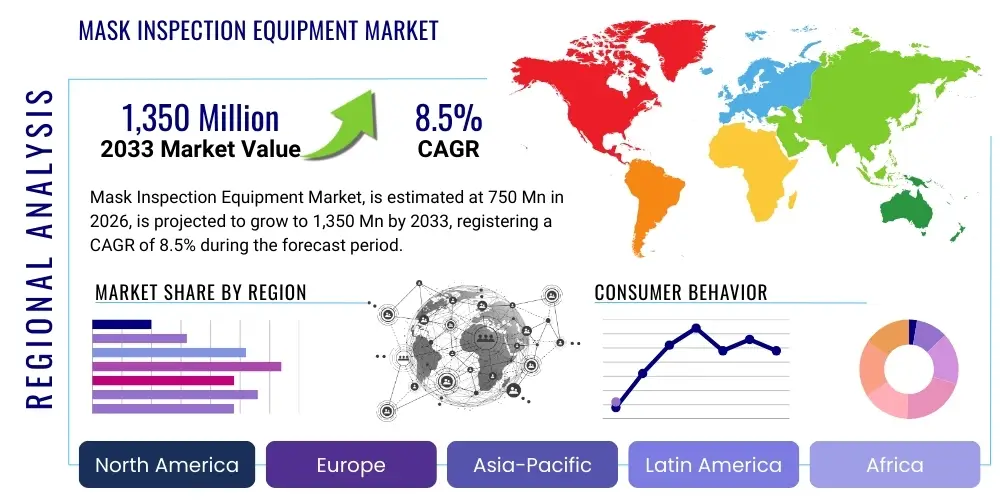

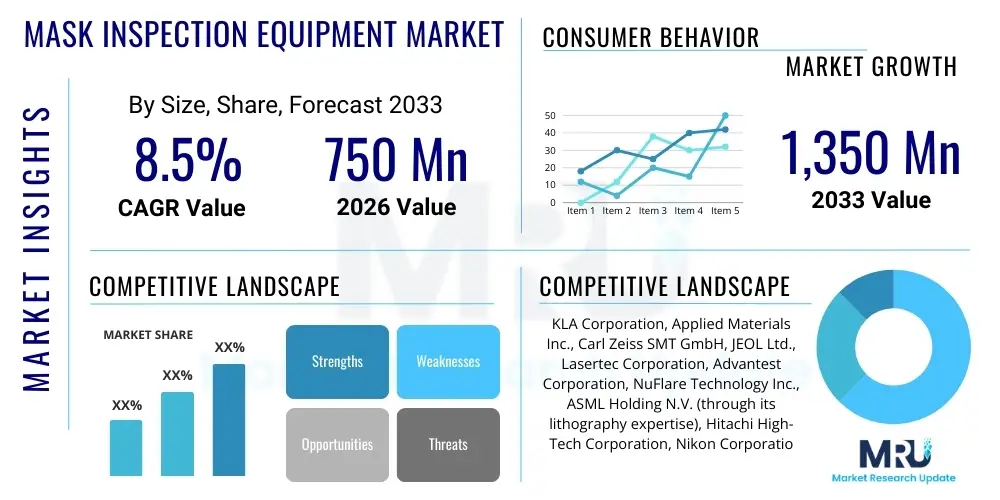

The Mask Inspection Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 1,350 Million by the end of the forecast period in 2033.

Mask Inspection Equipment Market introduction

The Mask Inspection Equipment Market encompasses highly specialized optical and electron-beam tools crucial for verifying the integrity of photomasks and reticles used in the semiconductor manufacturing process. Photomasks act as the master template for transferring circuit patterns onto silicon wafers during lithography. Any defect on the mask—ranging from foreign particles and pattern errors to chemical stains—will be replicated onto every subsequent chip, leading to catastrophic yield loss. Therefore, mask inspection is a non-negotiable step in the semiconductor fabrication workflow, ensuring that the critical dimensions and design specifications of the lithography template are met before high-volume manufacturing commences. The increasing complexity of integrated circuits, particularly the transition to sub-10nm nodes and the adoption of Extreme Ultraviolet (EUV) lithography, mandates ever-more sensitive and accurate inspection systems, driving significant investment in this specialized equipment sector.

Mask inspection equipment is broadly categorized based on the underlying technology, including Die-to-Die (D-D) comparison, Die-to-Database (D-B) comparison, and specialized techniques for advanced defects. Modern systems leverage sophisticated optics (Deep Ultraviolet or DUV) and electron beam technologies (E-beam) to achieve the nanometer-scale resolution required for advanced node verification. Major applications span research and development (R&D) in foundries, initial mask qualification, monitoring mask degradation during production, and verifying repair accuracy. The equipment delivers immense benefits, primarily by maximizing semiconductor yield, accelerating time-to-market for cutting-edge chips, and significantly reducing the substantial operational costs associated with mask set failures in high-volume production environments.

Key driving factors propelling the growth of this market include the global expansion of advanced semiconductor fabrication facilities (fabs), relentless progress in Moore's Law necessitating smaller feature sizes and highly complex mask structures (such as those used for Multi-Patterning and EUV), and the escalating cost of mask sets. A single EUV mask set can cost millions of dollars, making reliable, high-speed inspection indispensable for protecting these investments. Furthermore, the rising demand for high-performance computing (HPC), artificial intelligence (AI) chips, and advanced mobile processors ensures continuous pressure on equipment manufacturers to deliver faster throughput, higher sensitivity, and integration of AI algorithms for improved defect classification and root cause analysis.

Mask Inspection Equipment Market Executive Summary

The Mask Inspection Equipment Market exhibits robust growth driven primarily by structural shifts within the global semiconductor industry, particularly the accelerating transition towards advanced process nodes (5nm, 3nm, and below) and the widespread commercial deployment of EUV lithography. Business trends indicate a highly concentrated market dominated by a few key technology providers specializing in high-end DUV and EUV inspection capabilities, focusing heavily on R&D expenditure to address challenges related to defect sizing, mask blank inspection, and minimizing inspection time without sacrificing accuracy. A major trend involves the integration of advanced computational and machine learning techniques to enhance defect detection algorithms, allowing for faster differentiation between nuisance defects and critical flaws, thereby optimizing the entire mask lifecycle management process. Consolidation among technology leaders and strategic partnerships with major foundries remain central to securing long-term contracts and adapting tools to proprietary manufacturing flows.

Segment trends reveal that the Die-to-Database (D-B) inspection segment is experiencing faster growth, primarily because it is mandatory for complex reticles and features requiring comparison against the original design data, which is essential for EUV masks lacking the symmetry required for traditional Die-to-Die methods. The EUV mask inspection segment, though currently smaller in volume, represents the highest growth potential due to the critical nature of these masks and the severe challenges associated with detecting sub-20nm defects on highly reflective EUV multilayer structures. End-user demand is heavily skewed towards Integrated Device Manufacturers (IDMs) and pure-play foundries, which require the most sophisticated and high-throughput equipment available to manage multi-billion dollar fabrication lines. The market for used or refurbished equipment remains stable but constitutes a niche primarily serving mature nodes or less aggressive R&D environments.

Regionally, Asia Pacific (APAC) stands as the undisputed epicenter of demand, driven by massive investments in new fabrication plants and cutting-edge technology adoption by major players in Taiwan (TSMC), South Korea (Samsung, SK Hynix), and the rapidly expanding semiconductor manufacturing base in mainland China. While North America and Europe house the primary research and development centers and the headquarters of key equipment vendors, the immediate procurement and deployment of inspection tools are concentrated in APAC, reflecting the geographical shift of high-volume manufacturing. Sustained geopolitical tensions surrounding technology trade have emphasized regional self-sufficiency initiatives, potentially creating decentralized manufacturing hubs that will necessitate localized procurement of advanced inspection tools over the next decade, though APAC is expected to maintain its market dominance throughout the forecast period.

AI Impact Analysis on Mask Inspection Equipment Market

User inquiries regarding AI's influence in the Mask Inspection Equipment market frequently center on how machine learning can overcome the inherent limitations of traditional rule-based defect detection, especially concerning the escalating complexity and diminishing size of defects in advanced nodes. Common questions include the feasibility of using Deep Learning (DL) for accurate defect classification (distinguishing critical defects from false positives or nuisance variations), the computational requirements for integrating AI into high-speed inspection systems, and the ability of AI to adapt inspection recipes dynamically based on real-time process variations. Furthermore, users often express interest in how AI can facilitate predictive maintenance of the inspection equipment itself and accelerate the review process for human operators, who are overwhelmed by the vast quantity of data generated by modern high-resolution scans. The underlying theme is the expectation that AI must deliver higher yield, faster cycle times, and reduced operational expenditure.

The application of Artificial Intelligence, specifically deep neural networks, is fundamentally changing the landscape of mask defect detection and analysis. Traditional mask inspection often results in a high number of false positives—non-critical anomalies that require time-consuming manual review. AI algorithms trained on massive datasets of mask images and corresponding electrical test results can drastically improve defect classification accuracy and specificity, significantly reducing the "human review" bottleneck. This operational efficiency is critical in high-volume manufacturing environments where minimizing mask downtime is paramount. Moreover, AI enables more sophisticated analysis beyond simple pattern comparison, allowing systems to predict potential yield impact based on defect characteristics and location, thus prioritizing repairs only for truly critical defects.

Furthermore, AI is instrumental in optimizing the performance and usage of the inspection tools themselves. Machine learning models are being deployed for automated inspection recipe generation, adapting parameters such as illumination angles and sensitivity thresholds based on the specific design layout and process step, a task that was previously manual and iterative. In the realm of equipment maintenance, AI systems monitor sensor data (such as optics condition, vacuum levels, and beam stability) to predict component failures well in advance, transitioning fabs from reactive maintenance to highly efficient predictive maintenance schedules. This holistic integration of AI across detection, classification, and system optimization ensures that mask inspection equipment remains a viable bottleneck solution as feature sizes continue to shrink into the angstrom regime.

- Enhanced Defect Classification: AI algorithms reduce false positives, improving accuracy and shortening the critical review cycle time.

- Automated Recipe Optimization: Machine learning dynamically adjusts inspection parameters based on mask design complexity and specific process requirements.

- Predictive Maintenance: AI monitors tool health, forecasting potential equipment failures to maximize uptime and operational availability.

- Improved Data Handling: AI processes massive inspection datasets rapidly, extracting meaningful insights for root cause analysis in lithography processes.

- Accelerated Defect Review: Automated prioritization of critical defects minimizes the time human operators spend analyzing benign anomalies.

DRO & Impact Forces Of Mask Inspection Equipment Market

The Mask Inspection Equipment market is governed by a powerful set of interconnected drivers, restraints, and opportunities (DRO), which are highly sensitive to the technological trajectory of the semiconductor industry. The primary drivers include the relentless requirement for higher-density memory and logic chips, which mandates the use of complex lithography techniques like EUV and advanced multi-patterning, directly increasing the necessity for ultra-sensitive mask inspection. The escalating cost of advanced mask sets necessitates stringent quality control throughout the mask lifecycle, treating inspection as an indispensable insurance mechanism against financial losses. Conversely, market growth faces significant restraints, chiefly the extraordinarily high capital expenditure required for state-of-the-art inspection systems, which can only be justified by leading-edge foundries. Furthermore, the technical challenge of achieving high-speed inspection sensitivity for EUV masks, particularly concerning defect review and repair processes (which are currently slower than production requirements), acts as a continuous brake on efficiency.

Opportunities in the market revolve around technological advancements designed to overcome current restraints. A significant opportunity lies in the development of faster, higher-throughput E-beam inspection systems capable of characterizing small defects rapidly, bridging the current gap between detection speed and sensitivity. The adoption of software-driven solutions, including subscription-based models for advanced AI defect analysis and real-time process control linkages, presents a pathway for equipment vendors to diversify revenue streams beyond initial hardware sales. Furthermore, the emerging requirement for inspection solutions targeting advanced packaging technologies, such as 3D integration and wafer-level packaging, opens new, adjacent market segments outside of traditional planar IC fabrication. These opportunities are actively pursued by vendors through internal R&D and strategic acquisitions aimed at expanding their technological portfolio.

The collective impact forces of these DRO factors dictate market dynamics. The pervasive impact of Moore's Law acts as the foundational gravitational force, compelling continuous technological innovation in detection resolution (Impact Force: High). However, the oligopolistic nature of the market, dominated by a few specialized vendors, means that capital investment decisions are highly concentrated and subject to the economic cycles of the leading foundries (Impact Force: Medium-High). Regulatory and geopolitical forces, particularly export control policies concerning advanced technology, also exert significant pressure, influencing regional market growth and supply chain security, necessitating localized or diversified manufacturing strategies (Impact Force: Medium). Ultimately, the demand for faster, more powerful chips ensures that the requirement for cutting-edge mask inspection will remain critical, sustaining strong long-term growth despite short-term cyclical headwinds.

Segmentation Analysis

The Mask Inspection Equipment Market is meticulously segmented based on technology type, inspection method, and end-user application, reflecting the diverse requirements of the semiconductor ecosystem. Technological segmentation primarily distinguishes between Deep Ultraviolet (DUV) based systems, which are foundational for mainstream nodes and 193nm lithography, and the highly advanced Extreme Ultraviolet (EUV) based systems, designed specifically for the 7nm node and below. The inspection method is crucial, segmenting the market into Die-to-Die (D-D), which compares adjacent dies on the mask, and the technically more demanding Die-to-Database (D-B) comparison, which checks the fabricated pattern against the CAD design file. D-B is indispensable for masks lacking redundant patterns or those utilized in EUV processes. End-user segmentation captures demand distribution across major participants in the semiconductor value chain, including captive foundries (IDMs) and merchant foundries.

The segmentation by equipment type also details inspection solutions for various mask components. This includes dedicated Mask Blank Inspection tools, which check the underlying substrate before pattern deposition (critical for detecting defects on the multilayer stack of EUV blanks), and Patterned Mask Inspection systems, which verify the final etched circuits. The performance requirements differ vastly across these segments; blank inspection requires high sensitivity for extremely tiny, buried defects, while patterned inspection demands high throughput and accurate defect classification. Geographically, the market is dissected into major regions—North America, Europe, APAC, and RoW—reflecting manufacturing footprint and technological adoption rates.

Understanding these segments is vital for vendors to tailor their product offerings and R&D strategies. For instance, high-growth opportunities are concentrated within the EUV-related segments, necessitating massive investment in specialized vacuum environments and beam control technology. Conversely, the DUV segment remains stable, serving the vast majority of legacy and mature production nodes, requiring a focus on cost-effectiveness and sustained throughput. The complexity of the market means that equipment providers must often offer a portfolio spanning multiple technologies and methodologies to address the full spectrum of customer needs from the initial mask design verification through to final reticle use in the production environment.

- By Technology Type:

- Deep Ultraviolet (DUV) Inspection

- Extreme Ultraviolet (EUV) Inspection

- Electron Beam (E-Beam) Inspection

- By Inspection Method:

- Die-to-Die (D-D) Comparison

- Die-to-Database (D-B) Comparison

- Programmed Defect Inspection (PDI)

- By Equipment Type:

- Mask Blank Inspection Equipment

- Patterned Mask Inspection Equipment

- By End-User:

- Foundries (Pure-Play and Captive)

- Mask Shops (Merchant and In-House)

- Research & Development Institutes

Value Chain Analysis For Mask Inspection Equipment Market

The value chain for Mask Inspection Equipment is intricate and highly specialized, beginning with upstream suppliers who provide critical components such as high-precision optics, specialized light sources (e.g., excimer lasers for DUV, plasma sources for EUV), high-speed computing hardware, and vacuum systems necessary for E-beam tools. The research and development phase at the core equipment manufacturers (OEMs) is extremely intensive, requiring massive capital and intellectual property investment in advanced imaging and metrology algorithms. The complexity and precision of these components create high barriers to entry, resulting in a concentrated supplier base where quality and consistency of sub-systems directly influence the performance and sensitivity of the final inspection tool. Relationships between OEMs and key component suppliers are often highly collaborative and long-term.

Midstream activities are dominated by the Original Equipment Manufacturers (OEMs), who handle the system integration, proprietary software development (including AI/ML algorithms), assembly, calibration, and rigorous testing of the multi-million dollar inspection tools. Sales are typically direct, leveraging highly specialized technical sales teams due to the tool's integration complexity into the customer's fabrication line and the necessity for extensive after-sales service. The distribution channel is predominantly direct, bypassing traditional distributors, allowing the OEM to maintain control over installation, training, and maintenance contracts, which often represent a significant portion of the total lifecycle revenue. Indirect distribution channels are limited, sometimes involving specialized representatives in emerging regions or for mature, lower-end systems, but are rare for cutting-edge EUV inspection tools.

Downstream activities involve the end-users—primarily major semiconductor foundries and merchant mask shops—where the equipment is deployed in cleanroom environments. These users apply the tools for initial mask qualification, monitoring mask degradation, and verifying repairs. The value realization occurs through increased manufacturing yield and reduced operational risk stemming from mask defects. The continuous feedback loop from the downstream users regarding new defect types and required sensitivities drives the OEMs' ongoing R&D efforts. After-sales service, including software upgrades, preventive maintenance, and rapid technical support, forms a critical part of the downstream value delivery, ensuring optimal uptime for the highly capital-intensive equipment.

Mask Inspection Equipment Market Potential Customers

The primary customers for Mask Inspection Equipment are institutions directly involved in the fabrication and management of high-precision photolithography templates essential for semiconductor manufacturing. These customers fall mainly into two categories: Integrated Device Manufacturers (IDMs) and pure-play Foundries, often referred to as Captive or Merchant Mask Shops. IDMs like Intel, Samsung, and Micron utilize these tools in their in-house mask shops to ensure proprietary control over their critical lithography steps, particularly for advanced logic and memory manufacturing where mask quality directly impacts flagship product performance. Their purchasing decisions are driven by the need for the absolute highest sensitivity and the ability to handle a wide variety of proprietary mask types and processes.

Merchant Foundries, led by players like TSMC and GlobalFoundries, represent the largest segment of potential customers. They require vast quantities of inspection equipment to support the high volume of diverse mask sets produced for hundreds of different fabless customers across various technology nodes, including the most advanced EUV generations. For merchant foundries, throughput, reliability, and seamless integration into automated mask handling systems are paramount, as mask inspection is a critical path item that must not bottleneck production. They typically prioritize equipment with comprehensive Die-to-Database capabilities to verify complex, customized designs.

A smaller, yet strategically important, segment includes independent Merchant Mask Shops (like Photronics or Toppan) that supply masks to fabless companies or smaller IDMs. These shops often require flexible, scalable inspection solutions capable of processing high mix, low volume orders efficiently. Finally, government-funded and academic Research and Development institutes focused on next-generation lithography and semiconductor materials also constitute potential customers, albeit acquiring lower volumes, as they require cutting-edge tools for fundamental research and process exploration beyond current commercial norms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1,350 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KLA Corporation, Applied Materials Inc., Carl Zeiss SMT GmbH, JEOL Ltd., Lasertec Corporation, Advantest Corporation, NuFlare Technology Inc., ASML Holding N.V. (through its lithography expertise), Hitachi High-Tech Corporation, Nikon Corporation, Photronics Inc., Toppan Printing Co. Ltd., DNP (Dai Nippon Printing), AIT Corporation, Rigaku Corporation, Nanometrics Incorporated, Tokyo Electron Limited (TEL), Screen Holdings Co., Ushio Inc., Camtek Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mask Inspection Equipment Market Key Technology Landscape

The technology landscape of the Mask Inspection Equipment Market is characterized by a rapid evolution driven by the demanding requirements of sub-10nm lithography. The core technology remains high-resolution imaging, segmented primarily into two domains: optical and electron beam. Optical inspection systems, utilizing Deep Ultraviolet (DUV) light at 193nm wavelength, are the industry workhorses for non-EUV masks. These systems rely on sophisticated apochromatic optics, phase-shifting techniques, and advanced image processing to detect defects. However, DUV's capabilities are increasingly strained at the most advanced nodes, leading to the development of complex computational techniques, known as Computational Metrology and Computational Lithography (CL), integrated into the inspection process to predict the printability impact of a detected defect, rather than relying solely on physical size.

For the cutting edge, the technology focus shifts to Extreme Ultraviolet (EUV) inspection, where challenges are magnified due to the physics of 13.5nm light. EUV patterned mask inspection requires operating in a high-vacuum environment and dealing with highly reflective, complex multilayer mask blanks. Since traditional DUV light cannot effectively penetrate the EUV multilayer structure to identify critical defects in the blank stage, specialized Mask Blank Inspection tools, often utilizing soft X-ray or dedicated deep UV wavelengths combined with atomic force microscopy (AFM), have become essential. The transition to EUV also necessitates the adoption of E-beam (Electron Beam) inspection tools. E-beam offers superior resolution, capable of identifying sub-10nm defects, and is crucial for verifying critical dimension uniformity and complex patterns where optical methods struggle due to diffraction limits.

The integration of advanced data processing and algorithmic techniques is the most rapidly developing area. High-speed data acquisition from inspection tools—which generate petabytes of raw data—is useless without efficient post-processing. Key technological advancements include massive parallel processing architectures, specialized GPU acceleration for image reconstruction, and the aforementioned AI/ML integration. The future trajectory involves integrating inspection and metrology capabilities (In-Situ Monitoring) directly within the lithography cell, ensuring real-time feedback and potentially autonomous defect management. Furthermore, the industry is exploring Multi-Beam E-beam architectures to overcome the throughput limitations inherent in single-beam E-beam tools, aiming to achieve production-level speeds while maintaining necessary sensitivity for the forthcoming High-NA EUV generation.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global Mask Inspection Equipment market, primarily due to the concentration of the world's largest semiconductor foundries (TSMC, Samsung Electronics) and memory manufacturers (SK Hynix, Micron). Countries like Taiwan and South Korea are early and aggressive adopters of EUV technology and are continuously expanding their production capacity, driving immense demand for the latest high-end inspection tools. China is also rapidly increasing its domestic fabrication capabilities, fueled by government subsidies aiming for self-sufficiency, generating significant localized demand, particularly for DUV and mid-range equipment, although its access to the most advanced EUV tools may be constrained by export controls.

- North America: North America is a critical region for research, development, and the headquarters of major equipment vendors (e.g., KLA, Applied Materials). While manufacturing volume is lower compared to APAC, the region hosts advanced R&D centers and key captive fabs (Intel, Micron) requiring cutting-edge inspection tools for next-generation process development. Initiatives like the CHIPS Act are fostering new domestic fab construction, which is expected to boost equipment procurement significantly within the forecast period, strengthening North America’s demand share, particularly for E-beam and innovative AI-integrated solutions.

- Europe: Europe maintains a strong position in high-precision manufacturing, exemplified by the presence of key industry contributors like ASML and Carl Zeiss SMT. The demand for mask inspection equipment here is driven by advanced technology suppliers, specialized research institutions (like IMEC), and niche automotive/industrial semiconductor manufacturers. While market share is smaller than APAC, Europe remains essential for technological innovation and serves as a crucial hub for the supply chain of optical and EUV-related sub-systems.

- Latin America, Middle East, and Africa (MEA): These regions currently represent a minimal share of the global market. Demand is largely limited to academic research and localized assembly/packaging operations, which utilize mature node technologies, resulting in low volumes of mask inspection equipment procurement. Growth is anticipated to be slow, tied primarily to gradual development of local semiconductor ecosystems and potential R&D investments, rather than high-volume advanced manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mask Inspection Equipment Market.- KLA Corporation

- Applied Materials Inc.

- Carl Zeiss SMT GmbH

- Lasertec Corporation

- JEOL Ltd.

- Advantest Corporation

- NuFlare Technology Inc.

- ASML Holding N.V. (Supplier of EUV lithography systems requiring stringent mask control)

- Hitachi High-Tech Corporation

- Nikon Corporation

- Toppan Printing Co. Ltd. (Major Merchant Mask Shop)

- Photronics Inc. (Major Merchant Mask Shop)

- DNP (Dai Nippon Printing)

- AIT Corporation

- Rigaku Corporation

- Tokyo Electron Limited (TEL)

- Screen Holdings Co., Ltd.

- Ushio Inc.

- Camtek Ltd.

- Nanometrics Incorporated (Now part of KLA)

Frequently Asked Questions

Analyze common user questions about the Mask Inspection Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical challenge in EUV mask inspection?

The main challenge is achieving sufficient sensitivity (detecting defects smaller than 20nm) at high throughput, particularly for mask blank inspection, which requires checking multilayer structures for phase defects that can significantly impact printability. E-beam and actinic inspection technologies are actively being developed to meet these requirements.

How is Die-to-Database (D-B) inspection superior to Die-to-Die (D-D)?

D-B inspection compares the mask pattern directly against the original CAD design data, making it essential for complex or non-periodic structures (like EUV masks) where adjacent patterns might not be identical. D-D only compares adjacent patterns, which is inadequate for finding systematic design errors or inspecting masks without inherent redundancy.

Which region dominates the demand for Mask Inspection Equipment?

Asia Pacific (APAC), particularly driven by major foundries in Taiwan and South Korea, is the dominant region for demand and deployment of high-end mask inspection equipment due to massive investments in advanced node and EUV manufacturing capacity.

What role does Artificial Intelligence (AI) play in mask inspection?

AI significantly enhances mask inspection by improving defect classification accuracy, drastically reducing the number of false positives that require manual review. It also optimizes inspection recipes automatically and facilitates predictive maintenance for the highly complex equipment, improving overall operational efficiency.

How does the increasing cost of mask sets influence the market?

The rising cost of advanced mask sets (especially EUV) acts as a powerful driver, forcing foundries to invest in the most stringent inspection and metrology tools. Inspection equipment becomes an essential capital expenditure to protect multi-million dollar investments and ensure maximum manufacturing yield.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager