Maskants Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440836 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Maskants Market Size

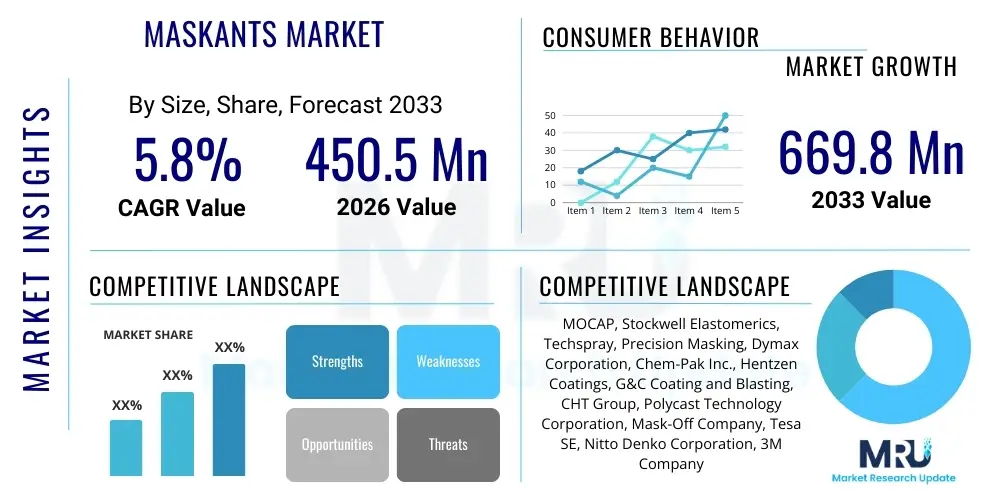

The Maskants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 580 Million in 2026 and is projected to reach USD 920 Million by the end of the forecast period in 2033. This growth is underpinned by escalating demand from critical end-use industries, particularly aerospace, automotive, and electronics, where precision surface finishing and protection are paramount. The increasing complexity of manufacturing processes and the need for enhanced product durability are primary drivers fostering this expansion.

Maskants Market introduction

The Maskants market encompasses specialized temporary coatings applied to surfaces to protect specific areas from chemical attack, abrasive blasting, plating, painting, or other surface finishing processes. These protective barriers are crucial in manufacturing, ensuring that only desired areas are treated, thereby maintaining the integrity and precision of complex components. Maskants are typically removed after the treatment process, leaving a clean, unaffected surface. Their formulation varies widely, including water-based, solvent-based, UV-curable, and peelable types, each tailored to specific application methods, substrate materials, and process chemistries.

Major applications for maskants span across industries requiring high precision and selective protection. In the aerospace sector, they are indispensable for chemical milling, anodizing, and plating of critical aircraft components, protecting intricate geometries from aggressive chemicals. The automotive industry utilizes maskants for selective plating, painting, and e-coating processes, ensuring aesthetic quality and corrosion resistance of various parts. Electronics manufacturing benefits significantly from maskants in circuit board fabrication, protecting sensitive components during soldering or coating operations, preventing short circuits and ensuring device reliability. Beyond these, maskants find utility in general industrial applications, medical device manufacturing, and decorative plating.

The benefits derived from using maskants are multifaceted, including superior surface protection, enhanced product quality, reduced material waste, and improved process efficiency. By providing a precise barrier, maskants prevent overspray, over-etching, or unintended plating on designated areas, leading to significant cost savings in rework and material consumption. Driving factors for market growth include the increasing demand for high-performance components across various industries, the rising complexity of manufacturing processes necessitating precise surface treatment, and advancements in maskant formulations offering improved performance, environmental compliance, and easier application/removal. Furthermore, the push for automation in manufacturing processes also fuels the demand for maskants that are compatible with robotic application systems.

Maskants Market Executive Summary

The Maskants market is experiencing robust growth, driven by key business trends such as the escalating demand for advanced materials in aerospace and defense, the electrification trend in the automotive sector, and continuous miniaturization in electronics. Manufacturers are focusing on developing eco-friendly and high-performance maskants that offer superior adhesion, chemical resistance, and ease of removal, addressing stringent environmental regulations and operational efficiency requirements. Customization and application-specific formulations are becoming pivotal competitive factors, as end-users seek tailored solutions for increasingly complex geometries and diverse substrate materials. Strategic collaborations between maskant producers and equipment manufacturers are also emerging to optimize application and curing processes, enhancing overall market value proposition.

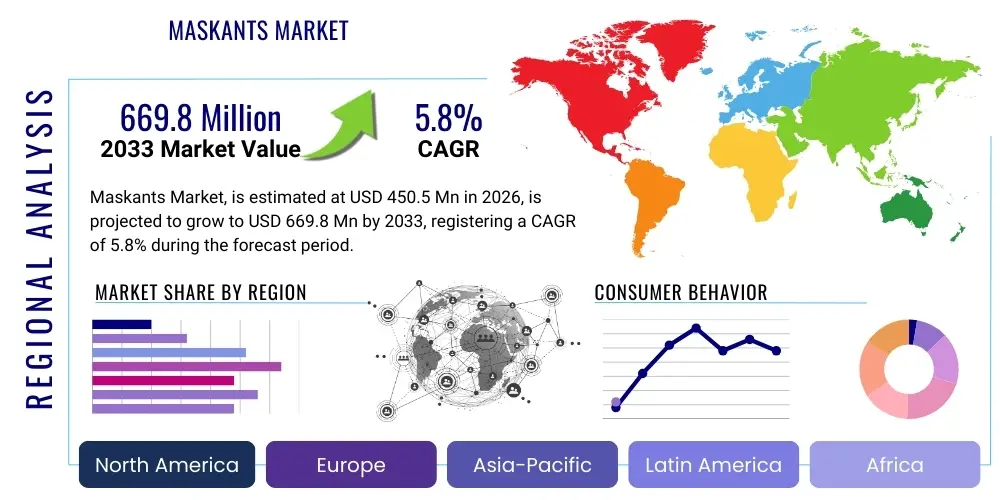

Regionally, the market exhibits dynamic trends with Asia Pacific leading in consumption and production, propelled by rapid industrialization, burgeoning manufacturing hubs, and significant investments in automotive and electronics sectors, particularly in China, India, and South Korea. North America and Europe demonstrate mature markets, characterized by stringent quality standards and a strong emphasis on high-performance and specialty maskants for aerospace and medical applications. Latin America and the Middle East & Africa are emerging as promising markets, driven by infrastructure development, expanding industrial bases, and increasing foreign direct investment in manufacturing. Regional variations in environmental regulations and industrial growth trajectories significantly influence the adoption and types of maskants utilized.

Segmentation trends highlight a growing preference for water-based and UV-curable maskants due to their lower Volatile Organic Compound (VOC) emissions and faster processing times, aligning with global sustainability initiatives and efficiency demands. The peelable maskants segment also continues to gain traction for its ease of removal and applicability in delicate surface protection. Application-wise, aerospace and defense remain the largest consumers, valuing the precision and reliability offered by maskants in critical component manufacturing. However, the automotive and electronics sectors are rapidly expanding their share, fueled by technological advancements and the increasing complexity of components requiring selective treatment, thus fostering diverse innovation across the market's segment spectrum.

AI Impact Analysis on Maskants Market

User inquiries regarding AI's impact on the Maskants Market frequently center around how artificial intelligence can enhance material formulation, optimize application processes, improve quality control, and predict performance characteristics. Common concerns include the initial investment costs, the learning curve for integrating AI systems, and the potential for job displacement, alongside strong expectations for increased efficiency, reduced waste, and the development of novel maskant properties. Users are keen to understand how AI can address the complexities of varying substrate materials, environmental conditions, and specific process requirements, moving beyond traditional trial-and-error methods towards data-driven, predictive solutions for maskant selection, application, and removal, ultimately aiming for superior finished product quality and streamlined operations.

- AI-driven material science can accelerate the development of new maskant formulations by predicting optimal chemical compositions for desired properties like adhesion, chemical resistance, and peelability, significantly reducing R&D cycles.

- Predictive analytics powered by AI can optimize maskant application parameters, such as spray patterns, film thickness, and curing times, based on real-time sensor data, substrate properties, and environmental conditions, leading to greater consistency and efficiency.

- Machine learning algorithms can be employed for advanced quality control, identifying defects in applied maskant layers or finished parts with higher accuracy and speed than manual inspection, minimizing rework and improving overall product quality.

- AI can facilitate process automation by integrating with robotic application systems, enabling precise and adaptive maskant deposition on complex geometries, thus enhancing manufacturing throughput and reducing human error.

- Through data analysis, AI can offer insights into the lifespan and performance degradation of maskants, allowing for predictive maintenance of application equipment and ensuring consistent product quality over time.

- Supply chain optimization benefits from AI by forecasting demand for specific maskant types, managing inventory, and streamlining logistics, thereby reducing operational costs and improving material availability.

- AI-enhanced simulation tools can model the behavior of maskants under various processing conditions, helping manufacturers to fine-tune processes virtually before physical implementation, saving time and resources.

- Personalized maskant solutions can be developed using AI to analyze customer-specific requirements and suggest optimal maskant types and application methods, leading to higher customer satisfaction and specialized product offerings.

DRO & Impact Forces Of Maskants Market

The Maskants market is propelled by several robust drivers, including the increasing demand from high-growth industries like aerospace, automotive, and electronics, which continually seek precision surface finishing and protection for complex components. The rising adoption of advanced manufacturing techniques that require selective protection, coupled with a persistent focus on improving product quality and durability, further fuel market expansion. Technological advancements in maskant formulations, leading to enhanced performance, environmental friendliness, and faster processing times, also act as significant accelerators. Additionally, the growing emphasis on reducing manufacturing waste and achieving operational efficiencies encourages the use of effective maskants that minimize rework and material consumption, establishing them as indispensable elements in modern industrial processes.

Despite these drivers, several restraints pose challenges to the market's growth trajectory. Stringent environmental regulations concerning Volatile Organic Compound (VOC) emissions and the disposal of certain chemical-based maskants necessitate continuous innovation in eco-friendly alternatives, which can be cost-intensive for manufacturers. The relatively high cost of specialty maskants, particularly for niche applications, can deter adoption by smaller enterprises or in cost-sensitive industries. Furthermore, the complexity associated with applying and removing certain maskant types, which often requires specialized equipment and skilled labor, can limit their widespread use. Competition from alternative masking techniques, though often less precise, also presents a challenge, particularly in applications where cost-effectiveness outweighs absolute precision, compelling maskant producers to continuously demonstrate superior value.

Opportunities within the Maskants market are vast and evolving, primarily centered around the development of advanced, sustainable, and application-specific solutions. The growing demand for water-based, UV-curable, and bio-based maskants represents a significant opportunity, aligning with global sustainability goals and regulatory pressures for reduced environmental impact. Customization of maskants for unique substrate materials, extreme temperature applications, or highly corrosive environments offers a pathway for market differentiation and value creation. Emerging markets in Asia Pacific, Latin America, and the Middle East & Africa present untapped potential due to rapid industrialization and increasing manufacturing capabilities. Moreover, integration with automation and robotic systems for maskant application and removal offers significant efficiency gains and new market avenues, addressing labor cost concerns and improving process consistency, thereby creating compelling long-term growth prospects for the industry.

Segmentation Analysis

The Maskants Market is meticulously segmented across various parameters to provide a comprehensive understanding of its intricate dynamics and diverse applications. This segmentation allows for targeted market analysis, identifying key growth areas, competitive landscapes, and evolving consumer preferences. Key segments include those based on product type, application method, end-use industry, and geographic region, each exhibiting unique growth drivers and market characteristics. Understanding these distinct segments is crucial for strategic planning, product development, and market entry strategies, enabling stakeholders to capitalize on specific opportunities and mitigate potential risks within the broader maskants ecosystem. The interplay between these segments often dictates the pace and direction of technological innovation and market penetration, making a detailed analysis indispensable for industry participants seeking a competitive edge.

- By Product Type

- Water-Based Maskants

- Solvent-Based Maskants

- UV-Curable Maskants

- Peelable Maskants

- Chemical Milling Maskants

- Plating Maskants

- Thermal Spray Maskants

- Other Specialty Maskants

- By Application Method

- Brush Application

- Spray Application

- Dip Application

- Screen Printing

- Automated Dispensing

- By End-Use Industry

- Aerospace and Defense

- Automotive

- Electronics

- General Industrial

- Medical

- Energy

- Decorative Plating

- Other Manufacturing Sectors

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Maskants Market

The value chain for the Maskants market begins with upstream activities, primarily involving the sourcing and processing of raw materials. This includes specialty polymers, resins, solvents, thickeners, pigments, and various chemical additives. Key raw material suppliers provide these foundational components, which are critical for determining the final properties and performance of the maskants. Strong relationships with reliable suppliers are crucial for ensuring consistent quality, managing costs, and enabling innovation in product development. Research and development also represent a significant upstream activity, where formulators innovate new maskant compositions to meet evolving industry demands, address environmental regulations, and enhance application performance and ease of removal. This stage significantly influences the overall value and competitive differentiation of the end product, as the chemical properties and physical characteristics of the raw materials directly dictate the efficacy of the maskant.

Moving downstream, the value chain encompasses the manufacturing, distribution, and end-use phases. Maskant manufacturers process the raw materials into finished products, adhering to strict quality controls and formulation specifications. This stage often involves blending, mixing, and packaging the maskants in various forms suitable for industrial application. Distribution channels play a critical role in connecting manufacturers with end-users. This typically involves a combination of direct sales from manufacturers to large industrial clients and indirect sales through specialized distributors and regional agents. Direct sales allow for closer client relationships, customization, and technical support, which is often preferred for complex industrial applications. Indirect channels, on the other hand, provide broader market reach, particularly to smaller and geographically diverse customers, leveraging distributors' local networks and logistical capabilities.

The end-use segment represents the final stage where maskants are applied in various industrial processes across sectors such as aerospace, automotive, electronics, and medical devices. The effectiveness and efficiency of maskants at this stage directly impact the quality of the finished product for the end-user. Post-application services, including technical support for optimal application methods, troubleshooting, and advice on safe removal and disposal, also contribute significant value. The interaction between manufacturers, distributors, and end-users is iterative; feedback from end-users regarding performance, ease of use, and environmental considerations often drives innovation back up the value chain, influencing raw material selection and product formulation. This cyclical flow ensures that maskant products continuously evolve to meet specific industry needs and regulatory requirements, enhancing their overall market value and utility.

Maskants Market Potential Customers

Potential customers for the Maskants market are diverse and span across a multitude of manufacturing sectors that require precise surface protection during various processing stages. The primary end-users are large-scale industrial manufacturers and specialized finishing shops. In the aerospace and defense industry, key customers include aircraft manufacturers, component suppliers, and MRO (Maintenance, Repair, and Overhaul) facilities that utilize maskants for chemical milling, anodizing, plating, and thermal spray applications on critical aircraft components. These customers demand extremely high-performance maskants that can withstand aggressive chemical environments and provide accurate masking for complex geometries, ensuring component integrity and longevity in demanding operational conditions. The precision required in this sector makes maskants an indispensable part of their manufacturing toolkit.

The automotive industry represents another substantial customer base, with vehicle manufacturers, Tier 1 and Tier 2 suppliers, and aftermarket specialists employing maskants for selective painting, electro-coating, chrome plating, and corrosion protection on various vehicle parts. As the automotive industry shifts towards electric vehicles and more sophisticated designs, the demand for maskants that can protect intricate electronic components and sensitive surfaces during multi-stage finishing processes is growing. Electronics manufacturers are also significant customers, using maskants in printed circuit board fabrication, semiconductor manufacturing, and assembly processes to protect sensitive areas from soldering, coating, or etching. The miniaturization trend in electronics further increases the need for highly precise maskants that can be applied and removed without damaging delicate circuitry, ensuring the functionality and reliability of electronic devices.

Beyond these major sectors, the general industrial segment includes a wide array of manufacturers involved in metal fabrication, machinery production, and durable goods, utilizing maskants for various surface treatments, including plating, painting, and shot blasting. The medical device industry is an increasingly important customer, requiring biocompatible and high-purity maskants for protecting intricate components during precision finishing processes, where product safety and performance are paramount. Other emerging customer segments include the energy sector for protecting components in power generation and oil & gas, and the decorative plating industry, where maskants enable unique aesthetic finishes on consumer goods and luxury items. These diverse applications highlight the broad utility and critical role of maskants across the global manufacturing landscape, driving continuous innovation and specialized product offerings tailored to distinct customer needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580 Million |

| Market Forecast in 2033 | USD 920 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chemtech Precision Coatings, Global Maskant Solutions, Advanced Protective Materials, EcoShield Maskants, SurfaceGuard Innovations, Zenith Chemical Technologies, ProtectoFilm Systems, UltraMask Solutions, ProForm Chemical, Specialty Masking Products, IndusChem Technologies, Apex Coatings Group, PrecisionGuard Solutions, TechShield Materials, Universal Masking Corp., Elite Surface Protection, InnovaCoatings, Optimal Maskants, SecureSurface Technologies, Dynamic Masking Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Maskants Market Key Technology Landscape

The Maskants market's technology landscape is characterized by continuous innovation aimed at enhancing performance, improving environmental sustainability, and optimizing application processes. A significant technological trend is the shift towards water-based and UV-curable formulations, driven by stringent environmental regulations concerning Volatile Organic Compound (VOC) emissions. Water-based maskants offer a safer, more eco-friendly alternative with reduced flammability and operator exposure, while UV-curable maskants provide rapid curing times, boosting throughput and reducing energy consumption in manufacturing lines. These advancements are critical for industries seeking to minimize their ecological footprint without compromising product quality or production efficiency. Further research in bio-based maskants, derived from renewable resources, is also gaining traction, promising even greater sustainability.

Another crucial technological development involves advanced polymer chemistry, leading to maskants with superior adhesion properties, enhanced chemical resistance, and precise peelability. These innovations ensure that maskants can withstand aggressive processing environments, such as strong acids, alkalis, or high temperatures, while also being easily and cleanly removable without leaving residues or damaging the protected surface. Formulators are also integrating smart materials and nanotechnology to develop maskants that can offer multi-functional properties, such as self-healing capabilities or integrated sensors for monitoring application quality. This level of sophistication allows for greater reliability and broader applicability in highly demanding end-use sectors like aerospace and medical devices, where material failure is not an option and precision is paramount for component integrity.

Furthermore, advancements in application and removal technologies are profoundly influencing the maskants market. Automated dispensing systems, robotic spray painting, and precision screen-printing techniques are becoming increasingly prevalent, ensuring consistent film thickness, accurate placement, and reduced labor costs. These technologies are often integrated with vision systems and artificial intelligence to optimize application parameters in real-time, adapting to complex geometries and varying substrate conditions. For removal, innovations include specialized peelable formulations that leave minimal residue, as well as solvent-free removal processes that simplify disposal and reduce environmental impact. The synergy between maskant formulation technologies and cutting-edge application/removal equipment is creating a holistic ecosystem that delivers higher efficiency, consistency, and environmental compliance, ultimately driving the evolution and adoption of maskants across diverse industrial applications globally.

Regional Highlights

- North America: This region represents a mature and significant market for maskants, driven by a robust aerospace and defense industry, a strong automotive manufacturing base, and a burgeoning medical device sector. The demand here is largely for high-performance, specialty maskants that meet stringent quality and safety standards. The U.S. remains the largest contributor, with ongoing investments in advanced manufacturing technologies and a focus on precision engineering. Canada also contributes significantly, particularly in aerospace and industrial applications. The region prioritizes product innovation, especially in environmentally compliant formulations, as regulatory pressures continue to mount, fostering a market environment ripe for advanced and sustainable maskant solutions.

- Europe: Europe stands as another key region, characterized by its advanced industrial base, particularly in Germany, France, and the UK. The automotive sector, aerospace manufacturing, and general industrial applications are major consumers of maskants. There is a strong emphasis on sustainability, leading to increased adoption of water-based and UV-curable maskants to comply with strict environmental regulations like REACH. Countries in Eastern Europe are also showing growth, fueled by rising foreign investments in manufacturing and increasing industrial output. The market here is driven by a need for high-quality, efficient, and eco-friendly solutions, pushing manufacturers to continuously innovate and adapt their product portfolios.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing and largest market for maskants globally, primarily driven by rapid industrialization, expanding manufacturing capabilities, and significant investments across automotive, electronics, and general industrial sectors in countries like China, India, Japan, and South Korea. China, in particular, dominates both production and consumption due to its immense manufacturing output. The region benefits from lower labor costs and a booming consumer electronics market, which fuels demand for maskants in printed circuit board manufacturing and device assembly. Increasing disposable incomes and urbanization further boost the automotive sector, driving the need for various surface protection solutions. This dynamic growth is expected to continue, making APAC a critical hub for maskant manufacturers.

- Latin America: The maskants market in Latin America is in an emerging phase, with Brazil and Mexico leading the regional demand. Growth is largely attributable to the expanding automotive industry, particularly in Mexico, driven by foreign direct investments, and a developing general industrial sector across the region. While the market is smaller compared to North America or Europe, increasing industrial output, infrastructure development, and a growing middle class are expected to stimulate demand for maskants in various manufacturing and finishing processes. Economic stability and trade agreements will play a crucial role in accelerating market growth and the adoption of more advanced maskant technologies.

- Middle East and Africa (MEA): The MEA region is experiencing gradual growth in the maskants market, influenced by investments in infrastructure, manufacturing, and oil & gas industries. Countries like Saudi Arabia, UAE, and South Africa are key contributors, with demand stemming from industrial coatings, automotive maintenance, and specialty chemical applications. The aerospace sector is also a developing segment in parts of the Middle East, contributing to the demand for high-performance maskants. While currently a relatively small market, increasing industrial diversification initiatives and economic development efforts are expected to unlock new opportunities for maskant suppliers in the long term, particularly for robust solutions capable of withstanding harsh environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Maskants Market.- Chemtech Precision Coatings

- Global Maskant Solutions

- Advanced Protective Materials

- EcoShield Maskants

- SurfaceGuard Innovations

- Zenith Chemical Technologies

- ProtectoFilm Systems

- UltraMask Solutions

- ProForm Chemical

- Specialty Masking Products

- IndusChem Technologies

- Apex Coatings Group

- PrecisionGuard Solutions

- TechShield Materials

- Universal Masking Corp.

- Elite Surface Protection

- InnovaCoatings

- Optimal Maskants

- SecureSurface Technologies

- Dynamic Masking Solutions

Frequently Asked Questions

What are maskants and their primary uses in manufacturing?

Maskants are temporary protective coatings applied to specific areas of a surface to shield them from chemical, abrasive, or thermal processes like plating, painting, or chemical milling. Their primary use is to ensure precise surface finishing and protection, preventing unintended treatment on designated areas, crucial for maintaining component integrity and quality in various industries.

Which industries are the largest consumers of maskants?

The largest consumers of maskants are the aerospace and defense, automotive, and electronics industries. These sectors heavily rely on maskants for critical applications such as chemical milling of aircraft parts, selective plating in automotive components, and protecting sensitive circuitry during printed circuit board manufacturing, where precision and surface integrity are paramount.

What types of maskants are available, and what are their key advantages?

Maskants are primarily categorized into water-based, solvent-based, UV-curable, and peelable types. Water-based maskants offer environmental benefits with lower VOCs. UV-curable maskants provide rapid curing times for increased production efficiency. Peelable maskants are valued for their easy, clean removal. Each type offers specific advantages depending on the application, substrate, and environmental regulations.

How do environmental regulations impact the maskants market?

Environmental regulations, particularly those targeting Volatile Organic Compound (VOC) emissions, significantly impact the maskants market by driving demand for eco-friendly formulations such as water-based and UV-curable maskants. These regulations compel manufacturers to innovate and develop sustainable solutions, influencing product development, market trends, and competitive strategies, ensuring compliance while maintaining performance.

What are the key growth opportunities for the maskants market?

Key growth opportunities include the development and adoption of sustainable, high-performance maskants (e.g., bio-based formulations), expansion into emerging markets (especially in Asia Pacific), and integration with advanced manufacturing technologies like automation and AI for optimized application. Customization for niche industrial applications and specialized substrate protection also presents significant avenues for market expansion and differentiation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Maskants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Maskants Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Water Based Maskants, Solvent-based Maskants), By Application (Aerosapce, Automotive, Industrial, Electronic, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager