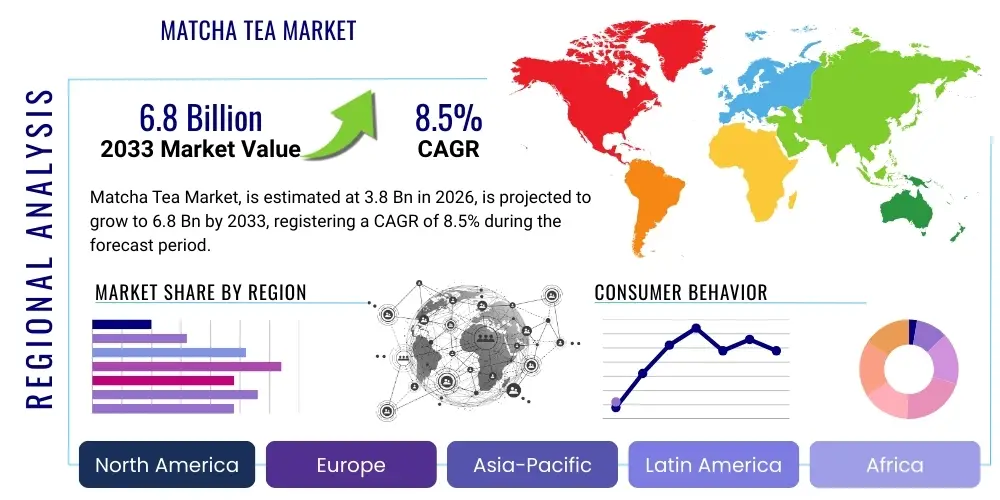

Matcha Tea Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442157 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Matcha Tea Market Size

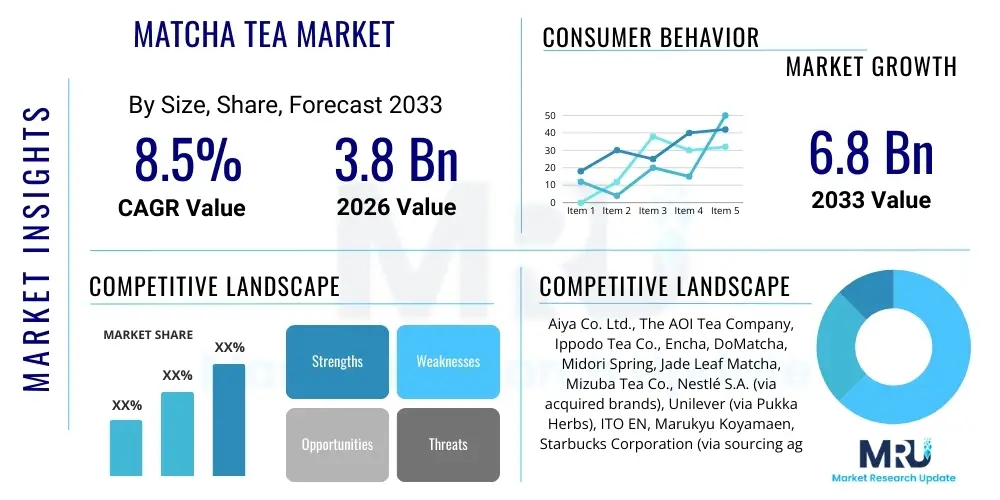

The Matcha Tea Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 6.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by increasing global awareness regarding the health benefits associated with matcha consumption, coupled with robust product innovation diversifying its application beyond traditional beverages into functional foods, supplements, and cosmetic formulations. The consistent consumer shift toward natural and organic ingredients further solidifies this upward trajectory, particularly across established and emerging economies in North America and Asia Pacific.

Matcha Tea Market introduction

The Matcha Tea Market encompasses the global production, distribution, and consumption of finely ground powder of specially grown and processed green tea leaves (Camellia sinensis). Unlike conventional green tea, where leaves are steeped and discarded, matcha consumers ingest the entire leaf, resulting in a much higher concentration of nutrients, particularly antioxidants (catechins) and L-theanine. This unique preparation and consumption method are central to its positioning as a premium health food product.

Matcha's product descriptions often emphasize its vibrant green color, rich umami flavor profile, and dense nutritional value. Major applications span several categories, including traditional ceremonial drinks, culinary ingredients (used in baking, desserts, and savory dishes), and as a key component in ready-to-drink (RTD) beverages and dietary supplements. The versatility of matcha allows it to penetrate diverse food and beverage segments, appealing to health-conscious consumers, specialty coffee shop patrons, and the functional food industry seeking natural energy boosters and detoxification properties.

Key benefits driving market adoption include enhanced metabolism, increased mental clarity, sustained energy without the typical caffeine crash, and potent anti-inflammatory effects due to high epigallocatechin gallate (EGCG) content. Driving factors are multifaceted: escalating consumer expenditure on premium, functional foods; growing incorporation of matcha into Western diets and café culture; sophisticated marketing focusing on its ceremonial heritage and superfood status; and the rising prevalence of chronic diseases prompting preventative health measures through diet. These collective attributes position matcha tea as a vital segment within the broader health and wellness industry.

Matcha Tea Market Executive Summary

The global Matcha Tea Market is currently characterized by significant business transformation, marked by accelerated innovation in product formats and aggressive expansion by key players into previously untapped geographical areas. Business trends indicate a strong move toward convenience and customization, with single-serve packets, RTD matcha lattes, and matcha-infused snack bars gaining substantial market traction. Strategic partnerships between established tea manufacturers and large food service chains are critical for expanding visibility and accessibility. Furthermore, sustainability and ethical sourcing (organic certification, fair trade practices) are becoming mandatory competitive differentiators, influencing purchasing decisions among affluent consumers in developed markets.

Regional trends reveal Asia Pacific, particularly Japan and China, maintaining dominance in terms of production and traditional consumption, yet North America and Europe demonstrate the highest growth potential, fueled by wellness movements and the rapid integration of matcha into mainstream café culture. In North America, the market is characterized by premiumization and diversification, whereas in Europe, there is a burgeoning interest in matcha as a healthier alternative to coffee. Emerging markets in Latin America and MEA are beginning to show promise, primarily driven by expanding middle-class populations and increased exposure to global wellness trends via digital media, though supply chain infrastructure remains a localized challenge.

Segmentation trends highlight the dominance of the conventional grade segment due to its widespread use in culinary applications and RTD products, although the ceremonial grade maintains high value due to its luxury positioning and traditional appeal. Distribution is increasingly shifting toward e-commerce platforms, offering specialized matcha brands direct access to consumers and enabling better control over product narrative and quality assurance. The application segment sees rapid growth in the food and beverage industry, leveraging matcha for its flavor and functional properties in items ranging from ice creams to dietary shakes, reinforcing its status as a versatile superfood ingredient.

AI Impact Analysis on Matcha Tea Market

User queries regarding the impact of Artificial Intelligence (AI) on the Matcha Tea Market frequently center around supply chain transparency, quality control optimization, and personalized consumer engagement. Key themes emerge around how AI can enhance cultivation predictability—forecasting optimal harvest times based on environmental data—and ensuring product authenticity to combat counterfeiting, a major concern in the high-value specialty tea sector. Users also express strong expectations for AI-driven personalized blend recommendations and dynamic pricing strategies that respond instantaneously to global inventory levels and localized demand shifts. The overarching concern is balancing traditional, artisanal production methods with the efficiency and scalability offered by sophisticated machine learning models without compromising the perceived quality or cultural value of matcha.

AI's initial impact is focused primarily on optimizing the agricultural phase. Machine learning algorithms analyze complex data sets pertaining to soil health, weather patterns, pest infestations, and fertilization efficacy, allowing producers to implement precision agriculture techniques. This optimization minimizes resource waste, enhances crop yield predictability, and crucially ensures the highest quality leaf production, which is essential for ceremonial grade matcha. Furthermore, AI-powered computer vision systems are being deployed during the processing stage—specifically during de-stemming and grading—to maintain consistency in color, texture, and particle size, thereby standardizing quality across large batches, a significant challenge in manual processing.

In the downstream market, AI is revolutionizing consumer analytics and retail strategy. Natural Language Processing (NLP) and machine learning analyze vast quantities of consumer sentiment data from social media, review sites, and e-commerce platforms, providing deep insights into flavor preferences, desired product formats (e.g., low sugar RTD, high-protein supplements), and regional marketing effectiveness. This allows companies to execute highly localized, targeted digital marketing campaigns and rapidly prototype new product innovations, ensuring that R&D investments align directly with demonstrated consumer demand, leading to higher conversion rates and minimized time-to-market for specialized matcha products.

- AI optimizes tea leaf cultivation parameters (soil, humidity, shading) for premium yield predictability.

- Machine learning algorithms enhance quality control through automated visual inspection of leaf grading and powder consistency.

- Predictive analytics improves supply chain efficiency by forecasting demand fluctuations and optimizing inventory management.

- NLP tools analyze consumer reviews for personalized product development and flavor profiling.

- AI-driven chatbots and virtual assistants provide real-time information on matcha preparation, health benefits, and sourcing transparency.

- Blockchain integration, verified by AI, ensures end-to-end traceability from farm to cup, addressing authenticity concerns.

DRO & Impact Forces Of Matcha Tea Market

The Matcha Tea Market is significantly shaped by compelling health drivers, strict supply chain restraints, and substantial opportunities for product innovation, all mediated by critical impact forces related to consumer trust and regulatory compliance. The principal driver is the globally increasing consumer preference for functional beverages that offer quantifiable health benefits, such as high antioxidant content and sustained energy release. This is strongly supported by widespread media coverage promoting matcha as a superior alternative to conventional coffee and green tea. Simultaneously, the market faces major restraints, predominantly the high cost of production associated with traditional shade-growing and stone-grinding methods, coupled with the susceptibility of raw material supply to unpredictable climate change, which threatens consistent yield and quality.

Opportunities for market penetration reside primarily in geographical expansion into underserved regions and sophisticated product differentiation. Developing specialized matcha blends targeting specific health outcomes (e.g., enhanced cognitive function, sleep aid formulation) offers significant commercial potential. Furthermore, creating accessible, low-cost entry-level matcha products and diversifying into the cosmetics and personal care sectors (matcha-based skincare) broadens the market base beyond the traditional beverage consumer. Successfully navigating the high entry barriers related to quality and authenticity forms a crucial strategic objective for new market entrants aiming to capitalize on these identified opportunities.

Impact forces govern the velocity and direction of market growth. Consumer education plays a vital role; as awareness increases regarding the difference between culinary and ceremonial grades, market segmentation becomes sharper and more valuable. Regulatory standards, particularly those concerning pesticide residue and organic certifications, heavily influence market access, especially in highly regulated regions like the European Union. Furthermore, the strong cultural association of matcha with Japan influences brand identity and pricing power; brands successfully leveraging this heritage often command premium prices, illustrating how cultural impact forces translate directly into economic value within this specialized tea segment.

Segmentation Analysis

The Matcha Tea Market is intricately segmented across product type, application, and distribution channel, reflecting the diverse consumer base and varying end-user demands for this versatile green tea powder. Product segmentation delineates between the premium, delicate Ceremonial Grade, used primarily for traditional whisked preparation, and the more robust Conventional/Culinary Grade, utilized extensively in the food service industry for lattes, smoothies, and baked goods. Understanding this distinction is crucial as it directly impacts pricing, sourcing, and target market strategy for manufacturers and retailers alike, with Ceremonial Grade commanding significantly higher margins.

Application segmentation illustrates the broad penetration of matcha across the consumer landscape. The Food & Beverages category remains dominant, encompassing both packaged RTD products and utilization within specialty coffee shops and restaurants. However, the Dietary Supplements and Pharmaceutical segment is exhibiting rapid acceleration, driven by the encapsulation of matcha extract into tablets and powders, marketed for its energy-boosting and metabolic benefits. The Cosmetics and Personal Care application, while smaller, offers niche growth potential, capitalizing on matcha’s antioxidant properties for anti-aging and skin health formulations, suggesting a diversified revenue stream for producers.

Distribution segmentation highlights the ongoing shift in purchasing behavior. Traditional distribution through specialty tea stores and supermarkets remains foundational, yet the expansion of e-commerce is transforming market reach, particularly for artisanal, high-end brands that can bypass intermediaries and connect directly with dedicated consumers. Moreover, the strong presence of matcha in Health & Wellness stores reinforces its identity as a specialized functional product rather than a standard commodity, supporting premium pricing structures and requiring tailored merchandising strategies to effectively communicate product value.

- By Product Type:

- Ceremonial Grade

- Conventional Grade (Culinary Grade)

- By Application:

- Food and Beverages (RTD, Bakery, Confectionery)

- Dietary Supplements and Nutraceuticals

- Cosmetics and Personal Care

- Others (Pharmaceuticals, Flavorings)

- By Distribution Channel:

- Offline Channels (Supermarkets, Hypermarkets, Specialty Stores)

- Online Channels (E-commerce Platforms, Direct-to-Consumer Websites)

- By Form:

- Ready-to-Drink (RTD)

- Powder

Value Chain Analysis For Matcha Tea Market

The value chain for the Matcha Tea Market is characterized by highly specialized upstream activities that confer significant value and differentiation potential, especially concerning cultivation practices. Upstream analysis focuses heavily on the shaded cultivation of tea leaves (Gyokuro or Tencha), primarily in Japan (Uji, Nishio) and select regions of China. This shading process, essential for boosting L-theanine and chlorophyll content, requires intensive manual labor and specific climate control, resulting in a high cost of raw material acquisition. Key upstream stakeholders include specialized tea growers and agricultural technology providers focusing on organic farming and precision agriculture to maximize the quality of the harvested Tencha leaves before they are processed into powder. Quality assurance at this stage—ensuring low pesticide residue and optimal nutrient profiles—is paramount for product viability and premium pricing.

Midstream activities involve processing and manufacturing. The harvested leaves are steamed, air-dried, de-stemmed, and de-veined to create Tencha, which is then traditionally stone-ground into the fine matcha powder. This meticulous, slow grinding process, often using granite stone mills, is crucial for preserving the color, flavor, and nutritional integrity of the final product. Manufacturers must invest heavily in specialized machinery and maintain stringent hygiene standards. Downstream analysis focuses on distribution and marketing. The distribution channel is bifurcated into direct channels (DTC via e-commerce for high-end ceremonial grades) and indirect channels (wholesalers, distributors, and major retailers for culinary grades and RTD products). The efficiency of packaging—specifically vacuum sealing to maintain freshness—and logistics handling (temperature and humidity control) directly impacts the shelf life and consumer perception of quality.

Direct distribution often provides higher profit margins and better brand control, leveraging digital marketing to educate consumers about the nuanced differences between grades. Indirect distribution, though broader in reach (supermarkets, major food service chains), necessitates robust supply chain partnerships and competitive volume pricing. The final stage involves the retailers and end-users (cafes, bakeries, supplement manufacturers, and individual consumers). Effective market positioning and consumer education are critical throughout the downstream segment, translating the inherent quality established upstream into perceived value at the point of sale, thereby successfully completing the high-value matcha supply chain lifecycle.

Matcha Tea Market Potential Customers

Potential customers for the Matcha Tea Market span several demographic and psychographic profiles, reflecting its dual positioning as a luxury, traditional beverage and a versatile, functional health ingredient. The primary end-user segment includes health-conscious millennials and Gen Z consumers in North America and Europe who prioritize wellness, natural energy sources, and sustainable, ethically sourced products. This group is often willing to pay a premium for certified organic or single-origin ceremonial grade matcha, using it as a daily coffee alternative or a component of their self-care rituals. They are heavily influenced by social media trends and often purchase through specialized e-commerce platforms and boutique health food stores, valuing authenticity and transparency.

A second major customer segment comprises the Food & Beverage industry, including commercial bakeries, large-scale RTD manufacturers, and national café chains. These industrial buyers primarily purchase Conventional or Culinary Grade matcha in bulk for its vibrant coloring, distinct flavor profile, and functional appeal in mass-market products like lattes, ice creams, protein bars, and baked goods. Their purchasing decisions are driven by cost-effectiveness, consistency in supply, and the ability of the ingredient to enhance the marketability of their final product by associating it with the 'superfood' trend. This segment requires reliable, high-volume B2B suppliers capable of meeting stringent industrial food safety standards.

The third significant segment includes nutraceutical and dietary supplement manufacturers. These customers utilize high-concentration matcha extracts or powders as active ingredients in capsules, pre-workout mixes, or functional health shakes, capitalizing on EGCG content for metabolic support and antioxidant delivery. Their focus is on scientific efficacy and purity, requiring suppliers to provide detailed Certificates of Analysis (CoA) confirming specific bioactive compound concentrations. As preventative healthcare continues to gain prominence globally, this sector represents a rapidly expanding buyer pool seeking standardized, scientifically validated matcha derivatives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 6.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aiya Co. Ltd., The AOI Tea Company, Ippodo Tea Co., Encha, DoMatcha, Midori Spring, Jade Leaf Matcha, Mizuba Tea Co., Nestlé S.A. (via acquired brands), Unilever (via Pukka Herbs), ITO EN, Marukyu Koyamaen, Starbucks Corporation (via sourcing agreements), Rishi Tea, The Tea Spot, Kenko Tea, Teaspoons & Co., Clearspring Ltd., Stash Tea Company, Tsubokichi Seicha. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Matcha Tea Market Key Technology Landscape

The technology landscape governing the Matcha Tea Market spans advanced agricultural methodologies, precise processing equipment, and sophisticated packaging technologies designed to maintain the product's delicate freshness and nutritional profile. In the agricultural phase, the adoption of specialized shading structures (Tana) coupled with automated irrigation and sensor-based environmental monitoring systems is crucial. These sensor networks track critical variables like humidity, soil nutrient levels, and light exposure, ensuring optimal conditions for Tencha leaf development, which directly correlates to the final quality of ceremonial grade matcha. Furthermore, DNA sequencing and biotechnology are increasingly used to analyze and propagate high-yield, disease-resistant tea cultivars specific to matcha production, guaranteeing genetic consistency over time.

In the manufacturing and processing phase, the traditional granite stone milling process, while valued for its low-heat characteristics that preserve nutrients, is being augmented by advanced milling technologies. While authenticity is maintained, modern facilities utilize closed-system, controlled-atmosphere grinding environments to prevent oxidation and contamination. Highly specialized air classification systems are also employed to ensure uniform particle size—a critical quality metric influencing matcha's foam stability (Neri) and mouthfeel. Robotics and automated sorting systems, including vision recognition, are beginning to replace manual labor in de-stemming and de-veining (Tencha preparation), improving operational efficiency and consistency across large production volumes necessary for the conventional grade market.

The retail and logistics technology stack is heavily focused on preservation. Oxygen-absorbing and nitrogen-flushed packaging techniques are standard practice to protect the volatile polyphenols and chlorophyll from degradation, extending shelf life significantly. Furthermore, leveraging Enterprise Resource Planning (ERP) systems integrated with Blockchain technology is becoming pivotal for traceability, especially for premium, single-origin matcha. This technological integration allows consumers to scan a QR code on the packaging to verify the exact farm, harvest date, and processing method, fulfilling the growing consumer demand for complete supply chain transparency and combating issues related to fraudulent or low-quality imitations prevalent in the global tea trade.

Regional Highlights

- Asia Pacific (APAC): Dominates the market both in terms of production volume and historical consumption, led by Japan (the benchmark for quality and ceremonial standards) and increasingly competitive production from China. The region drives innovation in traditional applications and serves as the primary global sourcing hub, maintaining influence over price points and quality metrics worldwide.

- North America: Exhibits the fastest growth rate, fueled by strong consumer interest in health and wellness, aggressive marketing, and its integration into popular culture via major café chains. The US market is characterized by high demand for certified organic, non-GMO, and ethically sourced products, driving premiumization.

- Europe: Represents a rapidly maturing market where matcha is successfully positioned as a luxury functional alternative to coffee. Countries like the UK, Germany, and France show high adoption, focusing primarily on clean label, natural ingredients, and functional health benefits. Regulatory adherence to EU food safety standards significantly impacts market entry here.

- Latin America (LATAM): An emerging market with potential driven by increasing urbanization and the rising middle class adopting global health trends. Consumption remains nascent but is growing, primarily focused on imported packaged RTD products and culinary applications in high-end restaurants in metropolitan areas like Brazil and Mexico.

- Middle East and Africa (MEA): Currently the smallest but showing slow, consistent growth, primarily concentrated in affluent urban centers (UAE, Saudi Arabia, South Africa). Market access is largely dependent on the tourism and luxury hospitality sectors, positioning matcha as an exclusive, high-value import item.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Matcha Tea Market.- Aiya Co. Ltd.

- The AOI Tea Company

- Ippodo Tea Co.

- Encha

- DoMatcha

- Midori Spring

- Jade Leaf Matcha

- Mizuba Tea Co.

- Nestlé S.A. (via acquired functional beverage brands)

- Unilever (via Pukka Herbs and other wellness portfolio integration)

- ITO EN

- Marukyu Koyamaen

- Starbucks Corporation (major end-user/sourcing partner)

- Rishi Tea

- The Tea Spot

- Kenko Tea

- Teaspoons & Co.

- Clearspring Ltd.

- Stash Tea Company

- Tsubokichi Seicha

Frequently Asked Questions

Analyze common user questions about the Matcha Tea market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Matcha Tea Market?

The primary driver is the widespread consumer shift towards natural, functional beverages offering superior health benefits, particularly high antioxidant levels (EGCG) and sustained energy without jitters, positioning matcha as a premium superfood and a healthier alternative to conventional coffee.

What is the key difference between Ceremonial Grade and Conventional Grade matcha?

Ceremonial Grade matcha is derived from the youngest, finest Tencha leaves, processed meticulously for optimal flavor (less bitterness, more umami) and nutrient profile, intended for traditional whisking. Conventional (Culinary) Grade uses slightly older leaves and is blended primarily for use as an ingredient in lattes, baking, and industrial food applications, where flavor intensity and color retention are prioritized over delicate texture.

Which geographical region holds the highest growth potential for matcha consumption?

North America (specifically the U.S. and Canada) exhibits the highest projected growth rate, driven by robust consumer adoption of wellness products, significant product diversification into RTD and supplements, and strong integration into specialty café culture and e-commerce platforms.

How is supply chain sustainability impacting purchasing trends in the matcha industry?

Sustainability and ethical sourcing are critical impact forces; consumers, particularly in Europe and North America, increasingly demand transparent sourcing, organic certification, and fair trade verification. Companies prioritizing these factors gain competitive advantages, allowing them to justify premium pricing and foster long-term consumer loyalty.

What are the primary restraints affecting the scalability and pricing of high-quality matcha?

The scalability and pricing of high-quality matcha are primarily restrained by the intensive, labor-heavy, shade-growing process (Tana), the slow, traditional stone-grinding required for fine powder, and the vulnerability of the specialized raw material supply to adverse climate variability and seasonal yield fluctuations.

How does the L-theanine content in matcha contribute to its market appeal?

The high L-theanine content is a significant selling point, particularly for cognitive health consumers. L-theanine, an amino acid, works synergistically with caffeine to promote "calm alertness," enhancing focus and relaxation without inducing the anxiety or "crash" associated with high caffeine intake, thereby appealing to high-performance professionals and students.

What role does the cosmetics industry play in the future expansion of the Matcha Tea Market?

The cosmetics segment is a growing opportunity, leveraging matcha’s potent antioxidant and anti-inflammatory properties. It is incorporated into face masks, serums, and cleansers, appealing to consumers seeking natural ingredients for anti-aging and skin detoxification, providing manufacturers with avenues for product diversification outside of traditional consumption.

What technological advancements are crucial for maintaining matcha quality during distribution?

Key technologies include advanced packaging solutions such as nitrogen-flushing and vacuum sealing, which prevent oxidation and preserve the color and nutrient integrity of the volatile powder. Furthermore, cold chain logistics and temperature-controlled storage are essential for large-scale, international distribution to prevent degradation.

How are matcha manufacturers utilizing digital marketing to reach potential customers?

Manufacturers utilize targeted digital marketing via social media and specialized health blogs, focusing on educational content regarding preparation methods, cultural heritage, and specific health outcomes. Direct-to-consumer (DTC) e-commerce channels are optimized using personalized recommendations driven by AI analytics to enhance engagement and conversion rates.

What impact does the presence of counterfeit products have on the market?

Counterfeit or low-quality, non-authentic products pose a significant risk, eroding consumer trust and undermining the premium positioning of true ceremonial matcha. This necessitates substantial investment in sophisticated quality verification processes, including third-party testing and implementation of advanced blockchain traceability solutions to guarantee authenticity to the consumer.

Explain the significance of the Uji region in Japan to the global matcha supply chain.

Uji, Kyoto Prefecture, is historically renowned as the birthplace of traditional matcha production and sets the gold standard for quality worldwide. Matcha sourced from Uji commands premium pricing due to its established reputation, specific terroir, and adherence to centuries-old cultivation and grinding techniques, making it a critical benchmark for ceremonial grade products globally.

What percentage of the market is dominated by the Food and Beverage application segment?

The Food and Beverage application segment typically holds the dominant share of the Matcha Tea Market by volume, accounting for a majority of consumption due to the widespread use of culinary grade matcha in lattes, smoothies, confectioneries, and the increasing volume demand from the ready-to-drink (RTD) sector globally.

How do certification standards, like organic status, influence consumer purchasing decisions?

Certification standards, particularly organic status and non-GMO verification, strongly influence purchasing behavior, especially in mature Western markets. These certifications signify product purity and ethical cultivation practices, acting as critical differentiators that enhance brand credibility and justify higher retail prices for discerning consumers prioritizing clean-label ingredients.

Describe the role of major food service chains in expanding matcha's market reach.

Major food service chains (e.g., global coffee retailers and quick-service restaurants) play a crucial role in mainstreaming matcha by introducing it to a broad consumer base who might not shop at specialty tea stores. Their high volume demand drives the need for consistent, industrial-grade matcha supplies, dramatically increasing overall market volume and public visibility.

What is the forecast outlook for the powdered versus ready-to-drink (RTD) matcha segments?

While the traditional powder segment maintains dominance in value due to high-end ceremonial grades, the ready-to-drink (RTD) segment is forecast to experience faster volumetric growth. This acceleration is driven by consumer demand for convenience, portability, and the increasing availability of shelf-stable, functional matcha beverages marketed for energy and wellness.

How is urbanization in emerging economies affecting matcha consumption patterns?

Urbanization in emerging economies exposes a growing middle class to global health and wellness trends through digital media and international travel. This leads to increased experimentation with imported premium products like matcha, contributing to rising consumption, particularly in capital cities and major commercial hubs within APAC and LATAM regions.

What is the significance of the "umami" flavor profile in high-quality matcha?

The umami (savory, rich) flavor is a signature characteristic of high-quality, shade-grown ceremonial matcha, resulting from high L-theanine and chlorophyll levels. This unique profile distinguishes premium matcha from regular green tea and is highly valued by connoisseurs, acting as a direct indicator of quality and proper cultivation techniques.

What are the typical lead times in the matcha supply chain from harvest to retail?

The supply chain lead time can vary significantly, but given the seasonal harvesting (primarily spring), extensive processing (steaming, drying, de-veining, stone-grinding), and meticulous packaging required, lead times often range from several weeks up to a few months, necessitating careful inventory planning, especially for seasonal ceremonial grades.

In what ways is AI being used to optimize matcha cultivation?

AI is primarily used for precision agriculture, employing machine learning to analyze sensor data on soil composition, moisture, light, and temperature. This allows farmers to precisely manage resource application (water, fertilizer) and predict optimal shading and harvest times, thereby maximizing the yield and quality of the sensitive Tencha leaves.

How do competitive pricing strategies differ between the powdered and RTD matcha segments?

Competitive pricing in the powdered segment is highly stratified, with ceremonial grade relying on premium, value-based pricing linked to heritage and quality, while culinary grade is volume-driven and cost-competitive. The RTD segment focuses on mass-market penetration, employing competitive retail pricing similar to other functional beverages, balancing ingredient cost with consumer convenience.

What are the major challenges in sourcing matcha sustainably?

Major sourcing challenges include mitigating the impact of climate change on specific terroir necessary for high quality, ensuring fair wages and safe working conditions for specialized labor involved in shade cultivation and grinding, and meeting growing global demand without resorting to chemically intensive farming methods that compromise organic status.

What trends are observed in matcha packaging innovation?

Packaging innovation focuses on maintaining maximum freshness and extending shelf life. Key trends include the use of aluminum tins and opaque, resealable pouches with specialized air-tight seals, often utilizing nitrogen-flushing technology. There is also a rising trend in single-serve sticks or packets for convenience and portion control, particularly for consumers on the go.

How does the perception of matcha as a ceremonial drink influence brand marketing?

The ceremonial perception is a powerful marketing tool, used to convey authenticity, premium quality, and cultural richness. Brands emphasize traditional Japanese aesthetics, storytelling, and preparation rituals (Chawan, Chasen) to differentiate high-end products, appealing to consumers seeking an experiential element alongside the health benefits.

Which specific antioxidant compound in matcha is most commercially valued, and why?

Epigallocatechin gallate (EGCG) is the most commercially valued compound. It is a powerful catechin linked to metabolic enhancement, cardiovascular health, and anti-inflammatory effects. High EGCG content is frequently highlighted in the marketing of dietary supplements and functional foods containing matcha extract.

What are the forecasted threats from substitution products in the functional beverage market?

Matcha faces competition from other functional beverage ingredients, notably turmeric lattes, mushroom coffees (e.g., lion's mane, chaga), and exotic adaptogen blends (e.g., ashwagandha). These substitutions pose a threat by offering alternative unique benefits or lower price points, forcing matcha brands to continually emphasize their unique combination of energy and cognitive enhancement benefits.

How do stringent regulatory requirements in Europe affect matcha import and distribution?

European Union regulations impose strict limits on pesticide residues and require detailed documentation regarding origin and processing standards. This necessitates that importers and manufacturers adhere to high food safety compliance levels, often favoring suppliers with robust traceability systems and organic certifications, thereby adding complexity and cost to the supply chain.

What role does flavor customization play in new product development for the culinary segment?

Flavor customization is essential for expanding the culinary segment, moving beyond traditional profiles. Manufacturers introduce flavored matcha powders (e.g., vanilla, ginger, coconut) and create specialized matcha-based blends tailored for use in specific products, such as high-protein shakes or low-sugar desserts, appealing to diverse consumer palates and dietary requirements.

How significant is direct-to-consumer (DTC) e-commerce for niche matcha brands?

DTC e-commerce is highly significant for niche and premium matcha brands, allowing them to control the brand narrative, build direct customer relationships through subscriptions, and manage inventory of high-value, perishable goods efficiently, bypassing high retail margins and ensuring product freshness upon delivery.

What is the estimated impact of climate change on future matcha production yields?

Climate change poses a significant threat, as the precise terroir and predictable weather patterns required for shade-grown tea are becoming unstable. Increased frequency of extreme weather events, shifts in rainfall patterns, and temperature variance threaten consistent quality and could lead to reduced yields, placing upward pressure on raw material costs for ceremonial grade matcha.

Describe the major differences in matcha consumption habits between Asian and Western markets.

Asian markets, particularly Japan, emphasize traditional, whisked consumption (Koicha, Usucha) rooted in ceremony and purity. Western markets, conversely, favor convenience and hybridization, primarily consuming matcha in lattes, smoothies, or mixed into food, viewing it primarily as a functional ingredient rather than a ceremonial beverage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Matcha Tea Market Size Report By Type (Drinking-use Matcha Tea, Additive-use Matcha Tea), By Application (Drinking Tea, Pastry, Ice Cream, Beverage), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Matcha Tea Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Drinking-use Matcha Tea, Additive-use Matcha Tea), By Application (Drinking Tea, Pastry, Ice Cream, Beverage), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager