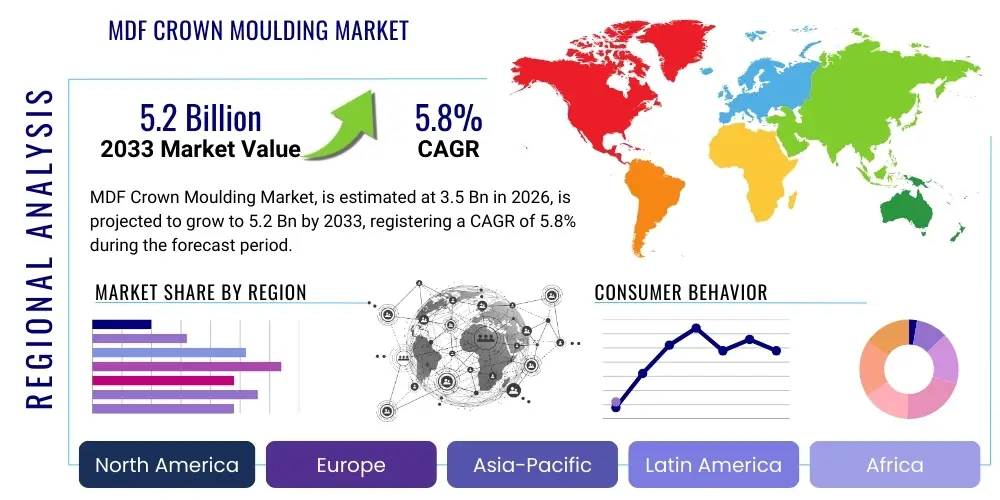

MDF Crown Moulding Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443169 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

MDF Crown Moulding Market Size

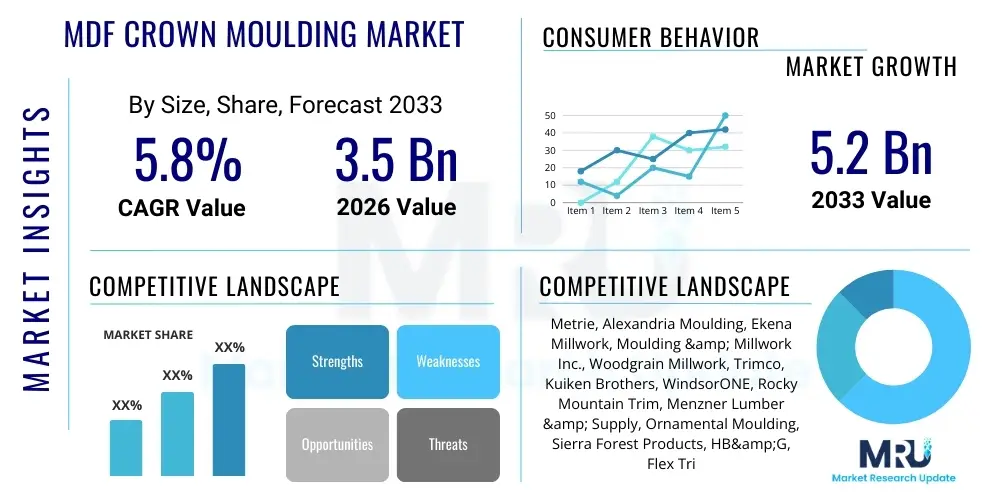

The MDF Crown Moulding Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033. This consistent expansion is driven primarily by increasing residential construction activities globally, particularly the surge in renovation and remodeling projects that favor cost-effective and aesthetically versatile interior finishing materials. The inherent stability and smooth finish of Medium-Density Fiberboard (MDF) crown moulding make it a preferred alternative to traditional wood products in large-scale building projects, ensuring sustained market valuation growth over the coming decade.

MDF Crown Moulding Market introduction

The MDF Crown Moulding Market encompasses the manufacturing, distribution, and sale of decorative trim used at the junction of walls and ceilings, fabricated primarily from Medium-Density Fiberboard. MDF is an engineered wood product made by breaking down hardwood or softwood residuals into wood fibers, combining them with wax and a resin binder, and forming panels by applying high temperature and pressure. Crown moulding specifically adds architectural detail and perceived value to interior spaces, functioning both aesthetically and often concealing minor structural imperfections.

The product’s versatility in design allows it to mimic complex traditional wood profiles while offering superior dimensional stability, which is highly advantageous in environments susceptible to minor fluctuations in humidity and temperature. Major applications span across residential new builds, multi-family housing projects, commercial offices, hospitality establishments, and extensive renovation and repair projects. The ease of installation, coupled with its smooth surface that accepts paint readily, positions MDF moulding as a highly efficient material for contractors and DIY consumers alike, reducing labor time and overall project costs.

Key benefits driving market adoption include its uniform density, freedom from knots and grain patterns, and cost-effectiveness compared to solid wood alternatives. Driving factors center on the sustained demand within the North American and European housing markets, where aesthetic appeal and material performance are crucial. Furthermore, stringent environmental regulations in some regions encourage the use of engineered wood products derived from recycled or sustainable fiber sources, positioning MDF crown moulding favorably in the green building movement, which further fuels its global consumption.

MDF Crown Moulding Market Executive Summary

The MDF Crown Moulding Market is characterized by resilient business trends rooted in the residential repair and remodel (R&R) sector, demonstrating less sensitivity to cyclical new construction downturns compared to primary building materials. Manufacturers are increasingly focusing on automation and high-speed profiling technologies to manage rising material costs and labor shortages, thus improving production efficiency and maintaining competitive pricing. Strategic partnerships between producers and large retail distribution chains, such as home improvement warehouses, are crucial for market penetration, ensuring widespread availability and consumer access across various geographies. Product innovation is driven by the demand for moisture-resistant (MR) MDF formulations suitable for high-humidity areas like bathrooms and kitchens, addressing historical limitations of the material.

Regionally, North America maintains market dominance, propelled by a strong culture of home personalization and robust housing turnover, which necessitates continuous interior upgrades. The Asia Pacific (APAC) region, however, is emerging as the fastest-growing market segment, primarily due to rapid urbanization, increasing disposable incomes, and large-scale government investments in infrastructure and housing projects in countries like China and India. European markets exhibit maturity, emphasizing sustainable sourcing and premium, intricate profiles, where MDF is valued for its consistency and durability in historical restoration efforts. Companies are establishing localized manufacturing hubs in high-growth regions to mitigate logistical complexities and reduce import tariffs, ensuring prompt supply to local contractors.

Segment trends indicate that standard density MDF crown moulding remains the dominant product type due to its cost advantage and suitability for most interior applications. Nevertheless, the Moisture-Resistant MDF segment is experiencing accelerated growth as consumers seek enhanced durability and longevity, particularly in climate zones with high humidity fluctuations. In terms of application, the Residential Construction segment, encompassing both new single-family homes and multi-family units, holds the largest market share, while the Renovation/Remodeling segment provides stable, long-term demand. The increasing preference for wider and taller crown moulding profiles, reflecting architectural trends toward grander interior aesthetics, also shapes segment development and manufacturing capacity expansion.

AI Impact Analysis on MDF Crown Moulding Market

Common user questions regarding AI's impact on the MDF Crown Moulding Market frequently revolve around how artificial intelligence can optimize manufacturing speed, minimize material waste, and enhance predictive maintenance in profiling machinery. Users are keen to understand if AI can revolutionize customized design generation, allowing homeowners and designers to quickly visualize and order unique profiles that are immediately translated into production specifications (mass customization). Furthermore, there is significant inquiry into AI-driven supply chain transparency, particularly concerning global wood fiber sourcing and logistics optimization, aiming to reduce lead times and buffer against supply volatility common in the engineered wood sector. Key expectations center on achieving higher operational efficiency, smarter inventory management based on localized demand forecasting, and ultimately, a reduction in the final product cost passed onto the consumer, enhancing MDF's competitive edge.

- AI-driven optimization of fiber blending and resin application processes to ensure consistent density and quality of the raw MDF panels, reducing internal defects and material variability.

- Predictive maintenance schedules for high-precision profiling and cutting machinery, minimizing unexpected downtime and maximizing machine utilization rates in the moulding production phase.

- Advanced demand forecasting models utilizing machine learning algorithms to analyze macroeconomic indicators, housing starts, and localized retail sales data, optimizing inventory levels for different profile styles and minimizing holding costs.

- AI-powered design generation tools that rapidly iterate on custom crown moulding profiles based on user-input architectural style and room dimensions, streamlining the pre-production design cycle.

- Implementation of robotic automation guided by AI vision systems for quality control inspection post-profiling, ensuring dimensional accuracy and surface finish compliance before packaging.

DRO & Impact Forces Of MDF Crown Moulding Market

The MDF Crown Moulding Market is significantly influenced by key macro and microeconomic forces that dictate market direction and profitability. Drivers include the high affordability and availability of MDF compared to solid wood, coupled with rapid globalization of construction standards favoring standardized, easy-to-install decorative components. Restraints primarily involve the susceptibility of standard MDF to water damage and swelling, limiting its use in exterior or high-moisture environments, alongside volatility in resin binder prices (petrochemical derivatives). Opportunities lie in developing advanced coating technologies, introducing high-performance MR and exterior-grade MDF formulations, and penetrating emerging markets in Southeast Asia and Latin America where construction activity is robust but engineered wood adoption is nascent. These factors collectively create a dynamic competitive landscape where material science and distribution network efficiency are critical determinants of success.

Impact forces acting upon the market are complex and multi-faceted. Economic forces, such as fluctuating interest rates, heavily influence housing starts and renovation spending, directly impacting demand for interior finishing products. Technological forces drive continuous improvement in production capabilities, resulting in smoother finishes and more intricate profile designs that were previously exclusive to natural wood carving. Regulatory forces increasingly focus on sustainability and formaldehyde emission standards (e.g., CARB P2 and EPA TSCA Title VI compliance), compelling manufacturers to invest in low or no-VOC resins, which adds complexity but enhances product credibility in health-conscious markets. Furthermore, competitive forces dictate pricing strategies and product differentiation, pushing companies toward vertical integration from raw fiber sourcing to final product distribution.

Geopolitical stability, particularly concerning the supply chains for wood fiber pulp and chemical binders, also exerts a strong impact force. Trade barriers or environmental regulations in key timber-producing regions can rapidly escalate raw material costs. However, the move toward localized manufacturing and regional sourcing within established economic blocs aims to mitigate these risks. Ultimately, consumer preferences act as a powerful force; the growing appreciation for architectural detail, often popularized through social media and design trends, sustains the demand for decorative mouldings, while the practical need for durable, low-maintenance materials keeps MDF positioned favorably against pricier alternatives.

Segmentation Analysis

The MDF Crown Moulding Market is structurally segmented based on crucial product characteristics, primarily encompassing the type of MDF used and the ultimate application or end-user industry. These segmentations are fundamental for stakeholders to understand specific demand dynamics, target marketing efforts, and tailor product development strategies. The primary segmentation by type includes Standard MDF, which forms the historical backbone of the market, offering the greatest cost advantages, and specialized variants like Moisture-Resistant (MR) MDF and Fire-Rated MDF, which cater to stringent performance requirements in specific commercial or high-humidity residential settings. Analyzing these segments helps quantify the shift towards higher-value, performance-enhanced products.

Segmentation by application reflects the primary consumer base and usage context, distinguishing between new construction versus existing property enhancements. Residential Construction accounts for the vast majority of consumption, driven by mass housing projects where uniformity and speed of installation are paramount. Commercial Construction, including office buildings and retail spaces, utilizes MDF crown moulding for aesthetic enhancement in common areas and executive offices. The Renovation and Remodeling segment provides critical resilience to the market, as property owners consistently seek affordable ways to update interior aesthetics, often replacing older trim with modern, larger MDF profiles. Geographic segmentation, while broad, highlights regional design preferences and regulatory environments that dictate product specifications, such as stricter fire codes in certain metropolitan commercial zones.

- By Type:

- Standard MDF

- Moisture-Resistant (MR) MDF

- Fire-Rated MDF

- Ultra-Light MDF

- By Application:

- Residential Construction (New Builds & Multi-Family)

- Commercial Construction (Office, Retail, Hospitality)

- Renovation and Remodeling (Residential & Commercial)

- By Profile Type:

- Traditional (Small and Medium Profiles)

- Modern/Grand (Large and Complex Profiles)

Value Chain Analysis For MDF Crown Moulding Market

The value chain for the MDF Crown Moulding Market is initiated by upstream activities centered on raw material procurement, primarily wood residuals (fiber) and chemical additives (resins, wax). Upstream analysis involves assessing the sourcing stability of sustainable fiber, often from softwoods, and managing the price volatility of urea-formaldehyde or melamine-based resins. Key players in this phase are large forestry operations, pulp producers, and chemical manufacturers. The midstream involves the core manufacturing process: converting raw fiber into MDF panels via high-pressure pressing, followed by specialized profiling, sanding, priming, and finishing (including specialized coating application) to produce the crown moulding strips. Efficiency in the profiling stage, utilizing advanced CNC machinery, is crucial for cost control and maintaining dimensional accuracy across high volume production runs.

The distribution network forms the downstream segment of the value chain, connecting manufacturers to the final end-user. Distribution channels are varied and typically involve both direct and indirect routes. Direct distribution often involves sales to large volume residential builders or commercial construction contractors who purchase materials in bulk directly from the mill or through manufacturer sales representatives. This route offers better margins but requires significant logistical capabilities and client management resources. Indirect distribution is the most pervasive, relying heavily on specialized moulding wholesalers, national home improvement retail chains (big box stores), and independent lumberyards. These intermediaries manage inventory, provide local accessibility, and cater to smaller contractors, remodelers, and DIY consumers.

The choice of distribution channel heavily impacts market reach and final pricing. Large retail channels offer mass-market exposure and consistent sales volume but demand lower wholesale pricing, placing pressure on manufacturers’ margins. Conversely, specialized wholesalers often stock a wider array of custom or niche profiles, serving high-end design markets. Optimization of this value chain involves minimizing transportation costs, implementing robust inventory management systems across all tiers, and ensuring adherence to quality standards at every production and distribution node. Sustainability certifications throughout the supply chain are also becoming integral, enhancing the value proposition and meeting the ethical sourcing demands of corporate buyers and environmentally conscious consumers.

MDF Crown Moulding Market Potential Customers

The primary potential customers and buyers of MDF Crown Moulding span the entire building and interior finishing ecosystem, categorized broadly into professional buyers and consumer retail purchasers. Professional buyers include large-scale residential developers and production builders who prioritize cost efficiency, material consistency, and rapid delivery for multi-unit housing projects. These clients purchase in extremely high volumes and seek long-term contracts with manufacturers offering standardized profiles and reliable supply chains. Commercial general contractors constitute another significant professional segment, focusing on materials that comply with specific fire and building codes, often opting for specialized Fire-Rated or durable MR MDF products for public spaces like hotels, restaurants, and corporate offices.

Specialized subcontractors, particularly finish carpenters and interior renovation specialists, represent a crucial segment of recurring buyers. These professionals value the ease of working with MDF—its smooth surface reduces preparation time, and its uniformity minimizes waste during cutting and joining. They often rely on local or regional distributors for timely access to a diverse inventory of profile sizes and styles. Furthermore, architects and interior designers act as influential specifiers, driving demand for specific, often bespoke or historically accurate, profiles. Their decisions dictate material choice for custom home builds and high-end remodeling projects, focusing on aesthetic quality and surface finish compatibility with luxury paint applications.

The consumer retail segment, dominated by Do-It-Yourself (DIY) homeowners, is facilitated primarily through big-box home improvement stores. These customers seek readily available, pre-primed, and easy-to-handle products suitable for small-scale renovation projects. Their purchasing decisions are highly influenced by price point, perceived ease of installation (often preferring lighter, smaller profiles), and the availability of accompanying instructional content. The sustained growth of the DIY renovation market, particularly in developed economies, ensures a stable, high-volume consumer base for standard, widely stocked MDF crown moulding profiles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Metrie, Alexandria Moulding, Ekena Millwork, Moulding & Millwork Inc., Woodgrain Millwork, Trimco, Kuiken Brothers, WindsorONE, Rocky Mountain Trim, Menzner Lumber & Supply, Ornamental Moulding, Sierra Forest Products, HB&G, Flex Trim, Future Moulding, TruStile Doors, Masonite International Corporation, Roseburg Forest Products, Patrick Industries, Inc., Prime-Line Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MDF Crown Moulding Market Key Technology Landscape

The technological landscape in the MDF Crown Moulding Market is characterized by continuous refinement in manufacturing precision, surface preparation, and material composition. Core technology centers on the extrusion and pressing of the raw MDF panels, followed by sophisticated computer numerical control (CNC) profiling. Modern CNC routers and moulders utilize multi-axis cutting heads capable of replicating intricate, complex profiles with extremely tight tolerances, significantly reducing material waste and ensuring batch-to-batch consistency. Advancements in cutting tool materials, such as specialized carbide and diamond-tipped cutters, allow for faster feed rates and prolonged tool life, directly contributing to increased throughput and lower operating costs in high-volume production facilities.

Surface finishing technology is critical to the perceived quality and ease of use of MDF crown moulding. Pre-priming technology involves the application of specialized water- or solvent-based primers designed specifically for engineered wood surfaces. Key innovations here include ultraviolet (UV) curing systems, which rapidly set the primer coat, providing a hard, smooth, defect-free surface that is ready for final painting immediately upon installation. This UV-cured priming not only speeds up the production process but also provides superior adhesion for subsequent topcoats, addressing a long-standing challenge of paint absorption and peeling common with standard wood products. Manufacturers invest heavily in optimizing these coating lines to meet the high-quality finish expectations of professional contractors.

Furthermore, technology related to material science is driving product diversification. This includes the formulation of new resin binders, such as phenol-formaldehyde or specialized polyurethane resins, used in moisture-resistant and exterior-grade MDF products to inhibit water penetration and microbial degradation. The integration of advanced sensor technology within pressing and profiling equipment facilitates real-time monitoring of density, moisture content, and dimensional conformity. This Industrial Internet of Things (IIoT) approach enhances process control, reduces the incidence of warping or internal stress, and aligns production closer to the "Industry 4.0" paradigm, guaranteeing superior product performance and contributing significantly to the reduction of manufacturing variability and energy consumption.

Regional Highlights

- North America (United States and Canada): This region is the largest and most mature market, characterized by strong consumer spending on residential maintenance and robust new home construction standards that mandate high-quality interior finishes. The dominant trend involves demand for large, historically accurate profiles (e.g., colonial, craftsman), and a high adoption rate of premium pre-primed products. The region benefits from extensive and efficient distribution networks, particularly through national retail chains, making product accessibility and availability a primary driver. Strict regulations regarding formaldehyde emissions (TSCA Title VI) drive the adoption of low-emission MDF products.

- Europe (Germany, UK, France): The European market displays steady growth, emphasizing sustainability and the use of locally sourced materials. Demand is strong in the renovation sector, particularly in Western European countries with aging housing stock. Manufacturers here focus heavily on aesthetic integration, often supplying mouldings that complement contemporary minimalist designs as well as classic historical styles. The market is subject to complex EU regulations concerning construction products and chemical safety (REACH), pushing innovation toward ultra-low VOC binders and certified sustainable wood fiber sourcing.

- Asia Pacific (China, India, Japan): APAC is the fastest-growing region, fueled by unprecedented urbanization and a massive influx of investment into both public and private residential infrastructure. While traditional materials still hold strong in many areas, the need for cost-effective, mass-producible, and uniform interior finishing materials is rapidly increasing MDF adoption. China leads the production capacity, serving both domestic demand and acting as a major global exporter. Key growth opportunities lie in the adoption of Western-style interiors in emerging middle-class housing and commercial building development throughout Southeast Asia.

- Latin America (Brazil, Mexico): This region is characterized by fragmented but developing construction markets. Demand for MDF crown moulding is growing, driven by affordable housing projects and increasing foreign investment in commercial properties. Price sensitivity is high, favoring standard, volume-produced profiles. Logistical challenges and fluctuating economic conditions, however, require manufacturers to adopt flexible distribution and inventory management strategies.

- Middle East and Africa (MEA): Growth is concentrated in the Gulf Cooperation Council (GCC) countries, driven by massive infrastructure and hospitality projects in places like UAE and Saudi Arabia. The extreme climate necessitates highly durable, sometimes customized, moisture-resistant moulding solutions. Demand often centers on high-end luxury profiles for commercial and upscale residential developments. Africa's market remains largely untapped, focused mainly on basic finishing materials, but shows long-term potential corresponding with future urban expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MDF Crown Moulding Market.- Metrie

- Alexandria Moulding

- Ekena Millwork

- Moulding & Millwork Inc.

- Woodgrain Millwork

- Trimco

- Kuiken Brothers

- WindsorONE

- Rocky Mountain Trim

- Menzner Lumber & Supply

- Ornamental Moulding

- Sierra Forest Products

- HB&G

- Flex Trim

- Future Moulding

- TruStile Doors

- Masonite International Corporation

- Roseburg Forest Products

- Patrick Industries, Inc.

- Prime-Line Products

Frequently Asked Questions

Analyze common user questions about the MDF Crown Moulding market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of MDF Crown Moulding over solid wood?

MDF crown moulding offers superior dimensional stability, meaning it is less prone to warping, cracking, or expanding due to changes in temperature or humidity compared to solid wood. It also provides a flawless, knot-free surface ideal for painting and is significantly more cost-effective for large projects, optimizing construction budgets.

Is MDF crown moulding suitable for high-humidity areas like bathrooms?

Standard MDF is generally not recommended for environments with high, persistent moisture. However, the market offers specialized Moisture-Resistant (MR) MDF crown moulding, formulated with water-repellent resins, which performs reliably in high-humidity areas, provided adequate ventilation is maintained.

How do sustainability regulations impact the MDF moulding manufacturing process?

Global sustainability regulations, particularly the EPA TSCA Title VI and EU standards, mandate the use of low or ultra-low formaldehyde-emitting resins in MDF production. Manufacturers must invest in continuous testing and certification processes to ensure compliance, driving a market shift towards greener, healthier engineered wood products.

Which geographic region demonstrates the highest growth potential for MDF crown moulding?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, exhibits the highest market growth potential. This growth is directly attributable to rapid urbanization, massive residential infrastructure development, and increasing adoption of modern interior finishing techniques requiring cost-efficient, high-volume products like MDF moulding.

What are the key technological advancements affecting MDF moulding production?

Key advancements include the use of high-speed CNC profiling machinery for precision and rapid customization, the integration of UV-cured priming systems for superior surface finish, and the development of advanced material formulations, such as exterior-grade MDF, to expand the product’s application scope beyond traditional interiors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager