Measurement Probes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442697 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Measurement Probes Market Size

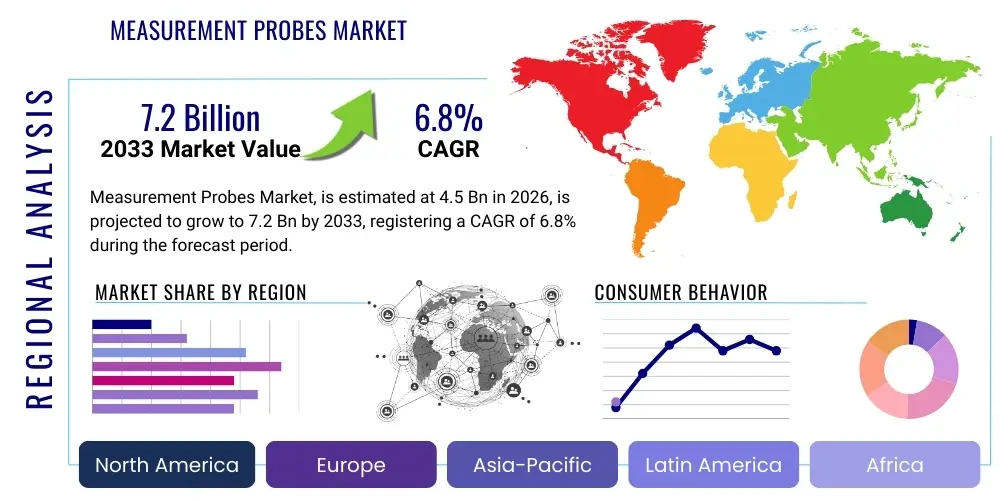

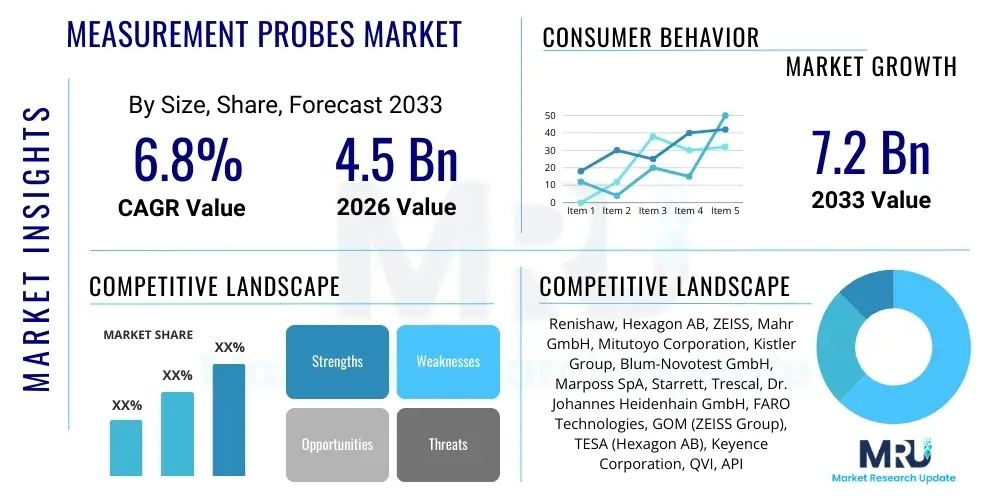

The Measurement Probes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Measurement Probes Market introduction

The Measurement Probes Market encompasses advanced sensing and data acquisition devices critical for dimensional metrology and quality control across various industries. These instruments are fundamental components utilized primarily within Coordinate Measuring Machines (CMMs), machine tools, and specialized inspection equipment to accurately determine the physical dimensions, geometrical tolerances, and surface characteristics of manufactured parts. The core function of a measurement probe is to interface with the workpiece surface, triggering a signal that communicates precise positional data back to the measuring system, thus ensuring compliance with stringent design specifications and regulatory standards.

The product portfolio within this market is diverse, ranging from highly precise contact probes, such as touch-trigger probes and continuous scanning probes, which physically interact with the object, to sophisticated non-contact technologies like laser triangulation probes, optical sensors, and structured light scanners, which utilize advanced optics for rapid, non-destructive inspection. Major applications span high-precision sectors including aerospace, where stringent safety tolerances are paramount, automotive manufacturing for engine component verification and body panel alignment, and medical device production requiring micro-level accuracy. The inherent benefits derived from utilizing high-quality measurement probes include enhanced manufacturing efficiency, significant reduction in scrap rates, and the facilitation of fully automated, inline quality inspection processes, crucial for achieving Industry 4.0 objectives.

Driving factors for the sustained market expansion include the global push toward miniaturization and complexity in manufactured components, particularly in consumer electronics and specialized medical implants, necessitating higher accuracy metrology solutions. Furthermore, the increasing adoption of automated inspection systems and smart factory initiatives globally mandates the integration of robust, high-speed probing systems capable of rapid data capture and instantaneous analysis. Regulatory frameworks demanding greater traceability and quality documentation in industries like aerospace and defense also contribute significantly to the consistent demand for advanced measurement probe technology, underscoring their irreplaceable role in modern quality assurance workflows.

Measurement Probes Market Executive Summary

The global Measurement Probes Market is poised for robust expansion, fundamentally driven by pervasive business trends centered on automation, digitization, and the escalating requirement for ultra-high precision in manufacturing processes globally. Key business trends include the shift towards integrating probing systems directly into production environments, moving metrology out of dedicated labs and onto the shop floor (In-Line Metrology). This necessitates probes engineered for durability, speed, and environmental resilience against temperature fluctuations, vibration, and debris. Furthermore, strategic alliances and mergers focused on combining software analytics capabilities with hardware precision are defining the competitive landscape, allowing vendors to offer integrated, end-to-end quality solutions rather than just standalone hardware components, thereby capturing greater value throughout the service lifecycle.

Regionally, Asia Pacific (APAC) stands out as the primary engine for market growth, attributed to the immense expansion of the manufacturing bases in countries like China, India, South Korea, and Japan, which are aggressively adopting advanced precision machinery and automated inspection equipment across automotive and electronics sectors. North America and Europe, characterized by mature industrial sectors like aerospace and advanced machinery, continue to demand high-end, customized probing solutions focused on complex geometries and stringent regulatory compliance, driving demand for advanced scanning and multi-sensor probe systems. Latin America, the Middle East, and Africa (MEA) present emerging opportunities, spurred by investments in infrastructure and localized manufacturing capabilities seeking initial deployments of reliable metrology solutions.

Segment trends highlight a noticeable migration toward non-contact measurement technologies, driven by the need for faster inspection cycles and the capability to measure delicate or flexible materials without physical deformation. However, contact probes, particularly high-accuracy continuous scanning probes, maintain dominance in applications requiring certified precision, such as internal bore measurement or geometric dimensioning and tolerancing (GD&T) verification on mission-critical components. The automotive and aerospace end-user segments remain the largest consumers, though the electronics and medical device sectors are demonstrating the fastest growth rates due to the increasing complexity and miniaturization demands inherent in their respective product portfolios, fueling specific demand for micro-probes and high-resolution optical systems.

AI Impact Analysis on Measurement Probes Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Measurement Probes Market frequently revolve around how AI can enhance measurement speed, improve accuracy by compensating for thermal or systematic errors, and automate the complex process of inspection path generation. Users are highly concerned about the potential for AI algorithms to interpret and handle large volumes of 3D point cloud data generated by scanning probes, seeking automated flaw detection, predictive maintenance for probe calibration, and the ability to correlate measurement results directly with machine tool parameters. The key themes summarized from these inquiries underscore expectations for AI to transition metrology from a reactive quality control activity to a proactive, predictive manufacturing intelligence system, drastically reducing human intervention and decision-making time in quality assurance.

The integration of AI is fundamentally transforming how data generated by measurement probes is processed and utilized, moving beyond simple dimensional reporting. Machine learning algorithms are being deployed to filter noise from raw sensor data, significantly enhancing the repeatability and reliability of measurements, especially in challenging environments. Furthermore, AI enables automated feature recognition from CAD models, allowing the measurement system to intelligently select the optimal probing strategy and sequence, minimizing measurement duration while maximizing coverage. This intelligent pathway generation is crucial for complex parts where manual programming is time-consuming and prone to human error, thereby democratizing sophisticated metrology operations.

In the context of generative design and adaptive manufacturing, AI provides the crucial feedback loop required for closed-loop control. Probe data analyzed by AI can instantaneously identify deviations and transmit corrective offset information directly back to the Computer Numerical Control (CNC) machine tool, facilitating autonomous process adjustment. This capability ensures that components are measured, analyzed, and corrected within the manufacturing cell, drastically reducing production delays and ensuring zero-defect manufacturing objectives. This shift emphasizes the transformation of measurement probes from mere data collectors into active components of a cohesive, intelligent manufacturing ecosystem, where predictive maintenance, sensor fusion, and real-time process optimization are standard operational procedures.

- AI optimizes probe path planning, minimizing inspection time.

- Machine learning enhances measurement accuracy by compensating for systematic and environmental errors.

- Automated data interpretation and defect classification accelerate quality assurance decisions.

- AI enables predictive maintenance for measurement probes, ensuring continuous calibration status.

- Integration facilitates closed-loop feedback systems for adaptive manufacturing process control.

DRO & Impact Forces Of Measurement Probes Market

The dynamics of the Measurement Probes Market are governed by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces (I) that collectively shape its trajectory. A primary driver is the accelerating trend of Industry 4.0 adoption, mandating the integration of automated quality inspection systems and sensor technology into every stage of the manufacturing process, particularly the requirement for instantaneous, high-density data capture. This driver is augmented by the global demand for increasingly complex, tight-tolerance components across sectors like electric vehicles (EVs) and advanced aerospace engine parts, which cannot be reliably inspected using manual methods, thereby cementing the reliance on highly accurate probing solutions.

However, the market faces significant restraints, notably the substantial initial investment required for high-end probing systems, including sophisticated CMMs and advanced software suites, which can be prohibitive for Small and Medium-sized Enterprises (SMEs). Furthermore, the inherent complexity in programming and operating advanced non-contact measurement probes necessitates highly skilled labor, leading to a prevalent skills gap in emerging markets. Technical restraints also persist, involving challenges in maintaining precision in harsh shop-floor environments characterized by fluctuating temperatures, vibrations, and contamination, demanding continuous technological innovation to enhance robustness and long-term calibration stability.

Significant opportunities exist in the burgeoning field of multi-sensor fusion technology, where combining tactile probing with optical, laser, and acoustic sensing capabilities offers unparalleled holistic component analysis and expands the probes' utility across diverse material types and surface finishes. The growing market for portable and handheld measurement devices, increasingly utilized for large-volume inspection (e.g., wind turbine blades, ship hulls), presents a substantial avenue for growth for wireless and miniaturized probe systems. Impact forces include stringent international quality standards (e.g., ISO certifications, AS9100 for aerospace) that enforce mandatory reliance on calibrated measurement equipment, compelling manufacturers to upgrade continuously. Moreover, the competitive pressure among manufacturers to reduce time-to-market and enhance product quality directly translates into heightened demand for faster, more reliable measurement probes capable of keeping pace with high-speed production lines.

Segmentation Analysis

The Measurement Probes Market is structurally segmented based on crucial dimensions, including the type of sensing technology employed, the specific application machinery, and the primary end-user industry served. Segmentation by type differentiates between contact probes, which rely on physical touch to register data points, and non-contact probes, which utilize various optical and electromagnetic principles for remote measurement. This foundational classification helps manufacturers tailor precision levels and speed capabilities to specific operational needs. Analyzing these segments is critical for understanding technological diffusion and market saturation across different precision manufacturing domains.

Further segmentation by application highlights the distinct requirements of various metrology platforms, most notably Coordinate Measuring Machines (CMMs), which demand highly accurate, often interchangeable probe heads for complex volumetric inspection, versus machine tools (such as CNC mills and lathes), which utilize probes primarily for on-machine inspection and tool setting, requiring robustness and rapid deployment. End-user segmentation provides insight into sectoral demand elasticity and technological preferences, with high-value sectors like Aerospace and Automotive driving demand for specialized, high-tolerance measurement solutions, while sectors like General Precision Manufacturing focus more on versatile, cost-effective standard systems. The detailed analysis of these segments is instrumental for strategic market positioning and resource allocation by market participants.

- By Type:

- Contact Probes

- Touch-Trigger Probes

- Continuous Scanning Probes (Analogue)

- Haptic Probes

- Non-Contact Probes

- Laser Probes (Triangulation, Scanning)

- Optical Sensors (Vision Systems)

- Structured Light Scanners

- By Application:

- Coordinate Measuring Machines (CMMs)

- Machine Tool Probing (On-Machine Inspection)

- Gauging and Specialized Inspection Equipment

- Portable Measuring Arms and Trackers

- By End-User Industry:

- Automotive

- Aerospace & Defense

- Precision Manufacturing & Job Shops

- Medical Devices

- Electronics & Semiconductor

- Energy (Oil & Gas, Power Generation)

Value Chain Analysis For Measurement Probes Market

The value chain for the Measurement Probes Market is initiated by upstream activities centered on the procurement of highly specialized raw materials, including microelectronics, high-precision sensors (e.g., strain gauges, piezoelectric elements, or advanced optics), and aerospace-grade alloys required for probe construction. Upstream analysis reveals a dependency on a specialized supply base for highly consistent, miniaturized components that meet stringent thermal stability and repeatability requirements. The manufacturing stage is complex, involving sophisticated cleanroom assembly, micro-machining, and rigorous calibration processes to ensure the probe's specified accuracy. Proprietary sensor technology and intellectual property around calibration algorithms form significant barriers to entry at this stage, emphasizing the importance of specialized expertise.

The midstream of the value chain focuses on integration, where the core probe technology is adapted and integrated into larger measuring systems, primarily CMMs, machine tools, or specialized robotic inspection cells. This stage includes software development for interfacing the probe data with metrology software packages (like CAD/CAM integration) and developing user interfaces for programming and analysis. Distribution channels are varied, encompassing both direct sales models, particularly for large, integrated solutions to major automotive or aerospace OEMs, and indirect distribution through specialized metrology distributors and system integrators who provide localized sales, technical support, and extensive application expertise to smaller manufacturing entities and job shops.

Downstream activities are dominated by post-sale services, including installation, calibration, repair, and essential software updates and training. Given the critical role of measurement probes in quality control, ongoing support and rapid replacement services are highly valued by end-users. Direct sales facilitate a closer relationship between the manufacturer and the end-user, allowing for custom solutions and direct feedback loops, which are critical for iterative product improvement. Conversely, indirect channels leverage local market knowledge and established client relationships to achieve wider market penetration, particularly in fragmented markets or regions requiring specialized import/export logistics and localized technical services, completing the sophisticated delivery and support mechanism for these high-precision instruments.

Measurement Probes Market Potential Customers

Potential customers in the Measurement Probes Market are diverse but predominantly centered in sectors demanding uncompromising dimensional accuracy and high levels of process control. The primary end-users, or buyers of the product, are quality assurance departments, production engineering teams, and dedicated metrology labs within large manufacturing enterprises. Automotive Original Equipment Manufacturers (OEMs) and their Tier 1 suppliers represent a massive consumer base, utilizing probes extensively for engine block inspection, gearbox components, body-in-white alignment, and increasingly for battery pack assembly tolerance verification in electric vehicles. Their demand profile emphasizes high-speed scanning and robust, automated systems capable of 100% inspection within fast-paced production lines.

The Aerospace and Defense sector constitutes another critical customer segment, characterized by extremely low-volume, high-mix production where precision is non-negotiable due to safety and performance criticalities. These entities require ultra-high-accuracy scanning and specialized five-axis probes for inspecting complex geometries such as turbine blades, structural components, and landing gear parts. Demand in this sector often leans toward custom-engineered, multi-sensor systems that can verify internal features and surface finishes simultaneously, often requiring detailed compliance documentation and long-term calibration traceability, making them premium segment buyers.

Beyond these major segments, the Medical Device manufacturing industry is rapidly growing, demanding micro-probes and advanced non-contact solutions for inspecting highly complex, miniature components like stents, orthopedic implants, and surgical instruments where tolerances are measured in micrometers. General precision machine shops and contract manufacturers also form a substantial customer base, requiring versatile, easy-to-use probes for on-machine inspection and general dimensional checks. These customers prioritize reliability, ease of integration with existing CNC machinery, and competitive pricing, often preferring standardized, robust touch-trigger probes for immediate application.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Renishaw, Hexagon AB, ZEISS, Mahr GmbH, Mitutoyo Corporation, Kistler Group, Blum-Novotest GmbH, Marposs SpA, Starrett, Trescal, Dr. Johannes Heidenhain GmbH, FARO Technologies, GOM (ZEISS Group), TESA (Hexagon AB), Keyence Corporation, QVI, API, Perceptron (Atlas Copco), Automated Precision Inc., AMETEK, Nikon Metrology, PolyWorks, Wenzel Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Measurement Probes Market Key Technology Landscape

The technology landscape of the Measurement Probes Market is characterized by continuous advancements aimed at improving speed, accuracy, and versatility in diverse manufacturing environments. A significant technological focus is placed on developing sophisticated, high-resolution sensor elements, especially in non-contact systems where improvements in laser optics, camera resolution, and structured light algorithms are enabling quicker capture of high-density point clouds with micrometric accuracy. In the realm of contact probing, the shift is toward advanced strain gauge and piezoelectric technologies that offer greater sensitivity and durability, facilitating continuous high-speed scanning (analog probing) rather than discrete point-to-point measurement, which is crucial for complex freeform surfaces.

Wireless communication and miniaturization represent another critical technological frontier. Modern measurement probes increasingly utilize advanced wireless protocols such as optimized radio frequency (RF) and Bluetooth Low Energy (BLE) transmissions to ensure reliable data transfer, free from the constraints of physical cables, which enhances flexibility and ease of integration onto multi-axis CMMs and machine tools. Miniaturization allows for probes to access previously inaccessible features, essential for inspecting complex internal cavities and densely populated electronic components. Furthermore, the development of intelligent probe changers and tool identification systems, often based on RFID technology, is enabling fully autonomous measurement sequences without human intervention, maximizing machine utilization and throughput.

Crucially, the concept of multi-sensor measurement is dominating the technology roadmap. Leading vendors are developing integrated probe heads that seamlessly combine tactile probing, high-speed laser scanning, and non-contact vision systems within a single setup. This sensor fusion capability allows users to select the optimal measurement methodology based on the specific feature being inspected—using contact for certified features and optical for rapid surface verification—thereby optimizing overall inspection time and maximizing data completeness. This technological convergence is paving the way for universal metrology platforms capable of handling heterogeneous measurement tasks without compromising precision, underpinning the future growth of specialized industrial automation.

Regional Highlights

The global distribution of the Measurement Probes Market shows distinct demand characteristics and growth trajectories across major geographical regions, influenced heavily by localized industrial development and technological adoption rates. Asia Pacific (APAC) holds the largest market share and exhibits the highest growth potential, primarily driven by China's aggressive investment in advanced manufacturing, the robust automotive sectors in South Korea and Japan, and the rapid expansion of electronics and precision engineering in Southeast Asia. Manufacturers in APAC are highly focused on mass production efficiency, leading to significant uptake of high-speed non-contact probes and automated in-line inspection systems to manage vast production volumes and maintain quality competitiveness on a global scale.

North America remains a highly specialized market, dominated by the stringent requirements of the Aerospace and Defense industries, coupled with strong growth in medical device manufacturing and advanced machinery production. This region demands high-accuracy, customized, and certified probing solutions, driving innovation in software integration, data traceability, and multi-sensor technologies. The regional market growth is steady, fueled by technological upgrades and the replacement cycle of existing CMM infrastructure with newer, more capable measurement platforms that support higher degrees of automation and compliance with demanding quality standards.

Europe represents a mature yet continually evolving market, anchored by Germany's precision engineering sector and the automotive industry across the continent. European manufacturers demonstrate a strong preference for integrated quality solutions, combining probes with advanced metrology software and statistical process control (SPC) tools. Regulatory pressures, particularly around environmental and safety standards, compel European companies to invest in highly repeatable and reliable probing systems to maintain quality throughout complex supply chains. Emerging markets in Latin America and the Middle East and Africa (MEA) are characterized by initial infrastructure investment and localized manufacturing build-up, creating demand primarily for standard, robust touch-trigger probes for general quality assurance applications, indicating future growth potential as industrialization deepens.

- Asia Pacific (APAC): Dominates in volume and growth due to massive automotive and electronics manufacturing bases; high demand for automated, high-speed inspection systems.

- North America: Focused on high-precision applications in Aerospace & Defense and Medical Devices; drives demand for custom, certified, and software-integrated probe solutions.

- Europe: Characterized by mature industrial sectors (Automotive, Machinery); strong emphasis on integrated quality control, high repeatability, and compliance with stringent technical standards.

- Latin America (LATAM) & Middle East and Africa (MEA): Emerging markets showing increasing adoption tied to infrastructure projects and localized industrialization; initial demand centered on foundational, reliable metrology equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Measurement Probes Market.- Renishaw

- Hexagon AB

- ZEISS

- Mahr GmbH

- Mitutoyo Corporation

- Kistler Group

- Blum-Novotest GmbH

- Marposs SpA

- Starrett

- Trescal

- Dr. Johannes Heidenhain GmbH

- FARO Technologies

- GOM (ZEISS Group)

- TESA (Hexagon AB)

- Keyence Corporation

- QVI

- API

- Perceptron (Atlas Copco)

- Automated Precision Inc.

- AMETEK

- Nikon Metrology

- PolyWorks

- Wenzel Group

- Zygo Corporation

- Carl Zeiss Industrial Metrology, LLC

Frequently Asked Questions

Analyze common user questions about the Measurement Probes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between contact and non-contact measurement probes?

Contact probes, such as touch-trigger and scanning probes, physically touch the object to register dimensional data, offering high mechanical accuracy and reliability for certified features. Non-contact probes, utilizing technologies like lasers or optics, measure surfaces remotely without physical interaction, offering faster inspection speed and the ability to measure delicate or flexible materials without deformation.

How is Industry 4.0 influencing the demand for measurement probes?

Industry 4.0 drives demand for automated, in-line metrology solutions, requiring probes capable of high-speed data capture and wireless communication. This shift emphasizes the integration of probing systems directly onto machine tools and robotic cells, enabling closed-loop feedback and real-time process control for predictive quality assurance.

Which end-user industry holds the largest market share for measurement probes?

The Automotive and the Aerospace and Defense industries collectively hold the largest market share, driven by their critical need for high-volume, high-precision component inspection, strict quality standards, and the adoption of advanced scanning technologies for complex part geometries.

What are the key technological advancements expected in the Measurement Probes Market?

Key advancements include sensor fusion, where multiple sensing technologies (contact, laser, optical) are combined into single heads; enhanced wireless communication for greater operational flexibility; advanced AI integration for automated path planning and error compensation; and continued miniaturization for inspecting micro-components.

What challenges do manufacturers face when implementing high-precision measurement probes?

Challenges include the high initial capital investment required for sophisticated equipment, the necessity for highly skilled personnel for complex programming and calibration, and maintaining measurement stability and accuracy in harsh, fluctuating shop-floor environments due to thermal effects and contamination.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager