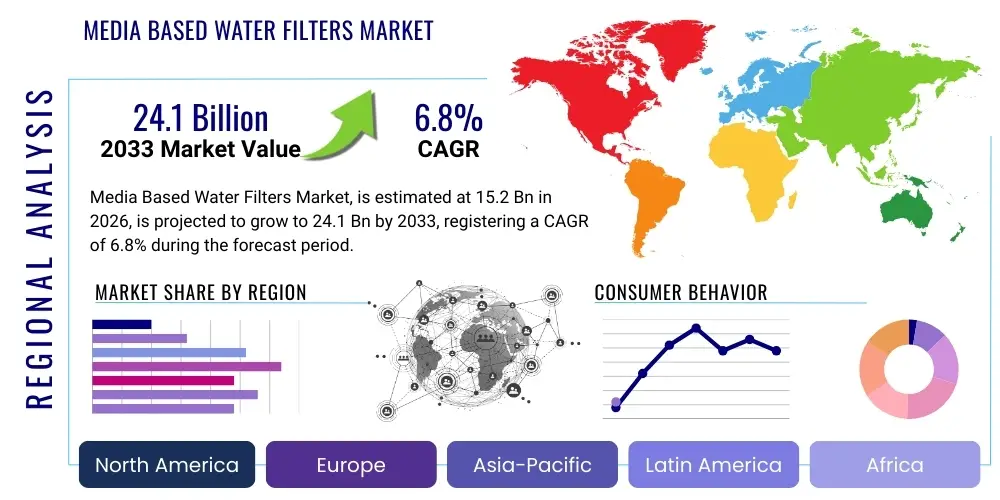

Media Based Water Filters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441858 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Media Based Water Filters Market Size

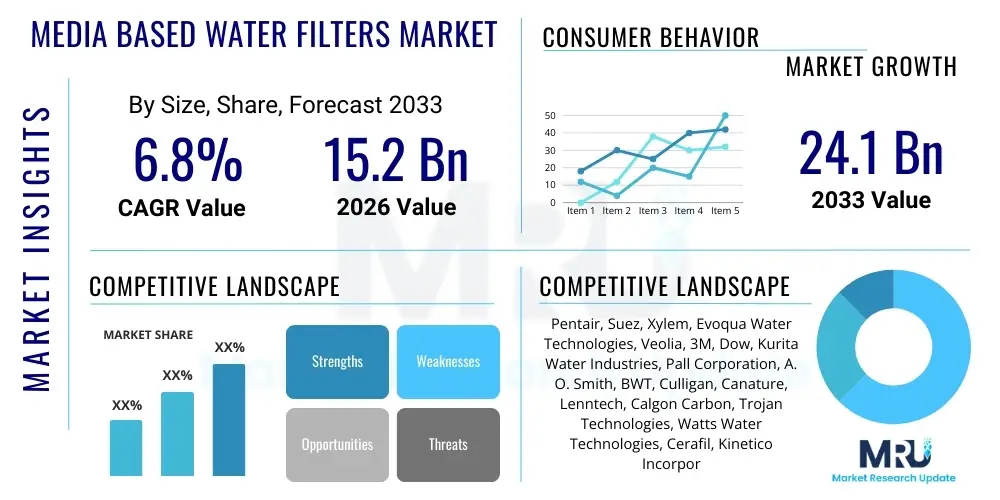

The Media Based Water Filters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 24.1 Billion by the end of the forecast period in 2033.

Media Based Water Filters Market introduction

Media based water filters represent a fundamental technology within the global water treatment sector, relying on physical, chemical, and biological mechanisms to remove contaminants, particulates, and undesirable elements from raw water sources. These systems utilize various granular materials—such as sand, activated carbon, anthracite, specialized resins, and ceramic materials—to achieve purification goals. The effectiveness of the filtration process is directly linked to the media characteristics, including particle size distribution, surface area, porosity, and specific adsorptive properties, making media selection crucial for specific water quality challenges, ranging from basic turbidity reduction to the removal of complex organic compounds and heavy metals.

The primary applications of media based water filters span municipal water treatment plants, where they serve as essential steps in pre-filtration and tertiary treatment processes, and diverse industrial sectors, including food and beverage, pharmaceuticals, power generation, and chemical processing. In the residential sector, point-of-entry (POE) and point-of-use (POU) media filters, particularly those utilizing activated carbon, are vital for improving taste, odor, and reducing chlorine levels and other localized contaminants. The widespread adoption is driven by the robust nature, relatively low operational complexity compared to membrane filtration, and cost-effectiveness of these systems, particularly for handling high flow rates and highly turbid water sources.

Key benefits driving market proliferation include superior performance in removing suspended solids and colloidal matter, adaptability to different source water qualities, and long media lifespan before replacement or backwashing is required. Moreover, increasing global concerns regarding waterborne diseases, coupled with stringent regulatory standards imposed by governmental bodies concerning discharge quality and potable water safety, necessitate the deployment of reliable and efficient filtration technologies, cementing the media based segment as a cornerstone of modern water infrastructure. The development of advanced media, such as catalytic carbons and ion-exchange resins, further expands the market scope by enabling targeted removal of emerging contaminants like pharmaceuticals and PFAS.

Media Based Water Filters Market Executive Summary

The Media Based Water Filters Market is characterized by steady technological evolution and robust demand, primarily fueled by global water scarcity issues, deteriorating raw water quality, and heightened regulatory enforcement across developed and developing economies. Business trends indicate a strong move toward sustainable and regenerative filtration solutions, focusing on minimizing backwash water waste and extending media life through innovative composite materials. Integration of smart monitoring systems (IoT sensors) is becoming a competitive necessity, allowing operators to optimize filter cycles, predict maintenance needs, and ensure compliance with real-time performance data, transitioning the market from traditional passive filtration to proactive, optimized water management.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, driven by massive investments in municipal water infrastructure spurred by rapid urbanization and industrial expansion, particularly in China, India, and Southeast Asian nations. North America and Europe maintain stable markets, characterized by replacement demand, strict environmental regulations governing wastewater discharge, and a high uptake of advanced media specialized for micropollutant removal. Trends in these mature markets favor high-efficiency systems and modular plug-and-play units designed for localized or decentralized water treatment applications, contrasting with the large-scale centralized systems prevalent in fast-developing regions.

Segment trends reveal that Activated Carbon remains the dominant media type due to its versatility in adsorption, while the Municipal and Industrial sectors collectively command the largest application share, reflecting the sheer volume of water processed by utilities and manufacturing facilities. Within the industrial segment, the electronics and power generation industries are rapidly increasing their demand for highly purified water, often requiring multi-media configurations combining sand, anthracite, and specialized resins for polishing stages. Furthermore, the residential market segment, though smaller in volume, exhibits high value growth, driven by consumer willingness to invest in certified filtration systems offering perceived health and wellness benefits.

AI Impact Analysis on Media Based Water Filters Market

Common user questions regarding AI's influence often center on its ability to enhance operational efficiency, reduce downtime, and improve water quality prediction in complex media filtration systems. Users frequently inquire whether AI can accurately determine the optimal backwash frequency, thereby saving significant amounts of water and energy, or if it can predict media exhaustion rates before performance degradation occurs. Key concerns revolve around the cost of integrating AI-driven sensor technology and the technical expertise required to interpret and act upon predictive models. The overarching expectation is that AI integration will fundamentally shift media filtration management from routine schedules to dynamic, performance-based operations, leading to demonstrable reductions in total cost of ownership and superior effluent consistency.

AI algorithms, leveraging machine learning (ML) models trained on historical operational data—including flow rates, inlet turbidity, pressure differentials, temperature, and effluent quality metrics—are transforming the management of media filters. These systems move beyond simple fixed-schedule or delta-P initiation of backwashing. Instead, they utilize predictive analytics to calculate the exact moment when the benefits of continued filtration are outweighed by the costs of pressure drop or the risk of breakthrough, ensuring maximum utilization of the filter bed capacity while guaranteeing water quality standards are met. This capability is critical for complex industrial water reuse systems where water quality fluctuations are common.

Furthermore, AI plays a pivotal role in optimizing the design and material science of future filter media. Generative algorithms can simulate countless combinations of granular materials, pore structures, and chemical surface modifications to predict performance against specific contaminants (e.g., arsenic, lead, microplastics) without extensive and costly physical experimentation. This acceleration of research and development facilitates the creation of highly specialized, tailor-made media that addresses emerging environmental challenges more effectively, thereby securing the long-term viability and competitiveness of media based filtration against alternative technologies like advanced membrane systems.

- AI optimizes backwash cycles based on real-time contamination load, reducing water usage and energy consumption.

- Machine learning models predict media exhaustion and failure points, ensuring proactive replacement and preventing compliance breaches.

- AI-driven sensors enable real-time performance monitoring and automated adjustment of coagulation and flocculation processes upstream of the filters.

- Advanced analytics facilitate the rapid identification of process anomalies and root cause analysis in large-scale municipal filtration plants.

- Generative AI accelerates the R&D cycle for novel composite media materials with enhanced adsorption kinetics and mechanical stability.

DRO & Impact Forces Of Media Based Water Filters Market

The Media Based Water Filters Market is shaped by a powerful interplay of drivers, restraints, and opportunities that determine investment cycles and technological adoption rates. A key driver is the globally increasing stringency of water quality regulations (e.g., updated EU directives, US EPA standards), compelling both municipal authorities and industrial operators to adopt robust filtration technologies to comply with increasingly lower permissible limits for various contaminants. This regulatory push is compounded by rapid global population growth and urbanization, particularly in Asia and Africa, which strain existing water infrastructure and necessitate the construction of new, large-capacity treatment facilities where media filters are the standard primary stage.

Restraints primarily revolve around the operational challenges inherent to media filtration. These include the significant energy and water required for the backwash process, which can represent a substantial operational expenditure, especially in water-scarce regions. Furthermore, the risk of media fouling, channeling, and biological growth necessitates frequent maintenance and media replacement, adding to the lifecycle cost and downtime. Competition from alternative advanced treatment methods, particularly ultrafiltration and nanofiltration membranes, poses a constraint, as membranes offer superior removal efficiency for microbial contaminants and smaller particulates, sometimes making them preferable in high-purity applications, though often at a higher capital cost.

Opportunities for growth are concentrated in the advancement of sustainable technologies and geographic expansion. The development of specialized, sustainable filtration media, such as bio-filtration systems and regenerative media that minimize waste, presents a strong commercial opportunity aligned with global sustainability mandates. Furthermore, the decentralized water treatment movement, serving remote communities and temporary industrial sites, presents a lucrative niche for compact, modular media filter systems. The impact forces acting on the market underscore that while regulatory demands provide necessary market impetus (Driver), capital intensity and operational complexity (Restraint) must be mitigated through technological innovation (Opportunity) to realize consistent long-term growth.

- Drivers:

- Increasing global water quality standards and regulatory mandates regarding effluent discharge.

- Rapid industrialization and urbanization, increasing demand for treated process water and wastewater recycling.

- Growing awareness of waterborne diseases and consumer demand for high-quality potable water filtration.

- Cost-effectiveness and robustness compared to high-end membrane technologies for pre-treatment applications.

- Restraints:

- High operational expenditures associated with frequent backwashing and the resulting water waste.

- Challenges related to filter media fouling, requiring regular maintenance and eventual replacement.

- Competition from advanced non-media technologies, such as microfiltration and ultrafiltration membranes, in specialized applications.

- Opportunities:

- Development and commercialization of smart, regenerative, and bio-filtration media materials.

- Expansion into emerging economies requiring basic, robust, and scalable water treatment solutions.

- Integration of IoT and AI for performance monitoring, predictive maintenance, and operational optimization.

- Impact Forces: The high regulatory impact (Force 5/5) necessitates continuous technological adaptation (Opportunity), while the cost sensitivity in municipal and industrial projects (Restraint) moderates overall market expansion speed.

Segmentation Analysis

The segmentation of the Media Based Water Filters Market provides critical insights into the structure of demand, technological preferences, and dominant end-user requirements. The market is primarily dissected based on the type of media utilized (e.g., granular activated carbon, sand, ceramic), the specific application within the water treatment process (pre-filtration, primary treatment, tertiary polishing), and the end-user vertical (municipal, industrial, residential). Understanding these segments allows manufacturers and suppliers to tailor product offerings—from large-scale rapid gravity filters used in municipal plants to compact carbon block filters utilized in household pitchers—to meet precise regulatory and performance criteria.

Segmentation by Media Type is crucial, as different materials target distinct contaminants. For instance, sand and multi-media filters excel at suspended solids removal and turbidity reduction, forming the backbone of physical separation. In contrast, activated carbon, owing to its massive surface area, dominates the removal of organic compounds, taste, odor, and chlorine, thereby serving a different functional necessity. The growth trajectory of specialized media, such as ion-exchange resins for softening and demineralization, and specialized mineral beds for heavy metal sequestration, often outpaces that of traditional bulk media, driven by increasing complexity in water source contamination profiles globally.

Segmentation by End-User illuminates where capital investment is concentrated. The municipal sector represents high volume demand for basic, reliable media due to the need to process vast quantities of water economically. The industrial sector, however, demonstrates higher value per unit, often requiring highly customized media combinations to meet exacting process specifications (e.g., semiconductor manufacturing requiring extremely low parts per billion contamination levels). The residential market, while fragmented, is heavily influenced by consumer trends and marketing related to health benefits, driving innovation in compact, aesthetically pleasing, and easy-to-replace filter cartridges, often using activated carbon or ceramic media for POU applications.

- By Media Type:

- Sand and Multi-Media Filters

- Activated Carbon (Granular and Block)

- Anthracite

- Ceramic Filters

- Specialty Media (Ion Exchange Resins, Manganese Dioxide, Zeolites)

- By Application:

- Pre-Filtration

- Primary Filtration

- Tertiary Treatment

- Polishing/Final Filtration

- By End-User:

- Municipal Water Treatment

- Industrial (Food & Beverage, Oil & Gas, Power Generation, Chemical & Petrochemical, Electronics & Semiconductor)

- Residential (Point-of-Entry and Point-of-Use)

- Commercial (Hotels, Hospitals, Educational Institutions)

Value Chain Analysis For Media Based Water Filters Market

The value chain for media based water filters begins with the Upstream Analysis, focusing on the sourcing and processing of raw materials. This stage involves the mining and purification of silica sand, anthracite coal, and natural zeolites, as well as the specialized production of high-grade activated carbon derived from coconut shells, wood, or coal through thermal activation processes. The cost and quality of these raw inputs significantly dictate the final price and performance of the filter media. Manufacturers rely on reliable, certified suppliers, often facing regulatory scrutiny regarding the environmental practices associated with mining and activation processes, adding complexity to the upstream procurement stage.

The Midstream phase involves the manufacturing and formulation of the filter cartridges or filter beds. This includes processes like media sizing, blending (for multi-media filters), chemical treatments (for specialty media), and the assembly of commercial-ready filter units. Key players in this stage invest heavily in quality control, ensuring particle size uniformity and mechanical strength to prevent media loss or premature failure during backwash cycles. Distribution channels then link the manufacturers to the end-users. Direct channels are typically utilized for large-scale municipal or industrial projects where engineering consultation and customized system integration are mandatory. This involves direct sales teams, specialized engineering firms, and system integrators who install and commission complex filtration trains.

The Downstream analysis focuses on end-user deployment and post-sale services. Indirect channels dominate the residential and commercial markets, utilizing a network of plumbing distributors, hardware retailers, e-commerce platforms, and specialized water treatment dealers who handle installation, consumer support, and replacement cartridge sales. Post-sales service, including performance monitoring, routine maintenance, and media replacement services, represents a critical, high-margin revenue stream. The efficiency and reliability of these service networks are crucial, especially for industrial clients where system downtime results in significant financial losses. The high demand for certified, easily replaceable residential filter cartridges continues to drive innovation in indirect channel marketing and logistics.

Media Based Water Filters Market Potential Customers

Potential customers for media based water filters are diverse, spanning public utilities responsible for large-scale municipal water provision and purification, highly regulated industrial manufacturers requiring precise water quality, and individual consumers seeking improvement in drinking water quality. Municipalities represent the largest volume buyers, utilizing media filters for sedimentation removal in surface water treatment and sometimes for tertiary polishing of wastewater before discharge or reuse. Their purchasing decisions are primarily influenced by regulatory compliance, long-term operational costs, and filter longevity.

The Industrial segment is highly segmented, with specific sectors acting as key buyers. The food and beverage industry requires media filters to ensure consistent taste and purity, often employing activated carbon to remove chlorine and organic precursors. The electronics and semiconductor industries demand ultrapure water, utilizing specialty media (like ion exchange resins) as a critical precursor to reverse osmosis systems. The power generation sector (especially thermal power plants) relies on filtration to manage boiler feed water quality and prevent scaling and corrosion. These buyers prioritize reliability, chemical compatibility, and the ability to handle high flow rates with minimal disruption.

Residential and commercial buyers constitute the fastest-growing customer base in terms of revenue growth, driven by decentralized solutions. Residential customers primarily seek Point-of-Use (POU) solutions (e.g., refrigerator filters, pitcher filters, under-sink units) focused on aesthetic improvements and health protection, favoring convenience and certification (e.g., NSF standards). Commercial customers (hotels, hospitals, corporate campuses) require robust systems capable of moderate to high flow rates, often combining media filtration with UV disinfection to protect guests and comply with localized health codes, representing a middle ground between small residential systems and large municipal infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 24.1 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pentair, Suez, Xylem, Evoqua Water Technologies, Veolia, 3M, Dow, Kurita Water Industries, Pall Corporation, A. O. Smith, BWT, Culligan, Canature, Lenntech, Calgon Carbon, Trojan Technologies, Watts Water Technologies, Cerafil, Kinetico Incorporated, VeloDyne |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Media Based Water Filters Market Key Technology Landscape

The current technology landscape in media based water filtration is rapidly evolving beyond basic sand filtration toward highly engineered, specialized media and integrated smart systems. A significant technological advancement is the focus on composite and advanced functionalized media, such as Granular Activated Carbon (GAC) modified with catalytic properties to enhance the removal of hard-to-treat contaminants like chloramines and hydrogen sulfide. Furthermore, the development of specialized ion-exchange resins tailored for selective removal of nitrates, arsenic, or PFAS (Per- and polyfluoroalkyl substances) represents a high-growth technological niche addressing emerging environmental concerns and regulatory gaps globally.

Modular and integrated filtration systems represent another crucial technological trend. These systems are designed for rapid deployment, scalability, and ease of maintenance, making them ideal for decentralized municipal applications or mobile industrial setups. These modern units often combine multiple media types (e.g., sand, anthracite, and garnet) within a single vessel to achieve multi-stage filtration effectiveness, optimizing particle stratification and minimizing bed fluidization during operation. This integration focuses on reducing the physical footprint and simplifying the piping and control systems compared to older, large-scale open filter bed designs.

Crucially, the convergence of filtration hardware with digital technologies, primarily the Internet of Things (IoT), is redefining operational efficiency. Modern media filters are increasingly equipped with integrated sensors monitoring key parameters such as pressure drop, temperature, flow, and turbidity in real-time. This IoT infrastructure provides the data backbone necessary for Artificial Intelligence and predictive maintenance software. These technological shifts are aimed squarely at mitigating the traditional restraints of media filtration—namely, excessive backwash consumption and unpredictable media lifespan—by turning historical maintenance schedules into dynamically optimized, data-driven operational protocols.

Regional Highlights

The global distribution of the Media Based Water Filters Market reflects varying levels of infrastructure maturity, regulatory rigor, and local water challenges. North America and Europe possess mature markets characterized by established infrastructure, high replacement demand, and strict environmental compliance, focusing primarily on technological upgrades and specialized filtration media for micropollutant removal and reuse applications.

North America (NA): This region is defined by highly centralized water management but is seeing rapid adoption of decentralized systems in industrial and commercial sectors. The primary drivers are the stringent regulations imposed by the EPA, particularly regarding the removal of disinfection byproducts (DBPs) and heavy metals. Activated carbon media systems are heavily utilized due to their efficacy in controlling these contaminants. The market exhibits high investment in automation and AI-driven monitoring to ensure continuous compliance and optimize operational costs in aging municipal treatment facilities. The focus is shifting toward specialized resins capable of targeted contaminant removal, particularly for communities dealing with localized groundwater contamination issues.

Europe: The European market is heavily influenced by the European Union’s Water Framework Directive and increasingly stringent standards for wastewater reuse and potable water quality. Sustainability and resource efficiency are paramount, driving demand for highly efficient, low-waste filtration processes, including bio-filtration systems that utilize media to support beneficial microbial growth for contaminant degradation. Germany, France, and the UK are key markets, characterized by advanced technological adoption and a strong preference for certified, long-lifecycle products. The emphasis on circular economy principles accelerates the research into and adoption of regenerative filter media solutions.

Asia Pacific (APAC): APAC is the fastest-growing region, contributing the largest share to new infrastructure installation. Rapid population growth, accelerating industrialization (especially textiles, manufacturing, and electronics), and pervasive water scarcity across major economies like China, India, and Indonesia are driving unprecedented demand. The market here is characterized by high volume purchases of conventional media (sand, multi-media filters) for large municipal and industrial projects, aimed at basic turbidity and solids removal. While price sensitivity remains a factor, the massive government spending on water infrastructure upgrades, coupled with foreign investment in advanced manufacturing, is simultaneously boosting demand for high-purity specialty media in high-tech industrial parks.

Latin America (LA): This region faces significant challenges related to access to clean water, aging infrastructure, and high levels of raw water turbidity. The media filter market here is expanding rapidly, primarily driven by international aid projects and necessity for basic filtration to improve public health outcomes. Demand is strong for robust, low-maintenance systems that can handle fluctuating input quality, making traditional, reliable multi-media filters highly sought after. Brazil and Mexico lead the region in terms of market size, with investments gradually increasing in wastewater treatment capacity rather than just potable water provision.

Middle East and Africa (MEA): Water scarcity is the defining challenge in MEA, leading to high dependence on non-conventional water sources, including desalination and municipal wastewater reuse. Media filters are indispensable in this region, serving critical roles in pre-treatment stages to protect energy-intensive reverse osmosis plants and in tertiary stages for water reuse in agriculture. Saudi Arabia, UAE, and South Africa are major consumers, focusing on robust solutions capable of handling saline and highly mineralized feed water. The market growth is inherently tied to government infrastructure spending on massive water security projects and industrial expansion in hydrocarbon processing and mining.

- North America: Focus on regulatory compliance, DBP removal, and AI integration for existing infrastructure optimization.

- Europe: High demand for sustainable, low-waste solutions and advanced media for micropollutant and pharmaceutical removal.

- Asia Pacific: Fastest growth market, dominated by new construction for municipal water treatment and heavy industrial process water.

- Latin America: High demand for robust, basic multi-media filters to cope with challenging source water quality and infrastructure deficits.

- Middle East and Africa: Critical need for media filters for pre-treatment in desalination and high-level polishing in water reuse schemes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Media Based Water Filters Market.- Pentair

- Suez

- Xylem

- Evoqua Water Technologies

- Veolia

- 3M

- Dow

- Kurita Water Industries

- Pall Corporation

- A. O. Smith

- BWT

- Culligan

- Canature

- Lenntech

- Calgon Carbon

- Trojan Technologies

- Watts Water Technologies

- Cerafil

- Kinetico Incorporated

- VeloDyne

Frequently Asked Questions

Analyze common user questions about the Media Based Water Filters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of media filters compared to membrane filtration?

Media filters offer superior handling of high-turbidity water, significantly lower capital costs for high-flow applications, and lower fouling rates compared to sensitive membrane systems. They are robust, easier to maintain, and excel in pre-treatment roles to protect downstream processes.

How often should filter media be replaced or regenerated in municipal applications?

The replacement frequency depends heavily on the media type, feed water quality, and application. Standard sand or anthracite media can last many years with proper backwashing. Activated carbon, however, requires replacement (or regeneration) when its adsorptive capacity for organic compounds is exhausted, typically every 1 to 5 years.

Which segment of the Media Based Water Filters Market is experiencing the fastest technological innovation?

Technological innovation is most pronounced in the Specialty Media segment, focusing on chemically functionalized resins and catalytic carbons designed for the highly selective removal of emerging contaminants such as PFAS, nitrates, and pharmaceutical residues, driven by strict regulatory pushes in developed markets.

What is the role of Activated Carbon in water treatment, and why is it the dominant media type?

Activated Carbon (AC) is dominant due to its exceptional ability to remove organic contaminants, chlorine, and taste/odor compounds through adsorption, resulting from its high porosity and large internal surface area. It is essential in both municipal and residential applications for aesthetic improvement and regulatory compliance regarding disinfection byproducts.

How is smart technology (IoT and AI) changing the operational costs of media filtration?

IoT and AI reduce operational costs by moving away from fixed maintenance schedules to performance-based, predictive protocols. This optimization minimizes unnecessary backwash cycles, saving water and energy, maximizes media lifespan, and reduces filter downtime, leading to substantial savings in labor and operational expenditures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Media Based Water Filters Market Statistics 2025 Analysis By Application (Drinking Water, Irrigation, Aquariums), By Type (RO Based, Activated Carbon Based), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Media Based Water Filters Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (SingleMedia Filters, DualMedia Filters, MultiMedia Filters), By Application (Commercial Use, Home Use), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager