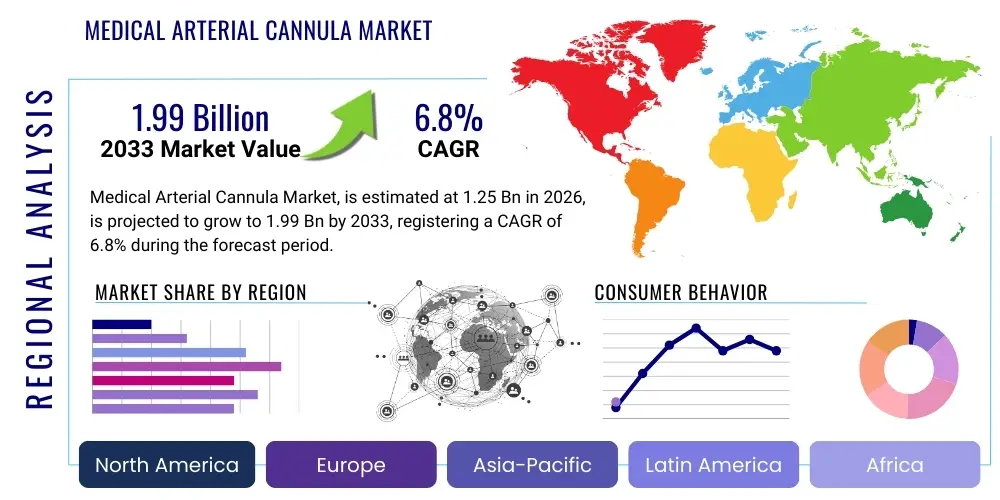

Medical Arterial Cannula Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442669 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Medical Arterial Cannula Market Size

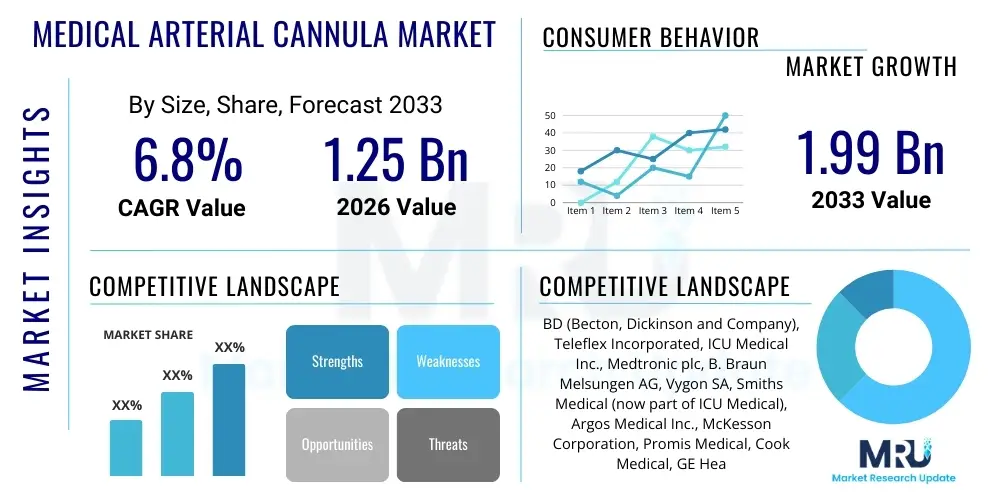

The Medical Arterial Cannula Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.99 Billion by the end of the forecast period in 2033.

Medical Arterial Cannula Market introduction

The Medical Arterial Cannula Market encompasses devices essential for accessing the arterial system, primarily used in critical care, surgery, and diagnostics. These cannulae facilitate continuous monitoring of arterial blood pressure, repeated blood sampling, and sometimes, the administration of medications or fluids directly into the arterial circulation. The increasing prevalence of cardiovascular diseases (CVDs), coupled with a rising number of complex surgical procedures requiring precise hemodynamic monitoring, forms the foundational demand driver for these devices globally. Arterial cannulation is a standard procedure in intensive care units (ICUs) and operating rooms (ORs), serving as a crucial tool for managing critically ill patients where rapid and accurate assessment of physiological status is paramount.

The product portfolio within this market includes devices differentiated by material composition, gauge size, length, and specialized features, such as integrated safety mechanisms to reduce needlestick injuries and enhance infection control. Major applications span cardiac surgery, neurosurgery, trauma care, and neonatal intensive care. The growing sophistication of minimally invasive surgical techniques also necessitates highly precise and reliable arterial access tools. Furthermore, the benefit derived from these cannulae—continuous, real-time physiological data—significantly contributes to improved patient outcomes by enabling faster clinical interventions and titration of vasoactive drugs. As healthcare infrastructure improves in developing economies, the adoption rate of advanced monitoring tools, including arterial cannulae, is accelerating.

Key driving factors fueling market expansion include the increasing geriatric population, which is inherently more susceptible to chronic conditions requiring critical monitoring; technological advancements leading to safer and easier insertion techniques (e.g., ultrasound-guided insertion); and stringent regulatory focus on patient safety, promoting the use of high-quality, disposable devices. The essential nature of continuous arterial pressure monitoring in high-acuity settings firmly establishes arterial cannulae as indispensable medical consumables, ensuring sustained growth across major clinical segments.

Medical Arterial Cannula Market Executive Summary

The Medical Arterial Cannula Market is characterized by steady technological evolution aimed at improving patient safety, reducing insertion complexity, and minimizing infection risks. Current business trends indicate a strong shift towards safety-engineered cannulae, often incorporating passive safety features and anti-microbial coatings. Furthermore, market competition is intensifying, leading key manufacturers to focus on vertical integration and strategic mergers and acquisitions to consolidate market share and expand their global distribution networks. The profitability of the market is closely linked to hospital purchasing cycles and regulatory clearances, driving significant investment into research and development (R&D) for enhanced material science, particularly focusing on biocompatibility and longevity of placement.

Regionally, North America and Europe currently dominate the market due to well-established healthcare infrastructure, high critical care expenditure, and rapid adoption of advanced monitoring technologies. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, driven by escalating healthcare expenditure, burgeoning medical tourism, and a rapid increase in the incidence of lifestyle-related chronic diseases requiring intensive monitoring. Governments in countries like China and India are also investing heavily in upgrading public hospital facilities, creating substantial new opportunities for market penetration. Latin America and the Middle East and Africa (MEA) present emerging market potential, although adoption remains contingent on overcoming economic barriers and establishing robust critical care training programs.

In terms of segmentation, the critical care segment, encompassing ICUs and emergency departments, remains the largest application area due to the pervasive need for real-time hemodynamic assessment. Based on material, polyurethane and fluorinated ethylene propylene (FEP) dominated the market, favored for their flexibility and reduced risk of trauma during insertion and prolonged indwelling time. The shift toward smaller gauge cannulae is also notable, particularly in pediatric and neonatal care, reflecting specialization in product offerings tailored to specific patient demographics, thus influencing product development and inventory management strategies for hospitals.

AI Impact Analysis on Medical Arterial Cannula Market

User queries regarding AI's influence on the Medical Arterial Cannula Market primarily center on how artificial intelligence can optimize the practical use and safety of these devices, rather than replacing the cannula itself. Key themes revolve around AI-driven hemodynamic monitoring platforms, automated decision support systems leveraging arterial pressure data, and the potential for AI algorithms to guide insertion procedures, thereby improving first-pass success rates and reducing complications. Users express interest in whether AI can predict complications related to arterial line placement, such as thrombosis or infection, far earlier than traditional monitoring methods. The underlying expectation is that AI integration will enhance the diagnostic value derived from the continuous data collected by arterial cannulae, transforming raw physiological signals into actionable clinical intelligence.

While the physical hardware of the cannula remains largely unaffected by AI, the surrounding ecosystem—data processing, risk prediction, and procedural guidance—is poised for significant transformation. AI algorithms are increasingly being applied to analyze complex waveforms generated via arterial cannulation, detecting subtle changes that might signify impending clinical deterioration, such as septic shock or hemorrhage. This shift transforms the arterial cannula from a simple data collection tool into an integral component of an advanced, predictive monitoring system. Furthermore, AI-powered image recognition tools, when paired with ultrasound, can provide real-time guidance during insertion, addressing the major clinical challenge of successful cannulation in difficult patient populations.

Consequently, future market competitiveness will not only depend on the quality of the cannula itself but also on the robustness of the data integration capabilities and the accompanying AI-driven analytical platforms provided by device manufacturers. Hospitals are seeking integrated solutions that enhance workflow efficiency and patient safety, prioritizing manufacturers who can seamlessly connect their cannulae to advanced monitoring networks. This paradigm shift mandates that companies in the Medical Arterial Cannula Market focus heavily on interoperability and developing application programming interfaces (APIs) to allow for smooth data exchange with hospital electronic health record (EHR) systems and third-party AI analytical engines.

- AI integration optimizes real-time hemodynamic data interpretation.

- Predictive analytics improve early detection of arterial line complications (e.g., thrombosis, infection).

- Computer vision and machine learning enhance ultrasound-guided insertion success rates.

- AI transforms cannulae data into actionable clinical insights for quicker intervention.

- Adoption of smart monitoring systems increases demand for cannulae with enhanced connectivity features.

DRO & Impact Forces Of Medical Arterial Cannula Market

The Medical Arterial Cannula Market is propelled by critical care demands and technical innovations, while constrained by procedural risks and cost pressures. Key drivers include the global escalation in chronic diseases, necessitating intensive care management, and continuous advancements in materials science yielding safer, more biocompatible devices. Opportunities lie primarily in expanding into emerging markets where critical care infrastructure is rapidly developing, and in integrating smart features that allow for wireless data transmission and AI-enhanced monitoring. Restraints include the persistent risk of complications such as infection, hemorrhage, and nerve damage associated with arterial line placement, alongside the high cost of advanced, disposable cannulae systems which can challenge budget constraints in resource-limited settings. These internal and external pressures collectively dictate market dynamics, influencing R&D priorities and adoption rates across various healthcare settings.

The primary impact force driving market expansion is the inescapable need for accurate, continuous physiological monitoring in high-acuity environments. For patients undergoing major surgery (especially cardiovascular and neurological procedures) or those in septic shock, intermittent blood pressure readings are insufficient; thus, the arterial cannula remains the gold standard for continuous invasive monitoring. This clinical necessity ensures stable, underlying demand. Conversely, the impact force acting as a restraint involves the increasing global emphasis on value-based healthcare. Payers and providers are scrutinizing the total cost of care, pressuring manufacturers to produce high-quality devices that demonstrably reduce complication rates and hospital stays, thereby balancing the high cost of the consumable against improved patient outcomes.

The dynamic interplay of these forces creates a highly competitive environment where product differentiation is key. Companies that invest in safety features, such as advanced coatings to prevent catheter-related bloodstream infections (CRBSIs) or innovative designs that minimize vessel trauma, are best positioned for long-term success. Furthermore, the regulatory environment acts as a significant external force; strict mandates regarding medical device safety, traceability, and sterility push the market towards single-use, high-specification products, potentially limiting low-cost alternatives but simultaneously ensuring high quality standards in mature markets.

Segmentation Analysis

The Medical Arterial Cannula Market is comprehensively segmented based on product type, material, application, end-user, and gauge size, reflecting the diverse clinical needs and technological differentiation within the critical care space. This detailed segmentation allows manufacturers to tailor their marketing strategies and R&D efforts towards specific, high-growth clinical niches, such as neonatal intensive care or specialized cardiovascular monitoring. The primary segmentation criteria highlight the critical balance between device flexibility, biocompatibility, and ease of insertion across different patient populations, from fragile newborns requiring fine-gauge devices to adults needing standard-sized monitoring lines during complex procedures. Understanding these segments is vital for stakeholders assessing market entry points and competitive advantages.

By product type, the market is broadly classified into single-lumen and multi-lumen cannulae, with single-lumen dominating due to its simplicity and primary function of continuous pressure monitoring. However, multi-lumen variants are gaining traction in scenarios requiring simultaneous fluid administration or blood gas analysis through secondary ports. Material segmentation is crucial, with polyurethane and FEP offering specific performance characteristics, such as enhanced kink resistance or superior biocompatibility, respectively. The application segments clearly demonstrate where the highest volume of procedures occurs, emphasizing critical care and operative settings as the bedrock of demand, followed by emergency medicine and specialized diagnostic procedures.

The end-user segmentation underscores the primary buyers and utilizers of arterial cannulae, with hospitals and specialty clinics being the largest consumers. Within hospitals, ICUs and operating rooms drive the bulk of procurement, demanding reliability and integration with existing monitoring equipment. Lastly, gauge size segmentation (e.g., 20G, 22G, 24G, and specialized pediatric sizes) directly correlates with the patient demographic and the specific vessel targeted for cannulation, demonstrating the necessity for a wide product range to address the variability in clinical practice and patient anatomy globally. This robust structure supports targeted commercial strategies and provides a granular view of market consumption patterns.

- By Product Type:

- Single-Lumen Arterial Cannulae

- Multi-Lumen Arterial Cannulae

- By Material:

- Polyurethane (PU)

- Fluorinated Ethylene Propylene (FEP)

- Polyvinyl Chloride (PVC)

- Others (Teflon, Silicone)

- By Application:

- Continuous Blood Pressure Monitoring

- Blood Sampling and Analysis

- Fluid and Drug Delivery (Specialized Use)

- By End-User:

- Hospitals (ICUs, ORs, Emergency Departments)

- Specialty Clinics

- Ambulatory Surgical Centers (ASCs)

- By Gauge Size:

- 20 Gauge

- 22 Gauge

- 24 Gauge and Smaller (Pediatric/Neonatal)

- Larger Sizes (Specialized Procedures)

Value Chain Analysis For Medical Arterial Cannula Market

The value chain for the Medical Arterial Cannula Market begins with upstream activities, predominantly involving raw material procurement and highly specialized manufacturing processes. Upstream components include the sourcing of medical-grade polymers (such as FEP, PU, or specialized silicones), precision stainless steel for needles, and specialized coatings (e.g., antimicrobial or heparin coatings). The complexity here lies in meeting stringent regulatory requirements for biocompatibility and sterility. Manufacturers must maintain high-level quality control over extrusion and molding processes to ensure the structural integrity and flexibility of the cannulae, which are critical for clinical performance and patient safety. Investment in automation and cleanroom technology at this stage is essential for mass production and compliance.

The midstream segment involves the core manufacturing, assembly, sterilization, packaging, and regulatory approval stages. Due to the high-risk classification of arterial cannulae, sterilization validation (typically ETO or gamma irradiation) is a critical and costly step. The distribution channel then takes over, which is bifurcated into direct and indirect routes. Direct sales involve manufacturers selling directly to large hospital networks or Group Purchasing Organizations (GPOs), often preferred for high-volume contracts and fostering direct clinical engagement. Indirect sales rely heavily on specialized medical device distributors who manage warehousing, inventory, and last-mile delivery to smaller hospitals, clinics, and surgical centers, particularly crucial in geographically dispersed or emerging markets.

Downstream activities focus on the end-user clinical application and post-market surveillance. The clinical adoption process requires intensive training for nurses and physicians on proper insertion and management techniques, often provided by the manufacturers or distributors. Post-market surveillance and feedback collection are integral for identifying potential defects, improving future product generations, and ensuring ongoing compliance. Ultimately, the efficiency and reliability of the supply chain—from polymer suppliers to clinical staff—directly impact patient safety and market accessibility. The increasing trend towards bundled solutions, where the cannula is sold alongside monitoring cables and transducers, further complicates inventory management and distribution logistics.

Medical Arterial Cannula Market Potential Customers

The primary end-users and buyers of medical arterial cannulae are sophisticated healthcare institutions requiring continuous invasive hemodynamic monitoring capabilities. Hospitals represent the largest customer base, specifically the Intensive Care Units (ICUs), including surgical, medical, cardiac, and neonatal ICUs, where continuous, accurate arterial pressure data is non-negotiable for managing critically unstable patients. Operating Rooms (ORs), particularly those conducting complex or high-risk surgeries such as cardiac bypass, organ transplants, neurosurgery, and major trauma procedures, are also significant volume consumers, utilizing cannulae for intraoperative management and titration of anesthetic agents. The requirement for these devices scales directly with the hospital's acuity level and surgical complexity.

Beyond traditional hospital settings, Emergency Departments (EDs) constitute a growing segment of potential customers, especially in high-volume trauma centers where rapid arterial access is necessary for immediate resuscitation and accurate monitoring of shock states. Specialty cardiology clinics and diagnostic centers that perform complex cardiac catheterization or specialized vascular procedures also represent niche but high-value customer segments, demanding high-precision cannulae tailored for their specific interventional needs. Furthermore, Military Field Hospitals and advanced trauma support units often maintain stocks of these devices due to their deployment in environments where immediate and accurate assessment of combat injuries is critical for rapid decision-making.

Group Purchasing Organizations (GPOs) and Integrated Delivery Networks (IDNs) in mature markets like North America and Western Europe act as significant consolidated buyers, influencing large-scale procurement decisions based on cost-effectiveness, contract reliability, and proven patient safety records. These large organizational buyers often prioritize standardization across their networks, favoring manufacturers who can offer a reliable supply chain and favorable pricing structures. The purchasing decision process is highly decentralized but requires clinical validation, involving key stakeholders such as critical care physicians, anesthesiologists, and materials management specialists.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.99 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BD (Becton, Dickinson and Company), Teleflex Incorporated, ICU Medical Inc., Medtronic plc, B. Braun Melsungen AG, Vygon SA, Smiths Medical (now part of ICU Medical), Argos Medical Inc., McKesson Corporation, Promis Medical, Cook Medical, GE Healthcare, Edwards Lifesciences, Boston Scientific Corporation, Terumo Corporation, Fresenius SE & Co. KGaA, Drägerwerk AG & Co. KGaA, Merit Medical Systems, Inc., SunMed LLC, and NIPRO Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Arterial Cannula Market Key Technology Landscape

The technology landscape of the Medical Arterial Cannula Market is primarily focused on enhancing safety, reducing complications, and improving the precision of placement. A significant technological advancement involves the materials used, with modern cannulae increasingly utilizing advanced polymers like high-grade polyurethane and fluoropolymers (FEP/PTFE) that offer superior flexibility, kink resistance, and biocompatibility compared to older PVC or Teflon materials. This material innovation is crucial for reducing local trauma and minimizing the risk of vessel damage during prolonged indwelling times in critically ill patients. Furthermore, there is a strong focus on passive safety technologies, such as integrated retraction mechanisms and needle guards, designed to automatically shield the contaminated needle upon removal, thereby protecting clinicians from accidental needlestick injuries and meeting global occupational safety standards.

Another major area of technological focus is the integration of guidewire technology and ultrasound compatibility. Historically, arterial cannulation relied heavily on the landmark technique, which has a higher rate of failure and associated complications. Current state-of-the-art cannulae often incorporate Seldinger technique features, allowing for placement over a guidewire, which significantly improves first-pass success rates, especially in patients with complex vascular anatomy or hypotension. The devices are increasingly designed to be highly visible under ultrasound, with specialized echogenic tips that ensure accurate visualization during placement, reducing procedural time and minimizing attempts, which directly correlates with improved patient outcomes and reduced healthcare costs.

Looking ahead, the technological frontier includes smart cannulae and advanced coatings. Research is accelerating on anti-infective coatings, such as chlorhexidine or silver-impregnated materials, aimed at drastically lowering the incidence of catheter-related bloodstream infections (CRBSIs), a major complication in ICUs. Moreover, the integration of micro-sensors within the cannula tip to provide highly localized physiological data, beyond just pressure, represents the next generation of smart monitoring devices. These technological improvements are collectively aimed at transforming the arterial cannula from a disposable commodity into a precision, risk-mitigating medical device that seamlessly integrates with advanced digital patient monitoring systems.

Regional Highlights

- North America: Dominates the global market, driven by high per capita healthcare spending, the presence of major medical device manufacturers, and extensive adoption of advanced patient monitoring systems in highly sophisticated critical care units. The region benefits from stringent regulatory frameworks promoting safety-engineered products and a high incidence of cardiovascular and respiratory diseases requiring invasive monitoring. The strong reimbursement landscape further supports the quick adoption of premium, innovative cannula products.

- Europe: Represents the second-largest market, characterized by well-established universal healthcare systems, particularly in Western European nations like Germany, France, and the UK. Market growth is sustained by an aging population and high standards of critical care provision. Regulatory bodies (like the European Medicines Agency) ensure high quality, although ongoing cost containment pressures influence procurement decisions towards value-based purchasing, favoring devices that minimize complications.

- Asia Pacific (APAC): Expected to register the highest CAGR during the forecast period. This accelerated growth is attributed to rapid improvements in healthcare infrastructure, substantial government investments in expanding critical care capacity, and the rising prevalence of lifestyle diseases across densely populated countries like China and India. The increasing accessibility of advanced medical technology and a growing medical tourism sector fuel the demand for high-quality arterial cannulae.

- Latin America (LATAM): Exhibits moderate growth potential. Market expansion is hindered by fluctuating economic conditions and variability in healthcare access. However, increasing investments in private healthcare facilities and the gradual standardization of critical care protocols, particularly in Brazil and Mexico, are creating new avenues for market entry for international players, albeit focusing on cost-effective solutions.

- Middle East and Africa (MEA): Emerging market characterized by fragmented growth. Countries within the GCC (Gulf Cooperation Council) show high demand due to oil wealth financing state-of-the-art medical facilities and importing high-end Western technology. Conversely, adoption in sub-Saharan Africa remains low, constrained by limited healthcare budgets and underdeveloped critical care infrastructure. Growth is driven primarily by specialized medical centers and trauma units.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Arterial Cannula Market.- BD (Becton, Dickinson and Company)

- Teleflex Incorporated

- ICU Medical Inc.

- Medtronic plc

- B. Braun Melsungen AG

- Vygon SA

- Smiths Medical (now part of ICU Medical)

- Argos Medical Inc.

- McKesson Corporation

- Promis Medical

- Cook Medical

- GE Healthcare

- Edwards Lifesciences

- Boston Scientific Corporation

- Terumo Corporation

- Fresenius SE & Co. KGaA

- Drägerwerk AG & Co. KGaA

- Merit Medical Systems, Inc.

- SunMed LLC

- NIPRO Corporation

- Cardinal Health

Frequently Asked Questions

Analyze common user questions about the Medical Arterial Cannula market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a medical arterial cannula?

The primary function is to provide continuous, real-time invasive monitoring of arterial blood pressure (hemodynamics) in critically ill patients, which is essential for accurate clinical management and titration of vasoactive medications in settings like the ICU and OR.

Which material segment is currently dominating the arterial cannula market?

Polyurethane (PU) and Fluorinated Ethylene Propylene (FEP) are the dominating material segments, favored for their superior biocompatibility, flexibility, and resistance to kinking, which helps in minimizing patient trauma and improving indwelling performance.

What are the key risks associated with arterial cannulation?

Key risks include localized or systemic infection (Catheter-Related Bloodstream Infections - CRBSIs), hemorrhage upon dislodgement, thrombosis or ischemia distal to the insertion site, and potential nerve damage. Manufacturers focus on safety-engineered designs and antimicrobial coatings to mitigate these risks.

How is AI influencing the future demand for arterial cannulae?

AI is influencing the market by enhancing the utility of the collected data. AI algorithms are used for predictive monitoring and automated waveform analysis, improving early diagnosis of complications and requiring cannulae with enhanced data connectivity capabilities, thereby driving demand for smart systems.

Which geographical region is expected to show the fastest market growth?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by significant government investments in critical care infrastructure, rising prevalence of chronic diseases, and improving access to advanced medical technology across major economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager