Medical Gas Pressure Regulators Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442044 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Medical Gas Pressure Regulators Market Size

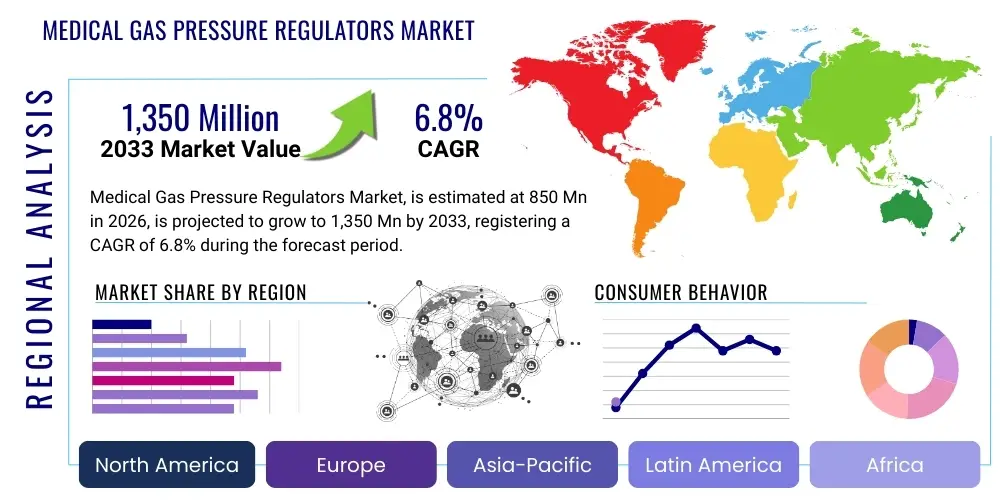

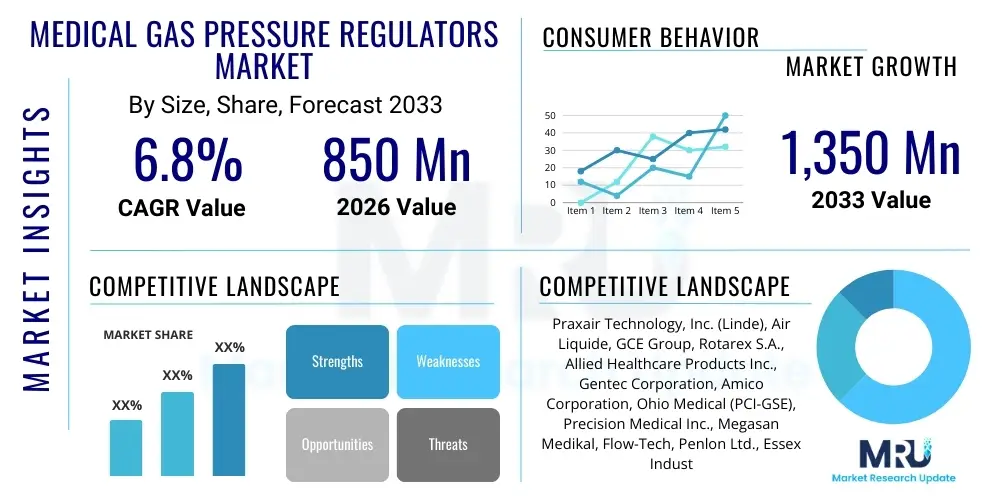

The Medical Gas Pressure Regulators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850 million in 2026 and is projected to reach USD 1,350 million by the end of the forecast period in 2033.

Medical Gas Pressure Regulators Market introduction

The Medical Gas Pressure Regulators Market encompasses devices essential for controlling and safely reducing the high pressure of medical gases stored in cylinders or supplied through central piping systems to levels suitable for patient application. These gases, including oxygen, nitrous oxide, medical air, and carbon dioxide, are critical in various clinical settings, such as operating rooms, intensive care units (ICUs), and emergency departments. The core function of these regulators is to ensure precise flow and pressure delivery, maintaining patient safety and optimizing therapeutic efficacy. Modern regulators are designed with advanced features, including integrated flowmeters, highly durable materials, and safety relief valves, complying with stringent global regulatory standards like ISO 10524-1.

The primary applications driving the demand for medical gas pressure regulators span across acute care, home healthcare settings, and specialized surgical procedures. In hospitals, these devices are indispensable for anesthesia delivery, respiratory support, and powering pneumatic medical tools. The increasing global burden of chronic respiratory diseases, such as Chronic Obstructive Pulmonary Disease (COPD) and asthma, necessitates reliable oxygen therapy delivery, thereby boosting the deployment of portable and stationary regulator systems. Furthermore, the rising volume of surgical procedures, particularly in emerging economies, contributes significantly to market growth as surgical suites are heavily reliant on controlled medical gas infrastructure.

Key benefits associated with advanced medical gas pressure regulators include enhanced patient safety through accurate pressure control, reduced risk of equipment failure due to over-pressurization, and improved workflow efficiency for clinical staff. Driving factors for market expansion include the continuous expansion of healthcare infrastructure globally, particularly the establishment of new hospitals and specialized clinics, stringent regulatory mandates emphasizing patient safety in gas delivery systems, and technological advancements leading to the development of lighter, more robust, and multifunctional integrated regulator-flowmeter units. The shift toward remote patient monitoring and the growing prevalence of home oxygen therapy also accelerate demand for user-friendly and reliable devices.

Medical Gas Pressure Regulators Market Executive Summary

The global Medical Gas Pressure Regulators Market is experiencing robust expansion driven primarily by the escalating demand for respiratory care devices and the modernization of healthcare infrastructure across developing regions. Business trends indicate a strong move toward integrated systems, where regulators are combined with flowmeters and alarm systems to provide comprehensive gas management solutions. Market participants are focusing on material innovations, utilizing lightweight alloys and high-grade polymers to enhance portability and sterilization compatibility, which is crucial for both hospital use and growing home care segments. Strategic mergers and acquisitions, alongside partnerships aimed at expanding distribution networks, are characteristic of the competitive landscape, as established players seek to consolidate their market positions and tap into niche markets like veterinary medicine and specialized laboratories.

Regionally, North America and Europe maintain leading positions due to established reimbursement policies, stringent safety standards, and high adoption rates of advanced medical technologies. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth in APAC is fueled by massive investments in healthcare infrastructure by governments in countries like China and India, the expanding patient pool requiring respiratory support, and increasing awareness regarding the standardization of medical equipment. Latin America and the Middle East and Africa (MEA) are also showing promising growth, primarily driven by governmental initiatives to improve access to essential medical services and the increasing prevalence of trauma and emergency care facilities requiring dependable gas delivery systems.

Segment trends reveal that the single-stage regulator category dominates the market share due to its simplicity, cost-effectiveness, and broad applicability in standard hospital environments. However, the multi-stage regulators segment is anticipated to witness faster growth, especially in applications requiring highly precise and stable pressure control, such as specialized research and high-volume clinical laboratories. Among applications, respiratory and resuscitation treatments command the largest market share, directly correlated with the rising incidence of chronic respiratory conditions. End-user analysis highlights hospitals and clinics as the primary consumers, although the home healthcare segment is rapidly gaining traction, propelled by demographic trends favoring remote and personalized care models, which requires durable and safe regulators for long-term use.

AI Impact Analysis on Medical Gas Pressure Regulators Market

User queries regarding AI's influence on medical gas pressure regulators often revolve around predictive maintenance, real-time safety monitoring, and optimization of gas usage efficiency in large healthcare facilities. Key themes include the feasibility of integrating smart sensors with traditional regulator hardware to preemptively detect pressure fluctuations or leaks, the role of machine learning algorithms in predicting maintenance schedules for high-wear components, and whether AI can optimize gas consumption patterns across hospital wings to reduce operational costs. Concerns frequently focus on the cybersecurity risks associated with integrating networked smart regulators and the regulatory hurdles in validating AI-driven maintenance systems for critical life support equipment. Overall, users expect AI to transition regulators from purely mechanical devices to intelligent components within a networked hospital infrastructure.

- AI integration facilitates predictive maintenance, reducing unexpected regulator failures and minimizing downtime in critical care settings.

- Machine learning algorithms can analyze real-time pressure and flow data to detect anomalies indicative of potential leaks or calibration drift, enhancing patient safety.

- Smart regulators connected to centralized AI platforms enable optimized inventory management of gas cylinders by predicting consumption rates based on patient load.

- AI-driven monitoring systems can provide rapid alerts regarding deviations from required therapeutic pressures, crucial for respiratory and anesthesia delivery.

- Generative AI tools assist manufacturers in designing highly optimized internal regulator geometries for improved flow stability and manufacturing efficiency.

- AI-enhanced diagnostic tools embedded within flowmeters can automatically calibrate pressure settings based on patient physiological parameters, pending regulatory approval.

DRO & Impact Forces Of Medical Gas Pressure Regulators Market

The market for medical gas pressure regulators is propelled by several robust drivers, primarily the global increase in the geriatric population, which correlates directly with a higher incidence of respiratory disorders requiring continuous oxygen therapy. Furthermore, the proliferation of centralized medical gas piping systems (MGPS) in newly constructed or renovated healthcare facilities mandates the installation of numerous line pressure regulators to manage pressure safely across various wards. Growing standardization and adherence to international regulatory norms, suchified by bodies like the ISO, FDA, and European Pharmacopoeia, compel healthcare providers to utilize certified and high-quality pressure regulation equipment, thereby sustaining market demand for compliant products.

However, the market faces significant restraints. High manufacturing costs associated with producing medical-grade, durable, and highly precise metal alloys for regulator bodies can restrict rapid price reduction, particularly impacting adoption in budget-constrained developing markets. Moreover, the necessity for frequent calibration and specialized maintenance of multi-stage regulators introduces complexity and ongoing operational expenditure for healthcare institutions. A major challenge involves the lack of awareness and skilled personnel in some regions regarding the proper handling and maintenance of high-pressure gas systems, which poses safety risks and leads to premature equipment replacement rather than timely repair.

Opportunities abound in the expansion of the home healthcare sector, where smaller, lightweight, and durable portable regulators are highly sought after for personal oxygen delivery systems. Technological advancements focused on integrated solutions—combining regulation, flow metering, and digital monitoring into a single, compact unit—represent a lucrative avenue for innovation. Furthermore, penetrating emerging markets through localized manufacturing and distribution partnerships offers significant long-term growth potential, particularly as these nations upgrade their public health infrastructure and increase emergency preparedness capabilities, requiring substantial inventories of reliable pressure regulation equipment for field hospitals and disaster response units.

The impact forces driving the Medical Gas Pressure Regulators Market are complex, centered primarily around strict regulatory enforcement and technological evolution towards integrated safety features. Regulatory pressure ensures quality, while technological innovation, particularly miniaturization and the development of magnetic resonance imaging (MRI) compatible regulators, expands application versatility. Economic dynamics, including healthcare budget allocations and reimbursement policies for respiratory equipment, heavily influence procurement decisions. Finally, the socio-demographic impact of rising chronic diseases ensures a sustained, high-volume requirement for precise and safe medical gas delivery systems globally.

- Drivers: Growing prevalence of respiratory diseases (COPD, asthma); Expansion and modernization of hospital infrastructure; Strict adherence to international medical gas safety standards (e.g., ISO 10524).

- Restraints: High initial investment and maintenance costs of specialized regulators; Risk of product recalls due to non-compliance or mechanical failure; Requirement for specialized training for safe operation and handling.

- Opportunities: Rapid growth in the home healthcare and ambulatory care sectors; Development of advanced, integrated regulator systems (regulator-flowmeter combinations); Untapped potential in emerging economies with expanding public health systems.

- Impact Forces: Regulatory scrutiny over patient safety (High Impact); Technological innovation in materials and integration (Medium Impact); Healthcare spending trends and budgetary constraints (Medium Impact).

Segmentation Analysis

The Medical Gas Pressure Regulators Market is highly segmented based on product type, gas type, material of construction, application, and end-user, reflecting the diverse clinical environments and specific gas delivery requirements globally. Understanding these segments is crucial for market participants to tailor their product offerings and strategic focus. Product segmentation differentiates between single-stage and dual-stage regulators, with dual-stage offering superior pressure control for sensitive applications, while single-stage regulators dominate high-volume, general use scenarios due to their simplicity and cost-effectiveness. The choice of material—typically brass, aluminum, or chrome-plated—is determined by durability, cost, and the specific corrosive properties of the medical gas being regulated.

Application segmentation illustrates the primary usage areas, with respiratory and anesthesia segments consistently holding the largest market share. Regulators used in respiratory care systems, particularly for supplemental oxygen therapy, constitute the backbone of market demand, driven by chronic illness management. Conversely, regulators designed for anesthesia machines must meet extremely stringent accuracy requirements to ensure precise dosage of anesthetic agents and oxygen mixtures. The growing adoption of Minimal Invasive Surgery (MIS) also necessitates specialized regulators for gases like carbon dioxide used for insufflation, adding complexity to the application landscape.

From an end-user perspective, hospitals and specialized clinics remain the dominant procurement entities, owing to the scale of their operations and the critical nature of the procedures they perform. However, the fastest-growing end-user segment is the home healthcare setting. This segment demands products that are highly reliable, lightweight, easy to use by non-professionals, and durable enough for consistent, long-term personal use. Manufacturers are increasingly prioritizing the development of robust, consumer-friendly portable regulators to capitalize on this significant shift toward decentralized care models.

- By Product Type:

- Single-Stage Pressure Regulators

- Dual-Stage Pressure Regulators

- By Gas Type:

- Oxygen Regulators

- Medical Air Regulators

- Nitrous Oxide Regulators

- Carbon Dioxide Regulators

- Other Specialty Gas Regulators (e.g., Nitrogen)

- By Material:

- Brass Regulators

- Chrome-Plated Brass Regulators

- Aluminum Regulators

- By Application:

- Respiratory and Resuscitation

- Anesthesia

- Diagnostic Applications

- Surgical Equipment Powering (Pneumatic Tools)

- Insufflation

- By End User:

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Home Healthcare Settings

- Emergency Medical Services (EMS)

- Research and Diagnostic Laboratories

Value Chain Analysis For Medical Gas Pressure Regulators Market

The value chain for medical gas pressure regulators begins with the upstream segment, dominated by raw material suppliers providing specialized metals (brass, aluminum, stainless steel) and high-performance polymer compounds required for diaphragms, seals, and gaskets. Quality control at this stage is paramount, as the materials must withstand high pressures, maintain inertness with medical gases, and resist corrosion. Key activities in the upstream include sourcing, purification, and precision machining of components. Manufacturers often engage in vertical integration for critical components to ensure stringent quality and supply reliability, complying strictly with medical device materials standards (e.g., biocompatibility and sterilization protocols).

The manufacturing stage involves the assembly, testing, calibration, and packaging of the final regulator devices. Manufacturers utilize high-precision CNC machinery and automated assembly lines to ensure consistency and minimize human error, particularly for the sensitive internal mechanisms responsible for pressure reduction and stability. Comprehensive pressure testing and mandatory validation of flow rates are non-negotiable regulatory requirements at this stage. Post-production, the distribution channel plays a critical role. Direct distribution is common for large institutional buyers (major hospital chains, government tenders), allowing for greater control over technical support and pricing.

Indirect distribution, primarily through specialized medical equipment distributors and regional resellers, is essential for reaching smaller clinics, pharmacies, and the rapidly growing home healthcare market. These distributors handle logistics, localized inventory management, and post-sales servicing, ensuring devices reach the end-users efficiently. The downstream activities focus on installation, training, and ongoing technical support, often managed by specialized technical staff employed by the manufacturer or authorized distributor. The efficacy of the value chain is ultimately measured by regulatory compliance, product reliability, and the swiftness of service delivery to critical care environments.

Medical Gas Pressure Regulators Market Potential Customers

The primary consumers and end-users of medical gas pressure regulators are institutions and individuals that require the precise and safe delivery of therapeutic and anesthetic gases. Hospitals, particularly large multi-specialty facilities, represent the largest customer segment. Their high patient turnover and extensive infrastructure—including operating theatres, intensive care units (ICUs), and emergency rooms—necessitate a large volume and variety of both line and cylinder regulators. Specialized clinics, such as pulmonary centers, dialysis centers, and cardiac care units, also constitute major institutional buyers, focusing on specific gas needs like oxygen and nitrous oxide.

Beyond traditional healthcare settings, the growing segment of potential customers includes home healthcare agencies and individual patients managing chronic respiratory conditions. This demographic typically purchases or leases portable oxygen concentrators and cylinders equipped with lightweight, easy-to-read pressure regulators designed for daily, non-clinical use. Furthermore, Emergency Medical Services (EMS) and ambulance operators are crucial customers, requiring robust, impact-resistant regulators capable of operating reliably under demanding, mobile conditions. Their demand centers on specialized, compact devices integrated with emergency kits.

Finally, a niche but important customer base includes research and diagnostic laboratories. These facilities use medical-grade gases (often specialty mixtures) for sensitive testing and calibration purposes, demanding high-purity regulators, often dual-stage, that offer extreme precision and stability, significantly beyond the requirements of general patient care applications. Veterinary hospitals and specialized animal clinics also contribute to demand, utilizing similar regulator technologies adapted for animal anesthesia and respiratory support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 million |

| Market Forecast in 2033 | USD 1,350 million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Praxair Technology, Inc. (Linde), Air Liquide, GCE Group, Rotarex S.A., Allied Healthcare Products Inc., Gentec Corporation, Amico Corporation, Ohio Medical (PCI-GSE), Precision Medical Inc., Megasan Medikal, Flow-Tech, Penlon Ltd., Essex Industries, Inc., Drägerwerk AG & Co. KGaA, Teleflex Incorporated, Becton, Dickinson and Company (BD), Victor Technologies (Colfax), Sunset Healthcare Solutions, Medical Equipment & Gas Solutions (MEGS), Heyer Medical AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Gas Pressure Regulators Market Key Technology Landscape

The technological landscape of the medical gas pressure regulators market is characterized by a strong emphasis on integration, material science advancement, and enhanced digital monitoring capabilities. A significant trend is the development of yoke-style regulators that integrate the pressure gauge, flowmeter, and regulator mechanism into a single, compact, and lightweight unit, significantly improving portability and ease of use, particularly in emergency settings and home healthcare. These integrated systems often feature precise click-style flowmeters, offering superior accuracy and reduced maintenance compared to traditional ball-and-tube flowmeters, and are increasingly manufactured using lighter-weight aluminum alloys instead of traditional, heavier brass bodies.

Another crucial technological advancement involves the introduction of Magnetic Resonance Imaging (MRI) compatible regulators. As the use of MRI scanning expands to critically ill patients requiring continuous life support, regulators must be designed entirely using non-ferrous materials (e.g., specialized plastics and aluminum alloys) to prevent dangerous magnetic interference and subsequent device malfunction in the high-field environment of the MRI suite. This specialization addresses a critical safety niche and necessitates stringent testing protocols. Furthermore, advancements in diaphragm and sealing technology, utilizing highly durable and resistant polymer composites, ensure longer service life and reduced risk of leaks, even under continuous high-pressure cycling.

Digital technology integration is reshaping monitoring capabilities. Modern regulators are increasingly equipped with digital pressure gauges that offer high-resolution displays and can interface wirelessly (e.g., via Bluetooth or Wi-Fi) with central monitoring systems or Electronic Health Records (EHRs). This digitalization allows for real-time tracking of gas consumption, automated safety checks, and remote diagnostics, aligning the devices with the broader 'smart hospital' concept. Future developments are focused on self-calibrating regulators and embedding sophisticated sensors to predict component failure based on wear, significantly boosting operational reliability and contributing to cost savings through proactive maintenance.

Regional Highlights

- North America: North America holds the largest share in the Medical Gas Pressure Regulators Market, primarily driven by highly advanced healthcare infrastructure, significant per capita healthcare expenditure, and the presence of major industry players. The region benefits from stringent regulatory frameworks (FDA) that mandate the use of certified, high-quality pressure control equipment in hospitals, bolstering market demand. The rapid adoption of home oxygen therapy due to the high prevalence of COPD and other chronic diseases further sustains the growth, focusing demand on compact and user-friendly devices. The market is mature but continuously innovates, particularly in integrated digital monitoring systems for better compliance and safety.

- Europe: The European market is characterized by mandatory adherence to the Medical Device Regulation (MDR) and ISO standards, ensuring high quality and safety in medical gas systems. Western European countries, particularly Germany, France, and the UK, are key contributors, driven by a large elderly population and well-established public healthcare systems. Regulatory emphasis on safety and the ongoing upgrade of older hospital facilities to meet modern gas pipeline standards create persistent demand for both central line regulators and cylinder regulators. Growth is moderate, focusing heavily on technology convergence and efficiency improvements in patient care delivery.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region during the forecast period. This acceleration is fueled by massive government investments aimed at expanding healthcare accessibility, building new hospitals and specialty clinics, and improving public health infrastructure in populous nations like China, India, and Southeast Asia. The rise in medical tourism and a substantial, growing patient base requiring surgical and respiratory care contribute significantly to demand. While pricing sensitivity remains a factor, the increasing awareness of international safety standards drives the procurement of quality regulators. Manufacturers are strategically partnering with local distributors to navigate diverse regulatory landscapes and optimize supply chain efficiencies.

- Latin America: The market in Latin America is growing steadily, primarily driven by improved economic conditions allowing for greater public and private investment in hospital construction and modernization. Brazil and Mexico are the dominant markets, where efforts to standardize healthcare services and enhance emergency medical systems increase the need for reliable gas pressure regulation equipment. Challenges include varying degrees of regulatory enforcement and economic volatility, but the fundamental demand for critical care devices ensures continuous market momentum.

- Middle East and Africa (MEA): The MEA region shows promising growth, largely concentrated in the Gulf Cooperation Council (GCC) countries (Saudi Arabia, UAE) due to their robust healthcare investment strategies and focus on achieving world-class medical standards. These nations are heavily investing in specialized healthcare city developments, demanding sophisticated gas management systems. In contrast, growth in Africa is concentrated in urban centers and driven by humanitarian aid and projects aimed at establishing basic critical care infrastructure, increasing the demand for cost-effective, durable, and easily maintained regulators suitable for austere environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Gas Pressure Regulators Market.- Praxair Technology, Inc. (Linde)

- Air Liquide

- GCE Group

- Rotarex S.A.

- Allied Healthcare Products Inc.

- Gentec Corporation

- Amico Corporation

- Ohio Medical (PCI-GSE)

- Precision Medical Inc.

- Megasan Medikal

- Flow-Tech

- Penlon Ltd.

- Essex Industries, Inc.

- Drägerwerk AG & Co. KGaA

- Teleflex Incorporated

- Becton, Dickinson and Company (BD)

- Victor Technologies (Colfax)

- Sunset Healthcare Solutions

- Medical Equipment & Gas Solutions (MEGS)

- Heyer Medical AG

Frequently Asked Questions

Analyze common user questions about the Medical Gas Pressure Regulators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Medical Gas Pressure Regulators Market?

The primary factor driving market growth is the globally increasing prevalence of chronic respiratory diseases, such as COPD and asthma, which necessitates continuous and safe oxygen therapy delivery. This demand is further amplified by continuous global expansion and modernization of critical care infrastructure, requiring reliable gas management systems.

What is the difference between single-stage and dual-stage medical gas pressure regulators?

Single-stage regulators reduce cylinder pressure to working pressure in one step, offering a cost-effective solution for non-critical, high-volume applications. Dual-stage regulators perform pressure reduction in two separate steps, providing superior accuracy, stability, and control, making them essential for highly sensitive procedures like anesthesia delivery or laboratory use where minor pressure fluctuations are unacceptable.

Which end-user segment is expected to witness the highest growth rate during the forecast period?

The Home Healthcare segment is projected to experience the fastest growth rate. This is due to the rising trend of decentralized care, patient preference for remote monitoring, advancements in portable oxygen systems, and increased awareness regarding managing chronic conditions outside of traditional hospital settings, boosting demand for lightweight, user-friendly regulators.

How do regulatory standards like ISO 10524 impact the manufacturing of these devices?

ISO 10524 and similar regional standards rigorously dictate the design, materials, construction, and testing protocols for medical gas pressure regulators. Compliance ensures devices meet critical safety and performance criteria, particularly concerning internal component durability and resistance to over-pressurization, significantly increasing manufacturing complexity and quality control requirements.

What are the key technological advancements being integrated into modern medical gas regulators?

Key technological advancements include the development of integrated regulator-flowmeter units for enhanced portability, the use of non-ferrous materials for MRI compatibility, and the incorporation of digital monitoring interfaces for real-time data transmission and predictive maintenance, transitioning regulators into smart, connected devices within hospital networks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Medical Gas Pressure Regulators Market Size Report By Type (Oxygen Pressure Regulators, Nitrous Oxide Pressure Regulators, Medical Air Pressure Regulators, Other Gas Pressure Regulators), By Application (Hospital, Home Care, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Medical Gas Pressure Regulators Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Medical Air Pressure Regulators, Nitrous Oxide Pressure Regulators, Oxygen Pressure Regulators, Other Gas Pressure Regulators), By Application (Home Care, Hospital, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager