Medical or Healthcare Scales Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441436 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Medical or Healthcare Scales Market Size

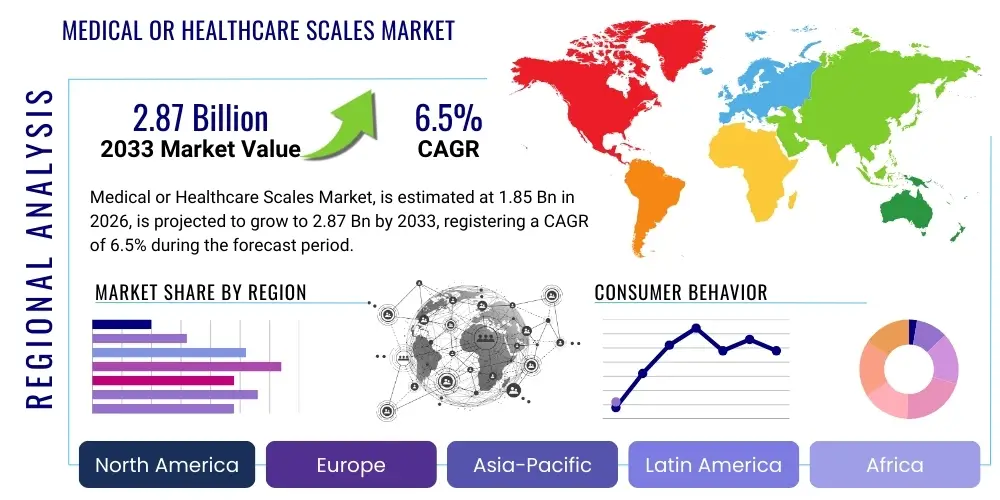

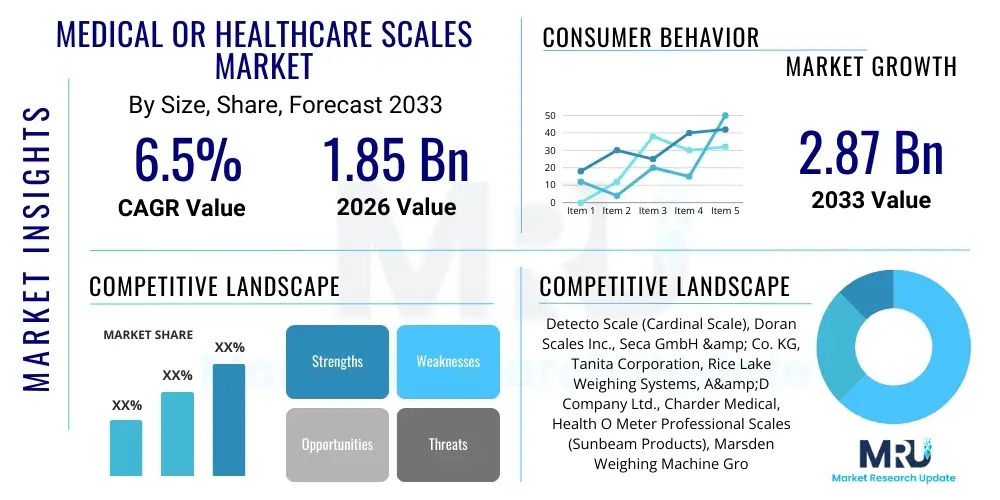

The Medical or Healthcare Scales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.87 Billion by the end of the forecast period in 2033.

Medical or Healthcare Scales Market introduction

The Medical or Healthcare Scales Market encompasses a diverse range of weighing devices specifically designed for clinical, diagnostic, and monitoring applications across various healthcare settings. These instruments are crucial tools for accurate measurement of patient body weight, a fundamental vital sign essential for diagnosis, determining medication dosages, nutritional assessment, and tracking treatment efficacy, particularly in managing chronic conditions such as heart failure, kidney disease, and obesity. The precision and reliability of these scales are highly regulated, requiring stringent certification to ensure patient safety and data integrity within Electronic Health Records (EHRs). Products range from basic mechanical scales to sophisticated digital and connected devices that offer features such as Body Mass Index (BMI) calculation, bioelectrical impedance analysis (BIA), and seamless integration into hospital information systems.

The primary applications of these scales span across critical care units, general wards, specialized clinics (pediatric, bariatric), and increasingly, in remote patient monitoring (RPM) and home healthcare environments. The rising global prevalence of chronic lifestyle diseases, coupled with an aging population that requires continuous health monitoring, serves as a significant impetus for market growth. Technological advancements, specifically the integration of IoT and cloud connectivity, are transforming scales from mere measuring devices into sophisticated data capture endpoints, facilitating telehealth and proactive clinical decision support. The shift towards digital scales is driven by the need for enhanced accuracy, ease of data transfer, and reduction in human error associated with manual record-keeping.

Key driving factors supporting the expansion of this market include mandatory regulatory requirements for consistent patient weight measurement in hospitals, the growing global burden of obesity necessitating specialized bariatric scales, and the expansion of ambulatory surgical centers and outpatient clinics. Furthermore, the increasing adoption of smart scales for personal health tracking, which often provides clinical-grade data accuracy, contributes significantly to the decentralized nature of weight management. Benefits derived from advanced medical scales include improved clinical workflows, enhanced patient safety through precise drug dosing, and longitudinal data tracking capabilities critical for managing complex health trajectories.

Medical or Healthcare Scales Market Executive Summary

The Medical or Healthcare Scales Market is characterized by robust growth fueled by technological innovation and increasing clinical integration demands. Business trends indicate a strong move toward developing connectivity features, making scales integral components of the wider digital health ecosystem, including EHRs and telehealth platforms. Manufacturers are investing heavily in producing high-capacity, specialized scales (like bed and wheelchair scales) to cater to the rising demographic of bariatric and mobility-impaired patients, enhancing both patient comfort and staff efficiency. Strategic mergers and acquisitions focused on securing advanced sensor technology and software capabilities are shaping the competitive landscape, emphasizing the shift from hardware dominance to data service provision.

Regional trends reveal that North America maintains market leadership, primarily due to well-established healthcare infrastructure, high technological adoption rates, and significant healthcare expenditure per capita, promoting the rapid integration of smart and connected weighing systems. Conversely, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, driven by massive investments in modernizing public and private healthcare facilities, increasing awareness of preventative health, and government initiatives aimed at improving primary care access. Europe, supported by stringent quality standards (e.g., Measuring Instruments Directive - MID), shows steady growth, focusing particularly on precision and standardized metrology across clinical settings.

Segmentation analysis highlights that the digital scales segment dominates the market due to superior accuracy and data handling capabilities, although specialized scales, particularly bariatric and infant scales, demonstrate high niche market growth. In terms of end-users, hospitals and clinics remain the largest consumers, but the fastest growing segment is expected to be home healthcare and remote patient monitoring, reflecting the global trend toward decentralized care. The drive for operational efficiency and patient safety is dictating the demand for scales that offer automated data capture, minimizing manual transcription errors and freeing up clinical staff time for direct patient care.

AI Impact Analysis on Medical or Healthcare Scales Market

Common user questions regarding AI's impact on medical scales frequently center on predictive health capabilities, the accuracy of automated diagnostics, and how seamlessly AI-driven insights integrate into existing clinical workflows. Users are keen to understand if AI can move beyond simple BMI calculations to provide actionable clinical intelligence, such as predicting decompensation in heart failure patients based on subtle, continuous weight fluctuations, or optimizing nutritional interventions. Concerns often revolve around the validation of AI algorithms against clinical standards and the ethical implications of using large-scale weight data, ensuring data privacy and minimizing bias in algorithmic predictions. Users expect AI integration to transform scales into proactive screening tools rather than passive measurement devices.

The most immediate and significant impact of AI is in enhancing the diagnostic utility of connected scales. AI algorithms can analyze temporal weight data patterns alongside other collected physiological parameters (e.g., blood pressure, heart rate) to identify deviations that signify impending health crises, far earlier than traditional methods. For instance, in chronic disease management, AI can detect small, non-obvious fluid retention spikes that may precede hospitalization for congestive heart failure, triggering immediate alerts to the care team. This transition from reactive monitoring to predictive intervention significantly elevates the value proposition of advanced medical scales, transforming them into critical components of telemedicine infrastructure.

Furthermore, AI is instrumental in refining the accuracy and user experience of multi-parameter scales, such as those employing Bioelectrical Impedance Analysis (BIA) for body composition assessment. Traditional BIA measurements can be highly susceptible to variables like hydration levels and time of day; AI models can correct for these confounding factors, providing more reliable body fat, muscle mass, and hydration metrics, essential for nutritional and sports medicine applications. This computational sophistication also aids manufacturers in developing self-calibrating smart scales, reducing maintenance overheads and ensuring sustained measurement precision in high-throughput clinical environments, ultimately improving the trustworthiness of data captured at the point of care.

- AI enables predictive health modeling by analyzing subtle, longitudinal weight data patterns to forecast acute events (e.g., heart failure decompensation).

- Automated anomaly detection algorithms identify critical weight gain or loss requiring immediate clinical intervention, improving patient safety and reducing hospitalization risk.

- Enhanced accuracy and calibration using machine learning to correct for environmental variables and patient-specific factors influencing BIA body composition analysis.

- Integration of scale data into AI-powered diagnostic support systems for optimizing drug dosages, especially in pediatric and bariatric populations.

- Development of personalized nutritional and exercise recommendations based on real-time body composition changes derived from smart scale data.

- Streamlined clinical documentation by using AI to automatically categorize and structure weight data for seamless insertion into Electronic Health Records (EHR) narratives.

DRO & Impact Forces Of Medical or Healthcare Scales Market

The market dynamics of medical scales are driven primarily by the escalating global prevalence of chronic diseases and the critical need for accurate biometric data in clinical decision-making. Key drivers include government mandates promoting preventative care, the necessity of precise weight measurements for calculating drug dosages in vulnerable populations (infants, elderly), and the undeniable link between weight management and outcomes for conditions like diabetes and hypertension. However, the market faces restraints such as the high acquisition and maintenance costs of advanced digital scales, which can be prohibitive for smaller clinics or emerging market hospitals, coupled with ongoing challenges related to achieving seamless interoperability between proprietary scale platforms and diverse hospital information systems (HIS). Opportunities are vast, particularly in the realm of remote patient monitoring (RPM), where connected scales offer consistent, reliable data collection outside traditional clinical settings, and in the growing specialized segments like automated patient weighing systems integrated into beds and stretchers, addressing infection control and staff injury risks.

Impact forces currently shaping the market are centered around regulatory standards and technological disruption. The pressure from regulatory bodies to ensure high metrological accuracy and data security (e.g., HIPAA, GDPR compliance) forces manufacturers to continually update technologies, raising the barrier to entry but improving overall product quality. Concurrently, the increasing patient acceptance of telemedicine and home monitoring is exerting a pull force on the demand side, favoring manufacturers that can deliver clinically validated, consumer-friendly devices. The bargaining power of large healthcare purchasing organizations (GPOs) acts as a downward pressure on pricing, requiring volume-based sales strategies, while the threat of substitution from alternative monitoring technologies, though currently low for basic weight measurement, pushes scale manufacturers toward integration of additional features like vital signs monitoring.

The market structure is also impacted by the rapid convergence of consumer technology and medical device standards. Consumer smart scales are approaching clinical accuracy, forcing traditional medical device companies to innovate faster, adding features such as Wi-Fi integration, EMR compatibility, and sophisticated analysis tools to differentiate their offerings. Furthermore, the global fight against healthcare-associated infections (HAIs) is driving demand for scales with anti-microbial surfaces and contact-free weighing mechanisms, establishing hygienic design as a non-negotiable factor in procurement decisions. This confluence of clinical need, technological capacity, and regulatory oversight defines the current competitive environment and future trajectory of the Medical or Healthcare Scales market.

- Drivers:

- Rising global prevalence of chronic diseases (e.g., obesity, diabetes) necessitating weight monitoring.

- Increasing aging population requiring frequent and often specialized (e.g., bariatric) weighing solutions.

- Mandatory requirements for accurate weight data in clinical protocols for drug dosing and nutritional assessment.

- Technological advancements in digital connectivity (IoT) and integration with EHR systems.

- Restraints:

- High initial capital expenditure for advanced, connected medical scales.

- Challenges in achieving universal interoperability standards across diverse healthcare IT environments.

- Stringent regulatory approval processes and compliance costs, particularly in developed economies.

- Risk of data breaches associated with networked scales handling sensitive patient health information.

- Opportunities:

- Expansion into Remote Patient Monitoring (RPM) and telehealth services for chronic condition management.

- Development of specialized scale niches (e.g., contactless weighing, integrated surgical scales).

- Growth in emerging economies due to improving healthcare infrastructure investments.

- Integration of AI and predictive analytics for enhanced diagnostic utility.

- Impact Forces:

- Bargaining Power of Buyers: High, driven by large hospital groups and GPOs demanding competitive pricing and long-term service contracts.

- Threat of New Entrants: Moderate, due to high regulatory hurdles and required capital investment for medical-grade certification.

- Threat of Substitutes: Low, as weight measurement remains fundamental, though substitutes may arise in integrated monitoring platforms that incorporate weight functionality.

- Intensity of Competitive Rivalry: High, driven by established global players and niche specialists competing on connectivity, accuracy, and specialized functionality.

Segmentation Analysis

The Medical or Healthcare Scales Market is comprehensively segmented based on product type, technology, application, and end-user, allowing for a granular analysis of demand patterns and growth drivers across different clinical niches. Segmentation by product type highlights the distinction between traditional mechanical scales, which are cost-effective and durable, and digital scales, which offer superior precision and data output capabilities. The market is increasingly pivoting towards specialized scales, such as infant, chair, bed, and bariatric scales, reflecting the need to accommodate patients with diverse mobility and weight requirements while maintaining clinical accuracy and caregiver safety.

Segmentation by technology reveals the critical evolution towards smart and connected devices. While basic electronic scales still hold a significant share, the highest growth is concentrated in scales featuring advanced features like Wi-Fi/Bluetooth connectivity, sophisticated body composition analysis (BIA), and self-calibration functions. The shift towards connectivity is paramount, driven by the global mandate to digitize patient records and improve the efficiency of data flow from the point of measurement directly into the Electronic Health Record (EHR). Furthermore, advanced technologies are enabling higher capacity and more robust scales required in specialized fields like orthopedics and bariatrics.

From an end-user perspective, hospitals and clinics constitute the largest revenue generating segment, owing to high patient throughput and regulatory mandates requiring high-precision, verified devices for critical care settings and surgical planning. However, the ambulatory care centers and home care segments are emerging as critical growth areas. This trend is a direct result of healthcare decentralization, where continuous remote monitoring of weight is leveraged to prevent readmissions and manage chronic conditions more effectively, creating demand for portable, durable, and highly reliable home-use medical scales that adhere to professional standards.

- By Product Type:

- Digital Scales

- Standard Digital Scales

- Smart/Connected Scales (Wi-Fi, Bluetooth enabled)

- Mechanical Scales

- Specialized Scales

- Bariatric Scales (High Capacity)

- Infant/Pediatric Scales (Tray, Diaper)

- Wheelchair Scales (Platform Scales)

- Bed Scales (In-bed weighing systems)

- Chair Scales

- Column/Height Measurement Scales

- By Technology:

- Load Cell Technology (Strain Gauge)

- Bioelectrical Impedance Analysis (BIA)

- Advanced Sensor Technology (Vibration compensation, Magnetic)

- By Application:

- Weight Monitoring for General Health

- Nutritional Assessment and Dietary Management

- Chronic Disease Management (e.g., Heart Failure, Kidney Disease)

- Pediatric and Neonatal Care

- Bariatric Care

- Drug Dosage Calculation

- By End-User:

- Hospitals and Clinics

- Diagnostic Laboratories and Research Centers

- Ambulatory Surgical Centers (ASCs)

- Fitness and Wellness Centers (Clinical Affiliated)

- Home Healthcare/Remote Patient Monitoring (RPM)

- Nursing Homes and Long-Term Care Facilities

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea, Australia)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA) (GCC Countries, South Africa)

Value Chain Analysis For Medical or Healthcare Scales Market

The value chain for the Medical or Healthcare Scales Market begins upstream with the procurement of specialized components, primarily high-precision load cells, advanced microprocessors, communication modules (Bluetooth/Wi-Fi chips), and medical-grade enclosures. Accuracy and reliability are critical at this stage, leading manufacturers to prioritize certified suppliers for load cells, which are the core component determining measurement precision. Quality control and regulatory compliance checks must be embedded early in the process, ensuring components meet strict metrological standards (e.g., NTEP or OIML certification), as well as safety and biocompatibility requirements, particularly for devices used in sterile or high-contact clinical environments.

The manufacturing phase involves assembly, rigorous calibration, and software integration, especially for smart scales requiring robust operating systems and secure data handling capabilities. Midstream activities are dominated by achieving regulatory clearance from bodies like the FDA or CE marking, a time-consuming and costly process that adds significant value and acts as a key market differentiator. Distribution channels are highly specialized; the indirect channel, relying on large medical equipment distributors and Group Purchasing Organizations (GPOs), is dominant for hospital sales, leveraging existing contracts and logistics infrastructure. Direct sales strategies are often employed for highly specialized or customized systems, such as integrated bed weighing solutions, ensuring expert installation and training.

Downstream activities focus on post-sale services, including mandatory periodic calibration, maintenance contracts, and software updates, which are essential for maintaining the operational life and clinical accuracy of the devices. For connected scales, the value proposition extends into data integration services, ensuring seamless communication with EHRs and providing technical support for IT infrastructure connectivity. Potential customers value comprehensive support packages alongside the initial hardware purchase, signifying that the lifecycle service offering is as critical as the product specifications themselves. This emphasis on long-term service differentiates medical scales from typical consumer electronics and solidifies customer loyalty.

Medical or Healthcare Scales Market Potential Customers

The primary cohort of potential customers for medical or healthcare scales consists of institutional healthcare providers, whose purchasing decisions are driven by regulatory requirements, patient safety protocols, and the need for seamless data integration into clinical workflows. Hospitals, including general, specialty, and university medical centers, are the largest buyers, requiring a full spectrum of scale types—from standard digital column scales in outpatient clinics to specialized, high-capacity bariatric scales and integrated bed scales in intensive care units. Furthermore, long-term care facilities and nursing homes represent a significant and growing customer base, focused on continuous monitoring of elderly residents for rapid detection of malnutrition or fluid imbalances, often preferring durable, easy-to-use chair scales.

A rapidly expanding segment of potential customers includes ambulatory surgical centers (ASCs) and specialized clinics such as dialysis centers, endocrinology practices, and cardiology clinics. These environments require highly accurate, professional-grade scales for precise medication management and diagnostic purposes, often prioritizing devices with strong connectivity features to streamline patient throughput. Separately, the burgeoning market for remote patient monitoring (RPM) and telehealth has dramatically expanded the customer profile to include home healthcare providers and directly, the patients themselves, who purchase clinical-grade smart scales recommended by their physicians for continuous, unsupervised data collection at home, which mandates user-friendliness combined with clinical accuracy validation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.87 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Detecto Scale (Cardinal Scale), Doran Scales Inc., Seca GmbH & Co. KG, Tanita Corporation, Rice Lake Weighing Systems, A&D Company Ltd., Charder Medical, Health O Meter Professional Scales (Sunbeam Products), Marsden Weighing Machine Group, Befour Inc., Kern & Sohn GmbH, Shekel Brainweigh Ltd., Welch Allyn (Hillrom), Bariatric Scale, Midmark Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical or Healthcare Scales Market Key Technology Landscape

The contemporary technology landscape of the Medical or Healthcare Scales Market is fundamentally defined by digitalization and the integration of advanced sensors designed for high accuracy and specific clinical scenarios. A primary technological focus is on enhancing measurement stability and precision, achieved through sophisticated, high-resolution load cells and specialized anti-vibration damping mechanisms that ensure accurate readings even in dynamic hospital environments, such as emergency rooms. The adoption of advanced calibration technologies, often involving temperature compensation and self-diagnostic features, ensures long-term operational integrity and reduces the frequency of manual recalibration, a critical requirement for maintaining regulatory compliance and patient safety standards across diverse institutional settings.

Connectivity constitutes the second major technological pillar, driving the market transformation toward smart devices. Modern medical scales are increasingly equipped with multiple wireless communication protocols, including Wi-Fi, Bluetooth Low Energy (BLE), and sometimes NFC, to facilitate seamless, secure, and automated data transmission. This capability is crucial for supporting Electronic Health Record (EHR) integration, allowing weight data to be instantly and accurately recorded in the patient’s file, drastically minimizing manual transcription errors and accelerating clinical workflows. Furthermore, some sophisticated professional scales integrate cellular connectivity, specifically targeting home healthcare and remote patient monitoring scenarios where dedicated Wi-Fi networks may not be reliably available, ensuring continuous data flow for critical chronic disease management.

Beyond simple weight measurement, technological advancements are heavily focused on bioelectrical impedance analysis (BIA) to provide comprehensive body composition data, moving the scale from a simple mass measurement device to a diagnostic tool. Multi-frequency BIA is used to estimate body fat, muscle mass, bone density, and hydration levels, providing valuable insights for nutritional therapy, critical care monitoring (fluid status), and geriatric care (sarcopenia assessment). The integration of modular designs and enhanced user interfaces, including large, bright LCD displays and voice guidance for patients, also represents a significant technological improvement, enhancing the usability and accessibility of specialized scales, such as those used for bariatric or visually impaired patients, ensuring accurate readings are achievable with minimal staff intervention.

Regional Highlights

Geographically, the Medical or Healthcare Scales Market exhibits distinct patterns influenced by healthcare spending, regulatory environments, and the speed of technological adoption. North America, encompassing the U.S. and Canada, commands the largest market share, predominantly driven by high prevalence of obesity, which fuels the demand for high-capacity bariatric scales, and substantial investments in digitized healthcare infrastructure. The region benefits from early and rapid adoption of connected scales that integrate seamlessly with advanced EHR systems, supported by robust regulatory frameworks (FDA) emphasizing high standards of accuracy and data security, thereby fostering a mature market characterized by technological sophistication and competitive pricing.

Europe represents a mature and steadily growing market, guided by stringent quality and metrology standards set by directives such as the Measuring Instruments Directive (MID), ensuring high precision and standardization across member nations. Countries like Germany, the U.K., and France are major contributors, driven by aging demographics and sophisticated public health systems that prioritize preventative care and standardized data collection. The European market shows a strong preference for high-quality, durable specialized scales (chair and bed scales), alongside a growing trend towards network integration within hospital groups, aiming for centralized data management and improved clinical efficiency across multiple facilities.

Asia Pacific (APAC) is forecasted to be the fastest-growing region, propelled by significant government-led investments in healthcare infrastructure development, particularly in emerging economies like China and India. Rapid modernization of hospitals, increasing health awareness, and the growing middle class demanding higher standards of care are key drivers. While cost sensitivity remains a factor, the increasing adoption of digital health initiatives and remote monitoring pilot projects, coupled with a vast patient population and rising rates of chronic conditions, presents substantial opportunities for manufacturers focusing on high-volume, cost-effective, yet clinically reliable, connected scale solutions.

- North America: Market leader due to high healthcare expenditure, established EHR infrastructure, and high rates of chronic disease and obesity necessitating bariatric and specialized scales. Strong emphasis on secure data transmission (HIPAA compliance).

- Europe: Steady growth driven by rigorous regulatory standards (MID), an aging population, and a focus on integrating medical devices into standardized national health systems for seamless patient data management. Germany and the UK lead in advanced technology adoption.

- Asia Pacific (APAC): Highest growth potential attributed to rapidly expanding healthcare access, governmental modernization programs, and increasing adoption of digital health technologies, particularly in countries like China, India, and Japan. Demand is rising for reliable, affordable digital scales.

- Latin America (LATAM): Emerging market characterized by increasing private healthcare investment and improving public health initiatives. Growth is tied to basic digitalization of healthcare records and increasing clinical awareness regarding precision weighing.

- Middle East and Africa (MEA): Growth centered primarily in GCC countries due to significant oil wealth reinvestment into state-of-the-art medical cities and specialized facilities, creating demand for advanced, imported medical scales and supporting technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical or Healthcare Scales Market.- Detecto Scale (Cardinal Scale)

- Doran Scales Inc.

- Seca GmbH & Co. KG

- Tanita Corporation

- Rice Lake Weighing Systems

- A&D Company Ltd.

- Charder Medical

- Health O Meter Professional Scales (Sunbeam Products)

- Marsden Weighing Machine Group

- Befour Inc.

- Kern & Sohn GmbH

- Shekel Brainweigh Ltd.

- Welch Allyn (Hillrom)

- Bariatric Scale

- Midmark Corporation

- Shandong Zaozhuang Electronic Weighting Apparatus Co., Ltd.

- Adam Equipment Co. Ltd.

- Mettler Toledo

- Reliance Medical Products

- Vishay Precision Group (VPG)

Frequently Asked Questions

Analyze common user questions about the Medical or Healthcare Scales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between medical scales and consumer scales?

Medical or healthcare scales are required to meet stringent regulatory standards (e.g., FDA, CE, NTEP) for metrological accuracy and are built for clinical environments. They offer higher precision, capacity, specialized functions (bariatric, bed weighing), and secure connectivity crucial for clinical documentation and dosage calculations, unlike standard consumer devices.

How is the Medical Scales Market being influenced by Remote Patient Monitoring (RPM)?

RPM is significantly driving demand for smart, connected medical scales that provide seamless, automated, and secure transmission of clinical-grade weight data directly from the patient's home to healthcare providers. This facilitates proactive chronic disease management and reduces costly hospital readmissions.

What role does Bioelectrical Impedance Analysis (BIA) play in the medical scales segment?

BIA transforms the scale into a diagnostic tool by measuring body composition (fat, muscle mass, hydration) using low-level electrical currents. This data is critical for nutritional assessment, managing fluid status in critical patients, and tracking long-term health metrics beyond simple body mass.

Which geographic region currently dominates the Medical or Healthcare Scales Market?

North America holds the largest market share, characterized by high rates of obesity and chronic conditions, coupled with established, technologically advanced healthcare systems that readily integrate smart and specialized weighing solutions, supported by high healthcare spending.

What are the main technical challenges manufacturers face regarding medical scale connectivity?

Manufacturers primarily face challenges ensuring seamless and secure interoperability with diverse proprietary Electronic Health Record (EHR) systems across different healthcare facilities. Additionally, maintaining data privacy (HIPAA, GDPR) during wireless transmission and guaranteeing consistent network reliability in varied clinical environments are key technical hurdles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager