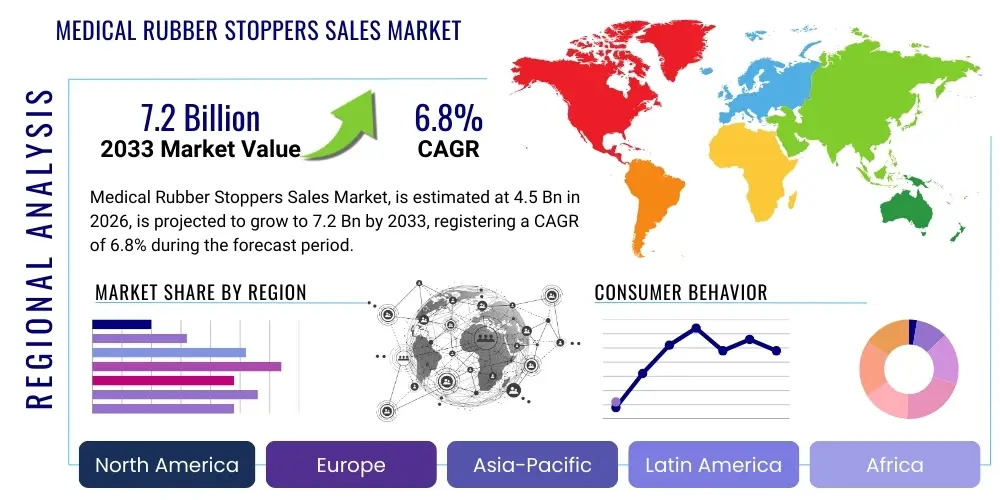

Medical Rubber Stoppers Sales Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441089 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Medical Rubber Stoppers Sales Market Size

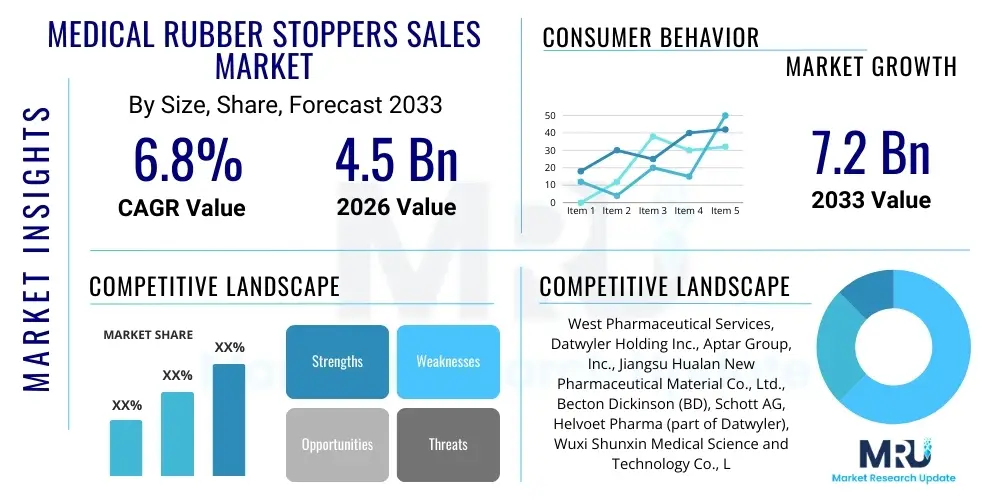

The Medical Rubber Stoppers Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by the escalating demand for injectable drugs, the expansion of global vaccination programs, and stringent regulatory requirements mandating high-quality primary packaging components. The stability and compatibility features offered by specialized rubber formulations are critical factors cementing their indispensability in pharmaceutical and biotechnological applications, particularly concerning sensitive biological materials and complex drug delivery systems. The market size reflects significant investments by pharmaceutical companies in high-speed, automated filling lines, necessitating consistent quality and dimensional accuracy in stopper manufacturing.

Medical Rubber Stoppers Sales Market introduction

The Medical Rubber Stoppers Sales Market encompasses the manufacturing and distribution of specialized elastomer components used as primary packaging closures for vials, syringes, cartridges, and infusion bottles within the pharmaceutical, biotechnology, and diagnostic industries. These stoppers, typically made from high-purity materials like bromobutyl or chlorobutyl rubber, are engineered to provide an impermeable seal, maintain product sterility, and minimize extractables that could compromise drug efficacy or patient safety. Their primary function is crucial in preserving the integrity of sensitive medications, including biologics, vaccines, and potent small molecule injectables, throughout their shelf life. The market is characterized by high barriers to entry due to the necessary compliance with global regulatory standards such as FDA, EMA, and ISO requirements, emphasizing material purity, sterilization validation, and particulate control.

Product descriptions within this market vary widely based on application. Vial stoppers (serum and lyophilization types) constitute a significant segment, designed specifically for use in combination with aluminum seals for injectables. Lyophilization stoppers feature specific configurations allowing vapor escape during the freeze-drying process while maintaining sterility post-closure. Major applications span life-saving vaccines, generic and branded injectable pharmaceuticals, blood plasma derivatives, and sophisticated diagnostic reagents. The benefits derived from high-quality medical rubber stoppers include superior chemical resistance, thermal stability, excellent sealing performance under varied pressure conditions, and reduced risk of drug-container interaction, which is paramount for sensitive formulations.

Driving factors propelling market growth include the global aging population leading to increased chronic disease management via injectable therapies, rapid advancements in biotechnology resulting in a richer pipeline of complex biologic drugs requiring specialized primary packaging, and the continuous expansion of immunization drives worldwide, particularly following pandemic preparedness efforts. Furthermore, strict regulatory scrutiny concerning container closure integrity (CCI) and material safety forces pharmaceutical manufacturers to prioritize certified, high-performance rubber stoppers, favoring suppliers who demonstrate robust quality management systems and contamination control protocols. Technological advancements in rubber formulations, such as the introduction of film-coated stoppers to further reduce extractables and adsorption, also contribute significantly to market dynamics.

Medical Rubber Stoppers Sales Market Executive Summary

The Medical Rubber Stoppers Sales Market is experiencing dynamic growth fueled by accelerating demand in emerging economies and persistent innovation in elastomer technology. Business trends highlight a strong shift toward high-performance, ready-to-use (RTU) and ready-to-sterilize (RTS) components, which streamline pharmaceutical manufacturing processes and reduce contamination risks. Key manufacturers are aggressively pursuing vertical integration and strategic partnerships to secure raw material supply chains (primarily high-purity butyl rubber) and to co-develop packaging solutions tailored for novel drug delivery systems, such as pen injectors and auto-injectors. Furthermore, sustainability is emerging as a critical trend, pushing manufacturers to explore environmentally friendlier sterilization methods and material compositions that maintain stringent quality requirements. The competitive landscape remains consolidated, with leading global players leveraging extensive regulatory expertise and large-scale manufacturing capacity to maintain market dominance, focusing on high-value segments like lyophilization and coated stoppers.

Regional trends indicate that North America and Europe currently represent the largest revenue generators due to mature pharmaceutical industries, significant R&D investment, and established regulatory frameworks that mandate premium primary packaging quality. However, the Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period. This surge is attributed to burgeoning healthcare infrastructure development, increasing domestic manufacturing of pharmaceuticals in countries like China and India, rising prevalence of chronic diseases, and improved access to advanced healthcare services. Latin America and the Middle East & Africa (MEA) also show promising growth, driven by expanding government initiatives to improve local vaccine production and injectable drug supply, although these regions often rely heavily on imports from established global suppliers.

Segmentation trends confirm that the Lyophilization Stoppers segment is growing robustly due to the increasing number of temperature-sensitive biologic drugs requiring freeze-drying for stability. By material, Butyl Rubber, particularly halobutyl variants (chlorobutyl and bromobutyl), remains the market leader due to its excellent gas barrier properties and chemical inertness. However, Silicone rubber is gaining traction in specialized applications like pre-filled syringes and plungers where lower friction and high-temperature tolerance are required. The key end-user segment remains Pharmaceutical & Biotechnology Companies, which demand stoppers in massive volumes for vaccine production and standard injectable vials. There is a discernible trend toward premiumization, with end-users increasingly prioritizing coated stoppers (e.g., PTFE-coated) over standard versions to mitigate leaching and adsorption issues, despite the higher initial cost.

AI Impact Analysis on Medical Rubber Stoppers Sales Market

User queries regarding the impact of Artificial Intelligence (AI) on the Medical Rubber Stoppers market primarily revolve around three central themes: enhancing quality control and inspection during manufacturing, optimizing supply chain logistics to prevent shortages, and accelerating R&D for novel, high-purity elastomer formulations. Users are concerned about how AI-driven machine vision systems can handle the high-speed inspection required for defect detection (such as micro-cracks or particulate contamination) on millions of units daily, expecting zero-defect tolerance. Furthermore, manufacturers are exploring AI’s predictive capabilities to manage complex, global supply chains that are highly susceptible to disruptions, aiming to forecast demand accurately, manage volatile raw material pricing, and ensure timely delivery of sterilized components. Expectations are high regarding AI's role in computational material science, potentially identifying new, safer polymer combinations that minimize drug-container interaction more effectively than current butyl formulations, thereby reducing the time and cost associated with formulation stability testing.

- AI-enhanced visual inspection systems utilizing deep learning algorithms improve defect detection accuracy and speed, leading to lower batch rejection rates.

- Predictive maintenance analytics powered by AI optimize manufacturing equipment uptime and consistency, critical for maintaining dimensional tolerances in high-volume production.

- AI-driven supply chain management optimizes inventory levels for volatile raw materials (e.g., high-purity butyl rubber) and provides real-time risk assessment for logistics.

- Computational Material Science accelerates the screening and development of novel, low-extractable elastomer formulations for specialized biological drugs.

- AI supports demand forecasting for global vaccine and injectable programs, allowing stopper manufacturers to scale production capacity preemptively and efficiently.

- Implementation of robotic process automation (RPA) integrated with AI assists in sterile handling and packaging processes, further reducing human intervention and contamination risks.

DRO & Impact Forces Of Medical Rubber Stoppers Sales Market

The Medical Rubber Stoppers Sales Market is shaped by significant drivers, stringent restraints, and substantial opportunities, collectively forming the key impact forces governing its expansion and structure. Primary drivers include the massive increase in injectable drug administration, driven by the global rise in chronic diseases like diabetes and cardiovascular disorders, and the continuous need for vaccination programs. The necessity for high-quality, regulatory-compliant primary packaging is a persistent driver, as regulatory bodies globally enforce stricter standards for container closure integrity (CCI) and particulate matter control. These forces push pharmaceutical companies toward premium, certified stopper solutions, guaranteeing stability and safety. However, the market faces strong restraints, notably the volatility and increasing cost of specialized raw materials, primarily high-purity butyl rubber, which depends on petrochemical supply chains. Another key restraint is the rigorous regulatory hurdle and the long lead times required for changing or validating new primary packaging components, which acts as a significant barrier to immediate innovation adoption.

Opportunities for growth are plentiful, particularly in the realm of specialized products. The burgeoning market for high-value biologics and cell & gene therapies necessitates ultra-pure, coated rubber stoppers that prevent interaction with sensitive drug substances. This opens up opportunities for manufacturers to invest in advanced coating technologies (e.g., fluoropolymer films) and offer ready-to-use (RTU) components, reducing preparation steps for end-users. Furthermore, emerging markets in APAC and Latin America present substantial untapped potential as local pharmaceutical manufacturing capabilities expand and per capita healthcare spending rises. The trend towards personalized medicine and the development of complex drug delivery devices (like wearable injectors) also creates demand for customized, technically challenging sealing solutions. Leveraging advanced manufacturing techniques, such as continuous processing and inline quality assurance, represents a critical opportunity for cost efficiency and enhanced quality.

The composite impact forces exerted on the market structure are predominantly moderate to high. The high impact of regulatory drivers ensures quality remains non-negotiable, supporting premium pricing for specialized products but simultaneously increasing compliance costs for manufacturers. The moderate to high restraint posed by raw material price fluctuations necessitates robust sourcing strategies and long-term contracts. Overall, the positive momentum generated by increasing global demand for injectable drugs and advanced vaccines is strong enough to outweigh the current supply chain and regulatory friction, ensuring steady market expansion. The high barriers to entry, driven by the need for regulatory validation and substantial capital investment in cleanroom manufacturing facilities, act as a stabilizing force, concentrating market share among established, compliant players.

Segmentation Analysis

The Medical Rubber Stoppers Sales Market is highly segmented based on material, product type, application, and end-user, reflecting the diverse and specialized requirements of the pharmaceutical industry. Segmentation by material is critical as it dictates the chemical compatibility, sealing performance, and gas barrier properties essential for drug stability. Product type segmentation distinguishes stoppers based on their functional design, such as those optimized for lyophilization (freeze-drying) versus standard serum vials. Application segmentation highlights the primary use case, whether for standard injectables, sensitive biologics, or diagnostics. This multi-layered segmentation allows suppliers to tailor their offerings precisely to the specific needs of pharmaceutical manufacturers, ensuring compliance with strict drug stability and container closure integrity mandates, thereby maximizing shelf life and patient safety across various therapeutic areas.

- By Material:

- Bromobutyl Rubber

- Chlorobutyl Rubber

- Natural Rubber/Polyisoprene

- Silicone Rubber

- Others (e.g., Synthetic Polyisoprene)

- By Product Type:

- Vial Stoppers (Serum Stoppers)

- Lyophilization Stoppers (Lyo Stoppers)

- Pre-filled Syringe Components (Plungers/Tips)

- Ampoule Stoppers

- Infusion Bottle Stoppers

- Cartridge Stoppers

- By Application:

- Vaccines

- Injectable Pharmaceuticals (Small Molecule Drugs)

- Biologics and Biosimilars

- Diagnostics

- Blood Collection and Processing

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Contract Manufacturing Organizations (CMOs)

- Compounding Pharmacies

- Research and Academic Institutions

Value Chain Analysis For Medical Rubber Stoppers Sales Market

The value chain for the Medical Rubber Stoppers market is intricate and highly specialized, beginning with the production of high-purity raw materials. Upstream analysis focuses on the petrochemical industry, which supplies the foundational polymers, primarily high-grade isobutylene, required for synthesizing butyl rubber. Key suppliers in this segment are often large chemical conglomerates that must meet stringent purity specifications for medical-grade polymers, which undergo compounding with specific curatives and additives. The quality control at the upstream level is paramount, as contaminants introduced here can compromise the final drug product integrity. Manufacturers of medical stoppers acquire these materials, process them in highly controlled cleanroom environments (often ISO Class 7 or 8), and subject them to complex molding, washing, and sterilization processes, representing the core manufacturing activity where value addition is highest through precision engineering and adherence to GMP standards.

The distribution channel involves several critical pathways, catering to the varied scale and geographic needs of end-users. Direct sales dominate the engagement with large pharmaceutical and biotechnology companies, where specialized product consultation, regulatory documentation (Drug Master Files - DMFs), and custom solutions are required. These direct channels facilitate strong technical collaboration regarding container closure integrity testing and material validation. Indirect distribution relies on specialized medical device or pharmaceutical packaging distributors, who serve smaller compounding pharmacies, research institutions, and regional CMOs, managing inventory and localized logistics. The choice between direct and indirect channels is often driven by the volume of procurement, the complexity of the component (e.g., standard serum stopper versus a specialized coated lyo stopper), and the level of required technical support.

Downstream analysis centers on the integration of these stoppers into the pharmaceutical filling and finishing process. Pharmaceutical manufacturers (the end-users) employ high-speed automated filling lines that demand zero defects in stopper dimensions and quality. Any failure in the sealing component can lead to substantial batch losses. Therefore, the downstream process heavily emphasizes quality assurance, including CCI testing post-filling. The relationship between the stopper manufacturer and the pharmaceutical company is long-term and highly interdependent, often requiring supplier change control agreements spanning years. The final downstream step involves the drug product reaching patients, underscoring the vital role of the stopper in ensuring drug efficacy and patient safety throughout the supply chain and usage lifecycle. Value chain optimization is increasingly focused on providing RTU (ready-to-use) stoppers, shifting the complex washing and sterilization processes from the pharma company back to the specialized stopper manufacturer.

Medical Rubber Stoppers Sales Market Potential Customers

The primary consumers and end-users of medical rubber stoppers are entities involved in the sterile packaging and delivery of injectable drugs and sensitive biological materials. The largest segment comprises Pharmaceutical and Biotechnology Companies, ranging from multinational corporations producing blockbuster vaccines and complex biologics to specialized firms developing advanced therapies like cell and gene products. These customers require high-volume, validated, and often customized rubber components that strictly comply with global regulatory requirements (e.g., USP, EP, JP guidelines) to ensure the stability and safety of their proprietary drug formulations. Their purchasing decisions are driven by supplier track record, regulatory compliance documentation (DMF status), quality assurance capabilities, and consistency in material properties, often leading to long-term supplier relationships that minimize the risk associated with packaging component changes.

A rapidly growing customer base includes Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs). As pharmaceutical companies increasingly outsource manufacturing and filling operations, CMOs become significant volume purchasers of rubber stoppers. CMOs require a broad portfolio of stoppers to service multiple clients and drug types, prioritizing flexibility, scalability, and fast turnaround times for customized projects. Their purchasing criteria often emphasize ready-to-use (RTU) components to reduce their own preparation time and risk. Furthermore, medical device manufacturers that produce pre-filled syringes, pen injectors, and wearable drug delivery systems represent crucial niche customers, demanding highly specific rubber components like plungers, tip caps, and sealing elements engineered for complex mechanical performance and precise dosing accuracy.

Secondary but important customer groups include diagnostic companies that utilize specialized stoppers for reagent vials and assay kits, and compounding pharmacies which require small to medium volumes of stoppers for personalized or specialized injectable preparations. Public health organizations and government vaccine procurement agencies also act as major buyers, particularly during large-scale immunization campaigns, focusing on cost-effective yet highly reliable components for vaccine vials. For all potential customers, the ultimate buying consideration transcends price; it is fundamentally centered on mitigating risk related to drug contamination, degradation, and ensuring the absolute integrity of the container closure system over the drug's intended shelf life.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | West Pharmaceutical Services, Datwyler Holding Inc., Aptar Group, Inc., Jiangsu Hualan New Pharmaceutical Material Co., Ltd., Becton Dickinson (BD), Schott AG, Helvoet Pharma (part of Datwyler), Wuxi Shunxin Medical Science and Technology Co., Ltd., Shandong Medicinal Glass Co., Ltd., Zhuhai Stoppercap Co., Ltd., SUMITOMO RUBBER INDUSTRIES, LTD., Nipro Corporation, Cardinal Health, Inc., Tekni-Plex, Inc., Franz Ziel GmbH, Laroche Industries, Saint-Gobain, J.W. Winco, Stevanato Group S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Rubber Stoppers Sales Market Key Technology Landscape

The technological evolution in the Medical Rubber Stoppers market is centered on enhancing product purity, ensuring absolute container closure integrity (CCI), and improving compatibility with increasingly sensitive drug formulations, particularly complex biologics. A crucial technology is the development and adoption of advanced polymer formulations, moving beyond traditional grey butyl towards high-ppurity, low-extractable bromobutyl and chlorobutyl rubber variants. These materials offer superior gas barrier properties and reduced interaction with drug components. Furthermore, manufacturing processes have seen significant technological upgrades, including the use of highly controlled, validated cleanroom environments and automated washing and siliconization processes that meet stringent regulatory standards like those required for RTU (Ready-to-Use) components. RTU technology is paramount as it shifts the burden of cleaning and sterilization from the pharmaceutical filler to the specialized component manufacturer, reducing operational complexity and contamination risk downstream.

Another dominant technological trend is the proliferation of surface treatment and coating technologies. The application of inert fluoropolymer films, such as PTFE (Polytetrafluoroethylene), onto the surface of rubber stoppers is critical. This coating creates a physical barrier that minimizes the potential for rubber extractables or leachables (which can compromise drug stability) to migrate into the pharmaceutical formulation, while simultaneously reducing the absorption of active drug ingredients onto the stopper surface. These coated stoppers, though more expensive, are rapidly becoming the standard for high-value injectable products, including monoclonal antibodies and gene therapies, where even minimal material interaction can have severe consequences. Continuous investment in precision mold design and computer-aided manufacturing (CAM) ensures that stoppers exhibit extremely tight dimensional tolerances, which is vital for seamless operation in high-speed, automated filling lines and for achieving reliable sealing.

Furthermore, technology related to quality assurance and inspection has seen massive transformation. The implementation of high-resolution, AI-powered machine vision systems during the final manufacturing and packaging stages allows for non-contact, 100% inspection of every stopper at high speeds, identifying microscopic defects, foreign particulates, and surface imperfections that human inspectors could miss. This technological enhancement is critical for meeting the pharmaceutical industry's zero-defect objective for primary packaging. Finally, the integration of sterilization technologies, such as validated steam and radiation sterilization cycles, is meticulously controlled and documented to provide certified sterile components, further driving value within the technology landscape by simplifying the end-user’s manufacturing pipeline and ensuring regulatory compliance across global markets.

Regional Highlights

- North America: This region holds a leading position in the Medical Rubber Stoppers market, driven by the presence of major global pharmaceutical and biotechnology hubs, high levels of R&D expenditure, and a robust regulatory environment (FDA). Demand is particularly strong for high-end products, including coated stoppers and pre-filled syringe components, supporting complex biologic drug pipelines. The U.S. remains the largest consumer, necessitating significant domestic manufacturing capacity and adherence to stringent quality standards like USP Class VI.

- Europe: Europe represents a mature and technologically advanced market, characterized by strict adherence to EMA regulations and a strong focus on quality and innovation. Countries like Germany, Switzerland, and France are key manufacturing and consumption centers. The region is seeing strong adoption of ready-to-use (RTU) components and is at the forefront of implementing new standards for container closure integrity (CCI) testing, ensuring sustained demand for premium rubber formulations.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by the rapid expansion of pharmaceutical manufacturing in China, India, and South Korea, coupled with significant public and private investment in healthcare infrastructure and vaccine production capabilities. Increasing populations and a growing prevalence of chronic diseases drive higher consumption of injectable drugs. While cost sensitivity remains a factor, the shift towards regulatory compliance is boosting demand for higher-quality, import-grade rubber stoppers.

- Latin America: This region exhibits moderate growth, driven by localized manufacturing expansions and increasing governmental focus on domestic pharmaceutical self-sufficiency, particularly concerning basic injectable medicines and vaccines. Brazil and Mexico are the dominant markets, relying on both regional production and imports. Quality consistency and competitive pricing are key determinants for market penetration in this region.

- Middle East and Africa (MEA): Growth in MEA is moderate but steady, largely concentrated in the GCC nations (Saudi Arabia, UAE) and South Africa, which are making strategic investments in biotechnology and pharmaceutical manufacturing to diversify their economies. The market heavily relies on international suppliers for specialized rubber components, though local assembly and packaging operations are slowly increasing demand for reliable, internationally certified products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Rubber Stoppers Sales Market.- West Pharmaceutical Services, Inc.

- Datwyler Holding Inc.

- Aptar Group, Inc.

- Jiangsu Hualan New Pharmaceutical Material Co., Ltd.

- Becton Dickinson (BD)

- Schott AG

- Helvoet Pharma (part of Datwyler)

- Wuxi Shunxin Medical Science and Technology Co., Ltd.

- Shandong Medicinal Glass Co., Ltd.

- Zhuhai Stoppercap Co., Ltd.

- SUMITOMO RUBBER INDUSTRIES, LTD.

- Nipro Corporation

- Cardinal Health, Inc.

- Tekni-Plex, Inc.

- Franz Ziel GmbH

- Laroche Industries

- Saint-Gobain

- J.W. Winco

- Stevanato Group S.p.A.

- Vetter Pharma International GmbH

Frequently Asked Questions

Analyze common user questions about the Medical Rubber Stoppers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What types of rubber materials are predominantly used for medical stoppers?

The most commonly used materials are high-purity halobutyl rubbers, specifically Bromobutyl and Chlorobutyl rubber, due to their excellent chemical inertness, low permeability, and superior gas barrier properties, which are essential for maintaining drug stability and product sterility over the required shelf life.

Why are coated medical rubber stoppers becoming increasingly popular in the pharmaceutical industry?

Coated stoppers, typically treated with a fluoropolymer film like PTFE, are preferred for sensitive drug formulations (e.g., biologics). The coating minimizes the leaching of rubber extractables into the drug and prevents the adsorption of active drug ingredients onto the stopper surface, thereby safeguarding drug efficacy and purity.

What is the significance of the "Ready-to-Use" (RTU) component trend in the stopper market?

RTU components are pre-washed, sterilized, and packaged to eliminate the need for pharmaceutical companies to perform complex and risk-prone cleaning and sterilization steps in-house. This streamlines manufacturing, reduces contamination risk, and saves significant operational time and cost for the end-user.

How do global regulations, such as FDA and EMA guidelines, impact the Medical Rubber Stoppers Market?

Regulations mandate strict quality control over material purity, dimensional tolerance, and testing protocols like Container Closure Integrity (CCI). Compliance is mandatory for market entry, driving demand towards established suppliers who maintain robust Quality Management Systems and comprehensive documentation, such as Drug Master Files (DMFs).

Which segment of the Medical Rubber Stoppers market is forecasted to experience the highest growth?

The Lyophilization Stoppers segment is projected to show high growth, driven by the expanding pipeline of biological and high-value drugs that require freeze-drying (lyophilization) for long-term stability. The demand for specialized lyo stoppers that can handle the process environment while ensuring integrity post-sealing is rapidly increasing globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager