Medical Vacuum Regulator Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443268 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Medical Vacuum Regulator Market Size

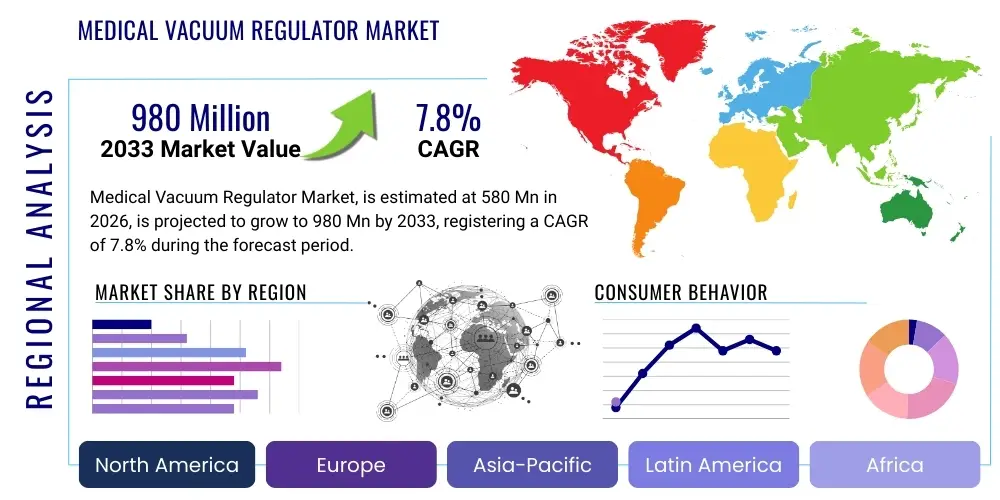

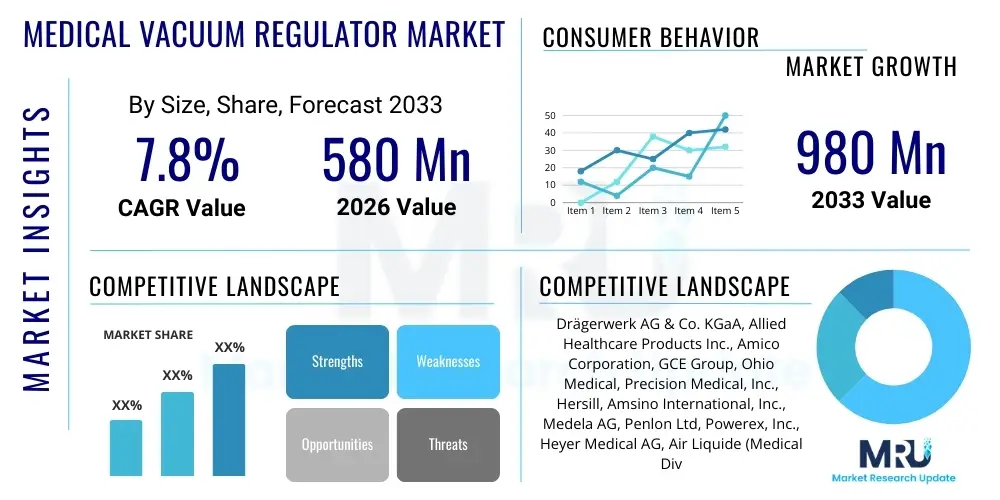

The Medical Vacuum Regulator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $580 Million in 2026 and is projected to reach $980 Million by the end of the forecast period in 2033. This consistent expansion is predominantly driven by the increasing number of surgical procedures performed globally, coupled with stringent regulatory requirements emphasizing patient safety and precise fluid management in clinical settings. Furthermore, the rising investment in healthcare infrastructure, particularly in emerging economies, is fueling the adoption of high-quality medical gas systems, where vacuum regulators play a critical, non-negotiable role in ensuring controlled suction and drainage, essential for various medical therapies and interventions.

Medical Vacuum Regulator Market introduction

The Medical Vacuum Regulator Market encompasses devices essential for controlling the suction pressure delivered by a central vacuum system to patients, crucial for procedures like aspiration, drainage, and surgical site management. These devices ensure that the negative pressure applied is precisely regulated, preventing tissue damage and optimizing therapeutic efficacy across various clinical environments, including operating rooms, intensive care units (ICUs), and emergency departments. Modern regulators feature enhanced safety mechanisms, digital displays, and modular designs, aligning with evolving clinical needs for improved infection control and streamlined workflow. They are indispensable components of medical gas delivery systems, guaranteeing the safe removal of fluids and gases from the patient body or operative field during critical care and surgical interventions.

Key applications of medical vacuum regulators span numerous medical disciplines, notably in thoracic surgery, general surgery, obstetrics, and respiratory care. Their primary function is to maintain constant, predefined vacuum levels necessary for removing blood, mucus, surgical smoke, and other bodily fluids. The market benefits significantly from the global rise in chronic respiratory diseases requiring pulmonary hygiene, the increasing volume of complex surgeries that depend on reliable fluid management, and the continuous push towards portable and user-friendly medical equipment, which necessitates lightweight and robust regulator designs. These drivers collectively contribute to the sustained demand across both acute care settings and long-term care facilities.

The core benefits associated with advanced vacuum regulators include superior patient safety through accurate pressure control, reduced risk of cross-contamination due to disposable components and stringent hygiene designs, and improved operational efficiency for clinical staff. Driving factors include mandatory compliance with international standards such as ISO 10079-3, technological innovations integrating electronic pressure monitoring and alarms, and the expansion of ambulatory surgical centers (ASCs) which require compact, high-performance equipment. The transition towards smart hospitals necessitates regulators capable of integrating seamlessly into centralized monitoring systems, further accelerating market maturity and sophistication in product offerings.

Medical Vacuum Regulator Market Executive Summary

The Medical Vacuum Regulator Market is experiencing robust growth fueled by several prevailing business trends, including the increasing consolidation of medical device manufacturing, the emphasis on regulatory compliance related to fluid management systems, and the accelerated demand for high-flow and high-precision regulators in critical care settings. Key industry players are focusing heavily on developing regulators with enhanced safety features, such as audible and visual alarms for pressure deviations, and implementing antimicrobial materials to mitigate hospital-acquired infections (HAIs). Furthermore, strategic partnerships between manufacturers and distributors are crucial for penetrating developing markets, allowing for wider adoption of sophisticated vacuum control technologies necessary for modern healthcare delivery, thereby ensuring optimized operational performance and adherence to evolving clinical protocols.

Regional trends highlight North America and Europe as dominant markets, primarily due to well-established healthcare infrastructure, high healthcare expenditure, and the early adoption of advanced medical technologies. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, driven by significant government investments in upgrading public healthcare systems, the rapidly expanding patient pool requiring surgical and critical care, and the rising prevalence of chronic illnesses necessitating prolonged suction therapy. Latin America and the Middle East and Africa (MEA) are also showing promising trajectories, motivated by the expansion of private hospitals and the gradual tightening of medical equipment safety standards, which mandates the use of reliable vacuum regulators in new and renovated facilities.

In terms of segment trends, the Continuous Vacuum Regulator segment maintains the largest market share, essential for ongoing suction tasks in operating rooms and ICUs, although the Intermittent Vacuum Regulator segment is gaining traction for specific procedures requiring periodic suction cycles, offering improved clinical versatility. By end-user, Hospitals remain the largest consumer segment, given their capacity for high-volume surgeries and critical care delivery. Nevertheless, the Ambulatory Surgical Centers (ASCs) segment is forecast to be the fastest-growing, reflecting the global shift towards outpatient procedures and minimally invasive surgical techniques, demanding portable and highly efficient vacuum regulation solutions. Technological advancement is concentrating on digital integration for remote monitoring and predictive maintenance capabilities.

AI Impact Analysis on Medical Vacuum Regulator Market

User queries regarding the impact of Artificial Intelligence (AI) on the Medical Vacuum Regulator Market primarily revolve around how AI can enhance precision, predict maintenance failures, and automate monitoring processes in critical care. Users are keen to understand if AI integration will lead to smarter, self-adjusting regulators capable of optimizing suction pressure based on real-time patient physiological data, thereby reducing the risk of complications such as pulmonary barotrauma or inadequate fluid removal. Key themes include the implementation of predictive analytics for system reliability, automated pressure anomaly detection, and the role of AI in improving compliance reporting and quality control during complex surgical procedures. The general expectation is that AI will transform vacuum regulation from a passive mechanical process into an active, data-driven system, ensuring unparalleled safety and operational efficiency within integrated hospital systems.

The direct impact of AI on the regulator hardware itself remains limited, as the core functionality is mechanical and gas-pressure dependent. However, AI significantly influences the peripheral systems and data management capabilities connected to these regulators. For instance, AI algorithms can analyze historical vacuum usage patterns across different hospital units, predicting peak demand periods and potential system bottlenecks, thus ensuring consistent supply and preemptive maintenance scheduling for the central vacuum plant and peripheral regulators. Furthermore, AI-driven monitoring systems can correlate vacuum pressure logs with patient clinical outcomes stored in Electronic Health Records (EHRs), identifying optimal suction parameters for specific patient demographics or surgical types, thereby driving evidence-based protocol refinement and improving overall clinical effectiveness.

The integration of AI also addresses growing concerns about device interoperability and cybersecurity in medical gas systems. AI platforms can function as an intelligent layer, standardizing communication protocols between the vacuum regulator’s digital output and the central Hospital Information System (HIS), flagging any inconsistencies or potential cyber threats attempting to compromise networked medical devices. This intelligence leads to highly robust operational performance, enabling healthcare providers to manage vast fleets of regulators efficiently across large facilities. Moreover, machine learning can personalize training for clinical staff by simulating different failure scenarios or complex procedures where precise vacuum control is paramount, fostering competence and minimizing human error in critical environments.

- AI enables predictive maintenance, reducing regulator downtime and ensuring system reliability through anomaly detection.

- Machine learning algorithms optimize suction pressure settings based on real-time patient data and surgical context.

- AI facilitates automated compliance reporting and logging of vacuum parameters for regulatory audits.

- Intelligent monitoring systems enhance patient safety by immediately flagging pressure deviations via networked alarms.

- Integration via AI platforms ensures seamless data transfer between regulators and Hospital Information Systems (HIS/EHRs).

- AI contributes to personalized clinical protocols by analyzing the efficacy of specific vacuum regimes on patient recovery.

DRO & Impact Forces Of Medical Vacuum Regulator Market

The dynamic landscape of the Medical Vacuum Regulator Market is shaped by a confluence of powerful drivers, stringent restraints, emerging opportunities, and significant impact forces. The primary drivers include the escalating global volume of surgical procedures, particularly in orthopedics, cardiology, and gastroenterology, which inherently require sophisticated and reliable fluid management systems. Another crucial driver is the increasing global geriatric population, which is more susceptible to chronic obstructive pulmonary diseases (COPD) and other respiratory ailments, necessitating prolonged aspiration and suction therapies. Furthermore, continuous governmental and regulatory pressure across North America and Europe to upgrade existing healthcare infrastructure and comply with evolving safety standards for medical gas systems acts as a constant impetus for new installations and replacement cycles of high-quality regulators.

Conversely, the market faces notable restraints that temper its growth trajectory. The high initial cost associated with advanced digital vacuum regulators and complex centralized vacuum systems poses a significant barrier to entry, especially for smaller hospitals and clinics in developing nations. Furthermore, the inherent risk of device contamination and the challenge of maintaining rigorous sterilization protocols for reusable components present ongoing operational hurdles and potential restraints on market expansion, despite the push towards single-use disposables in certain segments. Additionally, the fragmented nature of regulatory approval processes across diverse geographic regions complicates global market entry and standardization efforts for manufacturers, demanding substantial resource allocation for regulatory compliance across multiple jurisdictions, thereby slowing product rollout.

Significant opportunities abound, particularly in the realm of technological advancement and regional expansion. The rising trend toward home healthcare and remote patient monitoring creates a niche opportunity for developing compact, portable, and extremely reliable vacuum regulators suitable for non-clinical settings, potentially expanding the market footprint beyond traditional hospital environments. Moreover, manufacturers have a strong opportunity in integrating smart features, such as IoT connectivity and remote diagnostic capabilities, into regulators to cater to the burgeoning smart hospital segment seeking seamless equipment management and data integration. The untapped potential of emerging markets, specifically in Sub-Saharan Africa and Southeast Asia, driven by rapid urbanization and infrastructural development, offers long-term, high-growth revenue streams, provided local accessibility and affordability challenges can be effectively addressed through localized manufacturing and distribution strategies.

The key impact forces currently shaping the market include strict adherence to ISO 10079-3 standards, which dictate the technical specifications and performance requirements for medical suction equipment, exerting continuous pressure on manufacturers for quality assurance and design innovation. Economic volatility and geopolitical instability affect global supply chains, increasing the cost of raw materials and complex electronic components necessary for advanced digital regulators. Moreover, the increasing focus on sustainable healthcare practices is forcing manufacturers to consider the life cycle assessment of their products, favoring materials and designs that minimize environmental impact without compromising safety or functionality, thereby aligning market production with global ecological responsibilities and institutional sustainability mandates.

Segmentation Analysis

The Medical Vacuum Regulator Market is primarily segmented based on product type, technology, application, and end-user, reflecting the diverse clinical needs and operational environments utilizing these essential devices. Analyzing these segments provides a granular view of market dynamics, revealing where specific technological investments are yielding the highest returns and identifying burgeoning consumer bases. The segmentation by product type delineates between continuous and intermittent regulators, directly corresponding to the clinical requirement for constant suction versus cycles of suction and release, influencing device complexity and pricing. Understanding this segmentation is critical for manufacturers to tailor their portfolio to meet specialized medical demands, ensuring appropriate pressure control across a spectrum of procedures from basic drainage to complex surgical aspiration, thus maximizing clinical utility and market penetration.

Further analysis of the technology segment highlights the contrast between traditional analog (mechanical) regulators and modern digital (electronic) regulators. While analog systems remain prevalent due to their ruggedness and simplicity, the digital segment is experiencing accelerated growth driven by the need for high-precision, integrated monitoring, and the ability to interface with centralized hospital systems. Digital regulators offer superior accuracy, enabling fine-tuning of vacuum levels and providing real-time data logging crucial for critical care documentation and patient safety audits, positioning them as the future standard. The application segmentation, which includes segments like surgical procedures, respiratory management, and emergency medicine, dictates the volume and complexity of regulators required by different hospital departments, offering strategic direction for targeted marketing efforts based on procedural requirements.

The end-user segmentation clearly outlines the primary consumers: Hospitals, Ambulatory Surgical Centers (ASCs), Diagnostic Laboratories, and Home Care Settings. Hospitals dominate the market volume due to their comprehensive service offerings and high patient throughput, requiring a massive installed base of regulators in ICUs, operating theaters, and general wards. However, the fastest growth is observed in ASCs and Home Care settings, reflecting the decentralized trend in healthcare delivery. ASCs demand compact, high-performance, and reliable units for outpatient surgeries, while home care requires user-friendly, lightweight, and durable portable devices for chronic respiratory management, indicating a fundamental shift in where and how vacuum regulation is deployed across the healthcare continuum.

- By Product Type:

- Continuous Vacuum Regulators

- Intermittent Vacuum Regulators

- Continuous/Intermittent Vacuum Regulators (Combo Units)

- By Technology:

- Analog/Mechanical Regulators

- Digital/Electronic Regulators

- By Application:

- Surgical Procedures (General, Thoracic, Neuro)

- Respiratory Therapy and Management

- Emergency and Trauma Care

- Wound Drainage and Aspiration

- Anesthesia Delivery Systems

- By End-User:

- Hospitals (Public & Private)

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics and Diagnostic Centers

- Home Care Settings and Long-Term Care Facilities

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Mexico)

- Middle East & Africa (MEA)

Value Chain Analysis For Medical Vacuum Regulator Market

The Value Chain Analysis for the Medical Vacuum Regulator Market begins with upstream activities, focusing on the sourcing of critical raw materials and components, which include precision-engineered metals (e.g., brass, stainless steel), high-grade medical plastics (polysulfone, polycarbonate), and highly sensitive pressure sensing components and gauges. Upstream efficiency is fundamentally tied to supplier relationship management and quality control, as the performance and longevity of the final product depend heavily on the accuracy and durability of internal valves, diaphragms, and connection fittings. Regulatory compliance, specifically regarding material biocompatibility and sterilization resilience, is paramount at this stage, requiring rigorous testing and certification before integration into the manufacturing process, defining the initial cost structure and quality baseline for the medical device.

Midstream processes involve sophisticated manufacturing, assembly, and rigorous quality assurance testing, where core competencies lie in precision machining and cleanroom assembly to ensure zero contamination and maximal calibration accuracy. This stage includes designing user interfaces (analog gauges or digital displays), integrating safety features (e.g., overflow protection, shut-off valves), and securing necessary regulatory approvals (FDA, CE marking) which add significant value and market credibility. Direct and indirect distribution channels then move the finished product downstream. Direct channels often involve key opinion leader (KOL) engagement and direct sales teams targeting large hospital groups and government contracts, facilitating customized solutions and specialized training. Indirect channels, utilizing national and regional medical equipment distributors, are crucial for reaching smaller clinics, ASCs, and international markets, requiring strong logistics and inventory management capabilities.

Downstream activities focus on post-sale services, including installation, calibration, preventive maintenance, repair, and ongoing clinical education for end-users. The lifecycle management of medical gas equipment, particularly vacuum regulators which are frequently used and susceptible to wear, significantly impacts customer retention and long-term profitability. Furthermore, the handling of direct and indirect distribution channels necessitates distinct strategic approaches. Direct distribution ensures greater control over pricing and customer feedback loops, vital for product improvement, while indirect distribution offers broad geographic reach and scale, often leveraging established local infrastructure. Successful market participants optimize this entire chain by establishing vertical integration where possible, ensuring high-quality control from raw material to patient bedside, and offering comprehensive service contracts that extend product lifespan and enhance overall customer value.

Medical Vacuum Regulator Market Potential Customers

The primary and most substantial category of potential customers for medical vacuum regulators consists of large healthcare institutions, specifically public and private hospitals, including acute care facilities, specialized trauma centers, and tertiary referral centers. These environments represent high-volume end-users due to their requirement for centralized medical gas systems supplying numerous patient points across operating rooms, intensive care units (ICUs), neonatal intensive care units (NICUs), and recovery wards. Hospitals require a diverse portfolio of regulators, ranging from high-flow surgical models to highly sensitive, low-flow models for pediatric and neonatal applications. The purchasing decisions in this segment are heavily influenced by regulatory compliance, long-term durability, integration capability with existing hospital infrastructure, and total cost of ownership, making standardization and bulk purchasing contracts key determinants of market penetration.

A rapidly expanding customer segment includes Ambulatory Surgical Centers (ASCs) and specialized outpatient clinics. Driven by the shift towards less invasive procedures and cost containment strategies, ASCs require compact, highly reliable, and easily movable vacuum regulators that can support quick turnaround times and flexible procedural setups. While their individual purchase volume may be lower than that of major hospitals, the sheer increase in the number of ASCs globally makes them a critical growth area. These customers prioritize equipment portability, ease of cleaning and sterilization, and simplified operation, often favoring digital regulators that offer enhanced precision and minimal maintenance requirements, enabling efficient operation outside the traditional large hospital ecosystem.

The third significant customer segment encompasses Home Care settings and Long-Term Care Facilities (LTCFs). This segment is growing substantially due to the aging population and the increasing need for continuous respiratory support and chronic wound care management outside of acute settings. Customers in the home care segment require robust, lightweight, and extremely user-friendly portable vacuum regulators, often battery-operated, designed for ease of use by non-professional caregivers or patients themselves. Manufacturers targeting this niche must emphasize safety features, reliability, quiet operation, and affordability. Furthermore, diagnostic laboratories and emergency medical services (EMS) providers, requiring reliable suction for sample collection and on-site patient stabilization, represent specialized, smaller but highly critical end-users that prioritize instantaneous readiness and extreme ruggedness in their vacuum regulation equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580 Million |

| Market Forecast in 2033 | $980 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Drägerwerk AG & Co. KGaA, Allied Healthcare Products Inc., Amico Corporation, GCE Group, Ohio Medical, Precision Medical, Inc., Hersill, Amsino International, Inc., Medela AG, Penlon Ltd, Powerex, Inc., Heyer Medical AG, Air Liquide (Medical Division), Medicop, Inc., Shanghai Bojin Medical Instrument Co., Ltd., Flow-Tech, Ltd., GaleMed Corporation, Genstar Technologies Co., Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Vacuum Regulator Market Key Technology Landscape

The technological landscape of the Medical Vacuum Regulator Market is rapidly evolving, driven primarily by the need for enhanced precision, improved patient safety, and seamless integration into modern hospital infrastructure. A key technological trend is the transition from purely mechanical (analog) regulators to advanced digital regulators incorporating microprocessors and electronic sensing. These digital systems offer significantly higher accuracy in pressure setting and monitoring, crucial for delicate procedures like neurosurgery or neonatal aspiration, where even minor pressure variations can have serious clinical consequences. Furthermore, digital models often include features such as touch-screen interfaces, automated self-testing capabilities, and integrated data logging to facilitate compliance with stringent clinical documentation requirements, drastically reducing manual charting errors and improving workflow efficiency for clinical staff, particularly in high-stress environments like the ICU.

Another significant technological advancement centers around safety and infection control. Manufacturers are heavily investing in design innovations that incorporate antimicrobial materials on frequently touched surfaces and employ robust overflow protection mechanisms to prevent fluid backflow into the central vacuum system, a major source of contamination and potential system damage. Furthermore, the development of high-flow regulators capable of handling large volumes of aspirated material efficiently while maintaining precise control is critical for complex surgical applications. The focus on modular and disposable components, particularly canister assemblies and bacterial filters, is aimed at simplifying cross-contamination prevention protocols and minimizing the maintenance burden on hospital engineering teams, thereby supporting better infection management standards.

The emerging technological front involves the integration of connectivity and IoT capabilities. Modern regulators are increasingly equipped with wireless communication modules (e.g., Wi-Fi or Bluetooth) allowing them to connect directly to the hospital’s patient monitoring network and asset management systems. This connectivity enables remote monitoring of pressure settings, alerts staff to potential leaks or system failures in real-time, and facilitates predictive maintenance scheduling based on usage data. This digital transformation supports the 'Smart Hospital' concept, optimizing the utilization and maintenance of the vacuum infrastructure while providing a continuous stream of operational data necessary for quality improvement initiatives and regulatory compliance reporting, marking a fundamental shift toward data-driven clinical utility and systemic reliability.

Regional Highlights

- North America: North America, led by the United States, commands the largest share of the Medical Vacuum Regulator Market revenue. This dominance is attributable to the region's highly advanced healthcare system, substantial healthcare expenditure, mandatory adherence to rigorous safety standards (such as NFPA 99 for medical gas systems), and the high prevalence of complex surgical procedures. The market here is characterized by early adoption of premium digital regulators and a strong demand for innovative solutions in ASCs and trauma centers. The presence of major market players and robust R&D activities also solidify its leading position. The emphasis on device connectivity and integration with EHR systems is particularly pronounced in this mature market.

- Europe: Europe represents a significant market segment, driven by excellent healthcare infrastructure in Western European countries (Germany, France, UK), universal healthcare coverage, and strict compliance with the Medical Device Regulation (MDR) and ISO standards. The demand is robust for high-quality, durable equipment, often favoring European manufacturers. While growth rates might be lower than in APAC, the market is stable and characterized by consistent replacement demand and continuous infrastructure upgrade projects in hospitals, particularly focusing on energy-efficient and compliant medical gas systems across the region, spurred by public investment in healthcare modernization.

- Asia Pacific (APAC): The APAC region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This exponential growth is fueled by massive government investments in expanding healthcare access, the rapid construction of new hospitals and clinics in populous nations like China and India, and the rising awareness regarding standardized medical equipment usage. Although cost sensitivity remains a factor, the increasing volume of surgeries and the growing medical tourism sector are driving demand for mid-range to high-end regulators. Market penetration strategies in APAC often involve local manufacturing partnerships to overcome distribution hurdles and comply with localized regulatory requirements, ensuring affordability and accessibility in diverse socioeconomic environments.

- Latin America (LATAM): The LATAM market exhibits steady growth, primarily focused in Brazil and Mexico, driven by the expansion of private healthcare facilities and gradual improvements in public sector infrastructure. The market demand centers around reliable, cost-effective regulators. While regulatory standards are evolving, the increased incidence of trauma and respiratory illnesses contributes to a sustained need for dependable suction devices. Economic stability plays a critical role in capital expenditure for healthcare equipment in this region.

- Middle East & Africa (MEA): The MEA region presents a niche market opportunity, particularly in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) which are investing heavily in world-class medical cities and specialized healthcare services. The demand is typically for high-end regulators matching Western standards due to high healthcare spending power. In contrast, the African continent’s market is highly price-sensitive, with growth being contingent upon international aid and infrastructural projects, leading to a mixed demand for rugged, basic analog regulators alongside sophisticated digital systems in highly urbanized centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Vacuum Regulator Market.- Drägerwerk AG & Co. KGaA

- Allied Healthcare Products Inc.

- Amico Corporation

- GCE Group

- Ohio Medical

- Precision Medical, Inc.

- Hersill

- Amsino International, Inc.

- Medela AG

- Penlon Ltd

- Powerex, Inc.

- Heyer Medical AG

- Air Liquide (Medical Division)

- Medicop, Inc.

- Shanghai Bojin Medical Instrument Co., Ltd.

- Flow-Tech, Ltd.

- GaleMed Corporation

- Genstar Technologies Co., Inc.

- Zoll Medical Corporation

- ATMOS MedizinTechnik GmbH & Co. KG

Frequently Asked Questions

Analyze common user questions about the Medical Vacuum Regulator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Medical Vacuum Regulator Market?

The market growth is fundamentally driven by the escalating number of complex surgical procedures globally, requiring precise fluid management and aspiration; the rising prevalence of chronic respiratory diseases necessitating suction therapy; continuous technological advancements leading to safer, more precise digital regulators; and stringent regulatory mandates requiring hospitals to maintain high standards for medical gas system safety and performance, spurring equipment replacement cycles.

How do analog regulators compare to digital regulators in terms of clinical application and cost?

Analog (mechanical) regulators are typically lower in initial cost, highly durable, and favored for general ward suction or non-critical, high-volume applications where extreme precision is not mandatory. Digital (electronic) regulators, conversely, are significantly higher in cost but offer superior precision, integrated monitoring, data logging capabilities, and connectivity, making them essential for critical care, neonatal units, and specialized surgical settings where minute pressure control and comprehensive documentation are vital for optimal patient outcomes and regulatory compliance.

Which end-user segment is projected to show the fastest growth rate in the market forecast?

The Ambulatory Surgical Centers (ASCs) and the Home Care Settings segments are collectively projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is a result of the decentralized trend in healthcare delivery, increased focus on outpatient procedures for cost efficiency, and the growing requirement for portable, user-friendly, and high-performance suction equipment suitable for non-hospital environments, moving critical care services closer to the patient.

What role does ISO 10079-3 play in the Medical Vacuum Regulator Market?

ISO 10079-3 is a critical international standard that specifies the performance and safety requirements for suction equipment used in medical applications, including vacuum regulators. Adherence to this standard is mandatory in most mature markets, serving as a non-negotiable benchmark for product quality, operational safety, and reliability. Compliance ensures that regulators provide consistent, accurately measured vacuum pressure, safeguarding both the patient and the integrity of the hospital’s central vacuum system, thereby influencing design, manufacturing processes, and global trade viability.

How is connectivity technology impacting the next generation of medical vacuum regulators?

Connectivity, leveraging technologies like IoT and Wi-Fi, is transforming regulators into 'smart' networked devices. This allows for real-time remote monitoring of pressure settings and usage, facilitating predictive maintenance to minimize downtime, enhancing asset tracking, and enabling automated logging of operational data directly into the Hospital Information System (HIS). This integration improves overall workflow, reduces the risk of human error in manual checks, and supports centralized fleet management for large hospital systems, optimizing the clinical and operational performance of the entire medical gas infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager