Medicinal Bromobutyl Rubber Stoppers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442898 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Medicinal Bromobutyl Rubber Stoppers Market Size

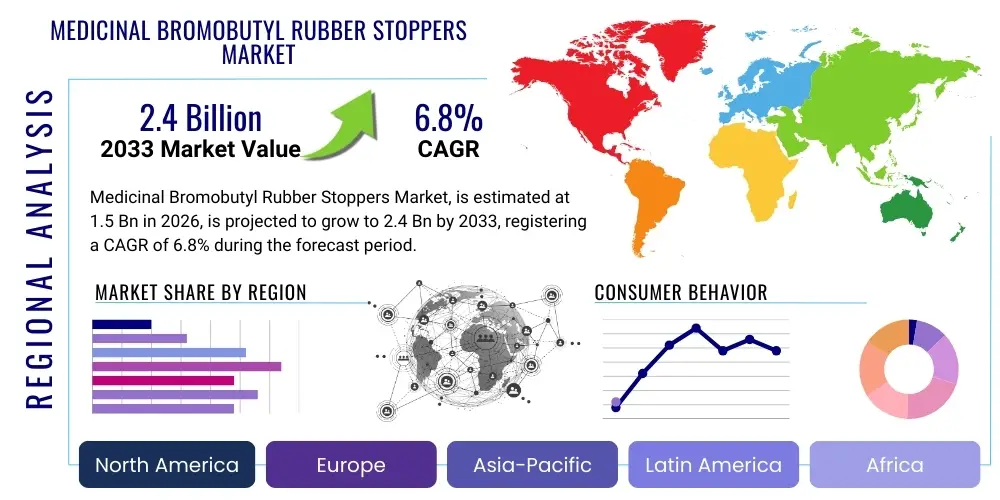

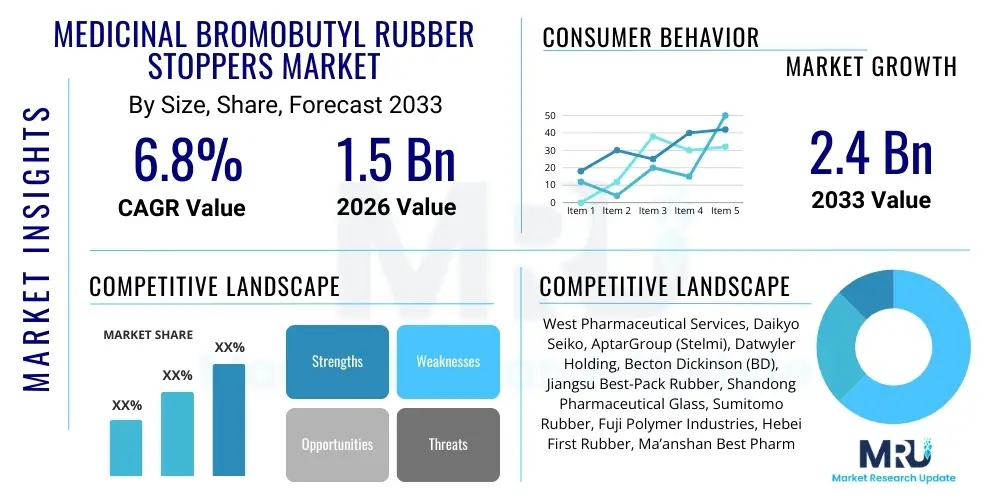

The Medicinal Bromobutyl Rubber Stoppers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the escalating demand for injectable drugs, including vaccines and complex biologics, which necessitate high-barrier primary packaging solutions to maintain product integrity and sterility. The stringent regulatory requirements set forth by major pharmacopeias (USP, EP, JP) for materials used in parenteral drug delivery systems further cement bromobutyl rubber as the preferred elastomer due to its low extractables profile and superior chemical resistance.

Market expansion is also intrinsically linked to the global growth in chronic disease management requiring long-term injectable therapies. As pharmaceutical manufacturing standards continue to evolve toward zero-defect components, suppliers of bromobutyl rubber stoppers are investing heavily in advanced molding technologies and certified cleanroom manufacturing environments (ISO 7 and ISO 8). The emphasis on reducing leachables and extractables is paramount, making high-purity bromobutyl formulations essential for sensitive drug products, thereby commanding premium pricing and sustaining market value growth over the forecast horizon. Emerging markets, characterized by improving healthcare infrastructure and increased access to vaccines, are expected to provide significant growth impetus, complementing the established markets of North America and Europe.

Medicinal Bromobutyl Rubber Stoppers Market introduction

The Medicinal Bromobutyl Rubber Stoppers Market encompasses the manufacturing, distribution, and utilization of highly specialized elastomer components used as closures for vials, cartridges, and syringes containing injectable pharmaceutical products. Bromobutyl rubber (BIIR) is favored in this application over natural rubber or chlorobutyl rubber due to its exceptional impermeability to gases, excellent resistance to heat and chemicals, and low interaction potential with drug formulations. These stoppers are critical components in primary packaging, ensuring the sterile integrity and shelf stability of sensitive drug products, including vaccines, oncology treatments, and advanced biological therapies.

The product is typically manufactured through high-precision compression or injection molding, followed by rigorous washing, siliconization, and sterilization processes to meet pharmaceutical compliance standards. Major applications include sealing sterile vials for lyophilized drugs and liquid injectables, acting as plunger stoppers in pre-filled syringes, and serving as components in intravenous (IV) delivery systems. The primary benefits derived from using bromobutyl stoppers include prolonged drug potency, enhanced patient safety through contamination prevention, and compliance with global regulatory standards like FDA and EMA guidelines. Driving factors for market growth include the robust pipeline of new biologic drugs, the global push for vaccination programs, and the increasing preference for ready-to-use pre-filled syringe formats which utilize specialized plunger stoppers.

Medicinal Bromobutyl Rubber Stoppers Market Executive Summary

The Medicinal Bromobutyl Rubber Stoppers Market is characterized by stable demand driven by mandatory pharmaceutical packaging requirements and rapid technological advancements aimed at minimizing particulate matter and ensuring container closure integrity (CCI). Business trends show consolidation among major rubber component manufacturers acquiring smaller specialized players to expand geographical reach and technology portfolios, particularly in high-precision molding and coating techniques such as Teflon or fluoropolymer coatings to further reduce extractables. Regional trends indicate mature markets like North America and Europe prioritizing high-quality, high-cost coated stoppers, while the Asia Pacific region exhibits the fastest growth due to expanding domestic pharmaceutical production and increased adoption of international quality standards, especially in China and India.

Segment trends highlight the dominance of Vial Stoppers in terms of volume, primarily serving multi-dose liquid injectables and lyophilized products. However, the Pre-filled Syringe Stopper segment is anticipated to register the highest growth rate, propelled by the convenience, accuracy, and reduced risk of contamination associated with self-administration of injectable therapies. Segmentation by material type shows Bromobutyl Rubber commanding the majority share due to its superior barrier properties compared to chlorobutyl alternatives. Furthermore, the rising adoption of ready-to-sterilize (RTS) and ready-to-use (RTU) stoppers is streamlining pharmaceutical manufacturing processes, driving demand for premium, pre-processed components, thereby influencing pricing and procurement strategies across the industry.

AI Impact Analysis on Medicinal Bromobutyl Rubber Stoppers Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the Medicinal Bromobutyl Rubber Stoppers Market primarily center on enhancing quality control, optimizing supply chain logistics, and predicting material performance variability. Users frequently question how AI algorithms can detect minute defects in rubber components—a critical safety concern—and how predictive analytics can manage the volatile sourcing and pricing of raw materials (isobutylene and isoprene). Furthermore, there is significant interest in utilizing machine learning for optimizing the complex vulcanization and molding processes, ensuring consistency in batches, and reducing waste in high-volume, high-precision manufacturing environments. Key user concerns revolve around the integration cost of AI-driven inspection systems and the standardization of data collection necessary for effective model training in a highly regulated industry.

The primary impact of AI adoption is expected to revolutionize the manufacturing quality assurance lifecycle. AI-powered vision systems, leveraging deep learning for defect recognition, are capable of identifying flaws invisible to traditional human or rule-based automated inspection systems, drastically lowering the acceptable quality limit (AQL) and ensuring higher product safety. Secondly, AI is being deployed in supply chain management to forecast demand fluctuations more accurately, especially crucial for vaccine production cycles, enabling manufacturers to manage buffer stocks of specialized bromobutyl formulations efficiently. This transition minimizes material waste and ensures compliance traceability throughout the production process, thereby enhancing operational efficiency and bolstering regulatory confidence in the final product.

- AI-driven visual inspection systems enhance defect detection precision, reducing AQL levels significantly.

- Predictive maintenance schedules for molding equipment, minimizing unplanned downtime and ensuring process stability.

- Machine learning optimization of compounding formulations and vulcanization cycles for enhanced batch consistency.

- Supply chain predictive analytics to manage raw material volatility and inventory levels effectively.

- Data analytics platforms tracking real-time performance of stoppers during drug stability studies.

- Automated compliance monitoring using Natural Language Processing (NLP) to track regulatory updates relevant to elastomer materials.

DRO & Impact Forces Of Medicinal Bromobutyl Rubber Stoppers Market

The Medicinal Bromobutyl Rubber Stoppers Market is significantly influenced by a confluence of accelerating drivers, stringent restraints, and substantial opportunities, all shaped by underlying impact forces derived from the pharmaceutical and regulatory environment. The primary driver is the global increase in chronic and infectious diseases, necessitating the continuous development and mass production of injectable pharmaceuticals, including sophisticated biologics and novel gene therapies that require the utmost primary packaging integrity. This is compounded by the demographic shift toward aging populations globally, which consume more injectable medications. Conversely, the market faces significant restraints, chiefly the volatile cost and limited supply chain resilience of petroleum-derived bromobutyl raw materials, alongside the extremely high capital expenditure required for establishing and maintaining cGMP-compliant (Current Good Manufacturing Practice) cleanroom production facilities, which poses a barrier to new entrants.

Opportunities for growth are concentrated in the rapid adoption of specialized coatings (e.g., fluoropolymer laminated stoppers) designed to achieve ultra-low extractables and eliminate silicone usage, catering to highly sensitive protein drugs. Furthermore, the growing trend toward self-administration of drugs and the consequent rise of pre-filled syringes and auto-injectors create a sustained high-demand niche for specialized plunger stoppers and needle shields. The dominant impact force shaping this market is regulatory stringency; global pharmacopeias continually update standards for leachables, extractables, particulate matter, and container closure integrity testing, compelling manufacturers to invest perpetually in quality improvements and advanced processing technologies. This regulatory pressure acts as both a barrier and a driver, favoring established companies capable of meeting these high-cost compliance mandates.

Segmentation Analysis

The Medicinal Bromobutyl Rubber Stoppers Market segmentation provides a granular view of demand across various product types, applications, and material specifications, reflecting the diversity of pharmaceutical packaging needs globally. The market is primarily segmented by Product Type (Vial Stoppers, Plunger Stoppers/Syringe Components, Bottle Stoppers), by Application (Vaccines, Antibiotics, Biologics, General Injectables), by Material Grade (Standard Bromobutyl, Coated/Laminated Bromobutyl), and by Processability (Ready-to-Use (RTU), Ready-to-Sterilize (RTS)). This detailed segmentation allows manufacturers to target specific, high-growth sub-segments, particularly those associated with sensitive biologic drugs that require premium, coated components to prevent protein aggregation or interaction.

The analysis reveals distinct pricing and volume dynamics across these segments. Vial stoppers remain the volume leader due to their ubiquitous use in traditional pharmaceutical manufacturing. However, the application segmentation highlights that the Biologics and Vaccine segments command higher Average Selling Prices (ASPs) for stoppers due to the critical nature and high value of the drugs they contain, demanding the highest quality, low-extractable bromobutyl grades, often featuring advanced coatings. Geographically, segmentation remains vital, with specific regulatory preferences and market maturity dictating the material grade and processing format (RTU vs. RTS) favored in regions like North America versus Asia Pacific.

- Product Type

- Vial Stoppers (Lyophilization Stoppers, Injection Stoppers)

- Plunger Stoppers/Syringe Components (For Prefilled Syringes, Cartridges)

- Bottle Stoppers (For Infusions and Large Volume Parenterals)

- Application

- Vaccines

- Biologics and Biosimilars

- Oncology

- Antibiotics and General Injectables

- Emergency and Critical Care Drugs

- Material Grade

- Standard Bromobutyl (Non-Coated)

- Coated Bromobutyl (e.g., Fluoropolymer/Teflon Coated)

- Processing Format

- Ready-to-Use (RTU)

- Ready-to-Sterilize (RTS)

Value Chain Analysis For Medicinal Bromobutyl Rubber Stoppers Market

The value chain for medicinal bromobutyl rubber stoppers is complex and highly specialized, beginning with the upstream supply of synthetic elastomers and compounding ingredients, progressing through high-precision manufacturing, and culminating in distribution to pharmaceutical companies. Upstream analysis involves the procurement of highly pure bromobutyl rubber, often sourced from a limited number of specialized petrochemical companies. Manufacturers must also secure specialized fillers, vulcanizing agents, and coatings. The control over raw material quality and consistency at this stage is crucial, as any variability directly impacts the stopper’s performance characteristics, such as extractables profile and barrier properties. The bargaining power of raw material suppliers is moderately high due to the specialty nature of medical-grade elastomers.

The midstream focuses on the manufacturing process, which includes compounding, molding (compression or injection), washing, siliconization/coating, and subsequent inspection and packaging in certified cleanroom environments. This stage adds the most significant value, relying heavily on technological expertise, validated processes, and capital investment in advanced machinery capable of high-tolerance manufacturing. Downstream analysis involves the distribution channel, which is typically characterized by direct sales relationships between the stopper manufacturer and the pharmaceutical or biotechnology company (the end-user). Given the critical nature of these components, long-term supply agreements and stringent quality documentation are standard practices, requiring robust logistics management that ensures product sterility and integrity during transit.

Distribution channels in this market are predominantly direct, necessitated by the highly regulated nature of the product and the need for detailed technical support and validation documentation. Indirect channels, involving specialized pharmaceutical distributors, may be utilized in smaller, regional markets or for generalized injectable products, but the preference remains for direct interaction to maintain full control over quality and supply chain integrity. The critical need for supplier qualification and audits by regulatory bodies further reinforces the reliance on direct sales, ensuring that quality assurance protocols are meticulously followed from the elastomer manufacturer’s facility directly to the drug filling line.

Medicinal Bromobutyl Rubber Stoppers Market Potential Customers

Potential customers for medicinal bromobutyl rubber stoppers are predominantly organizations operating within the pharmaceutical and biotechnology sectors that manufacture injectable medications, vaccines, and diagnostic agents. This includes multinational pharmaceutical giants producing large volumes of traditional and biologic drugs, mid-sized biotech firms specializing in niche, high-value therapies such as gene therapies, and contract manufacturing organizations (CMOs) that provide filling and finishing services for drug developers. Given the stopper's function as a critical primary packaging component, procurement decisions are influenced not only by cost but primarily by regulatory compliance, material compatibility with the drug formulation, and proven reliability regarding container closure integrity (CCI) over the product's lifespan.

Vaccine manufacturers represent a persistently high-volume customer segment, driven by global immunization programs and pandemic preparedness initiatives, demanding vast quantities of stoppers that meet strict requirements for long-term stability in refrigerated conditions. Furthermore, customers include specialized sterile compounding pharmacies that prepare patient-specific injectable medications, though their volume requirements are smaller, their demand for certified, high-purity components remains critical. The shift toward specialized high-value customers, such as biologics producers, drives the demand for premium, coated bromobutyl stoppers, reflecting a willingness to invest more in packaging to safeguard sensitive and expensive drug formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | West Pharmaceutical Services, Daikyo Seiko, AptarGroup (Stelmi), Datwyler Holding, Becton Dickinson (BD), Jiangsu Best-Pack Rubber, Shandong Pharmaceutical Glass, Sumitomo Rubber, Fuji Polymer Industries, Hebei First Rubber, Ma’anshan Best Pharm, Saint-Gobain, Tekni-Plex, Nipro Corporation, AR Flanges & Sealing Technology, Hubei Huaqiang, Changyi Enseal Technology, JSR Corporation, Asahi Kasei Corporation, Shin-Etsu Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medicinal Bromobutyl Rubber Stoppers Market Key Technology Landscape

The technological landscape within the medicinal bromobutyl rubber stoppers market is defined by innovations focused primarily on material purity, manufacturing precision, and surface modification to minimize drug interaction. A fundamental technology is the advanced compounding process, which ensures homogeneous mixing of the bromobutyl polymer with curing agents and fillers under highly controlled conditions to achieve specific physical properties like elasticity, barrier function, and reduced tendency for particulate shedding. Manufacturers are increasingly utilizing sophisticated analytical techniques, such as Fourier-transform infrared spectroscopy (FTIR) and Gas Chromatography-Mass Spectrometry (GC-MS), to validate batch consistency and confirm ultra-low levels of volatile organic compounds (VOCs) and extractable materials, thereby meeting the increasingly rigorous demands of regulatory bodies like the USP <1663> and <1664> chapters.

Another pivotal technological area involves high-precision molding and automated finishing. The shift from traditional compression molding to high-speed, multi-cavity injection molding allows for tighter dimensional tolerances, essential for high-speed filling lines and ensuring reliable container closure integrity (CCI). Subsequent post-molding treatment includes plasma treatment and specialized washing cycles utilizing WFI (Water for Injection) to remove surface contaminants and particulate matter. The adoption of Ready-to-Use (RTU) components is a key trend; this involves advanced washing, terminal sterilization (usually with irradiation or steam), and packaging in sealed, validated cleanroom bags, significantly reducing the preparation steps required by pharmaceutical manufacturers and lowering the risk of contamination during the filling process.

The most transformative technology in recent years is the application of surface coatings, such as fluoropolymer lamination (e.g., ethylene-tetrafluoroethylene or ETFE film). These coatings create an inert barrier between the bromobutyl elastomer and the drug product, virtually eliminating leachables and preventing adsorption of sensitive drug components onto the rubber surface. This is particularly crucial for complex biologic drugs and sensitive vaccines. Furthermore, AI-integrated optical inspection systems are rapidly becoming standard, employing high-resolution cameras and machine learning algorithms to detect micro-defects (e.g., flash, fissures, surface irregularities) with superior speed and accuracy compared to human inspectors, solidifying the push toward zero-defect manufacturing standards.

Regional Highlights

- North America: This region holds a leading market share due to the presence of major pharmaceutical and biotechnology hubs, high investment in R&D for novel drug delivery systems, and stringent adherence to FDA regulatory standards. The demand here is heavily skewed toward premium, coated bromobutyl stoppers used in high-value biologics and specialized therapies. Continuous innovation in pre-filled syringe technologies further drives the market for specialized plunger components.

- Europe: Europe represents a mature market, characterized by strong regulatory compliance enforced by the EMA and a large established pharmaceutical manufacturing base, particularly in Germany, Switzerland, and France. There is high utilization of both RTU and RTS stoppers, driven by the robust vaccine production sector and the manufacturing of essential generics. Market growth is steady, emphasizing quality and sustainability in material sourcing and production processes.

- Asia Pacific (APAC): APAC is the fastest-growing region, propelled by expanding healthcare access, increasing government expenditure on public health, and the rapid development of domestic pharmaceutical manufacturing capabilities, particularly in China and India. While price sensitivity remains a factor, the escalating adoption of international quality standards (USP/EP) and rising foreign direct investment in local pharmaceutical production are rapidly shifting demand toward high-quality bromobutyl stoppers, overtaking generic rubber alternatives.

- Latin America (LATAM): The LATAM market is growing steadily, supported by regional efforts to expand local vaccine production and improve primary healthcare infrastructure. Market adoption often follows global trends but at a slower pace. The main drivers include essential drug manufacturing and increasing imports of finished high-quality pharmaceutical components, primarily focused on vial stoppers for general injectables and antibiotics.

- Middle East and Africa (MEA): Growth in the MEA region is moderate, primarily concentrated in Gulf Cooperation Council (GCC) countries investing heavily in developing self-sufficient pharmaceutical industries. The demand is often met through imports of validated components from Europe and North America. Local manufacturing efforts are gradually increasing, demanding bromobutyl stoppers that meet global compliance standards for stability in hot and varied climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medicinal Bromobutyl Rubber Stoppers Market.- West Pharmaceutical Services

- Daikyo Seiko

- AptarGroup (Stelmi)

- Datwyler Holding

- Becton Dickinson (BD)

- Jiangsu Best-Pack Rubber

- Shandong Pharmaceutical Glass

- Sumitomo Rubber

- Fuji Polymer Industries

- Hebei First Rubber

- Ma’anshan Best Pharm

- Saint-Gobain

- Tekni-Plex

- Nipro Corporation

- AR Flanges & Sealing Technology

- Hubei Huaqiang

- Changyi Enseal Technology

- JSR Corporation

- Asahi Kasei Corporation

- Shin-Etsu Chemical

Frequently Asked Questions

Analyze common user questions about the Medicinal Bromobutyl Rubber Stoppers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of bromobutyl rubber over other elastomers in medicinal applications?

Bromobutyl rubber offers superior gas impermeability and a low level of extractables and leachables compared to chlorobutyl or natural rubber. This inertness is critical for maintaining the stability, efficacy, and sterility of sensitive injectable drug formulations, particularly biologics and vaccines.

How do regulatory requirements impact the manufacturing of medicinal rubber stoppers?

Regulatory bodies (e.g., FDA, EMA, USP) mandate stringent controls over material composition, cleanroom processing (cGMP), and container closure integrity (CCI) testing. These requirements necessitate high capital investment in certified facilities, continuous quality validation, and detailed documentation, acting as a high barrier to entry.

What is the difference between Ready-to-Use (RTU) and Ready-to-Sterilize (RTS) bromobutyl stoppers?

RTU stoppers are pre-washed, siliconized (optional), and sterilized (often via radiation or steam) and packaged in sealed bags, ready for immediate use on the filling line. RTS stoppers require the pharmaceutical customer to perform the final washing and sterilization steps before use.

Which application segment drives the highest market value for bromobutyl stoppers?

The Biologics and Vaccine application segments drive the highest market value. These high-value drugs require premium, often coated, bromobutyl stoppers to minimize material interaction and ensure long-term stability, commanding higher prices per unit compared to general injectable stoppers.

How is AI transforming quality control within stopper manufacturing?

AI is used in advanced visual inspection systems to identify microscopic defects and particulate matter with higher precision and speed than conventional methods. This ensures adherence to near-zero defect standards, improving overall product safety and manufacturing efficiency.

This extensive report analyzes the critical components driving the Medicinal Bromobutyl Rubber Stoppers Market, projecting growth from 2026 to 2033. Key drivers include global vaccination initiatives, the rise of chronic disease management using injectable drugs, and the indispensable need for superior primary packaging materials that ensure drug stability and patient safety. Bromobutyl rubber’s inert properties and high barrier function make it the material of choice for sealing sensitive pharmaceutical products like biologics and vaccines. The market structure is highly influenced by rigorous regulatory standards set by global pharmacopeias, leading to technological advancements in low-extractable coatings and high-precision manufacturing processes, including advanced compression and injection molding techniques. Segment analysis indicates that while vial stoppers maintain volume dominance, the pre-filled syringe component segment, particularly plunger stoppers, is seeing accelerated growth due to the convenience and safety offered by self-administration systems. Regional market dynamics show North America and Europe leading in adopting premium, coated (fluoropolymer laminated) stoppers for high-value therapies, whereas the Asia Pacific region is demonstrating the highest growth velocity, fueled by expanding domestic pharmaceutical production and increasing quality compliance. The value chain highlights the critical role of specialized raw material sourcing and the necessity of direct distribution channels to maintain strict quality control and regulatory traceability. Key market players are investing in automation, AI-driven quality assurance systems, and sophisticated cleanroom technology to meet the demanding specifications of the pharmaceutical industry. The future growth hinges on continuous innovation in material science, focusing on eliminating potential extractables and achieving validated container closure integrity for the next generation of complex therapeutic agents. The forecast underscores a persistent, stable demand trajectory, reinforced by mandatory packaging requirements and the non-substitutable nature of high-quality bromobutyl elastomers in parenteral drug delivery.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager