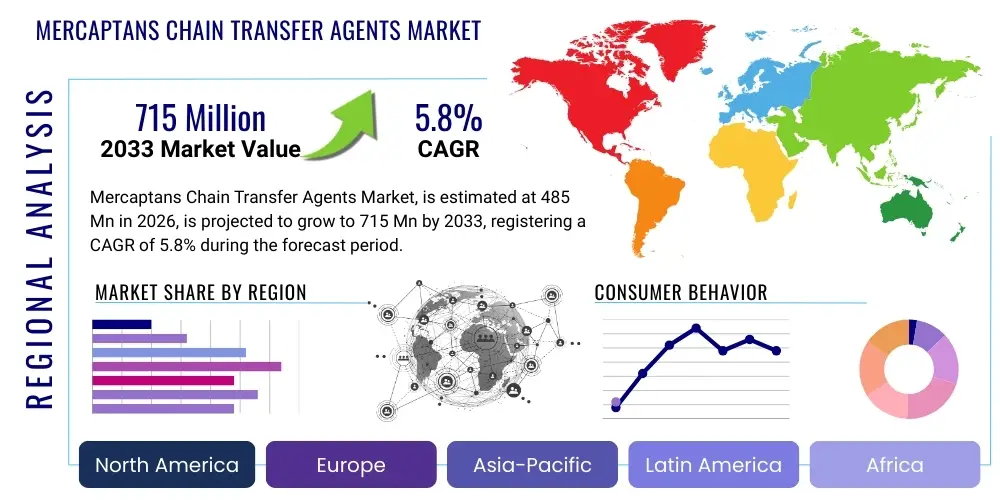

Mercaptans Chain Transfer Agents Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441388 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Mercaptans Chain Transfer Agents Market Size

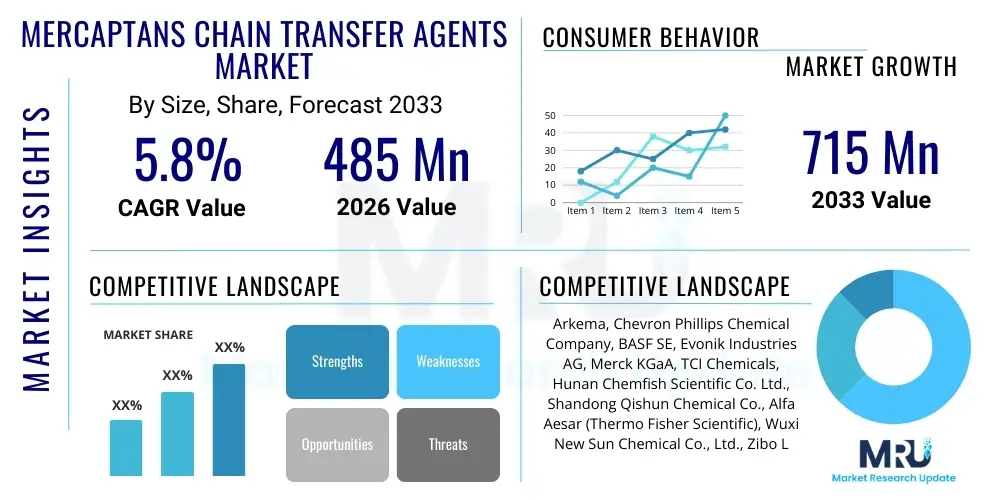

The Mercaptans Chain Transfer Agents Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 485 Million in 2026 and is projected to reach USD 715 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the escalating global demand for high-performance specialty polymers and the stringent requirement for precise molecular weight control in polymerization processes, particularly in applications such as coatings, adhesives, and advanced synthetic rubbers. Market maturation in developed regions is offset by rapid industrialization and expansion of chemical manufacturing capabilities across Asia Pacific economies.

Mercaptans Chain Transfer Agents Market introduction

Mercaptans, serving primarily as highly effective Chain Transfer Agents (CTAs), are indispensable chemical compounds utilized extensively across the polymer and chemical manufacturing sectors to regulate the degree of polymerization. These agents function by intercepting active free radicals during the polymerization reaction, thereby controlling the final molecular weight, molecular weight distribution, and the resulting physical properties of the synthesized polymers. Key mercaptans used include n-Dodecyl Mercaptan (n-DDM), Thioglycolic Acid (TGA), and various alkyl mercaptans, each selected based on the specific reactivity required for monomers such as styrene, acrylates, and vinyl acetate.

The product's essential role lies in its ability to fine-tune polymer specifications, which is critical for end-user industries demanding highly specific material characteristics, such as viscosity in coatings or elasticity in elastomers. Major applications span the production of polymers and resins used in automotive components, construction materials, and consumer goods. Furthermore, specialized grades of mercaptans are employed in the synthesis of pharmaceuticals and agrochemicals, acting as intermediates or catalysts, underscoring their cross-industry significance and value proposition.

Driving factors for market expansion include the pervasive trend toward high-solids and waterborne coating formulations, which often require precise polymer architecture for optimum performance and compliance with environmental regulations. Additionally, continuous innovation in controlled radical polymerization techniques, such as Reversible Addition-Fragmentation Chain-Transfer (RAFT) polymerization, where mercaptans derivatives play a pivotal role, is further stimulating demand. The market is also capitalizing on the growing pharmaceutical sector’s need for high-purity chemical auxiliaries in complex synthesis pathways.

Mercaptans Chain Transfer Agents Market Executive Summary

The Mercaptans Chain Transfer Agents market is characterized by moderate consolidation among large chemical manufacturers who leverage vertical integration to maintain supply chain stability and quality control. Current business trends indicate a strong shift towards bio-based and low-odor mercaptan derivatives, driven by increasingly strict occupational safety standards and environmental mandates, particularly in North America and Western Europe. Strategic collaborations focusing on sustainable production methods and maximizing yield efficiency are becoming commonplace, allowing companies to mitigate the impact of fluctuating crude oil derivative prices, which are key raw materials for many mercaptans.

Regional dynamics highlight the Asia Pacific (APAC) region as the primary engine of market growth, attributed to the rapid expansion of polymerization facilities, particularly in China and India, catering to massive domestic infrastructure and manufacturing needs. While APAC leads in consumption volume, North America and Europe maintain dominance in terms of technological innovation and adoption of premium, specialized mercaptan agents used in high-end specialty chemical manufacturing and advanced pharmaceutical synthesis. Regulatory clarity regarding the safe handling and disposal of sulfur-containing compounds remains a differentiating factor across regions, influencing local market strategies.

Segmentation trends reveal that n-Dodecyl Mercaptan (n-DDM) and related tertiary mercaptans continue to hold significant market share due to their broad applicability in general-purpose polymer manufacturing, including PVC and acrylics. However, the Thioglycolic Acid (TGA) segment is exhibiting the fastest growth, propelled by its utility in personal care products and specific polymerization processes where water solubility is required. The polymers and resins application segment remains the largest consumer, but demand from the fine chemicals and pharmaceutical sectors is rising at an accelerated pace, emphasizing a growing focus on high-value, niche applications.

AI Impact Analysis on Mercaptans Chain Transfer Agents Market

Common inquiries regarding AI's influence center on whether artificial intelligence can optimize reaction conditions to minimize CTA usage, predict polymer quality based on initial reactant ratios, and automate complex synthesis pathways involving mercaptans. Users are keenly interested in how machine learning algorithms can enhance R&D efficiency, particularly in simulating chain transfer kinetics and designing novel CTA structures with improved transfer efficiency and reduced byproduct formation. The general expectation is that AI will primarily serve as a powerful predictive tool, minimizing laboratory trial-and-error, improving consistency, and potentially lowering operational costs associated with polymer manufacturing processes reliant on precise CTA dosing.

The primary impact of AI adoption will be realized in process optimization and quality assurance within polymerization reactors. AI-driven predictive modeling can analyze multivariate data streams—including temperature, pressure, CTA concentration, and monomer conversion rate—in real-time to adjust dosing dynamically. This capability minimizes excessive mercaptan use, which is critical for cost management and reducing potential residual odors in final products. Furthermore, AI facilitates the rapid screening of potential chain transfer agents and their reactivity parameters, significantly accelerating the development cycle for new polymer grades tailored to emerging market needs, such as specialized medical device materials or advanced composite matrices.

Long-term implications suggest that AI could revolutionize the design of polymerization infrastructure. By employing digital twins and sophisticated simulation software, manufacturers can model the effects of different mercaptan types and concentrations under various operating conditions before physical implementation. This leads to more efficient reactor design, reduced energy consumption during synthesis, and a standardized approach to quality control that is less reliant on manual laboratory testing. However, the successful integration of AI requires significant investment in advanced sensors, data infrastructure, and specialized computational chemistry expertise.

- AI optimizes CTA dosing in real-time polymerization, enhancing cost efficiency and product consistency.

- Machine learning algorithms accelerate R&D by predicting transfer constants and polymer properties based on reactant selection.

- Predictive maintenance schedules for polymerization reactors are improved by AI analysis of chemical stress and material fatigue, influenced by CTA introduction.

- AI facilitates the creation of high-throughput virtual screening platforms for novel, environmentally friendly mercaptan derivatives.

- Data analytics driven by AI enhance supply chain risk management, forecasting potential disruptions in sulfur-based raw material sourcing.

- Digital twins of manufacturing plants leverage AI to simulate changes in chain transfer agent efficacy under varied operating parameters.

- Automated quality control systems use pattern recognition to detect deviations in molecular weight distribution caused by slight variances in CTA introduction.

DRO & Impact Forces Of Mercaptans Chain Transfer Agents Market

The Mercaptans Chain Transfer Agents market is strongly influenced by a combination of robust growth drivers, inherent industry restraints, and significant opportunities that collectively shape its trajectory. The primary driver is the accelerating global production of synthetic rubber and specialized polymers (e.g., polyacrylates, styrene-butadiene rubber (SBR)) critical for the burgeoning automotive, construction, and electronics sectors. The restraint is predominantly centered on the volatility of raw material costs, particularly the prices of sulfur and crude oil derivatives, which directly impact the manufacturing economics of mercaptans. Opportunities reside in the push towards sustainable chemistry and the development of high-purity mercaptan grades suitable for sensitive applications like biomedical polymers.

Impact forces dictate the competitive landscape and market responsiveness. Technological advancements in polymerization techniques, such as emulsion polymerization and controlled radical polymerization (CRP), exert a high impact force, compelling manufacturers to develop advanced CTAs with narrower molecular weight distribution capabilities. Environmental regulations represent another critical impact force; strict emission standards and demands for low-odor products necessitate investment in purification technologies and alternative bio-based feedstock sources. The substitution threat from non-mercaptan CTAs (e.g., thiols, disulfides, and some metal complexes) is a persistent moderate force, though mercaptans generally maintain superior efficacy and cost-effectiveness in standard polymerization processes.

The market faces operational challenges, where the strong, characteristic odor of many mercaptans necessitates specialized handling, storage, and transportation protocols, contributing to higher logistics costs (a moderate restraint). Conversely, the opportunity to enter high-margin niche markets, such as functionalized polymers for 3D printing or high-performance elastomers for aerospace, provides a strong incentive for diversification and focused R&D spending. Successful navigation of these forces requires continuous operational excellence, strategic raw material hedging, and focused innovation on performance and sustainability attributes.

Segmentation Analysis

The Mercaptans Chain Transfer Agents market is comprehensively segmented based on product type, application, and end-use industry, reflecting the diverse requirements across the global chemical landscape. Product segmentation differentiates based on chemical structure and function, including key commercial agents such as Thioglycolic Acid (TGA), n-Dodecyl Mercaptan (n-DDM), and various proprietary grades of alkyl and polyfunctional mercaptans. Application segmentation highlights the direct use cases, with polymers and resins representing the largest volume demand, while pharmaceutical synthesis and fine chemical production command higher value due to stringent purity requirements.

Analysis of product segments indicates that n-DDM remains fundamental to large-scale commodity polymer production, utilized heavily in the manufacturing of emulsion polymers for coatings and adhesives due to its excellent chain transfer efficiency. However, the growth rate is increasingly being driven by specialized segments. TGA and its derivatives are gaining momentum, not only in the polymerization sector but also in the personal care industry where its reducing properties are valued. The increasing demand for low-odor alternatives and functionalized mercaptans capable of introducing specific end-groups onto polymer chains is reshaping the competitive dynamics within product categories.

The end-use industry segmentation confirms the market's deep linkage to the macroeconomic performance of global manufacturing sectors. Plastics, coatings, and adhesives collectively represent the largest consumption block, directly tied to housing starts, automotive production, and general industrial output. The fastest growing end-use segments, however, include the pharmaceutical and agrochemical industries, where mercaptans are used as precise building blocks or reaction modifiers. This shift necessitates higher quality standards, greater regulatory compliance, and robust technical support from CTA suppliers.

- By Product Type:

- n-Dodecyl Mercaptan (n-DDM)

- Tertiary Dodecyl Mercaptan (t-DDM)

- Thioglycolic Acid (TGA) and Esters

- Methyl Mercaptan (Methanethiol)

- Ethyl Mercaptan (Ethanethiol)

- Isooctyl Thioglycolate

- Other Alkyl Mercaptans (e.g., Butyl Mercaptan)

- By Application:

- Polymerization and Resins Production

- Fine Chemical Synthesis

- Pharmaceutical Intermediates

- Agrochemicals and Pesticides

- Personal Care and Cosmetics (TGA derivatives)

- Flotation Agents and Mining Chemicals

- By End-Use Industry:

- Plastics and Polymers (e.g., PVC, Acrylics, SBR)

- Coatings and Paints

- Adhesives and Sealants

- Rubber and Elastomers

- Healthcare and Pharmaceutical

- Textiles and Leather

- Oil & Gas (Corrosion Inhibitors)

Value Chain Analysis For Mercaptans Chain Transfer Agents Market

The value chain for Mercaptans Chain Transfer Agents begins with the upstream acquisition and processing of basic raw materials, primarily sulfur, natural gas, and various petroleum feedstocks. Sulfur is typically converted into hydrogen sulfide, which then reacts with olefins or alcohols derived from the petrochemical industry to yield the specific mercaptan product. This upstream segment is capital-intensive and subject to commodity price fluctuations, making vertical integration an attractive strategy for major producers seeking cost advantages and supply security. Specialized technology and rigorous safety protocols are paramount at this initial stage due to the hazardous nature of intermediate materials.

Midstream activities encompass the precise chemical synthesis, purification, functionalization, and formulation of the chain transfer agents. Quality control is a critical determinant of value, especially for high-purity grades destined for the pharmaceutical or specialty electronics markets. Manufacturing efficiency, particularly minimizing byproduct formation and energy consumption, is key to maintaining competitive pricing. Distribution channels, forming the crucial link between production and end-use, involve both direct sales to large polymer manufacturers and indirect sales through specialized chemical distributors who provide inventory management and technical support to smaller consumers across diverse geographical regions.

Downstream analysis focuses on the end-user application within polymerization reactors. The performance of a CTA directly impacts the value-added properties of the final polymer (e.g., molecular weight, processing characteristics). Direct distribution channels are favored by large-scale polymer producers, enabling tailored technical service and bulk delivery. Indirect distribution via specialized chemical traders is common for regional or small-volume buyers, particularly in emerging markets. The value generated at this stage is measured by the ability of the CTA to enable the production of consistent, high-specification polymers that meet stringent industry standards, thereby facilitating the rapid commercialization of innovative materials across automotive, construction, and consumer goods sectors.

Mercaptans Chain Transfer Agents Market Potential Customers

The primary purchasers and end-users of Mercaptans Chain Transfer Agents are large-scale chemical conglomerates and specialty polymer manufacturers that require precise control over the molecular characteristics of their products. These customers utilize CTAs as essential reaction auxiliaries in bulk polymerization processes, including solution, suspension, and emulsion polymerization methods. Specifically, potential customers include global producers of acrylic resins, polyvinyl chloride (PVC), styrene-butadiene rubber (SBR), and various other elastomers and thermosetting polymers. Their purchasing decisions are critically influenced by CTA efficiency, consistency, and compliance with health and safety standards.

Beyond bulk polymer manufacturers, a high-value customer segment exists within the pharmaceutical and fine chemical synthesis industries. These buyers require ultra-high purity grades of mercaptans, often TGA and its derivatives, to act as complex intermediates or protecting groups in multi-step organic synthesis. These customers place a premium on certification, traceability, and batch-to-batch consistency, as the quality of the CTA directly impacts the yield and regulatory approval of their final drug products or specialty chemicals. This segment demands specialized packaging and stringent analytical documentation, distinguishing them from commodity purchasers.

Furthermore, specialized industrial customers include manufacturers of high-performance coatings, adhesives, and sealants, particularly those focusing on waterborne and solvent-free formulations where precise polymer architecture is paramount for adhesion and durability. The oil and gas industry also represents a steady customer base, utilizing specific mercaptans as intermediates for corrosion inhibitors or in flotation processes. The diverse requirements necessitate a market strategy that offers both bulk commodity pricing for industrial applications and customized, high-purity solutions for niche, technologically demanding sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 485 Million |

| Market Forecast in 2033 | USD 715 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arkema, Chevron Phillips Chemical Company, BASF SE, Evonik Industries AG, Merck KGaA, TCI Chemicals, Hunan Chemfish Scientific Co. Ltd., Shandong Qishun Chemical Co., Alfa Aesar (Thermo Fisher Scientific), Wuxi New Sun Chemical Co., Ltd., Zibo Luhong Chemical Co., Ltd., Jining Xingyuan Chemical Co., Ltd., Changzhou Dahua Chemical Co., Ltd., Toronto Research Chemicals Inc., Loba Chemie Pvt. Ltd., Tokyo Chemical Industry Co., Ltd. (TCI), Qingdao Jinhao Chemical Co., Ltd., Jiangsu Liyang Chemical Co., Ltd., Shanghai Chemdo Trading Co., Ltd., Spectrum Chemical Manufacturing Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mercaptans Chain Transfer Agents Market Key Technology Landscape

The manufacturing and application of Mercaptans Chain Transfer Agents are underpinned by established chemical synthesis routes, primarily relying on the reaction of hydrogen sulfide with corresponding olefins or alcohols. However, continuous technological improvements are focusing heavily on enhancing product purity, optimizing synthesis yield, and mitigating environmental impact. A key technological focus area is the development of continuous flow reactors for mercaptan production, which offers better control over exothermic reactions, improved safety profiles, and higher purity outputs compared to traditional batch processes. Furthermore, advanced distillation and filtration techniques are continuously being refined to reduce impurities and lower the residual odor characteristic of these compounds, meeting stringent customer demands in high-end applications.

In the application space, technological advancements in polymerization are driving the demand for specialized CTAs. The widespread adoption of Controlled Radical Polymerization (CRP) techniques, such as RAFT (Reversible Addition-Fragmentation Chain-Transfer), relies on the use of highly specific dithioester or trithiocarbonate derivatives, which are often synthesized using mercaptans as precursors. Manufacturers are investing heavily in the technology to produce these complex CTA derivatives with extremely narrow polydispersity indices (PDI), which is essential for creating advanced materials like block copolymers and macromonomers used in drug delivery and microelectronics. This technological shift is pushing CTA suppliers toward more complex synthetic capabilities.

The emphasis on green chemistry is another significant force shaping the technology landscape. Research is ongoing into the use of non-petroleum-based feedstock to synthesize bio-mercaptans, potentially reducing the reliance on volatile fossil fuels and improving the overall environmental footprint. Additionally, catalyst development for the production of mercaptans, focusing on highly selective and recyclable heterogeneous catalysts, aims to increase atom economy and decrease waste generation. These technological innovations are crucial for sustaining long-term market competitiveness and complying with evolving global sustainability goals, especially in Europe and North America.

Regional Highlights

The regional consumption of Mercaptans Chain Transfer Agents is highly correlated with the maturity and scale of the chemical manufacturing and end-use industries in each geographical area. Asia Pacific (APAC) stands out as the dominant region, commanding the largest market share in terms of volume and exhibiting the highest growth rate globally. This dominance is fundamentally fueled by substantial investments in infrastructure development, rapid urbanization, and the region's position as a global manufacturing hub for automotive, construction, and electronics components, all of which rely heavily on polymer-based materials requiring CTAs for quality control.

North America and Europe represent mature, high-value markets characterized by slower volume growth but higher adoption rates of premium and specialized CTA grades. These regions prioritize innovation in environmentally compliant chemistry, driving demand for low-odor, high-purity, and bio-based mercaptan derivatives. Strict regulatory frameworks, particularly REACH in Europe, necessitate robust product stewardship and traceability, influencing supplier selection and favoring established global manufacturers with strong regulatory compliance records. The healthcare and pharmaceutical sectors in these regions are key consumers of ultra-high-purity mercaptans, providing high-margin opportunities.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging regions experiencing moderate growth. LATAM's growth is tied to the expansion of its domestic manufacturing and infrastructure projects, particularly in Brazil and Mexico. MEA's market expansion is primarily linked to the growth of its downstream petrochemical processing capabilities and regional construction activities. While these regions currently exhibit lower per capita consumption compared to APAC, their ongoing industrialization efforts suggest significant long-term potential for increased CTA demand, especially for commodity polymer applications.

- Asia Pacific (APAC): Leads in market volume and growth due to high rates of polymer production (China, India) for construction and automotive industries. Focus on capacity expansion and cost efficiency.

- North America: Strong demand for specialized, high-purity mercaptans driven by advanced pharmaceutical and specialty polymer applications. Emphasis on environmental compliance and low-odor formulations.

- Europe: Characterized by stringent regulatory adherence (REACH) and a focus on sustainability and bio-based CTA solutions. Significant consumption in high-end coatings and fine chemicals.

- Latin America (LATAM): Moderate growth driven by regional industrialization and construction activities, primarily seeking cost-effective commodity-grade CTAs.

- Middle East and Africa (MEA): Growth stimulated by new petrochemical production capacities and large infrastructure projects, leading to increased localized polymer manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mercaptans Chain Transfer Agents Market.- Arkema

- Chevron Phillips Chemical Company

- BASF SE

- Evonik Industries AG

- Merck KGaA

- TCI Chemicals

- Hunan Chemfish Scientific Co. Ltd.

- Shandong Qishun Chemical Co.

- Alfa Aesar (Thermo Fisher Scientific)

- Wuxi New Sun Chemical Co., Ltd.

- Zibo Luhong Chemical Co., Ltd.

- Jining Xingyuan Chemical Co., Ltd.

- Changzhou Dahua Chemical Co., Ltd.

- Toronto Research Chemicals Inc.

- Loba Chemie Pvt. Ltd.

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Qingdao Jinhao Chemical Co., Ltd.

- Jiangsu Liyang Chemical Co., Ltd.

- Shanghai Chemdo Trading Co., Ltd.

- Spectrum Chemical Manufacturing Corp.

Frequently Asked Questions

Analyze common user questions about the Mercaptans Chain Transfer Agents market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Mercaptan Chain Transfer Agent in polymerization?

The primary function of a Mercaptan Chain Transfer Agent (CTA) is to precisely control the molecular weight and molecular weight distribution (polydispersity) of polymers synthesized via free radical polymerization. CTAs act by reacting with growing polymer radicals, terminating the active chain and initiating a new one, thereby limiting chain length and ensuring material consistency crucial for end-use performance characteristics.

Which product type of mercaptan CTA holds the largest market share and why?

n-Dodecyl Mercaptan (n-DDM) traditionally holds the largest volume market share. This is due to its high efficiency, cost-effectiveness, and broad applicability in large-scale industrial processes, particularly in the production of high-volume commodity polymers such as acrylics, styrene-butadiene rubber (SBR), and various emulsion polymers used in coatings and adhesives across the globe.

How do environmental regulations impact the Mercaptans CTA market?

Environmental regulations, particularly concerning odor and volatile organic compounds (VOCs), drive market innovation towards low-odor and bio-based mercaptan alternatives, such as functionalized thiols or bio-derived TGA. Regulations also increase operational costs related to specialized handling, storage, and waste management for sulfur-containing compounds, pushing manufacturers toward cleaner production technologies.

What is the role of mercaptans in advanced polymerization techniques like RAFT?

In controlled radical polymerization (CRP) techniques like RAFT (Reversible Addition-Fragmentation Chain-Transfer), mercaptans are often used as crucial chemical intermediates to synthesize the primary RAFT agents (dithioesters or trithiocarbonates). These specialized derivatives enable the synthesis of highly tailored polymers, block copolymers, and telechelic polymers with precise molecular architectures necessary for advanced material science applications.

Which end-use industry is expected to show the fastest growth rate for CTA consumption?

The pharmaceutical and specialty fine chemicals industries are projected to exhibit the fastest growth rate in value terms. This acceleration is driven by the increasing complexity of drug synthesis pathways and the demand for ultra-high-purity mercaptans to serve as essential building blocks or intermediates, where product integrity and stringent regulatory compliance necessitate premium-grade CTAs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager