Mercaptoethanol Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443128 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Mercaptoethanol Market Size

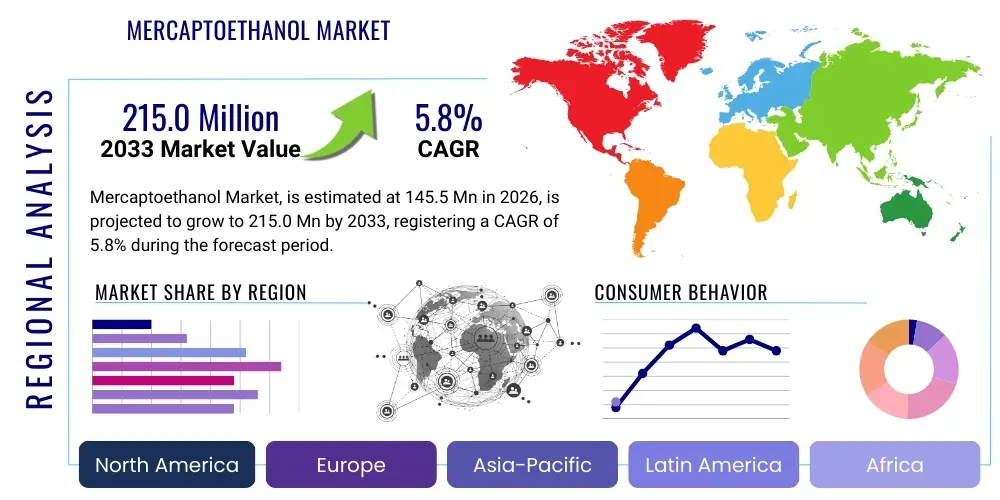

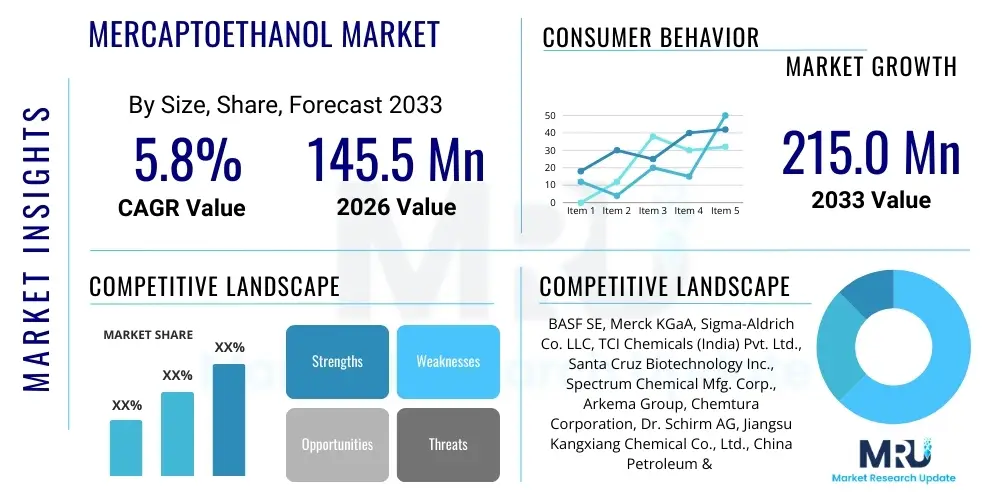

The Mercaptoethanol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 145.5 Million in 2026 and is projected to reach USD 215.0 Million by the end of the forecast period in 2033.

Mercaptoethanol Market introduction

Mercaptoethanol (ME), also known as 2-mercaptoethanol or β-mercaptoethanol, is a clear, colorless liquid characterized by a distinct, unpleasant odor. Chemically, it is a compound with the formula HOCH₂CH₂SH, featuring both a hydroxyl group and a thiol group. This dual functionality makes it an exceptionally valuable chemical intermediate across numerous industrial sectors. ME acts primarily as a reducing agent, capable of cleaving disulfide bonds found in proteins and playing a critical role in stabilizing enzyme solutions, particularly in biochemical and molecular biology applications. Its high reactivity and efficiency in reducing disulfide bonds are fundamental to its widespread adoption in laboratories and pharmaceutical manufacturing processes globally.

The product finds major applications across pharmaceuticals, agriculture, specialty chemicals, and biochemistry. In the pharmaceutical industry, ME is essential for synthesizing active pharmaceutical ingredients (APIs), acting as a crucial building block in complex chemical reactions. Agriculturally, it serves as an intermediate in the production of various pesticides, herbicides, and specialty fertilizers, enhancing crop protection and productivity. Furthermore, in molecular biology and protein analysis, ME is indispensable for the denaturation of proteins prior to techniques like SDS-PAGE (Sodium Dodecyl Sulfate Polyacrylamide Gel Electrophoresis), ensuring accurate analysis of protein structure and composition. The versatility of Mercaptoethanol is a key driver for its sustained market expansion, particularly as R&D investment in biotechnology and life sciences continues to surge.

Key driving factors supporting the market trajectory include the rapid expansion of the global pharmaceutical and biotechnology industries, especially in emerging economies. The increasing prevalence of complex diseases necessitates advanced drug discovery efforts, where Mercaptoethanol is a core reagent. Moreover, the growing demand for highly effective agricultural chemicals to boost yield security, coupled with innovations in polymerization processes utilizing ME as a chain transfer agent, further stimulates market growth. The chemical stability and effectiveness of ME in reducing protein structure complexity provide significant benefits, reinforcing its critical status within laboratory and industrial environments.

Mercaptoethanol Market Executive Summary

The Mercaptoethanol market exhibits robust growth driven primarily by escalating demand from the pharmaceutical and biotechnology sectors globally. Business trends show a significant push towards higher purity grades of ME, essential for sensitive applications like DNA sequencing and high-precision API synthesis, leading manufacturers to invest in advanced purification technologies. Strategic partnerships focusing on backward integration to secure feedstock supply and compliance with increasingly stringent environmental regulations regarding the handling and disposal of sulfur-containing compounds are dominating corporate strategies. Pricing stability is influenced by the volatility of raw material costs, specifically ethylene oxide and hydrogen sulfide derivatives, although sustained demand buffers short-term price fluctuations. Overall market dynamics point towards increased specialization and regulatory compliance becoming crucial differentiators among key players.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, largely attributed to the rapid expansion of chemical manufacturing bases, burgeoning pharmaceutical R&D activities in countries like China and India, and substantial investments in the agricultural sector. North America and Europe, while mature, maintain leading market shares owing to established biotechnology hubs and stringent quality standards that demand high-grade ME. These regions focus heavily on innovation, particularly in sustainable production methods and applications within personalized medicine. The shift of bulk chemical production capabilities towards APAC is redefining global supply chain logistics, making competitive pricing and logistics efficiency critical for market participants operating globally.

Segmentation trends highlight the dominance of the pharmaceutical application segment, reflecting the vital role of ME as a protein-reducing agent and chemical intermediate in drug development and manufacturing processes. The high-purity segment (99% and above) is experiencing accelerated growth due to increasing application in genomics and proteomics research. Furthermore, the agricultural sector remains a stable consumer, particularly for use in specialized agrochemical formulations. Market players are strategically segmenting their offerings based on purity and packaging size to cater effectively to the diverse needs of industrial consumers versus specialized research laboratories, thereby maximizing penetration across varied end-use industries.

AI Impact Analysis on Mercaptoethanol Market

Analysis of common user questions reveals significant interest in how Artificial Intelligence (AI) can optimize the synthesis and regulatory compliance associated with chemical intermediates like Mercaptoethanol (ME). Users frequently inquire about AI's role in accelerating API synthesis involving ME, predicting the environmental fate and toxicity profile of ME derivatives, and enhancing supply chain efficiency in highly regulated chemical markets. Key concerns revolve around the ethical deployment of AI in chemical R&D, the requirement for large, high-quality datasets for predictive modeling, and the potential displacement of traditional chemical optimization methods. Expectations center on AI significantly reducing research timelines, optimizing reaction parameters to minimize waste, and proactively identifying safer, more sustainable alternatives or derivatives of ME, thereby streamlining production and improving compliance adherence.

- AI-driven optimization of chemical reaction pathways involving Mercaptoethanol, leading to increased yield and reduced waste generation.

- Predictive modeling using machine learning algorithms to assess the long-term environmental and toxicological impact of ME usage.

- Enhanced supply chain management and inventory forecasting for ME feedstock and final product distribution, minimizing stockouts and logistics costs.

- Acceleration of drug discovery and materials science research by simulating complex biochemical interactions where ME acts as a reducing agent.

- Automation of regulatory documentation and compliance checking for ME usage in heavily regulated industries like pharmaceuticals and food contact materials.

- AI systems analyzing R&D data to identify potential substitutes or bio-based routes for Mercaptoethanol production, promoting sustainability.

DRO & Impact Forces Of Mercaptoethanol Market

The Mercaptoethanol market is influenced by a dynamic interplay of driving factors, constraints, opportunities, and impactful market forces. The primary drivers stem from the indispensable nature of ME in biotechnology for protein analysis and its critical role in the expanding pharmaceutical sector for complex API synthesis, particularly anti-cancer and antiviral drugs. Furthermore, the stabilized growth in the global agricultural industry, reliant on ME derivatives for effective crop protection chemicals, maintains sustained demand. Conversely, the market faces significant restraints, chiefly related to the inherent toxicity and strong odor associated with ME, necessitating rigorous handling protocols and substantial investment in specialized infrastructure, alongside increasing regulatory pressure concerning sulfur emissions and occupational exposure limits. These factors compel manufacturers to seek continuous improvement in safety standards and invest in closed-loop systems.

Opportunities for market growth are abundant, particularly with the emergence of sustainable chemistry and the push for bio-based Mercaptoethanol production methods, which could alleviate environmental concerns and regulatory hurdles. The escalating investment in genomics, proteomics, and advanced life science research provides a constantly growing niche market demanding ultra-high purity ME grades. Moreover, geographic expansion into rapidly industrializing regions of Latin America and Southeast Asia, coupled with the increasing adoption of contract manufacturing organizations (CMOs) utilizing ME, represents significant untapped potential. Innovation in delivery systems that minimize direct user exposure to the pungent chemical is also a critical opportunity space.

Key impact forces shaping the competitive landscape include technological forces, where advancements in continuous flow chemistry are optimizing ME production efficiency and purity. Regulatory forces exert a substantial impact; stricter Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulations in Europe and similar compliance frameworks elsewhere necessitate transparency and proven safety profiles, raising the barrier to entry for new players. Economic forces, tied to global economic cycles and raw material price volatility (especially ethylene oxide), dictate production costs and final market pricing. Lastly, competitive forces are intensifying, marked by continuous innovation in product grades and geographical expansion strategies adopted by major market participants aiming to secure long-term supply agreements with major pharmaceutical end-users.

Segmentation Analysis

The Mercaptoethanol market is comprehensively segmented based on purity level, application, and end-use industry, providing granular insights into demand patterns across various sectors. Purity segmentation is critical, as biochemical and pharmaceutical applications require stringent quality control, driving the demand for 99% and above purity grades, while industrial applications often utilize lower concentrations. Application segmentation highlights the diverse utility of ME, ranging from vital biological research reagents to mass-produced agricultural intermediates. End-use industry analysis reveals the dominant consumer base, led by the chemical and pharmaceutical sectors, reflecting ME's role as a versatile and essential chemical building block across specialized manufacturing ecosystems.

- By Purity

- 99% and Above

- 98% to 99%

- Below 98%

- By Application

- Pharmaceutical Intermediates (API Synthesis)

- Agrochemicals (Pesticides, Herbicides)

- Chemical Synthesis (Polymers, Thioethers)

- Biochemical Reagents (Protein Reduction, DNA Isolation)

- Textile and Dye Applications

- Cosmetics and Personal Care

- Others (Corrosion Inhibitors, Flotation Agents)

- By End-Use Industry

- Chemical Industry

- Pharmaceutical and Biotechnology Industry

- Agriculture Industry

- Cosmetics and Personal Care Industry

- Research and Academic Laboratories

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Mercaptoethanol Market

The value chain for the Mercaptoethanol market begins with the upstream procurement of essential raw materials, primarily ethylene oxide, hydrogen sulfide, and caustic soda. These precursors, often sourced from large petrochemical companies, undergo synthesis and reaction processes involving complex and often energy-intensive chemical methods. Upstream suppliers are characterized by high capital investment and technical expertise in handling hazardous substances. Securing stable, high-quality feedstock is paramount, as fluctuations in crude oil and natural gas prices directly impact the cost of ethylene oxide, subsequently influencing ME manufacturing costs. Strategic sourcing and long-term contracts with petrochemical suppliers are key competitive tactics in this stage.

The core manufacturing stage involves the conversion of raw materials into different grades of Mercaptoethanol, focusing heavily on purification processes to meet the exacting standards of the pharmaceutical and biotech industries. Direct distribution channels involve manufacturers selling high-volume ME directly to large-scale chemical processors, API manufacturers, and major agrochemical companies. This approach allows for tighter quality control and customized packaging solutions. Conversely, indirect distribution utilizes specialized chemical distributors and regional agents, particularly for catering to smaller research laboratories, academic institutions, and cosmetics manufacturers who require lower volumes and readily available stock. Distributors play a crucial role in managing inventory, handling logistics for hazardous materials, and providing localized technical support.

The downstream segment is dominated by specialized end-users who integrate ME into their final product manufacturing or research protocols. Pharmaceutical companies use it extensively in multistep organic synthesis, while agricultural firms formulate it into advanced pesticides. The end of the chain involves the disposal and recycling of ME-containing waste, which is highly regulated due to environmental and safety concerns. Efficiency and safety across the entire value chain, from raw material handling to waste management, are essential, with high-purity requirements in the pharma sector placing significant pressure on manufacturers to minimize contamination risks and ensure supply chain integrity.

Mercaptoethanol Market Potential Customers

The potential customer base for Mercaptoethanol is diverse yet concentrated in industries requiring precise chemical synthesis and high-level biological reduction capabilities. The primary buyers are multinational pharmaceutical companies and Contract Development and Manufacturing Organizations (CDMOs) specializing in complex API synthesis. These customers require Mercaptoethanol as a critical building block and reducing agent in proprietary drug manufacturing processes, demanding ultra-high purity and guaranteed supply reliability. The growth of outsourced pharmaceutical manufacturing globally directly correlates with increased demand from this segment, making them the most valuable and strategic customer group.

Another major segment comprises agrochemical manufacturers who utilize ME as an intermediate for synthesizing sulfur-containing pesticides and herbicides necessary for crop protection. These buyers prioritize cost-effectiveness and bulk supply consistency to meet seasonal agricultural demand. Research institutions, universities, and dedicated biotechnology laboratories form a distinct, high-value customer group that often purchases lower volumes but requires the absolute highest purity grades (molecular biology grade) for sensitive applications like protein purification, genomics research, and enzyme assays. These academic and research consumers are less price-sensitive but highly quality-sensitive.

Furthermore, specialty chemical producers and polymer manufacturers represent continuous purchasers, utilizing ME as a chain transfer agent in polymerization reactions or as an ingredient in the production of thioethers and specialty polymers. The cosmetics industry also uses ME derivatives, albeit in smaller quantities, typically as an ingredient in hair perming solutions due to its ability to manipulate disulfide bonds in keratin. Effective targeting requires manufacturers to tailor their marketing and distribution strategies based on the specific purity, volume requirements, and regulatory compliance needs of each distinct customer vertical, ensuring rigorous safety and handling guidelines are communicated effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 145.5 Million |

| Market Forecast in 2033 | USD 215.0 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Merck KGaA, Sigma-Aldrich Co. LLC, TCI Chemicals (India) Pvt. Ltd., Santa Cruz Biotechnology Inc., Spectrum Chemical Mfg. Corp., Arkema Group, Chemtura Corporation, Dr. Schirm AG, Jiangsu Kangxiang Chemical Co., Ltd., China Petroleum & Chemical Corporation (Sinopec), Mitsui Chemicals, Inc., Nippon Shokubai Co., Ltd., Parchem fine & specialty chemicals, Central Drug House (P) Ltd., Haihang Industry Co., Ltd., Loba Chemie Pvt. Ltd., Tokyo Chemical Industry Co., Ltd., Dow Chemical Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mercaptoethanol Market Key Technology Landscape

The manufacturing of Mercaptoethanol relies heavily on established chemical synthesis routes, primarily involving the reaction of ethylene oxide with hydrogen sulfide. However, the key technological advancements in the market are centered around process optimization and purification technologies, rather than fundamental changes in chemical reactions. Advanced continuous processing systems, such as continuous flow reactors, are increasingly being adopted to replace traditional batch processing. These systems offer superior control over reaction kinetics, enhanced safety due to smaller reaction volumes, and significantly improved product consistency and purity. Continuous flow technology helps manufacturers achieve the ultra-high purity grades (e.g., molecular biology grade) demanded by modern genomic and proteomic research, minimizing impurities that could interfere with sensitive biochemical assays.

Furthermore, environmental technologies play a crucial role in defining the competitive landscape. Given the inherent toxicity and sulfur content of Mercaptoethanol and its byproducts, advanced solvent recovery systems, highly efficient scrubbers for off-gas treatment, and innovative waste management protocols are paramount. Manufacturers are investing in catalytic reduction techniques and sophisticated distillation towers to maximize yield while minimizing regulatory liability associated with volatile organic compound (VOC) emissions. The integration of advanced sensor technology and Industrial Internet of Things (IIoT) platforms within production facilities allows for real-time monitoring and predictive maintenance, ensuring operational stability and continuous quality assurance throughout the highly exothermic production process.

A burgeoning technological area is the research into sustainable and bio-based production pathways for Mercaptoethanol. Driven by global sustainability goals and regulatory pressure, academic and industrial researchers are exploring methods involving fermentation or enzymatic catalysis, utilizing renewable carbon sources instead of petrochemical feedstocks. While these technologies are still nascent and often cost-prohibitive for large-scale industrial production currently, they represent the future direction for reducing the environmental footprint and volatility risk associated with conventional petrochemical-derived ME. Successful implementation of bio-based synthesis would fundamentally transform the upstream segment of the value chain and provide a significant competitive advantage in environmentally conscious markets.

Regional Highlights

The global Mercaptoethanol market exhibits distinct growth patterns across key geographical regions, dictated by regional industrial maturity, regulatory environment, and pharmaceutical manufacturing capacities. Asia Pacific (APAC) is projected to register the highest growth rate during the forecast period, primarily fueled by massive government and private investments in the chemical and pharmaceutical sectors in China, India, and Southeast Asia. The region benefits from lower operating costs, facilitating the establishment of large-scale ME manufacturing units, and rapidly expanding local consumption across agrochemicals and specialty chemical production, positioning APAC as a crucial hub for both production and consumption.

North America maintains a dominant position in terms of market value, largely driven by the presence of global biotechnology leaders, extensive funding for life sciences research, and robust pharmaceutical R&D activities. The demand in this region is heavily skewed towards high-purity, molecular biology-grade Mercaptoethanol, supporting advanced genomics and proteomics projects. Strict quality standards and established regulatory frameworks ensure premium pricing and focus on compliance, forcing manufacturers to adhere to cGMP (current Good Manufacturing Practice) standards for pharmaceutical ingredients.

Europe represents another key region, characterized by mature chemical and pharmaceutical industries, particularly in Germany, Switzerland, and the UK. The European market operates under the stringent regulatory oversight of REACH, which necessitates comprehensive safety data and handling protocols for Mercaptoethanol. While growth rates are moderate compared to APAC, the consistent demand from specialty chemical manufacturing and the strong presence of global contract research organizations (CROs) ensure stable consumption, with an increasing focus on sustainable sourcing and environmentally friendly production processes.

- Asia Pacific (APAC): Fastest growing market due to rapid industrialization, massive expansion of the chemical industry, and increasing domestic demand for agrochemicals and pharmaceuticals in China and India.

- North America: Leading market in terms of value, driven by significant R&D spending in the biotechnology and genomics sectors, demanding ultra-high purity ME for sensitive applications.

- Europe: Stable market governed by strict regulatory frameworks (REACH); high demand from established specialty chemical manufacturing and advanced pharmaceutical production hubs.

- Latin America (LATAM): Emerging market characterized by growing pharmaceutical manufacturing and expanding agricultural sectors, particularly in Brazil and Mexico, offering potential for market penetration.

- Middle East and Africa (MEA): Small but developing market, primarily focusing on import-based consumption, with nascent growth tied to local chemical processing industries and healthcare infrastructure improvements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mercaptoethanol Market.- BASF SE

- Merck KGaA

- Sigma-Aldrich Co. LLC

- TCI Chemicals (India) Pvt. Ltd.

- Santa Cruz Biotechnology Inc.

- Spectrum Chemical Mfg. Corp.

- Arkema Group

- Chemtura Corporation (now part of Lanxess)

- Dr. Schirm AG

- Jiangsu Kangxiang Chemical Co., Ltd.

- China Petroleum & Chemical Corporation (Sinopec)

- Mitsui Chemicals, Inc.

- Nippon Shokubai Co., Ltd.

- Parchem fine & specialty chemicals

- Central Drug House (P) Ltd.

- Haihang Industry Co., Ltd.

- Loba Chemie Pvt. Ltd.

- Tokyo Chemical Industry Co., Ltd.

- Dow Chemical Company

- Huntsman Corporation

Frequently Asked Questions

Analyze common user questions about the Mercaptoethanol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Mercaptoethanol and what are its primary uses?

Mercaptoethanol (ME) is a vital chemical compound and reducing agent utilized primarily in biochemistry to cleave disulfide bonds in proteins for analysis. Industrially, its major uses include manufacturing pharmaceutical intermediates (APIs), agrochemicals like pesticides, and as a chain transfer agent in polymer synthesis.

Which industries drive the highest demand for high-purity Mercaptoethanol?

The highest demand for ultra-high purity Mercaptoethanol comes from the pharmaceutical and biotechnology sectors, specifically for drug discovery, complex Active Pharmaceutical Ingredient (API) synthesis, and sensitive research applications such as genomics and proteomics.

What are the main market restraints impacting the growth of the Mercaptoethanol market?

The primary restraints include the inherent toxicity and strong, unpleasant odor of Mercaptoethanol, which necessitates costly and strict handling, storage, and disposal protocols. Additionally, increasingly stringent environmental regulations regarding sulfur emissions pose ongoing compliance challenges for manufacturers.

How is the Mercaptoethanol market segmented geographically?

The market is segmented into North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa (MEA). APAC is projected to show the fastest growth due to rapid industrial expansion, while North America holds the largest market share by value, driven by biotechnology research.

What technological advancements are influencing Mercaptoethanol production?

Key technological influences include the adoption of continuous flow chemistry for higher purity and efficiency, the implementation of advanced waste treatment and solvent recovery systems to meet environmental mandates, and emerging research into sustainable, bio-based synthesis pathways.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager