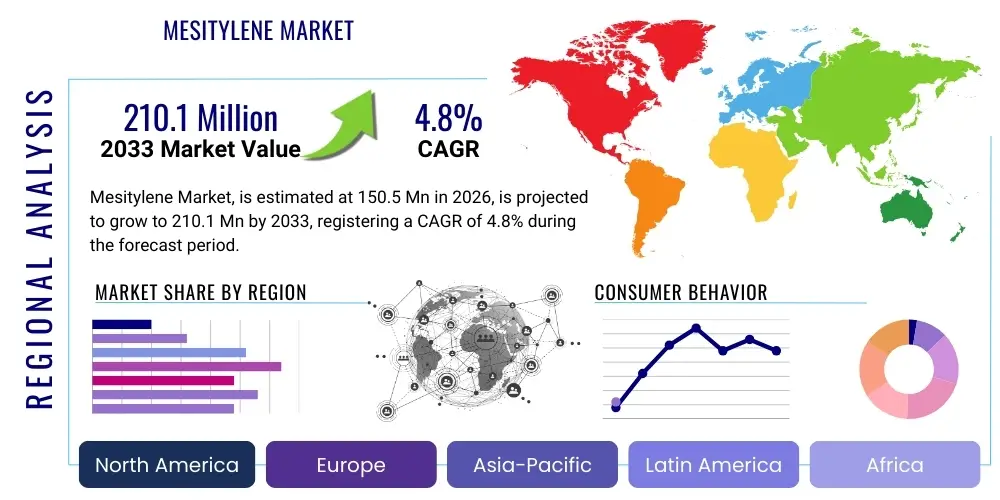

Mesitylene Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441321 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Mesitylene Market Size

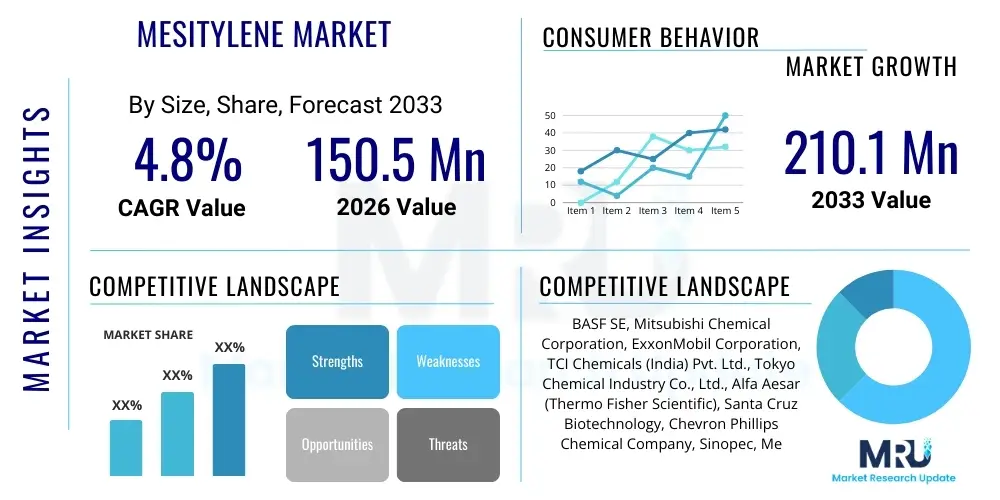

The Mesitylene Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 150.5 Million in 2026 and is projected to reach USD 210.1 Million by the end of the forecast period in 2033.

Mesitylene Market introduction

Mesitylene, chemically known as 1,3,5-trimethylbenzene, is a high-value aromatic hydrocarbon characterized by its low toxicity, high thermal stability, and low volatility. These unique physicochemical properties position Mesitylene as a crucial component in various advanced chemical processes and formulations. It serves primarily as a versatile solvent, a key precursor for specialized chemical intermediates, and a building block for high-performance materials. The demand for Mesitylene is intrinsically linked to the growth of end-use industries such as polymers, electronics, and specialty coatings, where its superior performance characteristics offer distinct advantages over conventional aromatic solvents and intermediates.

A major application driving market demand is its use in synthesizing trimellitic anhydride (TMA), a critical intermediate employed in the production of high-temperature resistant plasticizers, epoxy curing agents, and specialized alkyd resins for protective coatings. Furthermore, Mesitylene derivatives are increasingly vital in the semiconductor and electronics sectors, particularly as solvents or cleaning agents in the fabrication of integrated circuits, requiring stringent purity levels. The pharmaceutical and agrochemical industries also leverage Mesitylene as a reaction medium due to its inert nature and optimal boiling point, facilitating efficient synthesis of complex molecules.

The key driving factors propelling the market expansion include the burgeoning demand for high-performance engineering plastics in the automotive and aerospace industries, necessitated by stringent weight reduction and fuel efficiency mandates. Additionally, the rapid industrialization and expansion of chemical manufacturing bases, particularly across the Asia Pacific region, necessitate increased volumes of chemical intermediates like Mesitylene. The benefits derived from using Mesitylene—such as enhanced product stability, improved reaction yields, and superior performance in high-specification applications—continue to solidify its irreplaceable position within the specialty chemicals landscape, promising sustained growth throughout the forecast period.

Mesitylene Market Executive Summary

The Mesitylene market is undergoing dynamic shifts driven by evolving regulatory scrutiny concerning aromatic solvents and continuous advancements in catalyst technology aimed at enhancing synthesis efficiency. Key business trends indicate a strong industry focus on optimizing the separation and purification processes of C9 aromatic streams to achieve ultra-high purity Mesitylene required for sensitive electronic applications. Strategic partnerships and vertical integration among petrochemical producers are common, ensuring stable supply chains despite fluctuating upstream crude oil and xylene prices. Furthermore, innovation is centered on developing sustainable production routes, including exploring the use of bio-based feedstocks to mitigate the environmental footprint associated with conventional fossil fuel derivatives, aligning with global corporate sustainability goals and investor expectations.

Regionally, Asia Pacific (APAC) continues to dominate the global Mesitylene consumption and production landscape, primarily due to the massive presence of manufacturing units for polymers, paints and coatings, and electronics in countries like China, India, and South Korea. This dominance is supported by favorable government policies promoting industrial expansion and relatively lower operational costs. Conversely, North America and Europe are characterized by demand for high-grade, specialty Mesitylene used primarily in niche applications, such as advanced material synthesis and precision chemical engineering. These mature markets emphasize regulatory compliance (e.g., REACH in Europe) and tend to focus on innovation and high-purity product segments rather than bulk volume production.

Segment trends reveal that the Chemical Intermediates application segment, particularly the synthesis of Trimellitic Anhydride (TMA), holds the largest market share and is expected to exhibit robust growth, driven by the expansion of specialty plasticizers and high-performance resins. The solvent segment, while mature, is seeing renewed interest in specialized applications such as photoresists and fine chemical synthesis where its volatility profile is advantageous. Purity grade is becoming an increasingly critical differentiating factor; the demand for 99% minimum purity Mesitylene is outpacing standard grade growth, reflecting the strict quality requirements imposed by the rapidly expanding semiconductor and high-tech electronic component manufacturing industries globally.

AI Impact Analysis on Mesitylene Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Mesitylene market revolve around optimization of complex chemical synthesis processes, predictive modeling of feedstock prices (xylene isomers), and enhancing efficiency in purification and quality control. Users are keen to understand how AI-driven predictive maintenance can reduce downtime in capital-intensive distillation and reaction units, and how machine learning algorithms can rapidly identify optimal reaction conditions—such as temperature, pressure, and catalyst ratios—to maximize Mesitylene yield and purity from C9 aromatic streams. Additionally, interest lies in leveraging AI for global supply chain transparency, particularly in tracking raw material provenance and optimizing logistics to minimize transportation costs and lead times for bulk specialty chemicals. The key themes summarized highlight expectations for significant operational cost reduction, enhanced quality consistency, and faster R&D cycles enabled by data-driven insights.

- AI optimizes catalytic processes, reducing energy consumption and maximizing the yield of Mesitylene synthesis from xylene isomers.

- Predictive maintenance schedules in distillation columns minimize unplanned outages, improving overall production uptime and efficiency.

- Machine learning models accurately forecast demand fluctuations in key end-use industries, enabling optimized inventory management and preventing stockouts or oversupply.

- AI-enhanced spectroscopic analysis facilitates real-time, high-precision quality control, ensuring Mesitylene meets the stringent purity requirements for electronic applications.

- Generative AI assists in the rapid screening and design of novel, sustainable catalysts for Mesitylene production, accelerating R&D timelines.

DRO & Impact Forces Of Mesitylene Market

The Mesitylene market dynamics are influenced by a complex interplay of internal growth drivers, external restraints, and emerging opportunities, collectively shaping the competitive landscape and strategic direction of industry participants. Key driving forces include the sustained expansion of the specialty chemicals sector, particularly the rising global requirement for high-performance polymers and resins used in demanding applications such as aerospace, electric vehicle batteries, and high-temperature protective coatings. Mesitylene's role as a precursor for critical intermediates like Trimellitic Anhydride (TMA) directly links its market vitality to the robust growth observed in these advanced manufacturing domains. Additionally, the inherent stability and efficacy of Mesitylene derivatives in UV stabilizer formulations further cement its indispensable position across the plastics and coatings sectors.

However, the market faces significant restraints, predominantly the volatility and uncertain pricing of raw materials, primarily xylene isomers and other C9 aromatic components, which are derived from crude oil refining processes. These upstream price fluctuations directly impact the production cost of Mesitylene, potentially narrowing profit margins for manufacturers and complicating long-term pricing strategies. Furthermore, increasing global regulatory pressure regarding environmental emissions and the use of aromatic hydrocarbons, particularly in developed economies, necessitate substantial capital investment into cleaner production technologies and adherence to strict compliance standards, sometimes hindering market entry or expansion for smaller players. The development of cost-effective, non-aromatic substitutes, although currently limited in performance, poses a long-term substitution risk.

Opportunities for growth are abundant, notably in the development and commercialization of bio-based Mesitylene production routes, offering a sustainable alternative that addresses environmental concerns and reduces reliance on petrochemical feedstocks. The burgeoning demand from the electronics sector, specifically for ultra-high purity Mesitylene used as a specialized solvent in semiconductor fabrication and photolithography processes, presents a premium market segment with high growth potential. Moreover, advancements in catalytic distillation technologies and isomerization processes offer opportunities to enhance separation efficiency and reduce energy consumption during manufacturing, thereby improving the overall economic viability and environmental profile of Mesitylene production. The impact forces indicate that the positive momentum from specialty applications outweighs the challenges posed by feedstock pricing volatility.

Segmentation Analysis

The Mesitylene market is segmented primarily based on Application, Purity Grade, and End-Use Industry, reflecting the diverse requirements and technological demands of various sectors. Segmentation based on application helps to delineate the usage areas, with chemical intermediates being the most critical category due to the extensive volume required for producing secondary chemicals like TMA. Purity grade segmentation is vital, particularly the distinction between standard technical grade and ultra-high purity grades, which dictates suitability for sensitive end-uses like electronics. Analyzing these segments provides a clear understanding of market dynamics, growth drivers specific to each segment, and the competitive strategies adopted by market participants.

- By Application:

- Chemical Intermediates (Primarily Trimellitic Anhydride - TMA)

- Solvents and Reaction Media

- UV Stabilizers and Antioxidants

- High-Performance Coatings Additives

- By Purity Grade:

- Standard Grade (98% minimum)

- High Purity Grade (99% minimum and above)

- By End-Use Industry:

- Plastics and Polymers

- Automotive and Aerospace (Coatings and Resins)

- Electronics and Semiconductors

- Pharmaceuticals and Agrochemicals

- Paints and Coatings

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Mesitylene Market

The value chain for the Mesitylene market commences with the Upstream segment, dominated by major petrochemical producers who supply the primary feedstock: C9 aromatic fractions. These fractions are obtained during crude oil refining or catalytic reforming processes, specifically within the mixed xylenes stream. Efficient separation and isomerization technologies are crucial at this stage to isolate 1,3,5-trimethylbenzene from other C9 isomers. Key challenges upstream include managing the volatility of oil prices and optimizing extraction yields, as Mesitylene often represents a small, specialized fraction of the total aromatic output, requiring advanced separation techniques such as fractional crystallization or selective adsorption.

The Midstream segment involves the core manufacturing and purification of Mesitylene. Producers refine the crude product through multi-stage distillation and often employ proprietary purification technologies to achieve the requisite purity levels, especially for electronic-grade applications. Direct and indirect distribution channels facilitate the movement of Mesitylene from manufacturing plants to end-users. Direct sales are common for large volume, strategic customers in the polymer and chemical intermediate sectors, ensuring stable supply contracts and specialized technical support. Indirect channels utilize regional distributors and chemical traders, offering localized inventory and smaller quantities to SMEs in the pharmaceutical and specialty solvent markets.

The Downstream segment comprises the various end-use industries where Mesitylene acts as an essential input. This includes manufacturers of high-performance resins (requiring TMA), producers of specialty solvents for cleaning and coating applications, and companies formulating advanced UV stabilizers for plastics. The value derived at this end of the chain is high, particularly in the electronics and aerospace industries, where the purity and reliability of Mesitylene directly influence the quality and performance of the final high-tech product. Therefore, quality assurance and traceability throughout the supply chain are paramount, ensuring that product specifications are consistently met from the crude feedstock stage to the final application.

Mesitylene Market Potential Customers

The primary customers for Mesitylene span across several highly industrialized sectors, often requiring the product as a critical intermediate or a specialized solvent. Manufacturers engaged in the production of high-performance plastics and protective coatings represent a massive customer base. These companies heavily rely on Mesitylene as the precursor for Trimellitic Anhydride (TMA), which is essential in creating high-quality plasticizers that improve the flexibility and durability of polyvinyl chloride (PVC) products, as well as in manufacturing specialty resins for high-heat environments in the automotive and aerospace sectors. Their purchasing decisions are driven by consistent supply, competitive pricing, and technical support regarding synthesis optimization.

Another significant group of potential customers includes semiconductor fabrication plants and electronic component manufacturers. In this highly sensitive sector, Mesitylene, specifically the ultra-high purity grade, is used as a critical solvent in photolithography processes, cleaning agents, and specialized etching formulations. These customers prioritize quality assurance above cost, demanding strict adherence to minimal residue levels and specified purity standards (often 99.9% or higher). Failure to meet these stringent specifications can lead to significant defects in microelectronic devices, making supplier reputation and quality control track records paramount in selection.

Furthermore, agrochemical and pharmaceutical companies constitute a robust, albeit often smaller volume, customer segment. They utilize Mesitylene as an inert reaction medium during complex organic synthesis, benefiting from its optimal boiling point and chemical stability, which aids in controlled reaction environments necessary for producing Active Pharmaceutical Ingredients (APIs) and specialized pesticides. These buyers look for reliable, well-documented compliance with regulatory standards (such as cGMP) alongside assured product consistency, often purchasing through specialized chemical distributors who can handle smaller, specialized batch orders and provide required certification documentation efficiently.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150.5 Million |

| Market Forecast in 2033 | USD 210.1 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Mitsubishi Chemical Corporation, ExxonMobil Corporation, TCI Chemicals (India) Pvt. Ltd., Tokyo Chemical Industry Co., Ltd., Alfa Aesar (Thermo Fisher Scientific), Santa Cruz Biotechnology, Chevron Phillips Chemical Company, Sinopec, Merck KGaA, Loba Chemie Pvt. Ltd., Wako Pure Chemical Industries, Chemos GmbH, Avantor Performance Materials, Sigma-Aldrich (Merck), Central Drug House (CDH). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mesitylene Market Key Technology Landscape

The technological landscape for Mesitylene production is dominated by advanced catalytic processes centered around the efficient separation and isomerization of mixed C9 aromatic streams derived from petrochemical sources. The primary challenge lies in isolating 1,3,5-trimethylbenzene from its isomers (e.g., pseudocumene and hemimellitene) due to their similar boiling points and chemical structures. Modern synthesis technologies often employ specialized zeolitic catalysts that promote transalkylation and disproportionation reactions of lighter aromatics (like xylene) or selective adsorption techniques that leverage subtle differences in molecular geometry for high-purity extraction. Continuous research focuses on developing more selective and stable catalysts to enhance yield while minimizing side reactions and energy consumption, ensuring the process remains economically viable despite complex separation requirements.

The purification stage represents a critical technological bottleneck, especially for electronic and pharmaceutical grades. Conventional fractional distillation requires extremely tall columns and high energy input to achieve ultra-high purity (>99.9%). Consequently, the industry is increasingly adopting advanced separation methods, including extractive distillation and melt crystallization, which offer superior separation efficiency at potentially lower operating costs. These technologies are crucial for removing trace impurities that could compromise performance in highly sensitive end-use applications, particularly in the semiconductor industry where parts-per-billion contamination levels are unacceptable. Automation and process control systems, often integrated with AI, are standard practice to maintain tight control over process parameters and ensure batch-to-batch consistency in purity.

Looking ahead, technological innovation is heavily invested in sustainability. The exploration of bio-based synthesis pathways is gaining traction, investigating catalytic conversion of biomass-derived precursors into C9 aromatics, thereby offering a renewable alternative to fossil fuels. Furthermore, green chemistry principles are influencing process design, leading to the development of novel solvent-free or supercritical fluid-based extraction methods that reduce reliance on hazardous organic solvents. Successful implementation of these advanced and sustainable technologies will be key differentiators for market players, improving their environmental compliance profile and providing a competitive advantage in a market increasingly sensitive to sustainability metrics and circular economy initiatives.

Regional Highlights

The Mesitylene market exhibits significant regional disparities in terms of production capacity, consumption volume, and purity requirements, largely driven by varying levels of industrialization and regulatory frameworks.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, primarily fueled by massive chemical and manufacturing expansion in China, India, and South Korea. This region serves as the global hub for polymer, electronics, and coatings production, leading to high consumption of Mesitylene, especially the standard grade for chemical intermediates (TMA) and the high-purity grade for semiconductor fabrication. Government support for manufacturing and the availability of large, integrated petrochemical complexes drive both production and demand.

- North America: This region is characterized by high demand for specialty and ultra-high purity Mesitylene, particularly for advanced materials research, aerospace coatings, and high-specification electronics. Although production capacity is significant, consumption is heavily skewed toward high-value, niche applications where premium pricing is acceptable. Stringent environmental regulations necessitate advanced production technologies focused on minimizing emissions and waste streams.

- Europe: Similar to North America, Europe focuses on high-quality, specialized applications. The market is highly regulated, notably under the REACH framework, which drives innovation toward sustainable and safer production methods. Demand is robust in the automotive sector (for high-temperature resins and coatings) and in fine chemical synthesis, favoring suppliers who can demonstrate rigorous quality control and environmental compliance.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging markets with increasing industrial activity. Demand is growing steadily, primarily driven by expanding infrastructure projects and developing local manufacturing capabilities in paints, coatings, and basic plastics. The MEA region, capitalizing on its extensive petrochemical resources, holds potential for increased upstream production capacity, serving as a future supplier of C9 aromatics to global markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mesitylene Market.- BASF SE

- Mitsubishi Chemical Corporation

- ExxonMobil Corporation

- TCI Chemicals (India) Pvt. Ltd.

- Tokyo Chemical Industry Co., Ltd.

- Alfa Aesar (Thermo Fisher Scientific)

- Santa Cruz Biotechnology

- Chevron Phillips Chemical Company

- Sinopec

- Merck KGaA

- Loba Chemie Pvt. Ltd.

- Wako Pure Chemical Industries

- Chemos GmbH

- Avantor Performance Materials

- Sigma-Aldrich (Merck)

- Central Drug House (CDH)

- Kanto Chemical Co., Inc.

- Solvay S.A.

- Dow Inc.

- TotalEnergies SE

Frequently Asked Questions

Analyze common user questions about the Mesitylene market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Mesitylene primarily used for in the specialty chemical industry?

Mesitylene (1,3,5-trimethylbenzene) is predominantly used as a chemical intermediate for synthesizing Trimellitic Anhydride (TMA), a crucial precursor for high-performance plasticizers and specialized resins utilized in high-temperature coatings and insulating materials.

Which purity grade of Mesitylene is experiencing the fastest growth?

The High Purity Grade (99% minimum and above) Mesitylene is exhibiting the fastest growth due to surging demand from the electronics and semiconductor industries, where it is utilized as a specialized solvent requiring ultra-low levels of contaminants for critical processes like photolithography.

How does the volatile price of crude oil affect the Mesitylene market?

Since Mesitylene is derived from C9 aromatic fractions obtained during crude oil refining, volatility in crude oil prices directly impacts the cost of upstream feedstocks (xylenes). This translates to higher production costs and complexity in pricing strategies for Mesitylene manufacturers.

What technological advancements are crucial for the future of Mesitylene production?

Key technological advancements include the development of highly selective catalysts for xylene isomerization, advanced separation techniques (like melt crystallization) for achieving ultra-high purity, and the increasing exploration of sustainable, bio-based feedstocks to reduce reliance on petrochemical sources.

Which geographical region dominates the global Mesitylene market?

The Asia Pacific (APAC) region dominates the global Mesitylene market in terms of both production capacity and consumption volume, driven by large-scale manufacturing in polymers, coatings, and the rapidly expanding semiconductor industries in countries such as China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Mesitylene Market Statistics 2025 Analysis By Application (Solvents, Intermediates, Additives), By Type (Industrial Grade, Electdronic Grase, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Mesitylene Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Industrial Grade, Electdronic Grase, Other), By Application (Solvents, Intermediates, Additives, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager