Meta and Para Aramid Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441905 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Meta and Para Aramid Market Size

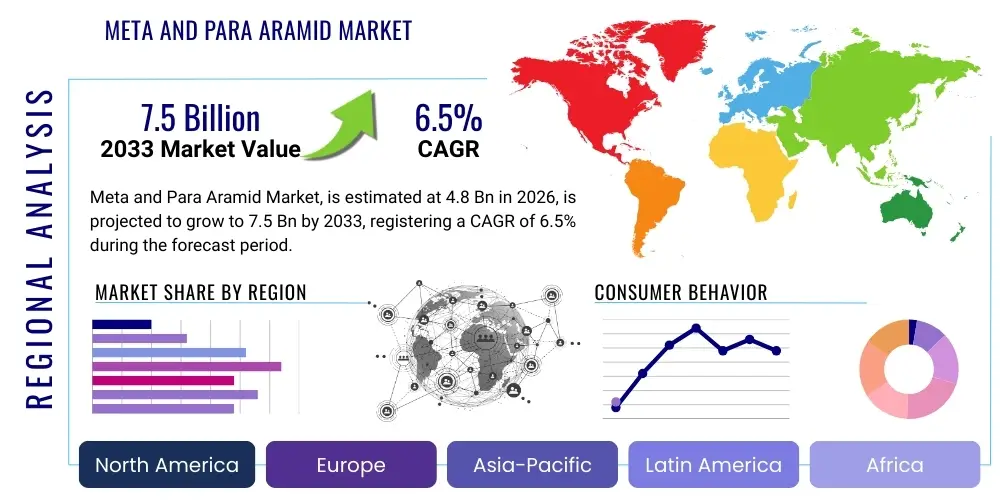

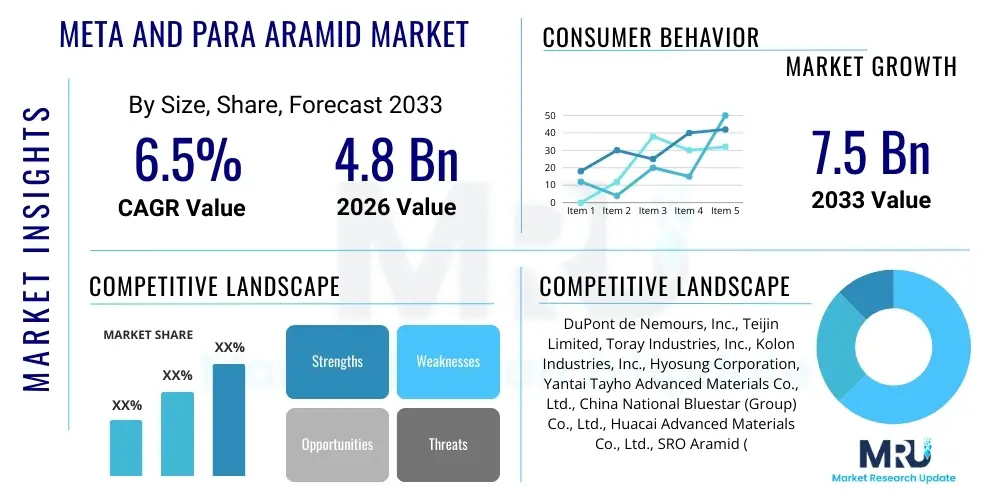

The Meta and Para Aramid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by increasing global mandates for enhanced safety standards across diverse industrial sectors, coupled with continuous technological innovations aimed at improving the thermal and mechanical performance of protective materials.

The valuation reflects the critical reliance of key end-use industries, particularly aerospace, defense, automotive, and electrical insulation, on the superior properties offered by aramid fibers. Meta-aramids, known for their excellent heat and flame resistance, dominate applications in thermal protective clothing and filtration systems, while para-aramids are prized for their exceptional tensile strength and modulus, making them indispensable in ballistic protection, ropes, and structural composites. The geographical spread of manufacturing hubs and the growing adoption of lightweight materials further contribute to this robust financial trajectory.

Meta and Para Aramid Market introduction

The Meta and Para Aramid Market encompasses the production, distribution, and application of high-performance synthetic fibers belonging to the polyamide class, characterized by high thermal stability and mechanical strength. Aramid fibers are categorized into two primary types: meta-aramids (e.g., Nomex, Teijinconex), which offer outstanding heat, flame, and chemical resistance, making them ideal for protective apparel and electrical insulation; and para-aramids (e.g., Kevlar, Twaron), which are renowned for their incredible strength-to-weight ratio and superior impact resistance, utilized extensively in ballistic vests, aerospace composites, and fiber optic cables. These fibers are crucial components in safety-critical and performance-demanding environments globally.

Major applications of aramid fibers span across industrial, defense, and civilian sectors. In industrial settings, they are used for high-temperature filtration bags, conveyor belts, and protective sleeves. The automotive industry employs them for brake pads, transmission belts, and structural reinforcement to enhance durability and reduce weight. Crucially, the defense and security sectors represent a cornerstone application, leveraging para-aramids for bulletproof vests, helmets, and vehicle armor due to their unparalleled ballistic properties. Meta-aramids ensure firefighter turnout gear, industrial workwear, and military flight suits offer reliable protection against thermal hazards.

The driving factors propelling the market forward include stringent occupational safety regulations enforced by governmental bodies like OSHA and the EU directives on PPE, necessitating the mandatory use of flame-resistant and high-durability materials in hazardous workplaces. Furthermore, advancements in composite material science, particularly in the aerospace sector, where the demand for lightweight yet extremely strong materials is constant, fuel the consumption of para-aramid fibers. The continuous infrastructure development in emerging economies, requiring high-strength materials for civil engineering applications, also contributes significantly to market growth.

Meta and Para Aramid Market Executive Summary

The Meta and Para Aramid Market is currently characterized by significant growth momentum, predominantly fueled by escalating global focus on workplace safety, expansion in defense spending, and technological advancements in lightweight materials crucial for the aerospace and electric vehicle (EV) sectors. Key business trends include intense competition among major manufacturers focused on backward integration to secure monomer supply (e.g., metaphenylenediamine and para-phenylenediamine) and heavy investment in R&D to develop specialty fibers offering enhanced performance characteristics, such as anti-static properties or improved dyeability. Strategic alliances and capacity expansions, particularly in Asia Pacific, are defining the competitive landscape, as companies strive to meet the burgeoning demand from high-growth industrial and automotive segments.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, driven by rapid industrialization, large-scale infrastructure projects, and the expanding manufacturing base for automotive and electronics industries, particularly in China and India. North America and Europe maintain dominance in terms of value, owing to high per capita spending on advanced protective gear, mature aerospace and defense industries, and rigorous implementation of safety standards. The trend toward domestic manufacturing of critical protective materials post-supply chain disruptions is strengthening regional self-sufficiency initiatives across these developed economies. The increasing adoption of electric vehicles globally is creating a niche but high-value demand for aramid-based separators and insulation materials to ensure battery safety.

Segment trends highlight the dominance of the para-aramid segment in terms of revenue, primarily due to its high cost and critical application in high-performance composites and ballistic protection. Conversely, the meta-aramid segment shows stable growth, anchored by continuous demand from the traditional protective clothing and electrical insulation markets. Application-wise, the security and defense sector remains the largest consumer, while the automotive and transportation sector is demonstrating the highest growth trajectory, particularly as manufacturers increasingly specify aramid fibers to improve vehicle safety and fuel efficiency through weight reduction. The overall market trajectory is highly dependent on global geopolitical stability influencing defense budgets and the regulatory environment governing industrial safety.

AI Impact Analysis on Meta and Para Aramid Market

Common user questions regarding AI's impact on the Meta and Para Aramid Market center around optimizing manufacturing processes, predicting material performance under extreme stress, and enhancing supply chain resilience. Users frequently inquire about how AI can accelerate new fiber development (e.g., developing next-generation aramid variants with optimized molecular structures), whether predictive maintenance utilizing machine learning can reduce equipment downtime in polymerization plants, and the potential of AI-driven demand forecasting to stabilize fluctuating raw material costs. The consensus expectation is that AI will primarily revolutionize the operational efficiency and quality control aspects of aramid production, rather than directly influencing product demand, which remains tied to regulatory and industrial needs. Furthermore, AI is anticipated to play a role in materials informatics, accelerating the discovery of novel composite formulations incorporating aramid fibers for specialized applications like hypersonics.

The integration of Artificial Intelligence and Machine Learning (ML) algorithms is set to significantly influence the manufacturing efficiency and quality assurance within the aramid production ecosystem. Specifically, AI-powered systems can analyze vast datasets from polymerization reactors, extrusion processes, and fiber treatment stages to identify optimal operational parameters, minimizing waste, reducing energy consumption, and ensuring batch-to-batch consistency—a critical factor for high-stakes applications such as aerospace and ballistics. This level of optimization translates directly into reduced production costs and enhanced material reliability, making high-performance aramids more economically viable for a broader range of industrial uses.

Beyond manufacturing, AI is revolutionizing the research and development pipeline for aramid materials. Computational chemistry and ML models are now employed to simulate the performance of new aramid variations before physical synthesis, drastically cutting down the time and cost associated with experimental trials. For end-users, especially in composite manufacturing, AI tools assist in predicting the lifespan and failure points of aramid-reinforced structures under specific environmental stresses (e.g., high temperatures, prolonged UV exposure), enabling engineers to design more resilient and durable products. This transition towards predictive material science, driven by AI, solidifies the future potential of advanced aramid fibers in extreme environments.

- AI-driven Predictive Maintenance: Reduces equipment downtime and optimizes asset utilization in polymerization facilities.

- Materials Informatics: Accelerates the R&D cycle for novel aramid derivatives and specialized composite formulations.

- Process Optimization: ML algorithms fine-tune reactor conditions (temperature, pressure) for improved yield and quality consistency.

- Supply Chain Resilience: AI enhances demand forecasting and raw material sourcing, mitigating risks associated with supply volatility.

- Quality Control Automation: Vision systems and deep learning algorithms perform non-destructive testing for fiber defects with high precision.

- Performance Prediction: Simulation tools powered by AI forecast the ballistic or thermal performance of aramid fabrics and composites.

DRO & Impact Forces Of Meta and Para Aramid Market

The dynamics of the Meta and Para Aramid Market are governed by a robust framework of Drivers, Restraints, and Opportunities (DRO), which collectively shape the market's trajectory and influence investment decisions. A primary driver is the pervasive need for superior protective gear in hazardous occupations, strongly supported by increasing regulatory enforcement globally, particularly in industrialized regions where occupational safety is paramount. This consistent demand from sectors such as firefighting, military, and construction underpins market stability. Simultaneously, the relentless pursuit of lightweighting in the aerospace, automotive (especially EV batteries for thermal run-away protection), and marine industries provides significant growth opportunities, as aramid fibers offer an unparalleled balance of strength and reduced mass compared to traditional materials. However, the high manufacturing cost associated with the complex polymerization and spinning processes, coupled with volatility in the prices of key precursors like terephthaloyl chloride and p-phenylenediamine, presents a notable restraint on widespread adoption, particularly in price-sensitive consumer applications or developing markets.

The overall impact forces are primarily characterized by the strong pull of essential high-performance applications and the counteracting pressure from economic feasibility constraints. High barriers to entry, stemming from the capital-intensive nature of production and the intricate technological know-how required for fiber synthesis, limit competitive intensity, allowing established players to maintain market dominance. The major opportunity lies in expanding applications in emerging technological fields, such as hydrogen fuel cells requiring robust, lightweight structural components and advanced electronic packaging needing high-temperature stability. Geopolitical factors also exert a significant impact, as defense budgets directly correlate with demand for ballistic protection, making the market susceptible to shifts in global security alignments and conflict levels.

Furthermore, substitution risk remains a persistent challenge, particularly from alternative high-performance fibers like Ultra-High-Molecular-Weight Polyethylene (UHMWPE) and Carbon Fiber, which compete directly with para-aramids in certain composite and ballistic applications. While aramids possess a unique advantage in thermal stability, advancements in competing material properties necessitate continuous innovation in aramid fiber science to maintain market share. Successfully navigating these impact forces requires manufacturers to focus on vertical integration, secure stable raw material sourcing, and invest strategically in application development to penetrate new, high-value segments.

Segmentation Analysis

The Meta and Para Aramid Market is highly segmented based on fiber type, application, and end-use industry, reflecting the diverse performance requirements and specialized functions of these high-performance materials. Analyzing these segments provides a clear roadmap of market investment and growth potential. Fiber type segmentation, distinguishing between meta-aramid and para-aramid, is crucial as their performance profiles are distinct, dictating their suitability for specific applications—meta-aramids lead in thermal protection, while para-aramids dominate structural and ballistic needs. The market is also granularly segmented across various end-use industries, including security & defense, automotive & transportation, aerospace, electrical & electronics, and industrial filtration, each having unique demands for material specifications, volumes, and pricing structures. Understanding these distinct segments is vital for manufacturers focusing on targeted marketing and product development efforts, especially those aiming to capitalize on high-growth areas like electric vehicle battery insulation and advanced aerospace composites.

- By Type:

- Meta-Aramid Fiber

- Para-Aramid Fiber

- By Application:

- Friction Materials and Gaskets

- Optical Fibers

- Tire Reinforcement

- Rubber Reinforcement

- Composites

- Security & Protection (Ballistic, Cut Protection)

- Others (Ropes, Cables, Belts)

- By End-Use Industry:

- Security and Defense

- Automotive and Transportation

- Aerospace

- Electrical and Electronics

- Industrial (Filtration, Protective Clothing)

- Medical

- Telecommunications

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Meta and Para Aramid Market

The value chain of the Meta and Para Aramid Market is characterized by high complexity, intellectual property intensity, and significant capital investment across all stages, starting from upstream chemical synthesis to specialized downstream application integration. The upstream segment involves the synthesis of high-purity monomers, such as metaphenylenediamine (MPD), isophthaloyl chloride (IPC) for meta-aramids, and para-phenylenediamine (PPD), terephthaloyl chloride (TPC) for para-aramids. This stage is dominated by a few global chemical giants, and control over these precursors is critical as they represent a substantial portion of the final product cost and directly influence the fiber's quality and performance. Securing stable and high-quality monomer supply is a strategic imperative for aramid fiber producers seeking competitive advantage and cost control, often leading to vertical integration strategies.

The midstream process involves polymerization, dissolution, and highly specialized spinning techniques (e.g., dry spinning for meta-aramids and dry-jet wet spinning for para-aramids) to produce the raw fibers. This manufacturing stage requires proprietary technology, patented processes, and substantial energy input, establishing high barriers to entry. Fiber producers then market the resulting fibers in various forms—staple, filament, pulp, and chopped fiber—to downstream integrators. The distribution channel is segmented into direct sales for large, specialized orders (e.g., defense contracts or aerospace manufacturers) and indirect sales through specialized distributors and agents who handle smaller volume orders and serve diverse industrial customers, providing technical support and local inventory management.

The downstream sector represents the application and conversion of aramid fibers into final products. This includes textile manufacturers converting fibers into fire-resistant fabrics, composite manufacturers incorporating them into prepregs and laminates, and end-product assemblers creating ballistic armor, brake linings, or filtration media. Potential customers often purchase directly from distributors or through specialized material consultants who advise on the appropriate aramid type and structure for demanding applications. The close collaboration between midstream manufacturers and downstream integrators is essential for customizing fiber specifications (e.g., denier, finish, twist) to meet the highly specific performance requirements of industries like deep-sea oil extraction or high-speed rail transportation, thereby maximizing value extraction across the chain.

Meta and Para Aramid Market Potential Customers

The potential customer base for the Meta and Para Aramid Market is highly diverse, spanning numerous industries where material failure or thermal vulnerability poses severe risks to human life, critical infrastructure, or operational continuity. End-users are primarily institutions and corporations requiring materials with exceptional characteristics—chief among them being government defense and homeland security agencies purchasing ballistic protection equipment (vests, helmets, vehicle armor) and military aircraft components. Industrial sectors, including petrochemical, metallurgy, and utilities, are significant buyers, utilizing meta-aramid fabrics for essential worker protective clothing (PPE) such as fire-resistant coveralls, gloves, and hoods, mandated by rigorous safety protocols to prevent injury from flash fires or extreme heat exposure.

Beyond traditional safety-critical sectors, the automotive and transportation industries represent a rapidly growing customer segment. Manufacturers of high-performance and electric vehicles are increasingly integrating aramid fibers into brake friction materials, clutch components, and specialized battery separation sheets to enhance safety, reduce noise, vibration, and harshness (NVH), and manage the thermal challenges associated with high-capacity lithium-ion batteries. Aerospace companies, both civilian and military, constitute another high-value customer group, utilizing para-aramid composites for interior paneling, aircraft flooring, rocket motor casings, and helicopter blades, capitalizing on their superior strength-to-weight ratio for fuel efficiency gains and structural integrity in demanding flight conditions.

Furthermore, telecommunication and electrical utility providers are key buyers of para-aramid yarns for reinforcing fiber optic cables and power transmission lines, offering mechanical protection against tension and external environmental factors without adding excessive weight. The breadth of potential customers, from individual first responders requiring specialized protective gear to multinational corporations designing advanced composite structures, underscores the indispensable nature of aramid fibers in modern, safety-conscious industrial environments. Customer decisions are often driven by regulatory compliance, material performance certifications, and long-term cost of ownership, favoring established, certified aramid suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont de Nemours, Inc., Teijin Limited, Toray Industries, Inc., Kolon Industries, Inc., Hyosung Corporation, Yantai Tayho Advanced Materials Co., Ltd., China National Bluestar (Group) Co., Ltd., Huacai Advanced Materials Co., Ltd., SRO Aramid (Jiangsu) Co., Ltd., JSC Kamenskvolokno, Kermel (Soldier Modernisation Limited), X-FIPER New Material Co., Ltd., Rubberex (M) Sdn Bhd, Fibre Extrusion Technology Ltd., Hebei Sino-Artec Special Fiber Co., Ltd., Aramid Fiber Co., Ltd., Wuxi Rongsheng Protective Equipment Co., Ltd., P-Aramid Group, Inc., Beijing Hengda High Tech Fibre Co., Ltd., Taekwang Industrial Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Meta and Para Aramid Market Key Technology Landscape

The technological landscape of the Meta and Para Aramid Market is dominated by highly specialized, proprietary polymerization and fiber spinning techniques that are essential for achieving the fibers' exceptional properties. For para-aramids, the critical technology is the use of liquid crystalline polymer solutions processed via dry-jet wet spinning, which aligns the polymer chains along the fiber axis with near-perfect parallelism. This alignment is fundamental to achieving the extraordinary stiffness and tensile strength (up to five times that of steel on an equal weight basis) for which para-aramids are known. Continuous process innovation focuses on optimizing these spinning parameters—including dope concentration, temperature, and air gap distance—to enhance fiber modulus and reduce surface defects, thereby improving overall material quality for highly demanding applications like high-pressure vessels and advanced ballistic plates.

In the meta-aramid segment, the key technology centers around wet or dry spinning of polymer solutions, followed by rigorous thermal post-treatment, which dictates the fiber's thermal resistance and stability. Recent technological advancements in meta-aramid manufacturing involve incorporating novel modifiers or co-polymers during the synthesis stage to enhance specific attributes such as UV resistance, dyeability, or moisture management, addressing historical drawbacks of the fiber. Furthermore, manufacturers are increasingly employing solvent recycling technologies to mitigate environmental impact and reduce operational costs associated with the expensive and often hazardous solvents used in the dissolution and spinning phases, contributing to a more sustainable manufacturing footprint.

Beyond core fiber production, significant technological evolution is occurring in downstream processing and application integration. Innovations in aramid pulp and short fiber technology are critical for friction materials (e.g., brake pads) and specialty paper production, where advanced surface treatments are used to improve adhesion and dispersion within complex matrices. The integration of nanotechnology, specifically incorporating carbon nanotubes or graphene into aramid matrices, is an emerging field aimed at creating hybrid composites with superior electrical conductivity, multi-functionality, and increased interlaminar shear strength. The focus on developing woven and non-woven fabrics with enhanced protection levels, such as those combining aramid fibers with ceramic materials for extreme thermal shielding or shear-thickening fluids for improved impact absorption, ensures the continued relevance and technological lead of aramids in high-performance material science.

Regional Highlights

The geographical distribution of the Meta and Para Aramid Market showcases distinct consumption patterns and manufacturing concentrations influenced by regulatory frameworks, industrial capacity, and defense spending levels across key regions.

- Asia Pacific (APAC): Positioned as the fastest-growing and largest consuming region, APAC is fueled by massive industrial expansion, particularly in automotive manufacturing, infrastructure development, and a rapid increase in the adoption of safety standards in countries like China, India, and South Korea. China is a major producer and consumer, driven by domestic defense needs and a vast electronics manufacturing base, while South Korea and Japan host key global manufacturers and are leaders in aramid-based composite technology.

- North America: This region maintains a significant market share, driven primarily by robust defense budgets, the presence of major aerospace manufacturers (Boeing, Lockheed Martin), and stringent fire and safety regulations (NFPA standards). The U.S. remains the core consumer of high-performance para-aramids for ballistic protection and advanced aerospace components, valuing highly certified, reliable materials.

- Europe: Characterized by mature industrial safety standards and a strong automotive sector, Europe is a major consumer of meta-aramids for protective clothing (firefighting, police) and industrial filtration applications. Germany, France, and the UK are key markets, focusing on sustainable manufacturing practices and high-end specialty applications in engineering and high-speed rail.

- Latin America (LATAM): Growth in LATAM is more nascent but accelerating, driven by infrastructure investments in countries like Brazil and Mexico, and rising demand for industrial safety PPE in the expanding oil, gas, and mining sectors. Market growth is closely tied to economic stability and the adoption of stricter labor laws.

- Middle East and Africa (MEA): This region shows stable growth, heavily reliant on the oil and gas industry, which necessitates large volumes of fire-resistant meta-aramid protective wear. Defense spending in geopolitical hotspots also drives demand for ballistic materials, particularly in the Arabian Peninsula countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Meta and Para Aramid Market.- DuPont de Nemours, Inc.

- Teijin Limited

- Toray Industries, Inc.

- Kolon Industries, Inc.

- Hyosung Corporation

- Yantai Tayho Advanced Materials Co., Ltd.

- China National Bluestar (Group) Co., Ltd.

- Huacai Advanced Materials Co., Ltd.

- SRO Aramid (Jiangsu) Co., Ltd.

- JSC Kamenskvolokno

- Kermel (Soldier Modernisation Limited)

- X-FIPER New Material Co., Ltd.

- Rubberex (M) Sdn Bhd

- Fibre Extrusion Technology Ltd.

- Hebei Sino-Artec Special Fiber Co., Ltd.

- Aramid Fiber Co., Ltd.

- Wuxi Rongsheng Protective Equipment Co., Ltd.

- P-Aramid Group, Inc.

- Beijing Hengda High Tech Fibre Co., Ltd.

- Taekwang Industrial Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Meta and Para Aramid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between Meta-Aramid and Para-Aramid fibers?

Meta-aramid fibers (e.g., Nomex) are utilized for their exceptional thermal and flame resistance, primarily in protective clothing and electrical insulation. Para-aramid fibers (e.g., Kevlar) are structurally distinct, known for their ultra-high tensile strength and stiffness, making them ideal for ballistic armor, composites, and structural reinforcement.

Which end-use industry drives the highest demand for aramid fibers globally?

The Security and Defense industry is the largest consumer, particularly for para-aramid fibers used in ballistic protection (body armor and vehicle protection) due to mandatory procurement requirements and increasing global military modernization efforts.

What are the primary factors restraining the growth of the aramid market?

The market faces restraints primarily due to the high capital expenditure required for production, resulting in elevated fiber costs, and price volatility in precursor chemicals, which limits the adoption of aramids in more cost-sensitive, high-volume industrial applications.

How is the automotive sector increasingly utilizing aramid materials?

The automotive industry uses aramids for brake and clutch friction materials, transmission belts, and tire reinforcement. Crucially, meta-aramids are gaining significant traction in Electric Vehicles (EVs) for battery cell separation and insulation to prevent thermal runaway and enhance overall fire safety.

Which region is expected to demonstrate the highest growth rate for aramid consumption?

Asia Pacific (APAC) is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by rapid industrialization, stringent regulatory adoption of safety standards in manufacturing sectors, and increasing defense spending across major economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager