Metal Beer Kegs Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442278 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Metal Beer Kegs Market Size

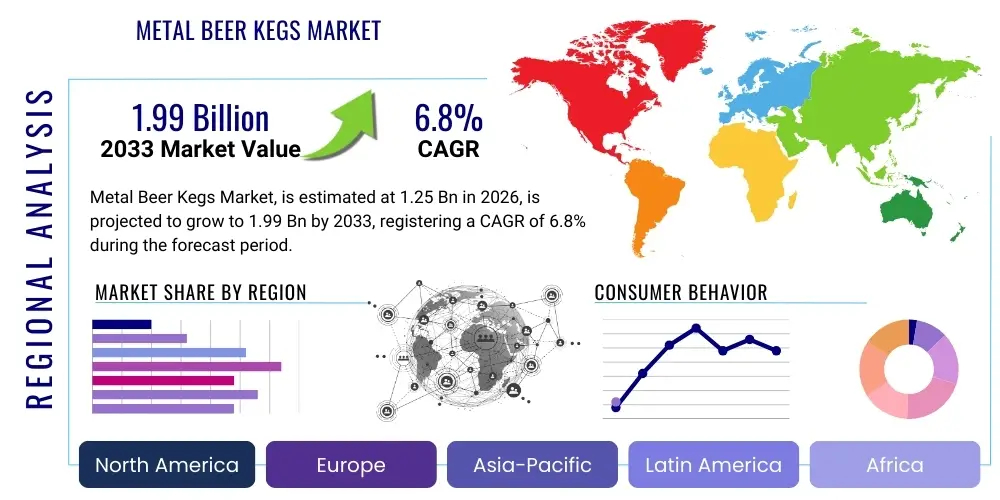

The Metal Beer Kegs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.99 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating global consumption of draught beer, particularly in emerging economies, coupled with significant advancements in sustainable and efficient logistics solutions championed by major breweries and microbreweries alike. The robustness, longevity, and recyclability of metal kegs, primarily stainless steel, ensure their continued preference over alternative packaging formats, cementing their integral role in the commercial beer distribution ecosystem across hospitality and retail channels worldwide.

Metal Beer Kegs Market introduction

The Metal Beer Kegs Market encompasses the manufacturing, distribution, and utilization of pressurized metal containers, predominantly stainless steel or occasionally aluminum, designed specifically for the storage and transportation of bulk quantities of beer. These containers are crucial for maintaining the quality, carbonation, and freshness of draught beer from the brewery to the point of dispense, primarily serving the On-Trade sector, including bars, restaurants, and pubs. The product, a highly durable vessel ranging typically from 20 liters to 50 liters in capacity, provides superior barrier protection against light, oxygen, and temperature fluctuations compared to cans or bottles. Major applications involve high-volume commercial brewing, specialized craft beer distribution, and international export logistics. Key benefits driving market adoption include the inherent reusability and extended lifespan of stainless steel kegs, which align with circular economy principles; the enhanced safety and hygiene provided by standardized coupling systems; and the logistical efficiencies gained through large-scale, stackable transportation. Driving factors include the sustained growth of the global craft beer movement, the expansion of the hospitality sector post-pandemic, and mandatory health and safety regulations promoting robust storage solutions, further supported by innovation in lightweighting technologies and tracking systems.

Metal Beer Kegs Market Executive Summary

The Metal Beer Kegs Market demonstrates resilience and steady growth, primarily fueled by shifting global preferences towards premium and craft draught beer experiences. Current business trends indicate a strong focus on optimizing supply chain efficiency through digitalization and advanced asset tracking, making keg management less cumbersome and more cost-effective for breweries of all sizes. Manufacturers are increasingly prioritizing investment in automated welding and passivation techniques to enhance the durability and hygiene of keg fleets, responding directly to the high turnover and rigorous cleaning demands of the sector. Regionally, the European market maintains dominance due to deeply entrenched draught beer culture and mature brewing industries, while Asia Pacific, specifically markets like China and India, exhibits the highest growth potential, driven by rapid urbanization and rising discretionary income leading to increased adoption of Westernized beverage consumption habits. Segment-wise, the stainless steel keg segment remains the largest due to its unrivaled longevity and material stability, although the one-way/disposable metal keg segment, often made of lightweight metals or hybrid materials, is gaining traction for short-haul, export-focused, or small-scale event logistics where return logistics are prohibitive, balancing sustainability goals with operational flexibility demands across the distribution network.

AI Impact Analysis on Metal Beer Kegs Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Metal Beer Kegs Market predominantly revolve around optimizing supply chain logistics, minimizing asset loss, predicting maintenance cycles, and ensuring quality control during manufacturing. Common themes include the potential for AI-driven predictive maintenance models to forecast internal corrosion or structural failure, the application of machine learning algorithms to optimize keg pooling and routing strategies, and the use of computer vision systems in high-speed manufacturing lines to detect weld defects or inconsistencies in material thickness, thereby enhancing product reliability. Concerns often center on the initial investment required for integrating AI with existing RFID/IoT tracking infrastructure and the necessity for highly specialized datasets related to keg handling and specific material fatigue rates under various environmental conditions. Overall expectations are high regarding AI’s capacity to significantly reduce operational expenditures (OpEx) related to lost or damaged assets and improve the sustainability profile of the keg ecosystem through hyper-efficient asset utilization.

- AI-driven Predictive Maintenance: Analyzing sensor data (e.g., pressure, temperature, usage cycles) to anticipate and schedule repairs for kegs, extending asset lifespan and reducing unexpected failures.

- Optimized Fleet Management: Utilizing machine learning algorithms to dynamic route planning and inventory distribution in keg pools, minimizing idle time and transportation costs based on real-time demand signals.

- Automated Quality Control (QC): Implementing computer vision and AI classifiers in manufacturing for high-speed detection of microscopic defects in welding seams, surface passivation, or valve assembly, ensuring structural integrity.

- Demand Forecasting and Production Scheduling: Applying predictive analytics to model seasonal fluctuations in draught beer consumption, allowing manufacturers to adjust production capacity proactively.

- Enhanced Security and Loss Prevention: Integrating AI with RFID and GPS data streams to identify unauthorized deviations, anomalies, or high-risk areas in the supply chain associated with keg theft or misplacement.

DRO & Impact Forces Of Metal Beer Kegs Market

The dynamics of the Metal Beer Kegs Market are shaped by a complex interplay of growth drivers stemming from the global rise of craft brewing and enhanced consumer preference for draught beverages, constrained by significant capital expenditure requirements and evolving regulatory standards. Opportunities are abundant in the development of lightweight materials and advanced smart tracking technologies, yet the market remains vulnerable to economic volatility impacting raw material prices and logistics costs. These forces collectively dictate investment patterns in durable asset acquisition versus temporary packaging solutions. The primary market drivers emphasize sustainability and efficiency, while restraints often center on operational hurdles, such as the costly reverse logistics process necessary for reusable assets. This continuous tension between maximizing asset lifespan and minimizing the total cost of ownership defines the competitive landscape for keg manufacturers and rental providers.

Drivers: A paramount driver is the exponential growth of the global craft brewing industry, which inherently relies on small-to-medium-capacity metal kegs to distribute highly localized, specialized brews while maintaining optimal quality. Furthermore, heightened consumer awareness regarding environmental sustainability favors reusable packaging solutions like stainless steel kegs over single-use alternatives, placing pressure on large breweries to maintain or expand their keg fleet infrastructure. The logistical advantages of metal kegs—such as superior stacking efficiency, compatibility with global standardization (e.g., DIN and Euro standards), and robustness against physical damage during transit—make them indispensable for high-volume, cross-border distribution channels. Regulatory requirements in developed markets concerning food safety and traceability also favor the hermetically sealed, easily sanitized metal containers, necessitating continuous investment in new, certified keg stock.

Restraints: The market faces considerable restraints, primarily the high initial capital expenditure (CapEx) required for breweries to purchase and maintain large fleets of stainless steel kegs, creating a substantial barrier to entry for smaller enterprises. The complexity and high cost of reverse logistics—the process of tracking, retrieving, cleaning, and sanitizing empty kegs—represent a massive operational constraint, especially in decentralized or international markets, leading many distributors to consider one-way packaging. Moreover, the vulnerability of the primary raw material, stainless steel, to price volatility in global commodity markets (particularly nickel and chromium) directly impacts manufacturing costs and, consequently, the final price of the kegs. The perpetual issue of keg loss or theft in poorly managed distribution chains also continues to be a financial drain, forcing companies to allocate resources towards expensive tracking technologies like RFID.

Opportunities: Significant market opportunities lie in the development and proliferation of smart keg technologies, integrating embedded sensors, GPS, and RFID to provide real-time location and condition monitoring (temperature, pressure, fill level), thereby revolutionizing asset management and reducing shrinkage. The emergence of lightweight metal alloys or innovative composite linings within traditional stainless steel structures offers avenues for reducing transportation costs and increasing handling efficiency without compromising durability. Furthermore, the expansion of commercial keg leasing and pooling services provides flexibility to small and medium-sized breweries, converting CapEx into OpEx and mitigating the financial burden of large-scale asset ownership, thereby facilitating wider market access to high-quality kegs. The untapped potential in developing nations, where consumption habits are rapidly shifting toward premium draught beer, presents substantial geographical expansion opportunities for established manufacturers.

Impact Forces: The impact forces driving transformation are primarily technological and economic. The advancement of Industry 4.0 principles, including high-precision robotic welding and automated cleaning protocols, has significantly increased the quality and consistency of manufactured kegs, driving down defects and extending operational life. Economically, the cost structure of shipping empty kegs back (reverse logistics cost) acts as a powerful deterrent, creating strong demand for lighter, stackable, and smarter solutions. Societal pressure for sustainable practices elevates the importance of lifecycle assessment (LCA) data for kegs, demanding transparency regarding material sourcing and end-of-life recycling programs. Competitive dynamics are intensified by the rising presence of hybrid and disposable plastic keg alternatives, compelling metal keg producers to continuously innovate on durability, security, and smart features to maintain market superiority.

Segmentation Analysis

The Metal Beer Kegs Market is meticulously segmented based on key functional attributes including Material Type, Capacity, and End-User, reflecting the diverse requirements of the global brewing industry and its associated distribution channels. Understanding these segments is critical for manufacturers to align production capabilities with specific market demands, such as the high-volume needs of multinational brewers versus the specialized requirements of regional craft breweries. Stainless steel dominates the material segment due to its inert properties and longevity, while various capacity segments, particularly the 30L and 50L sizes, cater to standard commercial distribution routes. The market structure highlights the clear division between large-scale established brands that necessitate long-lasting reusable assets and smaller players or exporters who often lean towards more flexible or disposable formats to manage complex logistics, thereby defining the core competitive strategies across the value chain.

- By Material Type:

- Stainless Steel Kegs

- Aluminum Kegs

- By Capacity:

- Below 20 Liters

- 20 - 30 Liters

- 30 - 50 Liters

- Above 50 Liters

- By End-User:

- Commercial Breweries (Large Scale)

- Craft Breweries (Small and Medium Scale)

- Distributors & Wholesalers

- By Application/Distribution Channel:

- On-Trade (Bars, Pubs, Restaurants)

- Off-Trade (Retail, Supermarkets for Home Use)

- Export/International Trade

Value Chain Analysis For Metal Beer Kegs Market

The value chain for the Metal Beer Kegs Market is complex and capital-intensive, starting with the sourcing of high-grade raw materials and extending through specialized manufacturing, intricate distribution logistics, and ultimately, asset management and recycling. Upstream activities are dominated by stainless steel suppliers who provide specific metal alloys crucial for food-grade contact and pressure resistance. These materials are then processed through highly specialized industrial manufacturing facilities, involving advanced deep drawing, precision welding, and surface passivation treatments to ensure durability and hygiene. The integration of technology, particularly in welding robotics and cleaning processes, significantly influences the quality and cost structure at this stage, establishing the foundation for long-term asset value and performance.

Downstream processes involve the extensive distribution network, which includes direct sales from manufacturers to large breweries, the utilization of third-party distributors and wholesalers, and the growing prominence of keg pooling services. These pooling services, which manage the rotation, tracking, and maintenance of standardized keg fleets, act as critical intermediaries, simplifying logistics for small-to-medium breweries. Direct channels are preferred by global brewing giants to maintain proprietary fleet control, while indirect channels facilitate market penetration for manufacturers and ease the operational burden on numerous craft beer producers. The final stage involves the end-user (brewers, pubs, restaurants) who interact with the kegs and the critical reverse logistics process, where empty kegs are collected, cleaned, and returned for refilling, thereby completing the circular lifecycle essential to the metal keg business model.

The interplay between direct and indirect distribution hinges on logistical efficiency and capital outlay. Direct distribution allows for stringent quality control over the assets but requires massive internal infrastructure for tracking and maintenance. Conversely, indirect distribution through established pooling companies like MicroStar or Keg Logistics offers scalability and reduced CapEx for breweries, positioning these service providers as crucial links in the downstream value chain. This segmentation ensures that metal kegs efficiently reach diverse markets, from high-volume, continuous supply environments (direct) to fragmented, high-variability environments (indirect/pooling). Success in the market is increasingly defined not just by the quality of the manufactured keg but by the sophistication of the associated asset management and reverse logistics systems employed across both direct and indirect channels.

Metal Beer Kegs Market Potential Customers

The primary consumers and buyers in the Metal Beer Kegs Market are segmented across the entire brewing ecosystem, ranging from massive, multinational brewing conglomerates to independent local brewpubs and specialized beverage manufacturers. Large commercial breweries represent the highest volume potential, requiring standardized 50L fleets for global and national distribution, where asset longevity and material consistency are paramount investment criteria. Craft breweries, however, are a rapidly expanding customer base, showing increased demand for smaller capacity kegs (20L to 30L) and demonstrating a high propensity to utilize keg pooling services or short-term leases to manage fluctuating production schedules and limited capital. Beyond beer production, potential customers also include producers of hard ciders, hard seltzers, kombucha, and ready-to-drink (RTD) cocktails that utilize metal keg formats for draught service in the hospitality sector, demonstrating the product’s application versatility and solidifying its broad commercial relevance within the broader alcoholic and non-alcoholic beverage industries seeking professional draught presentation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.99 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thielmann, Schaefer Container Systems, Blefa Kegs, NDL Keg, American Keg, Shinhan Industrial, Ardagh Group, Zhejiang Jingyi Metal, Petainer, MicroStar Logistics, Keg Logistics, Eurokeg, China International Marine Containers (CIMC), Polykeg, G&G Kegs. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metal Beer Kegs Market Key Technology Landscape

The technological landscape of the Metal Beer Kegs Market is characterized by continuous refinement in manufacturing processes, focusing heavily on robotics and material science to maximize durability, hygiene, and logistical intelligence. Core manufacturing technologies include advanced deep drawing processes for seamless shell construction, which minimizes weak points and enhances structural integrity, alongside precision orbital welding for coupling components and chime attachments, ensuring hermetic sealing and longevity under repeated pressure cycles. Crucially, surface treatment technologies like passivation and electropolishing are employed to create an inert internal surface that resists corrosion and prevents flavor contamination, a non-negotiable requirement for high-quality beer storage. Innovations in these areas directly impact the total cost of ownership (TCO) for breweries by reducing maintenance needs and extending the asset lifespan considerably.

Beyond physical manufacturing, the market is undergoing a profound digital transformation driven by the integration of smart technologies. The adoption of Radio Frequency Identification (RFID) tags and QR codes is now standard practice, enabling rapid, non-contact identification and inventory tracking throughout the complex supply chain. More advanced systems integrate Internet of Things (IoT) sensors directly into the keg valve or chime, providing real-time data on internal temperature, pressure, and GPS location. This technological evolution transforms the metal keg from a mere container into a smart asset, allowing breweries and pooling companies to gather actionable insights into distribution bottlenecks, potential abuse, and exact dispensing times, which is critical for mitigating losses and optimizing asset utilization rates across vast geographical areas.

Furthermore, technology related to material handling and cleaning is paramount. Fully automated Clean-In-Place (CIP) systems are essential for the sanitation process, utilizing high-pressure, temperature-controlled chemical cycles that must be validated for efficacy. Future technological focus areas include the development of next-generation, high-strength, lightweight stainless steel alloys or the use of durable, food-safe internal coatings that could reduce the overall weight of the keg without compromising its structural integrity. This move toward lightweighting, supported by advanced computational fluid dynamics (CFD) modeling during the design phase, seeks to directly address the environmental and economic cost associated with transporting heavy, reusable containers, ensuring metal kegs remain competitive against newer, lighter single-use packaging solutions.

Regional Highlights

The global Metal Beer Kegs Market exhibits distinct regional consumption patterns and growth drivers, reflecting varying levels of economic development, established brewing cultures, and regulatory environments. Europe currently holds the largest market share, driven by mature beer consumption habits, the strong cultural presence of draught beer (particularly in Germany, the UK, and Belgium), and stringent adherence to high-quality stainless steel standards (DIN and Euro specifications). The presence of major global keg manufacturers and sophisticated keg pooling infrastructure also consolidates Europe's market leadership, necessitating continuous investment in modern, durable assets to support the extensive network of pubs and bars across the continent.

North America, particularly the United States, represents a highly dynamic and technologically advanced market segment. Growth here is primarily fueled by the sustained expansion of the craft beer segment, which demands flexible keg capacities and has been a leading adopter of smart keg technologies (RFID/IoT) to manage fragmented distribution networks and minimize asset loss. Furthermore, strong domestic manufacturing capabilities and the high prevalence of specialized keg rental and logistics companies ensure efficient asset rotation and supply responsiveness within this region, balancing the demand for both owned fleets and leased assets across the continent.

Asia Pacific (APAC) is projected to be the fastest-growing region, propelled by rapid urbanization, a burgeoning middle class, and increasing westernization of beverage preferences, particularly in key markets such as China, India, and Southeast Asia. As draught beer gains popularity over packaged alternatives in urban hospitality environments, the demand for imported and locally manufactured metal kegs is escalating significantly. While this region presents immense growth opportunities, challenges related to establishing efficient reverse logistics infrastructure and managing the complexity of diverse regulatory frameworks across multiple countries necessitate tailored distribution strategies focusing initially on large metropolitan hubs.

- Europe: Market leader due to established draught beer culture, high penetration of reusable stainless steel kegs, and extensive adoption of European standards (DIN/Euro). Focus on asset longevity and robust pooling services.

- North America: High growth driven by the strong craft beer sector; rapid adoption of smart keg technology (RFID/IoT) for inventory control; high reliance on keg leasing and pooling models.

- Asia Pacific (APAC): Highest growth potential fueled by urbanization, rising disposable income, and increasing preference for premium draught beer in developing economies; logistics infrastructure development remains a key challenge and focus area.

- Latin America (LATAM): Steady growth linked to increasing industrialization of brewing and export activities; focus on balancing initial CapEx with demand for medium-capacity (30L) kegs.

- Middle East and Africa (MEA): Nascent market, primarily driven by international hotel chains and luxury hospitality sectors; limited local manufacturing, heavily reliant on imported kegs for specialized consumption zones.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metal Beer Kegs Market.- Thielmann

- Schaefer Container Systems

- Blefa Kegs

- NDL Keg

- American Keg

- Shinhan Industrial

- Ardagh Group

- Zhejiang Jingyi Metal

- Petainer (Hybrid/Disposable focus)

- MicroStar Logistics (Pooling Service Provider)

- Keg Logistics (Pooling Service Provider)

- Eurokeg

- China International Marine Containers (CIMC)

- PolyKeg S.r.l. (Hybrid/Disposable focus)

- G&G Kegs

- Gea Group (Equipment supplier impacting production)

- Biner Equipment Company (Distribution/Reseller)

- Penglai Jinfu Stainless Steel Products

- Zhejiang Jinyuan Metal Products

- Ningbo Eastar Stainless Steel Industry

Frequently Asked Questions

Analyze common user questions about the Metal Beer Kegs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What material is primarily used for commercial beer kegs and why?

Stainless steel is the primary material used for commercial beer kegs due to its superior durability, resistance to corrosion, non-reactive nature with beer components, and high reusability potential, allowing for lifespans often exceeding 30 years under proper maintenance and rigorous sanitation cycles.

How does the growth of craft brewing affect the Metal Beer Kegs Market?

The craft brewing growth significantly boosts the market demand, particularly for smaller capacity kegs (20L and 30L) and specialized stainless steel mini-kegs, simultaneously driving the expansion of third-party keg pooling and leasing services that cater to the logistical flexibility needs of smaller producers.

What role does smart technology, such as RFID, play in the keg market?

Smart technologies like RFID and IoT sensors are crucial for mitigating asset loss and optimizing logistics. They provide real-time tracking of location, temperature, and pressure, allowing breweries to efficiently manage vast fleets, reduce shrinkage, and ensure precise inventory allocation across the global distribution network.

What is the main challenge associated with using reusable metal beer kegs?

The primary challenge is the high cost and complexity of reverse logistics. Retrieving, tracking, cleaning, and sanitizing empty reusable kegs, particularly across fragmented distribution networks or international borders, requires substantial operational investment and infrastructure, often leading breweries to consider one-way packaging alternatives for distant markets.

Are aluminum kegs a significant threat to the stainless steel segment?

While aluminum kegs offer advantages in weight reduction and recyclability, they are not a significant long-term threat to stainless steel for standard commercial use due to stainless steel's superior long-term durability, higher resistance to denting, and proven structural integrity under high pressure and repeated cleaning cycles, which optimizes the asset's total lifetime value.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager