Metal Briquetter Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441644 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Metal Briquetter Market Size

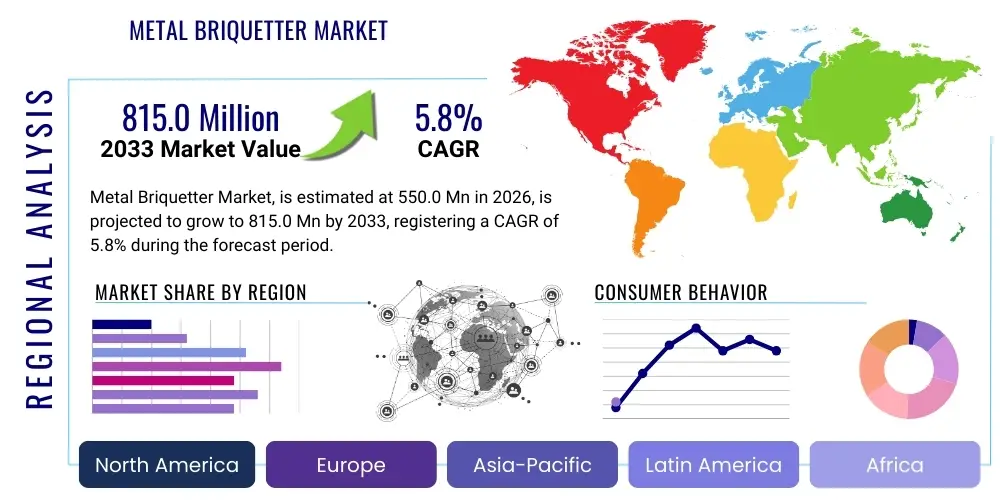

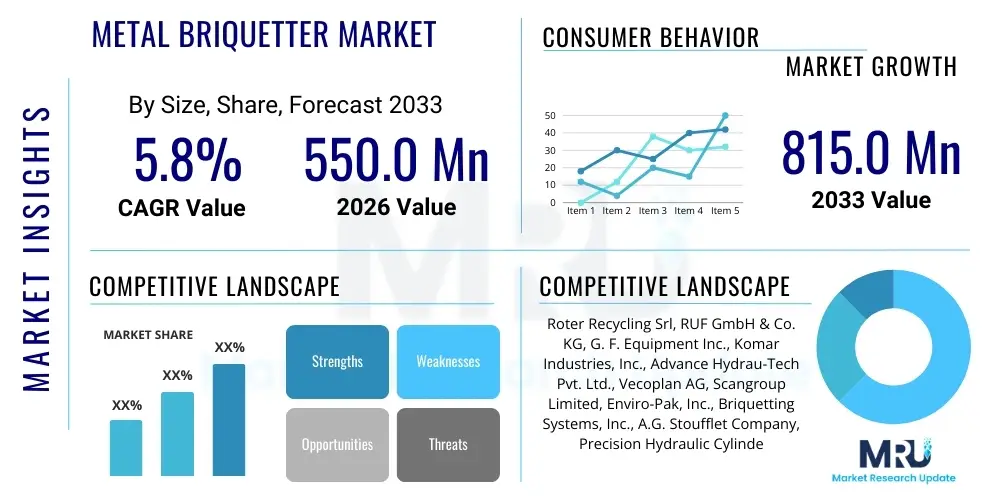

The Metal Briquetter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 550.0 Million in 2026 and is projected to reach USD 815.0 Million by the end of the forecast period in 2033. This consistent expansion is primarily fueled by stringent environmental regulations concerning waste management, coupled with the increasing global demand for recycled metallic materials across the automotive, aerospace, and construction sectors. The efficiency gains realized by companies adopting briquetting technology—specifically in reducing storage space, minimizing material handling costs, and maximizing the value of scrap metal—are key drivers accelerating market adoption worldwide.

Metal Briquetter Market introduction

The Metal Briquetter Market encompasses the manufacturing, distribution, and utilization of industrial machinery designed to compress loose metal shavings, chips, turnings, and swarf into dense, uniform briquettes. These briquetting machines utilize high hydraulic pressure, often without the need for binding agents, transforming low-density scrap material into high-density forms. This process significantly optimizes metal recycling operations by reducing material oxidation losses during melting, facilitating easier transport and storage, and improving overall furnace efficiency. The technology is critical in the circular economy framework, allowing manufacturers, particularly those in machining and metalworking, to reclaim valuable raw materials that would otherwise be costly to dispose of or process in their loose state.

Metal briquetters are applied across numerous industrial verticals, including primary aluminum and steel production, automotive component manufacturing, aerospace engineering, and specialized metallurgy operations dealing with exotic metals like titanium and tungsten. Major applications involve briquetting cast iron, aluminum, steel, brass, copper, and specialized alloys. The resultant briquettes are highly valued by smelters and foundries for their consistent size and composition, which leads to predictable and energy-efficient melt cycles. Furthermore, the briquetting process often involves extracting valuable cutting fluids (coolants and oils) from the scrap material, which can then be filtered and reused, adding an environmental and cost-saving benefit to the operation.

The driving factors for market growth include the rising global focus on sustainable manufacturing practices, the volatility of virgin metal prices, and technological advancements leading to more efficient, automated briquetting systems capable of handling diverse material types and particle sizes. Key benefits derived from adopting briquetting technology include a substantial reduction in waste volume (up to 90%), increased profitability from scrap materials due to higher bulk density, minimized transportation costs, and a safer, cleaner working environment by effectively managing wet or oily swarf. These integrated advantages position metal briquetters as indispensable tools in modern, high-volume machining facilities aiming for resource efficiency and operational excellence.

Metal Briquetter Market Executive Summary

The Metal Briquetter Market is poised for robust expansion driven primarily by escalating demand for resource recovery and stringent regulatory landscapes pushing industries toward zero-waste manufacturing goals. Business trends indicate a strong shift towards fully automated and integrated briquetting systems that can interface seamlessly with existing Computer Numerical Control (CNC) machining centers and swarf collection conveyors. Manufacturers are increasingly focusing on developing custom solutions tailored to specific metal types, such as high-pressure systems for steel and lighter-duty systems for aluminum, enhancing machine efficiency and reducing maintenance downtime. Furthermore, the integration of Industry 4.0 elements, including remote diagnostics and predictive maintenance powered by sensors, is transforming the operational models within the briquetting sector, improving uptime and overall throughput for end-users globally.

Regionally, the Asia Pacific (APAC) stands out as the leading market, fueled by massive industrialization, rapid growth in automotive production (particularly electric vehicles), and extensive infrastructure development in countries like China, India, and South Korea. North America and Europe maintain significant market shares, characterized by early adoption of advanced recycling technologies and high operational costs that mandate maximizing scrap value. European markets, in particular, benefit from stringent EU directives on waste reduction and material recycling, promoting investment in high-quality briquetting equipment. Meanwhile, emerging markets in Latin America and the Middle East and Africa (MEA) are demonstrating high growth potential as industrial clusters mature and seek cost-effective methods to manage increasing volumes of metal waste generated by their expanding manufacturing bases.

Segment-wise, the market is defined by machine type, material processed, and end-use application. Hydraulic briquetters dominate the market share due to their ability to achieve high compression ratios necessary for dense briquettes, especially those made from steel and cast iron. Material segmentation highlights the dominance of ferrous metals (steel and iron) due to their high volume in manufacturing waste, closely followed by non-ferrous metals like aluminum and copper. The automotive sector remains the primary end-user, utilizing briquetters to manage high volumes of swarf generated during powertrain and component manufacturing. However, the secondary metallurgy and specialized alloy sectors are witnessing the highest growth rates as the value proposition of briquetting high-cost, specialized materials becomes undeniable.

AI Impact Analysis on Metal Briquetter Market

Common user questions regarding AI's impact on the Metal Briquetter Market frequently revolve around optimizing machine performance, automating sorting processes, and enhancing maintenance schedules. Users are concerned about whether AI can truly differentiate between mixed metal swarf, thus improving feedstock quality before briquetting, and if predictive maintenance algorithms can minimize costly breakdowns in high-pressure hydraulic systems. Key themes that emerge include the desire for intelligent throughput management—adjusting pressure and cycle times automatically based on material input characteristics (density, moisture, alloy type)—and the implementation of AI-driven visual inspection systems to ensure briquette quality control. There is also significant interest in using machine learning to analyze energy consumption patterns, ensuring the briquetting process is optimized for minimal power usage while achieving maximum compression density, thereby directly impacting operational profitability.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is moving the Metal Briquetter Market from traditional, fixed-cycle operations toward smart, adaptive manufacturing processes. AI algorithms can process vast amounts of data collected from sensors—including pressure gauges, temperature monitors, vibration detectors, and throughput meters—to establish baseline optimal parameters for different scrap inputs. For instance, when processing a batch of aluminum swarf with residual oil content, the AI system can automatically adjust the compression hold time and pressure gradient to maximize oil recovery while ensuring the resultant briquette meets density specifications, a level of nuance unattainable through standard PLC control systems. This capability not only enhances the quality of the output briquettes but also extends the operational lifespan of critical hydraulic components by preventing unnecessary strain.

Furthermore, AI significantly enhances the preventative maintenance capabilities of modern briquetters. By analyzing vibration signatures and thermal data in real-time, ML models can predict imminent failures of pumps, seals, or hydraulic lines with high accuracy. This allows operators to schedule maintenance proactively during planned downtime, eliminating catastrophic failures that lead to expensive, unscheduled interruptions. Beyond maintenance, AI contributes to sophisticated material flow management. If the briquetter is part of a larger centralized recycling system, AI can manage inventory levels of different scrap types, deciding the optimal time and sequence for processing mixed materials to maintain a balanced flow to downstream users like smelters, ensuring continuous high-efficiency operation across the entire recycling value chain. The adoption of AI is therefore pivotal in achieving the industry goal of fully autonomous, lights-out recycling facilities.

- Enhanced Predictive Maintenance: AI models forecast hydraulic system failures and component wear, minimizing unplanned downtime.

- Adaptive Compression Control: Machine Learning optimizes pressure, cycle time, and density based on real-time scrap material analysis (type, moisture, size).

- Automated Material Sorting: AI-driven vision systems improve the identification and segregation of mixed metal swarf, enhancing feedstock purity.

- Energy Consumption Optimization: Algorithms analyze power usage patterns to reduce energy intensity per briquette cycle.

- Increased Output Quality: Real-time quality checks ensure consistent briquette size and density for improved foundry performance.

- Remote Monitoring and Diagnostics: AI facilitates sophisticated remote troubleshooting and performance tuning by manufacturers.

DRO & Impact Forces Of Metal Briquetter Market

The Metal Briquetter Market is shaped by a confluence of strong economic drivers, regulatory constraints, compelling opportunities for technological advancement, and underlying impact forces that dictate market direction and adoption rates. Key drivers include the overwhelming economic necessity for scrap metal densification, which directly increases the value of swarf and reduces logistics costs. This is counterbalanced by significant restraints such as the high initial capital investment required for hydraulic machinery and the technical challenges associated with processing specialized, highly abrasive alloys. Opportunities lie in the emerging demand for briquetting solutions for exotic metals (e.g., aerospace alloys) and the potential integration of briquetters into centralized, large-scale recycling hubs. These factors collectively exert continuous pressure, accelerating the innovation cycle and expanding the geographic reach of the technology, thereby maximizing resource efficiency across global manufacturing sectors.

Drivers: The primary economic driver is the significant increase in scrap metal value (up to 40% higher) when converted into dense briquettes compared to loose swarf, coupled with global price volatility of primary raw materials, making recycling essential. Furthermore, strict environmental compliance mandates, particularly in developed economies, necessitate effective waste stream management and oil/coolant reclamation, which briquetters perform exceptionally well. The rapid expansion of the automotive industry, specifically the manufacturing of complex components that generate high volumes of chips (like transmission casings and engine blocks), acts as a perpetual source of demand. Finally, technological maturity has led to the development of highly reliable and energy-efficient machines, reducing the total cost of ownership (TOC) and making briquetters accessible to medium-sized enterprises.

Restraints: Despite the benefits, the market faces headwinds from the substantial upfront cost of high-pressure briquetting systems, which can be prohibitive for smaller operations. Maintenance and operational complexity, requiring skilled technicians, also pose a challenge, particularly in regions with limited technical infrastructure. Another critical restraint is the technical difficulty in briquetting highly contaminated or mixed metal streams; impurities can compromise briquette quality and damage the machinery. Furthermore, the availability of alternative scrap processing methods, such as shredding and compaction (which may offer lower initial investment), sometimes provides competition, although briquetting typically yields higher density and recovery rates.

Opportunities: The market opportunity is immense, driven by the global trend toward lightweighting in the automotive and aerospace industries, increasing the volume of valuable aluminum, magnesium, and titanium scrap that needs efficient processing. The development of mobile or containerized briquetting units opens up new possibilities for on-site processing at smaller distributed manufacturing sites or remote locations. Moreover, leveraging IoT and AI for automated material identification and optimized machine performance presents a significant commercial opportunity for vendors offering smart, data-driven solutions. The increasing regulatory emphasis on Extended Producer Responsibility (EPR) schemes globally further incentivizes manufacturers to invest in effective internal recycling processes like briquetting.

Impact Forces: The market is influenced heavily by the Impact of Substitution, where high-density briquettes are increasingly substituting traditional raw materials (virgin ores) in secondary metallurgy, improving the sustainability profile of the end products. The Impact of Economic Cycles affects capital expenditure decisions; during periods of economic downturn, investments in new equipment are often deferred, but during upturns, high production volumes necessitate better scrap management. The Impact of Environmental Legislation is perhaps the most significant, continuously forcing industries to adopt best available technologies (BAT) for resource recovery. Finally, the Impact of Technological Diffusion ensures that advancements like automated feeding systems and higher tonnage presses quickly become industry standards, raising the barrier to entry for lower-quality solutions and benefiting established, innovative players.

Segmentation Analysis

The Metal Briquetter Market is extensively segmented based on machine type, the specific material processed, the design orientation (horizontal or vertical), and the diverse end-use applications across various industrial sectors. This comprehensive segmentation allows market participants to tailor their offerings to the distinct needs of different customer groups, whether they are high-volume automotive plants requiring continuous operation systems or specialized job shops handling low-volume, high-value exotic metals. Understanding these segment dynamics is crucial for strategic planning, revealing which technologies are gaining traction and which industrial sectors are poised for the highest growth in scrap metal recycling investment over the forecast period.

Segmentation by machine type, specifically classifying briquetters into hydraulic, mechanical, and hybrid systems, provides insight into the pressure capabilities and energy consumption profiles preferred by different users. Hydraulic briquetters dominate because they provide the extremely high forces required to create dense, robust briquettes suitable for steel and cast iron melting. Simultaneously, segmentation by material (ferrous, non-ferrous, and alloys) highlights the operational specializations required for handling materials with vastly different hardness and particle structure characteristics. For example, processing soft aluminum swarf requires a different throughput optimization strategy than processing hard tungsten carbide, driving the need for specialized machine design and material handling systems that prevent contamination and maximize material recovery yield.

The application-based segmentation (Automotive, Aerospace, Secondary Metallurgy, Machine Tool Industry) is perhaps the most crucial as it correlates directly with demand volume and economic value. The automotive industry, characterized by high-volume manufacturing, prioritizes high throughput and reliability. Conversely, the aerospace sector, dealing with costly materials like titanium and nickel alloys, prioritizes maximum material purity and recovery yield, often justifying higher investment in specialized, contamination-controlled briquetting solutions. The evolution within these segments, particularly the shift toward electromobility and the associated component manufacturing, is continuously redefining the parameters of scrap metal generation and the resulting demand for advanced briquetting technology capable of handling these new material compositions effectively.

- By Machine Type:

- Hydraulic Briquetters (Dominant Segment)

- Mechanical Briquetters

- Hybrid/Electro-Hydraulic Systems

- By Material Processed:

- Ferrous Metals (Cast Iron, Steel, Stainless Steel)

- Non-Ferrous Metals (Aluminum, Copper, Brass, Bronze)

- Exotic Alloys (Titanium, Nickel, Tungsten Carbide)

- By Operating Orientation:

- Vertical Briquetters (Lower Footprint, Batch Operation)

- Horizontal Briquetters (Higher Throughput, Continuous Operation)

- By End-Use Application:

- Automotive Industry

- Aerospace and Defense

- Secondary Metallurgy (Foundries and Smelters)

- Machine Tool and Fabrication Shops

- Recycling Centers and Scrap Yards

Value Chain Analysis For Metal Briquetter Market

The value chain for the Metal Briquetter Market begins with upstream activities involving the sourcing and processing of core components necessary for machine construction. This includes the acquisition of high-quality steel for the machine frame, specialized hydraulic components (pumps, valves, cylinders) from precision engineering suppliers, and advanced electrical control systems (PLCs, sensors, HMI screens). Manufacturing involves highly specialized fabrication, assembly, and rigorous testing phases to ensure the machinery can withstand the extreme pressures and continuous operation demands of industrial environments. The upstream phase is characterized by high dependence on component quality and adherence to strict engineering standards, particularly for hydraulic systems which define the machine's core performance and longevity.

The distribution channel represents the critical link between the manufacturer and the diverse end-user base. This market utilizes both direct and indirect channels. Direct sales are often preferred for large-scale, complex projects, such as supplying high-capacity briquetters to major automotive OEMs or centralized scrap yards. In these scenarios, manufacturers provide direct consultation, installation, and comprehensive after-sales support. Indirect distribution involves a network of specialized industrial equipment dealers, regional distributors, and system integrators who handle sales to small and medium-sized enterprises (SMEs) and offer localized support and maintenance. System integrators, in particular, play a crucial role by integrating the briquetter into a larger, automated swarf handling and fluid filtration system, providing a holistic recycling solution to the customer.

Downstream activities focus on the utilization and operational aspects of the briquetters. This stage involves the end-user (e.g., machining facility) generating metal swarf, feeding it into the briquetter, and then utilizing the resulting dense metal briquettes. The downstream value is realized when these briquettes are sold to secondary metallurgy facilities (foundries or smelters). The briquettes command a higher price than loose scrap due to reduced handling costs, minimized oxidation during melting, and improved melt efficiency. Effective downstream management also includes the recovery and purification of cutting fluids extracted during the briquetting process, providing an additional revenue or cost-saving stream for the end-user. Service, maintenance, and spare parts supply, often provided by the original equipment manufacturer (OEM) or certified distributors, complete the downstream value proposition, ensuring maximum uptime and efficiency for the invested capital equipment.

Metal Briquetter Market Potential Customers

The primary customers for Metal Briquetters are industrial operations that generate significant quantities of metal swarf, chips, or turnings as a byproduct of their manufacturing processes, and entities specializing in scrap metal management and recycling. These potential buyers are driven by the need to monetize their waste streams, reduce environmental liability, and optimize material logistics. Major End-Users include high-volume production facilities like those in the automotive sector, which generate massive amounts of aluminum and cast iron swarf from machining engine blocks, transmission components, and suspension parts. Given the high cost and volume of scrap generated, the return on investment (ROI) for briquetting equipment in this sector is typically very rapid, making them key strategic buyers.

Another crucial customer segment encompasses foundries and secondary metallurgy facilities. While they often purchase briquettes rather than own the machines, many large-scale foundries choose to integrate briquetters directly into their operations to process internally generated scrap and maintain control over the quality and composition of their feedstock. This is particularly relevant for specialized foundries dealing with high-performance alloys where purity is paramount. The machine tool industry, composed of smaller job shops and contract manufacturers, also forms a substantial customer base. While their individual volumes might be lower, their collective demand is strong, driven by the desire to increase the value of their scrap and reduce storage space constraints within constrained shop floor environments.

Furthermore, specialized end-users include aerospace manufacturers, who require high-precision briquetting solutions for expensive and difficult-to-handle metals like Inconel, Monel, and titanium. For these organizations, the recovery yield and purity achieved by briquetting are critical factors, often outweighing the initial capital cost. Finally, commercial recycling centers and large scrap metal yards purchase high-capacity briquetting systems to densify mixed metal streams collected from various sources, preparing the material for sale to international smelters. These buyers prioritize robust, high-throughput, and durable machines capable of continuous operation under demanding conditions, demonstrating the diverse application spectrum and robust customer base supporting the Metal Briquetter Market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550.0 Million |

| Market Forecast in 2033 | USD 815.0 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Roter Recycling Srl, RUF GmbH & Co. KG, G. F. Equipment Inc., Komar Industries, Inc., Advance Hydrau-Tech Pvt. Ltd., Vecoplan AG, Scangroup Limited, Enviro-Pak, Inc., Briquetting Systems, Inc., A.G. Stoufflet Company, Precision Hydraulic Cylinders Ltd., MetalForming Inc., Wamag Group, Run-Tech Industrial Co., Ltd., Greenmax (by Intco Recycling), ACE Recycling & Disposal, SSI Shredding Systems, Inc., Marathon Equipment Company, Nederman Holding AB, AIDA Engineering, Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metal Briquetter Market Key Technology Landscape

The technological landscape of the Metal Briquetter Market is characterized by continuous advancements focused on increasing automation, enhancing material processing flexibility, and improving energy efficiency. The core technology remains high-tonnage hydraulic pressing, but modern systems utilize sophisticated variable frequency drives (VFDs) and energy-efficient servo-pumps to optimize power consumption based on the material load, departing from traditional constant-speed hydraulic systems. Furthermore, the integration of advanced filtration technologies is now standard, enabling high-purity recovery of expensive cutting fluids, coolants, and emulsions during the briquetting process. This fluid reclamation adds significant economic value and addresses environmental concerns related to waste oil disposal, making the systems highly attractive to environmentally conscious manufacturers.

A significant shift is occurring in control systems, moving towards intelligent PLCs (Programmable Logic Controllers) and Human-Machine Interfaces (HMIs) that offer intuitive operation and deep diagnostics. These control systems are increasingly equipped with remote monitoring capabilities (IoT integration), allowing manufacturers to troubleshoot machines globally, gather operational data, and push software updates. For end-users, this translates into higher uptime and proactive maintenance planning. Specialized material handling is another vital technological area; advancements include automated screw conveyors, vibrating screens, and magnetic separators that pre-treat the swarf, ensuring a consistent, contaminant-free feed into the press chamber, which is crucial for maximizing briquette density and protecting internal components from abrasive damage.

The frontier of briquetting technology involves specialized application machinery tailored for exotic and high-value alloys, such as those found in additive manufacturing (3D printing) waste streams. These systems often require specialized press configurations and highly sealed environments to prevent oxidation or contamination of sensitive powdered or fine particle materials. The trend toward modular design is also prominent, enabling customers to scale their briquetting capacity or integrate the system easily into diverse plant layouts. Ultimately, the industry is moving towards highly integrated, data-driven recycling hubs where the briquetter is not a standalone machine but a smart component within a larger, interconnected resource recovery and processing ecosystem, governed by smart logic and predictive analytics.

Regional Highlights

The Metal Briquetter Market exhibits strong regional disparities in terms of maturity, adoption rate, and regulatory influence, profoundly impacting investment decisions and technology deployment. North America and Europe are mature markets, characterized by high automation levels, stringent environmental regulations, and a substantial installed base of high-capacity machines across the automotive and aerospace industries. These regions emphasize highly efficient, low-maintenance, and AI-enabled systems due to high labor costs and strict sustainability goals. Investment focus in these areas is often directed towards replacing older equipment with newer, energy-saving models and adopting solutions for specialized alloys like stainless steel and superalloys, ensuring maximum scrap purity.

Asia Pacific (APAC) represents the fastest-growing and largest market globally, fueled by rapid urbanization, massive infrastructural projects, and the dominance of countries like China, India, and Japan in global manufacturing output. The sheer volume of metal swarf generated by these economies, particularly in general manufacturing and vehicle production, necessitates widespread adoption of efficient briquetting technology. While cost-sensitivity remains a factor in certain sub-regions, the move toward environmental accountability and the scale of operations are accelerating the demand for large, robust, and moderately automated briquetting systems. Government initiatives promoting recycling and circular economy models further solidify APAC’s leading market position, driving both domestic manufacturing and imports of advanced machinery.

The Latin America (LATAM) and Middle East and Africa (MEA) regions are emerging markets with significant untapped potential. In LATAM, particularly Brazil and Mexico, the expansion of the automotive and heavy machinery sectors creates a growing need for optimized scrap metal management. The MEA region, particularly the Gulf Cooperation Council (GCC) states, is investing heavily in diversification away from oil, fostering growth in aluminum smelting, construction, and localized manufacturing, thereby driving demand for briquetters to process internal scrap streams efficiently and securely. Adoption in these regions is driven by initial cost-efficiency and robust construction, capable of handling diverse industrial conditions, though the market for advanced IoT integration is still nascent compared to Western counterparts.

- Asia Pacific (APAC): Market leader by volume; driven by automotive manufacturing growth in China and India, extensive industrialization, and favorable recycling mandates.

- Europe: Mature market; characterized by stringent EU environmental regulations (WEEE, ELV directives) driving high adoption of advanced, high-efficiency, and highly automated briquetting systems.

- North America: High value market; demand sustained by the aerospace industry, specialized manufacturing, and a focus on high recovery yields for expensive alloys; emphasis on predictive maintenance and IoT integration.

- Latin America (LATAM): Emerging growth market; demand primarily originates from the expanding domestic automotive production and primary metal processing sectors in Brazil and Mexico.

- Middle East & Africa (MEA): High potential growth; driven by economic diversification efforts, increasing aluminum and steel production, and new infrastructure projects requiring efficient scrap handling solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metal Briquetter Market, covering their product portfolios, strategic initiatives, and market positioning.- RUF GmbH & Co. KG

- Roter Recycling Srl

- G. F. Equipment Inc.

- Komar Industries, Inc.

- Advance Hydrau-Tech Pvt. Ltd.

- Vecoplan AG

- Scangroup Limited

- Enviro-Pak, Inc.

- Briquetting Systems, Inc.

- A.G. Stoufflet Company

- Precision Hydraulic Cylinders Ltd.

- MetalForming Inc.

- Wamag Group

- Run-Tech Industrial Co., Ltd.

- Greenmax (by Intco Recycling)

- ACE Recycling & Disposal

- SSI Shredding Systems, Inc.

- Marathon Equipment Company

- Nederman Holding AB

- AIDA Engineering, Ltd.

Frequently Asked Questions

Analyze common user questions about the Metal Briquetter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary economic benefit of using a metal briquetter?

The primary economic benefit is the substantial increase in the value of scrap metal (swarf) due to densification, which significantly reduces transportation costs, minimizes material loss during the melting process (less oxidation), and allows for high-purity reclamation of expensive cutting fluids and oils.

How do metal briquetters contribute to environmental sustainability?

Metal briquetters are critical for sustainability by promoting the circular economy. They reduce industrial waste volume, decrease the need for virgin ore extraction, conserve energy by improving foundry melt efficiency, and enable the recycling of cutting fluids, minimizing hazardous waste disposal.

Which types of materials can be processed efficiently using briquetting technology?

A wide range of materials can be efficiently processed, including ferrous metals (steel, cast iron), non-ferrous metals (aluminum, copper, brass, bronze), and high-value exotic alloys (titanium, nickel, tungsten carbide). The effectiveness often depends on the briquetter's pressure capacity and configuration.

What is the typical return on investment (ROI) period for a high-capacity metal briquetter?

The ROI period for a high-capacity briquetter typically ranges from 18 to 36 months, heavily dependent on the volume and market price of the scrap metal being processed, the cost of recovered cutting fluids, and the savings realized from reduced hauling and disposal fees.

How is AI being used to enhance modern metal briquetting operations?

AI integration enhances operations through predictive maintenance, optimizing machine performance to match varying material input characteristics, and improving energy efficiency by dynamically adjusting hydraulic pump speeds, thereby maximizing uptime and reducing operational costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager