Metal Casting Robots Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441178 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Metal Casting Robots Market Size

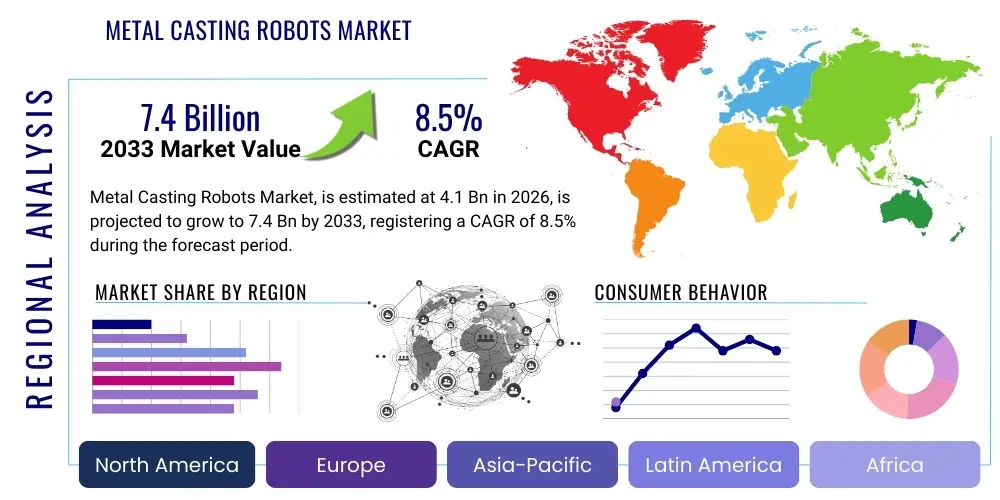

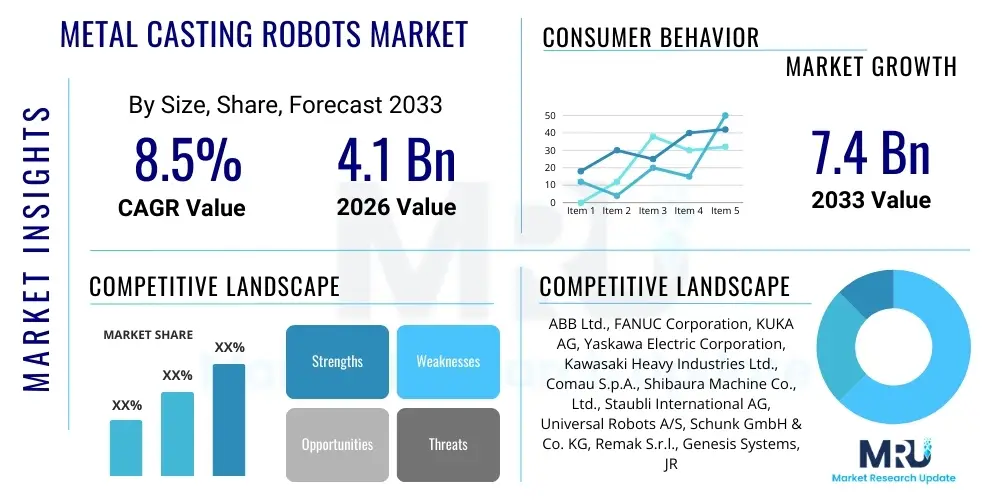

The Metal Casting Robots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 7.4 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by the escalating demand for high-quality, complex cast parts, particularly within the automotive and aerospace industries, coupled with the global trend towards factory automation and industrial digitalization.

Metal Casting Robots Market introduction

The Metal Casting Robots Market encompasses specialized industrial robotic systems designed to operate in the harsh environments inherent to foundry and casting processes, including high heat, dust, and exposure to molten metal. These robots perform critical tasks such as tending die casting machines, handling hot parts (extraction, quenching), fettling, grinding, and inspection. Their robust construction, often featuring protective coatings and pressurized housings, allows for reliable operation where human intervention poses significant safety risks, thereby enhancing overall production efficiency and consistency in the manufacturing of components made from materials like aluminum, zinc, and magnesium.

Major applications for metal casting robots span across various industrial sectors, with the automotive industry being the largest consumer, utilizing these systems for producing engine blocks, transmission components, and structural parts necessary for lightweight vehicle construction. Beyond automotive, applications are expanding rapidly into general manufacturing, heavy machinery, and consumer electronics sectors that require precision-cast components. The primary product descriptions include high-payload, articulated robots equipped with advanced vision and gripping capabilities tailored for repetitive, high-stress tasks essential for achieving uniform quality in mass production environments.

The core benefits derived from integrating these robotic solutions include significant improvements in operational safety by removing personnel from hazardous zones, achieving higher production throughput due to faster cycle times and reduced downtime, and ensuring exceptional part quality consistency that minimizes scrap rates. Key driving factors propelling market expansion involve the intense global competition necessitating lower manufacturing costs, the persistent challenge of labor shortages in skilled foundry positions, and stringent regulatory pressures related to workplace safety and environmental compliance, all of which favor the adoption of fully automated casting lines.

Metal Casting Robots Market Executive Summary

The Metal Casting Robots Market is characterized by accelerating business trends focused on the integration of artificial intelligence and machine learning for predictive maintenance and enhanced quality control, moving beyond simple task automation towards intelligent process optimization. Major robotics manufacturers are prioritizing the development of robust, specialized robot models capable of handling increasing payloads and operating under extreme thermal conditions, ensuring longevity and minimal service interruption. Furthermore, system integration services are becoming a crucial competitive differentiator, as end-users seek seamless, turnkey solutions that connect robots with existing peripheral equipment like furnaces, trimming presses, and cooling conveyors, streamlining the entire casting workflow for maximum efficiency and data utilization.

Regionally, the Asia Pacific (APAC) market, spearheaded by China, maintains its dominance, driven by massive investments in new automotive manufacturing capacity and rapid industrial modernization initiatives across the region. However, North America and Europe are exhibiting high-value growth, focused less on volume and more on adopting highly sophisticated, flexible robotic cells to address rising labor costs and facilitate the reshoring of complex manufacturing processes. European growth is particularly strong in high-precision die casting segments, driven by stringent quality standards in luxury automotive and aerospace applications, while North American expansion is bolstered by governmental pushes for industrial automation subsidies and modernization.

Segment trends reveal that the Die Casting application segment retains the largest market share, predominantly utilizing medium to high-payload articulated robots for fast cycle extraction and spraying operations. In terms of technology, the demand is shifting towards six-axis articulated robots due to their superior dexterity and reach, crucial for navigating complex casting setups. Concurrently, there is a pronounced trend towards smaller, collaborative robots being integrated for secondary tasks like inspection, finishing, and post-processing, signifying a diversification in robot type application based on specific process requirements, thereby maximizing the return on automation investment across the foundry value chain.

AI Impact Analysis on Metal Casting Robots Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Metal Casting Robots Market consistently center on transforming traditional, repetitive automation into intelligent, adaptive manufacturing processes. The primary questions revolve around how AI can enhance uptime through predictive failure analysis, improve casting quality via real-time defect detection using machine vision, and optimize complex operational parameters such as ladle movements, spray patterns, and cooling times. Users express high expectations for AI to solve critical challenges related to process variability, energy efficiency, and reducing the reliance on highly specialized human expertise for troubleshooting complex operational issues within the harsh foundry environment, driving demand for smart robotics platforms.

AI’s influence is moving the market beyond simple programmed trajectories towards cognitive robotic systems capable of continuous learning and autonomous decision-making. Specifically, the integration of deep learning algorithms into robot controllers allows for the dynamic adjustment of operational variables in response to real-time sensor feedback (temperature, pressure, vibration). This capability is critical in metal casting, where minor environmental shifts can significantly impact product quality. For instance, AI algorithms can predict melt quality based on optical sensor data and adjust pouring speed or cycle time instantaneously, minimizing porosity and surface defects, which historically required extensive post-processing inspection and high scrap rates.

Furthermore, AI-powered diagnostic tools are fundamentally changing maintenance protocols. By analyzing vast streams of operational data from motor currents, gearbox vibrations, and joint temperatures, AI can accurately forecast component failure well in advance, enabling condition-based maintenance rather than scheduled downtime. This significantly boosts Overall Equipment Effectiveness (OEE) and reduces catastrophic failures that lead to expensive, prolonged production halts. This adoption of smart, predictive technology assures end-users of higher reliability and lower total cost of ownership, making automation a more economically viable solution for high-volume casting operations worldwide.

- Enhanced predictive maintenance and fault diagnosis through machine learning analysis of vibration and temperature data.

- Real-time quality inspection and defect detection utilizing AI-powered 3D vision systems for superior consistency.

- Optimization of robot path planning and cycle times, adapting trajectories based on thermal mapping and part cooling requirements.

- Autonomous adjustment of critical casting parameters (e.g., spraying volume, die temperature) to minimize variance and scrap.

- Improved energy efficiency in robotic operation by optimizing acceleration and deceleration profiles based on load analysis.

DRO & Impact Forces Of Metal Casting Robots Market

The Metal Casting Robots Market is propelled by robust drivers centered on the imperative for enhanced productivity and safety in manufacturing, while simultaneously facing constraints related to high capital outlay and integration complexity. The primary driver remains the global automotive industry's continuous need for lightweight, high-integrity cast parts for electric vehicles (EVs) and fuel-efficient internal combustion engines, compelling foundries to adopt automated solutions to meet strict quality and volume demands. Opportunities are largely concentrated in the expansion of Industry 4.0 paradigms, which favor highly connected, data-driven casting cells and the shift towards advanced materials casting, such as specialized aluminum alloys and composites, demanding precise robotic handling.

Key drivers include the dramatic rise in labor costs across developed economies and the difficulty in recruiting and retaining personnel willing to work in the physically demanding and often dangerous foundry environment. Automation provides a quantifiable solution to mitigate workforce instability and ensures consistent operational standards around the clock. Conversely, significant restraints involve the substantial initial investment required for purchasing, customizing, and integrating highly specialized foundry robots, which can be prohibitive for small and medium-sized enterprises (SMEs). Furthermore, the operational complexity associated with programming and maintaining these advanced systems requires specialized technical skills, presenting an ongoing barrier to widespread adoption in regions lacking sufficient technical infrastructure.

The market impact forces are categorized into technology integration and economic pressures. Technological forces, such as the maturation of simulation software and the development of more durable robot components, reduce deployment risk and increase the lifespan of the equipment, positively influencing adoption rates. Economic forces, including volatility in raw material prices and global supply chain disruptions, put pressure on manufacturers to minimize waste and maximize efficiency, thereby increasing the value proposition of high-precision robotic casting solutions. The overall net effect of these forces suggests a sustained, high-growth trajectory, particularly as financing models evolve to make advanced robotics more accessible to a broader range of foundries seeking competitive advantages.

Segmentation Analysis

The Metal Casting Robots Market is comprehensively segmented across several dimensions, including the type of robot architecture used, the specific casting application performed, the robot’s payload capacity, and the primary end-user industry served. This segmentation provides a granular view of market dynamics, highlighting areas of fastest growth and concentrated demand. Analyzing these segments is critical for understanding technological adoption patterns and directing strategic market development efforts, especially concerning the differing requirements for large-scale gravity casting versus precision high-pressure die casting operations. The increasing complexity of manufacturing processes necessitates tailored robotic solutions, making segmentation based on functionality paramount for manufacturers.

The segmentation by robot type primarily focuses on articulated robots (6-axis), which dominate the market due to their superior flexibility and reach essential for complex mold tending and part extraction within confined spaces, followed by linear and specialized gantry robots utilized for simpler transfer tasks or handling extremely heavy loads. Application segmentation clarifies that die casting operations generate the highest revenue, given the sector's high automation rate and large production volumes, followed by investment casting and gravity casting. Furthermore, the segmentation by payload capacity—ranging from under 100 kg to over 300 kg—is directly correlated with the size of the components being manufactured, impacting the choice of robot required by specific end-user verticals, particularly between light vehicle parts and heavy machinery components.

- By Robot Type:

- Articulated Robots (6-Axis)

- SCARA Robots

- Gantry Robots

- Collaborative Robots (Cobots)

- By Application:

- Die Casting Machine Tending (Extraction and Spraying)

- Gravity Casting

- Investment Casting

- Finishing and Fettling (Grinding, Deburring)

- Inspection and Quality Control

- By Payload Capacity:

- Low Payload (Under 100 kg)

- Medium Payload (100 kg – 300 kg)

- High Payload (Above 300 kg)

- By End-User Industry:

- Automotive Industry (OEMs and Tier Suppliers)

- Aerospace and Defense

- Heavy Machinery and Industrial Equipment

- General Manufacturing

Value Chain Analysis For Metal Casting Robots Market

The value chain for the Metal Casting Robots Market is complex, stretching from upstream component suppliers to highly specialized downstream system integrators and final end-users. Upstream activities involve the procurement of specialized mechanical and electrical components, including high-torque motors, advanced controllers, precision sensors (vision and force), and robust protective materials designed to withstand extreme foundry conditions. Key suppliers include specialized component manufacturers for robotics arms, often global entities providing standardized, high-reliability parts. The integration of proprietary control software and operating systems by the main robot manufacturers is a crucial stage, determining the robot’s performance capabilities and ease of integration into foundry networks.

The midstream focuses on robot manufacturing and system assembly, where major robotics companies design, assemble, and test the specialized metal casting models. Distribution channels are varied, involving both direct sales to large, multinational automotive OEMs that have internal integration capabilities, and reliance on extensive networks of certified, independent system integrators. The indirect distribution route via integrators is highly critical in this market because metal casting requires complex customization—the robot cell must be precisely tailored to the specific dimensions, cycle times, and temperature profiles of the customer’s unique casting machinery and mold designs, a service the integrators specialize in providing.

Downstream activities center on deployment, maintenance, and after-sales support. System integrators play a pivotal role here, handling installation, calibration, safety certification, and initial operator training. End-users (e.g., automotive foundries) are seeking turnkey solutions that minimize production downtime during installation and maximize operational reliability post-deployment. The long lifecycle of industrial robots means that ongoing maintenance contracts, spare parts supply, and software updates are significant revenue streams within the downstream segment, emphasizing the importance of strong service networks provided by both the original equipment manufacturers (OEMs) and certified third-party service providers across all major geographic markets.

Metal Casting Robots Market Potential Customers

The primary customers and buyers of metal casting robots are organizations operating in high-volume, precision manufacturing sectors where component integrity and dimensional accuracy are paramount. The most significant customer base is found within the Automotive Industry, encompassing major Original Equipment Manufacturers (OEMs) and their extensive network of Tier 1 and Tier 2 suppliers. These customers utilize casting robots extensively for producing lightweight chassis components, engine parts (for ICE vehicles), and battery housings and structural components critical for modern electric vehicles, demanding high throughput and zero defect tolerance to meet stringent safety and efficiency standards mandated globally.

Another major segment of potential customers includes manufacturers in the Aerospace and Defense industry. Although the volume of components is lower compared to automotive, the precision and material requirements are significantly higher, focusing on investment casting and specialized alloy handling for critical engine and structural parts. These buyers require robots with exceptional accuracy, often integrated with advanced non-destructive testing and vision systems for absolute quality assurance. The high cost of failure in aerospace applications makes automation an essential requirement for repeatable, certified manufacturing processes, justifying the significant investment in advanced robotics.

Furthermore, General Manufacturing and Heavy Machinery sectors, including companies producing construction equipment, agricultural machinery, and industrial pumps, represent a steady and growing customer base. These entities require robust casting robots for handling large, heavy components made primarily from ferrous metals and high-strength alloys. The robots are typically high-payload models focused on tasks such as furnace charging, large mold handling, and heavy-duty fettling processes, aiming to improve worker safety and overcome the physical limits of manual labor in handling cumbersome, hot castings prevalent in these industries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 7.4 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, Kawasaki Heavy Industries Ltd., Comau S.p.A., Shibaura Machine Co., Ltd., Staubli International AG, Universal Robots A/S, Schunk GmbH & Co. KG, Remak S.r.l., Genesis Systems, JR Automation, Reis Robotics (part of KUKA), CMA Robotics S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metal Casting Robots Market Key Technology Landscape

The technological landscape of the Metal Casting Robots Market is defined by innovations aimed at enhancing robot resilience, precision, and connectivity within extremely demanding operational environments. A core focus is on specialized robot arm and joint protection, incorporating robust materials, sealed designs (IP67 or higher), and specialized thermal barriers to shield internal electronics and mechanics from heat radiated by furnaces and molten metal, ensuring longevity and consistent performance. Furthermore, advanced gripping and end-of-arm tooling (EOAT) technologies are pivotal; these include custom-designed grippers with specialized coatings resistant to high temperatures and rapid temperature cycling, crucial for securely handling delicate, hot castings immediately after extraction without causing deformation or thermal shock.

Connectivity and data integration technologies, central to the Industry 4.0 framework, are fundamentally transforming the utility of casting robots. Modern systems are equipped with Industrial Internet of Things (IIoT) sensors and network interfaces that facilitate real-time data exchange between the robot controller, the casting machine, the cooling unit, and central manufacturing execution systems (MES). This integration allows for sophisticated monitoring of operational parameters, immediate performance adjustments, and the collection of vast datasets necessary for machine learning applications, such as predictive quality modeling and cycle optimization, significantly elevating the robot’s value beyond simple physical labor replacement.

Simulation and offline programming software constitute another critical technology pillar. Given the complex nature of the foundry layout and the high cost of production downtime, advanced 3D simulation tools allow engineers to design, test, and validate robot paths and cell layouts virtually before physical deployment. These tools are often integrated with Digital Twin technology, enabling continuous optimization and troubleshooting in a risk-free digital environment. Furthermore, the increasing adoption of 3D vision systems paired with AI enhances flexibility, allowing robots to accurately locate, inspect, and handle irregularly shaped or slightly mispositioned parts, overcoming traditional limitations associated with highly structured robotic automation and paving the way for adaptive batch manufacturing in casting environments.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to dominate the metal casting robots market, primarily due to expansive industrialization, heavy investment in the automotive sector (especially in China, India, and South Korea), and governmental support for factory automation initiatives. China, as the world's largest producer of castings, drives volume demand, focusing on large-scale deployments for mass-producing automotive and consumer electronic components. The emphasis in this region is on scalability, cost efficiency, and rapidly replacing manual labor with high-throughput articulated robots.

- North America: The North American market (US and Canada) exhibits a mature demand structure characterized by a focus on high-value, sophisticated robotic cells. Growth is spurred by two key factors: the strong push for reshoring manufacturing operations and the imperative to increase domestic competitiveness against lower-cost foreign imports. Robotics adoption here is driven by necessity, addressing extreme labor shortages and demanding higher levels of automation, precision, and data connectivity (IIoT and AI integration) for complex components, particularly in aerospace and high-performance vehicle manufacturing.

- Europe: Europe represents a high-technology adoption region, with Germany and Italy leading in specialized die casting and heavy machinery production. The market is characterized by stringent quality standards and a high degree of technological integration. European manufacturers often invest in collaborative robot solutions for tasks where human-robot interaction is necessary, and they prioritize customized robotic cells that offer maximum flexibility for small-batch, high-mix production environments, driven by the continent's strong commitment to advanced manufacturing standards (Industry 4.0 implementation).

- Latin America, Middle East, and Africa (LAMEA): While smaller than the major regions, LAMEA is poised for accelerating growth, particularly in countries like Mexico (driven by automotive export manufacturing) and the Gulf Cooperation Council (GCC) nations (driven by infrastructure and diversification projects). Market expansion is currently focused on fundamental automation to improve safety and basic production efficiency in local foundries, often relying on imported, reliable articulated robot models adapted for local industrial conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metal Casting Robots Market.- ABB Ltd.

- FANUC Corporation

- KUKA AG (A Midea Group Company)

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries Ltd.

- Comau S.p.A.

- Staubli International AG

- Universal Robots A/S (Part of Teradyne)

- Seiko Epson Corporation

- Nachi-Fujikoshi Corp.

- Genesis Systems (A Nidec Company)

- JR Automation Technologies, LLC

- Keba AG

- Bastian Solutions (A Toyota Advanced Logistics Company)

- Remak S.r.l.

- CMA Robotics S.p.A.

- Schunk GmbH & Co. KG

- Gudel Group AG

- Wauseon Machine and Manufacturing

- Pinnacle Robotics

Frequently Asked Questions

Analyze common user questions about the Metal Casting Robots market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the Metal Casting Robots Market?

The primary driver is the accelerating demand for high-integrity, lightweight cast components, especially from the automotive industry (for EVs and advanced ICE vehicles), coupled with the critical necessity to improve worker safety and address persistent labor shortages in harsh foundry environments globally.

Which application segment holds the largest share in the Metal Casting Robots Market?

The Die Casting Machine Tending application segment, which involves the high-speed extraction and spraying of molds, dominates the market share due to the high volume, repetitive nature, and extreme thermal conditions of high-pressure die casting processes, necessitating robust automation for consistent cycle times.

How is Artificial Intelligence (AI) influencing the capabilities of casting robots?

AI significantly enhances capabilities by enabling predictive maintenance, real-time quality control through integrated vision systems for defect detection, and optimization of complex casting parameters such as pouring temperatures and cooling cycles, leading to reduced scrap rates and increased operational uptime.

What are the key technological restraints limiting the widespread adoption of these robots?

Key restraints include the substantial initial capital investment required for specialized, high-heat resistant robots and the significant complexity and cost associated with integrating these systems seamlessly into legacy foundry infrastructure and ensuring adequate technical expertise for ongoing programming and maintenance.

Which geographical region is expected to demonstrate the highest adoption rate for metal casting robots?

Asia Pacific (APAC), particularly driven by China, is expected to maintain the highest adoption rate due to large-scale expansion of automotive manufacturing capacity, lower operating expenditure focus, and continuous government investment in widespread industrial automation and modernization initiatives across the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager