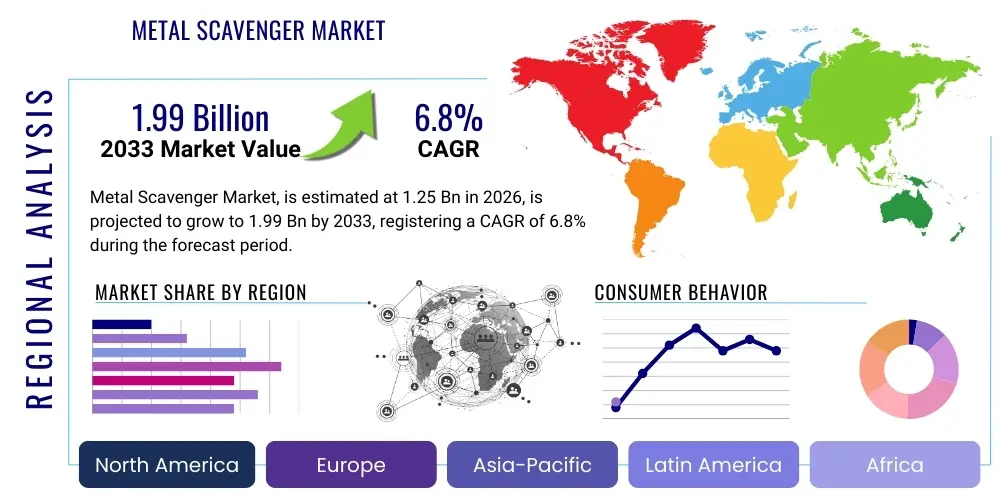

Metal Scavenger Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441466 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Metal Scavenger Market Size

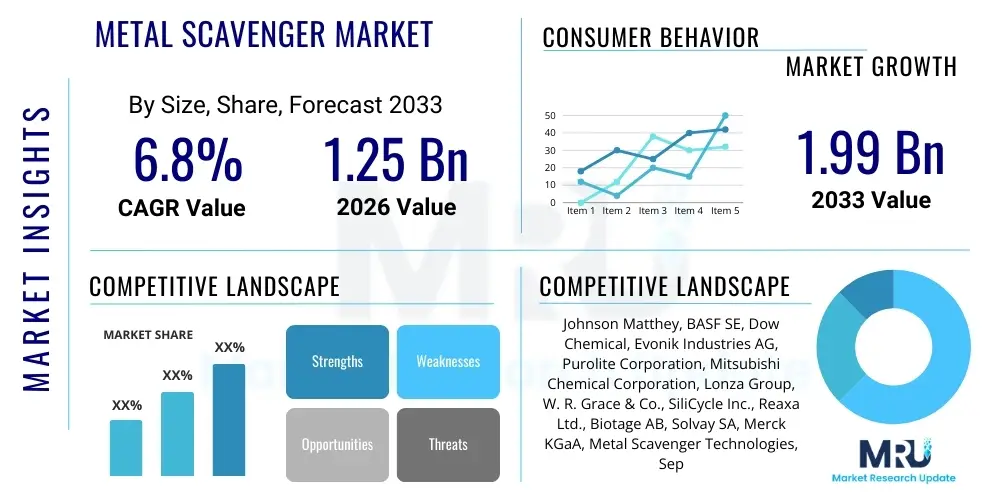

The Metal Scavenger Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.99 Billion by the end of the forecast period in 2033.

Metal Scavenger Market introduction

The Metal Scavenger Market involves the use of specialized chemical reagents designed for the highly selective removal of trace metal contaminants, primarily transition and precious metals, from complex liquid matrices. These contaminants, often originating as residues from homogeneous or heterogeneous catalysts, pose significant challenges to product quality, especially in regulated sectors like pharmaceuticals and advanced materials. Metal scavengers function by utilizing immobilized functional groups (ligands) strategically engineered onto solid supports—typically silica or polymer resins—which capture the target metal ions through chelation, adsorption, or precipitation mechanisms. The resultant solid-phase separation simplifies purification compared to traditional liquid-liquid extraction, enhancing yield and purity levels dramatically. The indispensability of these scavengers stems directly from the global chemical industry's increasing reliance on highly efficient, yet often metal-catalyzed, synthesis pathways such as cross-coupling reactions (e.g., Buchwald-Hartwig amination, Negishi coupling) that are essential for creating intricate molecular structures required for modern Active Pharmaceutical Ingredients (APIs) and specialty chemicals. The market is therefore fundamentally driven by the need to reconcile the efficiency of catalysis with stringent international purity standards, particularly those mandated by regulatory bodies like the FDA and EMA.

Product offerings within this market range from simple, non-selective adsorption media to highly sophisticated, tunable scavengers tailored for single metal removal. The design versatility allows manufacturers to choose scavengers based on operational parameters like solvent compatibility, temperature stability, and pH range. The main applications center around the purification of bulk pharmaceutical intermediates and APIs, ensuring compliance with stringent purity guidelines, including the ICH guidelines (Q3D on elemental impurities) which define permissible daily exposure limits for various metallic elements due to their potential toxicity. Beyond pharmaceuticals, metal scavengers are crucial in fine chemical synthesis where residual metals can poison expensive downstream catalysts, affect product color stability, or lead to undesirable side reactions, necessitating highly efficient cleanup protocols. Furthermore, the burgeoning field of continuous flow chemistry is significantly expanding the application scope, requiring scavengers that can perform efficiently at high flow rates and pressures, leading to technological evolution towards cartridge-based, stable, and highly permeable monolithic formats.

The core benefits derived from implementing effective metal scavenging protocols extend beyond mere regulatory compliance and product quality assurance. They contribute substantially to overall operational efficiency by significantly reducing the number of purification steps traditionally required, decreasing overall manufacturing cycle time, and minimizing the generation of hazardous waste associated with solvent-intensive liquid purifications. This improved process efficiency translates directly into lower manufacturing costs. Furthermore, in the context of precious metal catalysis (e.g., Palladium, Rhodium, Platinum), the use of scavengers allows for the highly efficient recovery of these extremely expensive catalysts from reaction waste streams, transforming a mandatory purification cost into a valuable resource recovery process, thereby significantly enhancing the economic sustainability of catalytic synthesis. This dual function—superior purification coupled with resource recycling—underscores the critical and growing role metal scavengers play in modern sustainable and economically viable chemical manufacturing, positioning them as essential components in optimizing industrial performance across diverse chemical and pharmaceutical verticals.

Metal Scavenger Market Executive Summary

The global metal scavenger market is experiencing robust, structurally driven growth, fundamentally propelled by the non-negotiable demand for ultra-high purity products within the pharmaceutical, biopharmaceutical, and advanced specialty chemical sectors. Current business trends illustrate a substantial market shift toward the innovation and adoption of highly selective, regenerable polymeric and silica-supported scavengers, which are designed to offer greater operational flexibility and reduced environmental impact compared to older, non-recyclable reagents. Strategic commercial activities, including targeted Mergers and Acquisitions (M&A) and specialized research collaborations, are predominantly aimed at integrating advanced materials science expertise with large-scale manufacturing capabilities. Key players are investing heavily in functionalized materials such as immobilized chelating resins and surface-modified mesoporous silicas to enhance binding kinetics and thermal stability, thus catering to complex industrial processes and continuous manufacturing demands, which represent a significant avenue for technological differentiation and market penetration.

Segment trends confirm the continued dominance of the pharmaceutical application sector, which accounts for the largest revenue share due to pervasive global regulation concerning elemental impurities in Active Pharmaceutical Ingredients (APIs). Within the technology segment, immobilized scavengers (both polymer and silica-based) maintain superior market penetration, favored for their ease of handling, adaptability to various chemical environments, and suitability for scalable column purification systems. However, the environmental remediation and wastewater treatment application segment is emerging as the fastest-growing niche, fueled by increasingly stringent global legislation regarding the discharge of heavy metals (like mercury, lead, and cadmium) into industrial effluents. This trend necessitates the development of specialized, cost-effective, high-capacity adsorbents tailored for aqueous systems, presenting substantial opportunities for new product development focused on sustainable environmental solutions.

From a geographical perspective, North America and Europe collectively command the majority of the market valuation, underpinned by their established, high-volume pharmaceutical manufacturing bases, advanced R&D ecosystems, and strict, early adoption of regulatory frameworks (like ICH Q3D). These regions prioritize premium, high-performance scavenger systems. Conversely, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the projection period. This acceleration is a direct result of rapid industrial expansion, significant foreign investment in specialty chemical and generic drug manufacturing facilities across countries such as China, India, and South Korea, and the increasing harmonization of local regulatory standards with international quality benchmarks. This expansion in APAC drives high demand not only for purification but also for cost-effective catalyst recovery solutions, positioning the region as the primary source of future market demand volume.

AI Impact Analysis on Metal Scavenger Market

Common user inquiries regarding AI's influence on the metal scavenger market predominantly center on the potential for data-driven material discovery, optimization of industrial processes, and predictive analytics for performance monitoring. Users frequently question how Artificial Intelligence, particularly machine learning (ML), can accelerate the identification of novel, highly selective ligands that target specific metal ions in complex chemical matrices, thereby drastically reducing traditional combinatorial synthesis time. Another significant area of interest is the feasibility of using ML algorithms to predict the optimal scavenger dosage, contact time, and temperature profile required for complex, multi-component reaction mixtures based on real-time input data, minimizing waste and ensuring guaranteed purity levels. The key themes consistently underscore the expectation that AI integration will fundamentally enhance efficiency, predictability, and environmental sustainability in purification chemistry, moving the industry toward 'smart', autonomous scavenging systems capable of instantaneous adjustment and self-optimization.

Artificial Intelligence, particularly through advanced computational chemistry and machine learning (ML) paradigms, is already beginning to catalyze a transformative shift in the research and development pipeline for novel metal scavengers. By applying sophisticated ML models to analyze and correlate vast chemical databases encompassing ligand structure, metal coordination complexes, solvent effects, and measured binding kinetics, researchers can rapidly predict the performance characteristics (selectivity, thermal stability, and loading capacity) of hypothetical scavenger materials. This computational approach significantly reduces the reliance on traditional, iterative, and resource-intensive experimental synthesis and screening methods. For instance, generative AI models can propose entirely new functionalized ligand architectures optimized for specific toxic or precious metals like Mercury or Palladium, leading directly to the creation of materials exhibiting previously unattainable levels of selectivity and capacity, accelerating time-to-market for next-generation products.

Furthermore, the integration of AI is poised to revolutionize the operational deployment and scaling of scavenging technologies in industrial manufacturing settings. Advanced process analytics, incorporating neural networks and deep learning tools, can analyze real-time spectroscopic data (e.g., ICP-MS, Raman) from purification streams continuously. This predictive capability allows plant operators to accurately determine the exact moment a scavenger resin approaches saturation, predict maintenance requirements for regeneration, or dynamically adjust flow rates to maintain purity targets. This level of precise, predictive control maximizes the working life of the scavenger material, minimizes reagent consumption, drastically reduces the risk of product contamination due to catalyst breakthrough, and optimizes overall resource utilization. This technological shift embodies a transition from static purification protocols to dynamic, highly responsive, and efficient manufacturing processes, critical for meeting the cost demands of large-scale, continuous pharmaceutical production.

- Accelerated discovery and design of novel, highly selective scavenger ligands using Machine Learning (ML) algorithms.

- Predictive modeling of adsorption capacity, kinetics, and optimal operational parameters based on complex reaction mixture input.

- Optimization of scavenger dosage and contact time in continuous flow chemistry through real-time data monitoring and AI-driven control loops.

- Enhanced quality control and process analytical technology (PAT) via AI-driven spectroscopic analysis for rapid, inline detection of metal breakthrough.

- Development of 'smart' manufacturing protocols for automated, optimal scavenger regeneration and recycling cycles, improving sustainability.

DRO & Impact Forces Of Metal Scavenger Market

The market dynamics for metal scavengers are defined by a complex interaction between regulatory drivers, technical restraints, and vast technological opportunities, which collectively establish the key impact forces steering market growth. A predominant driver is the ever-increasing stringency of global regulatory standards, notably the ICH Q3D guideline for elemental impurities, which imposes parts-per-million (ppm) or even parts-per-billion (ppb) limits on trace metals in pharmaceutical and food products, making highly efficient removal mandatory. Concurrently, the proliferation of complex organic synthesis pathways, which heavily rely on expensive and highly active precious metal catalysts (like Palladium and Rhodium), naturally generates a greater quantity of metal residues needing removal. The economic impetus derived from the ability of scavengers to efficiently recover these high-cost precious metals, thereby reducing operational expenditure and enhancing sustainability, serves as a powerful secondary market driver.

Despite the strong demand signals, the market faces several technical and economic restraints that moderate expansion. A significant technical challenge is the difficulty in designing 'universal' scavengers; selectivity remains highly metal- and solvent-dependent, often requiring manufacturers to develop customized solutions for each unique reaction matrix, which elevates R&D costs and complicates inventory management for end-users. Furthermore, the substantial initial capital investment required for implementing advanced large-scale scavenging and chromatography equipment, coupled with the necessity for highly trained technical personnel to manage complex resin regeneration and waste disposal procedures, acts as a considerable barrier to entry, particularly for Small and Medium Enterprises (SMEs). Finally, market stability is challenged by the fluctuating global prices of key raw materials, specifically the specialized chemical precursors needed for synthesizing functionalized polymers and high-grade silica supports.

Opportunities for exponential growth are concentrated in advanced material science and sustainable industrial applications. The burgeoning emphasis on Green Chemistry principles globally provides a significant avenue, encouraging the development of environmentally benign scavengers, such as biodegradable polymer supports or materials synthesized from renewable resources. A major technical opportunity lies in the advancement of high-performance, flow-compatible scavengers tailored for continuous manufacturing platforms, which require materials offering high throughput, minimal backpressure, and superior thermal stability. Furthermore, expansion into non-traditional chemical applications, particularly large-scale environmental remediation (cleanup of industrial spills, persistent heavy metal pollution in mining effluents) and the emerging field of critical metal recovery from electronic waste (e-waste) and battery recycling processes, represents substantial, untapped market potential that promises diversification beyond the core pharmaceutical segment and will define the next phase of market evolution.

Segmentation Analysis

The metal scavenger market is comprehensively segmented based on several critical parameters: the core support material used, the physical form of the product, the primary application area, and the specific metal ions targeted for removal. Segmentation by material type distinguishes between the traditionally favored polymer-supported scavengers, which offer high capacity and chemical resistance, and the rapidly growing silica-supported scavengers, valued for their superior thermal stability and faster kinetics, making them ideal for high-throughput applications. Application segmentation clearly highlights the dominance of the regulated pharmaceutical sector, which mandates maximum purity, followed by the fine chemical, catalysis, and increasingly, the environmental remediation segments. This granular segmentation aids both suppliers and users in identifying and targeting specific product requirements across highly diversified industrial needs.

- By Type:

- Polymer-Supported Scavengers: Highly cross-linked resins (e.g., polystyrene, polyethyleneimine) functionalized with chelating groups (e.g., thiol, amine, phosphine).

- Silica-Supported Scavengers: Ligands immobilized on porous silica gel, offering excellent mechanical and thermal stability, crucial for demanding processes.

- Carbon-Based Scavengers: Activated carbon and specialty carbon nanotubes functionalized for high-surface area adsorption.

- Metal Oxides and Other Inorganic Materials: Used primarily for non-precious and heavy metal removal in high-volume wastewater applications.

- By Application:

- Pharmaceutical Synthesis: Removal of trace metal catalysts (Pd, Pt, Rh) from Active Pharmaceutical Ingredients (APIs) and intermediates.

- Fine Chemical Manufacturing: Purity control in specialty chemicals, agrochemicals, and electronic materials.

- Petrochemical and Refinery Processes: Removal of trace contaminants that can deactivate heterogeneous catalysts.

- Catalysis and Metal Recovery: Scavenging and recycling of expensive precious metal catalysts from reaction mixtures.

- Environmental Remediation (Water Treatment): Large-scale removal of heavy metals (Hg, Pb, Cr) from industrial effluent and ground water.

- By Metal Targeted:

- Precious Metal Scavengers: Focused on Palladium (Pd), Platinum (Pt), Rhodium (Rh), Ruthenium (Ru), and Gold (Au).

- Heavy Metal Scavengers: Targeting highly toxic elements such as Mercury (Hg), Lead (Pb), and Cadmium (Cd).

- Transition Metal Scavengers: Designed for common industrial contaminants like Iron (Fe), Copper (Cu), Nickel (Ni), and Zinc (Zn).

- By Form:

- Bulk Resins and Powders: Used in large-scale batch reactors and fixed-bed column systems.

- Cartridges and Columns: Pre-packed, ready-to-use formats optimized for high-throughput screening and continuous flow systems.

Value Chain Analysis For Metal Scavenger Market

The value chain for the Metal Scavenger Market begins with a highly specialized upstream phase focused on the procurement of base materials and chemical functionalization. This stage involves sourcing high-quality, chemically pure base supports, predominantly cross-linked polymers and mesoporous silica. The critical value addition here lies in the precision synthesis and grafting of specialized functional groups—such as thiols, primary and secondary amines, or proprietary chelating ligands—onto the surface of these supports. Upstream efficiency is vital, as the homogeneity, loading capacity, and chemical stability of the final product are dictated by the quality control applied to the functionalization process. Raw material pricing, particularly for specialty chemical precursors used in ligand synthesis, significantly influences the final cost structure, demanding strong supplier relationships and robust inventory management to mitigate price volatility.

The midstream segment involves the core manufacturing, formulation, quality assurance, and packaging of the scavenger products. Manufacturers convert the functionalized materials into various commercial formats, ranging from fine powders and bulk resins for industrial column packing to pre-packed, flow-ready cartridges for automated systems. This phase requires stringent quality assurance protocols, including highly sensitive analytical testing (e.g., Inductively Coupled Plasma Mass Spectrometry - ICP-MS) to confirm material purity and verify the scavenger's actual binding capacity and selectivity under simulated operating conditions. Successful midstream execution often involves significant investment in specialized cleanroom facilities and sophisticated analytical instrumentation, ensuring that the final product consistently meets the ultra-high purity demands of pharmaceutical and specialty chemical clients globally.

Downstream activities are defined by the distribution, technical service, and final application support provided to end-users. Distribution channels are typically dual-pronged: direct sales are prioritized for large-volume customers, such as major pharmaceutical companies and refineries, allowing manufacturers to offer customized technical support, bespoke purification process development, and efficient bulk logistics. Indirect distribution relies on global chemical distributors, specialized chromatography suppliers, and localized sales agents to penetrate R&D laboratories, smaller specialty chemical producers, and diverse international markets. Technical support is a critical component of the downstream value proposition, involving consultation on optimal scavenger selection, process scale-up, and troubleshooting resin regeneration procedures, ensuring high customer retention and driving repeat business based on proven performance and integrated service delivery.

Metal Scavenger Market Potential Customers

The primary purchasers and key end-users of metal scavenger technologies are situated within industries that require absolute purity and operate under rigorous regulatory scrutiny, making product quality non-negotiable. The largest and most demanding customer base resides within the pharmaceutical and biotechnology sectors, specifically manufacturers engaged in synthesizing Active Pharmaceutical Ingredients (APIs) and complex intermediates, where the removal of residual metal catalysts is a mandatory requirement for achieving regulatory compliance (ICH Q3D). Additional significant consumers include specialty chemical manufacturers that produce high-ppurity materials for advanced electronics, agrochemicals, and polymers, where metal contamination can severely compromise performance characteristics. Furthermore, industrial environmental remediation firms, municipal water treatment facilities, and petrochemical refiners, seeking to protect expensive processing catalysts or comply with heavy metal discharge limits, represent high-volume, continuously expanding customer segments for specialized heavy metal and transition metal scavengers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.99 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson Matthey, BASF SE, Dow Chemical, Evonik Industries AG, Purolite Corporation, Mitsubishi Chemical Corporation, Lonza Group, W. R. Grace & Co., SiliCycle Inc., Reaxa Ltd., Biotage AB, Solvay SA, Merck KGaA, Metal Scavenger Technologies, Sepax Technologies Inc., Osaka Soda Co., Ltd., Qingdao Jinkai Chemical Technology Co., Ltd., Avantor, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metal Scavenger Market Key Technology Landscape

The technology landscape for the metal scavenger market is characterized by continuous refinement, focusing intensely on enhancing selectivity, thermal robustness, and applicability in high-efficiency manufacturing systems like continuous flow reactors. A foundational technological thrust involves the advancement of functionalized solid supports, moving beyond basic resins to highly ordered materials such as mesoporous silica and surface-modified graphitic carbon materials. This innovation enables higher surface area for ligand attachment, leading to significantly increased loading capacity and faster kinetic binding rates—critical performance indicators for industrial processes. Furthermore, there is a substantial focus on chemically engineering novel chelating ligands (e.g., highly specialized polyamines, modified phosphines, and thiourea derivatives) that can complex with targeted metals with extreme precision, minimizing the removal of desirable co-products or reactants from complex synthetic mixtures, thereby optimizing yield and process economics.

A second major technological trend is the adaptation of scavenging materials for integration into advanced purification platforms. The rapid expansion of continuous flow chemistry in pharmaceutical and fine chemical synthesis necessitates scavenger formats that are mechanically stable, resistant to high pressure, and capable of maintaining performance over extended periods without clogging or attrition. This has driven innovation towards pre-packed, high-efficiency cartridges and specialized monolithic scavengers, which offer exceptionally low backpressure and optimized mass transfer kinetics compared to traditional bulk resin systems. The application of sophisticated immobilization techniques, ensuring the covalent grafting of ligands to prevent leaching into the product stream—a major regulatory concern—is a central technological requirement driving trust and adoption in high-stakes environments, particularly in API manufacturing where traceability is paramount.

Finally, sustainability and efficiency gains are driving the development of advanced separation technologies, prominently featuring magnetically recoverable scavengers and regenerable resins. Magnetic scavengers, which utilize ligands immobilized on ferro-magnetic nanoparticles, allow for rapid, solvent-free separation of the spent material using an external magnetic field, dramatically simplifying post-reaction workup and filtration steps—a key benefit in high-throughput settings. Simultaneously, technological investment is substantial in developing robust, regenerable resins that can be cleaned and reactivated multiple times (often via acid washing or specialized solvent treatment) to strip the adsorbed metal. This regeneration capability significantly reduces consumable costs and minimizes hazardous solid waste, offering a compelling environmental and economic value proposition that is gaining traction across highly competitive global chemical markets seeking both cost-optimization and enhanced environmental stewardship.

Regional Highlights

- North America: This region maintains the largest market share, anchored by a dominant, technologically advanced pharmaceutical and biopharmaceutical sector, particularly in the United States. Demand is driven by strict FDA regulatory adherence to ICH Q3D guidelines, high investment in R&D for novel materials, and rapid adoption of continuous manufacturing requiring state-of-the-art flow-compatible scavenging technologies.

- Europe: Characterized by a highly mature fine chemical and specialty synthesis industry, particularly in Germany, Switzerland, and the UK. Market growth is sustained by stringent EU environmental regulations (e.g., REACH) and a strong commitment to Green Chemistry, fostering demand for highly selective, regenerable, and environmentally benign scavenger systems.

- Asia Pacific (APAC): Positioned as the fastest-growing market globally. The expansion is fueled by the rapid growth of generic and contract manufacturing organizations (CMOs) in China and India, increasing alignment with international regulatory standards, and massive industrialization, leading to simultaneous high demand for pharmaceutical purification and environmental heavy metal remediation solutions.

- Latin America (LATAM): Exhibits moderate, stable growth primarily centered around local pharmaceutical production and basic industrial chemical manufacturing. Demand is focused on balancing efficacy with cost-effectiveness, with increasing governmental focus on water quality management driving adoption in industrial effluent treatment.

- Middle East and Africa (MEA): Market growth is heavily concentrated in the upstream oil and gas and petrochemical refining sectors, where high-capacity metal scavengers are crucial for removing contaminants (like Vanadium and Nickel) that poison expensive heterogeneous catalysts used in cracking and upgrading processes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metal Scavenger Market.- Johnson Matthey

- BASF SE

- Dow Chemical

- Evonik Industries AG

- Purolite Corporation

- Mitsubishi Chemical Corporation

- Lonza Group

- W. R. Grace & Co.

- SiliCycle Inc.

- Reaxa Ltd.

- Biotage AB

- Solvay SA

- Merck KGaA

- Metal Scavenger Technologies

- Sepax Technologies Inc.

- Osaka Soda Co., Ltd.

- Qingdao Jinkai Chemical Technology Co., Ltd.

- Avantor, Inc.

Frequently Asked Questions

Analyze common user questions about the Metal Scavenger market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of metal scavengers in pharmaceutical manufacturing?

The primary function is to remove trace amounts of residual metal catalysts, such as palladium or platinum, from Active Pharmaceutical Ingredients (APIs) to ensure the final drug product meets stringent regulatory limits (often ppb level) for safety and quality compliance, adhering to guidelines like ICH Q3D.

How are metal scavengers segmented by material type?

Scavengers are predominantly segmented into polymer-supported (functionalized resins offering high capacity) and silica-supported types (offering high thermal stability and superior kinetics). Other types include carbon-based and inorganic metal oxides for specific applications.

Which application segment drives the highest demand in the market?

The Pharmaceutical Synthesis segment currently drives the highest demand globally due to mandatory regulatory requirements for minimizing catalyst residues in drug products, followed closely by the high-purity fine chemical synthesis market and environmental remediation.

What role does sustainability play in the development of new scavenging technologies?

Sustainability is crucial, driving R&D toward developing highly efficient, regenerable scavengers that can be reused multiple times, significantly reducing material consumption, waste generation, and allowing for the cost-effective recovery of expensive precious metals.

How is AI impacting the future design of metal scavengers?

AI, specifically Machine Learning (ML), is revolutionizing design by accelerating the discovery of novel, highly selective ligands and functionalized supports. It is also used in process analytical technology (PAT) to predict performance and optimize operational parameters in real-time, enhancing process efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager