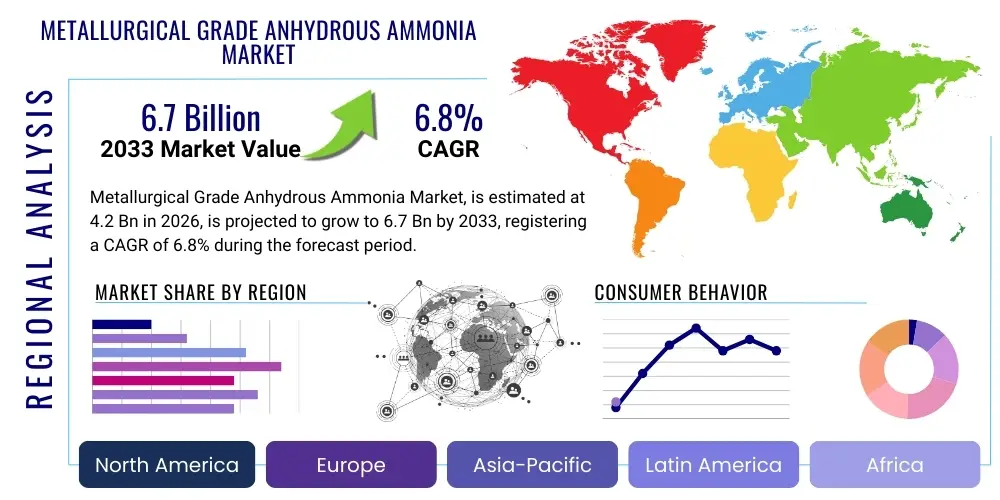

Metallurgical Grade Anhydrous Ammonia Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442723 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Metallurgical Grade Anhydrous Ammonia Market Size

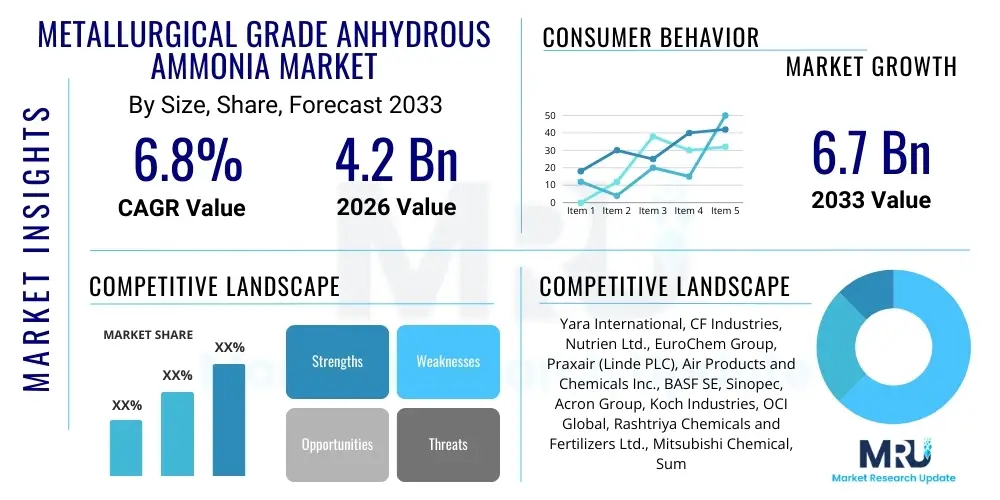

The Metallurgical Grade Anhydrous Ammonia Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally underpinned by the escalating global demand for high-performance alloys and specialty metals utilized across critical industrial sectors, including aerospace, defense, and advanced automotive manufacturing. The stringent quality requirements necessary for these advanced applications necessitate the ultra-high purity and controlled atmosphere capabilities that metallurgical grade anhydrous ammonia provides, distinguishing it from standard industrial grades. Furthermore, ongoing investments in developing economies aimed at expanding their foundational manufacturing and steel production capacities contribute substantially to the volumetric demand growth observed across all major geographic regions, particularly in Asia Pacific where large-scale infrastructure projects remain abundant.

Metallurgical Grade Anhydrous Ammonia Market introduction

Metallurgical Grade Anhydrous Ammonia (MGAA) is characterized by its exceptional purity, often exceeding 99.98%, and minimal moisture and oil content, making it indispensable for specific, highly sensitive metallurgical processes. This specialized chemical compound serves primarily as a source of nitrogen and hydrogen in controlled atmospheres, essential for bright annealing, nitriding, brazing, sintering in powder metallurgy, and various heat treatment operations required for specialty metals such and stainless steels and high-strength low-alloy steels. The demand for MGAA is intrinsically linked to the health of the high-end manufacturing sector, where material integrity and surface finish are paramount to product reliability and performance, particularly under extreme operational conditions such as high temperatures or corrosive environments.

The core application of MGAA lies in generating dissociated ammonia, which provides a reducing atmosphere critical for preventing oxidation during the heat treatment of metal parts. This capability ensures components maintain surface brightness, dimensional accuracy, and optimal mechanical properties, which is crucial for components used in sensitive applications like aircraft engine parts, surgical instruments, and critical automotive transmission components. Market expansion is currently being driven by advancements in powder metallurgy and additive manufacturing (AM), where precise atmosphere control is non-negotiable for ensuring the structural integrity and density of sintered or fused components, leading to higher consumption rates of ultra-pure ammonia.

Key driving factors accelerating the market include the global trend toward vehicle lightweighting, necessitating high-strength steels and aluminum alloys that require sophisticated heat treatment; the rapidly expanding aerospace industry, which demands certified materials with traceability; and increasing regulatory pressures that mandate higher quality and longer lifespan for manufactured goods. However, the market faces headwinds primarily related to the volatile pricing of natural gas, the primary feedstock for ammonia production, and the significant logistical challenges associated with the safe storage and transportation of pressurized anhydrous ammonia, which requires specialized infrastructure and adherence to rigorous safety standards.

Metallurgical Grade Anhydrous Ammonia Market Executive Summary

The Metallurgical Grade Anhydrous Ammonia market demonstrates resilient growth, underpinned by non-cyclical demand from specialized high-technology manufacturing sectors and robust expansion in traditional heavy industries, particularly in emerging Asian economies. Key business trends indicate a shift towards localized production hubs to mitigate global supply chain disruptions and volatile shipping costs, alongside a growing emphasis on integrating sustainable practices, such as exploring green ammonia synthesis pathways powered by renewable energy, to address environmental concerns and improve energy security. Investment is heavy in enhancing purification technologies to meet increasingly strict purity specifications demanded by next-generation metallurgy, especially for applications in electric vehicle battery components and advanced defense platforms.

Regionally, Asia Pacific maintains its dominance, driven by massive domestic infrastructure spending in China and India, coupled with the relocation of global manufacturing supply chains seeking lower operational costs. North America and Europe, while slower in volumetric growth, lead in technology adoption and premium segment consumption, characterized by high demand for MGAA in advanced powder metallurgy and specialized alloy manufacturing (e.g., turbine blades and medical devices). Segment trends highlight the Powder Metallurgy segment as the fastest-growing application, directly benefiting from the surge in additive manufacturing techniques and the requirement for precise, oxygen-free sintering atmospheres, demanding the highest quality MGAA grades.

The competitive landscape remains moderately consolidated, dominated by large chemical producers with extensive vertical integration, encompassing feedstock procurement, ammonia synthesis, and specialized purification capabilities. Smaller, regional players often focus on niche purification and specialized distribution services tailored to local regulatory frameworks and industrial clusters. Strategic imperatives for market participants involve securing long-term supply agreements with major industrial end-users, investing in safety and logistics infrastructure, and differentiating product offerings based on purity certifications and delivery reliability to command premium pricing in specialized market niches. This focus on reliability and quality ensures sustained market traction despite macroeconomic fluctuations that might affect broader industrial chemical markets.

AI Impact Analysis on Metallurgical Grade Anhydrous Ammonia Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Metallurgical Grade Anhydrous Ammonia Market generally revolve around optimizing the complex synthesis process, enhancing supply chain safety and efficiency, and ensuring product quality consistency. Users frequently inquire about AI's role in predictive maintenance for high-pressure storage and transport infrastructure, minimizing leaks and safety risks inherent to anhydrous ammonia. Another key concern focuses on how Machine Learning (ML) algorithms can analyze real-time operational data from the Haber-Bosch process to maximize yield while minimizing the enormous energy consumption associated with ammonia production, thereby addressing both cost and sustainability goals. Furthermore, end-users are keen to understand how AI-driven quality control systems can monitor and verify the ultra-high purity levels of MGAA required for sensitive metallurgical applications like aerospace component sintering, guaranteeing compliance without extensive manual intervention.

AI's primary influence is expected to revolutionize the operational and safety frameworks surrounding MGAA. In manufacturing, predictive models analyze multivariate data streams—including temperature, pressure, flow rates, and catalyst health—to anticipate potential process deviations, ensuring steady-state operations and maximizing hydrogen utilization efficiency. This capability directly reduces the cost of goods sold and minimizes the environmental footprint per ton of ammonia produced. Beyond synthesis, AI-powered logistics platforms use advanced routing algorithms and telemetry data to optimize the transport schedule and minimize transit risk, vital for a hazardous material like anhydrous ammonia, thus improving overall supply chain resilience and delivery reliability to remote metallurgical sites.

Moreover, the integration of AI in quality assurance is crucial for maintaining metallurgical grade specifications. Sophisticated vision systems and analytical sensor arrays, supported by ML, can detect trace impurities in real-time far faster and more reliably than traditional laboratory testing. This instantaneous feedback loop allows producers to make immediate process adjustments, ensuring the MGAA consistently meets the stringent specifications required for nitriding and sintering critical components, reducing the risk of material failure in high-value end-products. Consequently, AI acts as a multiplier for operational efficiency, safety, and product quality consistency across the entire MGAA value chain, solidifying its adoption as a strategic necessity rather than a mere technological enhancement.

- AI optimizes the Haber-Bosch synthesis process for maximum energy efficiency and yield.

- Predictive maintenance schedules for high-pressure storage tanks reduce the risk of catastrophic failures and leaks.

- Machine Learning algorithms enhance purity analysis and real-time quality control, ensuring consistent metallurgical grade specifications.

- AI-driven supply chain management improves logistics, reducing transportation risks and optimizing delivery routes for hazardous material.

- Data analytics supports better feedstock management, particularly concerning natural gas price volatility and procurement optimization.

DRO & Impact Forces Of Metallurgical Grade Anhydrous Ammonia Market

The Metallurgical Grade Anhydrous Ammonia market is shaped by a potent confluence of demand-side drivers rooted in technological advancements and supply-side constraints tied to production economics and regulatory oversight. The dominant driver is the accelerating demand for advanced, high-strength, lightweight materials across global manufacturing, particularly within the aerospace and electric vehicle (EV) sectors where precision heat treatment using controlled nitrogen atmospheres is essential for component performance and longevity. However, this growth is constantly tempered by the inherent restraints associated with ammonia—specifically, the significant volatility in natural gas prices, which directly impacts production costs, and the exceptionally stringent safety, handling, and environmental regulations governing its storage and cross-border transportation, which mandate substantial capital investment in compliant infrastructure.

Opportunities for market growth principally reside in the emerging field of Green Ammonia production, utilizing renewable energy sources like wind or solar to power electrolysis for hydrogen feedstock, potentially decoupling MGAA costs from fossil fuel price fluctuations and meeting corporate sustainability mandates. Additionally, the proliferation of specialized material processing techniques, such as advanced powder metallurgy components for additive manufacturing, presents a high-growth niche requiring superior-purity MGAA. The interaction between these forces creates a complex environment where innovation in synthesis technology (opportunity) must constantly overcome the high barriers of regulatory compliance (restraint) to capitalize on the increasing global need for advanced materials (driver). This dynamic equilibrium dictates strategic investments in both technology and supply chain security across the industry.

The primary impact forces acting upon this specialized market are environmental sustainability pressures, which push companies toward green synthesis methods; the increasing globalization of high-precision manufacturing, necessitating robust and reliable international supply chains; and technological convergence, particularly the adoption of advanced robotics and automation in material handling and heat treatment, which drives demand for consistent, ultra-pure processing inputs like MGAA. These forces collectively compel market participants to prioritize operational excellence, safety compliance, and technological differentiation to maintain a competitive edge, ensuring that the market trajectory remains upward, albeit subject to economic sensitivity to energy prices and geopolitical stability impacting feedstock supply.

Segmentation Analysis

The Metallurgical Grade Anhydrous Ammonia market is comprehensively segmented based on its application, purity level, and the end-use industry it serves, reflecting the diverse and highly specialized requirements of modern metallurgy. Understanding these segmentations is crucial as the required purity and delivery method often vary significantly based on whether the product is used for bright annealing, nitriding, or high-density powder metallurgy sintering. The market is primarily bifurcated based on application type, with heat treatment and nitriding consuming the largest volume, while the powder metallurgy segment typically demands the highest purity levels and thus commands premium pricing.

Further segmentation by purity level (e.g., 99.98% vs. 99.99%) dictates market entry barriers and competitive positioning, as only a few specialized producers can consistently meet the most stringent specifications required by industries like microelectronics and certified aerospace component manufacturing. Regional segmentation is vital, reflecting pronounced differences in industrial maturity and regulatory environments; for example, North America and Europe prioritize specialized, high-cost applications, whereas Asia Pacific's massive volume demand is driven by large-scale steel production and general manufacturing. This granular segmentation allows suppliers to tailor their logistics and quality control protocols precisely to the needs of specific end-user clusters, maximizing both operational efficiency and market penetration.

- By Application:

- Bright Annealing

- Nitriding and Nitrocarburizing

- Powder Metallurgy Sintering

- Brazing and Welding Atmospheres

- Other Heat Treatment Processes

- By Purity Level:

- 99.98% Purity

- 99.99% and Above Purity (Ultra-High Grade)

- By End-Use Industry:

- Aerospace and Defense

- Automotive (Including EV Components)

- Tool and Die Manufacturing

- Electronics and Semiconductors

- Heavy Machinery and Infrastructure

Value Chain Analysis For Metallurgical Grade Anhydrous Ammonia Market

The value chain for Metallurgical Grade Anhydrous Ammonia begins with the upstream procurement and processing of hydrocarbon feedstock, predominantly natural gas, which is subjected to steam methane reforming (SMR) or partial oxidation to produce hydrogen—the crucial ingredient for the Haber-Bosch synthesis process. This initial phase is capital-intensive and highly sensitive to global energy commodity pricing, defining the foundational cost structure of MGAA production. Subsequent steps involve the synthesis of industrial-grade ammonia, followed by a crucial purification stage where specialized technologies (such as molecular sieves, cryogenic distillation, or advanced catalytic converters) are employed to remove trace impurities, notably moisture, oil, and oxygen, thereby elevating the product to the necessary metallurgical grade purity required by demanding end-users. Efficiency and cost optimization in this upstream segment are highly reliant on robust energy infrastructure and adherence to stringent environmental discharge regulations, necessitating continuous investment in process control technologies.

The midstream logistics and distribution network involves the highly specialized handling and transportation of the purified anhydrous ammonia. Due to its hazardous nature and pressurized storage requirements, distribution relies on a combination of dedicated pipeline infrastructure (limited to certain regions), specialized rail tank cars, high-pressure road tankers, and ISO containers. Maintaining product integrity (purity) during transport is paramount, requiring strict quality checks and inert atmosphere protocols. Direct and indirect distribution channels coexist; large producers often engage in direct supply agreements (long-term contracts) with major metallurgical hubs (e.g., large steel mills or aerospace component manufacturers), ensuring consistent supply and technical support. Indirect channels involve regional chemical distributors who manage localized inventories, specialized cylinder filling operations, and just-in-time delivery services for smaller, dispersed end-users involved in niche heat treatment operations.

The downstream segment encompasses the utilization of MGAA within various manufacturing processes, where it is typically dissociated to create an atmosphere rich in hydrogen and nitrogen. End-users in the aerospace and automotive sectors demand meticulous certification and traceability documentation, creating significant barriers to entry for uncertified suppliers. The value added at this final stage is the consistent performance enhancement of the metal components—achieving superior surface hardness, reduced friction, and enhanced corrosion resistance. The overall profitability of the MGAA market is therefore determined not only by efficient upstream production but critically by the reliability, safety compliance, and purity guarantees embedded within the midstream and downstream service offerings, establishing a framework where logistics and specialized handling contribute significantly to the final product cost.

Metallurgical Grade Anhydrous Ammonia Market Potential Customers

The potential customers for Metallurgical Grade Anhydrous Ammonia are primarily large industrial entities operating in highly regulated and quality-critical manufacturing sectors that require controlled atmosphere processing for high-performance metal components. These buyers include major integrated steel manufacturers who utilize MGAA for bright annealing high-grade stainless steel coils and sheets, ensuring a pristine surface finish necessary for specialized applications like food processing equipment and architectural cladding. Additionally, the automotive industry, particularly manufacturers focused on critical powertrain components, transmission parts, and increasingly, components for high-voltage battery enclosures and electric motor shafts, represent a significant customer base, relying on MGAA for processes like nitriding to enhance surface durability and wear resistance.

The fastest-growing customer base resides within the aerospace and defense sectors, where component failure is unacceptable. Companies involved in manufacturing turbine blades, landing gear components, specialized fasteners, and airframe structures require the ultra-high purity MGAA for precise heat treatments and specialized sintering operations in powder metallurgy. These customers are characterized by extremely low tolerance for impurities, high certification requirements (e.g., AS9100, NADCAP accreditation), and a willingness to pay a substantial premium for guaranteed purity and reliable, traceable supply. Furthermore, specialized tool and die manufacturers, producing precision cutting tools and molds, utilize MGAA to achieve superior hardness and extended lifespan of their products through advanced nitriding techniques.

The expanding domain of additive manufacturing (3D printing) using metal powders is creating a new segment of potential customers, including specialized service bureaus and large original equipment manufacturers (OEMs) incorporating AM processes. Sintering metal powder parts requires an exceptionally clean, reducing atmosphere provided by dissociated MGAA to prevent oxidation, ensure high density, and achieve the desired mechanical properties in the final component. These customers seek smaller, high-purity batch deliveries and require close technical consultation regarding gas control and atmospheric composition within the sophisticated AM furnaces, signifying a shift toward highly technical customer relationships beyond traditional bulk chemical supply.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Yara International, CF Industries, Nutrien Ltd., EuroChem Group, Praxair (Linde PLC), Air Products and Chemicals Inc., BASF SE, Sinopec, Acron Group, Koch Industries, OCI Global, Rashtriya Chemicals and Fertilizers Ltd., Mitsubishi Chemical, Sumitomo Chemical, Borealis AG, LSB Industries, Inc., Trammo, Qatar Fertilizers Company (QAFCO), GSFC, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metallurgical Grade Anhydrous Ammonia Market Key Technology Landscape

The technology landscape for the Metallurgical Grade Anhydrous Ammonia market is primarily focused on two critical areas: optimizing the Haber-Bosch synthesis process for cost reduction and energy efficiency, and developing advanced purification and handling technologies to meet stringent purity specifications and safety standards. Traditional ammonia synthesis remains the core process, but technological innovations are heavily geared toward integrating carbon capture, utilization, and storage (CCUS) technologies to decarbonize the 'gray' ammonia production footprint. Furthermore, the advent of solid oxide electrolysis cells (SOECs) and high-efficiency electrolyzers is driving the commercial viability of 'Green Ammonia,' utilizing renewable electricity to generate carbon-free hydrogen, representing the most significant long-term technological disruption in the sector.

In terms of purification, which converts standard industrial ammonia into the high-grade metallurgical product, key technologies include advanced pressure swing adsorption (PSA) and specialized catalytic converters designed to meticulously strip away trace contaminants such as hydrocarbons, oxygen, and residual moisture. These purification trains must operate with extremely high reliability, as even minute impurities can compromise the integrity of high-value metal components in downstream processes like sensitive sintering. The use of advanced sensor technology, often integrated with AI, allows for continuous, real-time monitoring of gas chromatograph readings, ensuring that purity thresholds, often measured in parts per million (ppm), are consistently maintained before the product is stored or transferred to specialized, high-integrity transport containers.

Moreover, the technological focus extends to the safe and reliable delivery infrastructure. This includes innovations in storage tank materials designed for enhanced chemical resistance and integrity under pressure, specialized valve systems with superior leak detection capabilities, and next-generation monitoring equipment for transport vehicles (rail and road tankers). These technologies mitigate the substantial safety risks associated with anhydrous ammonia and comply with global hazardous material transport regulations. Investment in logistics technology, including GPS tracking and sophisticated scheduling software, further optimizes the supply chain, ensuring just-in-time delivery to geographically diverse metallurgical clusters while maintaining stringent safety protocols throughout the highly pressurized distribution lifecycle.

Regional Highlights

The global consumption landscape for Metallurgical Grade Anhydrous Ammonia is highly differentiated by regional industrial maturity, regulatory frameworks, and underlying economic drivers. Asia Pacific (APAC) stands out as the largest and fastest-growing market, largely driven by the monumental scale of steel production, rapid urbanization, and massive infrastructure projects across China, India, and Southeast Asia. This region primarily focuses on high-volume consumption for general heat treatment and large-scale bright annealing of steel, underpinned by government initiatives promoting domestic manufacturing expansion and defense modernization efforts. The high concentration of original equipment manufacturers (OEMs) and ancillary parts suppliers further cements APAC’s demand dominance, though the purity requirements may sometimes be slightly less stringent than those in Western, high-tech markets.

North America and Europe represent the mature, high-value segments of the MGAA market. While volumetric growth is steady rather than explosive, the demand is characterized by extremely high purity requirements (Ultra-High Grade) driven by highly regulated sectors such as aerospace, medical device manufacturing, and precision tool making. Regulatory environments, particularly in the European Union, impose severe constraints on production emissions and material handling safety, pushing market players towards premium, environmentally compliant sourcing, including early adoption of Green Ammonia alternatives. The focus here is less on bulk production and more on customized, technical supply solutions for specialized metallurgical operations, often involving advanced powder metallurgy techniques vital for next-generation material science research and development.

The Middle East and Africa (MEA), particularly the GCC nations, are significant players in the global supply side due to abundant, low-cost natural gas reserves, positioning them as key exporters of ammonia feedstock. However, their regional consumption of MGAA for high-precision metallurgy is relatively nascent, concentrated mainly around oil and gas infrastructure maintenance and nascent defense industry development. Latin America, influenced largely by commodity-driven economies and automotive manufacturing clusters in Brazil and Mexico, demonstrates moderate but consistent demand for MGAA in automotive component heat treatment and mining machinery applications. The region faces challenges related to logistics and infrastructure, often relying on imported purified ammonia or localized small-scale purification facilities, making supply chain resilience a critical factor for end-users.

- Asia Pacific (APAC): Dominates in volume consumption due to large-scale steel and automotive production in China and India; major driver is industrialization and infrastructure development.

- North America: High-value market segment driven by stringent quality control in aerospace, defense, and high-end automotive manufacturing; leads in demand for Ultra-High Grade MGAA.

- Europe: Characterized by strict environmental regulations and high demand for precision applications (tooling, medical devices); high focus on sustainable sourcing and Green Ammonia technology adoption.

- Middle East & Africa (MEA): Primarily an ammonia production and export hub; regional MGAA consumption is growing, driven by local industrial diversification and specialized energy sector maintenance.

- Latin America: Stable growth linked to automotive industry and heavy machinery maintenance; market resilience depends on overcoming logistical complexities associated with hazardous chemical distribution.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metallurgical Grade Anhydrous Ammonia Market, analyzing their product portfolios, strategic initiatives, regional presence, and competitive positioning within the global supply ecosystem.- Yara International ASA

- CF Industries Holdings, Inc.

- Nutrien Ltd.

- EuroChem Group AG

- Linde PLC (Praxair)

- Air Products and Chemicals Inc.

- BASF SE

- Sinopec

- Acron Group

- Koch Industries, Inc.

- OCI Global

- Rashtriya Chemicals and Fertilizers Ltd. (RCF)

- Mitsubishi Chemical Corporation

- Sumitomo Chemical Co., Ltd.

- Borealis AG

- LSB Industries, Inc.

- Trammo, Inc.

- Qatar Fertilizers Company (QAFCO)

- Gujarat State Fertilizers & Chemicals Limited (GSFC)

- Shandong Hualu-Hengsheng Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Metallurgical Grade Anhydrous Ammonia market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between standard industrial ammonia and metallurgical grade anhydrous ammonia (MGAA)?

The primary distinction is purity; MGAA features ultra-low levels of moisture, oil, and oxygen contaminants (typically <0.01%), which is critical because impurities can severely compromise the surface quality and mechanical integrity of metals during high-temperature heat treatment processes like bright annealing or sintering.

Which end-use industry is the largest consumer of Metallurgical Grade Anhydrous Ammonia?

The general heat treatment and integrated steel manufacturing sectors are currently the largest volumetric consumers of MGAA, although the aerospace and advanced automotive (including EV battery components) industries represent the segment demanding the highest purity specifications and fastest growth rates.

How is the market for MGAA affected by fluctuating natural gas prices?

Natural gas is the primary feedstock for producing hydrogen, which is essential for ammonia synthesis via the Haber-Bosch process. Therefore, significant volatility or sustained increases in natural gas prices directly inflate the operational costs for MGAA producers, often leading to increased market prices or margin compression.

What role does powder metallurgy sintering play in the growth of the MGAA market?

Powder metallurgy sintering requires an extremely precise and reliable reducing atmosphere, often derived from dissociated MGAA, to prevent oxidation during the consolidation of metal powders. The rapid expansion of additive manufacturing (3D printing of metal parts) directly drives demand for high-purity MGAA in this critical application.

What are the key technological advancements expected to impact the MGAA supply chain?

The most impactful technological advancements include the scaling of Green Ammonia production (using renewable energy to mitigate fossil fuel reliance) and the integration of AI-powered monitoring systems for real-time purity control and enhanced safety logistics during the transportation of the hazardous substance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager