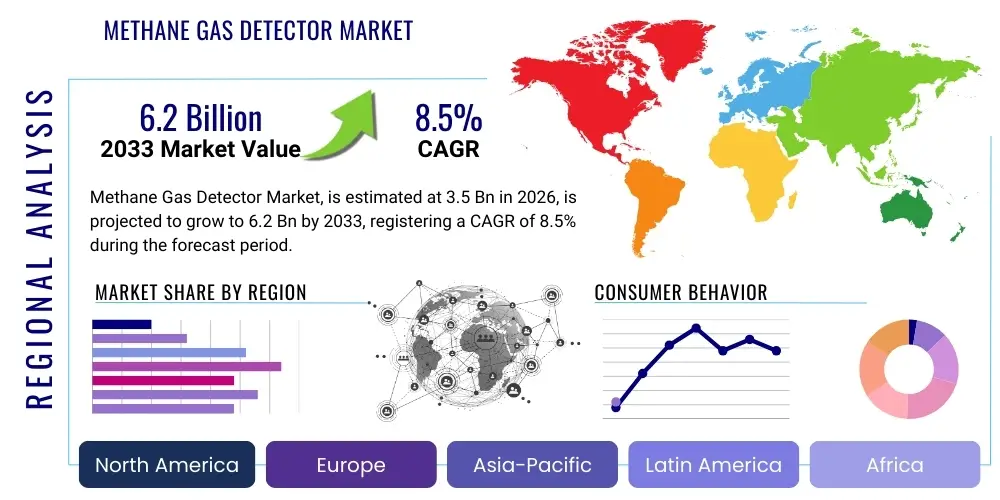

Methane Gas Detector Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442150 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Methane Gas Detector Market Size

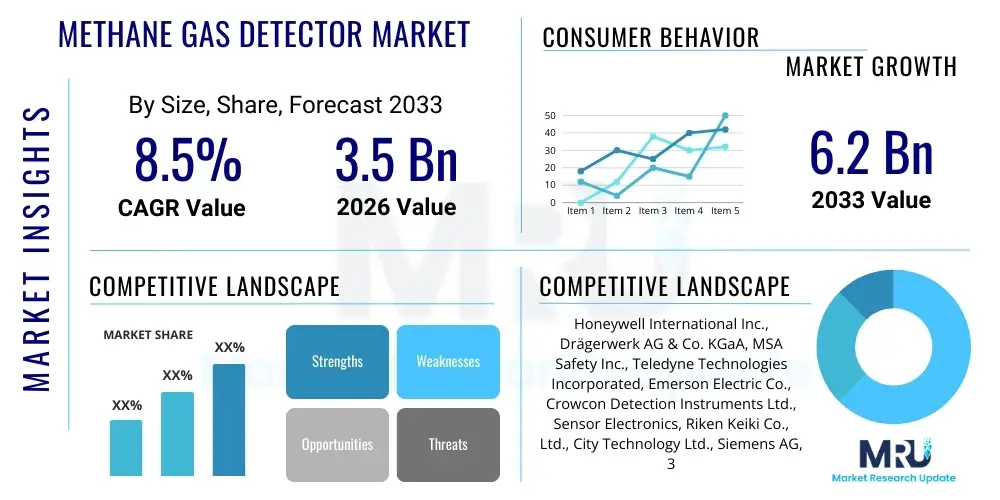

The Methane Gas Detector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Methane Gas Detector Market introduction

The Methane Gas Detector Market encompasses the global trade of devices designed to identify and quantify the presence of methane (CH4) gas in various environments. Methane, a colorless and odorless gas, poses significant safety risks due to its flammability, explosivity, and role as a potent greenhouse gas, necessitating robust monitoring solutions across industrial, commercial, and residential sectors. These detectors utilize various technologies, including catalytic bead sensors, infrared sensors (NDIR/TDLAS), and electrochemical cells, tailored to meet specific requirements regarding sensitivity, accuracy, response time, and environmental robustness. The core function of these products is preventive safety, providing early warning to mitigate catastrophic failures such as explosions in environments ranging from petrochemical refineries and natural gas pipelines to coal mines and wastewater treatment facilities, thereby ensuring compliance with stringent occupational safety and environmental regulations globally.

Product descriptions within this market span portable handheld devices used for leak detection and personal safety monitoring, and fixed systems integrated into plant infrastructure for continuous surveillance and automated alarm activation. Major applications are concentrated heavily in the upstream and midstream oil and gas sector, where methane leakage from drilling operations, transmission pipelines, and storage facilities is a persistent concern, alongside the mining industry, particularly coal mining, where methane accumulation is historically linked to devastating accidents. Furthermore, detectors are increasingly deployed in biogas facilities, landfill sites, and municipal gas distribution networks to monitor fugitive emissions and ensure operational integrity. The ongoing global transition towards cleaner energy sources, including natural gas as a bridge fuel, further amplifies the need for reliable methane detection technologies to ensure infrastructure safety and meet environmental reporting standards.

The principal benefits driving market expansion include enhanced worker safety through continuous environmental monitoring, significant reduction in property damage risk associated with explosions, and crucial compliance with escalating governmental safety and environmental mandates, particularly those targeting methane emissions reduction under international climate agreements. Key driving factors involve stricter occupational safety legislation (such as OSHA and EU directives), rapid industrialization in developing economies expanding the footprint of gas infrastructure, and technological advancements focusing on improved sensor longevity, reduced calibration frequency, and enhanced connectivity through the integration of Internet of Things (IoT) capabilities for centralized, real-time data analysis. These combined elements underscore the critical role methane gas detectors play in maintaining operational safety and achieving sustainability goals across diverse industrial landscapes.

Methane Gas Detector Market Executive Summary

The Methane Gas Detector Market is experiencing dynamic shifts characterized by a sustained focus on digitalization, regulatory compliance, and technological innovation aimed at improving detection reliability and reducing operational costs. Current business trends heavily favor the adoption of connected devices, utilizing wireless protocols and cloud-based data management platforms to enable remote monitoring, predictive maintenance scheduling, and sophisticated data logging necessary for compliance audits. Manufacturers are concentrating on developing highly selective sensors, particularly tunable diode laser absorption spectroscopy (TDLAS) sensors, which offer superior performance in harsh industrial environments, immunity to sensor poisoning, and rapid response times compared to traditional catalytic sensors. This technological arms race is elevating the overall market standard for safety and efficiency, moving systems beyond simple alarm mechanisms toward integrated safety ecosystems.

Regional trends indicate that the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by massive infrastructure investments in natural gas pipelines, rapid expansion of chemical manufacturing facilities, and accelerating urbanization that necessitates sophisticated municipal gas network monitoring. Conversely, North America and Europe, while being mature markets, continue to lead in technological adoption, driven by rigorous regulatory frameworks set by agencies like the EPA (USA) and the European Commission, pushing for advanced monitoring solutions to meet stringent emission reduction targets. The demand in these mature regions is often replacement-driven, focusing on upgrading legacy systems to incorporate IoT features, better precision, and lower total cost of ownership (TCO) through reduced maintenance needs. Emerging markets in Latin America and the Middle East are seeing significant activity spurred by large-scale oil and gas exploration and production projects, necessitating substantial investment in robust, fixed detection infrastructure.

Segment trends highlight the growing dominance of infrared (IR) technologies, both point IR and open path IR, largely displacing catalytic bead sensors in demanding industrial applications due to their inherent fail-safe nature and lower long-term maintenance costs, despite a higher initial investment. The fixed gas detector segment maintains the largest market share, essential for continuous area monitoring in refineries and chemical plants, yet the portable/wearable detector segment is demonstrating the fastest growth. This acceleration is driven by the increasing emphasis on personal safety monitoring (PSM) for mobile workers, utilizing compact, multi-gas detectors often integrated with GPS and man-down alarms. Furthermore, the application segment of Oil & Gas continues to be the primary revenue generator, although sectors like municipal utility management and industrial wastewater treatment are showing strong expansion due to heightened awareness regarding infrastructure safety and fugitive methane emissions.

AI Impact Analysis on Methane Gas Detector Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and Methane Gas Detection systems predominantly revolve around leveraging AI for predictive analytics, minimizing the critical problem of false alarms, and enhancing the efficiency of remote monitoring and response protocols. Common user concerns focus on whether AI can accurately distinguish between genuine methane leaks and environmental noise (such as humidity fluctuations or transient chemical vapors), and how machine learning algorithms can be applied to massive datasets generated by wide-area sensor networks to identify subtle precursors to potential catastrophic failures. There is high expectation that AI will transition detection systems from purely reactive safety measures to proactive risk management tools, optimizing resource deployment, and ensuring compliance by automatically generating verifiable audit trails. Users are particularly interested in the deployment of edge computing solutions within detection units to facilitate faster, localized decision-making, reducing reliance on centralized cloud processing for critical safety operations.

The core theme summarized from this analysis is the move toward "Intelligent Detection." AI is anticipated to revolutionize the market by drastically improving data integrity and operational responsiveness. Traditional systems often rely on fixed thresholds, leading to frequent nuisance alarms that diminish operator trust and increase labor costs associated with investigation. AI algorithms, trained on historical environmental and operational data, can contextualize sensor readings, factoring in variables like temperature, wind speed, and concurrent operational activities to confirm the validity of an alarm event before escalating the response. This capability is paramount in complex industrial environments where continuous operations generate inherent environmental variability. Furthermore, AI facilitates the integration of diverse sensor inputs, such as methane concentration data combined with satellite imagery or drone-based thermal imaging, creating a holistic, highly reliable picture of environmental hazards.

The long-term expectation is that AI will be foundational to next-generation sensor network architectures. Machine learning models will not only detect leaks but predict the likelihood and potential severity of future leaks based on equipment wear rates, maintenance histories, and pipeline stress data, moving methane detection firmly into the domain of predictive maintenance. This shift optimizes the lifecycle management of valuable infrastructure, reduces downtime, and substantially lowers the overall environmental impact associated with unintended methane releases. The adoption rate is expected to accelerate as computational costs decrease and industry standards for intelligent safety platforms emerge, integrating detection capabilities with broader plant automation and industrial control systems (ICS).

- AI-driven Predictive Maintenance: Utilizing sensor data and operational history to forecast sensor degradation and maintenance needs, ensuring continuous reliability.

- False Alarm Reduction: Machine learning algorithms analyze environmental variables (humidity, pressure, temperature) and background noise patterns to minimize nuisance alarms, enhancing operator confidence.

- Sensor Fusion and Data Correlation: AI integrates data from multiple disparate sensors (e.g., methane detectors, temperature probes, flow meters) to provide a centralized, validated hazard assessment.

- Automated Compliance and Reporting: Generating instantaneous, immutable reports and audit trails required for strict regulatory bodies, streamlining environmental compliance processes.

- Real-Time Leak Source Identification: Advanced spatial-temporal analysis using machine learning to pinpoint the precise location and size of a methane leak across vast pipeline networks or expansive plant areas.

- Optimization of Sensor Placement: Using AI simulation tools to determine the most effective and cost-efficient placement of fixed detectors based on airflow models and historical leak patterns.

- Edge Computing Integration: Deployment of localized AI models on detection devices to enable instantaneous decision-making and rapid alarm activation without reliance on cloud latency.

- Enhanced Response Protocols: Automatic triggering of predefined emergency response procedures, including valve shutdowns and ventilation system activation, based on AI-validated hazard severity assessments.

DRO & Impact Forces Of Methane Gas Detector Market

The market dynamics for Methane Gas Detectors are significantly shaped by a confluence of regulatory pressures, technological advancements, and economic realities inherent to highly sensitive industrial operations. Drivers are primarily centered on the enforcement of increasingly strict global occupational safety standards (e.g., ATEX, IECEx) mandating continuous monitoring in hazardous locations, coupled with governmental efforts to curb methane emissions as part of climate change mitigation strategies, such as the Global Methane Pledge. The ongoing expansion of global natural gas infrastructure, especially LNG terminals and long-distance pipelines in emerging economies, creates massive Greenfield opportunities for fixed detector deployment. Furthermore, the aging infrastructure in developed nations necessitates comprehensive monitoring to preempt leaks and ensure asset integrity, providing a consistent replacement and upgrade market.

Restraints, however, temper this growth trajectory. High initial capital expenditure, particularly for advanced spectroscopic technologies like TDLAS or sophisticated open-path systems, can deter adoption, especially among smaller industrial operators or in regions with limited regulatory enforcement. The complexity involved in the calibration, maintenance, and regular bump testing of sensors—a critical requirement for catalytic sensors to maintain accuracy—adds substantial operational overhead, often requiring specialized labor. Additionally, the challenge of sensor poisoning (where exposure to certain chemicals, such as silicone vapors, permanently degrades sensor performance) for catalytic beads remains a persistent technological limitation, pushing users toward more expensive, non-catalytic alternatives, slowing broader market penetration in cost-sensitive segments.

Opportunities for market stakeholders lie predominantly in the realm of enhanced integration and remote services. The proliferation of the Industrial IoT (IIoT) offers significant opportunities to develop unified, cloud-connected safety platforms that integrate gas detection with broader plant automation and control systems (SCADA/DCS). This allows for proactive maintenance, centralized data analytics, and improved compliance efficiency. The development of miniaturized and highly durable Microelectromechanical Systems (MEMS) sensors promises lower cost, smaller form factors, and reduced power consumption, opening new avenues for mass deployment in residential, commercial, and small-to-medium enterprise (SME) segments. These advancements, coupled with robust servicing contracts offering remote diagnostics and calibration support, represent the major growth pathways for service providers.

The impact forces within this market are heavily dominated by regulatory shifts and environmental governance. Regulatory bodies exert direct pressure on the industrial sector to adopt best-in-class detection technology, transforming voluntary safety measures into mandatory compliance costs. Technological advancements, particularly in infrared and laser technologies, act as a disruptive force, driving down the market share of older, less reliable catalytic technologies and influencing purchasing decisions toward TDLAS for high-criticality applications. Economic factors, such as volatile natural gas prices and global infrastructure investment cycles, indirectly influence market spending on safety equipment. Ultimately, the paramount impact force remains the imperative for worker safety and asset protection, which fundamentally underpins all investment decisions in methane detection equipment.

Segmentation Analysis

The Methane Gas Detector Market is segmented across several crucial dimensions, primarily defined by the underlying technology utilized for detection, the type of deployment (fixed or portable), and the final end-use application. Understanding these segmentations is critical for manufacturers to tailor their product offerings and for end-users to select systems that best meet their specific safety and operational requirements, considering factors like sensor lifetime, resistance to poisoning, operational environment, and initial cost versus long-term maintenance. The technological segmentation is currently undergoing the most pronounced shift, with mature catalytic sensors steadily yielding ground to advanced optical methods due to their inherent reliability and longevity.

Segmentation by Type distinguishes between fixed detectors, which are permanently installed for continuous area monitoring and wired into central control systems, and portable detectors, which are often handheld or wearable, providing personal safety monitoring for workers who move through different hazardous areas. The fixed segment accounts for the largest revenue share due to the mandated continuous monitoring in large-scale industrial facilities like refineries, power plants, and chemical manufacturing sites. Conversely, the portable segment is characterized by rapid growth, driven by stringent personal protective equipment (PPE) requirements and improvements in battery life and sensor miniaturization, allowing multi-gas detection in compact, rugged units.

The Application segmentation reveals the heavy reliance of the Oil & Gas sector on this technology, covering upstream exploration, midstream transmission, and downstream processing. However, significant growth is observed in secondary sectors such as water and wastewater treatment, where methane is a byproduct of anaerobic digestion, and the mining sector, specifically coal mining, which requires highly reliable fixed systems. The future expansion of the market will largely depend on the penetration into non-traditional segments like residential monitoring, light commercial facilities, and specialized environmental monitoring applications where regulatory requirements are only beginning to mature but present massive deployment potential.

- By Type:

- Fixed Gas Detectors

- Portable Gas Detectors

- By Technology:

- Catalytic (Pellistor) Sensors

- Infrared (IR) Sensors

- Point Infrared (PIR)

- Open Path Infrared (OPI)

- Tunable Diode Laser Absorption Spectroscopy (TDLAS)

- Semiconductor Sensors

- Electrochemical Sensors (for specific hybrid detectors)

- By Application/End-Use Industry:

- Oil & Gas (Upstream, Midstream, Downstream)

- Mining (Coal, Metal)

- Chemical & Petrochemical

- Utilities & Power Generation

- Water & Wastewater Treatment

- Residential & Commercial

- Industrial Manufacturing

Value Chain Analysis For Methane Gas Detector Market

The value chain for the Methane Gas Detector Market begins with the upstream procurement of highly specialized raw materials, including specialized semiconductors for sensor fabrication, optical components (lenses, emitters) for IR and TDLAS technologies, high-grade polymers for detector casings, and advanced electronics for processing units. Key upstream suppliers include component manufacturers specializing in high-precision measurement technologies and MEMS components. The quality and reliability of these specialized raw materials directly impact the accuracy and longevity of the final detection unit. Ensuring a resilient and non-toxic supply chain is critical, especially for catalytic sensors which require specific noble metals and ceramic elements. The integration of advanced microprocessors and wireless modules (e.g., LoRaWAN, Wi-Fi, cellular) is also a significant upstream cost factor, dictated by the demand for IIoT functionality.

The core manufacturing stage involves complex processes, including sensor assembly, calibration, housing fabrication, and final product integration. This stage is highly regulated, demanding stringent quality control and certification (e.g., ATEX, UL, CSA) to ensure explosion-proof operation in hazardous areas. After manufacturing, products move through the distribution channel. Distribution is segmented between direct sales to large, strategic end-users (like national oil companies or major EPC contractors) who require customized system integration, and indirect channels relying on value-added resellers (VARs), specialized safety equipment distributors, and industrial automation integrators. VARs play a crucial role by providing localized technical support, installation services, system commissioning, and integration with existing industrial control systems, adding substantial value to the fundamental hardware.

The downstream analysis focuses on the deployment, operation, and ongoing servicing of the detectors. End-users require not just the hardware, but comprehensive support services, including initial site assessment, tailored system design, periodic calibration (especially critical for compliance), sensor replacement, and maintenance contracts. This service component represents a significant revenue stream and a competitive differentiator for manufacturers. Direct channels often handle complex, high-volume installations requiring deep product knowledge, whereas indirect channels serve smaller industrial customers and provide localized, responsive after-sales support. The increasing adoption of subscription-based monitoring services and remote diagnostics further solidifies the role of the service segment in the downstream market, emphasizing long-term customer relationships and recurring revenue generation.

Methane Gas Detector Market Potential Customers

The primary customers for Methane Gas Detectors are organizations operating within highly hazardous environments where the risk of methane exposure is constant, or those mandated by law to monitor greenhouse gas emissions. These customers are typically concentrated in the energy, mining, and heavy industrial sectors, prioritizing capital investments in safety equipment as a non-negotiable operating expenditure aimed at minimizing human casualties, preventing asset destruction, and avoiding severe regulatory penalties and operational shutdowns. The purchasing decisions in these large industrial sectors are complex, often involving lengthy procurement cycles managed by engineering, procurement, and construction (EPC) firms or internal safety and compliance departments, prioritizing system reliability, certifications, and compatibility with legacy control systems.

A major segment of potential customers includes large integrated Oil & Gas companies (IOCs and NOCs), particularly those involved in hydraulic fracturing, natural gas processing, pipeline transmission, and liquefied natural gas (LNG) operations. For these entities, methane detectors are essential for ensuring the integrity of vast, geographically dispersed assets and protecting personnel working in inherently explosive environments. Secondary, yet rapidly growing, customer groups include municipal governments and utility providers responsible for maintaining gas distribution infrastructure, sewage systems, and water treatment plants, where anaerobic decomposition generates significant methane concentrations that pose risks to both public safety and infrastructure workers.

Furthermore, any industrial setting utilizing natural gas as a fuel source or handling volatile organic compounds (VOCs) that cross-react with some sensors represents a potential customer base. This encompasses sectors like chemical manufacturing (producing fertilizers, plastics, etc.), pharmaceuticals, and specialized manufacturing where cleanroom environments must be monitored or where flammable solvents are stored. The emerging market for residential and light commercial detectors targets homeowners, apartment complex managers, and small businesses seeking compliance with local fire codes and basic safety standards, offering simpler, lower-cost devices, often sold through retail and electrical contractor distribution networks. The diversity of these end-users necessitates a highly differentiated product portfolio across the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Drägerwerk AG & Co. KGaA, MSA Safety Inc., Teledyne Technologies Incorporated, Emerson Electric Co., Crowcon Detection Instruments Ltd., Sensor Electronics, Riken Keiki Co., Ltd., City Technology Ltd., Siemens AG, 3M Company, Industrial Scientific Corporation, Pem-Tech, General Electric (GE), Sensirion AG, GfG Instrumentation Inc., Det-Tronics (Carrier), Trolex, Bacharach Inc., and Figaro Engineering Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Methane Gas Detector Market Key Technology Landscape

The Methane Gas Detector market is defined by a fierce competition between established sensor technologies and cutting-edge optical and micro-sensor innovations. Traditionally, the market has relied heavily on catalytic combustion sensors (Pellistors), which operate by burning methane gas on a heated catalyst element, measuring the resulting temperature change and correlating it to gas concentration. While cost-effective and highly responsive to lower explosive limit (LEL) concentrations, Pellistors suffer from susceptibility to poisoning by silicones and halogenated compounds, require frequent calibration, and operate poorly in oxygen-deficient environments, necessitating ongoing innovation toward robust alternatives.

The primary technological disruption is driven by Infrared (IR) sensing, particularly Point Infrared (PIR) and Open Path Infrared (OPI). IR sensors measure the absorption of specific infrared wavelengths by methane molecules. These non-dispersive infrared (NDIR) sensors offer several critical advantages: they are immune to poisoning, require less frequent calibration, and feature a "fail-safe" operating mode, as any failure in the light source or detector is instantly recognized. Open Path IR systems are crucial for perimeter monitoring across large areas, such as gas compressor stations or refinery boundaries, providing continuous coverage over hundreds of meters, thereby reducing the number of point detectors required for extensive site monitoring and enhancing efficiency in leakage localization.

The highest level of precision and reliability is provided by Tunable Diode Laser Absorption Spectroscopy (TDLAS). TDLAS uses highly specific laser technology tuned to the exact absorption frequency of methane, offering unparalleled selectivity, rapid response times, and exceptional immunity to interfering gases. Although TDLAS systems carry a higher initial cost, their long-term stability and elimination of cross-sensitivity make them the preferred choice for critical applications, demanding minimal false alarms and maximum uptime, such as monitoring high-pressure pipelines or critical offshore platforms. Emerging technologies include Microelectromechanical Systems (MEMS) sensors, which promise significant cost reduction and miniaturization, enabling the deployment of smaller, more power-efficient detectors suitable for drone-based monitoring and pervasive IoT sensor networks, fundamentally changing the economics of widespread methane detection.

Regional Highlights

- North America: This region represents a mature, high-value market characterized by strict enforcement of safety standards (OSHA, EPA) and massive infrastructure investments in natural gas exploration, production (shale gas), and transmission. The market here is highly receptive to advanced technologies like TDLAS and wireless IoT integration, driven by the need for predictive maintenance and compliance reporting. The U.S. and Canada remain dominant, with replacement cycles for legacy equipment fueling consistent demand.

- Europe: Driven by rigorous EU directives concerning occupational safety and stringent environmental mandates aimed at reducing industrial methane emissions, Europe is a key adopter of certified, high-reliability fixed systems. Emphasis is placed on certified equipment (ATEX, IECEx) and the transition away from catalytic sensors toward non-dispersive infrared (NDIR) technology. Germany, the UK, and the Netherlands lead in adopting smart, networked detection systems, particularly in chemical and petrochemical sectors.

- Asia Pacific (APAC): Expected to demonstrate the fastest growth due to rapid industrialization, massive infrastructure development (pipelines, LNG terminals, manufacturing hubs) in China, India, and Southeast Asia. Market growth is fueled by both Greenfield projects and increasing regulatory scrutiny regarding industrial safety. While cost sensitivity remains a factor, driving demand for catalytic sensors, the push for modernization in key economies is rapidly increasing the adoption of advanced fixed IR systems for compliance and operational efficiency.

- Latin America: Characterized by significant activities in oil and gas exploration (especially Brazil and Mexico) and mining. The market is developing, driven by large state-owned energy companies investing heavily in safety infrastructure. Adoption tends to follow global standards but is often delayed due to economic volatility, focusing primarily on robust, explosion-proof fixed detectors for high-risk zones.

- Middle East and Africa (MEA): Dominated by large-scale upstream and downstream oil and gas activities in the GCC countries (Saudi Arabia, UAE, Qatar). These regions demand ultra-reliable, high-specification equipment, particularly advanced TDLAS and open-path IR systems, capable of operating effectively in harsh, high-temperature, and corrosive desert environments. Investment is consistently high, prioritizing asset protection and worker safety on massive oil and gas installations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Methane Gas Detector Market.- Honeywell International Inc.

- Drägerwerk AG & Co. KGaA

- MSA Safety Inc.

- Teledyne Technologies Incorporated

- Emerson Electric Co.

- Crowcon Detection Instruments Ltd.

- Sensor Electronics

- Riken Keiki Co., Ltd.

- City Technology Ltd. (part of Honeywell)

- Siemens AG

- 3M Company

- Industrial Scientific Corporation

- Pem-Tech

- General Electric (GE)

- Sensirion AG

- GfG Instrumentation Inc.

- Det-Tronics (Carrier)

- Trolex

- Bacharach Inc.

- Figaro Engineering Inc.

Frequently Asked Questions

Analyze common user questions about the Methane Gas Detector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for advanced methane gas detection technology?

The primary driver is the global escalation of stringent safety regulations and environmental mandates, particularly those targeting the reduction of fugitive methane emissions from industrial sources. Regulatory pressure necessitates the adoption of high-precision, reliable detection systems like TDLAS and advanced IR sensors to ensure worker safety and compliance with international climate goals.

How do Methane Gas Detectors contribute to sustainable operations in the Oil & Gas industry?

Methane detectors contribute significantly to sustainability by enabling the rapid identification and repair of leaks in pipelines and processing facilities, thereby minimizing the release of methane, a powerful greenhouse gas, into the atmosphere. This proactive leak detection and repair (LDAR) strategy reduces environmental impact and conserves valuable natural gas resources.

What are the key advantages of Infrared (IR) methane detectors over traditional catalytic sensors?

IR detectors offer fail-safe operation, immunity to sensor poisoning (unlike catalytic sensors), and require significantly less maintenance and calibration over their lifespan. Although they have a higher initial cost, their long-term operational stability and reduced susceptibility to environmental contaminants make them preferred for critical industrial applications.

In which geographical region is the Methane Gas Detector market expected to show the highest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the highest CAGR. This growth is driven by substantial investments in industrial infrastructure, rapid expansion of natural gas networks, and the increasing implementation of modern occupational safety standards across large economies like China and India.

How is Artificial Intelligence (AI) transforming the functionality of modern gas detection systems?

AI is transforming gas detection by utilizing machine learning for predictive maintenance, dramatically reducing false alarms by contextualizing sensor data with environmental factors, and enabling sensor fusion for highly reliable risk assessment. AI integration shifts the systems from reactive alarms to proactive, intelligent safety management platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager