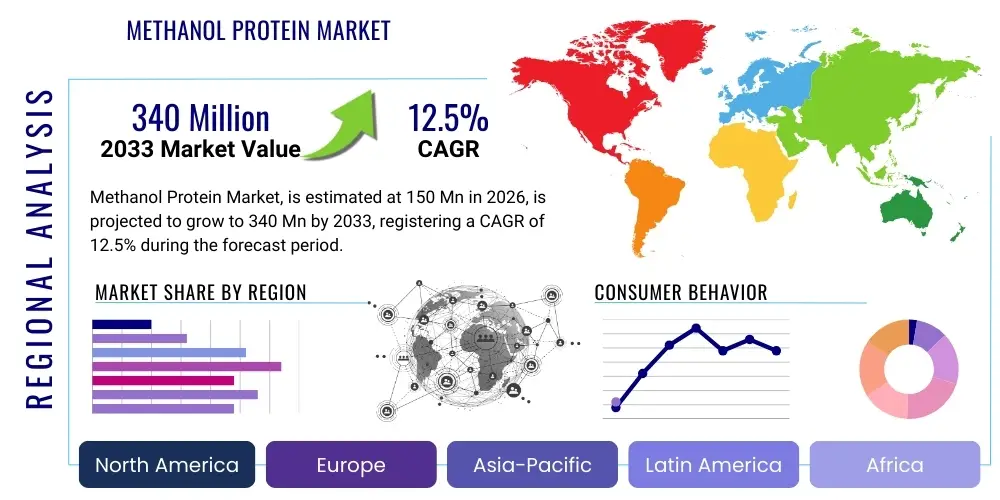

Methanol Protein Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441677 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Methanol Protein Market Size

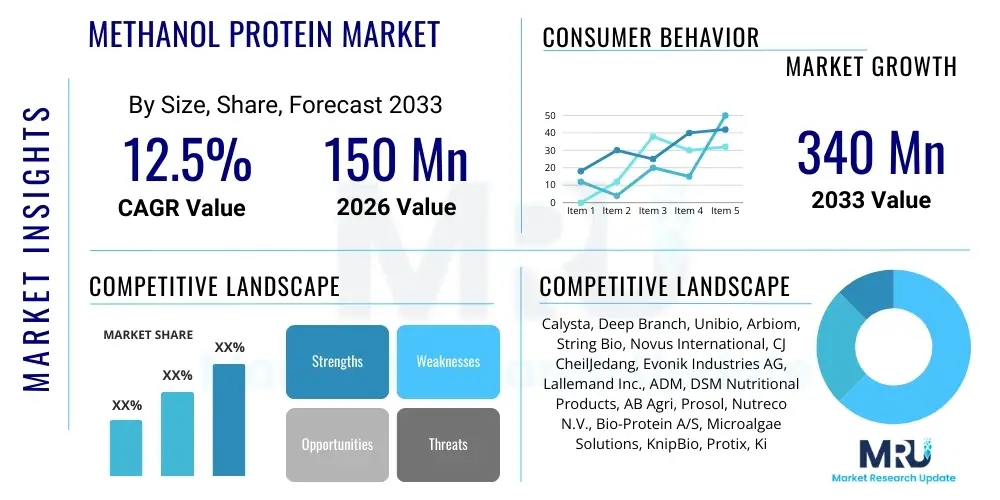

The Methanol Protein Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 150 Million in 2026 and is projected to reach USD 340 Million by the end of the forecast period in 2033.

Methanol Protein Market introduction

The Methanol Protein Market encompasses the production and utilization of single-cell protein (SCP) derived from methylotrophic bacteria or yeasts, which utilize methanol as their primary carbon source. This innovative product serves as a highly sustainable and protein-rich alternative to conventional animal and plant-based proteins, primarily targeting the burgeoning animal feed, aquaculture, and increasingly, the pet food sectors. Methanol protein offers a high biological value, containing essential amino acids, vitamins, and minerals, making it a crucial component in formulation strategies aimed at enhancing nutritional efficiency and reducing reliance on traditional feed components like fishmeal and soy meal.

Product descriptions center on the protein's composition, typically ranging from 60% to 80% crude protein content, produced through controlled fermentation processes. Major applications span industrial aquaculture—especially for salmon and shrimp farming—poultry feed, and swine diets, where its consistent quality and functional properties are highly valued. Key benefits driving adoption include significantly reduced environmental footprints compared to land-intensive agriculture, independence from climatic variables, and enhanced supply chain resilience. The production process leverages gas fermentation technology, converting readily available, cost-effective methanol into biomass efficiently.

Driving factors for market expansion include the global imperative for sustainable protein sourcing, increasing volatility in commodity feed prices (particularly soy and fishmeal), and robust governmental support for biotechnological solutions addressing food security. Furthermore, stringent regulatory scrutiny regarding deforestation and unsustainable fishing practices is compelling large industrial producers to seek novel, verifiable, and eco-friendly protein inputs. These factors collectively position methanol protein as a disruptive force within the global protein ingredient landscape.

Methanol Protein Market Executive Summary

The Methanol Protein Market is characterized by vigorous growth, driven by technological advancements in bioreactor design and increasing investment in large-scale production facilities across Europe and North America. Current business trends emphasize strategic partnerships between technology providers and major feed producers to optimize distribution and secure long-term supply agreements, shifting the product from a niche ingredient to a mainstream feed component. Sustainability credentials, including low water and land usage, are central to the competitive positioning of major players, fostering a strong emphasis on achieving regulatory approvals in key import regions to unlock massive commercial potential.

Regionally, Europe leads the market in terms of production innovation and regulatory clearance, particularly concerning novel feed regulations, while the Asia Pacific region, characterized by its dominant aquaculture industry, represents the largest immediate consumer base and future growth engine. North America is rapidly expanding its production capacity, capitalizing on abundant, low-cost methanol feedstock availability. Segment trends indicate that the application in aquaculture feed remains the primary revenue driver, although significant emerging growth is forecasted in the pet food and niche livestock (e.g., calf milk replacers) segments, reflecting broader industrial acceptance of single-cell protein derived from methanol.

Key strategic priorities for market stakeholders include optimizing downstream processing techniques to improve protein functionality and digestibility, thereby commanding premium pricing. Investment is heavily channeled into enhancing production efficiency (yields per bioreactor volume) and achieving economies of scale necessary to compete effectively with established protein sources. The executive outlook points toward consolidation in the mid-term, as established chemical and agricultural giants acquire or partner with specialized biotech firms to integrate these sustainable protein solutions into their extensive global portfolios.

AI Impact Analysis on Methanol Protein Market

Common user questions regarding the impact of AI on the Methanol Protein Market frequently center on how AI can enhance fermentation efficiency, reduce operating costs, and accelerate new strain development. Users are keen to understand the role of machine learning in optimizing bioreactor parameters (pH, temperature, oxygen levels) in real-time to maximize yield and purity, minimizing batch variations. Concerns also surface regarding the integration complexity of advanced AI models with existing industrial hardware and the data requirements necessary to train effective predictive maintenance and quality control systems. Users expect AI to stabilize production, lowering the barrier to entry for high-volume manufacturing, thus making methanol protein cost-competitive with soy.

- AI optimizes large-scale bioreactor performance by employing predictive modeling to maintain ideal growth conditions, significantly boosting protein yield and reducing energy consumption per kilogram of output.

- Machine learning algorithms accelerate the identification and modification of superior methylotrophic strains through high-throughput screening of genetic data, leading to faster commercialization cycles for enhanced protein profiles.

- Predictive maintenance driven by AI minimizes costly downtime in fermentation facilities by analyzing sensor data to anticipate equipment failures before they occur.

- AI enhances supply chain resilience by optimizing raw material procurement (methanol sourcing) and demand forecasting for the downstream aquaculture and feed markets.

- Data analytics platforms powered by AI ensure stringent quality control and regulatory compliance by continuously monitoring and verifying product purity and nutritional consistency.

DRO & Impact Forces Of Methanol Protein Market

The Methanol Protein Market is propelled by powerful drivers centered on sustainability and global food security, offset by significant regulatory hurdles and the challenge of scaling novel technology cost-effectively. Impact forces underscore the necessity for technological innovation to overcome price parity issues with conventional proteins and the critical need for consumer education and industry acceptance. The dynamics are heavily influenced by environmental policy shifts and the volatile pricing structures of competing feed ingredients like fishmeal, which create compelling opportunities for stable, non-cyclical protein alternatives. Ultimately, the market trajectory will be defined by the industry's ability to achieve robust economies of scale and secure widespread regulatory inclusion in major agricultural regions.

Drivers

The primary driver is the accelerating demand for sustainable protein sources, particularly within the fast-growing aquaculture sector. Methanol protein offers a solution that mitigates critical environmental pressures associated with traditional agriculture, such as high land use, excessive water consumption, and overfishing contributing to the depletion of wild fish stocks. Producers benefit from a highly efficient bioconversion process that utilizes readily available methanol feedstock, ensuring production stability regardless of seasonal or climatic variability, a significant advantage over crop-based proteins.

Furthermore, global initiatives focused on reducing dependence on soy and fishmeal, driven by concerns over deforestation, traceability, and fluctuating prices, strongly support the adoption of alternative proteins. Methanol protein boasts a high protein content (often exceeding 70%) and a balanced amino acid profile, making it a nutritionally superior substitute in complex feed formulations. The closed-loop nature of gas fermentation technology further appeals to large corporate buyers aiming to meet ambitious Scope 3 emission reduction targets and enhance the sustainability credentials of their product supply chains.

Governmental and corporate funding directed towards biotechnological solutions and novel food initiatives also acts as a potent accelerator. This funding not only supports research and development in optimizing bacterial strains for higher yields but also aids in navigating the expensive and complex processes required for large-scale industrial facility construction. The inherent safety profile, derived from non-pathogenic, generally recognized as safe (GRAS) microorganisms, provides a robust foundation for market acceptance and scalability.

Restraints

A major restraint facing the market is the relatively high upfront capital expenditure required for building and commissioning industrial-scale fermentation facilities. The technology, while proven, requires specialized bioreactors and sophisticated process control systems, leading to initial production costs that can temporarily render methanol protein less price-competitive against widely subsidized traditional feed ingredients like soy meal, which benefit from mature, entrenched supply chains and massive economies of scale.

Regulatory complexity and the often protracted timeline for novel food and feed ingredient approvals constitute a significant barrier to rapid market penetration. Methanol protein, classified as a novel protein source in many jurisdictions (like the European Union), must undergo rigorous, multi-year safety assessments. This slow regulatory pace delays market entry, restricts geographical expansion, and necessitates substantial investment in toxicology and nutritional studies, frustrating producers aiming for quick commercialization.

Market perception and acceptance also present a challenge. While highly accepted in industrial feed formulations, achieving broader acceptance among livestock farmers and potentially consumers (if the protein enters the human food chain indirectly) requires overcoming ingrained skepticism towards non-traditional, lab-produced ingredients. Misinformation or lack of understanding regarding the fermentation process and the safety of methanol as a feedstock necessitate significant expenditure on educational marketing campaigns to build trust and transparency throughout the value chain.

Opportunities

The vast expansion of the global aquaculture industry, particularly in high-value segments like Atlantic salmon, shrimp, and marine finfish, presents a tremendous opportunity, given these sectors' urgent need for highly digestible, sustainable replacements for expensive fishmeal. Methanol protein’s consistent nutritional profile and functional properties are perfectly suited for optimizing the growth and health of aquatic species, allowing producers to mitigate price and supply risks associated with wild-caught components.

Emerging applications in the high-growth pet food market and specialized nutrition segments (e.g., performance animal feeds and infant animal formulas) represent significant diversification opportunities. Consumers in these sectors are often willing to pay a premium for specialized, verifiable, and sustainable ingredients, offering higher margins than those typically found in bulk commodity livestock feed. Innovation in functional properties, such as using methanol protein derivatives to enhance gut health or immune response, will unlock new premium market niches.

Technological refinement in feedstock utilization and process integration offers a path toward cost reduction. Opportunities exist in leveraging cheaper or locally sourced methanol, or integrating production with renewable energy sources to further enhance the product's environmental performance. Furthermore, optimizing downstream processing techniques, such as enzymatic treatment and drying methods, to create specific functional ingredients (e.g., protein concentrates or isolates) will allow market players to capture higher value and better compete with established protein fractions.

Impact Forces

Impact forces are driven primarily by environmental regulations. Increasingly strict global policies targeting CO2 emissions, sustainable sourcing, and land-use change place significant pressure on traditional feed producers, accelerating the adoption of low-carbon intensity ingredients like methanol protein. Regulatory decisions, particularly novel feed approvals in major economic blocs like the EU and China, act as immediate market inflection points, enabling or restricting access to vast consumer markets.

Technological advancement and capital investment constitute another major impact force. Significant breakthroughs in strain engineering or fermentation technology that dramatically lower production costs or improve protein quality could instantly disrupt the price structure of the entire animal feed market, forcing rapid consolidation or expansion among incumbents. Conversely, a failure to secure sufficient, continuous private equity or venture capital investment could slow the necessary industrial scaling, leaving the technology vulnerable to lower-cost commodity inputs.

Finally, the volatility of competing commodity prices, particularly soy and fishmeal, exerts a powerful short-term influence. When traditional feed prices spike due to adverse weather events or geopolitical instability, the immediate economic attractiveness of methanol protein increases dramatically, prompting large buyers to rapidly shift procurement strategies and commit to long-term contracts for the alternative protein source. This price fluctuation reinforces the long-term value proposition of non-agricultural protein production.

Segmentation Analysis

The Methanol Protein Market is primarily segmented based on the Type of organism used for fermentation (bacteria vs. yeast), the Application area (aquaculture, poultry, swine, etc.), and the Form in which the product is supplied (powder, pellet, or liquid concentrate). Understanding these segments is crucial as the functional requirements and necessary regulatory clearances differ significantly between applications, dictating production parameters and pricing strategies. The choice between bacterial and yeast-based processes often influences the final protein yield and the amino acid profile, tailoring the product suitability for specific animal diets.

The largest application segment remains aquaculture, driven by the acute need for fishmeal substitution and the industry's rapid expansion. However, the poultry segment is emerging quickly due to the high volume of feed consumption globally and methanol protein’s demonstrated benefits in broiler and layer diets. Form-wise, powder and granular formats dominate, facilitating easy incorporation into existing feed milling operations, although increasing demand for customized functional concentrates is driving innovation in downstream processing.

Detailed analysis of segmentation highlights a crucial trend toward customization. Producers are increasingly developing differentiated products tailored for specific life stages of animals (e.g., early-stage feed for piglets or fingerlings) to maximize digestibility and nutritional efficacy. This precision-nutrition approach allows methanol protein producers to move beyond bulk commodity competition and establish themselves as specialized providers of high-performance feed ingredients, securing premium market positions.

- By Application:

- Aquaculture Feed (Salmon, Shrimp, Tilapia, Marine Finfish)

- Poultry Feed (Broilers, Layers, Turkeys)

- Swine Feed (Piglets, Growing Pigs, Sows)

- Pet Food

- Ruminant Feed (Calf Milk Replacers)

- Specialty Animal Feed

- By Form:

- Powder/Granular

- Pellets

- Liquid Concentrates

- By Type of Microorganism:

- Bacterial Protein (e.g., Methylococcus capsulatus)

- Yeast Protein (e.g., Pichia pastoris)

- By End-Use Industry:

- Feed Manufacturing

- Aquafeed Producers

- Pet Food Industry

- Direct Farm Use

Value Chain Analysis For Methanol Protein Market

The value chain for methanol protein begins with upstream sourcing, focusing primarily on securing low-cost, high-purity methanol feedstock, often derived from natural gas or increasingly, from renewable biomass sources to enhance sustainability credentials. This stage involves sophisticated logistics and supply contracts with major chemical or energy companies. The core transformation stage is the intermediate production, involving high-tech gas fermentation, biomass separation, purification, and drying, which requires significant capital investment and technical expertise in sterile industrial microbiology.

Downstream analysis focuses on processing and distribution. Once the single-cell protein is manufactured into a stable powdered form, it is subject to rigorous quality control checks for nutritional content, purity, and regulatory compliance. Distribution channels involve both direct sales to large, integrated feed manufacturers and indirect sales through specialized ingredient distributors who aggregate and tailor products for smaller regional mills. The efficiency of drying and packaging processes significantly impacts the final product shelf life and ease of incorporation into finished feed products.

Direct distribution channels are favored for large-volume customers, such as major international aquaculture companies, allowing producers to maintain greater control over pricing and technical support. Indirect channels, utilizing regional distributors, are crucial for penetrating fragmented livestock and specialty feed markets where specialized logistics and smaller batch sizes are required. Strong partnerships across the distribution network are essential, as the product often requires technical training for proper inclusion in feed formulations, differentiating methanol protein from simple commodity ingredients.

Methanol Protein Market Potential Customers

Potential customers for methanol protein are primarily large-scale industrial feed manufacturers who seek stable, reliable, and high-quality protein sources to replace conventional, volatile ingredients like fishmeal and soy protein concentrate. The aquaculture sector represents the most critical customer segment, specifically producers focusing on carnivorous fish species (salmon, trout) and high-density farmed shrimp, where high protein digestibility and superior amino acid profiles are crucial for optimal growth rates and feed conversion ratios (FCR). These customers prioritize nutritional consistency and verifiable sustainability claims to meet market demands.

Another major customer base includes global poultry and swine producers, especially those operating integrated production systems seeking to optimize feed costs while adhering to strict animal welfare and quality standards. For poultry, methanol protein is utilized in broiler finisher feeds and layer diets, enhancing protein quality without the risk of microbial contamination often associated with certain animal by-products. In swine, the focus is heavily on incorporating the protein into complex pre-starter and starter feeds for piglets, leveraging its high digestibility to support rapid early-life growth.

Emerging, high-value customers include specialized pet food manufacturers, particularly in the premium and prescription diet categories, where verifiable sourcing, novel ingredients, and sustainability resonate strongly with affluent consumers. Additionally, producers of highly specific nutritional supplements, such as calf milk replacers and performance horse feeds, represent niche buyers willing to pay a premium for the consistent, high-purity nature of single-cell protein that supports robust early development and athletic performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150 Million |

| Market Forecast in 2033 | USD 340 Million |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Calysta, Deep Branch, Unibio, Arbiom, String Bio, Novus International, CJ CheilJedang, Evonik Industries AG, Lallemand Inc., ADM, DSM Nutritional Products, AB Agri, Prosol, Nutreco N.V., Bio-Protein A/S, Microalgae Solutions, KnipBio, Protix, Kiverdi, White Dog Labs |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Methanol Protein Market Key Technology Landscape

The technological landscape of the Methanol Protein Market is dominated by gas fermentation technology, specifically the use of proprietary continuous fermentation bioreactors designed to optimize the growth of methylotrophic bacteria (e.g., Methylococcus capsulatus) or yeast strains using pure methanol and oxygen. The primary focus of innovation lies in enhancing volumetric productivity—maximizing the protein yield per unit volume of the fermenter—and improving the efficiency of mass transfer, particularly oxygen solubility, which is critical for the aerobic respiration of the microorganisms. Advanced bioreactor designs, including large-scale loop reactors and air-lift fermenters, are essential for achieving the necessary economies of scale to compete commercially.

Strain engineering represents the second critical technological pillar. Companies are heavily investing in genetic modification and metabolic pathway optimization to create robust strains that not only demonstrate superior growth rates on methanol but also produce a specific, desirable nutritional profile, such as increased levels of essential amino acids like methionine and lysine. Bioinformatics and high-throughput screening technologies are integral to accelerating the selection and optimization of these high-performance microbial hosts, ensuring the final product meets the stringent nutritional requirements of high-performance feed formulations without expensive supplementation.

Downstream processing technologies are equally important for overall commercial success. Post-fermentation, the biomass slurry must be efficiently separated, often utilizing proprietary centrifugation or membrane filtration techniques, and then dried into a stable powder or granule. Key technological differentiators here include energy-efficient drying methods (e.g., spray drying or vacuum drying) that minimize protein denaturation, thus preserving nutritional quality and digestibility. Continuous process monitoring and automation, heavily supported by AI and IoT sensors, are standard best practices across modern facilities to ensure consistency and compliance.

Regional Highlights

- Europe: Leading Innovation and Regulation

Europe stands as a global leader in the Methanol Protein Market, driven by robust regulatory support for sustainable and novel feed ingredients (under the Novel Food Regulation) and high environmental consciousness among consumers and producers. The region benefits from significant venture capital investment targeting biotech scale-ups and has operational, commercial-scale production facilities in countries like the UK, Denmark, and Norway. Key drivers include the region's massive aquaculture industry (especially Atlantic salmon farming) and the political necessity to decrease reliance on imported soy. The regulatory framework, though stringent, provides a clear pathway to market, attracting innovative players focused on achieving sustainability premium pricing. - North America: Scale and Feedstock Abundance

North America is characterized by its large potential for high-volume, cost-effective production, primarily due to the availability of abundant, competitively priced natural gas used as a precursor for methanol. The focus in this region is on achieving maximum industrial scale quickly. The regulatory environment is generally favorable, especially through the FDA's Generally Recognized as Safe (GRAS) status pathways. Key customers are large integrated poultry and swine operations, alongside an expanding aquaculture presence, particularly in the Great Lakes region and coastal areas. Strategic expansion involves leveraging existing infrastructure from the chemical and industrial biotechnology sectors to rapidly deploy large bioreactor capacity. - Asia Pacific (APAC): The Largest Consumption Market

The APAC region is poised to be the dominant consumer market for methanol protein, largely owing to its commanding position in global aquaculture, particularly in China, India, and Southeast Asia. The urgent need to find reliable, sustainable replacements for fishmeal in shrimp and finfish farming, coupled with soaring demand for high-quality protein due to population growth, fuels market uptake. While production capacity in APAC is currently trailing North America and Europe, investment is rapidly increasing, often involving joint ventures aimed at localizing production to meet massive regional demand and mitigate long-distance supply chain risks. Regulatory complexity varies significantly by country, requiring tailored market entry strategies. - Latin America (LATAM): Emerging Agricultural Powerhouse

Latin America, particularly Brazil and Argentina, represents a significant future growth area, given its prominence in global agriculture and livestock production. While historically dominated by soy production, there is growing internal recognition of the need for feed diversification. The application focus is dual: supplementing conventional feed for poultry and swine, and supporting the rapidly expanding regional aquaculture sectors in Chile and Ecuador. Challenges include securing stable, regionally optimized methanol feedstock and developing local regulatory frameworks conducive to novel feed adoption, often requiring intense educational efforts targeting major agricultural cooperatives. - Middle East and Africa (MEA): Sustainable Food Security Initiatives

The MEA region’s interest in methanol protein is strongly tied to national food security agendas and the necessity for drought-proof, land-independent protein production. Countries with significant sovereign wealth funds are investing in local production technologies to build resilient food supply chains, mitigating reliance on imports. Focus areas include large-scale aquaculture projects in the Gulf Cooperation Council (GCC) states and addressing nutritional deficiencies in livestock feed across sub-Saharan Africa. The market is currently nascent but possesses high potential for rapid, government-backed scaling, specifically leveraging abundant natural gas resources for methanol production in the Middle East.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Methanol Protein Market.- Calysta, Inc.

- Unibio International A/S

- Deep Branch Biotechnology Ltd.

- String Bio Private Limited

- Arbiom

- Novus International, Inc.

- Evonik Industries AG

- CJ CheilJedang Corp.

- Lallemand Inc.

- Archer Daniels Midland (ADM)

- DSM Nutritional Products

- AB Agri Ltd.

- Nutreco N.V.

- Bio-Protein A/S

- Kiverdi Inc.

- Protix B.V. (Indirect competitor/alternative protein)

- Microalgae Solutions

- KnipBio, Inc.

- White Dog Labs (now part of Calysta)

- Prosol S.p.A.

Frequently Asked Questions

Analyze common user questions about the Methanol Protein market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Methanol Protein and how is it produced?

Methanol Protein is a single-cell protein (SCP) biomass produced through continuous gas fermentation, utilizing methylotrophic bacteria or yeast that consume methanol as their sole carbon and energy source. This process is highly controlled, non-land-dependent, and results in a dried, protein-rich powder used primarily in animal feed.

Is Methanol Protein safe for consumption in aquaculture and livestock feed?

Yes, methanol protein is extensively tested and generally considered safe for feed applications. Producers utilize non-pathogenic microbial strains (often GRAS or Novel Feed approved) and rigorous purification steps. Regulatory bodies like the FDA and EFSA evaluate the product based on stringent nutritional and toxicological standards before granting market approval.

How does methanol protein compare economically to traditional proteins like fishmeal and soy?

While the initial cost of production can be higher due to large capital expenditure, methanol protein offers long-term price stability, reduced supply chain risk, and superior nutritional density (high protein content and balanced amino acid profile). As production scales, it is rapidly approaching cost parity, making it highly competitive, especially against volatile fishmeal prices.

What are the primary environmental benefits of using methanol protein?

The key environmental advantages include minimal land and water usage, drastically reduced carbon footprint compared to conventional agriculture, and zero reliance on fish stocks. Production is conducted in closed-loop systems, offering superior traceability and sustainability credentials compared to terrestrial proteins.

Which geographical regions are leading the production and adoption of methanol protein?

Europe, driven by strict sustainability mandates and supportive novel food regulations, leads in technological innovation and initial commercial deployment, especially catering to the aquaculture sector. North America is rapidly scaling production capacity due to favorable methanol feedstock economics, while Asia Pacific represents the largest immediate consumption market, focused heavily on its vast aquafeed needs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager