Methylglycinediacetic Acid Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441676 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Methylglycinediacetic Acid Market Size

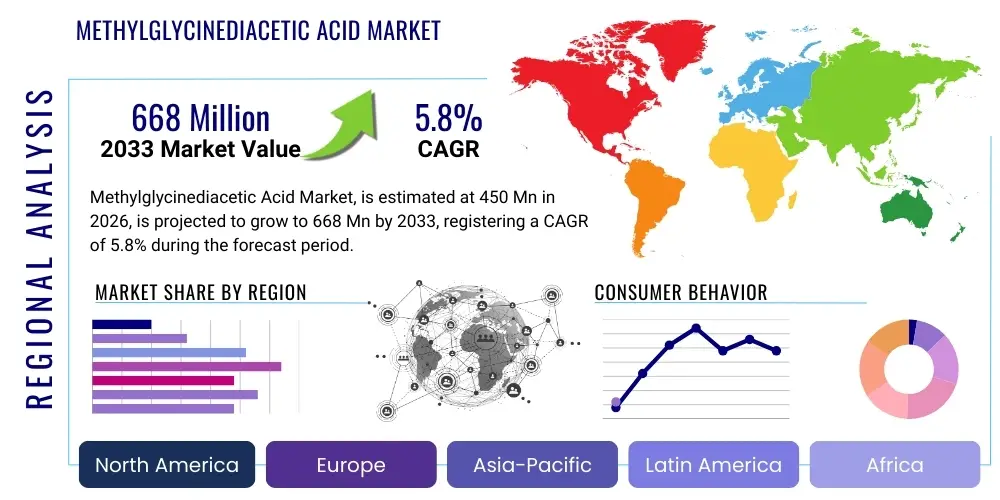

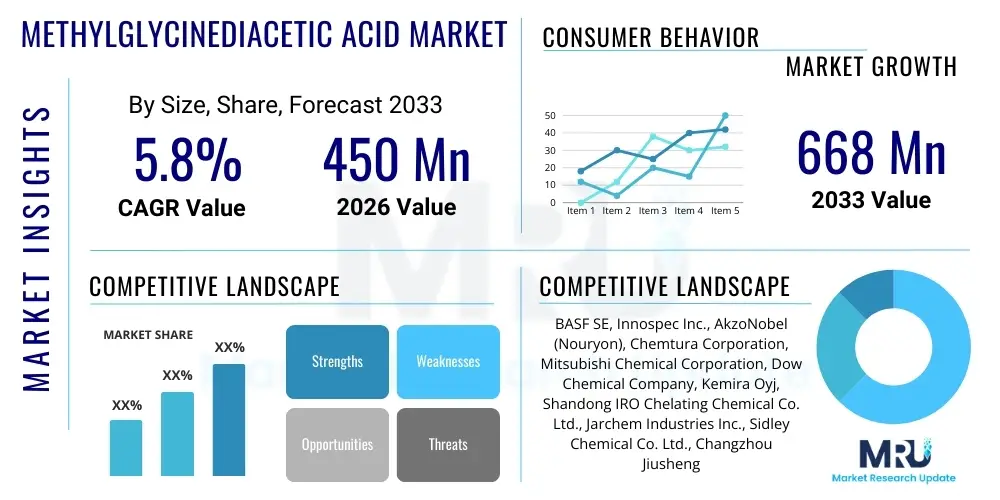

The Methylglycinediacetic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 668 Million by the end of the forecast period in 2033.

Methylglycinediacetic Acid Market introduction

Methylglycinediacetic Acid (MGDA) is a high-performance, readily biodegradable aminocarboxylate chelating agent. It serves as a crucial component in modern sustainable chemistry, primarily utilized to replace traditional, non-biodegradable complexing agents such as EDTA (Ethylenediaminetetraacetic Acid) and NTA (Nitrilotriacetic Acid), as well as phosphates in cleaning and industrial applications. MGDA's superior complexing ability, particularly its high stability across a wide pH range, makes it highly effective in sequestering metal ions that interfere with cleaning processes, stability of formulations, and efficiency of industrial systems. The push towards green chemistry standards and stringent regulatory mandates regarding environmental safety are the primary forces accelerating the adoption of MGDA across various sectors, ensuring its relevance in future chemical formulations.

The product is synthesized through specialized chemical processes, often involving the reaction of glycine, formaldehyde, and hydrogen cyanide, followed by hydrolysis and purification, although modern methods focus on more sustainable, often bio-based routes to enhance its 'green' profile. Key applications span across laundry and dishwashing detergents (where it enhances surfactant performance and prevents scale buildup), industrial and institutional (I&I) cleaning, water treatment, and specialized industrial processes such as textile dyeing and oilfield operations. Its effectiveness in hard water environments, coupled with its excellent ecotoxicological profile, positions MGDA as a premium, future-proof component in the chemical industry.

The main benefits of MGDA include enhanced cleaning efficacy, excellent biodegradability, low toxicity, and stability in formulation, thereby driving demand in regions with strict environmental oversight, particularly Europe and North America. Driving factors include global consumer preference for eco-friendly products, legislative restrictions on phosphate and persistent chelating agents, and technological advancements improving the cost-efficiency of MGDA synthesis. These factors collectively ensure sustained market expansion, pushing manufacturers to continuously innovate and scale production capacity to meet growing global requirements for sustainable chelates.

Methylglycinediacetic Acid Market Executive Summary

The Methylglycinediacetic Acid market is characterized by robust growth driven fundamentally by global sustainability mandates and the consequential shift away from conventional, persistent chelating agents. Key business trends include significant investment in expanding production capacities, particularly in Asia Pacific, to capitalize on localized supply chain efficiency and surging regional demand from the household and industrial cleaning sectors. Furthermore, product innovation focuses on developing specialized, high-purity grades of MGDA tailored for sensitive applications like cosmetics and pharmaceuticals, diversifying the traditional application base predominantly focused on detergents. Strategic partnerships between MGDA manufacturers and major consumer goods companies are streamlining adoption processes and embedding MGDA within mainstream product lines globally, signaling market maturation.

Regionally, Europe maintains its position as the largest market, primarily due to early and strict implementation of regulations banning phosphates in laundry and automatic dishwashing (ADW) detergents, establishing MGDA as a benchmark replacement. North America is following a similar trajectory, albeit at a slightly slower pace, with increasing state-level regulations pushing adoption. Asia Pacific is emerging as the fastest-growing region, fueled by rapid industrialization, increasing urbanization, rising disposable incomes leading to higher standards for cleaning products, and growing awareness of environmental impacts among consumers and policymakers in countries like China and India. This regional growth is supported by capacity expansion projects relocating synthesis capabilities closer to downstream users, improving logistics and reducing costs.

Segment trends highlight the dominance of the Detergents and Cleaners segment, particularly automatic dishwashing, where MGDA delivers superior performance in low-phosphate or phosphate-free formulations. Within this segment, the Liquid Detergent sub-segment is experiencing high growth due to convenience and formulation flexibility offered by MGDA. The Water Treatment segment is also witnessing increased uptake, leveraging MGDA’s anti-scaling and corrosion inhibition properties in municipal and industrial water cycles. Technological advancements in synthesis methods, focusing on minimizing byproducts and optimizing yield, are further enhancing the economic viability of MGDA, thereby solidifying its role across all key application areas and contributing to overall market expansion and stability.

AI Impact Analysis on Methylglycinediacetic Acid Market

Common user questions regarding AI's impact on the Methylglycinediacetic Acid market frequently center on how machine learning can optimize the synthesis process for better yields, whether AI can predict the performance and stability of MGDA in complex detergent formulations, and how intelligent supply chains can manage the sourcing of raw materials like glycine amid volatility. Users are particularly concerned with using AI to accelerate the research and development cycle for new, bio-based derivatives of MGDA, ensuring they meet stringent biodegradability criteria. The overall expectation is that AI integration will lead to significant cost reductions, enhanced product purity, and improved responsiveness to dynamic regulatory changes and fluctuating raw material pricing, solidifying MGDA’s competitive edge against alternative chelates.

AI's role is transformative, extending beyond simple data analysis into predictive manufacturing and formulation science. Machine learning algorithms are now being deployed to model complex chemical reactions involved in MGDA synthesis, allowing manufacturers to precisely control parameters such as temperature, pressure, and catalyst concentration to maximize output and minimize energy consumption. This optimization leads directly to lower operational costs and reduced environmental footprints, enhancing the sustainability claim of the final product. Furthermore, predictive modeling enables formulators to simulate how MGDA interacts with various surfactants, builders, and enzymes in different water hardness scenarios, dramatically cutting down the time and expense associated with traditional laboratory testing and accelerating time-to-market for innovative cleaning solutions.

In the supply chain, AI-powered systems are crucial for forecasting demand volatility and optimizing inventory levels for both raw materials and finished MGDA product. These systems analyze global chemical indices, geopolitical factors, and end-user demand fluctuations across detergent, water treatment, and textile industries, providing real-time insights for procurement and logistics. This minimizes risks associated with material shortages or excess inventory, crucial for maintaining competitive pricing. Additionally, quality control is enhanced through AI vision systems that monitor production lines for anomalies, ensuring that high purity standards required for specialized MGDA grades, such as those used in cosmetics, are consistently met, thereby driving efficiency and market confidence.

- AI optimizes MGDA synthesis pathways for increased yield and purity, reducing manufacturing costs.

- Machine learning predicts performance and stability of MGDA in diverse cleaning formulations, accelerating R&D cycles.

- Intelligent supply chain systems forecast raw material volatility (e.g., glycine) and optimize logistics for global distribution.

- Predictive maintenance implemented across production facilities minimizes downtime and maximizes asset utilization.

- AI-driven sustainability analysis models the full lifecycle impact of MGDA, aiding in compliance reporting and green claims verification.

- Automated quality control systems ensure batch consistency and adherence to stringent high-purity standards for specialized end-uses.

DRO & Impact Forces Of Methylglycinediacetic Acid Market

The Methylglycinediacetic Acid market is primarily propelled by stringent global environmental regulations, particularly the widespread governmental bans and restrictions on phosphates and traditional, poorly biodegradable chelating agents like EDTA and NTA across developed economies in Europe and North America. This regulatory push forces manufacturers of household and industrial cleaning products to rapidly adopt effective, sustainable alternatives, directly boosting MGDA demand. A key restraint, however, remains the relatively higher production cost of MGDA compared to legacy chelates, which occasionally challenges its competitive position in price-sensitive emerging markets. Furthermore, the reliance on specific chemical feedstock, particularly glycine, introduces supply chain volatility and pricing challenges that must be mitigated through robust sourcing strategies and technological advancements aimed at optimizing synthesis efficiencies. The cumulative impact forces, dominated by technological advancement and regulatory shift, heavily favor sustainable options, accelerating MGDA adoption and market growth.

Significant opportunities for market expansion lie in the growing demand from emerging economies, where rising standards of living and increasing environmental awareness are beginning to drive the transition toward premium, sustainable cleaning products. Expansion into niche applications, such as agriculture (as a micronutrient complexing agent), oil and gas exploration (for scale inhibition), and personal care products (as a stabilizer), further diversifies the revenue streams for manufacturers. The continued development of bio-based MGDA synthesis methods represents a vital opportunity to further enhance its environmental profile and potentially reduce dependency on petroleum-derived intermediates, thereby lowering production risks and improving cost competitiveness over the long term. These opportunities are highly attractive, encouraging significant R&D investment.

The core impact forces shaping the market involve the continuous pressure from Non-Governmental Organizations (NGOs) and consumer groups advocating for "green" chemistry, which places high scrutiny on ingredient sourcing and end-of-life biodegradability, making MGDA a preferred choice. Technology plays a critical role, as improvements in catalytic processes and continuous flow chemistry are gradually driving down the marginal cost of production, offsetting the raw material price challenges. Finally, the substitution threat from other environmentally friendly chelates (such as GLDA and IDS) necessitates constant innovation in MGDA product performance and cost structure to maintain market leadership, establishing a dynamic competitive environment where product differentiation is paramount.

Segmentation Analysis

The Methylglycinediacetic Acid market is broadly segmented based on its application, end-use industry, and grade type, reflecting the diverse needs of consumers ranging from large-scale industrial chemical processes to specialized household cleaning products. The Application segmentation clearly defines the primary consumption areas, with detergents and cleaners holding the largest share due to the global regulatory mandates concerning phosphate substitution, making MGDA an essential ingredient for modern, high-performance automatic dishwashing and laundry formulations. The End-Use analysis focuses on the buyers—commercial versus residential, while the Grade analysis differentiates between technical-grade MGDA used in bulk industrial applications and the high-purity grades required for sensitive sectors like pharmaceuticals and cosmetics, reflecting varying degrees of quality and pricing.

Further granularity in segmentation reveals specific market dynamics. Within the Detergents segment, automatic dishwashing tablets and liquid concentrates are the fastest-growing sub-segments, capitalizing on MGDA’s superior chelation performance in concentrated, low-water formulas. Similarly, the Industrial & Institutional (I&I) Cleaning segment, encompassing areas like facility sanitation and hospitality laundry, demands high-concentration, cost-effective MGDA solutions. Geographical variations also influence segmentation, with Europe and North America prioritizing the High Purity and Technical Grade MGDA for consumer products, while Asia Pacific demand is growing across all grade types driven by foundational infrastructure expansion in water treatment and general industrial cleaning.

Understanding these segmentations is critical for market stakeholders as it dictates strategic focus, pricing strategies, and tailored product development. For instance, manufacturers targeting the Water Treatment segment must emphasize MGDA’s capabilities in preventing mineral scale formation and mitigating corrosion in cooling towers and boilers, whereas those targeting the Personal Care segment must focus on documentation regarding low skin irritation and stability in complex cosmetic matrices. This multidimensional segmentation approach ensures that market players can efficiently allocate resources to the most profitable and strategically important product categories and geographical regions within the rapidly evolving landscape of sustainable chemistry.

- By Application:

- Detergents and Cleaners

- Automatic Dishwashing Detergents (Powders, Tablets, Gels)

- Laundry Detergents (Liquid and Powder)

- Industrial and Institutional (I&I) Cleaners

- Hard Surface Cleaners

- Water Treatment

- Boiler Water Treatment

- Cooling Water Treatment

- Descaling Agents

- Personal Care and Cosmetics

- Soaps and Shampoos

- Stabilizers for Cosmetic Formulations

- Industrial Processes

- Textile and Dyeing Auxiliaries

- Pulp and Paper Manufacturing

- Oilfield Chemicals (Scale Inhibitors)

- Agriculture (Chelating Agents for Micronutrients)

- By Grade Type:

- Technical Grade MGDA (Industrial and Bulk Applications)

- High Purity Grade MGDA (Cosmetics and Specialized Applications)

- By Form:

- Liquid (Aqueous Solution, typically 40% concentration)

- Powder/Granules (Trisodium Salt Form)

- By End-Use Industry:

- Household/Consumer Sector

- Commercial and Industrial Sector

- Municipal Sector (Water Infrastructure)

Value Chain Analysis For Methylglycinediacetic Acid Market

The value chain for Methylglycinediacetic Acid begins with the upstream sourcing of key raw materials, primarily glycine (or nitrilotriacetic acid derivatives in some older methods), formaldehyde, and in specific synthesis routes, methanol or other proprietary chemical precursors. The supply stability and pricing of these foundational chemicals are crucial, as they significantly influence the final cost of MGDA production. Manufacturers focus heavily on securing long-term supply agreements and implementing vertical integration strategies, especially concerning glycine sourcing, to mitigate price volatility and ensure a consistent input stream for continuous production. Efficiency in the upstream stage, including the selection of low-cost, environmentally friendly synthesis routes, is paramount to maintaining competitive pricing for the final product, setting the foundation for the market's profitability.

The midstream phase involves the complex chemical synthesis, purification, and formulation of MGDA, often resulting in either a concentrated liquid solution (typically 40% active substance) or a dried powder/granule form (trisodium salt). This manufacturing stage requires specialized chemical expertise and capital-intensive infrastructure to maintain high purity standards, particularly for the High Purity Grade MGDA demanded by the personal care and cosmetic industries. Process optimization, often utilizing AI and advanced catalytic chemistry, aims to reduce energy consumption, minimize byproduct generation, and maximize reaction yield, thereby controlling operating expenditure. Leading producers invest heavily in R&D here to develop proprietary, low-waste, or bio-based synthesis techniques to enhance their environmental credibility and market advantage.

The downstream distribution channel involves moving the finished MGDA product to a diverse range of end-users. Distribution relies heavily on both direct sales to major multinational detergent and chemical companies (like Unilever or P&G) and indirect sales through specialized global and regional chemical distributors (such as Univar Solutions or Brenntag) for smaller or geographically dispersed customers. Direct channels facilitate large-volume, long-term contracts, ensuring consistency in specification and pricing, while indirect channels provide market reach, localized inventory management, and technical support to numerous small and medium-sized enterprises (SMEs) in I&I cleaning and specialty chemical formulation. The effectiveness of the downstream channel is defined by efficient logistics, reliable technical support, and the ability to quickly adapt inventory to regional regulatory demands and seasonal shifts in end-user consumption patterns.

Methylglycinediacetic Acid Market Potential Customers

The primary potential customers and end-users of Methylglycinediacetic Acid are large-scale global manufacturers and formulators operating within the household and industrial cleaning sectors. Major multinational consumer goods corporations, responsible for brands encompassing laundry detergents, automatic dishwashing products, and hard surface cleaners, represent the largest volume buyers, utilizing MGDA to meet regulatory requirements for phosphate-free and biodegradable formulations while ensuring high cleaning efficacy. These companies typically require Technical Grade MGDA in bulk liquid form and engage in direct, long-term contractual purchasing agreements with primary manufacturers to guarantee supply security and predictable pricing structures essential for mass market production.

A second significant customer base includes industrial service providers and municipal authorities involved in specialized water treatment and process engineering. These buyers, including companies managing large industrial cooling towers, high-pressure boilers, and municipal water infrastructures, rely on MGDA for its superior scale inhibition and corrosion control properties, replacing less effective or environmentally hazardous alternatives. Furthermore, niche industrial segments such as textile and dyeing operations, which require metal ion sequestration to stabilize dyes and improve fabric quality, and oilfield service companies using chelates for enhanced recovery and pipeline scale management, also represent highly valuable, specialized customer segments seeking MGDA's high performance and environmental compliance.

The third tier of potential customers encompasses smaller, regional chemical formulators, distributors catering to the Industrial & Institutional (I&I) cleaning market (hospitals, schools, restaurants), and personal care product manufacturers. The personal care sector specifically demands High Purity Grade MGDA for use in shampoos, body washes, and cosmetic creams where it functions as a stabilizer and mild preservative booster. These smaller entities typically procure MGDA through chemical distributors, relying on their logistical networks and technical sales expertise. The continuous expansion of private label brands and increased consumer demand for certified sustainable products ensure that this diverse group of potential customers remains a robust source of incremental market growth.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 668 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Innospec Inc., AkzoNobel (Nouryon), Chemtura Corporation, Mitsubishi Chemical Corporation, Dow Chemical Company, Kemira Oyj, Shandong IRO Chelating Chemical Co. Ltd., Jarchem Industries Inc., Sidley Chemical Co. Ltd., Changzhou Jiusheng Chemical Co. Ltd., Shouguang Hongfa Chemical Co. Ltd., Lier Chemical Co. Ltd., Sigma-Aldrich (Merck KGaA), Wuxi Xishan Huada Chemical Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Methylglycinediacetic Acid Market Key Technology Landscape

The technology landscape governing the Methylglycinediacetic Acid market is primarily focused on enhancing synthetic efficiency, improving product purity, and promoting sustainable manufacturing practices. Traditional synthesis routes, often involving the reaction of glycine with formaldehyde and sodium cyanide followed by hydrolysis (Strecker synthesis derivative), are increasingly being optimized through advanced process control technologies. Key technological advancements include the use of continuous flow chemistry instead of batch processes, which allows for finer control over reaction kinetics, resulting in higher yields, reduced batch-to-batch variability, and significant energy savings, thereby lowering the overall production cost per unit volume. Manufacturers are also implementing advanced filtration and chromatography techniques to achieve the exceptionally high purity required for specialized applications like personal care, minimizing trace metal contaminants and ensuring compliance with stringent regulatory standards.

A major focus of ongoing technological innovation is the development and commercialization of bio-based synthesis routes for MGDA. This involves exploring methods that utilize fermentation or enzymatic processes using renewable resources, which would substantially reduce the market’s reliance on petrochemical-derived intermediates and further enhance MGDA’s environmental profile, appealing directly to the green chemistry movement. While these bio-based routes are often more complex and currently may involve higher initial capital expenditure, they offer strategic long-term advantages in terms of supply security, insulation from fossil fuel price volatility, and superior market positioning, especially in the highly regulated European market. Research is dedicated to scaling up these methods to achieve economic viability comparable to conventional chemical synthesis.

Furthermore, the integration of digitalization, including advanced sensor technology, real-time analytics, and robotic automation, is redefining the manufacturing process. Sensors monitor variables like pH, temperature, and reactant concentration in real-time, feeding data into predictive models that automatically adjust process parameters, minimizing waste and ensuring optimal reaction conditions. This digital transformation not only boosts operational efficiency and reduces labor costs but also aids in maintaining compliance records and improving overall plant safety. The sustained evolution of these technological platforms is vital for MGDA manufacturers to maintain their competitive edge against alternative, potentially cheaper, chelating agents and to secure market share in high-growth application segments.

Regional Highlights

- Europe: Europe stands as the dominant market for Methylglycinediacetic Acid, largely driven by the pioneering implementation of strict environmental legislation, particularly the phase-out and restriction of phosphates and persistent chelating agents in laundry and automatic dishwashing detergents. Regulations such as the EU Detergents Regulation mandate high biodegradability standards, making MGDA a cornerstone ingredient for chemical formulators across the region. High consumer environmental awareness and the presence of major global chemical manufacturers further consolidate Europe’s market leadership. The region focuses heavily on High Purity Grade MGDA for consumer and technical applications.

- North America (NA): The North American market, comprising the US and Canada, is experiencing strong growth, mirroring the European trend, driven by state-level bans on phosphates and increasing consumer demand for "green label" products. The US EPA and state regulatory bodies are increasingly scrutinizing persistent chemicals, accelerating the transition to sustainable alternatives like MGDA in both household and I&I cleaning sectors. The region shows high adoption rates in industrial water treatment and oilfield applications, leveraging MGDA's stability and efficacy in diverse industrial environments.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, characterized by rapid industrialization, urbanization, and rising middle-class disposable incomes, leading to increased consumption of high-performance cleaning products. While environmental regulations are less uniform than in Europe, countries like China, Japan, and South Korea are adopting stricter standards, boosting MGDA demand. Significant manufacturing capacity expansion by global players is occurring within APAC to serve the enormous regional demand base, making it a critical hub for future market growth, particularly in Technical Grade applications for textiles and industrial cleaning.

- Latin America (LATAM): The LATAM market is in an evolving phase, with adoption driven primarily by multinational consumer goods companies standardizing their product formulations across global regions to include sustainable ingredients. Brazil and Mexico are the largest consumers, exhibiting increasing awareness regarding sustainable chemistry. Market growth here is reliant on local economic stability and the gradual alignment of national regulations with global environmental best practices, focusing initially on cost-effective, Technical Grade MGDA.

- Middle East and Africa (MEA): The MEA market is exhibiting moderate but steady growth, heavily concentrated in the water-stressed GCC countries where MGDA is critical for industrial water treatment and desalination processes due to its efficacy in scale control. The cleaning and personal care markets are also growing, supported by foreign investment and the establishment of local production facilities adopting international formulation standards. Growth remains dependent on infrastructure development and ongoing investments in industrial sectors like oil & gas and manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Methylglycinediacetic Acid Market.- BASF SE

- Innospec Inc.

- AkzoNobel (Nouryon)

- Mitsubishi Chemical Corporation

- Dow Chemical Company

- Kemira Oyj

- Shandong IRO Chelating Chemical Co. Ltd.

- Jarchem Industries Inc.

- Sidley Chemical Co. Ltd.

- Changzhou Jiusheng Chemical Co. Ltd.

- Shouguang Hongfa Chemical Co. Ltd.

- Lier Chemical Co. Ltd.

- Sigma-Aldrich (Merck KGaA)

- Wuxi Xishan Huada Chemical Co. Ltd.

- ADEKA CORPORATION

- Kuraray Co. Ltd.

- Huntsman Corporation

- Tessenderlo Group

- Clariant AG

Frequently Asked Questions

Analyze common user questions about the Methylglycinediacetic Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Methylglycinediacetic Acid (MGDA) and why is it used in cleaning products?

MGDA is a readily biodegradable aminocarboxylate chelating agent. It is primarily used as a sustainable alternative to traditional phosphorus-based compounds and non-biodegradable chelates like EDTA, enhancing cleaning efficiency by sequestering hard water ions (calcium and magnesium) and stabilizing formulations.

How do global environmental regulations affect the demand for MGDA?

Strict regulations, especially in Europe and North America, that ban or restrict the use of phosphates and persistent chemicals in detergents directly drive the demand for eco-friendly substitutes. MGDA’s superior biodegradability profile ensures regulatory compliance, making it a preferred choice for reformulation efforts worldwide.

Which application segment holds the largest share in the MGDA market?

The Detergents and Cleaners segment, particularly the Automatic Dishwashing Detergent sub-segment, accounts for the largest market share. MGDA provides essential non-streaking performance and superior efficacy required for high-concentration, phosphate-free ADW products globally.

Is MGDA production cost-competitive with traditional chelating agents?

While MGDA historically faced higher production costs than legacy agents like EDTA, continuous technological advancements, process optimization, and large-scale manufacturing have significantly improved cost-competitiveness. Its superior performance and environmental benefits often justify the marginal cost difference for premium and regulated products.

What is the key trend driving market growth in the Asia Pacific region?

Rapid industrialization, rising consumer disposable incomes leading to higher quality standards for cleaning products, and increasing local regulatory scrutiny on environmental pollution are the primary factors fueling exponential market growth for Methylglycinediacetic Acid across the Asia Pacific region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager