Micro Bioreactor System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443461 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Micro Bioreactor System Market Size

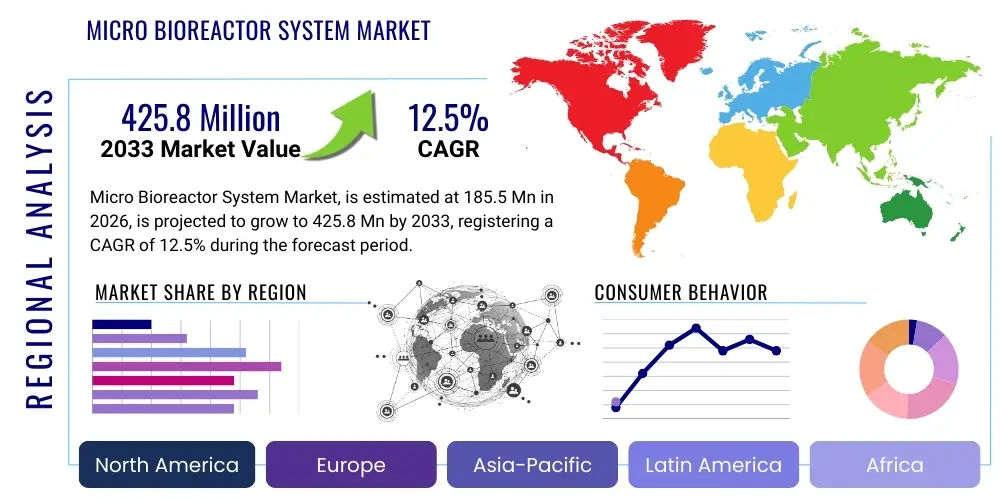

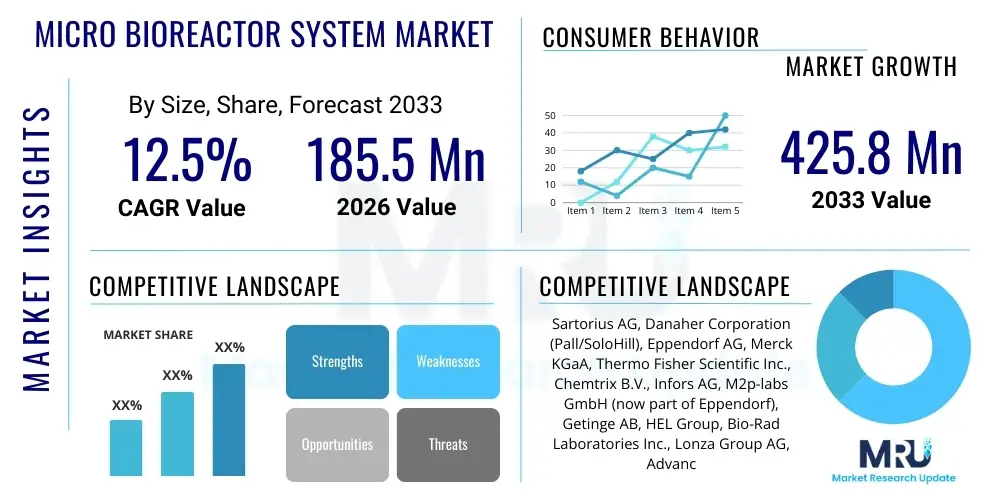

The Micro Bioreactor System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 185.5 million in 2026 and is projected to reach USD 425.8 million by the end of the forecast period in 2033.

Micro Bioreactor System Market introduction

Micro bioreactor systems represent a paradigm shift in upstream bioprocess development, moving critical experimentation from time-consuming, large-volume benchtop reactors into miniaturized, parallelized platforms. These advanced systems, typically operating with culture volumes ranging from microliters to a few milliliters, replicate the highly controlled environment of traditional stirred tank reactors (STRs), managing essential parameters such as dissolved oxygen (DO), pH, temperature, and mixing rate with remarkable precision. The inherent efficiency of these small-scale systems makes them indispensable for accelerating early-stage R&D, primarily enabling high-throughput screening of cell lines, rapid media formulation optimization, and comprehensive process parameter mapping, all of which are crucial steps in the commercialization pathway of modern biopharmaceuticals. The ability to run numerous experimental conditions simultaneously, often utilizing 24- or 48-well microtiter plate formats with individual control capabilities, dramatically reduces the experimental cycle time compared to conventional methods, offering profound cost and labor advantages across the biomanufacturing industry value chain.

The product portfolio within this market includes automated, semi-automated, and manual systems, with automated parallel systems commanding the highest market share due to their seamless integration capabilities with robotic liquid handling workstations and Laboratory Information Management Systems (LIMS). Major applications span the entirety of bioprocess development, including cell line development (CLD) for selecting high-yielding clones, process characterization required by regulatory bodies, and specialized applications such as microbial fermentation and mammalian cell culture for complex biologics like monoclonal antibodies (mAbs) and recombinant proteins. The core benefits derived from adopting micro bioreactors include vastly accelerated screening timelines, reduced consumption of expensive reagents and cell culture media, minimized operational footprint, and superior data quality generated under highly reproducible conditions. Furthermore, the small scale minimizes risks associated with handling highly potent or scarce biological samples, suchving critical materials during early development phases.

Key driving factors underpinning the robust market expansion include the exponential growth in the global pipeline of biopharmaceutical products, particularly sophisticated therapies such as personalized medicines, cell therapies, and gene therapies, all of which necessitate stringent and rapid process optimization prior to clinical trials. There is also a significant industry-wide mandate to adhere to Quality by Design (QbD) principles, which requires comprehensive process understanding achievable only through the systematic data generation capabilities of high-throughput micro bioreactors. Financial investment from both government bodies and venture capital firms specifically targeting biotechnology infrastructure and advanced biomanufacturing technology further catalyzes market growth. Additionally, the continuous technological advancements focused on integrating high-fidelity, non-invasive sensors and advanced analytical tools, such as spectroscopic probes and mass spectrometry compatibility, enhance the utility and value proposition of these systems, ensuring their continued relevance as foundational tools in modern biological engineering laboratories.

Micro Bioreactor System Market Executive Summary

The Micro Bioreactor System Market is currently shaped by significant business trends emphasizing enhanced connectivity, miniaturization, and full automation to meet the increasing throughput demands of the biopharmaceutical sector. Key business strategy involves the development of proprietary software ecosystems that offer real-time data integration, advanced kinetic modeling, and cloud-based data storage solutions, allowing for global collaboration and seamless data transfer between R&D sites and manufacturing plants. Market participants are heavily investing in disposable technology, specifically pre-sterilized consumables, to address contamination risks and reduce validation efforts, positioning recurring consumable sales as a crucial revenue stream. Strategic consolidations, including mergers and acquisitions, are frequently observed as larger life science tool providers seek to integrate specialized microfluidics and automation expertise to offer comprehensive, end-to-end bioprocess solutions, securing their competitive edge against pure-play micro bioreactor specialists.

Regionally, the market exhibits a clear concentration of demand in established biopharma hubs, with North America maintaining its leadership position due to unparalleled investment in advanced biotechnological research, particularly in the rapidly evolving cell and gene therapy space. European adoption remains strong, driven by rigorous bioprocess validation requirements and a well-developed network of academic and industrial research centers. Conversely, the Asia Pacific (APAC) region is forecasted to be the fastest-growing market segment, primarily propelled by massive infrastructure investment in China and India aimed at establishing domestic biomanufacturing capabilities and the increasing trend of Western companies outsourcing early-stage process development activities to cost-competitive Asian Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs). This regional shift is compelling major global vendors to establish dedicated sales and support networks in key APAC countries to capitalize on this exponential growth trajectory.

Analysis of segment trends confirms the dominance of automated micro bioreactor systems over manual and semi-automated alternatives, reflecting the industry’s prioritizing of high efficiency and reduced variability inherent in fully controlled environments. Among applications, cell line development and upstream process optimization remain the most critical and revenue-intensive segments, as these systems provide the fundamental data required for regulatory submissions and successful scale-up. Furthermore, the end-user segmentation clearly indicates that Pharmaceutical and Biotechnology companies are the primary purchasers, yet the rapidly expanding outsourced service sector (CROs/CMOs) is becoming an increasingly influential buyer base, often demanding the newest and most parallelized systems to maintain service competitiveness. This sustained demand across multiple end-user types and the continuous refinement of system capacity and control mechanisms ensure a positive and robust market outlook throughout the forecast period, emphasizing miniaturization without compromising critical process parameter fidelity.

AI Impact Analysis on Micro Bioreactor System Market

Analysis of common user questions reveals significant interest in utilizing Artificial Intelligence (AI) to transform the traditional empirical approach to bioprocess development, which historically relies heavily on manual, iterative testing within micro bioreactor arrays. Users frequently query how AI and machine learning (ML) algorithms can be effectively deployed to handle the vast, multidimensional datasets generated by high-throughput micro bioreactors, moving beyond simple statistical analysis to uncover complex, non-linear relationships between media components, physical parameters, and biological outcomes (e.g., productivity, viability, glycosylation patterns). A key theme is the expectation that AI can drastically minimize the necessity for laborious design of experiments (DoE) studies by intelligently suggesting optimal experimental designs, thus further accelerating the screening phase which is already fast due to the micro-scale platform itself. Concerns often focus on the required computational infrastructure, the standardization of data inputs necessary for training robust ML models, and the perceived 'black-box' nature of deep learning algorithms when used for predicting delicate biological phenomena, requiring validation methods that ensure regulatory acceptance.

The impact of AI is fundamentally centered on enhancing data utilization and predictive power. Micro bioreactors are highly effective at generating large volumes of kinetic data simultaneously, but extracting actionable insights that guarantee successful scale-up remains challenging. AI addresses this bottleneck by providing sophisticated tools for pattern recognition, feature extraction, and anomaly detection in real-time. For instance, ML models trained on historical micro bioreactor runs can accurately predict the performance of a cell line or the titer yield under novel, unscreened conditions, thereby optimizing resource allocation and saving months of laboratory work. Furthermore, the application of reinforcement learning within closed-loop micro bioreactor setups allows the system to autonomously adjust parameters (like feed rate or pH setpoint) in response to real-time metabolic feedback, effectively implementing optimal control strategies dynamically, which is crucial for maximizing product quality and yield in complex cell culture systems.

This transformative capability is leading to the concept of Bioreactor Digital Twins, where an AI-driven virtual model of the bioprocess, built from micro bioreactor data, can simulate the effects of process changes before they are applied physically. This shift from physical experimentation to virtual optimization ensures greater efficiency, repeatability, and control fidelity, aligning perfectly with modern Biomanufacturing 4.0 initiatives. Key industry players are actively partnering with AI software companies to embed ML-based decision support tools directly into their micro bioreactor control software. This integration ensures that the data generated—from high-content, low-volume runs—is immediately processed into actionable intelligence, significantly bridging the technological gap between high-throughput screening and commercial-scale production, thus maximizing the return on investment in these advanced analytical platforms across the pharmaceutical and contract manufacturing sectors.

- AI-driven optimization of media and feed strategies based on real-time sensor data and historical performance trends.

- Predictive modeling for automated scale-up risk assessment, extrapolating micro-scale mass transfer dynamics to pilot-scale performance.

- Enhanced high-throughput data analysis and anomaly detection using machine learning algorithms to identify cell stress or contamination events early.

- Implementation of Digital Twin technology to simulate bioprocess behavior virtually, optimizing parameters without physical resource consumption.

- Accelerated cell line development through automated selection and predictive yield forecasting based on comprehensive screening data.

- Improved control loop feedback mechanisms for real-time parameter adjustments, maximizing cell viability and product quality in parallel micro-wells.

- Automated generation of regulatory-compliant documentation for critical process parameter (CPP) validation using AI-processed data.

DRO & Impact Forces Of Micro Bioreactor System Market

The Micro Bioreactor System Market is fundamentally driven by the accelerating pace and increasing complexity of global biopharmaceutical research and development, particularly the need to rapidly screen and optimize processes for novel therapeutic modalities such as complex proteins, viral vectors for gene therapy, and delicate cellular products. The foremost driver is the imperative for pharmaceutical and biotechnology companies to reduce the timeline from candidate identification to clinical manufacturing. Micro bioreactors address this directly by allowing hundreds of experiments to be conducted simultaneously in parallel, dramatically compressing the time required for cell line selection and process characterization from months to weeks. Additionally, the inherent cost efficiency, stemming from minimal consumption of expensive cell culture media and smaller labor requirements compared to traditional systems, further incentivizes broad-scale industry adoption, especially as R&D budgets face increasing scrutiny to deliver high-quality results efficiently.

Despite these powerful drivers, the market faces significant restraints. A primary impediment is the high initial capital investment associated with acquiring fully automated, high-throughput micro bioreactor platforms, including the cost of integrated robotic liquid handlers, specialized software licenses, and necessary auxiliary equipment. This initial barrier limits adoption, particularly among smaller academic labs and emerging biotech start-ups with restricted funding. Furthermore, the persistent, albeit shrinking, challenge of 'scale-up' remains a critical restraint. Successfully translating the optimal conditions identified in a microliter-scale environment to a 1000-liter manufacturing bioreactor involves complex hydrodynamics and mass transfer considerations that are difficult to perfectly replicate, requiring specialized expertise and extensive verification studies, which can complicate the process validation phase and slow down the seamless transition to large-scale manufacturing.

Opportunities for profound market growth are anchored in the burgeoning fields of regenerative medicine and personalized medicine, where the requirement for small-volume, highly controlled, patient-specific bioproduction is ideally suited to micro bioreactor capabilities. Significant opportunity lies in the continuous technological refinement of integrated analytical tools, such as embedding Raman spectroscopy or advanced imaging techniques directly into the micro bioreactor vessel, enabling non-invasive, high-content measurement of cellular metabolites and product quality attributes in real-time. Moreover, the geographic expansion into high-growth emerging economies like those in APAC, coupled with the increasing trend of outsourcing bioprocess development to specialized CROs/CDMOs—who rely heavily on high-throughput micro bioreactors to maintain competitiveness—presents substantial opportunities for key market players to secure long-term revenue streams through both capital equipment sales and recurring consumables contracts, further mitigating the impact of high initial purchase costs over the system lifecycle.

Segmentation Analysis

The Micro Bioreactor System Market segmentation provides a granular view of demand dynamics across technological choices, specific scientific applications, and differing end-user requirements. Segmenting by system type—Automated, Semi-Automated, and Manual—is essential as it reflects the trade-off between capital investment and required throughput. Automated systems, exemplified by high-parallelization platforms like the ambr series, dominate revenue generation due to their superior capability to manage hundreds of independent bioreactions simultaneously with minimal human error, a necessity in industrial bioprocessing. Semi-automated and manual systems, while lower in throughput, remain relevant for smaller academic research groups or initial proof-of-concept studies where budget constraints are stricter, providing basic control features but requiring more hands-on intervention for sampling and feed additions.

Application segmentation clarifies the functional utility driving system adoption. Cell Line Development (CLD) constitutes the largest and most critical application segment, as efficient CLD is foundational to the subsequent success of any bioprocess. Micro bioreactors accelerate the arduous task of screening thousands of clones to identify those exhibiting the highest productivity and genetic stability under manufacturing-relevant conditions. Process Optimization, the second major segment, focuses on rapidly mapping the design space (temperature, pH, DO, media feeds) necessary to achieve maximum yield and optimal product quality once a robust cell line is selected. Drug screening and toxicology applications are also growing, particularly in early drug discovery, where the systems are used to assess the cytotoxicity and efficacy of new drug candidates on mammalian cells in a physiological context, providing critical early data before costly in vivo studies are initiated.

End-user segmentation highlights the primary revenue streams. Pharmaceutical and Biotechnology Companies are the definitive key purchasers, driven by internal R&D mandates and extensive drug pipelines, requiring investment in multiple systems across different development stages. Contract Research and Manufacturing Organizations (CROs/CDMOs) form the fastest-growing end-user segment; their business model relies on maximizing experimental efficiency and offering rapid turnaround services, making high-throughput micro bioreactors an essential competitive tool. Academic and Research Institutes, while generally smaller volume purchasers, are crucial for driving technological adoption of niche applications, such as stem cell cultivation or tissue engineering, and are significant influencers in the long-term direction of bioprocess technology innovation.

- By Type: Automated Micro Bioreactor Systems (highest CAGR), Semi-Automated Micro Bioreactor Systems, Manual Micro Bioreactor Systems.

- By Application: Cell Line Development (largest segment), Process Optimization, Drug Screening and Toxicology, Media Development, Microbial Fermentation, Stem Cell Research.

- By End-User: Pharmaceutical and Biotechnology Companies (largest revenue contributor), Contract Research and Manufacturing Organizations (CROs/CMOs), Academic and Research Institutes.

- By Capacity: Below 5 mL (most common for HTS), 5 mL to 15 mL (mid-scale validation), Above 15 mL (approaching benchtop scale).

Value Chain Analysis For Micro Bioreactor System Market

The Micro Bioreactor System value chain initiates robustly at the upstream level with highly specialized material and component sourcing, which is critical for system performance and reliability. Key upstream suppliers include manufacturers of high-purity optical sensing components—the optodes and fluorophores used for non-invasive pH and DO measurement—and polymer fabricators responsible for disposable vessel production. Innovation in this segment is focused on reducing the cost and variability of disposable consumables while ensuring high optical clarity and gamma sterilization compatibility. Furthermore, the supply of sophisticated micro-motors, fluidic controllers, and precise temperature regulation units are essential inputs. Manufacturers often maintain tightly controlled relationships with these specialized component suppliers to ensure quality control, particularly for sensors that directly impact the fidelity of critical process parameter (CPP) measurements, which are paramount in bioprocess validation environments.

The midstream phase involves the core manufacturing, integration, and proprietary software development by the key market players. System manufacturers invest heavily in R&D to optimize mixing dynamics within the small reactor volumes, often utilizing computational fluid dynamics (CFD) modeling to ensure mass transfer coefficients closely mimic large-scale reactors—a crucial factor for scale-up success. Distribution channels are predominantly direct in established markets like North America and Europe, allowing vendors to offer comprehensive pre-sales consultation, custom integration services, and specialized, proprietary post-sales technical support. Direct distribution ensures tight control over the complex installation and validation processes required by pharmaceutical clients. Conversely, indirect distribution through specialized regional laboratory equipment distributors is more common in nascent or geographically challenging markets (e.g., specific APAC or MEA regions), leveraging local expertise and inventory handling to facilitate broader market access.

Downstream activities focus heavily on installation qualification (IQ), operational qualification (OQ), and continuous supply of proprietary consumables and software updates. Consumables—specifically the disposable microtiter plates, reservoirs, and specialized probes—constitute a lucrative, predictable, and high-margin recurring revenue stream, often making the lifetime value of the customer significantly higher than the initial hardware purchase price. Potential customers rely heavily on vendors not only for operational training but also for application support relating to scale-up translation and data interpretation, meaning the effectiveness of downstream technical application specialists directly influences customer retention and brand loyalty. This high dependence on proprietary consumables and specialized support creates significant barriers to entry for new competitors and strengthens the market position of established manufacturers who can deliver end-to-end validated solutions.

Micro Bioreactor System Market Potential Customers

The primary and most lucrative customer base for Micro Bioreactor Systems consists of global Pharmaceutical and Biotechnology Companies, encompassing both large multinational corporations and emerging biotech startups heavily focused on novel therapeutic development. These customers utilize micro bioreactors as their foundational high-throughput screening tool across all phases of upstream bioprocess development, including clone selection, media optimization, and early-stage process characterization for regulatory submissions. Their purchasing drivers are centered on minimizing time-to-market for high-value biologics, mitigating research risks by running hundreds of parallel experiments under tightly controlled conditions, and adhering to strict Quality by Design (QbD) mandates. Their substantial and often increasing R&D budgets ensure that they consistently adopt the newest, most automated, and highest-capacity micro bioreactor systems available, alongside large volumes of specialized, proprietary consumables for their internal process development pipelines.

Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) represent the rapidly expanding service-based customer segment. These potential customers leverage micro bioreactors as a core component of their service offerings, enabling them to provide rapid, cost-effective, and high-throughput screening services to pharmaceutical clients who outsource their bioprocess development needs. For CROs/CDMOs, the investment in micro bioreactors translates directly into a competitive advantage by allowing them to handle a greater volume of client projects faster and more reliably than competitors relying on older or manual systems. Their purchasing decisions prioritize system parallelization, automation features, and the ability to integrate seamlessly with client-specific LIMS systems, ensuring rapid project turnaround and robust data package generation for their diverse client base.

Finally, Academic and Government Research Institutes are essential secondary customers. While they may not purchase the large quantities of consumables or the highest-capacity systems seen in industry, these institutions play a critical role in validating new technologies, exploring niche applications such as tissue engineering and synthetic biology, and training the next generation of bioprocess scientists. Their demand is driven by specific research grant requirements, focusing on systems that offer flexibility, accessibility for diverse cell types (e.g., stem cells, challenging microbial strains), and strong data output necessary for high-impact publications. Their influence as key opinion leaders often shapes future industry standards and accelerates the adoption of novel micro bioreactor features, such as advanced spectroscopic monitoring or microfluidic integration, across the broader commercial market landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 Million |

| Market Forecast in 2033 | USD 425.8 Million |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sartorius AG, Danaher Corporation (Pall/SoloHill), Eppendorf AG, Merck KGaA, Thermo Fisher Scientific Inc., Chemtrix B.V., Infors AG, M2p-labs GmbH (now part of Eppendorf), Getinge AB, HEL Group, Bio-Rad Laboratories Inc., Lonza Group AG, Advanced Instruments, Esco Group, Applikon Biotechnology B.V., ambr systems (Sartorius Stedim Biotech), HiTec Zang GmbH, CerCell ApS, C-CIT Sensors AG, Biotage AB. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Micro Bioreactor System Market Key Technology Landscape

The core technological advancement defining the micro bioreactor market is the miniaturization and integration of high-fidelity sensor technology. Non-invasive optical sensors (optodes) for measuring pH and dissolved oxygen are critical, allowing for continuous, real-time monitoring of critical process parameters without compromising the sterility of the small culture volume. These optodes, coupled with LED excitation and fluorescence detection systems, offer superior precision and responsiveness compared to traditional galvanic sensors, which are impractical at the micro-scale. Furthermore, technological focus is intensely placed on designing efficient mixing mechanisms, such as orbital shaking or specialized impellers driven by magnetic coupling, which ensure low shear stress—vital for sensitive mammalian cell cultures—while maintaining high mass transfer rates necessary for optimal gas exchange and nutrient distribution across all parallel wells, directly impacting the quality and viability of the cell culture experiments being performed.

The second major technological pillar involves advanced automation and microfluidic capabilities. Modern micro bioreactor systems integrate sophisticated robotic liquid handling systems capable of precision feeding, sampling, and inoculation across multiple parallel reactors simultaneously, eliminating human variability and significantly increasing throughput reliability. Microfluidic-based micro bioreactors are particularly innovative, utilizing microchannels and chambers to precisely control the cellular environment down to the single-cell level, making them ideal for specialized applications like single-cell analysis and rapid continuous fermentation studies. The software infrastructure supporting these physical components is equally vital, featuring sophisticated Process Analytical Technology (PAT) tools, predictive control algorithms, and robust data management platforms that facilitate remote monitoring, compliance documentation, and seamless integration with broader enterprise-level manufacturing systems, ensuring that data generated at the micro-scale is traceable and interpretable for downstream scale-up activities.

The shift towards disposable technology represents a dominant technological trend influencing material science within the market. Single-use plastic components, including pre-sterilized microtiter plates and specialized vessels made from high-grade polymers, are replacing traditional glass or stainless steel reactors. This technology drastically simplifies preparation, reduces labor costs associated with cleaning and sterilization validation, and virtually eliminates the risk of cross-contamination between runs, which is paramount in regulated environments. Continuous R&D efforts are focused on improving the gas permeability and chemical compatibility of these disposable polymer materials to ensure optimal cell growth conditions across diverse cell lines, ranging from robust microbial strains to fragile human pluripotent stem cells (hPSCs). Furthermore, the future integration of advanced analytical tools, such as embedded NIR or Raman spectroscopic probes directly into the disposable vessels, promises to unlock real-time, high-content metabolite and product quality monitoring, providing unprecedented insight into cellular performance kinetics.

Regional Highlights

North America

North America maintains its unquestioned leadership in the Micro Bioreactor System Market, driven overwhelmingly by the sheer scale of R&D investment within the United States. The region boasts the world's highest concentration of major global pharmaceutical and biotechnology companies, alongside an extensive network of highly funded academic and government research institutions. Adoption rates are exceptionally high for fully automated, high-end systems, particularly those tailored for cutting-edge fields like cell and gene therapy manufacturing, where rapid process optimization is non-negotiable for regulatory success. Favorable regulatory frameworks, coupled with significant venture capital inflows into biotech startups, ensure continuous capital expenditure on advanced bioprocessing instrumentation. The U.S. market acts as a global benchmark for technological adoption and dictates key market trends, compelling manufacturers to launch their newest, most advanced systems here first.

Europe

Europe holds the second-largest market share, supported by robust biopharmaceutical manufacturing hubs in nations such as Germany, Switzerland, the UK, and the Netherlands. Market growth is sustained by strong governmental support for biomanufacturing excellence and the widespread adoption of stringent Quality by Design (QbD) methodologies mandated by the European Medicines Agency (EMA), which necessitates the use of high-throughput screening tools like micro bioreactors for comprehensive process understanding and robust validation documentation. While the market is technologically mature, growth rates are slightly less aggressive than APAC due to more established infrastructure and regulatory homogeneity. However, key European vendors are globally competitive innovators, especially in developing specialized systems for microbial fermentation and continuous bioprocessing applications, ensuring the region remains a vital segment for technological advancement and large-scale deployment.

Asia Pacific (APAC)

The Asia Pacific region is forecast to experience the highest CAGR over the forecast period, representing the most dynamic growth engine for the Micro Bioreactor System Market. This accelerated expansion is fundamentally fueled by massive governmental initiatives in countries like China, India, South Korea, and Japan, dedicated to bolstering domestic biomanufacturing capabilities and reducing reliance on imported pharmaceuticals. The flourishing ecosystem of Contract Research Organizations (CROs) and CDMOs in the region, offering competitive cost structures for outsourced bioprocess development, drives strong demand for high-throughput, efficient micro bioreactors. As domestic R&D budgets increase and local regulatory standards mature, APAC is rapidly transitioning from a technology consumer to a significant technology producer and innovator, making it an essential strategic target for all global market players seeking long-term growth and market diversification.

- North America: Market dominance, driven by extensive R&D expenditure in cell and gene therapy and high adoption of automated parallel systems.

- Europe: Strong second position, sustained by mature pharmaceutical industries, adherence to QbD principles, and specialized focus on process development validation.

- Asia Pacific (APAC): Highest expected growth rate, fueled by government investment, major outsourcing trends, and rapid expansion of domestic biomanufacturing infrastructure.

- Latin America & MEA: Emerging segments characterized by increasing healthcare investments and initial adoption in academic and nascent local pharmaceutical production facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Micro Bioreactor System Market.- Sartorius AG

- Danaher Corporation (Pall/SoloHill)

- Eppendorf AG

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Infors AG

- M2p-labs GmbH (now part of Eppendorf)

- Chemtrix B.V.

- HEL Group

- Bio-Rad Laboratories Inc.

- Lonza Group AG

- Advanced Instruments

- Esco Group

- Applikon Biotechnology B.V.

- ambr systems (Sartorius Stedim Biotech)

- HiTec Zang GmbH

- CerCell ApS

- C-CIT Sensors AG

- Getinge AB

- Biotage AB

- Alfa Wassermann Separation Technologies

Frequently Asked Questions

Analyze common user questions about the Micro Bioreactor System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a micro bioreactor system and how does it benefit bioprocess development?

A micro bioreactor system is a miniaturized, parallelized reactor platform that precisely controls critical process parameters (pH, DO, temperature, mixing) in small volumes (microliters to milliliters). It accelerates bioprocess development by enabling high-throughput screening of cell lines and media formulations, reducing experimental time and minimizing the consumption of expensive cell culture media, thereby cutting operational costs and speeding up time-to-market for biologics.

Are micro bioreactors suitable for both microbial and mammalian cell cultures?

Yes, modern micro bioreactor systems are designed with versatility to handle both microbial fermentation (which requires high mass transfer rates) and sensitive mammalian cell cultures (which require low shear stress). Manufacturers offer specialized impeller designs, gas supply controls, and temperature regulation profiles optimized specifically to cater to the unique metabolic and physical requirements of both bacterial/yeast strains and CHO/HEK cell lines used in biopharmaceutical production.

What is the current technological trend regarding sensors in micro bioreactor systems?

The dominant trend is the shift towards advanced, non-invasive optical sensing technologies (optodes) for real-time monitoring of pH and dissolved oxygen. These sensors are often integrated into disposable vessel components, maintaining sterility and eliminating the need for complex in-vessel calibration. Furthermore, there is growing integration of spectroscopic probes (like Raman) for real-time, non-destructive monitoring of metabolites and product quality attributes (PAT).

Which geographical region exhibits the fastest growth potential for this market?

The Asia Pacific (APAC) region, driven primarily by China and India, is forecasted to show the highest Compound Annual Growth Rate (CAGR). This accelerated growth is attributed to significant government investment in local biotechnology infrastructure, increasing domestic pharmaceutical production capabilities, and the rising prevalence of outsourcing bioprocess development to Asian Contract Research and Manufacturing Organizations (CROs/CDMOs).

What are the key challenges associated with scaling up micro bioreactor results?

The primary challenge involves maintaining fidelity during the translation of process parameters from microliter volumes to industrial-scale tanks (e.g., thousands of liters). Differences in mass transfer coefficients, mixing hydrodynamics, and shear stress profiles must be carefully managed. The adoption of AI and predictive modeling is aimed at bridging this gap by using micro-scale data to accurately forecast and optimize the conditions required for robust performance at the commercial manufacturing scale.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager