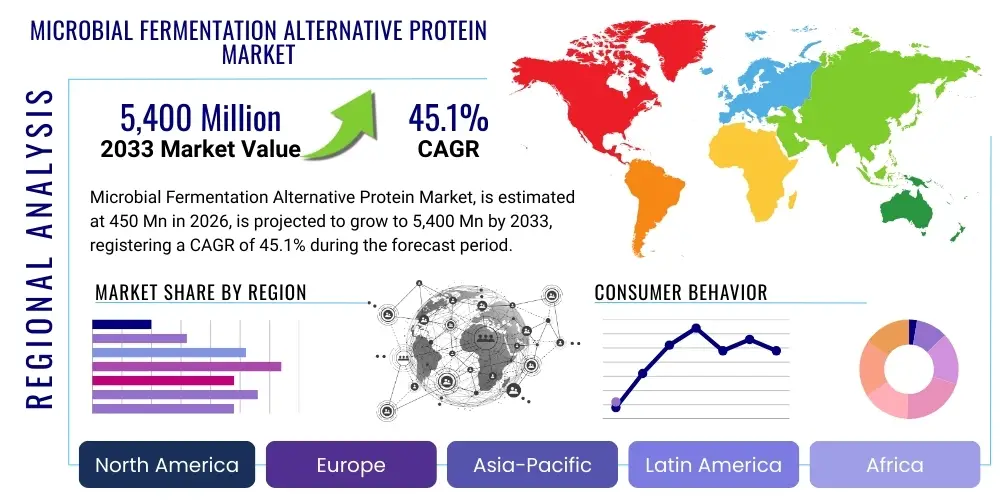

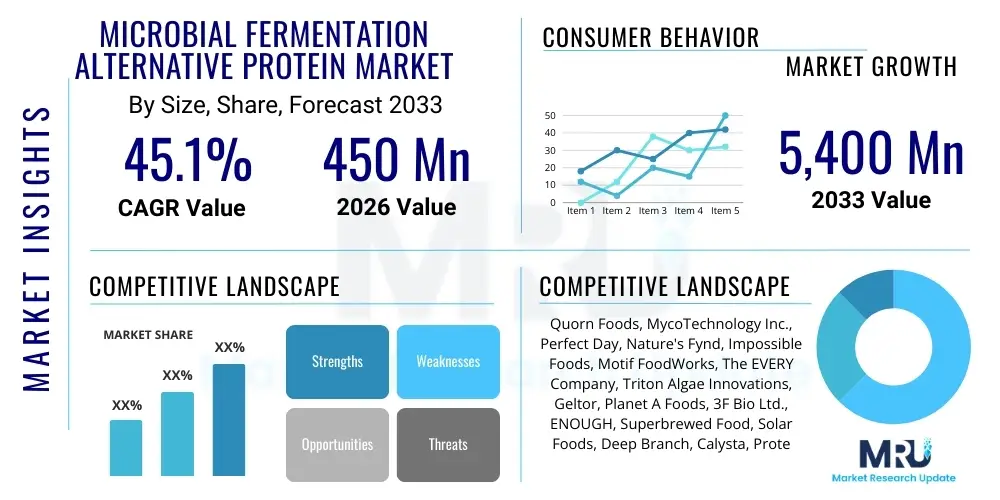

Microbial Fermentation Alternative Protein Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441054 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Microbial Fermentation Alternative Protein Market Size

The Microbial Fermentation Alternative Protein Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 45.1% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 5,400 Million by the end of the forecast period in 2033.

Microbial Fermentation Alternative Protein Market introduction

The Microbial Fermentation Alternative Protein Market encompasses the production of protein ingredients and finished food products utilizing microorganisms—such as fungi, yeast, bacteria, or algae—as tiny cell factories. This process leverages advanced biotechnology to convert low-cost feedstocks (like sugars or agricultural side streams) into highly nutritious, functional, and sustainable proteins, fundamentally changing the landscape of global food production. Products derived from microbial fermentation include mycoprotein, biomass protein concentrates, and specific functional ingredients produced through precision fermentation, such as animal-free dairy whey or egg proteins. The core benefit of this technology lies in its immense efficiency; it requires significantly less land, water, and time compared to traditional animal agriculture, offering a scalable solution to meet the rapidly rising global demand for protein in an environmentally sound manner. Microbial fermentation provides unparalleled control over the production environment, ensuring consistent output quality, functional properties tailored for specific food applications, and dramatically reduced contamination risks compared to conventional protein sources.

Major applications span across the entire food and beverage industry, including meat and seafood analogues, dairy alternatives (milk, cheese, ice cream), nutritional supplements, and specialized ingredients used in baking and confectionery. Driving factors center primarily around global sustainability imperatives, including the need to mitigate climate change and reduce the ecological footprint associated with traditional livestock farming. Furthermore, shifting consumer dietary patterns, notably the rise of flexitarianism and veganism, coupled with increasing population demands, provide powerful impetus for market expansion. The technological advancements in genetic engineering and bioprocessing further enhance the efficiency and economic viability of scaling up fermentation platforms, making these alternative proteins cost-competitive with conventional sources sooner than anticipated. Early adoption is focused heavily in North America and Europe, regions with established biotechnology infrastructure and high consumer awareness regarding climate-friendly food choices.

The inherent advantages of microbial proteins, such as their complete amino acid profiles, high bioavailability, and versatile functionality (e.g., texture, emulsification), make them highly desirable in product formulation. These proteins not only serve as a sustainable backbone for meat substitutes but also offer novel possibilities for creating hybridized food products that blend traditional plant-based ingredients with fermentation-derived components to improve flavor, texture, and nutritional density. The market is currently characterized by significant private investment, extensive R&D activity focusing on developing new, high-yielding strains, and a push toward achieving regulatory approvals across major global jurisdictions. This synthesis of sustainability, nutritional superiority, and production efficiency positions microbial fermentation as a critical pillar in the future of the sustainable food system.

Microbial Fermentation Alternative Protein Market Executive Summary

The Microbial Fermentation Alternative Protein Market is poised for explosive growth, fueled by strong alignment between consumer demand for sustainable nutrition and technological breakthroughs in biomanufacturing. Business trends highlight massive influxes of venture capital and corporate partnerships focused on scaling fermentation capacity globally, moving technologies from laboratory pilot scales to industrial 100,000-liter bioreactors. A significant trend involves the vertical integration of technology developers and food manufacturers seeking to control the supply chain from strain development to final consumer product, ensuring quality and competitive pricing. Precision fermentation, in particular, is witnessing rapid commercialization, especially in the production of functional ingredients like high-value enzymes, fats, and specific proteins that mimic animal-derived counterparts exactly. This focus on functional mimicry rather than mere replacement is a key strategic shift driving market acceptance and product performance in end-user applications.

Regionally, North America and Europe currently dominate the market due to robust regulatory frameworks, high levels of consumer environmental awareness, and significant existing biotech infrastructure. These regions are the primary drivers of innovation and initial commercial deployment. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, propelled by immense population density, growing disposable income, and increasing concerns over traditional livestock farming practices. Countries like Singapore, China, and Australia are actively investing in local production capabilities to enhance food security and reduce reliance on imported protein sources. Regulatory clarity and government incentives promoting sustainable agriculture are crucial determinants of market maturity across all major geographical zones. Emerging markets in Latin America and the Middle East are beginning to show promise, particularly in applying fermentation technology to utilize locally sourced, undervalued feedstocks.

Segment trends reveal that the Biomass Fermentation segment, primarily led by mycoprotein, currently holds a larger market share due to its earlier market entry and established production methods. However, the Precision Fermentation segment is anticipated to exhibit the highest CAGR, reflecting its superior ability to produce high-purity, highly functional proteins that command premium pricing and satisfy specific nutritional requirements, especially in the dairy and supplement sectors. In terms of application, the Food & Beverage sector remains the largest consumer, driven primarily by the demand for alt-meat and alt-dairy products, but the Animal Feed segment is rapidly emerging as a substantial growth avenue, offering sustainable alternatives to traditional soy or fishmeal proteins. The competitive landscape is characterized by intense competition among startup innovators, large food conglomerates, and specialized ingredient manufacturers, all vying to achieve cost parity and mass-market scalability for their proprietary strains and bioprocessing techniques.

AI Impact Analysis on Microbial Fermentation Alternative Protein Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Microbial Fermentation Alternative Protein Market primarily revolve around accelerating the R&D cycle, optimizing bioprocess efficiency, and ensuring product safety and consistency at industrial scale. Key concerns frequently raised include how AI can identify novel, superior microbial strains faster than traditional methods, manage the complexity of large-scale bioreactor operations, and reduce the high operational costs associated with fermentation. Expectations are high that AI and Machine Learning (ML) will serve as the core competitive advantage, enabling companies to drastically cut time-to-market for new ingredients and achieve the elusive cost parity with animal proteins. Users are particularly interested in AI's role in predictive maintenance, real-time quality assurance, and the design of novel protein structures that offer enhanced functionality in food applications. The general consensus is that AI integration is not just beneficial, but essential for the long-term sustainability and scalability of the fermentation industry.

The deployment of AI tools allows for unparalleled precision in strain engineering and metabolic pathway optimization. Traditional strain development is a labor-intensive, trial-and-error process; however, AI can analyze vast genomic datasets, predict the performance of engineered strains under various conditions, and simulate fermentation yields before wet-lab experiments begin. This dramatically reduces the cost and time involved in identifying high-performance microorganisms capable of producing high titers of target proteins. Furthermore, AI excels at modeling and controlling the complex, non-linear dynamics within large industrial bioreactors. Factors such as pH, dissolved oxygen levels, temperature, and nutrient feed rates must be constantly managed. AI algorithms utilize sensor data streams to provide predictive control, preemptively adjusting parameters to maximize yield, prevent batch failure, and minimize energy consumption. This capability is vital for moving microbial protein production into the realm of cost-effective, continuous manufacturing processes.

Beyond the core production process, AI enhances supply chain resilience and quality control. Machine learning models can analyze sensory data (e.g., spectroscopy, chromatography) in real-time to detect subtle variations in product composition or contamination, far surpassing human capability. This ensures that every batch meets stringent food safety and functional specifications, building consumer and regulatory trust. On the business side, AI-driven market analysis helps companies identify optimal pricing strategies, predict consumer acceptance for novel ingredients, and tailor product formulations for specific regional tastes. By automating and optimizing critical stages from discovery to quality assurance, AI significantly de-risks the scaling process, transforming the microbial fermentation sector into a highly efficient, data-driven biomanufacturing powerhouse ready to compete directly with established agricultural giants.

- Accelerated Strain Discovery: AI analyzes genomic data to identify and engineer high-yield, robust microbial strains rapidly.

- Bioprocess Optimization: Machine Learning models enable real-time predictive control of bioreactor parameters (temperature, pH, feeding) to maximize protein output and efficiency.

- Predictive Maintenance: AI algorithms forecast equipment failures, minimizing downtime and ensuring continuous operation in capital-intensive facilities.

- Quality Assurance Automation: Real-time sensor data processed by AI ensures consistent product purity and functional integrity across all production batches.

- Enhanced Protein Design: Computational tools design novel protein sequences optimized for specific textures, flavors, and nutritional properties in food applications.

DRO & Impact Forces Of Microbial Fermentation Alternative Protein Market

The microbial fermentation market is driven by compelling sustainability narratives and superior production efficiency, counterbalanced by significant initial capital investment requirements and ongoing regulatory complexity. The primary driver is the demonstrable environmental advantage over animal agriculture, specifically the drastically lower land, water, and greenhouse gas requirements. Coupled with this, technological maturity—including advancements in continuous fermentation and gene editing techniques—has made large-scale production increasingly feasible, boosting yields and lowering operating costs over time. Conversely, the market faces hurdles, mainly the steep upfront cost associated with building and operating sophisticated bioreactor facilities (Restraints). Consumer acceptance remains another significant restraint; novel proteins often face skepticism regarding their 'naturalness' and processing methods, necessitating substantial investment in transparent consumer education. Opportunities abound in utilizing fermentation to create hybrid products that solve current plant-based limitations (texture, flavor) and tapping into emerging markets in Asia and Latin America seeking food security solutions and diversified protein sources. Impact forces, such as climate change urgency and shifting global dietary guidelines favoring plant and alternative proteins, exert continuous pressure on the food industry to adopt these scalable technologies rapidly.

Drivers: The global imperative to achieve net-zero carbon emissions is a monumental driver for this market, positioning fermentation-derived proteins as a necessary component of a sustainable food system. High productivity rates—microbial systems can produce protein in hours or days, unlike months for livestock—ensure quick scalability to meet sudden demand fluctuations. Furthermore, the inherent versatility of fermentation allows producers to create highly functional ingredients that traditional plant proteins cannot easily replicate, such as high-purity fats, specific amino acids, and tailored flavoring compounds, which are crucial for improving the palatability and nutritional profile of meat and dairy alternatives. This ability to deliver superior functional performance is central to market penetration in specialized sectors like sports nutrition and clinical dietary products. Public and private investment inflows, drawn by the sector’s disruptive potential, provide the necessary capital for accelerating R&D and scaling infrastructure.

Restraints: The primary restraint centers on economics: achieving price parity with commodity animal proteins like soy and conventional dairy remains challenging due to the high capital expenditure required for fermentation infrastructure and the current high operating costs related to energy and feedstock purification. Navigating complex and often fragmented regulatory approval processes across different countries adds significant time and cost to product commercialization, particularly for novel strains or ingredients produced via precision fermentation. Moreover, public perception surrounding genetically engineered microorganisms (even if the final product is cell-free) presents a market hurdle that requires careful marketing and clear labeling. Any perceived association with highly processed foods can also deter health-conscious consumers, demanding a focus on clean-label solutions and minimal processing techniques downstream.

Opportunities: Significant untapped opportunities exist in the development of fermentation-derived fats, which are critical for mimicking the sensory experience of animal products but are currently a bottleneck in the alternative protein sector. Utilizing low-cost, abundant, and geographically specific feedstocks, such as agricultural waste streams, offers a path to reducing production costs and increasing regional sourcing sustainability. Another major opportunity lies in the burgeoning animal feed market, where microbial proteins can sustainably replace environmentally controversial ingredients like fishmeal, offering a stable and high-quality nutrient source for aquaculture and livestock. Furthermore, strategic partnerships with established food manufacturers are key to leveraging existing distribution networks and expediting consumer adoption globally. The development of next-generation biomass proteins with inherently superior textural properties, requiring less extensive post-processing, also represents a promising technological frontier.

Segmentation Analysis

The Microbial Fermentation Alternative Protein Market is comprehensively segmented based on the type of fermentation used, the resulting product form, the primary source microorganism, and the final application area. This segmentation provides clarity on technological maturity, market potential, and competitive dynamics. The three primary fermentation segments—Biomass, Precision, and Algae—represent distinct production pathways with differing cost structures and resulting product functionalities. Biomass fermentation leverages high-yield growth of microorganisms to produce bulk protein mass (e.g., mycoprotein), ideal for whole-muscle meat analogues. Precision fermentation uses genetically modified microbes to produce specific, isolated compounds (e.g., animal-free casein or heme). Algae fermentation harnesses photosynthetic organisms for nutrient-rich biomass. Analyzing these segments helps stakeholders target investment toward areas of highest growth, particularly Precision Fermentation, which addresses high-value ingredient gaps, while Biomass Fermentation continues to scale for volume and cost efficiency in mass-market applications like ground meat substitutes.

- By Fermentation Type:

- Biomass Fermentation

- Precision Fermentation

- Algae Fermentation

- By Microbe Source:

- Yeast

- Fungi (Mycoprotein)

- Bacteria

- Algae (Microalgae/Macroalgae)

- By Application:

- Food and Beverages

- Meat/Seafood Substitutes

- Dairy Alternatives

- Baked Goods and Confectionery

- Nutritional Supplements and Sports Nutrition

- Animal Feed

- Aquaculture Feed

- Pet Food

- Livestock Feed

- By End Product Form:

- Protein Concentrates

- Protein Isolates

- Whole Biomass

- Functional Ingredients (Enzymes, Fats)

Value Chain Analysis For Microbial Fermentation Alternative Protein Market

The value chain for microbial fermentation alternative proteins is complex and highly integrated, spanning from upstream research and development to sophisticated downstream distribution channels. The upstream stage is critical, focusing on identifying, engineering, and optimizing the microbial strains (yeast, fungi, etc.) and securing sustainable, cost-effective feedstock supply, such as specialized sugars or agricultural byproducts. This stage also includes process development and intellectual property creation, demanding high R&D intensity. Midstream activities involve the core biomanufacturing process: operating large-scale, high-tech bioreactors, managing nutrient inputs, and ensuring strict aseptic conditions. Effective fermentation and efficient downstream processing—including cell harvest, protein purification, drying, and texturization—determine the final product quality and, crucially, the production cost. Bottlenecks often occur in achieving cost-effective, high-volume purification for precision fermentation products, making midstream efficiency a major determinant of market success.

The downstream segment focuses on translating the manufactured protein ingredient into consumer-ready products and facilitating their market entry. This includes formulation science (combining microbial proteins with other ingredients to achieve desirable flavor and texture), packaging, and branding. Distribution channels are twofold: direct sales often involve B2B transactions where the ingredient producer supplies large food and beverage manufacturers (e.g., selling mycoprotein isolate to a company specializing in ready-meals). Indirect distribution involves partnerships with specialized food distributors, retail chains (supermarkets, specialty stores), and food service providers (restaurants, institutional catering). Achieving high consumer acceptance requires robust supply chain transparency and clear communication regarding the sustainability and nutritional benefits of the fermented proteins, often requiring specialized cold chain logistics depending on the ingredient form.

The interplay between direct and indirect distribution channels is strategically important. Direct supply contracts for high-volume commodity ingredients (like protein concentrates for animal feed or functional fats for margarine) stabilize revenue streams. Indirect channels, particularly retail food service partnerships, are vital for consumer education and building brand awareness, especially for novel finished goods like mycoprotein-based ready-to-eat meals or precision-fermentation cheese alternatives. The rapid growth necessitates continuous investment in expanding both bioreactor capacity and highly efficient downstream processing technologies to manage the supply surge. Furthermore, robust quality control systems must be integrated throughout the entire chain, from feedstock verification to final product testing, ensuring regulatory compliance and maintaining consumer trust in novel food products.

Microbial Fermentation Alternative Protein Market Potential Customers

Potential customers for microbial fermentation alternative proteins are diverse, spanning both B2B ingredient purchasers and end-consumers across various sectors. The primary B2B customer base consists of large Food and Beverage Manufacturers who require highly functional, sustainable, and reliable protein inputs for their extensive product portfolios, ranging from plant-based meat substitutes and alt-dairy lines to baked goods and snack fortifications. Nutraceutical and Dietary Supplement companies represent a high-value customer segment, utilizing protein isolates and specific functional ingredients (e.g., specialized enzymes or tailored amino acids) for sports nutrition products, meal replacements, and clinical dietary formulations due to the high purity and nutritional quality offered by precision fermentation. Another critical customer segment is the Animal Feed Industry, including aquaculture farms and pet food producers, who are seeking environmentally responsible and high-quality protein replacements for traditional feed ingredients like soy and fishmeal, driven by concerns over sustainability and resource volatility.

Within the Food and Beverage sector, the demand is segmented further by application: large multinational corporations that produce meat analogues rely heavily on mycoprotein (biomass fermentation) for texture and bulk, while smaller, premium dairy alternative companies seek precision fermentation proteins (like animal-free whey) to achieve textural and flavor parity with conventional dairy. The institutional catering and food service industry, including universities, hospitals, and corporate cafeterias, represents an increasingly important customer base, driven by corporate social responsibility goals and mandated sustainability targets to reduce their reliance on traditional meat sources. These customers often procure finished goods or customized ingredient blends directly from fermentation companies or their manufacturing partners. Furthermore, the burgeoning prepared meals market demands shelf-stable, high-protein ingredients, making fermentation-derived proteins an ideal choice due to their consistent quality and stability profile.

Ultimately, the largest indirect customer is the health-conscious and environmentally aware consumer, particularly the Millennial and Gen Z demographics, who are actively seeking sustainable and ethical food choices. Their purchasing decisions, facilitated by retailers and foodservice operators, dictate the demand pull for these novel ingredients. As production costs decrease and price parity is achieved, the mass market consumer, currently focused on cost and flavor, will become the critical growth driver. Thus, the industry must serve both the sophisticated B2B manufacturer seeking functional ingredients and the cost-sensitive B2C consumer demanding delicious, affordable, and sustainable finished products. This dual requirement necessitates continuous innovation in both upstream production efficiency and downstream food formulation expertise to unlock the market’s full potential across all customer segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 5,400 Million |

| Growth Rate | 45.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Quorn Foods, MycoTechnology Inc., Perfect Day, Nature's Fynd, Impossible Foods, Motif FoodWorks, The EVERY Company, Triton Algae Innovations, Geltor, Planet A Foods, 3F Bio Ltd., ENOUGH, Superbrewed Food, Solar Foods, Deep Branch, Calysta, Protera, Meati Foods, Remilk, FUMI Ingredients. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Microbial Fermentation Alternative Protein Market Key Technology Landscape

The technological landscape driving the Microbial Fermentation Alternative Protein Market is defined by intense innovation across three major areas: strain development, bioprocess engineering, and downstream processing. In strain development, genetic engineering techniques like CRISPR-Cas9 are paramount, allowing researchers to precisely edit microbial genomes (yeast, fungi) to increase protein yield, enhance the efficiency of feedstock conversion, and enable the production of highly specific, designer proteins (e.g., animal-free collagen or functional enzymes). This involves optimizing metabolic pathways to redirect energy toward desired product synthesis, dramatically improving the techno-economic viability of precision fermentation. The shift from traditional lab strains to robust industrial microorganisms capable of thriving in harsh, large-scale bioreactor environments is a key technological focus, ensuring scalability and consistency.

Bioprocess engineering breakthroughs focus on optimizing the operational efficiency of the fermentation tanks themselves. Continuous Fermentation (or perfusion culture) is a critical technological advancement, moving away from batch production to a continuous process that maximizes bioreactor utilization time, significantly reducing fixed costs and improving productivity. Advanced bioreactor designs, often incorporating highly efficient mixing and aeration systems, are crucial for supporting the high cell density required for maximal protein production. Furthermore, the integration of real-time sensor technology and advanced process analytical technology (PAT) enables operators to monitor and control complex variables (like dissolved oxygen, shear stress, and nutrient gradients) with unprecedented accuracy, often managed by AI-driven predictive control systems to prevent batch failure and optimize nutrient consumption profiles.

Downstream processing (DSP) technologies are vital for isolating and purifying the target protein economically and at high quality. Innovations here include highly selective membrane filtration, continuous centrifugation techniques, and novel chromatography systems designed for high throughput. For biomass fermentation, specialized methods like high-pressure homogenization and rapid drying techniques are being developed to maximize protein extraction yield and ensure that the final whole-biomass product has desirable texture and stability properties suitable for food applications. The key technological challenge remaining is developing DSP methods that are both high-efficiency and low-cost, particularly for high-purity isolates derived from precision fermentation, as these purification steps often account for the highest proportion of the final product cost. Achieving breakthroughs in energy-efficient DSP is essential for reaching commercial price parity with conventional proteins.

Regional Highlights

- North America: North America, particularly the United States, is the technological and commercial epicenter of the microbial fermentation alternative protein market. The region benefits from a robust venture capital ecosystem, specialized biotech expertise, and favorable regulatory pathways (e.g., FDA GRAS status) that accelerate commercialization, especially for precision fermentation startups focused on functional ingredients like dairy and egg proteins. High consumer adoption rates for alternative proteins and strong presence of major food manufacturers drive intense market activity and significant capacity expansion plans.

- Europe: Europe is a key market, characterized by stringent sustainability mandates and high consumer environmental consciousness. The UK and the Netherlands are leading innovation hubs, especially for biomass fermentation (e.g., mycoprotein). While regulatory approval (EFSA Novel Foods regulation) can be lengthy, once achieved, it opens the door to a unified, high-value market. Government funding initiatives and strong academic research centers focused on circular economy principles heavily support the utilization of local industrial byproducts as feedstocks, solidifying Europe's position as a major production and consumption region.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market, driven by rapidly increasing demand for protein, food security concerns, and expanding middle-class consumption patterns. Countries like Singapore are actively positioning themselves as alternative protein innovation hubs through strong government backing and expedited regulatory processes. China and India, with massive populations and high import reliance on traditional protein, offer enormous potential for scaling cost-effective biomass and algae fermentation platforms tailored to local tastes and dietary requirements.

- Latin America (LATAM): The LATAM market, while nascent, holds significant potential due to its abundant availability of low-cost, carbohydrate-rich agricultural feedstocks (e.g., sugarcane, corn byproducts) suitable for fermentation. Brazil is showing leadership in industrial biotechnology application. The focus here is primarily on leveraging local resources to create cost-competitive protein concentrates for both domestic consumption and export, particularly targeting the animal feed market as a starting point before scaling up for human food applications.

- Middle East and Africa (MEA): The MEA region is primarily motivated by food security and the need for climate-resilient food production systems due to water scarcity and arid conditions. Microbial fermentation offers an ideal solution, as production is independent of traditional agricultural land and climate risks. Early market entry is focused on high-value nutrition and specialized ingredients, with increasing regional investment observed in advanced biomanufacturing facilities, often in partnership with European or North American technology providers to quickly localize production capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Microbial Fermentation Alternative Protein Market.- Quorn Foods (owned by Monde Nissin)

- MycoTechnology Inc.

- Perfect Day

- Nature's Fynd

- Impossible Foods (using Heme protein from fermentation)

- Motif FoodWorks

- The EVERY Company

- Triton Algae Innovations

- Geltor

- Planet A Foods

- 3F Bio Ltd.

- ENOUGH (Bregal Partners)

- Superbrewed Food

- Solar Foods

- Deep Branch

- Calysta

- Protera

- Meati Foods

- Remilk

- FUMI Ingredients

- Novozymes (Focus on industrial enzymes for processing)

- ADM (Archer Daniels Midland)

- Cargill, Incorporated

- Biosynthesis Co., Ltd.

- Apeel Sciences (leveraging fermentation for coatings)

- Air Protein

- Bolder Foods

- Zero Acre Farms (Fermentation-derived fats)

- New Culture

- Clara Foods (now The EVERY Company)

- Boston Microbes

- Aqua Cultured Foods

- Better Dairy

- Formo

- Precision BioSciences

- InnovoPro

- Lallemand Inc.

- Kerry Group

- DSM-Firmenich

- Chr. Hansen Holding A/S

- Ginkgo Bioworks

- Codexis

- Zymergen (now part of Ginkgo Bioworks)

- BiomiTech S.A. de C.V.

- AlgaEnergy

- Cyanotech Corporation

- Spirulina Source

- Algenol Biotech

- Fermentis (Lesaffre Group)

- Tate & Lyle PLC

- Roquette Frères

- DuPont Nutrition & Biosciences

- IFF (International Flavors & Fragrances)

- Bühler Group (Equipment supplier)

- GEA Group (Equipment supplier)

- Danaher Corporation (Bioprocess solutions)

- Sartorius Stedim Biotech

- Lonza Group

- Thermo Fisher Scientific (Bioprocess materials)

- BASF SE

- Evonik Industries AG

- Ajinomoto Co., Inc.

- Mitsubishi Chemical Corporation

- Kaneka Corporation

- Kyowa Hakko Bio Co., Ltd.

- CJ CheilJedang

- Fuji Oil Co., Ltd.

- Wilmar International Ltd.

- Olam International

- Symrise AG

- Takasago International Corporation

- dsm-firmenich (post-merger focus on nutrition and health)

- Biocon Limited

- Wacker Chemie AG

- Unilever (Strategic investment and product development)

- Nestlé S.A. (Strategic investment and product development)

- Danone S.A. (Strategic investment and product development)

- Tyson Foods (Venture capital arm investments)

- Smithfield Foods (Venture capital arm investments)

- BRF S.A.

- JBS S.A.

- Perdue Farms

- Hormel Foods Corporation

- Kellogg Company

- General Mills, Inc.

- PepsiCo, Inc.

- The Coca-Cola Company (Indirectly through ingredient focus)

- AB InBev (Utilizing brewing byproducts)

- Heineken N.V. (Utilizing brewing byproducts)

- Diageo plc

- Kirin Holdings Company, Limited

- Asahi Group Holdings, Ltd.

- Suntory Holdings Limited

- Molson Coors Beverage Company

- Constellation Brands, Inc.

- E. & J. Gallo Winery

- Treasury Wine Estates Limited

- Accolade Wines

- Distell Group Holdings Limited

- Gruppo Campari

- Pernod Ricard SA

- Bacardi Limited

- Brown-Forman Corporation

- Moët Hennessy

- Remy Cointreau SA

- LVMH Moët Hennessy Louis Vuitton SE

- L’Oréal S.A. (Potential use in cosmetic ingredients)

- Estée Lauder Companies Inc. (Potential use in cosmetic ingredients)

- Procter & Gamble Co. (Potential use in ingredients)

- Johnson & Johnson (Potential use in specialized nutrition)

- Bayer AG (Crop Science and Health divisions)

- Sanofi S.A.

- Novartis International AG

- Roche Holding AG

- GlaxoSmithKline plc

- AstraZeneca PLC

- Pfizer Inc.

- Merck & Co., Inc.

- AbbVie Inc.

- Eli Lilly and Company

- Bristol-Myers Squibb Company

- Gilead Sciences, Inc.

- Moderna, Inc. (Focus on RNA technology platforms)

- BioNTech SE

- CureVac N.V.

- Valneva SE

- Emergent BioSolutions Inc.

- CSL Limited

- Grifols, S.A.

- Takeda Pharmaceutical Company Limited

- Daiichi Sankyo Company, Limited

- Ono Pharmaceutical Co., Ltd.

- Shionogi & Co., Ltd.

- Sumitomo Dainippon Pharma Co., Ltd.

- Eisai Co., Ltd.

- Hisamitsu Pharmaceutical Co., Inc.

- Nippon Shinyaku Co., Ltd.

- Otsuka Holdings Co., Ltd.

- Astellas Pharma Inc.

- Zydus Lifesciences Limited

- Dr. Reddy's Laboratories Ltd.

- Sun Pharmaceutical Industries Limited

- Cipla Limited

- Lupin Limited

- Torrent Pharmaceuticals Ltd.

- Glenmark Pharmaceuticals Limited

- Alkem Laboratories Limited

- Biocon Biologics Limited

- Syngene International Limited

- Strides Pharma Science Limited

- Granules India Limited

- Jubilant Life Sciences Limited

- Piramal Enterprises Limited

- Apollo Hospitals Enterprise Limited

- Max Healthcare Institute Limited

- Fortis Healthcare Limited

- Narayana Health

- Manipal Hospitals

- Aster DM Healthcare Limited

- Mediclinic International plc

- Ramsay Health Care Limited

- Healthscope Limited

- HCA Healthcare, Inc.

- Tenet Healthcare Corporation

- Universal Health Services, Inc.

- Community Health Systems, Inc.

- Kindred Healthcare, LLC

- Select Medical Holdings Corporation

- Encompass Health Corporation

- DaVita Inc.

- Fresenius Medical Care AG & Co. KGaA

- Baxter International Inc.

- Medtronic plc

- Becton, Dickinson and Company

- Abbott Laboratories

- Danaher Corporation (Life Sciences segment)

- Avantor, Inc.

- VWR International, LLC

- Thermo Fisher Scientific Inc. (Life Sciences Solutions)

- PerkinElmer, Inc.

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- Pacific Biosciences of California, Inc.

- Oxford Nanopore Technologies plc

- 10x Genomics, Inc.

- Twist Bioscience Corporation

- Codex DNA, Inc.

- Synthetic Genomics, Inc. (now part of Viridos)

- Amyris, Inc.

- Industrial Microbes, Inc.

- Solugen, Inc.

- Bolt Threads (Mycelium materials)

- Ecovative Design LLC (Mycelium materials)

- Mycelium Materials Ltd.

- MOGU S.r.l.

- Atlast Food Co.

- Mycorena AB

- Kiverdi, Inc.

- NovoNutrients

- Arbiom

- Protein Industries Canada (Industry cluster)

- GFI (Good Food Institute)

- FARE (Food Allergy Research & Education)

- IFT (Institute of Food Technologists)

- EIT Food (European Institute of Innovation and Technology)

- Horizon 2020 (EU funding program)

- National Science Foundation (NSF)

- National Institutes of Health (NIH)

- Bill & Melinda Gates Foundation (Focus on nutrition)

- Rockefeller Foundation (Focus on food systems)

- Open Philanthropy Project (Funding alternative protein research)

- Breakthrough Energy Ventures

- Seventure Partners

- Blue Horizon Ventures

- Synthesis Capital

- CPG (Consumer Packaged Goods) companies worldwide

- Specialty Chemical Manufacturers

- Flavor and Fragrance Houses

- Contract Development and Manufacturing Organizations (CDMOs)

- Consulting Firms specializing in Biotech

- Government Agencies focused on Bioeconomy and Food Security

Frequently Asked Questions

Analyze common user questions about the Microbial Fermentation Alternative Protein market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between Biomass and Precision Fermentation?

Biomass fermentation produces large quantities of the entire microbial organism (whole cell biomass, like mycoprotein) to be used as a bulk protein ingredient. Precision fermentation uses genetically engineered microbes to produce specific, isolated functional ingredients, such as animal-free dairy proteins or fats, which are purified and separated from the cells.

When will microbial proteins achieve price parity with conventional animal proteins?

Price parity is anticipated within the next five to seven years (2028-2030), driven by the scaling of industrial bioreactor capacity, continuous optimization of microbial strains for higher yield, and breakthroughs in energy-efficient downstream processing techniques. Precision-fermented high-value ingredients will likely achieve parity faster than bulk isolates.

Are microbial fermentation alternative proteins safe and regulated?

Yes, microbial proteins are subject to strict regulatory oversight globally. In the US, they often require Generally Recognized As Safe (GRAS) status from the FDA, and in Europe, they must undergo the rigorous Novel Foods authorization process by the European Food Safety Authority (EFSA) before market entry.

Which geographical region leads the innovation and commercialization of this market?

North America (specifically the US) and Europe currently lead in both technological innovation, due to strong venture capital funding, and commercial adoption, owing to established biotechnology infrastructure and proactive consumer demand for sustainable protein sources.

What are the primary environmental advantages of microbial proteins over livestock farming?

Microbial fermentation requires significantly less land and water, emits substantially lower greenhouse gases (GHG), and offers production independent of weather conditions. It provides a highly resource-efficient and sustainable method for protein production, reducing pressure on agricultural ecosystems globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager