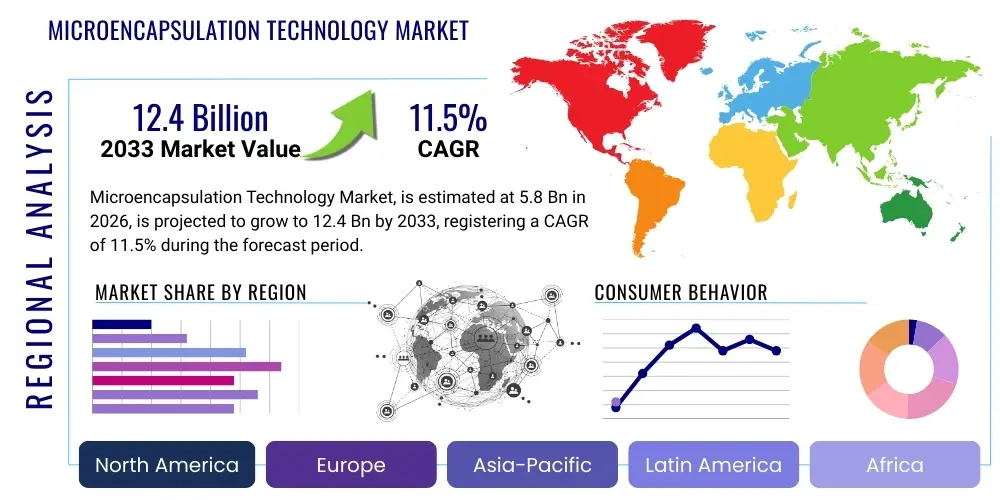

Microencapsulation Technology Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441851 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Microencapsulation Technology Market Size

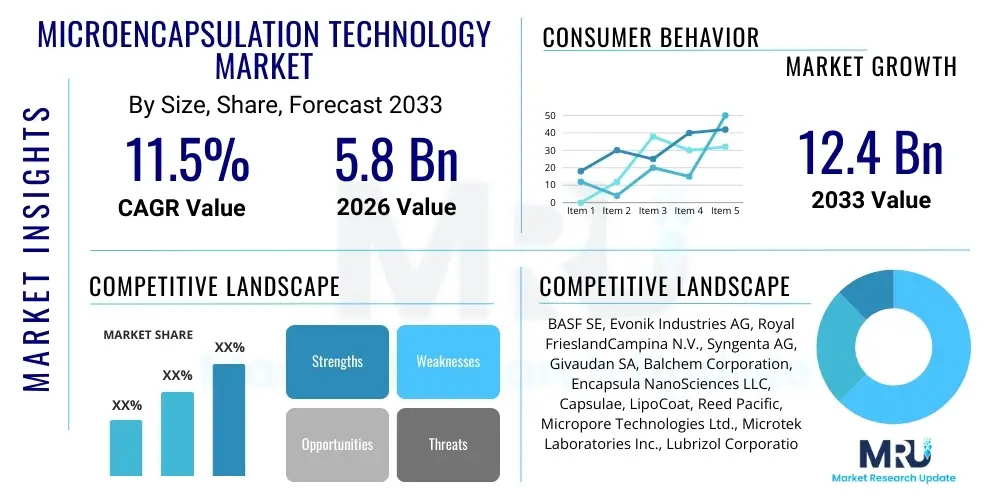

The Microencapsulation Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 12.4 Billion by the end of the forecast period in 2033.

Microencapsulation Technology Market introduction

Microencapsulation technology involves the precise containment of active substances within a tiny shell or matrix, forming microparticles ranging from a few microns to several hundred microns in diameter. This sophisticated process serves several critical industrial purposes, primarily protecting the core material from environmental degradation, controlling its release rate, masking undesirable properties (like taste or odor), and enhancing material handling safety. The core materials encapsulated are highly diverse, spanning pharmaceuticals (Active Pharmaceutical Ingredients or APIs), food ingredients (flavors, aromas, probiotics), and agricultural chemicals (pesticides, fertilizers).

Major applications of microencapsulation technology are concentrated in high-value industries. In the pharmaceutical sector, it is foundational for drug delivery systems, enabling sustained or targeted release profiles that improve therapeutic efficacy and patient compliance. The Food & Beverage industry utilizes microencapsulation extensively to preserve sensitive nutrients, extend the shelf life of ingredients, and deliver complex flavor profiles during processing or consumption. Furthermore, the technology is crucial in cosmetics for delivering sensitive vitamins and anti-aging compounds, ensuring their stability until they reach the intended skin layer.

The primary benefits driving market expansion include enhanced bioavailability, prolonged stability of reactive ingredients, and the optimization of material handling by converting liquids or unstable solids into fine, free-flowing powders. Key driving factors encompass the burgeoning demand for functional foods rich in encapsulated probiotics and omega-3 fatty acids, the accelerating adoption of advanced drug delivery systems in chronic disease management, and the increasing focus on sustainable and efficient agrochemical formulations that minimize environmental impact through controlled release.

Microencapsulation Technology Market Executive Summary

The global Microencapsulation Technology Market is characterized by robust technological innovation, driven predominantly by advancements in coacervation techniques, spray drying, and specialized emulsification methods. Current business trends indicate a strong focus on strategic mergers and acquisitions among large chemical and pharmaceutical entities to consolidate expertise and intellectual property related to novel shell materials, particularly biodegradable and biocompatible polymers. A key business imperative across all end-use sectors is the development of scalable, cost-effective encapsulation techniques that maintain high efficiency and narrow particle size distribution, catering to the stringent quality requirements of regulated industries like pharmaceuticals and infant nutrition.

Regionally, North America and Europe currently dominate the market due to established regulatory frameworks favoring innovative drug delivery and high consumer awareness regarding functional ingredients. However, the Asia Pacific region is poised for the most rapid expansion, fueled by increasing investment in the healthcare and processed food sectors in countries such as China, India, and Japan. This regional shift is underpinned by rising disposable incomes, urbanization, and a growing domestic manufacturing base focused on both specialty chemicals and generic pharmaceuticals, making it a critical hub for future market growth.

Segment trends reveal that the pharmaceutical application segment maintains the largest market share, driven by the indispensable nature of controlled release formulations in modern medicine. Within technology segments, spray drying remains the most widely adopted and cost-effective method for high-volume production, although solvent evaporation and various forms of complex coacervation are gaining traction due to their superior ability to encapsulate volatile or sensitive core materials. The encapsulating material segment is seeing a significant shift towards natural polymers (like alginate and gelatin) and lipids, favored for their biocompatibility and improved sustainability profiles, especially in food and cosmetic applications.

AI Impact Analysis on Microencapsulation Technology Market

Users frequently inquire about how Artificial Intelligence (AI) can streamline the formulation process, predict the stability and release kinetics of microcapsules, and optimize manufacturing parameters for scale-up. Common questions center on AI's capability to screen large libraries of shell and core material combinations to identify optimal pairings for specific delivery requirements. There is a strong expectation that machine learning (ML) algorithms will significantly reduce the time and cost associated with experimental trial-and-error in R&D, leading to faster development cycles for novel drug delivery systems and functional food ingredients. Furthermore, users are keen to understand AI's role in predictive maintenance and quality control within high-throughput microencapsulation facilities, ensuring consistent particle size distribution and encapsulation efficiency, thereby enhancing product reliability and reducing batch failures.

- AI-driven optimization of material selection (shell polymers, core actives) based on predictive models of physicochemical interactions.

- Machine learning algorithms used for predicting the controlled release profile (zero-order, first-order kinetics) under varying environmental conditions.

- Real-time monitoring and predictive maintenance in encapsulation equipment (e.g., spray dryers, fluidized beds) to optimize yield and energy consumption.

- Automated image analysis and computer vision systems for high-throughput quality control of microparticle size and morphology.

- Enhanced simulation capabilities using AI to model complex multiphase systems involved in emulsification and coacervation processes, reducing experimental burdens.

- Accelerated discovery of novel delivery matrices, focusing on biodegradable and stimuli-responsive materials using combinatorial chemistry aided by AI.

- Optimization of complex process parameters (temperature, flow rate, pH) to maximize encapsulation efficiency and minimize material waste in continuous manufacturing.

DRO & Impact Forces Of Microencapsulation Technology Market

The Microencapsulation Technology Market is significantly propelled by the critical need across industries for enhanced material protection and controlled release functionalities. The paramount driver remains the pharmaceutical sector’s reliance on encapsulation for advanced drug delivery, improving therapeutic index, and extending patent life for established drugs. Concurrently, strict regulations mandating the reduction of solvent use and the push for environmentally sustainable delivery systems in agriculture and textiles further accelerate the adoption of encapsulation techniques. Restraints predominantly involve the high capital investment required for scaling up specialized encapsulation technologies, particularly complex coacervation and liposomal encapsulation, which can be prohibitively expensive for smaller manufacturers. Furthermore, regulatory hurdles related to novel excipients and the standardization of encapsulated ingredient testing present significant barriers to rapid market entry.

Opportunities for growth are abundant in emerging applications such as self-healing materials, smart textiles, and personalized medicine, where microcapsules can respond to specific stimuli (pH, temperature, mechanical stress) to release repairing agents or active therapeutic compounds. The shift towards natural, clean-label ingredients in the Food & Beverage industry also presents a massive opportunity for encapsulating sensitive flavors and oils using natural polymers and lipids. The impact forces are strong and predominantly positive, characterized by the irreplaceable role encapsulation plays in extending product stability and enabling functionalities that conventional mixing or blending techniques cannot achieve. The persistent requirement for better efficacy and reduced side effects in drug delivery ensures a sustained demand curve, making the technology deeply entrenched in future product innovation strategies across multiple vertical markets.

Segmentation Analysis

The Microencapsulation Technology Market is meticulously segmented based on the composition of the shell material, the nature of the core material being protected, the specific technology utilized for the process, and the ultimate end-use application. This multidimensional segmentation allows for precise market sizing and strategic targeting. Shell material segmentation highlights the dominant role of polymers, while core material distinction underscores the commercial importance of flavors, fragrances, and therapeutic agents (APIs). Technology segmentation clarifies the maturity and scalability of methods, ranging from mature spray drying to emerging specialized techniques like supercritical fluid technology. Application analysis demonstrates the market's high dependency on pharmaceutical and functional food demands, which necessitate specialized, highly regulated encapsulation processes.

- By Technology:

- Spray Drying

- Spray Congealing/Chilling

- Emulsion Polymerization

- Coacervation (Simple & Complex)

- Solvent Evaporation

- Extrusion

- Fluid Bed Coating

- Liposome Encapsulation

- Supercritical Fluid Technology

- By Core Material:

- Pharmaceutical & Health Care Products (APIs, Vitamins, Probiotics)

- Food & Beverage Ingredients (Flavors, Functional Oils, Acidulants)

- Phase Change Materials (PCMs)

- Agrochemicals (Pesticides, Fertilizers)

- Cosmetics & Personal Care Products (Fragrances, Essential Oils)

- Other Industrial Chemicals (Dyes, Adhesives)

- By Shell Material:

- Polymers (Natural & Synthetic)

- Gums & Resins (Gum Arabic, Carrageenan)

- Lipids (Waxes, Fatty Acids)

- Proteins (Gelatin, Casein)

- Others (Inorganic materials, Polysaccharides)

- By Application:

- Pharmaceuticals & Healthcare

- Food & Beverages

- Agrochemicals

- Cosmetics & Personal Care

- Textiles

- Construction Materials

- Paints & Coatings

Value Chain Analysis For Microencapsulation Technology Market

The value chain for microencapsulation technology begins with the upstream segment, which involves the sourcing and preparation of highly specialized raw materials. This includes high-purity core materials—such as pharmaceutical APIs, specialized flavors, or high-potency agrochemicals—and the sourcing of excipients and shell materials, predominantly specialized polymers (like PLGA, ethyl cellulose), food-grade proteins (gelatin, albumin), and sophisticated lipids. Quality control and material standardization are critical upstream challenges, as the success of the encapsulation process is highly dependent on the precise physicochemical properties of these starting components. Suppliers of high-grade polymers and specialized chemicals hold significant leverage within this phase.

The midstream phase constitutes the core manufacturing activities: the actual encapsulation processes utilizing technologies such as spray drying, coacervation, or liposomal preparation. This stage is highly technology-intensive and requires substantial capital investment in proprietary equipment and specialized expertise in process engineering to achieve desired particle size distribution, encapsulation efficiency, and controlled release kinetics. Research and development activities, often involving partnerships between technology developers and application specialists (e.g., pharmaceutical companies), are crucial drivers of value creation in this segment. Manufacturing costs are dominated by energy consumption and the costs of proprietary excipients.

The downstream segment involves the incorporation of the encapsulated products into final consumer or industrial goods, distribution through specialized channels, and eventual end-user purchase. Distribution channels are highly varied; direct channels are common for high-value B2B pharmaceutical ingredients, requiring secure and temperature-controlled logistics. Indirect channels, involving specialty chemical distributors, are utilized for bulk food and cosmetic ingredients. The final value realization occurs when the encapsulated material delivers its intended functional benefit (e.g., enhanced drug efficacy, extended flavor shelf life) to the ultimate end-user, thereby justifying the premium associated with the microencapsulated format.

Microencapsulation Technology Market Potential Customers

The potential customer base for microencapsulation technology is extremely diverse, driven by the technology's ability to solve critical formulation and stability challenges across highly regulated and consumer-focused industries. Pharmaceutical manufacturers represent the largest segment of potential customers, relying on encapsulation for oral solids, injectable depots, and specialized topical formulations that require precise temporal or spatial drug release. These customers seek solutions that improve patient compliance, mitigate side effects, and enable the commercialization of inherently unstable therapeutic compounds. Drug developers are increasingly demanding innovative, scalable encapsulation techniques that are compliant with stringent Good Manufacturing Practices (GMP) and global regulatory standards.

Another major segment includes food and beverage processors, specifically those involved in functional foods, dietary supplements, and specialized flavor production. These buyers require microcapsules to protect sensitive nutrients (like vitamins, omega-3 oils, probiotics) from oxidation, mask bitter tastes, and ensure flavors are released only upon consumption or specific processing steps (e.g., baking). For this group, clean-label requirements and cost-efficiency are paramount factors influencing purchasing decisions, often favoring scalable technologies like spray drying using natural carriers such as modified starch or gum arabic.

Furthermore, agrochemical companies constitute a rapidly growing customer base, utilizing microencapsulation to create safer, more efficient pesticide and fertilizer formulations. These customers prioritize controlled-release mechanisms that reduce the frequency of application, minimize environmental runoff, and decrease the toxicity exposure risk for applicators. Beyond these major segments, key buyers also include cosmetic manufacturers seeking enhanced delivery of anti-aging ingredients, textile producers developing smart fabrics with encapsulated fragrances or phase change materials, and specialized chemical producers requiring precise handling of reactive industrial agents.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 12.4 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Evonik Industries AG, Royal FrieslandCampina N.V., Syngenta AG, Givaudan SA, Balchem Corporation, Encapsula NanoSciences LLC, Capsulae, LipoCoat, Reed Pacific, Micropore Technologies Ltd., Microtek Laboratories Inc., Lubrizol Corporation, AVEKA Group, Kemin Industries Inc., International Flavors & Fragrances (IFF). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Microencapsulation Technology Market Key Technology Landscape

The technological landscape of microencapsulation is characterized by a portfolio of mature, high-volume methods coexisting with highly specialized, precision techniques designed for sensitive or complex core materials. Spray drying remains the industrial workhorse due to its inherent scalability, low operational cost, and applicability across food, flavor, and some pharmaceutical powders. It involves atomizing an emulsion or dispersion containing the core and shell materials into a drying chamber where the solvent (usually water) rapidly evaporates, forming solid microparticles. However, spray drying is limited by the heat sensitivity of some core materials, prompting the development of low-temperature alternatives like spray congealing/chilling for encapsulating heat-labile lipids and waxes.

For applications requiring highly precise particle size, narrow distribution, and superior barrier properties—crucial in advanced drug delivery—chemical methods such as complex coacervation and solvent evaporation are utilized. Complex coacervation relies on the phase separation of polymer mixtures in an aqueous environment to form a liquid polymer layer around the core, offering excellent control over shell thickness and composition, particularly important for essential oils and sensitive APIs. Solvent evaporation, conversely, is preferred for lipid-soluble actives using synthetic biodegradable polymers like Poly(lactic-co-glycolic acid) (PLGA), often forming microspheres that facilitate sustained release over weeks or months following injection.

Emerging and specialized technologies include liposome encapsulation and membrane emulsification. Liposomes, microscopic lipid vesicles, are highly versatile for encapsulating hydrophilic and hydrophobic drugs and are crucial in targeted delivery and vaccine technology. Membrane emulsification, though nascent, offers significant advantages in producing highly monodisperse (uniform size) microcapsules, which is essential for certain diagnostic and high-precision pharmaceutical applications. The future technological trajectory is focused on continuous manufacturing processes and greener, solvent-free techniques, enhancing both efficiency and environmental safety across the industry.

Regional Highlights

- North America: This region maintains a leading position, driven by the massive pharmaceutical industry in the United States and Canada, which invests heavily in controlled release drug formulations. The stringent regulatory environment necessitates high-quality, reproducible encapsulation processes, favoring advanced technologies like liposomal and polymeric microsphere development. Growth is also bolstered by robust demand for functional foods and dietary supplements, particularly those containing encapsulated probiotics and vitamins.

- Europe: Characterized by a strong presence in specialized chemicals, cosmetics, and advanced food technology (especially in Germany, France, and the UK). European regulations, particularly REACH standards, promote the adoption of microencapsulation in agrochemicals to minimize environmental exposure. The market is highly mature, focusing on innovation in natural and sustainable shell materials, such as bio-based polymers, aligning with EU sustainability mandates.

- Asia Pacific (APAC): Expected to register the highest growth rate during the forecast period. This acceleration is attributed to rapidly expanding healthcare expenditure, increasing incidence of chronic diseases demanding better drug delivery, and the swift modernization of the food processing industry, particularly in China and India. Government initiatives supporting domestic manufacturing of specialty chemicals and active ingredients further propel the adoption of scalable encapsulation technologies, such as spray drying and fluid bed coating.

- Latin America (LATAM): Growth in this region is primarily driven by the agricultural sector, where microencapsulation is increasingly used to improve the efficiency and extend the efficacy of fertilizers and pesticides, helping to boost crop yields. The developing pharmaceutical market, especially in Brazil and Mexico, contributes moderately, focusing largely on generic drug formulations requiring stability enhancement.

- Middle East and Africa (MEA): This region is an emerging market with potential growth centered on investment in infrastructure, construction (using encapsulated PCMs for thermal regulation), and burgeoning personal care industries. Adoption is currently slower than in other regions, constrained by limited local manufacturing capabilities and reliance on imported encapsulated ingredients, though demand for high-end cosmetic and food products is rising in GCC countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Microencapsulation Technology Market.- BASF SE

- Evonik Industries AG

- Royal FrieslandCampina N.V.

- Syngenta AG

- Givaudan SA

- Balchem Corporation

- Encapsula NanoSciences LLC

- Capsulae

- LipoCoat

- Reed Pacific

- Micropore Technologies Ltd.

- Microtek Laboratories Inc.

- Lubrizol Corporation

- AVEKA Group

- Kemin Industries Inc.

- International Flavors & Fragrances (IFF)

- Symrise AG

- Firmenich International SA

- Cargill, Incorporated

- Ashland Global Holdings Inc.

Frequently Asked Questions

Analyze common user questions about the Microencapsulation Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of utilizing microencapsulation technology in product formulation?

Microencapsulation provides three core benefits: protection of sensitive core materials (like flavors, vitamins, or APIs) from degradation by heat, light, or oxygen; controlled or sustained release of the active ingredient over a defined period or in response to a specific trigger; and improved handling, converting liquids or unstable solids into easy-to-manage, free-flowing powders.

Which microencapsulation technology dominates the market and why is it preferred?

Spray drying is currently the most dominant technology, particularly in the Food & Beverage and bulk chemical segments. It is preferred due to its high efficiency, low operating cost, exceptional scalability for large-volume production, and its ability to utilize a wide range of cost-effective, food-grade shell materials like maltodextrin and starches.

How is microencapsulation technology contributing to the shift towards sustainable agriculture?

In agriculture, microencapsulation enables the creation of controlled-release fertilizers and pesticides. This approach reduces the required application frequency, minimizes active ingredient runoff into water systems, decreases applicator exposure, and enhances the overall efficacy of inputs by ensuring the active agent is released precisely when and where the plant needs it, thereby promoting sustainability.

What are the key regulatory challenges impacting the introduction of new microencapsulated products?

Key challenges involve the regulatory approval of novel shell materials and excipients, especially for pharmaceutical and food applications. Regulators require extensive toxicological data and detailed evidence demonstrating the stability, batch-to-batch consistency, and defined release profile of the encapsulated product, leading to lengthy and costly approval processes.

Which application segment is expected to drive the highest revenue growth in the next decade?

The Pharmaceutical and Healthcare segment is anticipated to drive the highest revenue growth, sustained by the crucial role microencapsulation plays in developing novel drug delivery systems, particularly for oncology, chronic disease management, and specialized vaccines. The high value and therapeutic necessity of these products ensure premium pricing and consistent demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager