Microfluidic Syringe Pumps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441523 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Microfluidic Syringe Pumps Market Size

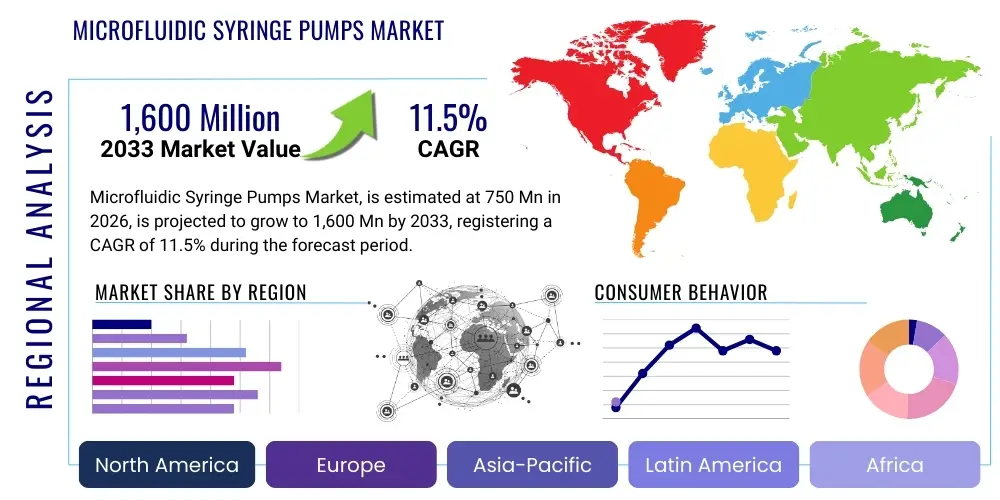

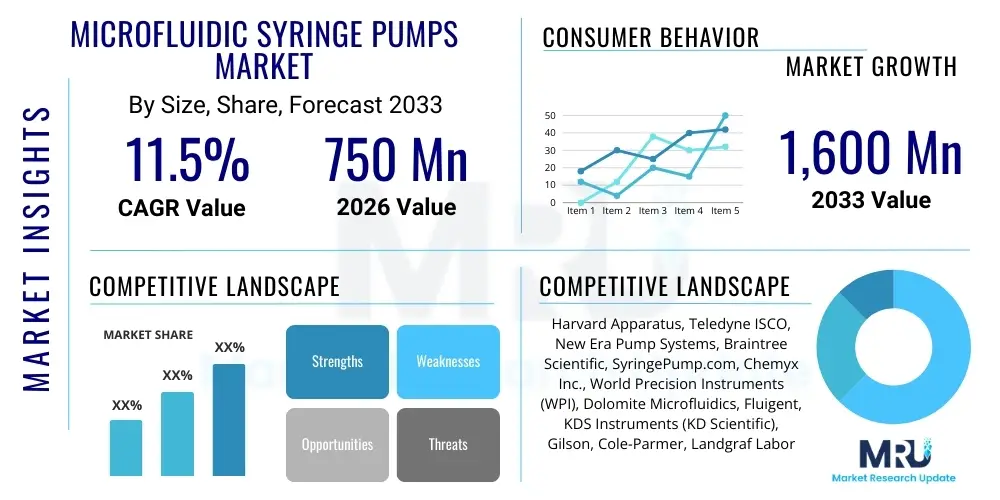

The Microfluidic Syringe Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1,600 Million by the end of the forecast period in 2033.

Microfluidic Syringe Pumps Market introduction

The Microfluidic Syringe Pumps Market encompasses precision fluidic control systems designed specifically for handling minute volumes of liquids, typically in the picoliter to microliter range, crucial for microfluidic chips and lab-on-a-chip applications. These pumps offer unparalleled accuracy, repeatability, and low pulsation flow, essential features for sensitive experimental setups such as drug discovery, single-cell analysis, and complex chemical synthesis. Unlike traditional large-scale pumps, microfluidic syringe pumps utilize stepper motors and highly refined mechanics to achieve smooth, controlled movement over extended periods, minimizing shear stress on delicate biological samples and ensuring high fidelity in complex assay procedures.

Major applications of microfluidic syringe pumps span across biomedical research, diagnostics, and advanced manufacturing. In the biomedical sector, they are indispensable for creating stable concentration gradients, perfusing cell cultures in bioreactors, and accurately dispensing reagents onto microarray platforms. The increasing complexity of microphysiological systems (Organ-on-a-Chip) drives demand, as these platforms require precise, long-term flow control that traditional pump technologies cannot sustain. Furthermore, the miniaturization trend in analytical chemistry, focusing on portable and automated instruments, significantly boosts the adoption of compact, highly reliable microfluidic pump solutions.

The primary benefits derived from using microfluidic syringe pumps include reduced reagent consumption, enhanced speed of analysis, and improved experimental reproducibility due to highly stable flow rates. Driving factors for market expansion include the rapid proliferation of personalized medicine initiatives, which rely on high-throughput screening and detailed cellular analysis, and substantial government and private investment into microfluidics research infrastructure globally. The capability of these pumps to integrate seamlessly into automated laboratory workflows further positions them as foundational technology for the future of chemical and biological experimentation.

Microfluidic Syringe Pumps Market Executive Summary

The Microfluidic Syringe Pumps Market is undergoing robust expansion, characterized by significant technological advancements focusing on enhanced automation, miniaturization, and improved pressure capabilities. Business trends highlight a strong shift toward system integration, where pump manufacturers collaborate with microfluidic chip developers to offer complete turnkey solutions for end-users, primarily academic research institutions and pharmaceutical companies. Key commercial activities involve strategic acquisitions aimed at consolidating specialized fluid handling technologies and heavy investment in R&D to develop pumps compatible with ultra-high viscosity fluids and challenging chemical media. The move towards wireless control and remote monitoring capabilities is also emerging as a pivotal business differentiator, enhancing usability in constrained or high-containment laboratory environments.

Regional trends indicate North America currently holds the largest market share, driven by extensive biomedical research funding, the presence of major biopharmaceutical companies, and rapid technological adoption in California's biotech clusters and the Boston-Cambridge innovation corridor. However, the Asia Pacific region (APAC) is projected to exhibit the highest growth rate (CAGR), fueled by expanding medical device manufacturing in China, increasing government focus on advanced diagnostics in India, and the rising establishment of precision medicine research centers across South Korea and Japan. Europe maintains a steady market presence, supported by strong academic research infrastructure and strict regulatory frameworks that necessitate precise, documented fluid handling methods in quality control processes.

Segment trends reveal that the academic and research laboratories segment remains the largest consumer base, due to the foundational need for highly accurate experimental fluid control. By product type, the single-channel syringe pumps dominate the market volume, offering cost-effective precision for routine applications, though multi-channel and high-pressure pumps are experiencing faster revenue growth as complex, parallel processing applications like advanced cell culture and combinatorial chemistry gain traction. Furthermore, the segment focusing on high-pressure capabilities, essential for handling flow resistance in densely integrated microfluidic systems, is witnessing substantial investment and technological refinement to meet the demands of advanced industrial and bioengineering applications.

AI Impact Analysis on Microfluidic Syringe Pumps Market

Users frequently inquire about how Artificial Intelligence (AI) can optimize the operational performance and data utilization derived from microfluidic syringe pump systems, particularly concerning automated calibration, predictive maintenance, and closed-loop feedback control. Key concerns revolve around integrating disparate data streams from the pumps (flow rate, pressure, volume dispensed) with sensor data from the microfluidic chip (temperature, chemical reactions, cell responses). The expectation is that AI algorithms will move beyond simple automation to enable intelligent, adaptive experimentation, where the pump parameters are adjusted in real-time based on the observed experimental output, accelerating discovery and reducing the need for extensive manual parameter tuning, especially in complex organ-on-a-chip or high-throughput drug screening scenarios.

The primary themes emerging from user inquiries center on applying machine learning for anomaly detection in fluidic systems—identifying subtle deviations in pressure or flow that indicate blockages or malfunctions before catastrophic failure. Researchers seek confirmation that AI can handle the non-linear relationship between pump input parameters and actual fluid behavior within complex microchannels, leading to more accurate models and better experimental replication. Furthermore, the role of AI in synthesizing massive datasets generated by automated screening processes, where microfluidic pumps are core dispensing elements, is highly anticipated, potentially allowing for the rapid identification of optimal experimental conditions or novel therapeutic candidates.

The integration of AI into the Microfluidic Syringe Pumps Market is shifting the focus from simply providing precision hardware to offering "smart" fluidic platforms. This transition involves embedding proprietary AI models directly into pump control software, providing users with predictive modeling tools that optimize experimental design and maintenance schedules. This intelligence layer enhances efficiency, reduces material waste, and significantly accelerates the rate of scientific breakthroughs achieved using these sophisticated microfluidic systems, ultimately broadening their application scope from academic research into high-volume clinical diagnostics and pharmaceutical manufacturing.

- AI enables real-time, closed-loop control of flow rates based on sensor feedback (e.g., pH or concentration), optimizing dynamic biological experiments.

- Predictive maintenance schedules are generated using machine learning to analyze motor performance and pressure trends, minimizing downtime and component failure.

- Automated calibration and dispensing protocols are refined by AI algorithms, ensuring superior accuracy and repeatability across multiple experimental runs.

- Data synthesis and pattern recognition in high-throughput screening campaigns are accelerated, linking precise fluid handling parameters to desired experimental outcomes.

- AI facilitates the development of digital twins for microfluidic setups, allowing researchers to simulate complex fluid dynamics before running physical experiments.

DRO & Impact Forces Of Microfluidic Syringe Pumps Market

The Microfluidic Syringe Pumps Market is driven by the escalating demand for miniaturized diagnostics, the rapid adoption of organ-on-a-chip technologies, and substantial growth in pharmaceutical R&D spending focused on high-throughput drug screening. Key drivers include the inherent advantages of microfluidic systems, such as minimal sample volume requirements and reduced analysis time, which translate directly into cost savings and accelerated research timelines. These drivers are further amplified by continuous technological improvements in pump control software and motor precision, making these systems more user-friendly and reliable for non-specialist personnel in diverse laboratory settings.

However, the market faces significant restraints, primarily the high initial cost associated with specialized microfluidic equipment, including the pumps and integrated chips, which can be prohibitive for smaller research laboratories or developing institutions. Furthermore, the steep learning curve required for operating and troubleshooting complex microfluidic setups, particularly system integration challenges and the complexity of maintaining reliable seals at micro-scale interfaces, acts as a barrier to wider market penetration. Compatibility issues between different manufacturers' chips and pumps also occasionally impede seamless adoption, necessitating proprietary solutions that limit flexibility.

Opportunities for market growth lie in the untapped potential of clinical diagnostics, particularly point-of-care (PoC) testing devices where precise, automated fluidic control is paramount for reliable results outside of central labs. The burgeoning field of personalized medicine and genomics, requiring minute volume handling for sequencing libraries, offers a sustained revenue stream. The impact forces indicate that the substitution threat is moderate, as alternative pumping technologies (peristaltic or pressure-driven systems) exist but often lack the required precision for core microfluidic applications. The bargaining power of buyers is moderate due to the specialized nature of the product, while the intensity of rivalry among the few key manufacturers remains high, driving innovation and competitive pricing strategies focused on enhancing precision and expanding multichannel capabilities.

Segmentation Analysis

The Microfluidic Syringe Pumps Market is systematically segmented based on product type, application, end-user, and flow rate range, allowing for a detailed understanding of consumer preferences and technological needs across different sectors. Analyzing these segments provides crucial insights into which areas are experiencing the fastest technological uptake and where sustained market demand is concentrated. The segmentation by product type helps differentiate between high-volume, cost-sensitive demands (often met by single-channel pumps) and advanced research requirements (driving demand for multi-channel and high-pressure systems).

Segmentation by application highlights the distinct requirements of different scientific fields; for example, drug discovery demands pumps optimized for chemical compatibility and high-throughput reliability, while biomedical diagnostics require systems optimized for automation and portability. End-user analysis reveals that academic institutions remain crucial for market volume, but the fastest revenue growth originates from the pharmaceutical and biotechnology industry due to intensive R&D investments and integration into automated screening pipelines. Flow rate range segmentation is fundamental, distinguishing between standard picoliter/nanoliter flow systems and the emerging demand for ultrafast microliter flow rates needed for continuous flow chemistry applications.

- By Product Type:

- Single-Channel Syringe Pumps

- Multi-Channel Syringe Pumps

- High-Pressure Syringe Pumps

- OEM Syringe Pump Modules

- By Application:

- Drug Discovery and Screening

- Genomics and Proteomics

- Cell Culture and Perfusion Systems

- Chemical Synthesis and Analysis

- Diagnostics and Point-of-Care (PoC) Testing

- Environmental Monitoring

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Contract Research Organizations (CROs)

- Hospitals and Diagnostic Laboratories

- By Flow Rate Range:

- Nanoliter/Picoliter Range Pumps

- Microliter Range Pumps

- Milliliter Range Pumps (High-speed microfluidics)

Value Chain Analysis For Microfluidic Syringe Pumps Market

The value chain for the Microfluidic Syringe Pumps Market begins with upstream activities dominated by specialized component suppliers. This includes manufacturers of highly precise stepper motors, advanced micro-mechanics (lead screws, bearings), and sophisticated electronic control boards (microcontrollers and proprietary firmware). The quality and reliability of these upstream components are paramount, as the final pump performance—accuracy, resolution, and longevity—is directly dependent on the tolerance and robustness of the core mechanics. Given the niche nature of ultra-high precision fluidics, the bargaining power of these specialized component suppliers can be significant, influencing overall manufacturing costs and lead times.

The middle segment of the chain involves the core manufacturing and integration processes carried out by major pump manufacturers. This stage includes custom design, software development for flow control algorithms, assembly, rigorous quality control testing (calibration and validation), and system integration expertise necessary to connect the pump seamlessly with external sensors and microfluidic chips. Manufacturers often invest heavily in proprietary software interfaces that offer enhanced usability and connectivity features, creating a competitive advantage. Distribution channels then handle the movement of the finished products, utilizing both direct sales models (especially for large institutional clients requiring extensive support) and indirect models through specialized regional distributors.

Downstream activities involve reaching the end-users: academic laboratories, pharmaceutical R&D, and diagnostic centers. Direct distribution channels are often preferred when dealing with large clients like major pharma companies or multinational CROs, as they require specialized technical support, training, and long-term maintenance contracts. Indirect channels, relying on distributors, are critical for penetrating diverse geographical markets and smaller university labs. The success downstream hinges not only on the pump's physical performance but also on the quality of application support and the availability of consumable syringes and associated fluidic accessories tailored for microfluidic operation.

Microfluidic Syringe Pumps Market Potential Customers

The primary end-users and potential customers for microfluidic syringe pumps are highly specialized organizations requiring extremely precise and reproducible fluid dispensing in volumes typically under 100 microliters. This core customer base includes pharmaceutical companies engaged in drug discovery, where high-throughput screening of compounds necessitates exact dispensing of reagents onto microarrays or within microtiter plates. Biotechnology firms utilize these pumps extensively for developing advanced cell culture models, such as microphysiological systems (Organ-on-a-Chip), demanding long-term, low-pulsation flow for maintaining cell viability and accurate nutrient perfusion.

Academic and government research laboratories represent the largest volume segment, using microfluidic syringe pumps as foundational equipment for chemical synthesis, fundamental biological research, and developing novel analytical methods. These customers prioritize flexibility, compatibility with various fluidic setups, and robust, easy-to-use software interfaces suitable for diverse research projects. Furthermore, the growing segment of Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) constitutes high-value customers, requiring high-reliability, automated multi-channel systems to handle client-specific assay development and small-batch production runs in a regulated environment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1,600 Million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Harvard Apparatus, Teledyne ISCO, New Era Pump Systems, Braintree Scientific, SyringePump.com, Chemyx Inc., World Precision Instruments (WPI), Dolomite Microfluidics, Fluigent, KDS Instruments (KD Scientific), Gilson, Cole-Parmer, Landgraf Laborsysteme, Microliter Analytical Technology, ProSense |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Microfluidic Syringe Pumps Market Key Technology Landscape

The technological landscape of the Microfluidic Syringe Pumps Market is defined by continuous improvements in motor control, material science for fluidic pathways, and integration capabilities. Core technology revolves around highly precise stepper motors coupled with refined linear actuators (e.g., lead screws) designed to eliminate backlash and mechanical jitter, which are detrimental to nanoliter flow control. Recent advancements focus on high-resolution microstepping and closed-loop feedback mechanisms that use encoders to verify piston movement in real-time, drastically improving flow stability and guaranteeing repeatability over long dispensing cycles necessary for complex biological perfusion studies or long-running electrochemical analyses.

A significant trend involves the development of specialized high-pressure syringe pumps capable of overcoming the substantial fluidic resistance encountered in highly integrated microfluidic devices and complex packed-bed columns. These pumps utilize reinforced mechanics and robust housing to maintain stable flow rates up to several hundred bars of pressure, expanding the application of microfluidics into areas like supercritical fluid extraction and high-pressure chemical reactions. Furthermore, communication technology is advancing, with many modern pumps featuring Ethernet, Wi-Fi, and proprietary network interfaces, enabling seamless integration into Laboratory Information Management Systems (LIMS) and automated robotic handling platforms (automation).

The market is also witnessing a push towards modular and scalable systems, offering interchangeable syringe holders and customizable flow channels. This flexibility is supported by sophisticated, intuitive control software that allows users to program complex flow patterns, including ramping, oscillating, and gradient profiles, without extensive coding knowledge. Material science plays a vital role, with manufacturers increasingly adopting chemically inert materials (like PEEK, PTFE, and high-grade ceramics) for fluid contact surfaces to ensure broad compatibility with aggressive solvents, highly concentrated acids, and delicate biological buffers, thereby maintaining sample integrity and pump longevity across diverse applications.

Regional Highlights

- North America: Dominates the global microfluidic syringe pumps market, primarily due to the colossal expenditure on biotechnology and pharmaceutical R&D, particularly in the United States. The region benefits from a robust ecosystem of specialized academic institutions and a high concentration of market-leading companies focused on advanced diagnostics and cell therapy research, requiring the highest standards of fluidic precision. Government initiatives like the NIH funding programs for microphysiological systems strongly drive the early adoption of next-generation, high-performance pump systems, positioning the region as the epicenter for technological innovation and commercialization.

- Europe: Represents a mature and stable market, characterized by strong governmental support for life science research and a stringent regulatory environment (e.g., EMA) that favors documented, repeatable experimental methodologies. Countries like Germany, Switzerland, and the UK are major contributors, fueled by world-class chemical and pharmaceutical industries and deep-rooted academic excellence in fluid mechanics and bioengineering. The focus here is increasingly on integrating microfluidic platforms into standardized industrial processes and clinical diagnostics, demanding reliable, certified, and maintainable syringe pump systems.

- Asia Pacific (APAC): Expected to be the fastest-growing region, driven by explosive growth in R&D infrastructure in China and India, coupled with increasing outsourcing activities (CROs/CDMOs) from Western pharmaceutical companies. Government initiatives aimed at modernizing healthcare systems, especially in areas like point-of-care testing and endemic disease diagnostics, boost the demand for cost-effective, high-precision dispensing equipment. Japan and South Korea lead in adopting complex microfluidic systems for advanced materials science and semiconductor manufacturing applications alongside biomedical uses.

- Latin America (LATAM): A developing market segment showing gradual growth, largely concentrated in Brazil and Mexico, driven by increasing public health spending and foreign direct investment in establishing biotechnology hubs. Market growth here is sensitive to economic stability and relies heavily on imported technology; the focus is primarily on foundational research and diagnostic applications, where basic precision syringe pumps are replacing traditional manual techniques.

- Middle East and Africa (MEA): Currently the smallest market share, but experiencing targeted growth in specific high-income nations (e.g., UAE, Saudi Arabia) investing heavily in building advanced research capabilities and diversifying their economies away from oil. Investments are concentrated in high-value areas like genomics and specialized diagnostics, necessitating the import of high-end microfluidic pumping solutions to establish modern biomedical research centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Microfluidic Syringe Pumps Market.- Harvard Apparatus

- Teledyne ISCO

- New Era Pump Systems

- Braintree Scientific

- Chemyx Inc.

- World Precision Instruments (WPI)

- Dolomite Microfluidics

- Fluigent

- KDS Instruments (KD Scientific)

- Gilson, Inc.

- Cole-Parmer

- Landgraf Laborsysteme

- Microliter Analytical Technology

- ProSense

- Shenzhen Landers Technology Co., Ltd.

- Infusion Technology, Inc.

- SY-LAB Geräte GmbH

- Bio-Rad Laboratories, Inc. (Indirectly through fluid control components)

Frequently Asked Questions

Analyze common user questions about the Microfluidic Syringe Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between standard and microfluidic syringe pumps?

Microfluidic syringe pumps are specifically engineered for exceptionally high resolution and ultra-low flow rates (picoliters to microliters), utilizing advanced stepper motors and backlash-free mechanics to ensure smooth, stable, and pulsation-free flow, which is critical for sensitive microchannel applications.

Which application segment drives the highest demand for these pumps?

The Drug Discovery and Screening application segment currently drives the highest demand, particularly within pharmaceutical and biotechnology companies utilizing high-throughput screening and complex microphysiological systems (Organ-on-a-Chip) for efficient compound testing.

What are the key technical specifications to consider when purchasing a microfluidic syringe pump?

Key technical specifications include flow rate accuracy and precision (low coefficient of variation), resolution (minimum achievable step volume), pressure capability (critical for high-resistance chips), and compatibility with multi-channel and automated systems.

How is Artificial Intelligence (AI) influencing the future development of these pumps?

AI is enabling the development of 'smart' fluidic platforms by facilitating real-time, closed-loop feedback control and predictive maintenance, allowing the pumps to adapt flow parameters automatically based on external sensor data and optimize complex experimental protocols.

Which geographical region exhibits the fastest growth rate in the Microfluidic Syringe Pumps Market?

The Asia Pacific (APAC) region is projected to register the fastest Compound Annual Growth Rate (CAGR), driven by significant government investment in biomedical research infrastructure and expanding manufacturing capabilities in countries such as China and India.

The Microfluidic Syringe Pumps Market is defined by the critical need for absolute precision in fluid handling, reflecting the increasing sophistication of biological and chemical research at the microscale. The market’s sustained growth is fundamentally tied to the success of advanced applications like personalized medicine, where the accuracy of sample delivery directly impacts diagnostic reliability and therapeutic efficacy. Technological advancements continue to focus on overcoming the physical limitations inherent in microscale fluidics, specifically addressing issues related to flow resistance and fluid shear stress. Innovations in hardware, such as the adoption of magnetic actuators and piezoelectric mechanisms alongside traditional stepper motors, are constantly pushing the boundaries of flow resolution down towards the femtoliter range, catering to emerging single-molecule detection applications. Furthermore, the integration of wireless communication standards and cloud-based data logging tools ensures that these precision instruments can participate effectively in the fully networked laboratory of the future, supporting remote operation and streamlined data management for global research collaborations. Manufacturers are strategically positioning themselves not just as hardware providers but as comprehensive fluid control system developers, offering integrated software solutions and extensive application support to navigate the complexities of microfluidic experimentation. This holistic approach is essential for reducing the operational complexity faced by end-users and accelerating the commercial adoption of microfluidic technologies in routine diagnostic and industrial quality control settings. The convergence of microfluidic pumping technology with advanced analytical instruments, such as mass spectrometers and flow cytometers, highlights a major trend toward creating highly integrated, automated analytical systems that drastically reduce sample preparation time and boost overall lab productivity. The market remains competitive, with companies frequently updating their product lines to offer enhanced multichannel capacity and specialized pumps optimized for handling bio-inks or highly viscous polymers, catering to the growing demands of 3D bioprinting and advanced materials research, solidifying the market's long-term growth trajectory and critical role in modern scientific discovery.

Regional market dynamics are significantly shaped by localized investment patterns and regulatory environments. In North America, the high cost of pumps is readily absorbed by substantial private sector R&D budgets and favorable federal grant structures, allowing for the rapid deployment of the latest, most expensive high-end models. Conversely, the high growth potential in the APAC region is often realized through demand for more cost-effective, robust systems suitable for scaling up high-volume manufacturing processes and government-led public health initiatives. This regional differentiation necessitates varied commercial strategies, requiring vendors to maintain flexible product portfolios catering to both premium, research-grade needs and scalable, economically viable production requirements. The expansion into niche areas such as micro-robotics and environmental sensing further diversifies the customer base, ensuring sustained market resilience against temporary fluctuations in any single application sector. The ongoing need for miniaturization in chemical reactors and continuous flow synthesis platforms represents a significant, durable demand segment, leveraging high-pressure microfluidic syringe pumps to manage the inherent back pressure and ensure safe, efficient reaction control at elevated temperatures and pressures. Addressing fluid compatibility remains a continuous technical challenge, driving material science innovation within the value chain to prevent corrosion, adsorption, or chemical leaching when handling aggressive reagents or precious biological samples, which further drives up the value proposition of specialized microfluidic syringe pump solutions over conventional alternatives.

The market is increasingly influenced by the strategic partnerships formed between pump manufacturers and developers of consumable microfluidic chips. These collaborations aim to ensure optimal compatibility and performance, reducing the burden of system integration for the end-user. Standardization efforts, though slow, are also contributing to market maturation, potentially easing concerns regarding proprietary interfaces and system interoperability, which have historically restrained broader adoption. The shift toward modular design allows users to customize their fluidic setups easily, adapting a single pump module for various experimental scales and complexities simply by swapping out syringe sizes or adding specialized valve manifolds. This flexibility enhances the pump's lifecycle value and appeals strongly to multi-disciplinary research institutions. Furthermore, the focus on developing compact, portable microfluidic syringe pump units is vital for expanding market presence in field-based research, remote diagnostics, and emergency response applications, moving the technology beyond the confines of the established centralized laboratory. These portable units require enhanced battery life, ruggedized casing, and intuitive touchscreen controls, representing a distinct engineering challenge and market opportunity. The overall direction of the Microfluidic Syringe Pumps Market is characterized by a drive toward greater intelligence, higher integration, and uncompromising precision, reinforcing its role as an enabling technology across the life sciences and high-tech manufacturing sectors globally.

Specific technological advances within the control systems of microfluidic syringe pumps are crucial for maintaining market competitiveness. For example, some high-end models now incorporate sophisticated thermal management systems to stabilize the fluid temperature within the syringe barrel, preventing volume changes due to thermal expansion, a critical factor when dispensing sub-microliter volumes with extreme accuracy. The adoption of advanced communication protocols, beyond basic RS-232, includes USB-C and dedicated industrial fieldbus protocols, facilitating industrial automation and remote operation in GxP-compliant environments where data traceability and control reliability are mandatory. The ongoing evolution of pump firmware aims to offer enhanced features such as auto-priming routines, air bubble detection, and compensation algorithms that dynamically adjust flow rates to counteract minor pressure fluctuations within the microchannel network. These subtle software enhancements are often as important as the mechanical precision itself, providing a layered approach to system reliability. Moreover, the environmental impact and sustainability are becoming relevant factors; manufacturers are exploring the use of recyclable materials and developing mechanisms to reduce the energy consumption of high-power stepper motors, aligning with broader corporate social responsibility goals and end-user preferences for environmentally conscious lab equipment. The continuous refinement of syringe pump design to minimize dead volume and maximize dispense efficiency directly reduces reagent waste, a major economic and environmental benefit in high-cost pharmaceutical applications.

Regarding regulatory compliance, the Microfluidic Syringe Pumps Market is increasingly affected by requirements in the medical device and diagnostics sector. Pumps intended for use in clinical diagnostic instruments must adhere to stringent standards (e.g., FDA clearance, CE marking), necessitating thorough validation documentation and traceable manufacturing processes. This requirement elevates the barrier to entry for new competitors but strengthens the position of established manufacturers known for quality and regulatory expertise. The pharmaceutical sector's push for continuous manufacturing and Quality by Design (QbD) principles also favors sophisticated fluid control systems that offer verifiable performance metrics and integration with process analytical technology (PAT). These specialized requirements ensure that the microfluidic syringe pump is recognized not merely as a laboratory tool but as a precision industrial component essential for maintaining product quality and consistency in highly regulated environments. The development pipeline includes specialized pumps resistant to electromagnetic interference (EMI) and vibration, expanding their utility into challenging industrial settings and complex analytical instrument trains where environmental noise can compromise precision performance.

The competitive landscape is characterized by companies specializing exclusively in microfluidics versus larger scientific instrument conglomerates that offer pumps as part of a broader laboratory equipment catalog. The specialists tend to lead in high-end, bespoke precision capabilities, while the larger conglomerates leverage their distribution networks and existing customer relationships to offer more standardized, volume-driven solutions. Mergers and acquisitions are common strategies used to integrate specialized software or component technologies into broader product lines, ensuring that key market players can offer fully optimized microfluidic platforms. For instance, the acquisition of a company specializing in high-pressure sealing technology can immediately enhance a manufacturer's capacity to serve the continuous flow chemistry segment. The long-term growth of the market hinges on the successful translation of microfluidic research discoveries into commercially viable clinical and industrial products, necessitating continued investment in scalable, reliable, and standardized pumping solutions that can transition seamlessly from the benchtop to the production floor or the bedside.

Finally, the educational aspect of the market is paramount. As microfluidics becomes a standard part of engineering and biological curricula, the demand for affordable, robust training systems that incorporate functional syringe pumps is increasing. Manufacturers are responding by offering educational kits and dedicated training programs, cultivating future users and accelerating the adoption rate across academic and emerging industrial sectors. This educational outreach contributes to a higher level of technical competency among researchers, enabling them to design more complex and effective microfluidic experiments, thereby driving demand for increasingly sophisticated fluid handling equipment in the future. The ability to program complex flow patterns easily and simulate fluid behavior prior to running an experiment (often using AI-enhanced software tools) significantly lowers the operational barrier, making microfluidic technology accessible to a wider pool of scientists and engineers, which ensures the market's trajectory remains strongly upward throughout the forecast period.

The Microfluidic Syringe Pumps market, despite its high precision and niche application focus, demonstrates a robust defense against market disruption due to the inherent difficulty of replicating its required performance parameters using alternative, less complex fluid transfer mechanisms. Pressure-driven systems, while sometimes competitive, often lack the long-term, low-pulsation flow stability and the gravimetric control essential for cell viability studies or extremely sensitive concentration gradient generation, tasks where syringe pumps excel. This fundamental technical superiority in controlled volume delivery ensures a continued stronghold in high-value, high-precision research segments. Furthermore, the specialized materials utilized in the syringe barrels and plungers, such as highly polished glass or PTFE, are crucial for minimizing surface interactions and ensuring chemical inertia, especially when handling aggressive or proprietary pharmaceutical formulations, cementing the syringe pump's indispensable role in specialized chemical and biological laboratories.

Investment in advanced manufacturing techniques, such as additive manufacturing (3D printing) for complex pump components, is being explored by major players to accelerate prototype development and customize pump geometries for specific OEM integration projects. While not yet widespread for critical mechanical components, 3D printing is enhancing the speed at which specialized housing, mounting brackets, and fluid manifold interfaces can be designed and deployed, contributing to faster time-to-market for tailored solutions. The customization trend is especially strong in the OEM module segment, where medical device manufacturers require highly integrated, compact pump engines designed to fit within portable diagnostic instruments, often necessitating unique form factors and communication protocols. This demand for custom OEM modules represents a lucrative, high-volume segment that requires specialized engineering support and stringent quality assurance processes, reinforcing the necessity for suppliers to have robust in-house design and validation capabilities.

The market's resilience is also supported by the increasing requirement for highly sensitive and multiplexed analysis in molecular diagnostics. Techniques like digital PCR and microarray spotting, which rely on the accurate and rapid deposition of minuscule droplets of fluid, cannot be reliably performed without the sub-microliter precision offered by microfluidic syringe pumps. As these diagnostic technologies become mainstream in clinical settings, the demand for corresponding high-precision fluid control hardware escalates. The trend toward automated liquid handling workstations in centralized labs often integrates arrays of microfluidic syringe pumps to manage reagent addition and waste removal with unparalleled accuracy across hundreds of samples simultaneously, driving efficiency and minimizing human error in diagnostic pipelines. This move towards high-throughput automation ensures that the market for these specialized pumps remains strategically important across both research and increasingly, clinical operational environments.

Finally, cybersecurity concerns are becoming relevant, particularly for syringe pumps integrated into networked research labs or manufacturing facilities. As pump control systems move towards cloud-based monitoring and remote operation, ensuring the security of the proprietary control algorithms and experimental data flowing through these systems is crucial. Manufacturers are now incorporating hardened operating systems and secure communication protocols to mitigate risks associated with unauthorized access or malicious interference, a requirement that adds another layer of complexity and value to modern microfluidic syringe pump solutions. This emphasis on security and data integrity is essential for maintaining trust in GxP-regulated sectors and large-scale industrial deployments, ensuring that microfluidic syringe pumps remain at the technological forefront of reliable and traceable precision fluid control.

The technological evolution further involves the development of specialized algorithms to compensate for fluid compressibility and temperature-induced viscosity changes, which become significant error sources at high pressures and extreme flow resolutions. High-end microfluidic syringe pumps now feature iterative control mechanisms that learn the characteristics of the specific fluid and syringe materials used, allowing for dynamic adjustment of motor commands to deliver a true volumetric flow rate that is independent of transient physical disturbances. This level of computational sophistication differentiates market leaders and justifies the premium pricing associated with ultra-high precision units. Moreover, the integration of non-contact sensors directly into the pump mechanism to monitor plunger position with sub-micron accuracy is critical for guaranteeing the repeatability required for advanced micro-reaction synthesis and delicate biological handling where variance can destroy expensive samples or invalidate entire experimental runs.

Another key area of technological advancement is the creation of specialized "pulsation dampeners" and proprietary flow smoothing techniques specifically designed for microfluidic scale. While traditional syringe pumps are inherently low-pulsation, achieving zero pulsation at the nanoliter scale, particularly when switching between infusion and withdrawal cycles or managing pressure head changes, remains a technical challenge. Innovations in valve technology, including miniature, electronically controlled rotary or diaphragm valves that minimize switching time and internal volume, are being coupled with the syringe pump mechanics to achieve near-perfect continuous flow profiles essential for perfusion studies that demand constant environmental conditions for living cells. This focus on minimizing flow noise is a major driver in the high-end academic and biopharma sectors, ensuring that the microfluidic setup itself does not introduce artifacts into the biological system under study.

In terms of intellectual property (IP), the Microfluidic Syringe Pumps Market is protected by numerous patents covering specific aspects of motor control, mechanical actuation, sensor integration, and user interface software. Manufacturers continuously file new patents related to novel designs that improve pressure handling, reduce footprint, or enhance multi-channel synchronization, forming a strong IP barrier that protects market share and encourages sustained R&D investment. For end-users, this signifies a rapidly evolving market where the latest equipment often provides quantifiable performance benefits over systems even a few years old, driving cyclical replacement demand and fostering continuous innovation within the supply base. The synthesis of mechanical engineering, computational fluid dynamics, and advanced electronics remains the core competency defining success in this highly specialized, precision-driven market sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager