Microscope Glass Cover Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441182 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Microscope Glass Cover Market Size

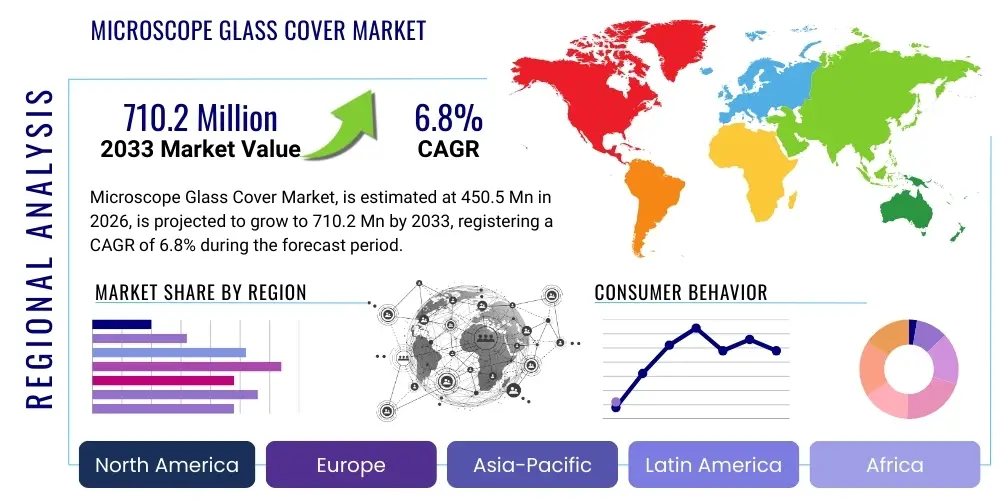

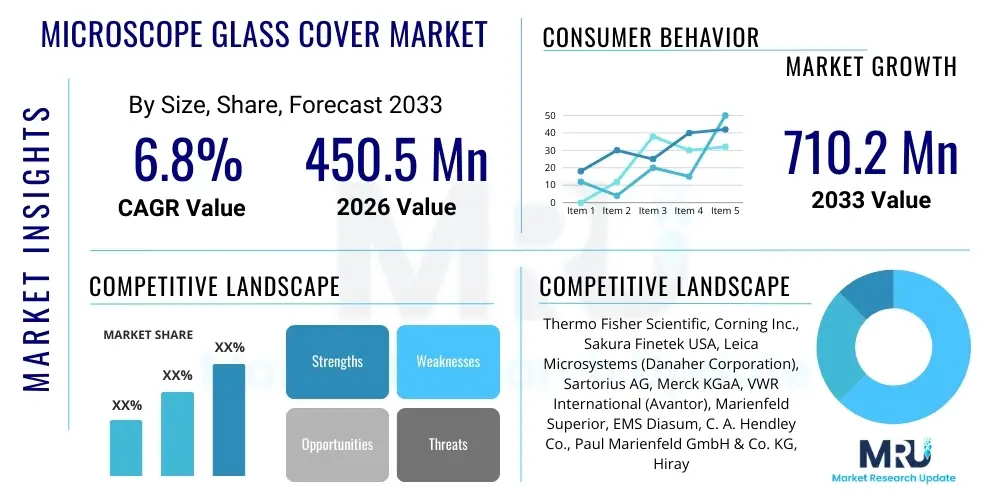

The Microscope Glass Cover Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 710.2 Million by the end of the forecast period in 2033.

Microscope Glass Cover Market introduction

The Microscope Glass Cover Market encompasses the manufacturing and distribution of thin, flat pieces of glass or plastic used to cover specimens mounted on a microscope slide. These coverslips, essential components in microscopy, serve several critical functions: they flatten the sample, protect the objective lens from contact with the specimen, and ensure an even thickness of the material being examined, which is vital for high-resolution imaging, particularly with oil immersion objectives. The quality and uniformity of these coverslips directly impact the clarity and accuracy of microscopic observations, making them indispensable consumables in scientific research, clinical diagnostics, and educational institutions worldwide.

The primary applications of microscope glass covers are deeply rooted in life sciences and healthcare. They are extensively utilized in histopathology for tissue sample analysis, hematology for blood smear examination, microbiology for bacterial and cellular studies, and cytology for cell morphological assessments. Furthermore, coverslips are crucial in advanced research fields such as genetic sequencing, in-vitro fertilization (IVF), and live-cell imaging, where maintaining sample integrity and optimal optical properties is paramount. The increasing prevalence of infectious diseases and chronic conditions, coupled with growing investments in pharmaceutical and biotechnology R&D, continually drives the demand for high-quality microscope consumables.

Key benefits driving market adoption include enhanced optical performance, crucial for digital pathology and high-throughput screening systems, protection of fragile specimens from dehydration or contamination, and standardization of sample preparation. Driving factors include the globalization of research activities, the expansion of diagnostic laboratories, technological advancements leading to automated microscopy systems, and the rising global healthcare expenditure, particularly in emerging economies where clinical infrastructure is rapidly developing.

Microscope Glass Cover Market Executive Summary

The Microscope Glass Cover Market is characterized by steady expansion, primarily fueled by the accelerating pace of biological research and the increasing volume of diagnostic testing globally. Major business trends indicate a shift towards specialized, high-performance coverslips, including those pre-treated for specific cell cultures or optimized for super-resolution microscopy. Consolidation among key manufacturers to enhance global distribution networks and the emphasis on sustainable manufacturing practices are also prominent business characteristics shaping the competitive landscape. The market exhibits resilience due to its nature as a high-volume consumable product, ensuring continuous revenue streams.

Regionally, North America and Europe maintain dominance owing to robust R&D infrastructure, high adoption rates of advanced automated microscopy, and substantial private and government funding for life science studies. However, the Asia Pacific region, particularly China and India, is emerging as the fastest-growing market segment. This rapid growth is attributed to massive investments in healthcare infrastructure development, the establishment of new pharmaceutical manufacturing hubs, and the rapid expansion of academic and government research institutions focusing on infectious disease control and genomic research. This regional trend highlights a geographical shift in demand and manufacturing capabilities.

Segment-wise, the market sees high growth in specialized glass materials, such as borosilicate and quartz, offering superior thermal and chemical resistance compared to traditional soda-lime glass. Furthermore, the segmentation by thickness (e.g., No. 1.5H) is becoming increasingly critical as modern microscopy requires extremely precise optical surfaces for advanced imaging modalities like confocal and TIRF microscopy. The application segment remains dominated by clinical diagnostics and academic research, but the industrial sector (e.g., materials science) is showing niche growth, demanding specialized oversized or chemically resistant coverslips. These trends underscore the market’s move towards customization and high precision.

AI Impact Analysis on Microscope Glass Cover Market

User inquiries regarding AI's influence on the Microscope Glass Cover Market frequently revolve around automation, image analysis accuracy, and the standardization required for machine vision systems. Common themes include whether AI-driven diagnostics necessitate stricter quality control for coverslips, if automated slide preparation using robotics reduces human error related to cover placement, and the role of specialized glass properties (like flatness and refractive index) in optimizing input for deep learning algorithms used in digital pathology. Users are keen to understand how AI-powered quantitative analysis, which demands impeccable image quality, translates into increased pressure on manufacturers to minimize imperfections and ensure optical consistency across high-volume production batches, ultimately driving demand for premium, defect-free products.

The integration of Artificial Intelligence, particularly in digital pathology and high-throughput screening, significantly raises the performance bar for microscope glass covers. AI systems rely on consistent and high-fidelity image data; inconsistencies caused by uneven coverslips, scratches, or refractive index variations can introduce noise, leading to misinterpretations or reduced diagnostic confidence in automated analysis. Consequently, the demand shifts away from basic, lower-cost coverslips towards premium, ultra-flat, and chemically inert versions that maintain optical integrity throughout the staining and imaging process. AI acts as a quality regulator, indirectly increasing the average selling price and quality standards in the market.

Furthermore, AI-driven automation in laboratory workflows necessitates product design changes that accommodate robotic handling. Coverslips must meet tighter tolerances regarding dimensions and packaging to ensure seamless integration with automated slide loaders and imagers, reducing jamming and operational downtime. This technological requirement prompts manufacturers to invest in precision tooling and automated quality control measures (often leveraging AI vision systems themselves) to verify dimensional accuracy and surface quality before packaging, thus enhancing the overall efficiency and reliability of the coverslip supply chain tailored for the modern, automated laboratory environment.

- AI systems demand ultra-high consistency and flatness in coverslips to ensure image fidelity for deep learning algorithms.

- Increased quality standards driven by digital pathology require premium, defect-free glass covers, raising manufacturing precision requirements.

- Robotic slide preparation benefits from precisely dimensioned and uniformly packaged coverslips, optimizing automated lab workflows.

- AI-driven quality control in manufacturing helps identify minute optical defects, improving output quality and reducing batch variability.

- Specialized coverslips with optimized refractive indices become critical for advanced AI imaging modalities such as quantitative phase imaging (QPI).

DRO & Impact Forces Of Microscope Glass Cover Market

The Microscope Glass Cover Market dynamics are heavily influenced by the interplay between continuous advancements in life science research (Drivers), stringent regulatory requirements (Restraints), and the emergence of innovative microscopy technologies (Opportunities). The primary impact forces originate from the ever-increasing global expenditure on healthcare and biotechnology R&D, which ensures a perpetual demand for essential laboratory consumables. However, the market faces headwinds from substitute technologies, such as microfluidics and label-free imaging, which bypass traditional slide preparation methods. Successful market navigation requires manufacturers to balance cost efficiency, vital for high-volume consumables, with the necessary investment in advanced material science to meet the exacting demands of sophisticated imaging techniques.

Drivers primarily center on the rising global prevalence of chronic diseases, necessitating continuous pathological examination and diagnostics, coupled with the rapid expansion of academic and corporate biomedical research focusing on drug discovery and personalized medicine. These activities inherently require vast quantities of high-quality coverslips. Additionally, standardization efforts in pathology—such as moving towards digital imaging platforms—reinforce the need for standardized, optically perfect coverslips. The impact forces created by these drivers exert upward pressure on production capacity and quality control standards across the industry, promoting investment in high-throughput manufacturing lines capable of maintaining tight tolerances.

Restraints include intense price competition, particularly in the standard soda-lime glass segment, which compresses profit margins and limits investment in R&D for small players. Furthermore, the emergence of advanced, slide-free diagnostic methods (e.g., capsule endoscopy, liquid biopsy) poses a long-term substitution threat, potentially plateauing the growth of traditional coverslip applications. Opportunities lie in developing specialized, high-value products, such as polymer coverslips optimized for specific cell culture environments, chemically modified coverslips for advanced binding applications, or ultra-thin coverslips tailored for specialized super-resolution microscopes. Leveraging these opportunities allows manufacturers to capture premium market segments less sensitive to price pressures and capitalize on niche, high-growth scientific fields.

Segmentation Analysis

The Microscope Glass Cover Market is comprehensively segmented based on material, thickness, application, and end-user, reflecting the diverse requirements across various scientific and clinical disciplines. Material type dictates optical clarity and chemical resistance, with standard soda-lime glass dominating volume and specialized borosilicate and fused silica capturing high-end, demanding applications. Thickness segmentation is crucial as it directly impacts spherical aberration correction in high-numerical aperture objectives, driving the market towards precise No. 1.5 and No. 1.5H standards for advanced research imaging. Understanding these segments is key for manufacturers positioning their product lines and addressing the specific needs of pathologists versus academic researchers.

The application-based segmentation reveals that clinical diagnostics, encompassing histopathology and hematology, accounts for the largest market share due to the sheer volume of routine testing conducted globally. However, the academic and research segments are crucial for driving technological advancements, demanding premium products suitable for complex experiments like live-cell imaging and confocal microscopy, often requiring specific surface treatments or coatings. End-user segmentation categorizes consumption into hospitals, diagnostic laboratories, and academic institutions, with diagnostic labs rapidly increasing their consumption volume due to outsourcing and regional expansion of testing services.

The increasing complexity of scientific research necessitates ongoing product specialization. For example, specific segments of the market now focus solely on disposable plastic coverslips for applications where biohazard concerns or extremely high-volume, automated processes require cheaper, lower-impact consumables, despite a minor trade-off in optical quality compared to glass. The market structure thus supports a dual supply chain: one optimized for cost and volume (clinical routine) and another focused on precision, specialized materials, and custom surface modification (advanced research), ensuring that segmentation analysis remains central to strategic planning in this market.

- By Material Type:

- Soda-Lime Glass

- Borosilicate Glass (D 263™ M, Corning 7059)

- Fused Silica/Quartz

- Polymer/Plastic (Polystyrene, Polycarbonate)

- By Thickness:

- No. 0 (0.085 – 0.13 mm)

- No. 1 (0.13 – 0.17 mm)

- No. 1.5 (0.17 – 0.18 mm)

- No. 1.5H (High Performance)

- No. 2 (0.19 – 0.23 mm)

- Other specialized thicknesses (e.g., ultra-thin)

- By Application:

- Clinical Diagnostics (Pathology, Hematology)

- Academic & Research Institutions (Cell Biology, Microbiology)

- Drug Discovery & Biotechnology

- Forensics

- Industrial Microscopy (Materials Science)

- By End-User:

- Hospitals & Clinics

- Diagnostic Laboratories (Independent and Reference Labs)

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Government & Public Health Agencies

Value Chain Analysis For Microscope Glass Cover Market

The value chain for the Microscope Glass Cover Market begins with the sourcing of specialized raw materials, primarily high-grade silica sand for glass production, which must meet stringent purity standards. Upstream activities involve bulk glass manufacturing (melting, annealing) followed by specialized secondary processing steps such as precision cutting, edge grinding, and meticulous cleaning to achieve the required flatness and dimensional tolerances. Key challenges upstream include minimizing glass defects (e.g., striae, bubbles) which can impair optical quality. Leading manufacturers often integrate glass formulation and cutting processes internally to ensure stringent quality control suitable for high-magnification microscopy, differentiating themselves from basic commodity producers.

Midstream processing focuses on surface treatments, which include application of hydrophilic or hydrophobic coatings, or specialized treatments for cell adherence (e.g., poly-L-lysine coating). Following treatment, the coverslips undergo rigorous automated inspection, often utilizing machine vision, for flaws, scratches, or dimensional deviations. Packaging is a critical step, requiring vacuum sealing or specialized dispensing boxes to maintain cleanliness and prevent breakage during transport. The efficiency of midstream operations, particularly minimizing waste during precision cutting and maximizing throughput of the cleaning process, directly influences the final cost and quality of the product.

Downstream activities involve distribution channels, which are segmented into direct sales to large research consortia or major diagnostic lab networks, and indirect sales through a vast network of scientific distributors (e.g., Fisher Scientific, VWR) and specialized medical suppliers. Direct channels allow for better margin control and specialized customer service for custom orders, whereas indirect channels ensure broad market penetration, especially to smaller clinical labs and academic departments globally. The effectiveness of the logistics network in minimizing breakage and contamination during the final delivery phase is crucial, emphasizing the importance of robust secondary packaging solutions for this fragile consumable product.

Microscope Glass Cover Market Potential Customers

The primary end-users and buyers in the Microscope Glass Cover Market span the entirety of the life sciences, healthcare, and materials science ecosystems, requiring products for both high-volume routine analysis and highly specialized, low-volume experimental work. Potential customers include major reference laboratories that process millions of patient samples annually, demanding cost-effective, high-volume products, alongside world-renowned academic research centers that require premium, precisely manufactured coverslips optimized for cutting-edge techniques like super-resolution imaging or single-molecule microscopy. The purchasing decision is often a blend of price sensitivity (for diagnostic labs) and technical specification compliance (for research entities).

Hospitals and clinical pathology departments are consistent large-scale buyers, consuming coverslips for routine procedures such as biopsy analysis, cytological screening, and microbial culture examination. These institutional buyers prioritize reliability, sterility, and compatibility with automated staining and slide-mounting equipment. Pharmaceutical and biotechnology companies represent another significant customer base, driving demand for specialized coverslips used in toxicity testing, high-content screening (HCS), and complex cell culture assays during preclinical drug development. Their demand is highly inelastic regarding price but extremely sensitive to quality and certification standards.

Furthermore, educational institutions, from universities to technical colleges, constitute a steady customer segment, primarily purchasing standard grade coverslips for student training and basic biological laboratory exercises. Emerging markets and government public health agencies, particularly those focusing on disease surveillance (e.g., malaria, tuberculosis) in developing regions, are increasingly important buyers, often prioritizing bundled consumables (slides and covers) and stable supply chains. Manufacturers must tailor their marketing and distribution strategies to address the varied volume, quality, and regulatory needs of these distinct customer groups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 710.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Corning Inc., Sakura Finetek USA, Leica Microsystems (Danaher Corporation), Sartorius AG, Merck KGaA, VWR International (Avantor), Marienfeld Superior, EMS Diasum, C. A. Hendley Co., Paul Marienfeld GmbH & Co. KG, Hirayama Manufacturing Corporation, Glaswarenfabrik Karl Hecht GmbH & Co KG, Deltalab, Globe Scientific Inc., Matsunami Glass Ind., Ltd., Electron Microscopy Sciences (EMS), CITOTEST Labware Manufacturing Co., Ltd., ESCO Medical, ProSciTech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Microscope Glass Cover Market Key Technology Landscape

The technology landscape for microscope glass covers is focused less on radical invention and more on enhancing precision manufacturing processes and material science optimization to meet the demanding requirements of modern high-resolution microscopy. Key technologies involve ultra-precision cutting and grinding techniques, such as diamond-edge grinding and laser ablation, necessary to achieve near-perfect edge geometry and uniform thickness (especially crucial for No. 1.5H coverslips). The ability to consistently control thickness variation within a few micrometers across large batches is a core technological competency, directly impacting optical performance and compatibility with automated focus systems found in digital slide scanners.

A second major technological area is surface treatment and coating technologies. This includes plasma treatments to modify hydrophilicity, crucial for uniform liquid spreading, and proprietary chemical vapor deposition (CVD) or sputtering techniques used to apply specialized coatings like gold or titanium oxide for enhanced cell adhesion or specific optical properties required in advanced techniques like Surface Plasmon Resonance (SPR) microscopy. Furthermore, the development of specialized polymer compositions offers chemically resistant and disposable alternatives for highly sensitive biological applications, requiring mastery of polymer molding and anti-static treatments to ensure debris-free surfaces.

Quality assurance represents a critical technological investment. Advanced automated optical inspection (AOI) systems, often incorporating high-resolution cameras and pattern recognition software, are deployed to scan every coverslip for microscopic defects such as scratches, dust particles, striae, or bubbles that would be impermissible for high-end research applications. This technology significantly reduces manufacturing defects, guaranteeing the consistency required for quantitative analysis and maintaining the trust of specialized research institutions, differentiating premium manufacturers in a highly commoditized market segment.

Regional Highlights

Regional variations in the Microscope Glass Cover Market reflect differences in healthcare expenditure, research infrastructure, and regulatory environments.

- North America (U.S., Canada): Dominates the market value due to massive funding directed towards biomedical R&D, a high concentration of leading pharmaceutical and biotechnology companies, and the early adoption of advanced digital pathology systems. The region demands premium, high-specification coverslips (e.g., No. 1.5H borosilicate) and drives innovation in coated coverslips for specialized cell culture.

- Europe (Germany, UK, France): Characterized by strong academic research funding, particularly in Germany and the UK, and robust clinical diagnostics markets. Europe is a major consumer of both standard and specialized coverslips, emphasizing quality standards mandated by European Union regulations. Germany, in particular, hosts several legacy precision glass manufacturers.

- Asia Pacific (China, India, Japan): Projected as the fastest-growing region. Growth is underpinned by rapid expansion of diagnostic testing services, government initiatives to improve healthcare access, and the proliferation of low-cost manufacturing capabilities, especially in China. While high-volume, low-cost products dominate clinical use, Japan maintains a strong demand for high-precision components in its sophisticated electronics and materials science research sectors.

- Latin America (Brazil, Mexico): Exhibits steady growth driven by increasing foreign investment in healthcare infrastructure and rising awareness of diagnostic needs. The market is highly price-sensitive, with demand concentrated on standard, reliable soda-lime glass coverslips for routine clinical testing.

- Middle East and Africa (MEA): Represents a nascent market with pockets of high growth in the GCC countries (UAE, Saudi Arabia) due to substantial investments in specialized medical cities and research centers. Demand often follows global standards but is heavily influenced by international procurement and tenders, requiring certified, high-quality products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Microscope Glass Cover Market.- Thermo Fisher Scientific

- Corning Inc.

- Sakura Finetek USA

- Leica Microsystems (Danaher Corporation)

- Sartorius AG

- Merck KGaA

- VWR International (Avantor)

- Marienfeld Superior

- EMS Diasum

- C. A. Hendley Co.

- Paul Marienfeld GmbH & Co. KG

- Hirayama Manufacturing Corporation

- Glaswarenfabrik Karl Hecht GmbH & Co KG

- Deltalab

- Globe Scientific Inc.

- Matsunami Glass Ind., Ltd.

- Electron Microscopy Sciences (EMS)

- CITOTEST Labware Manufacturing Co., Ltd.

- ESCO Medical

- ProSciTech

Frequently Asked Questions

Analyze common user questions about the Microscope Glass Cover market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between No. 1.5 and No. 1.5H coverslips?

The No. 1.5 coverslip has a nominal thickness of 0.17 mm (±0.02 mm). The No. 1.5H (High Performance) standard is stricter, often maintaining a thickness of 0.170 mm (±0.005 mm). This tighter tolerance is essential for advanced, high-numerical aperture (NA) objectives to minimize spherical aberration and achieve optimal resolution, critical for confocal and super-resolution microscopy.

Why is Borosilicate glass preferred over Soda-Lime glass for certain applications?

Borosilicate glass (like Pyrex or D 263™ M) offers superior chemical resistance and a lower coefficient of thermal expansion compared to standard soda-lime glass. It is preferred for applications involving harsh chemicals, extreme temperature variations, or prolonged storage, minimizing leaching of alkaline compounds that could interfere with sensitive biological samples.

How does the shift towards digital pathology impact the demand for coverslips?

Digital pathology scanners require extremely flat and clean coverslips to ensure perfect focusing across the entire slide for image stitching and automated analysis. This shift increases the demand for premium, ultra-flat coverslips (like No. 1.5H) and drives manufacturers to invest heavily in automated defect detection to meet the stringent quality requirements of machine vision systems.

What are the key drivers for market growth in the Asia Pacific region?

Growth in the Asia Pacific region is primarily driven by rapidly increasing government investment in public health infrastructure, the expansion of diagnostic laboratory networks, and substantial growth in generic pharmaceutical manufacturing and biological research activities, generating high-volume demand for clinical consumables.

Are polymer or plastic coverslips a significant substitute threat to traditional glass covers?

While polymer coverslips (e.g., polystyrene) are gaining traction, particularly in high-throughput screening and flow cell applications due to their disposability and low cost, they are generally not suitable for the highest-resolution oil immersion objectives because their optical properties (refractive index and flatness) are inferior to precision glass. They represent a specialized niche rather than a direct replacement for high-end glass products.

Further Analysis and Customization Options

To provide a deeper understanding of the market complexities and specific competitive dynamics, the Microscope Glass Cover Market report offers extensive options for customized analysis. Detailed segmentation studies can be conducted focusing on high-growth niche applications, such as the demand forecast for specialty coverslips used in advanced electrophysiology or microfluidic chip integration. This customization allows stakeholders, particularly manufacturers and investors, to fine-tune their strategic efforts and product development pipelines towards highly profitable sub-segments, moving beyond standard commodity market dynamics.

In-depth competitive benchmarking can be performed, specifically analyzing the manufacturing capabilities, supply chain robustness, and distribution agreements of the top 5 to 10 key players across different regions, focusing on their patented technologies for achieving ultra-flat surfaces or specialized coatings. A customized geographical breakdown can also provide granular data on consumption rates and regulatory impacts within specific high-potential countries, such as South Korea, Brazil, or the Nordic nations, offering localized market intelligence critical for expansion decisions and resource allocation.

Furthermore, forecasting models can be refined to incorporate scenario planning based on potential disruptions, such as the wider adoption of slide-free diagnostic technologies (e.g., advanced liquid biopsy systems) or fluctuations in the global silica and chemical raw material supply chains. By utilizing specialized proprietary datasets and expert interviews, customized reports provide actionable insights into future market trajectories, risk assessment, and partnership opportunities, making the research highly relevant to specific business needs and strategic planning horizons beyond the standard scope of the published market overview.

Microscope Glass Cover Manufacturing Challenges and Innovations

Manufacturing microscope glass covers presents unique challenges centered around achieving optical perfection and maintaining stringent dimensional consistency at industrial scales. The primary hurdle lies in the precise cutting and annealing of thin glass sheets (often less than 200 micrometers thick) without introducing microfractures, internal stress, or warping, which would significantly degrade image quality under high magnification. Maintaining cleanliness throughout the process is paramount; even microscopic dust particles can render a batch unusable for high-end research. Manufacturers must continuously invest in Class 100 or better cleanroom environments and sophisticated automated washing protocols to meet zero-defect standards required by advanced microscopy applications.

Innovation in manufacturing is focused on increasing throughput while simultaneously improving quality tolerances. One key technological area involves continuous glass drawing processes, which aim to produce glass ribbons of highly consistent thickness, minimizing the need for extensive post-production grinding. Automated edge finishing technologies, such as advanced laser cutting and highly controlled polishing, replace traditional mechanical methods, significantly reducing material waste and improving edge safety—a critical factor for laboratory personnel safety and compatibility with robotic handling systems. These process innovations are vital for meeting the soaring demand from automated high-throughput screening (HTS) laboratories.

Furthermore, the development of specialty glass compositions is an ongoing innovation challenge. For instance, manufacturers are working on glasses with tailored refractive indices that precisely match modern immersion oils and objectives, maximizing light transmission and resolution. Another area of focus is the industrial scale production of pre-coated coverslips (e.g., collagen, poly-D-lysine) that maintain stability and sterility over long shelf lives, streamlining complex cell culture protocols for end-users. Overcoming the technical difficulties associated with applying nanoscale functional coatings uniformly across vast quantities of thin glass surfaces represents a significant competitive differentiator in the specialized segment of the market.

Regulatory and Quality Standards Landscape

The Microscope Glass Cover Market operates within a framework of stringent regulatory and quality standards, primarily driven by their classification as essential laboratory consumables, often used in diagnostic procedures that directly impact patient care. Although generally not classified as high-risk medical devices, coverslips must comply with general device requirements pertaining to cleanliness, biocompatibility (if intended for clinical use), and sterility. Key regulatory bodies influencing the market include the U.S. FDA, the European Medicines Agency (EMA) through CE Mark requirements, and various national health authorities, particularly concerning coverslips that are packaged sterile or pre-treated for clinical sample mounting.

Quality management systems, such as ISO 9001 and ISO 13485 (for medical device manufacturing), are critical certifications that manufacturers must obtain to ensure consistency and traceability. For coverslips used in highly regulated environments like clinical pathology and drug quality control, adherence to Good Manufacturing Practices (GMP) is expected. These standards dictate precise protocols for raw material sourcing, production environment control, final product inspection, and packaging integrity. The increasing reliance on digital pathology necessitates compliance with additional optical standards, sometimes mirroring those required for camera lenses, specifically regarding flatness (DIN ISO 8255/1) and refractive index consistency.

The global push for standardization in clinical laboratories further tightens quality requirements. Standardized cover thickness, particularly the No. 1.5 standard (0.17 ± 0.02 mm), is universally accepted to ensure interoperability between slides prepared in different laboratories and examined using different microscope brands and objective lenses. Failure to meet these dimensional standards can introduce significant errors in quantitative image analysis, especially in volumetric or confocal studies. Consequently, quality control processes, including batch-to-batch consistency testing, are not just optional advantages but mandatory requirements for market access and credibility, particularly in lucrative Western markets and advanced research institutes.

Market Strategy and Pricing Analysis

Market strategies in the Microscope Glass Cover sector are bifurcated, addressing both the high-volume commodity segment and the high-value specialty segment. For standard soda-lime coverslips used in routine clinical diagnostics, the dominant strategy is cost leadership achieved through massive scale, efficient logistics, and optimized automated manufacturing processes, often leveraging low-cost production centers in Asia Pacific. Price competition in this segment is intense, making distribution efficiency and large-scale procurement contracts key determinants of success and market share.

Conversely, the strategy for specialized, premium coverslips (e.g., borosilicate No. 1.5H, coated polymer covers) focuses on differentiation. Manufacturers in this segment compete on technical performance, brand reputation, certification, and the ability to meet highly specific scientific requirements (e.g., ultra-low autofluorescence, specific surface treatments for neuronal culture). Pricing in this segment is significantly higher, reflecting the substantial R&D investment, specialized material costs, and reduced yield rates associated with precision manufacturing. Strategic partnerships with leading microscope manufacturers and major research consortia are crucial for maintaining premium positioning and capturing niche, high-margin opportunities.

Distribution strategy plays a pivotal role in pricing and market penetration. Large multinational scientific supply companies (e.g., Thermo Fisher, Avantor) utilize their expansive global sales channels and procurement influence to offer bundled deals (coverslips, slides, reagents), often locking in large institutional buyers with preferential pricing models. Smaller, specialty manufacturers often rely on direct sales or highly specialized technical distributors who can provide application support and target highly specific research laboratories, avoiding the intense price wars characteristic of the general consumables market. Effective inventory management and robust supply chain resilience are critical components of a successful market strategy, mitigating risks associated with supply volatility and ensuring timely delivery of these essential laboratory items.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager