Microsilica Powder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442452 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Microsilica Powder Market Size

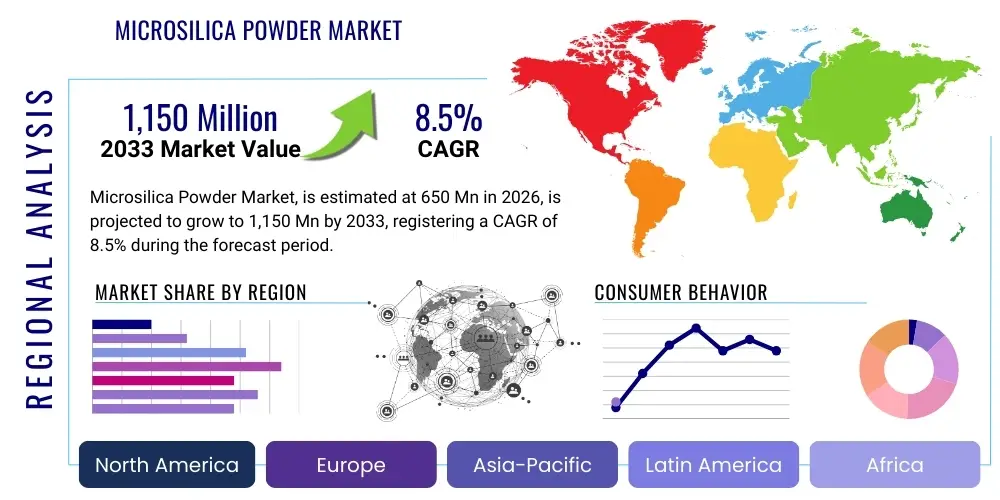

The Microsilica Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $650 Million USD in 2026 and is projected to reach $1,150 Million USD by the end of the forecast period in 2033.

Microsilica Powder Market introduction

The Microsilica Powder Market, also widely known as Silica Fume Market, centers around an ultrafine powder collected as a byproduct from silicon and ferrosilicon alloy production. This material is primarily valued for its highly pozzolanic properties, extremely small particle size, and high amorphous silicon dioxide content, typically exceeding 85%. Its unique physical and chemical characteristics make it indispensable in high-performance construction and specialized industrial applications.

Major applications of microsilica powder span across several heavy industries, notably in the production of high-strength and ultra-high-performance concrete (UHPC), which demands superior durability, reduced permeability, and enhanced structural integrity. Beyond construction, it is crucial in refractories, where it improves high-temperature resistance and thermal shock capabilities, and in polymers, elastomers, and specialty cements, acting as a high-performance filler or strengthening agent. The primary benefit of integrating microsilica is the significant enhancement of material properties, leading to longer service life and reduced maintenance costs for infrastructure projects globally.

Market growth is predominantly driven by the escalating global demand for sustainable and durable construction materials, particularly within rapidly developing economies in Asia Pacific and robust infrastructure refurbishment efforts in North America and Europe. Regulatory emphasis on environmentally friendly building practices further fuels the adoption of microsilica as a means to create materials with lower life-cycle environmental impact. Additionally, technological advancements in the optimization of microsilica grades (such as densified versus undensified forms) and improved processing efficiency contribute significantly to its market expansion across diverse industrial verticals.

Microsilica Powder Market Executive Summary

The Microsilica Powder Market is experiencing robust growth fueled by irreversible trends favoring high-performance materials in infrastructure and industrial sectors. Business trends indicate a strong move toward supply chain localization and increased capacity additions, particularly in regions where major ferrosilicon production occurs, minimizing transportation costs associated with this fine powder. Strategic partnerships between microsilica producers and large construction chemical companies are becoming commonplace, aimed at securing consistent supply for major infrastructure projects and developing specialized blended cement products. Furthermore, sustainability requirements are driving innovation toward utilizing this industrial byproduct effectively, positioning key players who can offer tailored, high-purity grades for niche refractory and polymer applications at a competitive advantage.

Regionally, the Asia Pacific market dominates both in consumption and production capacity, primarily due to massive urbanization, aggressive infrastructure development programs in China and India, and significant public investment in civil engineering works such as bridges, dams, and high-rise buildings. North America and Europe demonstrate mature demand, characterized by high adoption rates of specialized concrete (e.g., self-consolidating concrete and UHPC) in bridge deck rehabilitation and nuclear containment structures, focusing intensely on material longevity and resilience. Latin America and the Middle East and Africa (MEA) are emerging as high-growth potential regions, underpinned by large-scale energy projects and ambitious national development visions requiring durable construction solutions in challenging environmental conditions.

Segment trends reveal that the construction application segment remains the largest volume consumer, driving the overall market trajectory. Within construction, the demand for densified microsilica is outpacing undensified powder, primarily due to logistics efficiency and easier handling at construction sites. The refractory segment, while smaller in volume, offers higher profit margins, driven by the specialized needs of the steel, cement, and glass manufacturing industries for high-purity, low-iron content microsilica grades. Continuous research into utilizing microsilica in specialty polymers and coatings promises future diversification and resilience against cyclical downturns in the general construction sector, ensuring long-term market stability and growth.

AI Impact Analysis on Microsilica Powder Market

User queries regarding AI's influence on the Microsilica Powder market frequently revolve around how AI can optimize production processes, enhance material quality control, and revolutionize application methods in construction. Key concerns often include the potential for AI-driven predictive maintenance to reduce costly furnace downtime in ferrosilicon plants (where microsilica is generated), and the use of machine learning algorithms to optimize concrete mix designs, ensuring precise inclusion rates of microsilica for targeted strength and durability outcomes. Users are keen to understand if AI can accelerate the transition towards fully automated quality assurance, detecting impurities or variations in particle distribution faster than traditional lab testing, thereby ensuring consistent product performance crucial for high-specification projects.

The core theme emerging from these inquiries is the expectation that AI and associated digital technologies will fundamentally transform efficiency across the microsilica value chain. Specifically, AI is anticipated to boost operational efficiency in the highly energy-intensive production of the primary product (ferrosilicon), thus stabilizing the supply and cost of the byproduct, microsilica. Furthermore, in the downstream construction sector, AI-driven digital twins and structural health monitoring systems will increasingly rely on data generated from high-performance materials incorporating microsilica, necessitating stricter specification adherence and traceable material sourcing, which AI can manage.

Finally, there is significant interest in how AI can inform R&D efforts. Machine learning models can analyze vast datasets concerning cement hydration kinetics, predicting the optimal performance of novel microsilica-cement blends under various environmental stresses (e.g., extreme temperatures or chloride exposure). This capability drastically shortens the development cycle for new high-performance concrete formulations, accelerating the market's ability to meet increasingly stringent engineering standards globally.

- AI-driven Predictive Maintenance: Optimizing ferrosilicon furnace operations to ensure stable, cost-effective microsilica byproduct supply.

- Quality Control Automation: Utilizing computer vision and machine learning for real-time particle size analysis and impurity detection in microsilica powder.

- Optimized Mix Design: Employing algorithms to precisely calculate optimal microsilica inclusion rates in concrete for specific performance requirements (e.g., strength, permeability).

- Supply Chain Analytics: Enhancing traceability and forecasting demand for specialized microsilica grades based on regional construction project pipelines.

- R&D Acceleration: Using machine learning to model the performance characteristics of new microsilica-based composites under diverse environmental conditions.

- Digital Twin Integration: Linking microsilica material data into construction digital twin models for enhanced structural performance monitoring and lifecycle prediction.

DRO & Impact Forces Of Microsilica Powder Market

The Microsilica Powder Market's trajectory is determined by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. Key drivers include the global mandate for durable infrastructure, especially in coastal and seismically active regions, coupled with the rising use of high-strength concrete in mega-projects such as high-speed rail networks and expansive port facilities. The material’s ability to significantly reduce concrete permeability and enhance resistance to alkali-silica reaction (ASR) makes it a preferred additive, especially when facing stringent governmental infrastructure specifications focused on a 100-year design life. This foundational demand ensures continuous growth regardless of short-term economic fluctuations in the general housing sector.

However, the market faces significant restraints, primarily revolving around the supply-side dependencies and logistical challenges. Microsilica is a byproduct; therefore, its supply volume and stability are inherently linked to the primary production cycles and output of the ferrosilicon and silicon metal industries. Fluctuations in these primary markets, coupled with the high cost associated with transporting, handling, and storing this ultra-fine powder—especially the required densification process to improve handling—pose substantial logistical and financial hurdles. Furthermore, competition from alternative high-performance pozzolans, such as ground granulated blast furnace slag (GGBS) and fly ash (though often used complementarily), can occasionally limit price elasticity and market penetration in less critical applications.

Opportunities for market growth are abundant, particularly in emerging applications such as geopolymers, advanced refractory materials for renewable energy production (e.g., solar panel manufacturing), and specialized industrial flooring and repair mortars. The drive toward circular economy models strongly favors microsilica utilization, turning an industrial waste product into a high-value engineering material, attracting supportive regulatory frameworks. Impact forces such as rapid urbanization in APAC, stringent environmental regulations necessitating material recycling, and continuous investment in materials science R&D aimed at maximizing cement replacement potential will amplify market momentum throughout the forecast period, pushing the boundaries of material performance and application diversity.

Segmentation Analysis

The Microsilica Powder market is systematically segmented based on Grade, Application, and geographic region, allowing for detailed market analysis and strategic planning. The segmentation by Grade—primarily into Densified and Undensified—reflects the differing requirements for handling efficiency versus raw material properties, influencing both pricing and logistics structures. Densified microsilica is highly preferred by large-scale construction projects and ready-mix concrete suppliers due to its reduced volume and easier handling, despite a slightly higher cost. Undensified microsilica, being the rawest form, often serves specific industrial applications like oil well cementing or certain refractory mixes where homogeneity in liquid suspension is prioritized.

Segmentation by Application reveals the primary end-use sectors driving demand. The construction sector, including high-performance concrete and specialty mortars, accounts for the dominant share due to the widespread adoption in civil engineering and commercial construction. However, the Refractories segment represents a high-value niche, where microsilica acts as a bonding agent and anti-washout additive, significantly improving the performance of monolithic refractories used in demanding environments like kilns and furnaces. Other vital segments include polymers and elastomers, which utilize microsilica for enhanced abrasion resistance and thermal stability, and specialty grouts, especially for offshore and geotechnical stabilization works.

Understanding these segments is crucial for market stakeholders, as growth rates and demand drivers vary significantly across end-use industries. For instance, the Construction segment’s demand is often linked to governmental spending on infrastructure, whereas the Refractories segment’s consumption correlates more closely with steel and cement production levels globally. Producers are increasingly tailoring product specifications, such as varying carbon content or purity levels, to optimally serve these distinct application requirements, moving away from a one-size-fits-all approach to maximize market penetration and profitability.

- Grade:

- Densified Microsilica

- Undensified Microsilica

- Application:

- High-Performance Concrete (HPC)

- Refractory and Ceramics

- Oil, Gas, and Geothermal Wells (Cementing)

- Elastomers and Polymers

- Specialty Grouts and Mortars

- Others (e.g., Chemical additives, Wastewater Treatment)

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Microsilica Powder Market

The value chain for the Microsilica Powder Market begins with the upstream processes, centered entirely on the production of silicon metal or ferrosilicon alloys in submerged arc furnaces. Microsilica is collected as an incidental byproduct during the condensation of silicon monoxide fumes generated in these high-temperature smelting operations. Critical factors in the upstream analysis include the efficiency of furnace operations, the quality of quartz and carbon input materials, and the effectiveness of baghouse filtration systems used for collecting the ultrafine dust. Supply stability is highly sensitive to the capacity utilization and operational consistency of these primary metallurgical facilities, creating a bottleneck that can influence global microsilica availability and pricing.

The midstream phase involves the processing of the collected microsilica. Since the raw, undensified material is extremely light and difficult to handle, most producers engage in densification—a key value-addition step. This processing involves mechanical compaction or pelletization to reduce volume, significantly lowering shipping costs and improving handling characteristics for end-users. Quality testing, focusing on parameters such as SiO2 content, loss on ignition (LOI), and particle size distribution, is crucial at this stage to certify the product for high-specification applications like UHPC or high-purity refractories. Direct and indirect distribution channels then move the product from processing plants to final consumers.

The downstream analysis focuses on the end-user applications. Direct sales often target large-volume consumers, such as major ready-mix concrete companies, specialized refractory manufacturers, and multinational oilfield service firms requiring customized batches. Indirect channels involve distributors, agents, and construction chemical blenders who incorporate microsilica into proprietary blends (e.g., concrete admixtures or repair mortars) before selling to smaller construction sites or industrial buyers. The final stage involves the application, where the value of microsilica is realized through enhanced material durability, corrosion resistance, and structural longevity, ultimately benefiting infrastructure owners and civil engineers.

Microsilica Powder Market Potential Customers

Potential customers for Microsilica Powder are highly diversified across heavy industries, but they are primarily concentrated in sectors prioritizing material performance, durability, and resilience over sheer volume. The largest segment of buyers are Ready-Mix Concrete Producers and Precast Concrete Manufacturers. These customers utilize microsilica to meet stringent engineering specifications for major public works, including transportation infrastructure (bridges, tunnels), marine structures (piers, jetties), and high-rise commercial buildings that require high-strength, low-permeability concrete to resist environmental degradation and seismic forces. Their purchasing decisions are driven by consistent supply, certified quality (meeting standards like ASTM C1240), and logistical efficiency, favoring densified grades.

Another crucial customer group includes Refractory Manufacturers, particularly those serving the steel, aluminum, glass, and cement industries. These buyers require specific, often low-iron and high-purity grades of microsilica to improve the flow, packing density, and hot strength of monolithic refractory casts and gunning mixes used to line high-temperature process equipment. For this segment, the product’s ability to minimize rebound loss during application and enhance thermal shock resistance is paramount. Furthermore, Oilfield Service Companies constitute a specialized high-value customer base, utilizing microsilica in well cementing operations to achieve high compressive strength and reduce permeability in deep, high-pressure, high-temperature (HPHT) environments, ensuring well integrity and longevity.

Smaller, yet rapidly growing customer segments include specialty chemical formulators and polymer compounders. These buyers incorporate microsilica as a functional filler to enhance the mechanical properties, dimensional stability, and fire resistance of specialized products such as industrial coatings, rubber products, and advanced composite materials. Geotechnical contractors and firms specializing in structural repair also represent key buyers, using microsilica-enhanced grouts for soil stabilization, crack injection, and precision anchoring where superior flow characteristics and rapid strength development are necessary.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $650 Million USD |

| Market Forecast in 2033 | $1,150 Million USD |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Elkem ASA, Wacker Chemie AG, Ferroglobe PLC, SIKA AG, KCC Corporation, FINNFJORD AS, Dow Corning (Xiameter), BASF SE, Microsilica LLC, CeraChem Private Limited, Norchem Inc., Silkem d.o.o., CHRYSO SAS (Saint-Gobain), China Silicon Corp. Ltd., Qinghai Lianda Chemical Co., Wuxi Xinhuizi Chemical Co. Ltd., US Silica Company, RESCON Micro Silica Pvt. Ltd., Applied Material Solutions, Inc., TRAX Industrial Chemicals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Microsilica Powder Market Key Technology Landscape

The technology landscape surrounding the Microsilica Powder market is primarily focused on optimizing its recovery, processing, and integration into end-use materials. The foundational technology remains the high-efficiency filtration systems, such as advanced baghouses, used to capture the ultrafine fume (microsilica) produced during the smelting of silicon alloys. Continuous process control monitoring, often involving sensors and automated dust collection systems, is crucial for maximizing yield and maintaining a consistent chemical composition, particularly the amorphous silica content which dictates the material's pozzolanic activity. Innovations in furnace operation, including oxygen enrichment and improved electrode management, indirectly enhance microsilica yield and purity.

In terms of processing technology, densification techniques are paramount. This involves advanced mixers, compactors, and pelletizing equipment designed to increase the bulk density from as low as 150 kg/m³ for raw material up to 700 kg/m³ for densified product. Technological advancements here focus on achieving consistent particle packing while minimizing energy consumption and ensuring the densified material breaks down readily when introduced into cementitious mixes. Specialized blending and quality control technologies, including laser diffraction particle sizing and X-ray fluorescence (XRF) analysis, are utilized by leading players to guarantee product specifications, particularly for demanding applications like nuclear containment structures.

Furthermore, application technology development significantly impacts market adoption. This includes the development of highly efficient admixture systems that facilitate the uniform dispersion of microsilica in concrete, even at high inclusion rates, preventing clumping and maximizing the material’s performance benefits. In refractory applications, advancements in binder technology, specifically focusing on low-cement castables (LCCs) and ultra-low-cement castables (ULCCs) that utilize microsilica as a critical component, allow for superior high-temperature stability and reduced porosity, extending the service life of industrial furnaces and heat treatment equipment.

Regional Highlights

The global consumption and production landscape of microsilica powder is heavily stratified, reflecting variations in industrial infrastructure, construction activity levels, and regulatory frameworks concerning high-performance materials. Each major geographic region presents unique demand drivers and competitive dynamics, influencing global pricing and supply stability.

- North America: Characterized by mature demand and high-value consumption, primarily driven by infrastructure rehabilitation projects (e.g., bridge deck repairs, road concrete resurfacing) focused on maximizing durability against severe freeze-thaw cycles and chloride attack. The U.S. and Canada are significant consumers of high-quality, certified microsilica, particularly in the oil and gas sector for HPHT well cementing and in highly specialized defense and nuclear construction. Stringent quality standards (ASTM and AASHTO) ensure consistent adoption rates, driving demand for premium, densified grades.

- Europe: Europe represents a significant market sustained by strong regulatory pushes towards sustainable building practices and long-life infrastructure. Demand is high in Germany, France, and the Nordic countries, focusing on specialized concrete for high-speed rail, tunnels, and marine environments. The presence of major ferrosilicon producers ensures a localized supply, although high energy costs impact domestic production competitiveness. European consumption is also strongly linked to the automotive and aerospace industries for advanced materials research.

- Asia Pacific (APAC): APAC is the undisputed leader in volume consumption and capacity expansion, largely powered by unprecedented urbanization and public investment in mega-infrastructure projects in China and India. The region's demand is characterized by rapid adoption in massive civil engineering projects (dams, coastal defenses, high-rise buildings). While regional production capacity is high, quality variations exist, leading to segmented markets where high-purity grades are often imported for specific refractory and high-end construction applications.

- Latin America (LATAM): Growth in LATAM is driven by large-scale mining, energy (oil & gas), and port development projects, particularly in Brazil and Mexico. The market is developing, with increased awareness of microsilica's benefits in tropical and aggressive environments. Adoption is gradually increasing as governments implement stricter quality control measures for publicly funded infrastructure, moving away from conventional cement-based materials to those offering better long-term structural integrity.

- Middle East and Africa (MEA): This region exhibits immense growth potential, fueled by ambitious national development plans (e.g., Saudi Vision 2030, UAE infrastructure programs). Demand is concentrated in regions requiring extreme durability and resistance to harsh desert conditions, high temperatures, and high chloride content (coastal projects). Microsilica is essential for critical projects like desalination plants, high-rise towers, and specialized concrete required for deep offshore oil wells. The region relies heavily on imports but is witnessing initial domestic production investments linked to local metallurgical industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Microsilica Powder Market.- Elkem ASA

- Wacker Chemie AG

- Ferroglobe PLC

- SIKA AG

- KCC Corporation

- FINNFJORD AS

- Dow Corning (Xiameter)

- BASF SE

- Microsilica LLC

- CeraChem Private Limited

- Norchem Inc.

- Silkem d.o.o.

- CHRYSO SAS (Saint-Gobain)

- China Silicon Corp. Ltd.

- Qinghai Lianda Chemical Co.

- Wuxi Xinhuizi Chemical Co. Ltd.

- US Silica Company

- RESCON Micro Silica Pvt. Ltd.

- Applied Material Solutions, Inc.

- TRAX Industrial Chemicals

Frequently Asked Questions

Analyze common user questions about the Microsilica Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of microsilica in concrete?

The primary function of microsilica in concrete is two-fold: it acts as a highly reactive pozzolan, consuming calcium hydroxide to form additional binder (C-S-H gel), and its ultrafine particles fill microscopic voids, resulting in dramatically reduced permeability, increased compressive strength, and enhanced durability against chemical attacks and abrasion.

Is microsilica supply stable, given that it is a byproduct?

Microsilica supply stability is inherently linked to the global production cycles of ferrosilicon and silicon metal. While supply volumes can fluctuate with metallurgical industry output, long-term contracts and strategic sourcing partnerships with major producers (like Elkem and Ferroglobe) help large consumers mitigate instability and ensure a reliable supply chain.

What is the difference between densified and undensified microsilica?

Undensified (raw) microsilica is the immediate, very light powder collected from furnace fumes, posing handling challenges. Densified microsilica has been mechanically compacted to significantly increase its bulk density, making it easier and more cost-effective to transport, store, and batch at construction sites, making it the preferred commercial form.

Which application segment drives the highest volume demand for microsilica?

The High-Performance Concrete (HPC) and civil infrastructure application segment drives the highest volume demand for microsilica globally. This is due to increasing mandatory specifications for durable concrete in major infrastructure projects, including bridges, marine structures, and specialized industrial flooring.

What regulatory standards govern the quality of microsilica powder?

Key regulatory standards include ASTM C1240 in North America and EN 13263 in Europe, which specify requirements for silica fume used as a mineral admixture in hydraulic-cement concrete and mortar. Compliance with these standards is mandatory for acceptance in high-specification public and private projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager