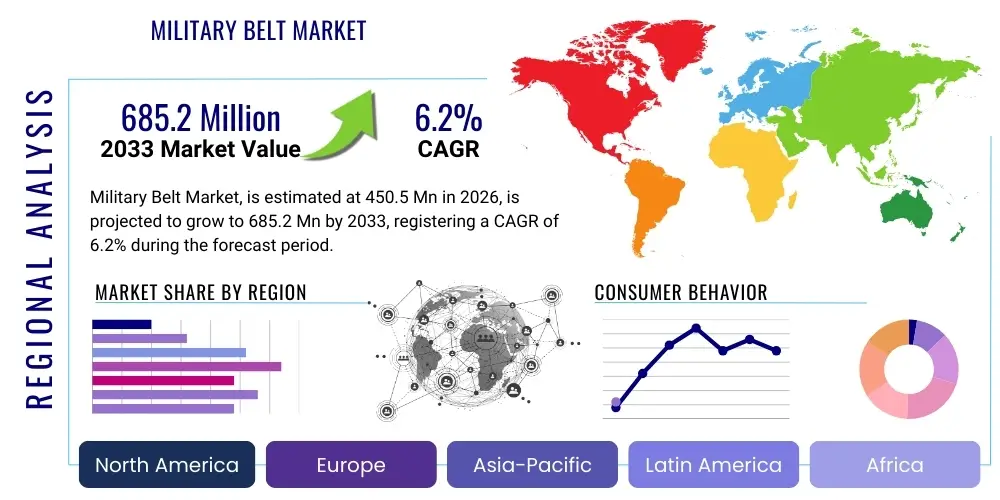

Military Belt Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441972 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Military Belt Market Size

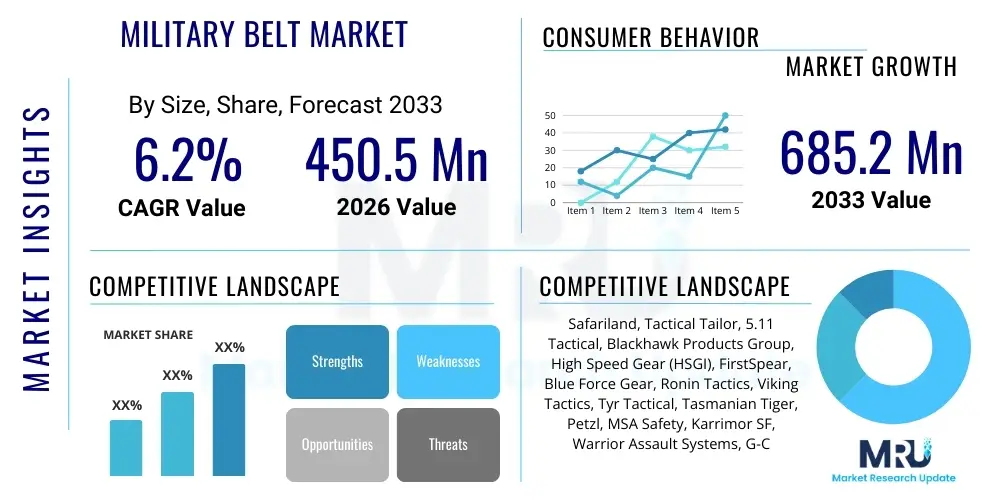

The Military Belt Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 685.2 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally underpinned by the continuous drive among global defense forces to modernize their soldier systems, focusing specifically on enhanced load-bearing capabilities, improved ergonomic design, and integration with modular equipment systems like MOLLE/PALS. The increasing procurement budgets dedicated to individual soldier gear, coupled with stringent requirements for high durability and performance in extreme operational environments, are key factors influencing this robust market expansion.

The valuation reflects not just the sheer volume of procurement but also the increasing average selling price (ASP) of advanced tactical belts, which often incorporate specialized materials such as high-strength nylon webbing, proprietary polymer blends, and quick-release hardware certified to withstand high loads. Demand is particularly strong in NATO countries and rapidly modernizing defense sectors across the Asia-Pacific, where older, less functional equipment is systematically being replaced by state-of-the-art modular belts that serve as critical components of the soldier's overall load carriage system. Furthermore, the specialized segments, including ballistic-rated belts and those designed for high-altitude or maritime operations, command premium pricing, further contributing to the overall market size growth.

Military Belt Market introduction

The Military Belt Market encompasses the design, manufacture, and distribution of specialized belts engineered for use by armed forces, law enforcement, and paramilitary organizations. These products are far removed from standard commercial belts, functioning instead as foundational components of the tactical load carriage system, designed to integrate seamlessly with body armor, tactical vests, and drop-leg platforms. Key products include tactical belts, duty belts, rigger belts, and modular load-bearing belts (often utilizing the MOLLE system). The primary objective of these belts is to securely and efficiently distribute essential combat gear, ammunition pouches, sidearms, and communication devices, ensuring quick access and minimal fatigue for the operator during extended operational periods.

Major applications span diverse operational scenarios, including conventional infantry deployment, special operations raids, maritime security, and rapid urban policing actions. The benefits derived from advanced military belts are centered on enhanced operational efficiency, superior ergonomics, and increased survivability. Modern belts feature quick-release buckles (such as genuine Cobra buckles) for rapid jettisoning in emergency situations, superior tensile strength to handle heavy loads without deformation, and non-reflective materials for stealth and camouflage. Driving factors propelling this market include global military modernization programs, escalating geopolitical tensions necessitating sustained readiness, and technological advancements in material science that allow for lighter yet stronger equipment, directly addressing soldier feedback regarding weight reduction and comfort.

Military Belt Market Executive Summary

The Military Belt Market is characterized by robust growth, driven primarily by continuous investments in soldier modernization and the persistent global demand for highly durable, modular load carriage solutions. Business trends indicate a strong shift toward highly customized and integrated systems, moving away from standalone belts to components that interact directly with exoskeletons and advanced personal protective equipment (PPE). Leading manufacturers are focusing heavily on intellectual property protection related to quick-release mechanisms and proprietary high-tenacity materials. Furthermore, there is a pronounced emphasis on supply chain resilience, given the specialized nature of materials sourcing, particularly for components requiring Mil-Spec certifications, which mandates stringent quality control processes and traceability for defense contractors.

Regionally, North America maintains market dominance due to massive defense expenditures and the presence of globally recognized defense contractors and innovative gear manufacturers. However, the Asia Pacific region is demonstrating the highest growth velocity, fueled by the rapid military expansion and technological acquisition strategies of countries like China, India, and South Korea, which are increasingly replacing outdated webbing with advanced tactical systems. Segment trends highlight the Load-Bearing Belt segment (incorporating MOLLE systems) as the fastest growing, reflecting the universal necessity for customization and flexibility in mission profiles. Concurrently, the Nylon Webbing material segment remains dominant due to its cost-effectiveness, strength-to-weight ratio, and proven durability, though high-performance alternatives like specialized polymer composites are gaining traction, particularly for lightweight requirements in special forces applications.

AI Impact Analysis on Military Belt Market

Common user and industry questions concerning AI integration often revolve around how artificial intelligence can optimize the design process, predict material failure, and integrate belts into broader soldier sensor networks. Key themes include the potential for AI algorithms to design ergonomic load distributions specific to individual soldier biometrics, optimizing comfort and reducing long-term musculoskeletal strain. Users also express interest in predictive maintenance capabilities, where embedded micro-sensors within the belt materials, monitored by AI, could alert commanders to potential structural weaknesses or stress points before catastrophic equipment failure occurs in the field. The overarching expectation is that AI will transition the military belt from a passive equipment holder to an active, smart component of the soldier's connected battlefield system, enhancing both safety and mission effectiveness through real-time data analysis.

- AI-Assisted Design Optimization: Utilizing generative design algorithms to create anatomically optimized belt contours and material layering, minimizing hot spots and maximizing load distribution efficiency based on simulation data.

- Predictive Maintenance Integration: Deploying embedded micro-sensors linked to AI systems to monitor material fatigue, stress accumulation, and imminent failure points in webbing, stitching, and hardware.

- Smart Load Management: AI algorithms analyzing real-time weight distribution and kinetic data from the belt system to provide immediate feedback to the soldier, optimizing posture and reducing energy expenditure.

- Automated Quality Control: Employing computer vision and machine learning during manufacturing to detect microscopic flaws in specialized webbing and stitching that are undetectable through conventional human inspection methods.

- Integration with Wearable Computing: Serving as a stable platform for mounting AI-enabled modules for power distribution or connectivity hubs for other soldier systems (e.g., communications or GPS).

- Supply Chain Optimization: Using AI to forecast material requirements, manage inventory of specialized buckles and nylon webbing, and secure sourcing amidst geopolitical uncertainties, ensuring consistent production.

DRO & Impact Forces Of Military Belt Market

The Military Belt Market is primarily driven by global military modernization initiatives focused on soldier system lethality and survivability, coupled with rising global defense expenditures aimed at maintaining operational readiness in response to escalating geopolitical conflicts. These drivers create a sustained demand for lightweight, high-performance, and modular load carriage solutions. However, the market faces significant restraints, notably the highly stringent defense procurement regulations and lengthy certification cycles (Mil-Spec standards), which increase development costs and limit the speed of innovation adoption. Furthermore, reliance on specific patented technologies for quick-release systems (e.g., Cobra buckles) creates potential supply chain bottlenecks and high licensing costs, impacting smaller manufacturers. The key opportunity lies in exploiting advancements in lightweight materials (polymer composites, carbon fiber integration) and further integrating tactical belts with networked soldier systems (smart uniforms), positioning them as vital data and power conduits, which offers substantial avenues for value addition and differentiated product offerings in specialized segments.

Impact forces within the military belt sector are intense, manifesting across competitive dynamics and technological substitution risks. The threat of new entrants is moderate; while manufacturing webbing is relatively straightforward, achieving the requisite Mil-Spec certifications and establishing trust with major government procurement agencies presents a significant barrier to entry. Supplier bargaining power is high, especially concerning proprietary hardware like certified quick-release buckles and specialized ballistic-rated materials, which are often sourced from a limited number of specialized vendors worldwide. Buyer bargaining power (the defense ministries) is exceptionally high due to large volume orders and the stringent requirements for customization and long-term support, leading to highly competitive bidding processes that pressure margins. The threat of substitutes is relatively low, as belts remain a core, indispensable element of current load carriage doctrine, although technological evolution in integrated tactical vests or future exoskeleton technologies could partially displace the belt's load-bearing function over the very long term.

Market stability is constantly influenced by budgetary cycles and shifts in military doctrine. A major driver is the increasing complexity of battlefield environments, demanding equipment that performs optimally across highly variable conditions, from arid deserts to dense jungle humidity, driving innovation in material treatments (e.g., anti-microbial and IR-reduction coatings). Conversely, economic downturns or shifts in government priorities can lead to delayed procurement cycles or budget freezes, immediately restraining market growth. Strategic opportunities exist in developing dual-use technologies, catering not only to the specialized military sector but also expanding into the professional law enforcement and high-end outdoor tactical gear markets, thereby diversifying revenue streams and achieving economies of scale in manufacturing specialized hardware and webbing.

Segmentation Analysis

The Military Belt Market is comprehensively segmented based on product type, material composition, application, and distribution channel, providing a detailed framework for understanding market dynamics and targeted procurement strategies. Product segmentation delineates the functional specialization of the belts, ranging from basic utility rigger belts to highly complex modular load-bearing systems. Material segmentation reflects the ongoing industry pursuit of optimal strength-to-weight ratios and durability against abrasion, moisture, and chemical exposure, encompassing traditional nylon webbing and advanced technical textiles. Application segmentation highlights the diverse end-uses, from daily duty wear to mission-critical tactical deployment. These segments are critical for manufacturers to align their product development with specific military and defense sector requirements, ensuring compliance and maximizing operational utility in diverse scenarios.

- By Product Type:

- Rigger Belts (Utility and Safety focused)

- Duty Belts (Standard law enforcement/military use)

- Modular Load-Bearing Belts (MOLLE/PALS system integration)

- Padded Combat Belts (Designed for heavy loads and comfort)

- Specialized Tactical Belts (e.g., Quick-release, Rescue/Rappel certified)

- By Material:

- Nylon Webbing (Dominant segment, known for durability)

- Polymer Composites (Used for lightweight and stiff construction)

- Leather (Primarily for traditional duty belts)

- Other High-Performance Fabrics (e.g., Cordura, Proprietary blends)

- By Application:

- Army/Ground Forces

- Navy/Maritime Forces

- Air Force

- Special Operations Forces (SOF)

- Law Enforcement & Homeland Security

- By Distribution Channel:

- Direct Government Procurement (G2G/B2G contracts)

- Defense Distributors & Agents

- Retail & E-commerce (Niche market for non-Mil-Spec/training gear)

Value Chain Analysis For Military Belt Market

The value chain for the Military Belt Market is highly specialized, beginning with the upstream analysis dominated by specialized raw material suppliers. This phase involves sourcing high-tensile synthetic fibers (nylon, polyester, specialized aramid fibers) and proprietary metal components (aluminum, steel alloys) necessary for high-strength webbing and certified quick-release buckles. A critical dependency exists on a limited number of suppliers capable of meeting stringent defense specifications (Mil-Spec, NATO standards) for tensile strength, IR signature reduction, and corrosion resistance. Manufacturers then engage in precision textile weaving, heat treatment, stitching, and assembly, often requiring ISO or equivalent defense quality certifications. Vertical integration across the manufacturing process, particularly regarding buckle and hardware fabrication, offers significant competitive advantages by ensuring control over quality and intellectual property for quick-release mechanisms, which is essential for specialized tactical products.

The downstream analysis focuses heavily on efficient and compliant distribution. For large-scale military procurement, the primary distribution channel is Direct Government Procurement (B2G contracts), often facilitated through established defense contractors who act as prime vendors. This channel necessitates rigorous compliance with lengthy tendering processes and often requires local manufacturing or partnership agreements (offset obligations) in the recipient country. Indirect distribution occurs through authorized defense distributors and niche tactical gear retailers who cater to smaller units, private security details, or professional law enforcement agencies not covered under large national contracts. Effective channel management requires manufacturers to maintain excellent relationships with both procurement agencies and reliable, compliant logistical partners who can handle ITAR and similar regulatory burdens associated with defense equipment export. The integrity of the distribution network is crucial for maintaining product authenticity and preventing the infiltration of non-certified or counterfeit tactical gear into sensitive supply chains.

Military Belt Market Potential Customers

The primary customers in the Military Belt Market are national defense ministries and departments of homeland security globally, representing the highest volume and value procurement segment. These end-users demand products that adhere strictly to performance specifications and interoperability standards (e.g., integration with existing modular systems like MOLLE). The largest customer segments include the standing armies of major military powers such as the United States (Department of Defense), NATO member countries (through coordinated purchasing programs), and rapidly modernizing armed forces in the Asia-Pacific (e.g., India, Australia, Japan). Procurement decisions are fundamentally driven by the need for enhanced soldier lethality, improved ergonomic support during sustained operations, and compliance with updated soldier system modernization objectives, ensuring the belts are integral parts of a cohesive tactical uniform system.

A secondary, yet significant, customer base includes specialized paramilitary organizations, border control agencies, and elite tactical police units (SWAT, Gendarmerie). These groups prioritize specific functional requirements, such as rapid adjustability, secure weapon retention (duty belts), and specialized features for rescue or rappelling operations, often leading to demand for premium, custom-engineered products. Furthermore, the burgeoning private military and security contractor (PMSC) industry represents a growing commercial segment, requiring high-quality, professional-grade tactical belts that mirror military specifications but often operate outside strict government procurement protocols, focusing on reliability and immediate availability. Strategic marketing efforts must be tailored to address the distinct acquisition cycles, budget constraints, and technical specifications mandated by each of these varied customer groups, ranging from multi-year defense contracts to small-batch commercial purchases.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 685.2 Million |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Safariland, Tactical Tailor, 5.11 Tactical, Blackhawk Products Group, High Speed Gear (HSGI), FirstSpear, Blue Force Gear, Ronin Tactics, Viking Tactics, Tyr Tactical, Tasmanian Tiger, Petzl, MSA Safety, Karrimor SF, Warrior Assault Systems, G-Code Holsters, Maxpedition, Kitanica, Raven Concealment Systems, Crye Precision. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Military Belt Market Key Technology Landscape

The technological landscape of the Military Belt Market is defined by continuous innovation across three main areas: materials science, hardware mechanism design, and integration capabilities. In material science, the focus is on utilizing high-performance textiles such as mil-spec nylon webbing with enhanced breaking strength, often coupled with treatments for chemical resistance, water repellency, and, critically, infrared (IR) signature reduction to minimize detection under night vision devices. A key technological advancement involves the layering and stitching techniques, moving towards laser-cut laminate systems that reduce weight, increase modularity (PALS/MOLLE slots), and improve overall stiffness without compromising comfort. This shift ensures the belt maintains its structural integrity and load-bearing capacity even under extreme tactical stress, distinguishing it markedly from non-military grade equipment.

Hardware technology is primarily driven by the mandatory requirement for rapid, fail-safe operation. The ubiquitous quick-release buckles, most notably the patented Cobra buckle variants, represent the high standard for load capacity and swift emergency jettison. Innovation in this area centers on reducing the weight of these metal hardware components by substituting aluminum alloys or advanced polymers while maintaining the full load rating. Furthermore, technological progress includes integrated inner/outer belt systems (Velcro or hook-and-loop secured) that allow the tactical belt to be quickly donned over or integrated with a soft duty belt, enhancing stability and preventing shifting during dynamic movement, which is essential for ensuring fast access to mission-critical equipment mounted on the belt platform.

Finally, the concept of the 'smart belt' is emerging, driven by sensor integration and connectivity. Although still nascent, this technology involves embedding micro-sensors for physiological monitoring (e.g., heart rate, load strain) and integrating small power conduits to supply electricity to belt-mounted electronics, such as communication devices or advanced sighting systems. This integration transforms the belt from a simple load carrier into a central component of the soldier's networked system. The future technology landscape will likely see military belts adopting more sophisticated load leveling and suspension technologies, potentially integrating with lightweight exoskeleton elements to further reduce the physical burden on the operator during prolonged deployments and demanding combat scenarios.

Regional Highlights

- North America (Dominant Market Share): The North American market, led by the United States, commands the largest share due to unparalleled defense spending, continuous equipment modernization programs (such as the Soldier Protection System initiatives), and the high concentration of key manufacturers and technological innovators. Procurement is characterized by high volume, stringent Mil-Spec requirements, and a preference for proprietary, certified hardware, driving both market value and technological complexity. Canada also contributes significantly through its specialized tactical unit requirements and participation in NATO standardization efforts, focusing on extremely durable, cold-weather compatible gear.

- Europe (Mature Market with High Specialization): Europe represents a mature market with significant demand arising from NATO countries and domestic defense initiatives aimed at interoperability. Countries such as the UK, Germany, and France are prominent buyers, focusing heavily on integrating military belts with existing body armor systems and adherence to specific national and NATO standards (STANAGs). The region is highly focused on quality, lightweight design, and ecological compliance (REACH regulations), driving specialized product development and fostering niche high-end manufacturers catering specifically to Special Operations Forces (SOF).

- Asia Pacific (Fastest Growing Market): The APAC region is projected to exhibit the highest CAGR, driven by escalating regional tensions, border disputes, and the widespread modernization of armies across India, China, and Southeast Asian nations. This growth is characterized by large-scale replacement of older, textile-based webbing with modern, polymer-composite load-bearing systems. While price sensitivity exists in some sub-regions, countries like Australia and Japan demand equipment on par with NATO standards, accelerating the adoption of premium, modular tactical belts and stimulating localized manufacturing and technology transfer initiatives.

- Middle East and Africa (MEA) (Dependent on Geopolitical Stability): The MEA market is highly dynamic and volatile, with demand often spiking based on regional conflicts and internal security threats. Procurement is heavily reliant on defense contracts with Western nations and requires equipment optimized for arid, high-heat environments. Key buyers include Saudi Arabia, UAE, and Israel, which invest heavily in specialized tactical gear for counter-terrorism and border security operations. The African market is characterized by varied purchasing power, often seeking durable, cost-effective solutions for infantry and internal security forces.

- Latin America (Steady, Focused Growth): The Latin American market shows stable, focused growth, primarily driven by investments in internal security and counter-narcotics operations. Demand is centered around reliable duty belts and professional-grade tactical gear for specialized police forces and small, well-equipped rapid reaction military units. Brazil and Mexico are the largest spenders in this region, focusing on equipment that balances durability and tactical functionality in complex urban and jungle environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Military Belt Market.- Safariland

- Tactical Tailor

- 5.11 Tactical

- Blackhawk Products Group

- High Speed Gear (HSGI)

- FirstSpear

- Blue Force Gear

- Ronin Tactics

- Viking Tactics

- Tyr Tactical

- Tasmanian Tiger

- Petzl (Focus on specialized hardware/rescue aspects)

- MSA Safety

- Karrimor SF

- Warrior Assault Systems

- G-Code Holsters

- Maxpedition

- Kitanica

- Raven Concealment Systems

- Crye Precision

Frequently Asked Questions

Analyze common user questions about the Military Belt market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Rigger Belt and a Modular Load-Bearing Belt?

A Rigger Belt is fundamentally designed for emergency safety, used primarily for securing an individual, rappelling, or extraction, emphasizing robust hardware and high tensile strength. A Modular Load-Bearing Belt (LBB) is engineered primarily for carrying equipment (pouches, holsters) using systems like MOLLE, focusing on stability, distribution of weight, and seamless integration with tactical vests rather than explicit life-safety functions, although many incorporate quick-release safety features.

Which materials are standard for achieving Mil-Spec durability in tactical belts?

The standard material is high-tenacity nylon webbing, often reinforced with specific stitching patterns and treated for resistance to UV light, abrasion, and infrared signature detection. High-end belts increasingly utilize advanced proprietary laminate materials (often Cordura-based) that are laser-cut to achieve greater strength-to-weight ratios and enhanced modularity compared to traditional sewn webbing.

How do quick-release buckles enhance soldier safety and operational readiness?

Quick-release buckles, such as those meeting stringent load ratings (e.g., Cobra buckles), allow the operator to instantly and safely jettison all carried gear in emergency scenarios, such as falling into water, becoming entangled, or requiring urgent medical access. This rapid release capability is crucial for mitigating risks associated with drowning or entrapment, significantly enhancing soldier survivability.

What technological advancements are driving the growth of the Military Belt Market?

Key advancements include the transition to lighter, stiffer polymer composite systems for enhanced load stability, the adoption of laser-cut modularity (reducing bulk), and the integration of these belts with networked soldier systems for power management and connectivity, transforming them into functional parts of a cohesive electronic ecosystem rather than just simple equipment platforms.

Which region currently leads the global procurement of specialized military belts?

North America, led by the United States Department of Defense, holds the dominant market share due to its massive defense expenditure, continuous commitment to individual soldier modernization programs, and the presence of globally leading defense and tactical gear manufacturers who are primary suppliers for specialized, high-specification military belts.

The strategic analysis of the Military Belt Market highlights a critical intersection of military doctrine, material science, and ergonomic engineering, positioning the belt as a non-negotiable element of modern tactical systems. The sustained drive for lightweight, durable, and highly modular equipment ensures that market growth will continue to outpace general defense budget increases, reflecting the specialized nature of individual soldier requirements in contemporary warfare. Future market evolution will be centered on enhanced systems integration and leveraging smart technologies to improve operational effectiveness and reduce physiological burden on the end-user. The highly competitive landscape demands continuous innovation in hardware design, material composition, and adherence to evolving international defense standards to maintain market relevance and secure lucrative long-term government contracts globally. Specialized segments, particularly those serving Special Operations Forces (SOF), will continue to set the benchmark for technological sophistication and command premium pricing, driving overall value creation within the industry sector.

Furthermore, manufacturers must navigate complex international trade regulations and geopolitical sensitivities, particularly concerning the export of equipment deemed critical to military capabilities. Establishing localized production or strategic partnerships in high-growth regions like Asia Pacific is becoming increasingly vital for securing regional procurement agreements and overcoming protectionist trade barriers. The focus remains steadfast on addressing the soldier’s core needs: load carriage efficiency, rapid accessibility to mission-critical items, and uncompromising reliability under the most arduous operational conditions. This commitment to functional excellence, backed by rigorous testing and certification processes, defines success in the specialized Military Belt Market, ensuring sustained high demand for certified, high-performance tactical gear across global defense establishments for the duration of the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager