Military Land Vehicles Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443514 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Military Land Vehicles Market Size

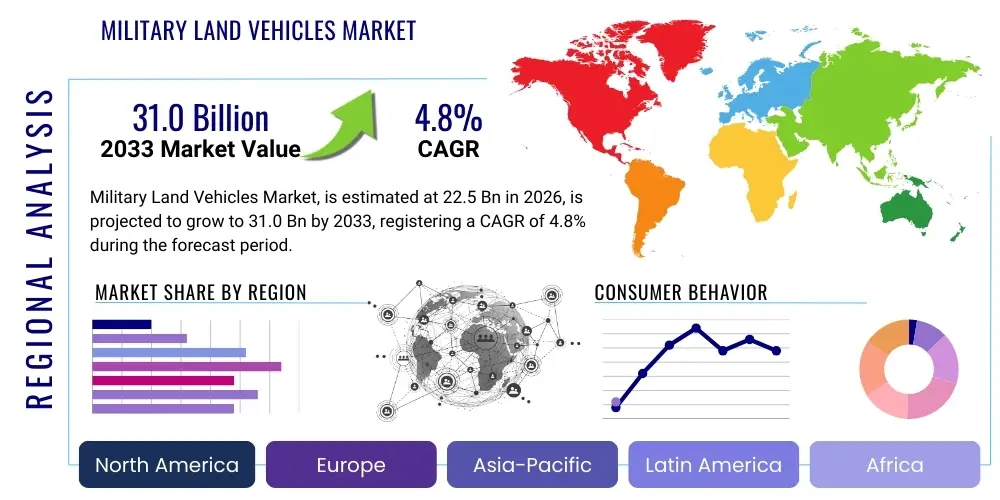

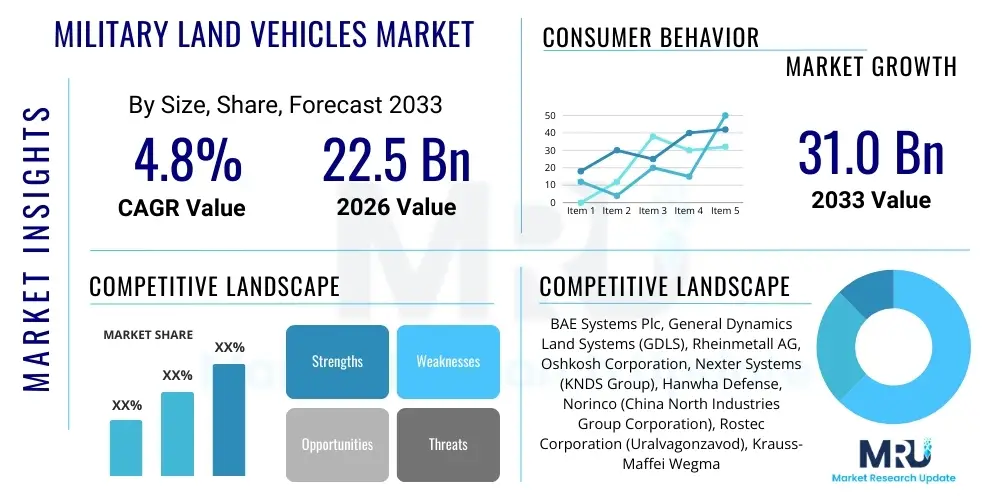

The Military Land Vehicles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 22.5 Billion in 2026 and is projected to reach USD 31.0 Billion by the end of the forecast period in 2033.

Military Land Vehicles Market introduction

The Military Land Vehicles Market constitutes a highly specialized and strategically vital segment of the global defense industry, focusing on the development, manufacturing, sales, and sustainment of heavy armored vehicles, light tactical platforms, and associated support systems designed for ground combat and operational mobility. This market encompasses a broad array of platforms, including Main Battle Tanks (MBTs) serving as the spearhead of ground forces, Infantry Fighting Vehicles (IFVs) providing high protection and integrated offensive capability for mechanized infantry, and Armored Personnel Carriers (APCs) essential for transporting troops safely through contested environments. Furthermore, the segment includes specialized vehicles such as Mine-Resistant Ambush Protected (MRAP) vehicles, critical tactical utility trucks for logistics, and highly advanced reconnaissance vehicles that form the backbone of modern military ground capabilities. The essence of the product lies in balancing three critical factors: lethality, survivability, and mobility, all of which are continuously refined through massive investment in cutting-edge defense technology and systems integration.

Modernization programs are aggressively redefining product descriptions within this market, moving away from purely mechanical systems toward sophisticated digital architectures. Today's military land vehicles are not merely armored boxes; they are complex, networked warfighting nodes, incorporating advanced features such as Active Protection Systems (APS) capable of neutralizing anti-tank threats, state-of-the-art C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) suites, and modular designs that allow rapid reconfiguration for various mission sets—from high-intensity combat to peacekeeping operations. Major applications extend across the full spectrum of military operations, including offensive mechanized warfare, counter-insurgency and urban combat scenarios, border patrol, and the critical logistical function of maintaining supply lines across vast or hazardous operational theaters. The market’s resilience is intrinsically linked to global security dynamics, ensuring continuous demand for vehicles that offer superior protection against evolving threats, notably sophisticated anti-tank guided missiles (ATGMs) and improvised explosive devices (IEDs).

The fundamental benefits derived from investment in this market include decisively enhanced troop survivability through multi-layered armor solutions and electronic countermeasures, operational superiority achieved via superior situational awareness and networked lethality, and significantly improved logistical efficiency enabled by reliable, powerful propulsion systems and predictive maintenance technologies. Driving factors fueling the robust market growth are manifold: persistent global geopolitical tensions compelling nations to upgrade outdated armored inventories; the substantial increase in defense budgets across key regions like Asia-Pacific and Europe; and the technological imperative to adopt unmanned and robotic combat vehicles (RCVs) to reduce combat exposure risks for personnel. The necessity of replacing Cold War-era fleets, which have reached their operational lifespan limits and lack the capacity to integrate modern digital systems, forms a crucial baseline driver for procurement volumes, securing the market's trajectory through the forecast period and beyond, necessitating large-scale, multi-billion dollar platform replacement contracts.

Military Land Vehicles Market Executive Summary

The global Military Land Vehicles Market is currently navigating a transformational period, characterized by accelerated technological insertion and a strategic pivot toward enhanced modularity and digitization, which is reshaping established business models. Business trends indicate a shift in OEM focus from solely manufacturing platforms to providing integrated capability packages, which include comprehensive through-life support (MRO), training simulations, and continuous technology upgrades. Geographically, market competitiveness is intensifying, with traditional Western prime contractors facing strong challenges from emerging defense industrial bases in Asia, particularly China and South Korea, which are aggressively pursuing export opportunities. Furthermore, the trend toward government-led defense industry consolidation in Europe aims to create larger entities capable of competing on a global scale and efficiently managing complex multi-national defense programs, thereby streamlining the supply chain and reducing unit costs for advanced systems like the next-generation Main Ground Combat System (MGCS) development.

Regional dynamics highlight divergent investment strategies. North America maintains its position as a foundational market, largely due to unwavering commitment to technological superiority, evidenced by massive R&D spending on future force concepts, including optionally manned vehicles and advanced sensor integration programs. The Asia Pacific region is the key growth engine, exhibiting the highest projected Compound Annual Growth Rate (CAGR). This expansion is intrinsically tied to defense parity requirements, territorial disputes, and the subsequent aggressive procurement of heavy armor and sophisticated air defense-capable land platforms by nations such as India, Australia, and Japan. Conversely, European market activity is heavily concentrated on standardizing platforms like the Boxer and Piranha families to improve interoperability within NATO structures, coupled with urgent short-term procurement driven by the necessity to resupply equipment transferred to conflict zones, accelerating long-delayed modernization efforts across the continent.

Segmentation analysis reveals nuanced procurement preferences. The Wheeled Vehicle segment (4x4 to 8x8 configurations) is witnessing faster relative growth than the traditional Tracked Vehicle segment, primarily driven by superior road mobility, lower logistics footprint, and reduced life cycle costs, making them highly attractive for large-scale conventional and expeditionary operations. However, the heavy tracked platforms (MBTs and heavy IFVs) still command significant investment for specialized roles requiring high protection and sustained combat intensity. Notably, the C4ISR and Protection Systems segments—particularly Active Protection Systems (APS)—are experiencing substantial growth within the broader vehicle market, as militaries worldwide recognize that modern threats necessitate layered defense mechanisms rather than relying solely on passive, heavy armor. This segment trajectory emphasizes the importance of digital readiness and enhanced battlefield awareness as critical components of future ground superiority, leading to significant MRO spend on digital retrofits.

AI Impact Analysis on Military Land Vehicles Market

The inquiry into the impact of Artificial Intelligence (AI) on Military Land Vehicles reveals a collective user expectation centered on achieving cognitive superiority on the battlefield, alongside mitigating human exposure to immediate danger. Analysis of common user questions indicates high interest in how AI systems can move beyond simple automation to genuine tactical decision support, specifically concerning complex tasks like rapid threat classification, identification of optimal firing solutions, and coordinated movement in networked formations. A recurring theme is the potential for AI-driven logistics—using algorithms to predict maintenance failures and optimize spare parts delivery based on real-time vehicle usage data—significantly enhancing fleet operational readiness, a persistent challenge in defense logistics. Furthermore, the ethical debate surrounding the delegation of lethal decision-making to autonomous systems (LAWS) remains a prominent, high-stakes concern for military planners and the public alike, guiding the pace of adoption in key functionalities.

AI's primary transformative role in military land vehicles today lies in its capacity to handle the exponential surge in battlefield data generated by high-definition sensors, advanced radar, and electronic intelligence systems. By employing machine learning and deep learning models, AI enables real-time sensor fusion, instantly correlating information streams to construct an accurate, holistic operational picture. This capability dramatically accelerates the Observe-Orient-Decide-Act (OODA) loop, granting equipped forces a decisive advantage. For example, in an IFV, AI autonomously filters distracting clutter, identifies camouflaged targets, and suggests optimal weapon allocation based on priority and ammunition status, freeing human operators to focus on higher-level strategic command tasks. This technological leap is critical for future conflict, where the speed of decision-making often dictates the success or failure of complex maneuvers, necessitating robust, hardened AI hardware integrated directly into the vehicle's electronic backbone.

Looking forward, AI is the foundational technology enabling the concept of Robotic Combat Vehicles (RCVs) and autonomous convoys. These systems, utilizing advanced perception algorithms and pathfinding AI, are designed to navigate complex, contested terrains, either remotely controlled or operating semi-autonomously as 'loyal wingmen' to manned vehicles. The shift towards electrification in ground platforms complements AI integration, as electric drive systems provide the necessary power generation for sophisticated onboard processing and cooling required by high-performance AI hardware. The overall impact extends to dramatically enhancing vehicle lifecycle management: AI-driven diagnostics minimize unnecessary servicing, maximize component lifespan, and ensure peak performance, making AI integration a fundamental requirement for all future major armored vehicle procurements and modernization efforts across the globe, thereby influencing system requirements and procurement specifications.

- Enhanced Situational Awareness (SA) via sensor fusion and rapid data interpretation using deep neural networks.

- Implementation of Predictive Maintenance (PdM) for optimized vehicle readiness and reduced lifecycle costs through machine learning prognostics.

- Development of semi-autonomous and fully autonomous operational modes for logistics, convoy operations, and high-risk reconnaissance tasks (RCVs).

- Improved targeting, fire control, and identification friend or foe (IFF) systems utilizing computer vision and advanced pattern recognition algorithms.

- Deployment of advanced threat detection and countermeasure systems (Active Protection Systems) managed by high-speed AI processors.

- Optimization of military logistics, including real-time dynamic route planning, asset tracking, and fuel consumption management across large vehicle fleets.

- Facilitation of complex manned-unmanned teaming (MUM-T) operations, where AI coordinates the actions of robotic assets supporting human crews.

- Acceleration of training through AI-driven simulation environments that adapt dynamically to trainee performance and battlefield complexity.

DRO & Impact Forces Of Military Land Vehicles Market

The market trajectory for Military Land Vehicles is profoundly shaped by a powerful confluence of internal market stimuli and external geopolitical forces. The primary Drivers include the widespread need for fleet replacement, particularly in Europe and Asia, where large inventories of Cold War-era platforms are technologically incapable of meeting modern operational demands or integrating contemporary digital architecture. This mandatory obsolescence cycle is compounded by persistent, escalating geopolitical conflicts, ranging from interstate tensions to sustained counter-insurgency operations, which directly translate into increased defense budget allocations specifically targeting ground combat superiority. Furthermore, the rapid advancement and mandatory integration of survivability technologies, such as Active Protection Systems (APS), compel even recent vehicle acquisitions to undergo immediate upgrade cycles, securing consistent demand for components and specialized services, thus minimizing procurement gaps.

Conversely, significant Restraints impede market velocity and increase risk for manufacturers. The foremost restraint is the immense capital expenditure required for research, development, and testing (RD&T) of new armored platforms, which often spans a decade or more before initial operating capability is reached, tying up large amounts of private and public funds. Compounding this is the inherently lengthy, complex, and highly politicized governmental procurement process, which is often subject to budget cuts, program re-scoping, and unpredictable delays, creating significant uncertainty for major defense contractors. Furthermore, stringent export control regulations, especially concerning advanced technologies like stealth materials, AI-enabled fire control, and high-energy weapons systems, limit the addressable market size for leading manufacturers and complicate international technology transfer necessary for securing major global sales and establishing international supply chains.

Opportunities for disruptive market growth reside primarily in technological evolution and shifting operational requirements. The opportunity to capitalize on the development of modular vehicle architectures, allowing a single chassis design (e.g., Piranha or Boxer) to fulfill multiple roles—APC, IFV, command post, or ambulance—provides militaries with significant cost savings in training, logistics, and maintenance, thus driving high-volume contracts. The shift toward sustainable defense capabilities presents an opportunity in the niche market for hybrid and fully electric military land vehicles, offering reduced acoustic signatures and lower running costs. Crucially, the expansion of the lucrative Maintenance, Repair, and Overhaul (MRO) segment, driven by technology insertion programs to extend the life of existing platforms (Life Cycle Extensions), ensures stable, long-term revenue streams for OEMs, independent of volatile new procurement cycles. Key Impact Forces are the rise of asymmetric warfare necessitating high protection (MRAPs), and the mandatory move towards network-centric operations, dictating C4ISR capability as a non-negotiable requirement for all new vehicle platforms, fundamentally reshaping vehicle design criteria.

Segmentation Analysis

The detailed segmentation of the Military Land Vehicles Market is essential for understanding the highly diverse demand landscape driven by varied mission profiles, geographic challenges, and budgetary limitations of global defense forces. The primary segmentation by Vehicle Type (MBTs, IFVs, APCs, etc.) reflects the core mission role, with MBTs commanding the highest unit cost and technological complexity, focusing on maximum protection and lethality, whereas Tactical Trucks represent high-volume, lower-cost platforms crucial for logistical resilience. The market demonstrates significant stratification based on operational requirements; for example, Western militaries often prioritize highly protected, modular wheeled vehicles for rapid deployment, contrasting with the heavy armored doctrine favored by some Eastern powers requiring robust tracked vehicles designed for high-intensity, peer-on-peer conflict scenarios where sustained maneuverability is paramount.

Segmentation by Platform—Tracked versus Wheeled—is critically important and defines mobility characteristics. Tracked vehicles offer superior off-road performance, weight distribution, and maneuverability in extreme terrain (e.g., sand or snow), making them essential for frontline combat and heavy support roles, absorbing significant R&D in suspension and powerpack technology. Conversely, wheeled vehicles (4x4, 6x6, 8x8) are increasingly favored for rapid road movement, urban operations, and general transportation due to their superior strategic mobility, lower operational footprint, and reduced wear and tear, representing a compromise between protection and deployability. The ongoing trend favors the versatility of the 8x8 platform, which provides an optimal balance for many modern operational environments, particularly for European expeditionary forces and counter-insurgency tasks.

Furthermore, segmentation by Technology, particularly the delineation between Manned and Unmanned Ground Vehicles (UGVs), highlights the future direction of military capabilities. While manned vehicles form the current majority, the UGV segment is poised for explosive growth, driven by advances in autonomy and the strategic goal of minimizing human presence in the most dangerous combat zones. This technological segmentation also includes the propulsion system (diesel vs. hybrid/electric), where the move toward hybridization is opening new sub-markets focused on maximizing energy efficiency and enabling silent operation for stealth reconnaissance missions, fundamentally altering the long-term design specifications required from powertrain suppliers and fostering new vendor relationships within the value chain.

- By Type:

- Main Battle Tanks (MBTs)

- Infantry Fighting Vehicles (IFVs)

- Armored Personnel Carriers (APCs)

- Tactical Trucks (Heavy, Medium, Light Logistics & Transport)

- Light Armored Vehicles (LAVs) & Patrol Vehicles

- Mine-Resistant Ambush Protected (MRAP) Vehicles

- Self-Propelled Howitzers (SPH) & Artillery Support Vehicles

- Combat Engineering Vehicles & Recovery Vehicles

- By Platform:

- Tracked Vehicles (Optimized for heavy combat and rough terrain)

- Wheeled Vehicles (4x4, 6x6, 8x8 configurations, optimized for speed and strategic mobility)

- By Technology:

- Manned Vehicles (Traditional crewed platforms)

- Optionally Manned Vehicles (OMVs)

- Unmanned Ground Vehicles (UGVs) / Robotic Combat Vehicles (RCVs)

- By System:

- Propulsion System (Diesel, Hybrid-Electric, Pure Electric Powertrains)

- Weapon Systems (Turrets, Cannon, Missile Launchers, Remote Weapon Stations - RWS)

- Protection Systems (Active Protection Systems - APS, Passive/Reactive Armor, Signature Management)

- C4ISR Systems (Communication, Sensor Suites, Battle Management Systems)

- By End User:

- Army (Primary customer base)

- Special Forces (Demand for highly specialized, stealthy, and mobile platforms)

- Naval Infantry/Marines (Focus on rapid deployment and amphibious capability)

Value Chain Analysis For Military Land Vehicles Market

The value chain for military land vehicles is inherently hierarchical, starting with the upstream sourcing of highly controlled and specialized components. Upstream activities involve suppliers of strategic raw materials, primarily high-strength ballistic steel, composite materials like advanced ceramics and carbon fiber for weight-sensitive armor applications, and rare earth metals essential for complex electronics and optical systems (optronics). Manufacturers in this segment face extremely high regulatory hurdles and require specialized certification to meet military quality standards (e.g., ISO 9001, AS9100). The competitive advantage in the upstream sector is centered on material science innovation, particularly in developing lighter armor solutions that maintain or exceed current protection levels, driven by the persistent requirement to counter increasingly effective anti-armor munitions and reduce transportability costs, leading to intense competition among specialized material suppliers.

The core manufacturing and assembly stage is dominated by a few prime contractors who serve as system integrators. These OEMs manage vast international supply chains, coordinating the integration of complex subsystems provided by specialized Tier 1 suppliers, such as power packs (engines and transmissions), sophisticated weapon stations (Remote Weapon Systems - RWS), fire control computers, and C4ISR suites. The key to competitive success in this central stage is not just production capacity but deep expertise in systems integration, ensuring that all subsystems function harmoniously under extreme combat stress and adhere to stringent interoperability standards (e.g., NATO STANAGs). The distribution channel is almost exclusively direct, conducted under rigorous government-to-government (G2G) or B2G contract frameworks. Direct procurement ensures strict control over technology transfer, security requirements, and long-term political accountability, minimizing the role of commercial intermediaries and focusing all sales efforts directly onto government procurement offices.

Downstream activities, encompassing MRO, spares provisioning, training, and modernization services, account for the majority of the total cost of ownership over the vehicle's lifespan and are a critical profit center. Through-life support is highly specialized, requiring dedicated maintenance facilities, access to proprietary diagnostics, and a commitment to obsolescence management for electronic components. Modernization programs, often focusing on inserting digital cockpits, hybrid propulsion systems, and enhanced APS onto existing platforms, serve to extend the service life of aging fleets by decades, often involving international collaboration. The indirect revenue generated through long-term service contracts ensures that OEMs maintain close relationships with their defense customers long after the initial sale, making service capability and parts supply chain resilience central components of the overall value proposition and essential elements for geopolitical sales success, securing decades of recurring revenue streams.

Military Land Vehicles Market Potential Customers

The potential customer base for Military Land Vehicles is overwhelmingly state-controlled, comprising national Ministries of Defense, procurement agencies, and associated paramilitary organizations. The primary purchasing entities are the standing armies of major industrialized and militarily active nations. These customers—including the U.S. Army, the Chinese People's Liberation Army (PLA), and various European and Asian armies—seek large-scale platform procurements (MBTs, IFVs, tactical logistics vehicles) requiring high technological sophistication, stringent compliance with domestic performance standards, and guaranteed long-term logistical support. Procurement decisions in this top tier are driven by long-term strategic doctrine, complex multi-year budgetary cycles, and strategic alignment with key international allies (e.g., NATO or regional security pacts), placing a premium on platforms that demonstrate high survivability and superior network integration capabilities within a joint forces operational framework.

A second crucial customer segment consists of developing nations in politically volatile regions, notably the Middle East, North Africa, and Southeast Asia. These customers are actively engaged in rapid fleet modernization, often driven by immediate internal security threats (such as counter-insurgency and asymmetric warfare) or regional arms races. Their demand centers heavily on proven, combat-tested platforms, such as MRAPs and multi-role APCs, prioritizing vehicles that offer a strong balance of protection and cost-effectiveness. These contracts frequently involve complex offset requirements, compelling OEMs to transfer manufacturing knowledge or invest in local industrial infrastructure, thus necessitating flexible negotiation strategies and a willingness to establish regional service centers to secure the sale and maintain compliance with local content requirements, often relying on established export-grade variants.

A distinct, high-value niche market exists within specialized defense units, including Special Operations Forces (SOF) and border protection agencies. These end-users require highly customized, often lightweight, air-transportable armored vehicles designed for specific, rapid-reaction missions. Their requirements often diverge from conventional force needs, focusing on stealth characteristics, high-speed mobility over rugged terrain, and advanced communications systems tailored for inter-agency coordination. While procurement volumes for this segment are smaller, the specialized nature and high-technology content of these platforms command premium pricing, making them an important target for innovative and agile defense technology providers specializing in low-volume, high-specification military equipment. Maintaining global political stability and positive diplomatic relations remains foundational to accessing and sustaining relationships with this highly controlled customer base, as purchases are often highly sensitive and politically regulated.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 22.5 Billion |

| Market Forecast in 2033 | USD 31.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BAE Systems Plc, General Dynamics Land Systems (GDLS), Rheinmetall AG, Oshkosh Corporation, Nexter Systems (KNDS Group), Hanwha Defense, Norinco (China North Industries Group Corporation), Rostec Corporation (Uralvagonzavod), Krauss-Maffei Wegmann (KMW) (KNDS Group), Lockheed Martin Corporation, ST Engineering, Iveco Defence Vehicles, Textron Systems, Tata Advanced Systems, L3Harris Technologies, Volvo Defense, Patriot3, ELBIT Systems Ltd., Denel Vehicle Systems, Navistar Defense LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Military Land Vehicles Market Key Technology Landscape

The contemporary technology landscape for military land vehicles is fundamentally focused on achieving a state of "digital survivability," where protection is derived not only from passive armor but also from interconnected electronic and cognitive systems. Leading technological advancements center on developing highly integrated layered protection systems. This involves combining sophisticated passive armor materials, such as advanced ceramic composites and lightweight alloys, with Active Protection Systems (APS). Modern APS utilizes high-speed radar and electro-optical sensors to detect and track incoming threats (like ATGMs and RPGs) and deploys counter-measures, ranging from soft-kill disruption (jamming) to hard-kill interception (launching small projectiles). The continuous refinement of APS performance and size, weight, and power (SWaP) characteristics is a major R&D priority, ensuring protection against the latest generation of tandem-warhead munitions and loitering aerial threats, demanding robust computing power and extremely low latency processing to maintain effectiveness in high-saturation environments.

A second defining technological area is the mandatory transition to digital open-system architectures (OSA). Unlike older, proprietary analog systems, OSA facilitates the rapid integration of new subsystems, sensors, and software, enabling continuous capability upgrades without requiring complete platform replacement. This architecture is essential for realizing network-centric warfare, where vehicles act as nodes in a broader military internet of things, sharing targeting data, situational reports, and logistical status in real-time with dismounted troops, air assets, and command centers. The implementation of robust, resilient communications hardware and software-defined radio (SDR) technology ensures interoperability between coalition forces and mitigates electronic warfare threats, which are increasingly prevalent in modern conflict theaters, thus necessitating significant investment into cybersecurity for vehicle operating systems and robust data link protection mechanisms.

Finally, the evolution of propulsion and mobility systems is paramount. While traditional internal combustion engines (ICE) remain prevalent, the industry is heavily investing in advanced hybrid-electric and pure-electric powertrains. Hybridization offers critical tactical advantages: silent watch capability, reduced thermal signature (making the vehicle harder to detect), and the ability to export substantial electrical power to run energy-intensive onboard systems such as directed energy weapons or complex electronic countermeasures. Furthermore, advances in intelligent suspension systems, such as hydropneumatic or electro-mechanically controlled solutions, enhance off-road performance, stabilize weapon platforms on the move, and allow for active ride height adjustments, ensuring that these increasingly heavy and complex platforms retain strategic and tactical maneuverability under harsh operational conditions, thus maximizing the vehicle's utility across diverse geographic regions and minimizing crew fatigue over extended operations.

Regional Highlights

The market dynamics for Military Land Vehicles are inextricably linked to regional security postures, economic capacity, and technological sophistication, creating distinct regional market profiles. North America, led by the defense industry complex in the United States, commands the largest market share globally. This dominance is secured by continuous, large-scale investments in research, development, test, and evaluation (RDT&E) for programs like the Optionally Manned Fighting Vehicle (OMFV) and advanced robotics programs, aimed at maintaining global technological superiority. The region's focus is characterized by the procurement of high-specification, cutting-edge platforms, prioritizing survivability against sophisticated peer threats and full operational interoperability with NATO and other key allies, driving the demand for advanced digital architectures and AI-enabled systems across the entire fleet of tracked and wheeled vehicles, ensuring readiness for rapid global deployment.

The Asia Pacific (APAC) region is projected to register the fastest growth, fueled by aggressive military modernization programs in response to complex territorial disputes and the rise of regional military powers. China's rapid indigenous development and mass production of MBTs and IFVs (e.g., Type 99 and Type 04/08 families) contribute substantially to regional market size, alongside India's ongoing procurement strategies aimed at replacing obsolete inventories and strengthening border defense capabilities against multiple adversaries. Southeast Asian nations, facing both internal security challenges and maritime threats, are increasingly investing in highly mobile, light armored vehicles and MRAP-style platforms. This intense regional competition necessitates substantial spending, driving high procurement volumes and fostering a robust domestic defense industrial base, particularly in countries like South Korea and Australia, which are emerging as major defense technology exporters capable of competing globally.

Europe represents a crucial, complex market undergoing significant transformation. Following geopolitical shifts, NATO member states are committed to meeting increased defense spending targets, driving demand for urgent fleet replacement and enhancement. The market trend here favors joint procurement programs focused on standardized, multi-role platforms, such as the Boxer MRAV, to maximize interoperability and reduce long-term logistics costs across allied forces. Western Europe focuses on high-technology, wheeled IFVs optimized for rapid expeditionary capabilities, while Eastern European countries are urgently procuring heavy armor and modern artillery systems, often sourced from Western prime contractors, to enhance territorial defense capabilities. The Middle East and Africa (MEA) market is distinctively focused on counter-insurgency and internal conflict vehicles, driving consistent demand for MRAPs and specialized tactical trucks, largely influenced by fluctuating oil revenues and localized security crises, making proven protection and rugged reliability key purchasing criteria for sustained operational viability.

- North America: Market leader; focused on AI integration, robotic combat vehicles (RCVs), and next-generation replacement programs for legacy platforms; emphasis on global expeditionary capability and technological superiority.

- Asia Pacific (APAC): Highest growth trajectory; driven by significant defense budget increases in China, India, and South Korea; strong focus on indigenous production, heavy armor acquisition, and border security platforms to counter regional threats.

- Europe: Driven by NATO standardization and urgent capability gaps; emphasis on multi-role wheeled armored vehicles and accelerated modernization of heavy tracked systems in the Eastern flank to meet alliance commitments.

- Middle East & Africa (MEA): Sustained high demand for specialized counter-insurgency platforms (MRAPs, protected patrol vehicles); procurement heavily influenced by regional conflicts and strategic energy reserves and necessity for high IED protection.

- Latin America: Stable market with gradual modernization focusing on internal security and border control; preference for cost-effective, easily maintainable light armored vehicles and tactical logistics solutions suitable for low-intensity conflicts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Military Land Vehicles Market.- BAE Systems Plc

- General Dynamics Land Systems (GDLS)

- Rheinmetall AG

- Oshkosh Corporation

- Nexter Systems (KNDS Group)

- Hanwha Defense

- Norinco (China North Industries Group Corporation)

- Rostec Corporation (Uralvagonzavod)

- Krauss-Maffei Wegmann (KMW) (KNDS Group)

- Lockheed Martin Corporation

- ST Engineering

- Iveco Defence Vehicles

- Textron Systems

- Tata Advanced Systems Ltd.

- L3Harris Technologies

- Volvo Defense

- Patriot3

- ELBIT Systems Ltd.

- Denel Vehicle Systems

- Navistar Defense LLC

Frequently Asked Questions

Analyze common user questions about the Military Land Vehicles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Military Land Vehicles Market?

Market growth is primarily driven by escalating global geopolitical instability, leading to increased national defense spending, widespread programs to replace technologically obsolete legacy armored fleets, and the imperative to integrate advanced systems like active protection and AI for enhanced troop survivability and lethality.

How is the integration of Unmanned Ground Vehicles (UGVs) affecting traditional armored vehicle procurement?

UGVs and Robotic Combat Vehicles (RCVs) are shifting procurement focus towards optional manned/unmanned capabilities and digitally networked platforms. While they do not immediately replace traditional manned vehicles, UGVs are increasingly utilized for high-risk reconnaissance, logistics, and perimeter security roles, forming symbiotic teams with manned platforms.

Which geographical region holds the largest market share and why?

North America holds the largest market share, predominantly due to the substantial and sustained defense budget of the United States, which invests heavily in cutting-edge military technology, continuous modernization programs, and extensive international defense cooperation agreements.

What is the key technological trend dominating future military land vehicle development?

The key trend is the convergence of advanced survivability and digitalization. This includes integrating sophisticated Active Protection Systems (APS), adopting hybrid-electric powertrains for operational advantages, and implementing open-system digital architectures (C4ISR) to ensure seamless network-centric warfare capabilities.

What distinguishes Tracked Vehicles from Wheeled Vehicles in market utility?

Tracked Vehicles (e.g., MBTs) offer superior cross-country mobility and higher weight capacity for armor/weaponry, suitable for direct combat. Wheeled Vehicles (e.g., APCs, MRAPs) offer superior strategic mobility, higher road speed, lower maintenance complexity, and better fuel efficiency, optimizing them for rapid deployment and general troop transport.

What role does modularity play in the modern design of military land vehicles?

Modularity is crucial as it allows a single vehicle chassis to be quickly reconfigured with different mission packages (e.g., IFV, command post, or medical evacuation). This significantly reduces overall life-cycle costs, streamlines logistics, and enhances tactical flexibility across diverse operational requirements by maximizing commonality of parts.

How is predictive maintenance (PdM) being applied in the Military Land Vehicles sector?

PdM utilizes AI and machine learning to analyze real-time performance telemetry data from vehicle subsystems (engine, transmission, weapon systems). This allows defense logistics teams to forecast component failures before they occur, drastically reducing unplanned vehicle downtime, optimizing spare parts inventory management, and maximizing fleet readiness rates.

What is the current primary procurement focus for European armies?

European armies, particularly NATO members, are primarily focused on achieving interoperability and standardization through multi-national programs. Key procurement areas include highly mobile, protected wheeled vehicles (8x8 platforms) for rapid reaction forces, and urgent upgrades/replacement of heavy armor to enhance territorial defense capabilities.

What is the largest restraint on market growth?

The largest restraint is the confluence of extremely high, long-term research and development costs required for advanced platforms, coupled with highly volatile and lengthy governmental procurement cycles that can introduce substantial budgetary and political risk for prime contractors.

What are the implications of hybrid-electric powertrains for combat vehicles?

Hybrid-electric powertrains offer critical tactical benefits, including "silent watch" capability (reduced acoustic and thermal signatures), improved fuel efficiency, extended operational range, and the ability to export high electrical power necessary to run future energy-intensive systems like electronic warfare equipment or high-powered sensors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager