Military Sleeping Bag Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442455 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Military Sleeping Bag Market Size

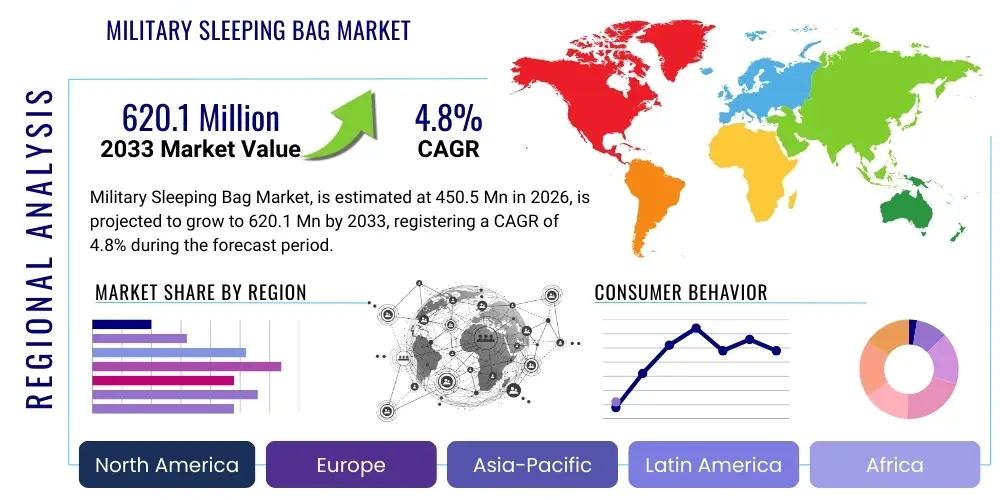

The Military Sleeping Bag Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. This robust growth trajectory is underpinned by increasing global defense spending, continuous military modernization efforts across major economies, and a heightened focus on soldier survivability and operational effectiveness in diverse climatic zones. The stringent performance requirements mandated by defense agencies globally necessitate the adoption of high-specification, technologically advanced sleeping systems that can withstand extreme environmental conditions, driving premium pricing and market expansion. The integration of advanced materials such as high-loft synthetic fibers, lightweight down alternatives, and durable, water-resistant outer shells contributes significantly to the increasing market valuation.

The market is estimated at USD 450.5 Million in 2026, reflecting the stable procurement cycles and initial integration of next-generation sleeping systems across NATO and allied forces. This valuation is based on established contracts for modular sleeping systems designed for versatility and extreme temperature performance. The foundational market size in 2026 is driven primarily by scheduled replacement cycles for legacy equipment and immediate operational needs in active conflict zones where rapid deployment and reliable performance are paramount to troop welfare and mission success.

The market is projected to reach USD 620.1 Million by the end of the forecast period in 2033. This substantial increase is attributed to anticipated long-term defense contracts for multi-year procurement, the increasing demand from special operations forces for ultra-lightweight and highly specialized systems, and the entry of innovative material science solutions that enhance thermal efficiency while reducing pack weight. Furthermore, sustained geopolitical instability fuels continuous investment in logistical and survival gear, making high-performance military sleeping bags a critical, non-negotiable component of modern soldier equipment loadout, securing its elevated market position by 2033.

Military Sleeping Bag Market introduction

The Military Sleeping Bag Market encompasses the manufacturing, distribution, and sale of specialized thermal insulation systems designed exclusively for use by armed forces, paramilitary units, and tactical law enforcement agencies worldwide. These products are engineered far beyond commercial specifications, focusing critically on extreme durability, minimal weight, maximum thermal efficiency across diverse temperature ranges, and strict compliance with military standards regarding flammability, water resistance, and compressibility. The market is characterized by long procurement cycles and high barriers to entry due to rigorous testing and certification processes required by defense ministries globally, ensuring only the most robust and reliable systems are adopted for field operations.

Military sleeping bags, which often form part of comprehensive modular sleep systems (MSS), are critical components of field sustainment gear, allowing soldiers to maintain core body temperature and recover adequately during extended operations in harsh environments, ranging from arctic tundra and high-altitude mountainous terrain to arid deserts and humid jungles. Major applications include extended field training exercises, forward operating base deployments, disaster relief operations where military assets are mobilized, and continuous combat readiness scenarios. Key benefits derived from these advanced systems include enhanced soldier endurance, reduced risk of cold-weather injuries (such as hypothermia), increased operational readiness, and reduced logistical burden due to lightweight and compact designs. These benefits directly contribute to mission success, positioning the sleeping bag as a high-value piece of equipment.

Driving factors for this specialized market include the persistent trend of military modernization, particularly in Asia Pacific and Eastern Europe, where defense budgets are growing to match emerging security challenges. Furthermore, technological advancements in material science—specifically the development of proprietary synthetic insulations (e.g., Climashield, Primaloft) and highly durable yet lightweight shell fabrics (e.g., high-tenacity nylon ripstops)—are enabling manufacturers to meet increasingly demanding performance specifications. The global emphasis on soldier personal equipment optimization, treating the individual soldier as a complex operational platform, further accelerates the demand for premium, modular, and mission-specific sleeping solutions.

Military Sleeping Bag Market Executive Summary

The Military Sleeping Bag Market is experiencing steady growth driven by global military expenditure shifts toward soldier survivability and operational longevity in varied theaters. Key business trends indicate a strong move towards modular sleeping systems (MSS) that offer scalability in warmth, allowing military users to adapt their gear seamlessly from temperate to extreme cold environments. Manufacturers are focusing heavily on integrating lightweight yet durable materials, complying with increasingly strict fire resistance standards, and ensuring compatibility with existing military-issue components like bivouac sacks and specialized tents. Strategic partnerships between specialized textile developers and defense contractors are becoming crucial for securing large, multi-year procurement contracts, defining the competitive landscape.

Regional trends highlight North America, dominated by US defense procurement (DOD), as the leading market due to extensive research and development investment and the largest standing military force requiring constant equipment upgrade cycles. Asia Pacific (APAC) represents the fastest-growing region, fueled by the modernization programs of countries like China, India, and South Korea, which are rapidly replacing older, bulkier equipment with advanced, domestically or internationally sourced high-performance gear. Europe maintains a mature market characterized by the steady demand from NATO member states focusing on interoperability and high-quality, specialized equipment for rapid reaction forces deployed in varied climates, particularly Scandinavian and Central European nations prioritizing extreme cold weather capability.

Segment trends underscore the dominance of the Synthetic Insulation segment due to its superior performance when wet, faster drying time, and comparative ease of bulk procurement and maintenance compared to down alternatives, which require meticulous care. The Extreme Cold Weather segment is commanding a premium due to the complexity of achieving reliable thermal protection at temperatures below -20°F, requiring highly specialized engineering and materials. Furthermore, the Special Forces End-User segment is generating significant revenue growth, prioritizing ultra-lightweight, packable, and non-reflective systems suitable for reconnaissance and clandestine operations, driving innovation in material compression and weight reduction techniques across the industry.

AI Impact Analysis on Military Sleeping Bag Market

User inquiries regarding AI's influence on the Military Sleeping Bag Market often center on its role in advanced material development, logistics, and predictive maintenance rather than direct product function. Common questions include: Can AI optimize insulation material composition for better warmth-to-weight ratio? How can AI improve military supply chain efficiency for large-volume tactical gear procurement? Will AI-driven predictive modeling forecast equipment failure or replacement needs in harsh environments? The core themes reveal user expectations for AI to act as an optimization tool—enhancing the R&D cycle for next-generation textiles, automating the customization of gear based on complex environmental mission data, and streamlining the highly complex defense logistics networks to ensure timely and precise deployment of mission-critical sleeping systems across global theaters of operation, minimizing waste and maximizing readiness.

- AI-Driven Material Optimization: Accelerates the discovery and testing of novel textile compounds, thermal coatings, and insulation blends (e.g., phase-change materials) to achieve optimal warmth-to-weight ratios and enhanced durability, significantly reducing R&D timeframes.

- Predictive Logistics and Inventory Management: Utilizes machine learning algorithms to forecast regional demand fluctuations, optimize storage conditions, and preemptively manage inventory replacement cycles based on climate data, usage intensity, and mission profiles, ensuring continuous availability of specialized bags.

- Customization and Ergonomics Modeling: Employs AI to analyze soldier body metrics and environmental exposure data, leading to the rapid design of highly customized and ergonomic sleeping systems that maximize thermal performance and comfort specific to the user and operational area.

- Quality Control and Failure Analysis: Implements computer vision and deep learning techniques during the manufacturing process to ensure zero-defect assembly and uses operational data to predict potential points of failure (e.g., zipper stress, seam degradation) under extreme field use.

- Supply Chain Transparency and Security: Leverages blockchain technology managed by AI systems to ensure the provenance and integrity of critical materials used in high-specification military gear, mitigating risks associated with counterfeit or substandard components in the defense supply chain.

DRO & Impact Forces Of Military Sleeping Bag Market

The market dynamics for Military Sleeping Bags are governed by a unique interplay of compelling drivers centered on modernization and tactical necessity, stringent restraints related to cost and lifecycle management, and transformative opportunities emerging from technological convergence. Drivers include sustained geopolitical tensions compelling nations to invest in high-performance equipment, the imperative for improved soldier welfare leading to better thermal regulation standards, and continuous technological breakthroughs in lightweight, high-loft materials. Conversely, major restraints involve the significant initial R&D investment required for specialized material certification, the extended and often unpredictable procurement cycles within defense organizations, and intense cost scrutiny from government budget constraints which favor long-term, high-durability products over frequent replacements. Opportunities arise through modular integration with other soldier systems (e.g., combat clothing, shelter systems), penetration into emerging markets that are initiating rapid defense equipment upgrades, and the development of integrated electronic features for thermal regulation or medical monitoring.

The core driving force remains the strategic necessity for soldier endurance; modern conflicts necessitate long periods of operation in remote, often highly variable environments, making reliable sleep and thermal protection non-negotiable for cognitive and physical performance. This demand is further amplified by the increasing deployment of specialized units requiring equipment that minimizes detection (low IR signature) while maximizing operational payload efficiency. Geopolitical volatility acts as a constant demand stimulus, ensuring defense ministries maintain consistent procurement lines for essential field survival gear. The stringent military specifications, while initially acting as a restraint for entry-level manufacturers, ultimately drive the technological ceiling for existing players, fostering continuous innovation in thermal physics and material science.

Restraints are deeply embedded in the defense procurement structure. High certification costs for materials (e.g., fire retardancy, low IR visibility testing) create significant financial hurdles. Furthermore, defense budget instability can lead to procurement pauses or cancellations, forcing manufacturers to manage fluctuating order volumes. The products themselves face the restraint of extended operational lifecycles; military bags are designed to last for many years in harsh conditions, which inherently limits the frequency of replacement demand compared to fast-moving consumer goods. The interplay of these forces dictates that market success is highly dependent on achieving superior performance metrics while managing complex regulatory compliance and long-term contractual obligations.

- Drivers:

- Escalating Global Defense Spending and Military Modernization Initiatives.

- Increasing Focus on Soldier Welfare and Operational Readiness in Extreme Climates.

- Technological Advancements in Lightweight and High-Performance Insulation Materials.

- Demand for Modular Sleeping Systems (MSS) to Increase Versatility across Mission Profiles.

- Restraints:

- High Initial Research and Development Costs for Specialized Military-Grade Textiles.

- Rigorous and Prolonged Government Testing and Certification Processes.

- Extended Product Lifecycles, Limiting the Frequency of Replacement Demand.

- Stringent Defense Budget Constraints and Volatility in Procurement Cycles.

- Opportunities:

- Integration of Smart Textiles and Wearable Technology for Health Monitoring.

- Expansion into Emerging Defense Markets (e.g., Southeast Asia, Africa) Undergoing Equipment Upgrades.

- Development of Sustainable and Environmentally Compliant Manufacturing Processes.

- Niche Demand for Ultra-Specialized Gear for Arctic or High-Altitude Reconnaissance Units.

- Impact Forces:

- Bargaining Power of Suppliers: Moderate to High, driven by the specialized nature and limited availability of high-performance technical textiles and proprietary insulation technology.

- Bargaining Power of Buyers (Defense Agencies): High, due to large volume procurement contracts, standardized specifications, and stringent quality control requirements leading to intense price negotiations and adherence to military standards.

- Threat of New Entrants: Low, due to high capital requirements, long lead times for regulatory approval, and established relationships between defense contractors and primary military buyers.

- Threat of Substitutes: Moderate, as alternative thermal protection measures exist (e.g., specialized shelters, heated clothing), but the sleeping bag remains the most practical and weight-efficient solution for sustained recovery in the field.

- Intensity of Competitive Rivalry: High, driven by established players competing fiercely for long-term government contracts and tenders, focusing on technological superiority and proven field performance.

Segmentation Analysis

The Military Sleeping Bag Market is systematically segmented based on crucial operational parameters, including the temperature rating which dictates the bag's applicability in various climates, the insulation material which affects performance and weight characteristics, and the end-user category which influences design specifications and procurement quantities. A deep dive into these segments provides clarity on market demand patterns and technological focal points. The Temperature Rating segment, for instance, dictates the complexity of the materials and construction, with Extreme Cold Weather systems commanding the highest prices due to the requirement for multi-layer, highly engineered thermal barriers. Understanding these segmentations is vital for manufacturers aiming to align their product portfolios with specific military doctrine and regional deployment strategies, ensuring compliance and maximizing market penetration across diverse defense departments globally.

The segmentation by Insulation Material is particularly critical, dividing the market between traditional goose/duck down (often reserved for specialized ultra-light, dry environments due to its superior loft-to-weight ratio) and various advanced synthetic fibers. Synthetic insulation, such as proprietary continuous filament polyester or microfibers, holds a dominant position because of its resilience to moisture, its ability to retain thermal properties when wet, and easier maintenance protocols required for large-scale military deployment. End-User segmentation provides insight into procurement hierarchy, distinguishing between the massive volume needs of general Army forces (requiring durable, cost-effective solutions) versus the highly specialized, stealth, and weight-sensitive requirements of Special Operations Forces (SOF), which drive the innovation curve toward lighter, more technical systems. Distribution channels, typically dominated by direct sales to government agencies, ensure a tightly controlled supply chain, focusing on security and compliance rather than consumer marketing.

- By Temperature Rating:

- Extreme Cold Weather (-20°F and below)

- Cold Weather (0°F to -20°F)

- Mild Weather (30°F and above)

- Modular Systems (MSS, offering layered versatility)

- By Insulation Material:

- Synthetic Insulation (e.g., Primaloft, Climashield)

- Down Insulation (Water-resistant treated down)

- By End-User:

- Army

- Navy (Marine Forces)

- Air Force

- Special Operations Forces (SOF)

- By Distribution Channel:

- Direct Government Procurement

- Defense Contractors/Integrators

- Specialized Tactical Retailers (Limited Volume)

Value Chain Analysis For Military Sleeping Bag Market

The value chain for military sleeping bags is highly specialized and complex, beginning with the upstream supply of technical raw materials, which represents a significant point of control and differentiation. Upstream activities involve R&D and manufacturing of highly specialized components, including proprietary synthetic insulation fibers (e.g., specific microfilament structures), high-tenacity nylon or polyester shell fabrics treated for IR suppression and water resistance, and specialized, durable components like military-grade zippers and buckles. Suppliers of these core technical textiles often operate under strict confidentiality agreements and must meet rigorous military specifications (e.g., Mil-Spec), meaning the bargaining power of specialized material suppliers is notably high, impacting the overall production cost and lead time for manufacturers.

Midstream activities primarily encompass the design, cutting, sewing, and assembly processes carried out by defense contractors or specialized textile manufacturers. This stage is characterized by meticulous quality control and compliance checks, ensuring that every finished product meets the stipulated thermal rating, pack size, and durability requirements set out in the government tender. Direct manufacturing operations often require ISO certifications and adherence to domestic content rules, adding layers of complexity to the production phase. The downstream segment involves the logistics and distribution, predominantly characterized by direct selling models.

Distribution channels are overwhelmingly dominated by direct procurement: manufacturers or their authorized defense integrators sell directly to the military or defense ministry (Direct Sales). Indirect channels are marginal and typically limited to smaller contracts for tactical or reserve units, sometimes managed through specialized, vetted tactical gear distributors. The emphasis is always on a secure, accountable, and transparent supply chain to prevent the infiltration of non-compliant or counterfeit gear. This direct-to-government model minimizes intermediary costs but places the burden of logistics, quality assurance, and long-term service agreements directly on the manufacturer, solidifying a close relationship between the producer and the defense buyer.

Military Sleeping Bag Market Potential Customers

The primary and most critical segment of potential customers for military sleeping bags consists of global defense ministries and their affiliated armed forces—the Army, Navy (including Marine Corps), Air Force, and highly specialized Special Operations Forces (SOF). These entities represent high-volume, continuous procurement buyers due to the necessity of equipping large standing armies and managing routine replacement cycles for gear that is subject to extreme wear and tear in operational environments. Procurement decisions within this core customer base are driven not by price elasticity but by technical compliance, proven field performance, reliability under stress, and the adherence to detailed technical specifications (e.g., weight, compressed volume, thermal rating curve, infrared signature management). Customer focus groups within this sector are extremely focused on ensuring that the equipment contributes directly to soldier survivability and mission success.

Beyond the conventional military structure, a significant secondary customer base includes paramilitary organizations, national guard units, border patrol agencies, and tactical law enforcement teams (e.g., SWAT, rapid response). While these customers typically procure smaller volumes, their demand often focuses on high-durability, slightly more adaptable systems that bridge the gap between pure military specification and commercial availability. Furthermore, government agencies involved in large-scale disaster response (e.g., FEMA equivalents internationally) often maintain stocks of military-grade sleeping systems due to their superior longevity and performance in emergency humanitarian relief scenarios, representing an opportunistic yet consistent customer segment that values reliability and quick deployment capabilities.

International aid and security contractors operating in high-risk zones also form a niche, yet high-value, customer group. These contractors require equipment that meets near-military specifications for their personnel deployed in hostile or remote locations, often favoring lightweight and robust systems that are readily deployable and reliable, mirroring the functional demands of special forces units. The purchasing decision here is typically decentralized but guided by adherence to specific security standards and operational requirements defined by the client contracts, often overlapping with the higher-end product offerings designed for Special Operations Forces.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 620.1 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Propper International, Outdoor Research, Snugpak, Kifaru International, Tactical Tailor, Wiggy's, Eureka!, NEMO Equipment, Therm-a-Rest, Black Diamond Equipment, Kelty, Slumberjack, Marmot, Carinthia, Western Mountaineering, Feathered Friends, BAE Systems, L.L. Bean (Tactical Division), ADS Inc., Mustang Survival. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Military Sleeping Bag Market Key Technology Landscape

The technological landscape of the Military Sleeping Bag market is characterized by a relentless pursuit of the optimal warmth-to-weight ratio coupled with extreme ruggedness and specialized features for military operational requirements. A core technological focus lies in advanced insulation materials. While traditional down offers superior compressibility, the industry heavily favors specialized synthetic insulation systems, such as proprietary continuous-filament polyester batting. Technologies like Climashield Apex or Primaloft Gold are engineered to provide maximum thermal efficiency even when exposed to damp conditions, a critical requirement for sustained field use where drying is often impossible. These insulation technologies are constantly refined to minimize thermal bridging and maximize loft retention over extended compression cycles, a significant technical hurdle in designing military gear that must be packed tightly for long periods.

Beyond insulation, shell and liner fabrics are areas of intensive innovation. Modern military sleeping bags utilize advanced high-tenacity nylon or specialized ripstop polyester fabrics treated with Durable Water Repellent (DWR) finishes and, critically, infrared (IR) suppression technology. IR suppression materials are designed to minimize the thermal signature of the user, rendering them less detectable by night vision and thermal surveillance equipment—a non-negotiable requirement for Special Operations Forces and forward reconnaissance units. Furthermore, the construction techniques often incorporate differential cuts and specialized baffling structures to prevent cold spots and ensure even loft distribution across the entire bag, which necessitates advanced CAD modeling and precision manufacturing techniques unique to the defense sector.

The trend towards modularity represents a key design technology, shifting away from single-temperature bags to integrated sleeping systems (MSS). These systems typically involve multiple, interoperable components—a lightweight patrol bag, a heavier intermediate bag, and a waterproof/breathable Gore-Tex or proprietary bivouac sack. The technological challenge lies in ensuring perfect functional compatibility between all layers, allowing the soldier to rapidly adjust their thermal protection based on mission changes and unexpected environmental shifts. Future technological advancement is geared toward incorporating flexible, lightweight heating elements powered by external battery sources and integrating sensors for physiological monitoring, transforming the sleeping bag from a passive piece of survival gear into an active component of the soldier system.

Regional Highlights

Regional dynamics are critical drivers of procurement, specification, and market growth within the Military Sleeping Bag segment. North America, led overwhelmingly by the United States Department of Defense (DOD), represents the largest and most technologically advanced market. The DOD’s extensive and continuous modernization programs, coupled with its deployment across all major global climate zones—from the Arctic to the Middle East—necessitate massive, high-specification procurement contracts for sophisticated modular sleeping systems (MSS). The US market also benefits from a robust domestic defense contracting industry that invests heavily in cutting-edge material science, setting the global standard for thermal performance, durability, and compliance with strict military specifications (Mil-Spec). Canada also contributes significantly, focusing particularly on extreme cold weather capabilities.

Europe constitutes a mature, high-value market, primarily driven by NATO member states prioritizing interoperability and demanding gear that performs reliably in the diverse environments of the European continent, from the Scandinavian Arctic to the Mediterranean. Key purchasing nations like Germany, the UK, France, and Nordic countries require equipment compliant with STANAG (Standardization Agreements), often favoring highly specialized manufacturers known for their quality and longevity. The focus here is balanced between standard-issue gear for infantry and highly technical, ultra-light solutions for special forces and reconnaissance units, especially in counter-terrorism and rapid deployment roles.

Asia Pacific (APAC) is projected to be the fastest-growing market, propelled by escalating defense expenditures in major regional powers such as China, India, Japan, and South Korea. As these nations modernize their armed forces, they are rapidly transitioning away from bulky, older-generation equipment towards compact, high-performance tactical gear. The market growth in APAC is characterized by a mix of domestic production and significant international imports, particularly for high-end technology not yet available locally. The diverse climates within APAC, ranging from high-altitude Himalayas to tropical jungles, mandate a wide range of product specifications, further stimulating market expansion across both cold and warm weather segments. The Middle East and Africa (MEA) market growth is driven primarily by ongoing conflict and internal security needs, requiring durable, desert-optimized, and reliable equipment procured either through foreign military sales or local defense integrators.

- North America: Market leader due to massive US DOD spending, advanced R&D, and demand for multi-climate modular systems. Home to leading global defense contractors.

- Europe: Mature market focused on NATO interoperability, high-specification quality, and specialized cold weather gear (Nordic countries). Procurement driven by precision and longevity.

- Asia Pacific (APAC): Fastest-growing region, fueled by large-scale military modernization programs (India, China, South Korea) and diverse climate requirements (tropical, high-altitude). Increasing demand for technical import substitution.

- Latin America (LATAM): Emerging market with gradual modernization focusing on standard patrol gear and domestic manufacturing capacity building, primarily addressing internal security and jungle operations needs.

- Middle East and Africa (MEA): Growth linked to geopolitical instability and counter-insurgency operations. High demand for durable, desert-climate optimized, and rapid-deployment equipment, often sourced via foreign military sales (FMS).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Military Sleeping Bag Market. These companies are recognized for their robust defense contracting capabilities, stringent quality control measures, and continuous technological innovation in thermal regulation and durable textile engineering, ensuring they remain preferred suppliers to major global military forces. Their competitive strategies often center on securing long-term government tenders and maintaining high-level military certification for their specialized product lines, including advanced modular sleeping systems and extreme weather gear.- Propper International

- Outdoor Research

- Snugpak

- Kifaru International

- Tactical Tailor

- Wiggy's

- Eureka!

- NEMO Equipment

- Therm-a-Rest (Cascade Designs)

- Black Diamond Equipment

- Kelty (Exerpeutic International)

- Slumberjack

- Marmot (Newell Brands - Tactical Line)

- Carinthia

- Western Mountaineering (Specialized High Altitude)

- Feathered Friends (Niche Down Specialist)

- BAE Systems (Through Integration)

- L.L. Bean (Tactical Division)

- ADS Inc. (Defense Distributor/Integrator)

- Mustang Survival

Frequently Asked Questions

Analyze common user questions about the Military Sleeping Bag market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between military and commercial sleeping bags?

Military sleeping bags are engineered to meet stringent Mil-Spec standards, emphasizing extreme durability, mandatory fire retardancy, low IR (infrared) signature visibility for stealth, resilience in wet conditions, and compatibility with modular sleep systems (MSS). Commercial bags primarily prioritize comfort and lightweight design for consumer use, lacking the required operational specifications of defense agencies.

Which insulation material is predominantly used in military sleeping bags, and why?

Synthetic insulation, such as high-loft continuous filament polyester (e.g., Climashield, Primaloft), is predominantly used. This is favored because it retains up to 80% of its thermal performance when wet, dries quickly, and is more resilient to repeated compression and long-term storage than natural down, which loses loft rapidly when exposed to moisture.

How does the military ensure the longevity and performance of procured sleeping bags?

Longevity and performance are ensured through rigorous pre-procurement testing against defined temperature rating curves (e.g., EN 13537 or specific Mil-Spec protocols), mandatory destructive testing for durability (tear strength, zipper cycling), and ongoing quality assurance checks during production. Equipment is required to withstand extreme temperature fluctuations and high operational stress over multi-year deployment cycles.

What is a Modular Sleeping System (MSS) and its importance to military logistics?

An MSS is a system composed of two or more sleeping bags (e.g., Patrol Bag and Intermediate Bag) and a waterproof bivouac cover that can be used separately or combined to achieve varying temperature ratings, typically ranging from 30°F down to -40°F. The MSS is crucial for military logistics as it reduces the variety of equipment needed, allowing a single system to cover diverse operational climates efficiently.

What role does IR signature management play in modern military sleeping bag design?

IR signature management is critical for operational security, particularly for Special Forces and reconnaissance units. Modern military bags incorporate specialized, low-emissivity fabrics and coatings (IR suppression) designed to absorb or scatter near-infrared light and minimize heat retention visible to night vision and thermal surveillance equipment, thereby reducing the soldier's thermal footprint.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager