Milk Analyzers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441797 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Milk Analyzers Market Size

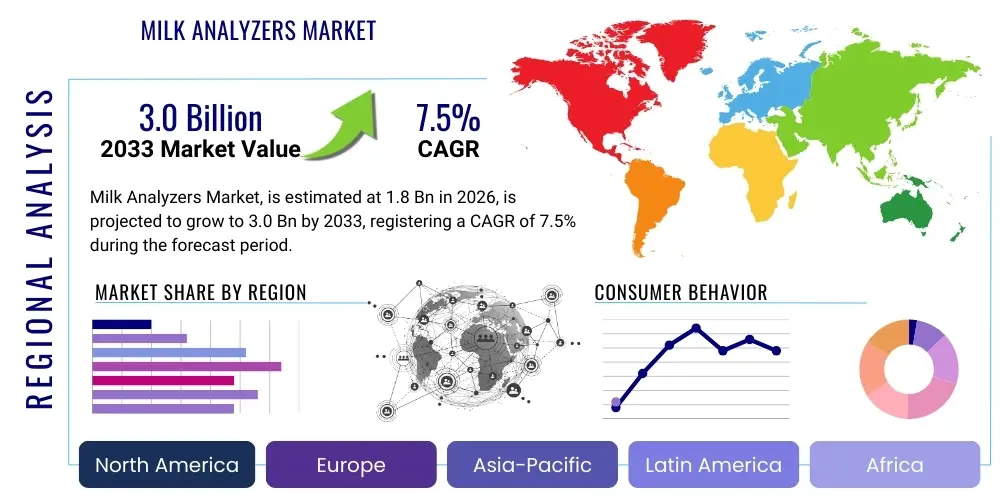

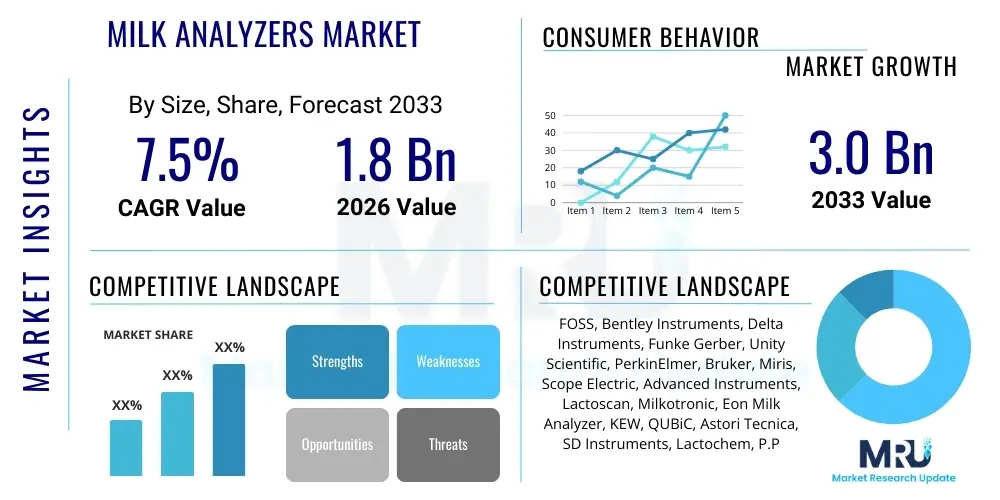

The Milk Analyzers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.0 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by increasing global concerns regarding food safety and quality control within the expansive dairy industry supply chain. The need for rapid, accurate, and cost-effective testing solutions at various collection points and processing facilities is accelerating the adoption of sophisticated analytical instruments. Furthermore, stringent regulatory frameworks enforced by governmental and international food safety bodies, particularly in developed economies, mandate comprehensive testing for parameters like fat content, protein, lactose, somatic cell count (SCC), and adulterants, thereby solidifying market expansion.

Market expansion is also supported by technological advancements, specifically the integration of Fourier-Transform Infrared (FTIR) spectroscopy and ultrasonic technology, which offer non-destructive and simultaneous analysis of multiple milk components. Developing regions, particularly in Asia Pacific and Latin America, are witnessing significant investment in modernizing their dairy infrastructure to meet rising consumer demand for standardized dairy products, further fueling the procurement of milk analyzing equipment. The shift from traditional, time-consuming chemical testing methods to automated, high-throughput analyzers provides dairy producers and processors with substantial operational efficiencies, justifying the initial investment in this specialized equipment.

Milk Analyzers Market introduction

The Milk Analyzers Market encompasses instruments designed to determine the chemical composition and physical properties of raw and processed milk and dairy products. These essential devices play a critical role in quality assurance, fraud detection, and determining the economic value of milk based on its constituent percentages, such as fat, protein, lactose, and total solids. The fundamental product description involves compact, calibrated instruments utilizing technologies like ultrasonic waves, mid-infrared spectroscopy, or chemiluminescence to provide near-instantaneous results, contrasting sharply with historical methods that required extensive laboratory procedures. Major applications span the entire dairy value chain, including farm-level monitoring for herd health, dairy cooperative collection centers for payment processing, and large-scale processing units for quality control prior to pasteurization and product manufacturing.

The primary benefits derived from using advanced milk analyzers include enhanced operational efficiency due to rapid testing cycles, improved detection of economically motivated adulteration (EMA) such as water addition or foreign substances like melamine, and precise classification of milk quality, which directly impacts producer payout structures. Key driving factors propelling this market include the global expansion of the organized dairy sector, the escalating prevalence of infectious diseases in livestock necessitating rapid pathogen or Somatic Cell Count (SCC) detection, and heightened consumer awareness regarding the nutritional and safety standards of food products. The convergence of IoT and cloud connectivity with these analyzers enables remote diagnostics and centralized data management, further cementing their indispensable nature in modern dairy farming and processing.

Furthermore, regulatory harmonization across borders concerning dairy product standards acts as a significant catalyst. Countries participating in global trade must ensure their exported dairy commodities meet stringent international health and quality benchmarks, often requiring the utilization of certified, high-precision milk analyzers. The increasing preference for high-quality, traceable dairy ingredients in the booming functional food and beverage industry necessitates rigorous component analysis, driving demand for benchtop models capable of complex, multi-parameter measurements. The continuous innovation focusing on portability and robustness is opening new avenues for deployment in remote or underserved geographical areas, ensuring widespread access to quality testing capabilities.

Milk Analyzers Market Executive Summary

The Milk Analyzers Market demonstrates strong momentum, driven by structural shifts toward advanced food safety protocols and digital integration across the dairy supply chain. Key business trends indicate a pronounced move toward sophisticated, multi-parameter analyzers, particularly those employing mid-infrared technology, offering superior speed and accuracy compared to older ultrasonic models. Strategic mergers, acquisitions, and partnerships aimed at expanding geographical reach and integrating complementary technologies (e.g., combining compositional analysis with pathogen detection capabilities) characterize the competitive landscape. Furthermore, subscription-based service models for maintenance and software updates are gaining traction, shifting operational expenditure dynamics for end-users, while manufacturers are focusing on creating rugged, easy-to-use interfaces suitable for non-laboratory environments, such as dairy collection centers.

From a regional perspective, Asia Pacific is slated to exhibit the highest growth rate, fueled by the rapid expansion and formalization of the dairy industry in countries like India and China, coupled with increased per capita consumption of processed dairy products and growing government emphasis on combating milk adulteration. North America and Europe, while mature, remain dominant in terms of revenue, driven by continuous technological upgrades, strict regulatory enforcement concerning Bovine Spongiform Encephalopathy (BSE) and antibiotic residues, and high adoption rates of automated laboratory-grade analyzers in large processing facilities. Emerging regions, including Latin America and the Middle East, are experiencing rising demand due to infrastructure modernization projects and improved cold chain logistics requiring reliable quality checkpoints.

Segment trends reveal that the By Technology segment is dominated by Infrared Spectroscopy due to its comprehensive analytical capabilities and rapid results, positioning it favorably over traditional chemical and basic ultrasonic methods. In the By Application segment, Milk Processing Units account for the largest market share, given their high volume throughput and mandatory regulatory testing requirements. However, the Dairy Farms and Collection Centers segment is projected to grow faster, spurred by the need for instant quality checks at the source to prevent the integration of substandard or adulterated milk into the main supply flow. The shift towards portable and handheld devices within the Product Type segment supports this decentralized testing trend, enabling quality control closer to the farm.

AI Impact Analysis on Milk Analyzers Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Milk Analyzers Market frequently center on predictive maintenance, enhanced fraud detection, and the automation of data interpretation. Common concerns revolve around how AI can minimize human error in quality control, whether machine learning algorithms can accurately identify novel or emerging adulterants not programmed into existing libraries, and the feasibility of using historical compositional data (fat, protein, SCC) processed by AI to predict or model herd health outcomes or optimal feed formulations. The consensus expectation is that AI integration will shift milk analysis from merely reporting current compositional status to providing actionable, predictive intelligence across the dairy supply chain, optimizing resource allocation and significantly boosting food safety resilience. Users expect AI to move beyond basic spectral data processing to enable deep learning applications for identifying complex chemical patterns indicative of fraudulent activity or subclinical disease indicators.

The immediate impact of AI is visible in spectral analysis optimization. High-throughput analyzers generate vast amounts of infrared or ultrasonic data points for every sample. Traditional software relies on pre-defined calibrations, whereas AI and Machine Learning (ML) algorithms can continuously refine these calibrations, detecting subtle deviations that standard multivariate analysis might miss, thereby improving accuracy, especially in complex matrices like milk from different breeds or geographical regions. Furthermore, ML is being applied to correlate analytical results with operational parameters, helping dairy processors identify systemic issues in their raw material sourcing or processing environment proactively. For instance, an AI model analyzing fluctuations in protein content and viscosity might predict potential equipment malfunctions or inconsistencies in the thermal treatment process before they escalate into production failures.

A longer-term impact involves integrating milk analyzer data with other farm management systems (IoT sensors, herd records, climate data). AI acts as the central intelligence layer, processing disparate data sets to provide holistic insights. This capability allows for predictive modeling of milk yield based on feed adjustments and composition trends or the early detection of mastitis across the herd by analyzing slight, persistent increases in SCC detected by automated inline analyzers. This transition transforms milk analyzers from simple testing instruments into vital components of a comprehensive, intelligent farm-to-fork traceability and management system. The automation of reporting, regulatory compliance checks, and trend analysis reduces administrative overhead and enhances compliance efficiency, crucial for global exporters navigating varied regulatory requirements.

- Enhanced Adulteration Detection: AI/ML algorithms identify subtle spectral deviations, rapidly flagging unknown or emerging adulterants (e.g., non-dairy proteins, unusual chemical traces).

- Predictive Maintenance: AI analyzes instrument performance data (sensor drift, calibration history) to forecast potential component failures, reducing downtime.

- Automated Diagnostics: ML models correlate milk composition data (SCC, urea, fat ratios) with herd health metrics, providing early warnings for metabolic disorders or infectious diseases.

- Real-time Calibration Optimization: AI continually adjusts and validates analytical calibrations based on environmental and sample variations, ensuring sustained accuracy.

- Data Silo Integration: AI enables the seamless merger of analytical results with enterprise resource planning (ERP) systems and farm management software for holistic supply chain visibility.

DRO & Impact Forces Of Milk Analyzers Market

The Milk Analyzers Market is significantly influenced by a powerful combination of Driving factors, Restraints, and Opportunities (DRO), collectively exerting impact forces that shape market dynamics and investment decisions. The key driver is the universal push for improved food quality standards and enhanced traceability, particularly in response to high-profile cases of milk adulteration, which have eroded consumer trust globally. This is compounded by mandatory governmental regulations (e.g., FDA, EFSA standards) requiring sophisticated testing for antibiotic residues and pathogens. However, market growth is restrained by the high initial capital expenditure associated with advanced spectroscopic analyzers, particularly the benchtop models, making adoption challenging for small-scale dairy farmers and collection centers in developing regions. Furthermore, the necessity for specialized technical training and ongoing calibration complexity acts as a procedural barrier to widespread deployment, particularly concerning high-end FTIR instruments. The compelling opportunity lies in the development of low-cost, robust, and highly portable ultrasonic analyzers integrated with cloud services, making precision testing accessible and affordable for the fragmented smallholder dairy sector, while simultaneously leveraging IoT for remote diagnostics and data aggregation.

Impact forces are currently pushing the market towards technology convergence and decentralization. The pressure from consumers and regulatory bodies for transparency (a high impact force) is forcing processors to implement rigorous testing protocols not just at the processing plant, but upstream at the collection point. This demand accelerates innovation in portability and speed. Conversely, the high cost of advanced reagents and calibration standards represents a persistent structural impediment, particularly sensitive to global supply chain volatility. The positive impact force derived from rapid urbanization and increasing per capita income in Asia is expanding the demand base for packaged and processed dairy, which inherently requires standardized quality analysis throughout the production process. Additionally, the need for rapid mastitis detection on-farm (using Somatic Cell Count analysis) is driving the proliferation of dedicated, rapid testing kits and devices, presenting a niche but high-growth sector.

The competitive rivalry, another significant impact force, is intense, driving continuous R&D investment in miniaturization and connectivity features. Key players are vying to offer solutions that reduce complexity while maximizing analytical throughput. This rivalry benefits the end-user by providing more feature-rich devices at potentially more competitive price points over time. The threat of substitutes, while low (as sophisticated analytical equipment cannot be easily replaced by simple chemical kits), drives manufacturers to continuously expand the parameter testing capabilities of their analyzers—for instance, moving beyond fat/protein analysis to include pH, freezing point, and specific adulterant screening within a single instrument. Overall, regulatory mandates and technological leapfrogging in emerging economies are the dominant forces pushing market value upward, while cost constraints and required technical expertise serve as mitigating factors slowing full market penetration.

Segmentation Analysis

The Milk Analyzers Market segmentation provides a granular view of demand distribution and technological preferences across various end-user requirements and operational scales. The market is primarily segmented based on Technology, determining the underlying analytical mechanism; Product Type, differentiating based on size and mobility; Application, specifying the end-user environment; and finally, the components of the product itself. This analysis allows manufacturers to tailor products precisely to the needs of different consumer groups, ranging from high-throughput industrial processors requiring maximum accuracy to individual dairy farmers needing rugged, rapid field testing capabilities. Understanding these segments is crucial for strategic market positioning and resource allocation, reflecting the diverse needs spanning simple quality control to advanced compositional analysis and contaminant detection.

The segmentation by Technology reveals a clear hierarchy in precision and cost, with Infrared Spectroscopy (specifically FTIR and Mid-Infrared) dominating high-value applications due to its ability to measure numerous components simultaneously with high accuracy, essential for payment determination and large-scale quality control. Ultrasonic analysis, conversely, holds a strong position in basic compositional analysis at the collection level, favored for its lower operational cost, portability, and non-reagent-based operation. Product type segmentation distinguishes between highly accurate, laboratory-grade benchtop devices, crucial for R&D and central labs, and lightweight, often battery-operated portable or handheld units, optimized for efficiency and ease of use in field environments like farms and mobile collection centers. The ongoing trend is towards the convergence of high accuracy and portability, facilitated by miniaturization of spectroscopic components.

Segmentation by Application highlights where the majority of capital investment is directed. Milk Processing Units are the cornerstone of demand, requiring extensive battery of tests for large volumes before processing. However, the fastest-growing segment is Dairy Farms/Collection Centers, driven by mandates for quality assessment before milk leaves the initial collection point, minimizing risk earlier in the supply chain. The component segmentation emphasizes that while hardware sales dominate, the importance of integrated software for data management, remote monitoring, and regulatory compliance reporting is rapidly increasing, transforming the service component into a vital revenue stream for market leaders. This comprehensive segmentation reflects the dynamic nature of the dairy industry’s transition towards integrated, data-driven quality management systems.

- By Technology:

- Infrared Spectroscopy (FTIR, Mid-Infrared)

- Ultrasonic Analysis

- Flow Cytometry

- Reagent-based Photometric Methods

- By Product Type:

- Benchtop/Laboratory Analyzers

- Portable/Handheld Analyzers

- By Application:

- Milk Processing Units

- Dairy Farms/Collection Centers

- Research Institutes and Academic Laboratories

- Quality Control and Government Laboratories

- By Component:

- Hardware (Sensors, Optics, Pumps)

- Software and Data Management Systems

- Services (Maintenance, Calibration, Training)

Value Chain Analysis For Milk Analyzers Market

The Value Chain for the Milk Analyzers Market begins with upstream activities focused heavily on specialized component manufacturing and research and development (R&D). Upstream analysis involves the procurement of high-precision components such as optical sensors, specialized infrared sources (for FTIR models), ultrasonic transducers, microprocessors, and sophisticated fluidics systems. This stage is characterized by high technological dependency on specialized suppliers, particularly for advanced optical and electronic components. Major manufacturers invest heavily in proprietary sensor technology and software algorithms (the core intellectual property) that translate physical measurements into accurate compositional data. Quality control and rigorous testing of prototypes are crucial upstream activities to ensure the reliability and accuracy required for regulatory compliance, establishing a foundation of trust in the final product's measurement capabilities.

Midstream activities encompass the manufacturing, assembly, calibration, and distribution phases. Calibration is a critical and unique aspect of the milk analyzer value chain, often requiring certified reference materials (CRMs) to ensure devices conform to international standards like ISO or AOAC. Distribution channels are varied: Direct sales strategies are typically employed for high-value benchtop units sold to large corporate dairy processors or government labs, allowing for direct consultation, installation, and specialized training. Indirect channels, involving authorized distributors, dealers, and value-added resellers (VARs), are often utilized for wider reach, particularly for portable ultrasonic analyzers targeting numerous small-to-medium-sized collection centers or remote farms. These intermediaries often provide the localized sales and immediate technical support necessary in diverse geographical markets.

Downstream analysis focuses on deployment, maintenance, and ongoing service provision, which constitutes a significant and growing revenue stream. End-users require extensive training on operation, troubleshooting, and routine maintenance, particularly calibration procedures. Post-sales service is paramount; downtime for a milk analyzer can severely disrupt a dairy processor's operations. Consequently, long-term service contracts, remote diagnostic capabilities (often enabled by IoT and cloud connectivity), and certified service technicians are vital downstream elements. The efficiency and quality of the downstream support directly influence customer retention and brand reputation. Furthermore, the downstream phase includes software updates and data integration services, ensuring the analyzers remain compatible with evolving regulatory reporting requirements and enterprise data systems, thereby maximizing the lifetime value of the hardware investment.

Milk Analyzers Market Potential Customers

The primary consumers and buyers in the Milk Analyzers Market are diverse, reflecting the various stages where quality assessment is critical within the dairy supply chain. The largest segment of end-users consists of Milk Processing Units, ranging from small local dairies to multinational dairy corporations (e.g., Nestle, Lactalis, Fonterra). These entities require high-throughput, accurate benchtop analyzers (typically FTIR) for rapid assessment of raw milk upon receipt, quality control throughout processing, and final product composition verification before packaging. Their purchasing decisions are driven by throughput needs, regulatory compliance demands, and the need for precision to optimize ingredient usage and maintain brand consistency.

The second major group includes Dairy Farms and Milk Collection Centers (MCCs). MCCs, acting as intermediate hubs, use robust, often portable ultrasonic or basic mid-infrared analyzers primarily to determine payment to individual farmers based on fat and solid non-fat (SNF) content and to screen for basic adulterants (like added water). Large modern dairy farms also increasingly use compact analyzers for on-farm testing, primarily to monitor herd health (e.g., Somatic Cell Count analysis for mastitis detection) and optimize feed management based on compositional feedback. Their procurement criteria prioritize durability, simplicity of operation, and cost-effectiveness suitable for harsh field environments, often preferring non-reagent methods to minimize recurring costs.

Other significant potential customers include Government Regulatory Bodies and Quality Control Laboratories, which utilize the highest precision laboratory-grade analyzers for verification, arbitration testing, and establishing national dairy standards. Academic and Research Institutes also represent a steady demand source, utilizing specialized analyzers for nutritional studies, food science research, and developing new detection methodologies for contaminants or novel dairy products. These secondary customer groups focus on sensitivity, advanced parameter detection capabilities, and compatibility with complex research protocols, often leading them to purchase advanced spectrophotometric models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.0 Billion |

| Growth Rate | CAGR 7.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FOSS, Bentley Instruments, Delta Instruments, Funke Gerber, Unity Scientific, PerkinElmer, Bruker, Miris, Scope Electric, Advanced Instruments, Lactoscan, Milkotronic, Eon Milk Analyzer, KEW, QUBiC, Astori Tecnica, SD Instruments, Lactochem, P.P. Systems, Ekso Milk Analyzers |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Milk Analyzers Market Key Technology Landscape

The technological landscape of the Milk Analyzers Market is dominated by two primary methodologies: Infrared Spectroscopy and Ultrasonic Analysis, alongside emerging niche technologies like Flow Cytometry. Infrared Spectroscopy, particularly Fourier Transform Infrared (FTIR) and Mid-Infrared (MIR) techniques, represents the gold standard for comprehensive compositional analysis. These technologies work by passing specific wavelengths of infrared light through the milk sample and measuring the resulting absorption spectrum. Different milk components (fat, protein, lactose, total solids) absorb light at characteristic wavelengths, allowing for simultaneous, non-destructive quantification. FTIR is highly valued in high-throughput settings due to its speed, accuracy, and ability to be calibrated for a vast array of parameters, including somatic cell count (SCC) proxies and urea, providing a detailed chemical fingerprint of the milk sample necessary for quality grading and fraud detection in advanced markets.

Ultrasonic analysis offers a highly cost-effective and portable alternative, particularly popular in collection centers and small farms. This technology measures physical properties, specifically the speed of sound and acoustic impedance through the milk sample, correlating these measurements to components like fat, protein, and density. Unlike FTIR, ultrasonic analyzers typically do not require reagents and are simpler to operate, leading to lower operating costs and maintenance requirements. However, they generally offer lower precision and fewer analytical parameters compared to spectroscopic methods, and their accuracy can be slightly more susceptible to sample temperature variations. Manufacturers are constantly improving ultrasonic sensor design and algorithm sophistication to close this accuracy gap, making these devices increasingly competitive for essential parameter checks at the source.

Emerging technologies like Flow Cytometry are gaining traction for highly specialized applications, notably the precise and direct counting of Somatic Cells (an indicator of mastitis) and viable bacteria. Flow cytometry involves staining individual cells and passing them through a laser beam, detecting scattered and fluorescent light signals. While typically slower and more complex than proxy methods offered by FTIR, flow cytometry provides indisputable, highly accurate microbial and somatic cell counts, making it indispensable for critical herd health management and ensuring compliance with strict regulatory limits on bacterial load. The future technological landscape is trending towards integrated multi-sensor platforms that combine the speed of ultrasonic methods, the comprehensive capability of MIR, and the precision of flow cytometry into a single, modular unit, enhanced by cloud-based AI algorithms for real-time diagnostics and predictive quality control.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to the increasing organization and industrialization of the dairy sector, particularly in populous countries like India and China, where consumption of high-quality dairy is soaring. Governments in this region are heavily investing in technology to combat widespread milk adulteration (a major issue) and enforce strict quality standards, driving the rapid adoption of portable analyzers at the grassroots level and advanced FTIR systems in new processing plants.

- North America: This region holds a significant market share, characterized by large-scale, automated dairy farms and processing facilities. Demand is driven by the need for high-throughput laboratory analysis, stringent regulatory requirements for antibiotic and pathogen testing, and the early adoption of AI-integrated analyzers for advanced herd management and predictive quality control. Continuous technological innovation and replacement cycles maintain strong market stability.

- Europe: Europe is a mature market, known for its rigorous quality standards (e.g., EU food safety regulations) and high consumption of premium dairy products. The primary demand centers around high-precision benchtop FTIR systems used by established co-operatives and processors for payment determination based on detailed compositional analysis. Emphasis is placed on certified calibration standards and accurate analysis of specialized components like urea and casein fractions.

- Latin America (LATAM): Growth in LATAM is spurred by ongoing efforts to modernize the agricultural sector and integrate local dairy production into international trade networks. Countries like Brazil and Argentina are increasing their investments in milk analyzers to standardize quality and improve export competitiveness. The market favors rugged, easy-to-use ultrasonic analyzers initially, with a gradual shift toward spectroscopic methods as infrastructure improves.

- Middle East and Africa (MEA): This region is an emerging market, driven by governmental food security initiatives and increasing reliance on processed dairy to meet growing urban population demands. Challenges related to high temperatures and fragmented infrastructure necessitate robust, low-maintenance equipment. Strategic investments by Gulf Cooperation Council (GCC) countries in large-scale dairy farms are creating concentrated pockets of high demand for advanced analytical instruments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Milk Analyzers Market.- FOSS

- Bentley Instruments

- Delta Instruments (Part of FOSS)

- Funke Gerber

- Unity Scientific

- PerkinElmer

- Bruker

- Miris

- Scope Electric

- Advanced Instruments

- Lactoscan

- Milkotronic

- Eon Milk Analyzer

- KEW

- QUBiC

- Astori Tecnica

- SD Instruments

- Lactochem

- P.P. Systems

- Ekso Milk Analyzers

Frequently Asked Questions

Analyze common user questions about the Milk Analyzers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technological difference between ultrasonic and infrared milk analyzers?

Ultrasonic analyzers measure physical properties (speed of sound) to estimate composition, offering lower cost and portability without reagents. Infrared (FTIR/MIR) analyzers measure chemical properties (light absorption) for simultaneous, highly accurate quantification of multiple components (fat, protein, lactose, etc.) and are typically used in high-throughput laboratory settings.

How is AI specifically improving the accuracy and reliability of milk quality testing?

AI, particularly Machine Learning (ML), improves accuracy by continuously optimizing calibration models based on vast data sets, detecting subtle deviations indicative of emerging or unknown adulterants, and minimizing the impact of matrix variations (e.g., milk from different breeds or regions) which traditionally challenge fixed calibration methods.

What is the most critical restraint hindering the widespread adoption of high-end milk analyzers in developing regions?

The most critical restraint is the high initial capital expenditure (CAPEX) required for advanced spectroscopic instruments (FTIR), coupled with the need for specialized technical expertise for ongoing calibration, maintenance, and handling of certified reference materials, making them financially prohibitive for smaller collection centers.

Which segment of the dairy supply chain is generating the fastest growth in demand for milk analyzers?

The Dairy Farms and Collection Centers segment is exhibiting the fastest growth. This acceleration is driven by the industry's need for instant quality checks at the source (upstream testing) to ensure payment accuracy, minimize spoilage, and proactively screen for adulteration before milk enters the main processing stream.

Beyond standard composition, what advanced parameters can modern milk analyzers accurately measure?

Modern spectroscopic analyzers can accurately measure advanced parameters crucial for quality and health diagnostics, including Somatic Cell Count (SCC) proxies (for mastitis), freezing point (to detect added water), urea content (related to animal feed efficiency), and specific fractions of protein like casein.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Milk Analyzers Market Statistics 2025 Analysis By Application (Dairy Production Field, Milk Collection Stations, Lab Field), By Type (Ultrasonic Milk Analyzer, Infrared Milk Analyzer), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Milk Analyzers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Ultrasonic Milk Analyzer, Infrared Milk Analyzer, Others), By Application (Cows, Goats, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager