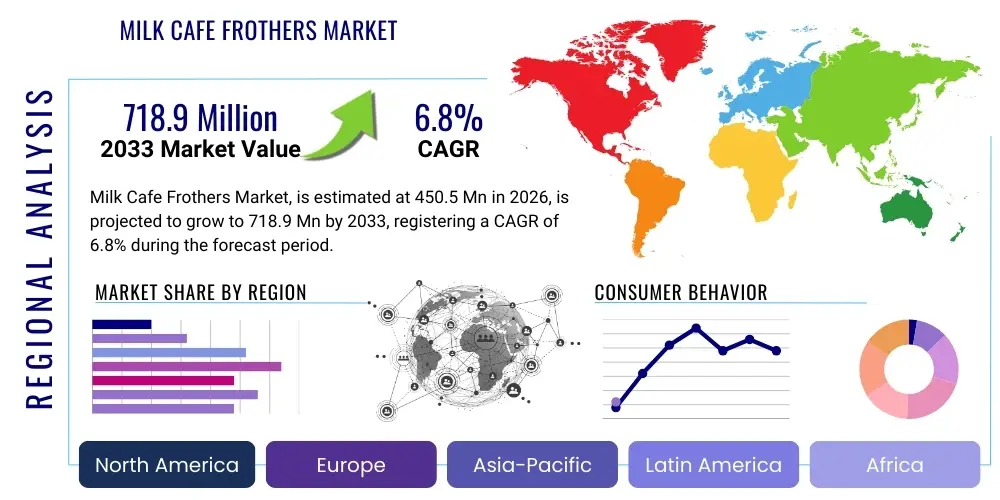

Milk Cafe Frothers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442750 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Milk Cafe Frothers Market Size

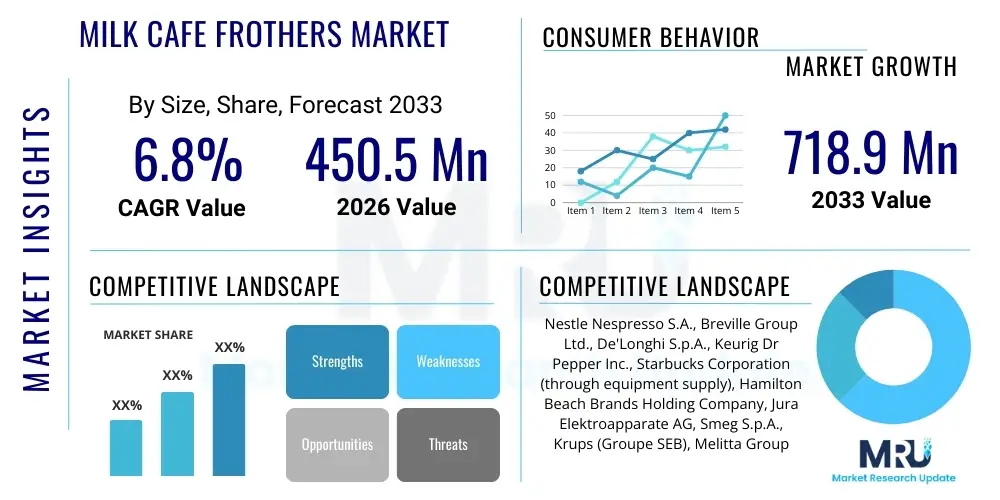

The Milk Cafe Frothers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $450.5 Million in 2026 and is projected to reach $718.9 Million by the end of the forecast period in 2033. This consistent expansion is underpinned by the robust and continuing global proliferation of specialty coffee culture, demanding sophisticated, reliable, and high-throughput equipment capable of producing consistent microfoam across diverse milk types, including dairy and an ever-expanding array of plant-based alternatives. The investment propensity among café owners towards durable, commercial-grade machinery that minimizes operational complexity and maximizes efficiency during peak hours is a central factor driving this upward valuation trajectory. Furthermore, technological refinements in frothing mechanics, such as induction heating systems and automated texture control, contribute significantly to the market's monetary expansion and adoption rates in high-volume foodservice environments.

Milk Cafe Frothers Market introduction

The Milk Cafe Frothers Market encompasses professional-grade and industrial equipment designed specifically for commercial food service establishments, including specialty coffee houses, large-scale restaurants, hotels, and corporate dining facilities. These advanced devices are crucial for producing high-quality, perfectly textured milk foam, known as microfoam, which is fundamental to preparing premium espresso beverages such as lattes, cappuccinos, and macchiatos. Unlike consumer-grade models, cafe frothers are engineered for exceptional durability, continuous high-volume operation, precision temperature control, and rapid cycle times, which are essential for maintaining service speed and consistency in demanding commercial settings. The primary product segments include high-powered steam wands integrated into espresso machines, dedicated automatic induction frothers, and advanced systems that offer customizable aeration and temperature profiles for various milk fat contents and non-dairy bases. Key applications revolve around improving beverage quality and reducing barista dependency on manual skills, ensuring every drink meets stringent quality standards regardless of the operator's experience level.

The burgeoning popularity of specialty coffee worldwide, often characterized by complex flavor profiles and artistic latte art, directly fuels the demand for superior frothing technology. Commercial frothers provide substantial operational benefits, including significant time savings due to faster heating elements and reduced milk waste through precise volumetric dosing. They also enhance the overall consumer experience by ensuring consistently velvety texture and optimal temperature, attributes that define high-end cafe offerings. Major driving factors include the global expansion of café chains, increasing disposable income in emerging economies enabling greater expenditure on premium beverages, and the ongoing trend of menu diversification, particularly the integration of specialty drinks that require high-quality frothed milk. The shift towards plant-based milks (oat, almond, soy) further necessitates the adoption of specialized frothers that can optimize foam structure for these alternatives, which behave differently under standard frothing conditions due to varying protein and fat compositions.

In essence, the Milk Cafe Frothers Market is an integral component of the professional coffee ecosystem, providing the technological backbone necessary to meet rising consumer expectations for consistency and quality. The market is increasingly characterized by features emphasizing automation and ease of cleaning, driven by operational needs to minimize downtime and labor costs. As competition intensifies within the hospitality sector, investment in reliable, high-performance frothing equipment becomes a non-negotiable strategy for cafes aiming to differentiate themselves through superior product execution. The integration of digital controls and IoT capabilities is also beginning to mark the landscape, allowing for better inventory management and performance diagnostics, further cementing the frother's role as a critical asset in modern commercial kitchens.

Milk Cafe Frothers Market Executive Summary

The Milk Cafe Frothers Market is experiencing robust acceleration driven by multifaceted shifts across business models, geographic regions, and consumer segments. Business trends clearly indicate a strong move toward automation and integration, where standalone frothers are being replaced or augmented by sophisticated, multi-functional units integrated directly into super-automatic espresso machines or modular beverage stations. This trend reflects the commercial imperative to optimize labor productivity and ensure unwavering quality control, particularly as global labor costs rise. Furthermore, there is a pronounced supply chain focus on developing robust, modular designs that allow for easier maintenance and compliance with stringent commercial sanitation standards, thereby reducing the total cost of ownership for end-users. Strategic partnerships between equipment manufacturers and major coffee roasters or multinational café chains are defining market penetration strategies, ensuring equipment compatibility and standardized operational procedures across vast networks. Sustainability concerns are also influencing purchasing decisions, favoring models with high energy efficiency ratings and components made from recyclable or durable materials that extend product lifecycles.

Regionally, the market presents a dichotomy of maturity and rapid expansion. North America and Europe, characterized by established specialty coffee markets, focus heavily on premiumization, demanding technologically advanced frothers with precise controls tailored for nuanced specialty drinks and complex non-dairy requirements. These regions prioritize innovation in texture and temperature profiling. Conversely, the Asia Pacific region, particularly countries like China, India, and Southeast Asian nations, represents the primary growth engine. Rapid urbanization, the adoption of Western café culture among a burgeoning middle class, and extensive HORECA (Hotel, Restaurant, Catering) sector development are fueling massive demand for reliable, entry-level to mid-range commercial frothing equipment suitable for quick service models. Latin America and the Middle East show steady growth, often driven by tourism sectors and localized investments in sophisticated hospitality infrastructures that support premium offerings. Local regulations concerning electrical standards and material safety also play a critical role in regional product adaptation and market entry strategies.

Segment trends underscore the rising dominance of automatic induction frothers due to their inherent safety, speed, and ease of cleaning compared to traditional steam wands, especially in environments where staff training turnover is high. However, integrated steam wands remain essential in high-end specialty shops where baristas require maximum manual control for complex latte art execution. The fastest-growing segment is undeniably linked to the preparation of non-dairy milks; frothers optimized specifically for oat milk, in particular, are seeing unprecedented demand. From an end-user perspective, independent coffee shops remain vital, but large institutional buyers (universities, hospitals, corporate campuses) are increasingly adopting high-capacity commercial units to provide quality coffee services internally, broadening the traditional consumer base beyond classic retail food service. Ultimately, the market narrative is one of precision, efficiency, and adaptability, catering to the increasingly sophisticated and diversified palate of the global coffee consumer.

AI Impact Analysis on Milk Cafe Frothers Market

Common user questions regarding AI's impact on the Milk Cafe Frothers Market frequently revolve around automation capabilities, predictive maintenance, and quality consistency. Users typically inquire: "Can AI truly automate the perfect microfoam texture for every type of milk?" "How will AI-driven diagnostics reduce equipment downtime and maintenance costs?" and "Will AI integration make traditional barista skills obsolete?" The consensus across these questions highlights a desire for enhanced operational efficiency and flawless quality control, acknowledging that AI could bridge the gap between human error and consistent machine performance. Analysis reveals that stakeholders expect AI to move beyond simple automation (like auto-dosing) and enter the realm of sophisticated sensory analysis and process optimization, using machine learning to adjust heating elements, frothing time, and air injection based on real-time factors such as ambient temperature, milk temperature, and the specific composition of the milk being used. This shift aims to standardize the sensory experience of specialty coffee across all service locations, irrespective of local staff proficiency. Furthermore, users anticipate AI playing a crucial role in managing inventory by accurately predicting milk consumption based on sales patterns, minimizing spoilage and optimizing procurement cycles.

- AI-driven predictive maintenance scheduling based on usage patterns and sensor data, significantly reducing unplanned equipment failure.

- Automated quality control systems utilizing machine vision and sensors to analyze microfoam density and texture in real-time, adjusting parameters instantly.

- Optimized preparation algorithms that automatically compensate for variations in milk type (dairy vs. non-dairy) and ambient conditions to ensure consistency.

- Integration with Point of Sale (POS) systems for AI-powered demand forecasting, optimizing milk inventory and reducing supply chain waste.

- Enhanced user interfaces offering personalized operational guidance and troubleshooting via machine learning diagnostics.

- Development of self-learning frothing profiles that adapt to new milk formulations or desired texture specifications over time.

DRO & Impact Forces Of Milk Cafe Frothers Market

The market dynamics of Milk Cafe Frothers are governed by a complex interplay of growth stimulants, inherent limitations, and untapped commercial avenues, all synthesized under critical impact forces. The primary drivers include the accelerated global expansion of café culture, especially in urban centers across emerging economies, which necessitates high-quality, reliable equipment to support scaling operations. Furthermore, the persistent and growing consumer demand for premium, customized, and consistently executed espresso beverages places pressure on cafes to invest in advanced frothing technology that minimizes human variability. A significant restraint is the relatively high initial capital expenditure required for commercial-grade induction or integrated frothing systems compared to traditional steam wands, which can deter smaller independent cafes with tighter budgets. Additionally, the complexity involved in maintaining strict hygiene standards for milk handling equipment represents an ongoing operational restraint, requiring robust design solutions and rigorous cleaning protocols. The proliferation of plant-based milk alternatives, while an opportunity, also presents a restraint in the sense that older or less advanced frothers struggle to produce acceptable foam texture from these varied compositions, demanding costly equipment upgrades.

Opportunities in the Milk Cafe Frothers market are largely concentrated around technological innovation and geographical expansion. The development of frothers explicitly designed for specific non-dairy milks (e.g., dedicated oat milk frothers) allows manufacturers to capture niche premium segments. Furthermore, the burgeoning demand from institutional foodservice providers—such as large corporate campuses, hospitals, and educational facilities increasingly offering high-quality coffee programs—represents a substantial, often overlooked, expansion territory beyond traditional retail cafes. Opportunities also exist in developing IoT-enabled equipment that provides real-time performance data, allowing café chains to remotely monitor operational efficiency and consistency across their outlets, leveraging data analytics for proactive maintenance and staff training needs. The rising focus on sustainability creates an opportunity for manufacturers to innovate using energy-efficient components, such as magnetic induction heating, which can reduce utility costs for end-users, thereby enhancing the overall value proposition of high-end machinery.

The impact forces within this market are predominantly centered on standardization and the speed of service. The need for absolute consistency in beverage preparation across various outlets compels large chains to adopt standardized, often automated, frothing solutions. This standardization acts as a critical force shaping procurement decisions. Secondly, the competitive nature of the retail coffee market means that speed of service is paramount, especially during morning and lunch rush hours. Frothing technology that significantly reduces the preparation time for complex drinks—through rapid heating, parallel processing, or instantaneous self-cleaning capabilities—exerts a powerful positive impact force on market adoption. Conversely, regulatory impact forces related to food safety and sanitation, particularly in highly regulated markets like Europe and North America, drive compliance innovation, forcing manufacturers to design systems that are easy to disassemble and sterilize, influencing both material choice and overall product architecture. The cumulative effect of these drivers, restraints, and opportunities, mediated by these internal and external impact forces, dictates the product lifecycle and the overall market valuation trajectory.

Segmentation Analysis

The Milk Cafe Frothers Market is meticulously segmented based on product type, technology, end-user application, and geographical distribution, providing granular insights into varying demand dynamics and adoption rates. Analyzing these segments is essential for stakeholders to develop targeted marketing and product strategies that align with specific commercial needs within the hospitality and foodservice sectors. The core segmentation by product type differentiates between high-capacity automated frothers, typically employing induction heating or magnetic stirring mechanisms for consistent texture; integrated steam wands, which are inherent components of professional espresso machines and rely on manual barista skill; and specialized semi-automatic devices designed for lower-volume specialty uses or for non-traditional settings. Technological advancement is increasingly differentiating the market, particularly regarding temperature precision and the ability to customize froth density for various milk alternatives, reflecting a market moving towards highly specialized functions rather than generalized performance. End-user segmentation reveals a focus on traditional retail coffee chains versus institutional foodservice and independent specialty shops, each presenting unique purchasing criteria regarding capacity, durability, and integration capabilities. The market structure thus reflects both technological sophistication and operational necessity across a diverse commercial landscape.

- By Product Type:

- Integrated Steam Wands (Manual and Automatic Steam Arms)

- Standalone Automatic Frothers (Induction and Heating Coil Based)

- Super-Automatic Integrated Systems (Fully Automated Milk Dosing and Frothing)

- By Technology:

- Magnetic Induction Heating Technology

- Convection/Heating Element Technology

- Pressure and Steam Injection Systems

- By Capacity:

- Low Volume (Below 5 Liters per Hour)

- Medium Volume (5–15 Liters per Hour)

- High Volume (Above 15 Liters per Hour)

- By Milk Type Compatibility:

- Dairy Milk Optimized Frothers

- Plant-Based Milk Optimized Frothers (Oat, Soy, Almond Specific)

- By End-User:

- Specialty Coffee Chains (Regional and Global)

- Independent Coffee Shops and Cafes

- Hotels, Restaurants, and Catering (HORECA)

- Institutional Foodservice (Corporate, Education, Healthcare)

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy)

- Asia Pacific (China, Japan, South Korea, Australia)

- Latin America (Brazil, Mexico)

- Middle East and Africa (MEA)

Value Chain Analysis For Milk Cafe Frothers Market

The value chain for the Milk Cafe Frothers Market begins with rigorous upstream activities involving the sourcing of high-quality raw materials, primarily stainless steel, advanced polymers for housing and internal components, and complex electronic elements such as precise temperature sensors, microprocessors, and induction coils. Upstream suppliers are characterized by specialized manufacturing capabilities, emphasizing materials that are food-grade, highly durable, and resistant to corrosion and thermal stress inherent in commercial environments. Manufacturers must manage complex global procurement networks, ensuring the quality and traceability of components, particularly those related to heating and electronic control, which are vital for product performance and regulatory compliance. Research and development activities, which often involve collaboration between engineers and professional baristas to refine frothing algorithms and ergonomic design, represent a significant value-add in this stage, leading to patented technologies that differentiate key market players. Efficient inventory management and streamlined assembly processes are crucial to maintaining cost competitiveness in the final product output.

The midstream segment involves the core manufacturing, assembly, and quality assurance processes. Specialized facilities are required to assemble commercial frothers, involving precise engineering of motor mechanisms, integration of heating systems, and calibration of pressure and temperature controls. Quality checks are rigorous, ensuring devices meet stringent certifications related to electrical safety, sanitation (e.g., NSF standards), and performance consistency. Distribution channels, forming the crucial link between manufacturers and end-users, are segmented into direct and indirect routes. Direct sales often involve large global coffee chains or institutional buyers negotiating procurement contracts directly with the manufacturer or their regional subsidiaries, often including installation, training, and long-term service agreements. Indirect channels rely heavily on specialized HORECA equipment distributors, kitchen supply wholesalers, and specialized coffee equipment retailers who provide localized sales support, financing options, and immediate inventory access to independent and smaller cafe operators.

Downstream activities center on deployment, maintenance, and post-sales service, which are essential for maximizing the operational lifespan and reliability of high-capital commercial equipment. Installation and initial staff training are critical value-adds provided by distributors, ensuring proper usage and minimizing early-stage failures. Maintenance services, including preventative checks and rapid repair capabilities, are key differentiators, as downtime for a frother can severely impact a café’s daily revenue. The continuous supply of specialized cleaning solutions and replacement parts (such as magnetic impellers or seals) further defines the downstream ecosystem. Consumer feedback gathered at this stage, particularly concerning ease of cleaning and long-term reliability under heavy usage, informs the next generation of product design, creating a feedback loop that enhances the market's overall value proposition. The most effective value chains are those that seamlessly integrate sophisticated technology with robust, localized service networks.

Milk Cafe Frothers Market Potential Customers

The primary target customer base for the Milk Cafe Frothers Market consists of commercial entities operating within the expansive foodservice and hospitality industries where specialty coffee beverages are a core or significant menu offering. The most prominent end-users are specialty coffee chains, both multinational giants (who require vast quantities of standardized, highly durable equipment) and smaller regional chains (who prioritize cost-effectiveness and localized service support). These customers demand consistency above all else, driving the adoption of automatic and semi-automatic frothers that minimize reliance on individual barista skill. Independent, high-end, or "third-wave" coffee shops represent another vital segment; while they may prioritize integrated steam wands for manual control and superior latte art execution, they still require premium equipment with exceptional steaming power and thermal stability to handle high customer throughput during peak service times.

Beyond traditional cafes, the HORECA sector—comprising luxury hotels, fine dining restaurants, and high-volume catering services—constitutes a rapidly growing segment. Hotels often require highly automated, easy-to-use systems for breakfast service and in-room dining, prioritizing user-friendliness for non-specialized staff. Corporate and institutional foodservice represents an emerging, high-potential customer base. Large companies, universities, and healthcare systems are increasingly investing in sophisticated internal coffee programs to enhance employee and student satisfaction, requiring durable, high-capacity equipment capable of continuous operation in a non-traditional retail setting. These institutional buyers are often budget-conscious but prioritize robustness and a low total cost of ownership over the equipment's lifespan.

Additionally, small bakeries, dessert shops, and specialty beverage kiosks that offer a limited coffee menu but seek to maintain high-quality standards are also crucial buyers, typically opting for medium-capacity standalone frothers. The purchasing criteria for all these potential customers fundamentally shift based on their daily volume, desired beverage complexity, staff skill level, and budget constraints. Manufacturers and distributors must tailor their product offerings, whether focusing on high-tech integration for global chains or reliable, easy-to-clean robustness for smaller independent operators, to effectively capture the diverse demands inherent in the commercial coffee ecosystem. The increasing popularity of specialty non-dairy options is further broadening the customer base by necessitating equipment upgrades across virtually all commercial settings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450.5 Million |

| Market Forecast in 2033 | $718.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestle Nespresso S.A., Breville Group Ltd., De'Longhi S.p.A., Keurig Dr Pepper Inc., Starbucks Corporation (through equipment supply), Hamilton Beach Brands Holding Company, Jura Elektroapparate AG, Smeg S.p.A., Krups (Groupe SEB), Melitta Group, Vevor, WMF Group, Thermoplan AG, Franke Coffee Systems, Schaerer Ltd., Nuova Simonelli, La Marzocco International, Rancilio Group, Astoria, Dalla Corte. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Milk Cafe Frothers Market Key Technology Landscape

The technological landscape of the Milk Cafe Frothers Market is defined by continuous innovation aimed at enhancing speed, precision, and ease of use, moving the industry further away from manual, inconsistent steam wand operation. One of the most significant advancements is the widespread adoption of magnetic induction heating technology. Induction frothers offer superior energy efficiency and speed, heating milk rapidly without directly heating the vessel's base, thereby preventing scorching and making cleaning significantly easier. This technology allows for extremely precise temperature control, crucial for optimizing the texture and sweetness of both dairy and sensitive plant-based milks. Furthermore, induction systems typically incorporate magnetic stirring mechanisms that create a fine, uniform microfoam structure, reducing the volumetric variation often associated with traditional methods. These systems are increasingly featuring smart sensors and microprocessors that monitor and adjust heating profiles dynamically in response to real-time changes in milk volume and temperature, ensuring consistent results across consecutive frothing cycles.

Another pivotal area of technological development lies in sophisticated pump and aeration systems. Advanced commercial frothers now utilize finely tuned pump mechanisms combined with specialized aeration chambers that allow baristas or automatic systems to modulate the volume and size of air bubbles injected into the milk. This customization is critical for achieving the distinct textures required for different beverages—a stiff foam for a traditional cappuccino versus a smooth, liquid microfoam for latte art. Manufacturers are also heavily investing in integrated cleaning technologies, recognizing that hygiene is paramount in commercial settings. Many high-end units feature automated rinse cycles and modular designs that allow for tool-free disassembly of milk lines, reducing the labor intensity and time required for meeting stringent food safety regulations. These integrated solutions minimize the risk of bacterial growth and cross-contamination, offering a substantial operational advantage.

The emerging technological frontier integrates IoT and connectivity features into commercial frothers. IoT-enabled devices allow café owners and chain management to monitor equipment performance remotely, track usage statistics, and receive alerts for predictive maintenance needs. This data-driven approach enhances operational planning and optimizes equipment deployment across multiple locations. Furthermore, advanced super-automatic espresso machines are increasingly integrating sophisticated refrigeration and frothing modules that are programmed with detailed milk profiles for dozens of different beverage recipes. This integration eliminates the need for separate manual steps, streamlining workflow and drastically shortening service times. Ultimately, the technology landscape is characterized by a push towards systems that are highly precise, robust, data-enabled, and optimized for handling the chemical nuances of the growing variety of non-dairy alternatives available in the market today.

Regional Highlights

- North America: Characterized by a mature and highly competitive specialty coffee market, demanding premium, high-tech, and integrated frothing solutions. The U.S. drives substantial demand, particularly in automated systems optimized for high throughput and consistency across national chains. Focus is shifting towards equipment capable of handling the high consumption rate of oat and almond milks, driving technology innovation in texture control.

- Europe: A region with deep-rooted coffee traditions (especially Italy and France), demonstrating high demand for both manual, high-quality integrated steam wands (for traditional artistry) and energy-efficient induction frothers. Strict adherence to EU food safety regulations drives innovation in easy-to-clean, certified commercial equipment. Germany and the UK lead the adoption of automated cafe solutions in corporate and institutional settings.

- Asia Pacific (APAC): The fastest-growing regional market, fueled by explosive urbanization and the swift adoption of Western café culture, particularly in China, South Korea, and Southeast Asia. The focus is on robust, mid-range commercial equipment that can withstand high temperatures and humidity. Investment in HORECA infrastructure, driven by tourism, ensures continuous high-volume demand.

- Latin America: Demonstrates steady growth tied closely to expanding local coffee production and consumption, alongside tourism infrastructure development. Demand focuses on durable, easy-to-maintain machinery, often imported. Price sensitivity is higher in independent markets, though premiumization is observed in major metropolitan areas like São Paulo and Mexico City.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) states due to high disposable income and significant investments in luxury hotel and restaurant sectors. These markets prioritize equipment offering aesthetic appeal, sophisticated technology, and high capacity to cater to affluent clientele and large hospitality venues. South Africa serves as a key regional hub for equipment distribution.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Milk Cafe Frothers Market.- Nestle Nespresso S.A.

- Breville Group Ltd.

- De'Longhi S.p.A.

- Keurig Dr Pepper Inc.

- Starbucks Corporation (through equipment supply contracts)

- Hamilton Beach Brands Holding Company

- Jura Elektroapparate AG

- Smeg S.p.A.

- Krups (Groupe SEB)

- Melitta Group

- Vevor

- WMF Group

- Thermoplan AG

- Franke Coffee Systems

- Schaerer Ltd.

- Nuova Simonelli

- La Marzocco International

- Rancilio Group

- Astoria

- Dalla Corte

Frequently Asked Questions

Analyze common user questions about the Milk Cafe Frothers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between commercial cafe frothers and consumer models?

Commercial frothers are engineered for significantly higher volume, superior durability, and precise temperature control, featuring faster cycle times and robust components to withstand continuous, high-throughput operation in professional foodservice settings, unlike smaller, occasional-use consumer units.

How is the rising demand for non-dairy milk alternatives impacting frother technology?

The market is shifting towards specialized induction and automated systems capable of adjusting heat and aeration parameters dynamically. Non-dairy milks (like oat or almond) require specific, often lower, temperatures and different shearing forces to achieve stable, high-quality microfoam, driving innovation in customizable frothing profiles.

What are the key technological advancements driving operational efficiency in commercial frothers?

Key advancements include magnetic induction heating for rapid, scorch-free operation; IoT integration for remote monitoring and predictive maintenance; and automated cleaning and rinsing cycles, which collectively reduce labor costs and minimize equipment downtime during peak service hours.

Which geographical region exhibits the highest growth potential for Milk Cafe Frothers?

The Asia Pacific (APAC) region, driven by rapid urbanization and massive expansion of the HORECA sector and specialty coffee chains, presents the highest growth potential. Countries like China and India are rapidly adopting commercial frothing equipment to meet burgeoning consumer demand for westernized coffee beverages.

What is the greatest operational challenge faced by cafe owners regarding frothing equipment?

Maintaining rigorous hygiene and minimizing milk residue buildup is the greatest challenge. This necessitates investment in frothers with self-cleaning functionality and modular designs that facilitate easy disassembly and sterilization, ensuring compliance with strict public health and food safety regulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager