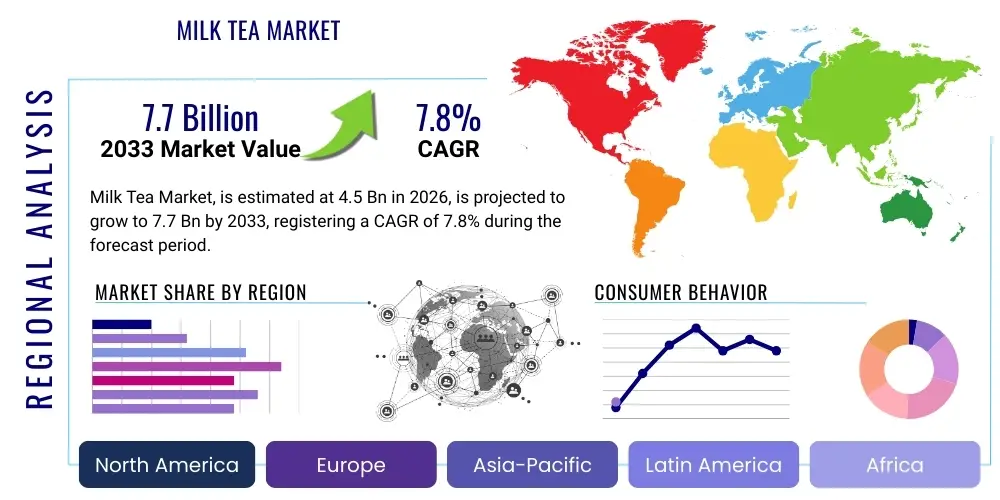

Milk Tea Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442744 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Milk Tea Market Size

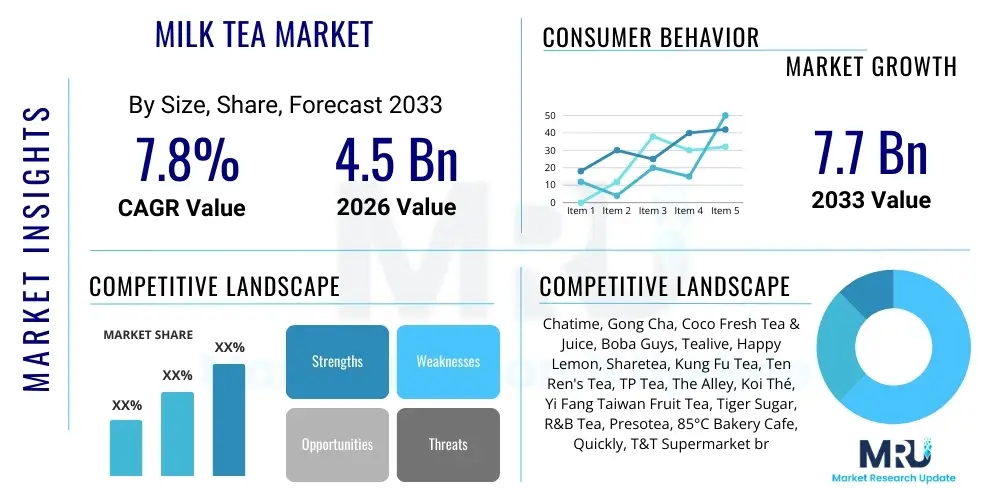

The Milk Tea Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $7.7 Billion by the end of the forecast period in 2033.

Milk Tea Market introduction

The global Milk Tea Market encompasses a wide spectrum of beverages, ranging from traditional freshly brewed boba (bubble) tea to highly sophisticated ready-to-drink (RTD) options available in modern retail formats. Originating primarily from Taiwan and rapidly gaining global prominence, milk tea is characterized by the blend of tea, milk (dairy or non-dairy), and sweeteners, often enhanced by various toppings such as tapioca pearls (boba), jelly, or pudding. Major applications span quick-service restaurants, specialized cafes, and the burgeoning consumer packaged goods (CPG) sector, catering to the demand for convenient and customizable beverage experiences across all demographics. This beverage serves not only as a refreshing drink but also as a social and cultural phenomenon, particularly among younger consumers in urbanized areas, driving significant market expansion globally.

Key benefits driving the market include the perceived indulgence and treat-like quality of the product, extensive flavor customization capabilities allowing consumers to tailor sugar and ice levels, and the strong presence of social media influencers promoting unique flavor combinations and limited-time offerings. The beverage’s adaptability to incorporating health-conscious ingredients, such as plant-based milks (oat, almond, soy) and natural sweeteners, further broadens its appeal to health-aware segments. The intense competition among specialized milk tea chains necessitates continuous product innovation and aggressive marketing, contributing to sustained market visibility and consumer engagement.

Driving factors propelling the Milk Tea Market include rapid urbanization, increasing disposable incomes in emerging economies, and the strong Westernization of dietary preferences, particularly in Asia Pacific where the product holds deep cultural roots. Furthermore, the expansion of delivery services and e-commerce platforms has made milk tea highly accessible, boosting sales volume even during non-peak hours. The introduction of seasonal flavors, functional additives, and attractive, sustainable packaging are critical components fostering brand loyalty and encouraging repeat purchases, solidifying milk tea's position as a staple in the global beverage landscape.

Milk Tea Market Executive Summary

The global Milk Tea Market demonstrates robust growth, primarily propelled by rapid franchising expansion of international chains and aggressive product diversification into the RTD segment. Current business trends indicate a significant shift towards premiumization, where consumers are willing to pay higher prices for ethically sourced ingredients, organic tea bases, and customized flavor profiles, driving up Average Selling Prices (ASP). Regional trends highlight the sustained dominance of the Asia Pacific market, particularly in East and Southeast Asia, which serves as the innovation hub for new flavors and concepts; however, North America and Europe are exhibiting the highest growth trajectories fueled by strong immigration patterns and rising acceptance of Asian food and beverage culture. Segment trends show that Freshly Brewed milk tea still commands the largest market share due to its customizable nature, but the RTD segment is accelerating its growth significantly, leveraging extensive distribution networks in supermarkets and convenience stores to offer shelf-stable alternatives that cater to on-the-go consumption needs.

From a competitive standpoint, the market is characterized by a fragmented landscape where global chains compete fiercely with local independent cafes, necessitating continuous investment in brand experience and digital engagement. Strategic alliances, mergers, and acquisitions focused on securing sustainable supply chains for key raw materials—especially quality tea leaves, tapioca pearls, and specialized syrups—are emerging as crucial business strategies. Technological adoption, specifically in point-of-sale systems and advanced inventory management (managing perishable milk and custom ingredients), is optimizing operational efficiencies and enhancing customer throughput, especially in high-volume urban locations. Sustainability remains a major focus, with increasing pressure from regulatory bodies and consumers demanding biodegradable straws, cups, and ethical sourcing practices throughout the value chain.

The immediate outlook suggests that investment in digital ordering infrastructure, loyalty programs, and diversification beyond traditional boba into cheese foam teas, fruit-infused milk teas, and low-sugar alternatives will define market success. The market’s resilience during economic fluctuations is evidenced by milk tea’s status as an affordable indulgence, ensuring steady demand. Long-term forecasting emphasizes the importance of penetrating untapped markets in Latin America and the Middle East, where consumer awareness and acceptance of Asian beverages are still in nascent stages but growing rapidly due to globalization and cross-cultural food exploration.

AI Impact Analysis on Milk Tea Market

Common user inquiries regarding AI in the Milk Tea Market frequently revolve around optimizing supply chain logistics (predicting tapioca pearl and fresh milk demand), enhancing personalized flavor recommendations, and automating customer service via AI-powered chatbots and order kiosks. Key concerns often focus on the potential loss of the 'artisanal touch' inherent in freshly brewed tea preparation if automation becomes too extensive, alongside ethical considerations regarding consumer data usage for hyper-personalization. Users are highly expectant of AI delivering faster service times, particularly during peak hours, and minimizing ingredient waste through highly accurate demand forecasting. The integration of AI tools is largely anticipated to professionalize the fragmented market, offering scalable solutions for quality control, flavor consistency across global franchises, and dynamic pricing strategies based on localized consumer willingness to pay and real-time operational costs.

The application of predictive analytics, a core AI capability, is profoundly impacting inventory management within the milk tea sector, where ingredients often have short shelf lives. By analyzing historical sales data, weather patterns, and local event schedules, AI algorithms can accurately forecast the demand for specific ingredients—such as fresh milk, various flavors of popping boba, or specific seasonal fruit purees—thereby drastically reducing spoilage and ensuring optimal freshness, which is paramount to the quality of the final beverage. This level of precision minimizes capital tied up in inventory and stabilizes operational expenses across multi-site enterprises, offering a significant competitive advantage in the highly price-sensitive QSR segment. Furthermore, AI contributes to enhanced customer relationship management by segmenting customer behavior based on purchase frequency, preferred customization level (sugar/ice), and favored toppings.

Beyond logistics, AI is actively used to drive marketing effectiveness and innovation. Generative AI tools are being employed to analyze popular flavor profiles globally and suggest novel, market-ready combinations that minimize product development cycles. In physical stores, AI-driven digital signage provides real-time, context-aware suggestions (e.g., recommending a cold matcha tea on a hot afternoon), boosting impulse purchases. Automation in dispensing mechanisms, guided by machine learning to ensure precise measurement of syrups and toppings, guarantees flavor consistency, which is crucial for maintaining brand integrity across vast franchise networks. These technological integrations move the milk tea industry towards a data-driven operational model, ensuring efficiency while maintaining perceived quality.

- AI-driven Demand Forecasting: Optimizes perishable inventory (milk, fresh fruit) and reduces food waste across franchise networks.

- Personalized Recommendation Engines: Utilizes purchase history to suggest new flavor combinations or customized sweetness levels, boosting customer engagement.

- Automated Kiosk Ordering: Speeds up service during peak hours and reduces order errors through natural language processing (NLP).

- Quality Control Monitoring: Uses computer vision and sensors to ensure consistency in tea brewing time, temperature, and topping ratios.

- Supply Chain Optimization: Predicts logistical bottlenecks for imported ingredients like specialty tea leaves and tapioca pearls.

- Chatbot Customer Support: Provides instant responses regarding menu options, store locations, and loyalty program details.

- Dynamic Pricing Strategy: Adjusts prices based on time of day, current stock levels, and local competitive analysis using machine learning models.

DRO & Impact Forces Of Milk Tea Market

The Milk Tea Market’s trajectory is shaped by a confluence of powerful drivers (D) such as growing consumer interest in customizable, experiential beverages and the aggressive expansion of franchise models into previously underserved markets. Restraints (R) primarily include rising public health concerns regarding high sugar content, leading to regulatory scrutiny and necessitating costly reformulations towards low-sugar or natural sweetener options. Opportunities (O) are abundant, focusing on product diversification into functional beverages (e.g., incorporating probiotics or vitamins) and expanding the presence of Ready-to-Drink (RTD) variants into mainstream global retailers. The collective impact forces governing the market emphasize globalization, shifts in dietary preferences towards Asian cuisine, and technological advancements in food service automation, creating an environment of high growth but also significant competitive pressure and continuous adaptation requirements.

Key drivers include the pervasive influence of social media platforms, which transform visually appealing milk tea creations into viral trends, thereby accelerating adoption among Gen Z and Millennials. The relatively low barrier to entry for establishing a milk tea shop, coupled with high potential profit margins, encourages continuous entrepreneurial activity and market saturation, forcing innovation. The increasing availability of high-quality, shelf-stable ingredients (e.g., aseptic milk alternatives and concentrated tea extracts) simplifies the supply chain for franchise operators globally. These factors combine to sustain a highly dynamic and rapidly expanding consumer base, eager for novel and culturally significant refreshment options, further augmented by strong diaspora communities promoting the product in Western markets.

However, the market faces strong resistance from persistent health campaigns linking sugary drinks to chronic diseases, compelling major players to invest heavily in costly R&D for natural alternatives like stevia, monk fruit, or erythritol, without compromising the distinct flavor profile. Supply chain volatility, particularly for premium tea leaves sourced from specific Asian regions and the specialized manufacturing of high-quality tapioca pearls, poses logistical and cost restraints exacerbated by geopolitical factors. Furthermore, the market's high fragmentation leads to intense price wars in densely competitive urban centers, pressuring profit margins for smaller operators. Successfully navigating these restraints while capitalizing on opportunities—such as geographical expansion and premium, health-focused offerings—will dictate market leadership throughout the forecast period.

Segmentation Analysis

The Milk Tea Market is systematically analyzed across several key dimensions, primarily categorized by Product Type, Flavor Profile, and critical Distribution Channels, reflecting the diversity in consumer preferences and purchasing behavior. This multi-faceted segmentation allows stakeholders to accurately gauge demand variations and tailor their strategies—whether focusing on in-store customization (Freshly Brewed segment) or maximizing shelf visibility (Ready-to-Drink segment). Understanding these segmentation dynamics is vital for effective product portfolio management and targeted marketing campaigns aimed at maximizing market penetration across different consumer demographics and geographical regions, optimizing inventory holding, and managing logistics complexity effectively.

The segmentation by Product Type distinguishes between the artisanal, customizable experience offered by Freshly Brewed outlets and the convenience and stability provided by RTD packaging. Flavor segmentation captures the shift from traditional Classic Black Milk Tea towards trendy, highly personalized options like Brown Sugar Boba or specialized fruit-infused varieties, catering to experimental tastes. Distribution Channel analysis highlights the crucial role of specialized Milk Tea Cafes as brand-building centers versus the widespread consumer reach achieved through online delivery aggregators and mass-market supermarkets, crucial for volume sales and immediate consumption needs.

- Product Type:

- Freshly Brewed/Prepared (Customizable, Specialty Cafes)

- Ready-to-Drink (RTD) (Bottled/Canned, Shelf-Stable)

- Flavor:

- Classic Black Tea

- Taro

- Matcha/Green Tea

- Brown Sugar/Caramel

- Fruit-Infused (Mango, Strawberry, Passion Fruit)

- Specialty (Oolong, Thai Tea, Herbal Infusions)

- Topping Type:

- Tapioca Pearls (Boba)

- Pudding & Jelly (Grass Jelly, Egg Pudding)

- Cheese Foam/Milk Foam

- Others (Popping Boba, Red Bean)

- Sweetener Type:

- Sugar/Syrups (Traditional)

- Artificial Sweeteners (Diet/Low Calorie)

- Natural Sweeteners (Honey, Stevia, Monk Fruit)

- Distribution Channel:

- Cafes & Specialty Milk Tea Stores (QSR)

- Supermarkets & Hypermarkets (RTD Focus)

- Convenience Stores

- Online Retail & E-commerce

Value Chain Analysis For Milk Tea Market

The value chain for the Milk Tea Market begins with upstream activities focused on securing high-quality raw materials, particularly specialized tea leaves (black, green, oolong), milk components (dairy and non-dairy powders/liquids), and the crucial tapioca pearls, which are often sourced globally from regions like Taiwan, Thailand, or Vietnam. Upstream analysis involves rigorous quality checks, sustainable sourcing certifications, and establishing long-term contracts with specialized ingredient manufacturers to ensure supply consistency and flavor standardization across franchise operations. Logistical complexities are high due here to the perishable nature of some ingredients (e.g., fresh fruit, specialized milk), requiring cold chain management and efficient cross-border transportation, which significantly influences the final cost structure and operational feasibility, especially for international expansion.

Midstream activities encompass the actual preparation and blending process. For freshly brewed tea, this involves standardized brewing techniques, precise measurement of customized ingredients (syrups, toppings), and robust inventory management within the store or central commissary. For RTD products, the midstream focuses on large-scale industrial processing, including sterilization, aseptic packaging, and quality assurance testing to achieve long shelf stability, requiring significant capital investment in advanced manufacturing technology. Quality consistency—maintaining the delicate balance of tea strength, milk richness, and sweetness profile—is the key success factor in this stage, differentiating premium brands from mass-market offerings and directly influencing consumer perception and loyalty.

Downstream activities center on distribution and direct consumer engagement. Distribution channels are bifurcated: specialized Milk Tea Cafes rely on direct physical interaction, often enhanced by digital ordering and delivery platforms (e.g., DoorDash, Grab), providing a customized experience. Indirect channels, primarily used for RTD products, involve leveraging major supermarket chains, convenience stores, and online retailers to achieve maximum geographical penetration and accessibility. Effective brand communication, targeted promotions, and seamless omnichannel integration are essential elements in the downstream segment, driving final purchase decisions and managing brand perception in a highly competitive retail environment. The speed and quality of delivery service are now critical determinants of downstream performance in urban markets.

Milk Tea Market Potential Customers

Potential customers for the Milk Tea Market primarily encompass Millennials (Ages 28–43) and Generation Z (Ages 12–27), who are highly receptive to novel food experiences, heavily influenced by social media trends, and value product customization and convenience. This core demographic segment is attracted by the experiential aspect of milk tea consumption, often viewing it as a social activity or an affordable luxury. They prioritize ingredient transparency, seek out limited-edition seasonal flavors, and are comfortable engaging with brands through digital ordering and loyalty applications. Their high disposable income relative to older generations, coupled with an active lifestyle, drives consistent demand for both the specialty cafe experience and convenient RTD formats for immediate consumption during work or leisure activities.

Secondary target groups include the broader population seeking quick, refreshing alternatives to traditional carbonated soft drinks or coffee. Specifically, the growing market for health-conscious consumers represents a significant expansion opportunity, targeted through offerings that utilize plant-based milk alternatives (oat, soy, almond), low-calorie sweeteners, and functional ingredients such as collagen or adaptogens. Furthermore, the substantial and expanding Asian diaspora globally represents a crucial consumer base, driven by cultural familiarity and nostalgia, ensuring sustained demand in regions outside of Asia Pacific, such as North America, Australia, and Europe. Catering to specific cultural flavor preferences (e.g., distinct use of red bean or herbal jelly) allows market players to capture niche, yet highly loyal, consumer segments effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chatime, Gong Cha, Coco Fresh Tea & Juice, Boba Guys, Tealive, Happy Lemon, Sharetea, Kung Fu Tea, Ten Ren's Tea, TP Tea, The Alley, Koi Thé, Yi Fang Taiwan Fruit Tea, Tiger Sugar, R&B Tea, Presotea, 85°C Bakery Cafe, Quickly, T&T Supermarket brands, Lipton (RTD offerings) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Milk Tea Market Key Technology Landscape

The operational success and scalability of milk tea franchises are increasingly reliant on sophisticated technology, transforming the traditionally manual preparation process into a more standardized and efficient operation. A major technological focus is the adoption of advanced Point-of-Sale (POS) systems integrated with mobile ordering platforms, allowing seamless pre-ordering, payment processing, and loyalty program management. These systems collect granular data on consumer preferences, peak ordering times, and ingredient consumption, feeding directly into inventory management algorithms. Automation is key in maintaining product consistency; this includes automated tea brewing machines that control temperature and steeping time precisely, and robotic arms or automated dispensers used for accurate measurement of syrups and toppings, minimizing human error and reducing labor costs during high-volume periods. The commitment to technological infrastructure enables rapid scaling while safeguarding the core value proposition of consistent quality across diverse geographical locations.

Furthermore, cold chain logistics technology plays a crucial role, particularly for maintaining the integrity of imported ingredients and perishable items like fresh milk and specialized fruit purees required for premium milk tea variants. IoT sensors are deployed throughout the supply chain and within store refrigeration units to monitor temperature and humidity in real-time, preventing spoilage and ensuring ingredient safety, which is essential for maintaining consumer trust and adhering to stringent food safety standards globally. Packaging innovation also forms a significant part of the technology landscape; this includes the development of environmentally friendly, biodegradable plastics and unique sealing technologies that maintain the freshness and temperature of the beverage during transit, crucial for the expanding home delivery market segment.

Digital engagement technology, particularly AI-powered tools, is reshaping the customer experience. Milk tea companies are utilizing augmented reality (AR) filters for social media marketing to showcase new products and virtual loyalty cards accessible via mobile wallets, enhancing customer retention and driving repeat visits. Kitchen Display Systems (KDS) integrate seamlessly with mobile and kiosk orders, optimizing order fulfillment flow and reducing preparation time, thereby significantly enhancing customer satisfaction metrics, especially crucial in highly congested urban markets where speed of service is a primary competitive differentiator. This comprehensive technological ecosystem—spanning logistics, preparation, and customer interface—is pivotal for navigating the intense market competition and securing long-term operational viability and financial profitability within the global milk tea sector.

Regional Highlights

The global consumption landscape for milk tea is highly uneven, with Asia Pacific (APAC) serving as both the origin point and the largest current market, dominated by high consumption rates in China, Taiwan, and Southeast Asian countries like the Philippines, Vietnam, and Thailand. This region dictates global flavor trends and ingredient innovation, driven by deeply ingrained cultural habits and intense local competition. However, North America, spearheaded by the United States and Canada, represents the fastest-growing region, fueled by increasing Asian immigration, high rates of cross-cultural culinary adoption, and strong presence of major franchise brands expanding their store footprints in major metropolitan areas like New York, Los Angeles, and Vancouver. The European market, though smaller, is showing exceptional potential, particularly in the UK, Germany, and France, where younger demographics are increasingly embracing customized Asian beverages.

The Middle East and Africa (MEA) currently hold the smallest market share but are poised for exponential growth. Urban centers in the GCC countries (UAE, Saudi Arabia) are experiencing rapid consumer acceptance due to high urbanization rates, significant influx of international residents, and strong purchasing power, making them key targets for aggressive franchise expansion strategies focusing on premium, high-end offerings tailored to local tastes (e.g., less sugar-focused options). Latin America is also an emerging market, with initial successful introductions in Brazil and Mexico showing promise, capitalizing on local fruit flavors and adapting to regional consumer preferences regarding sweetness and texture. Strategic localization of marketing and flavor profiles is essential for sustainable growth in these nascent, yet high-potential, geographical territories.

- Asia Pacific (APAC): Market Dominance and Innovation Hub. Characterized by high density of specialty stores, cultural relevance, and advanced development of RTD products, particularly in China and Taiwan.

- North America: Fastest Growth Region. Driven by strong immigration, cultural blending, and aggressive expansion of Asian QSR chains into major coastal and inland cities. Focus on premiumization and customization.

- Europe: High Penetration Potential. Rapid adoption among younger urban populations in Western Europe, expanding beyond major capital cities into secondary markets, emphasizing unique flavors and sustainable sourcing.

- Latin America (LATAM): Emerging Market Opportunity. Nascent market with strong initial success in metropolitan areas; growth dependent on adapting products to local palate and establishing efficient distribution networks.

- Middle East and Africa (MEA): High-Value Niche Growth. Focus on high-end, premium franchise concepts in the GCC region, catering to diverse expatriate populations and high disposable income demographics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Milk Tea Market.- Chatime

- Gong Cha

- Coco Fresh Tea & Juice

- Boba Guys

- Tealive

- Happy Lemon

- Sharetea

- Kung Fu Tea

- Ten Ren's Tea

- TP Tea

- The Alley

- Koi Thé

- Yi Fang Taiwan Fruit Tea

- Tiger Sugar

- R&B Tea

- Presotea

- 85°C Bakery Cafe

- Quickly

- T&T Supermarket brands

- Lipton (RTD offerings)

Frequently Asked Questions

Analyze common user questions about the Milk Tea market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Milk Tea Market globally?

The primary factor is the increasing demand for customizable and experiential beverages, strongly influenced by social media trends and the aggressive global expansion of specialized milk tea franchise models into Western markets.

How is the market addressing concerns related to high sugar content in traditional milk tea?

The market is actively addressing health concerns through product innovation, offering consumers natural sweeteners (stevia, monk fruit), plant-based milk alternatives, and explicitly allowing high levels of customization regarding sugar and ice percentages.

Which geographical region exhibits the fastest growth rate for milk tea consumption?

North America, particularly the United States and Canada, is projected to register the fastest compound annual growth rate, driven by cultural integration, immigration, and expanding availability of specialty tea shops.

What is the difference between Freshly Brewed and Ready-to-Drink (RTD) milk tea segments?

Freshly Brewed milk tea offers high customization and is prepared in specialized cafes, focusing on the experience. RTD milk tea is packaged (bottles/cans), shelf-stable, and distributed via mass retail channels like supermarkets, prioritizing convenience and accessibility.

How does technology, specifically AI, impact milk tea operations?

AI significantly impacts operations by providing highly accurate demand forecasting for perishable ingredients, optimizing supply chain logistics, and enhancing customer experience through automated ordering kiosks and personalized flavor recommendations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager