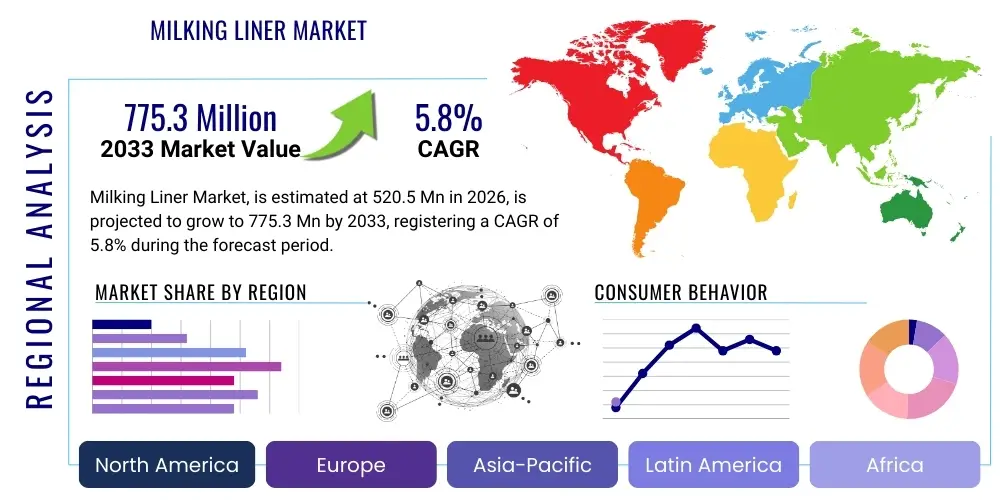

Milking Liner Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443572 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Milking Liner Market Size

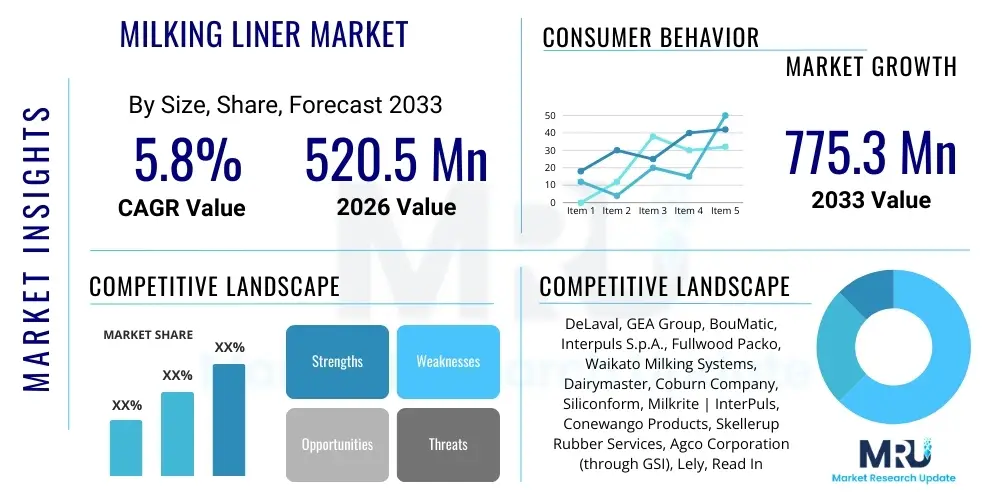

The Milking Liner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 520.5 Million in 2026 and is projected to reach USD 775.3 Million by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the global emphasis on enhancing dairy farm efficiency, coupled with the necessity for regular replacement of liners to maintain optimal udder health and milk quality. The shift toward automated and large-scale dairy farming operations further accelerates the demand for high-performance, durable milking liners, which are essential components of the milking clusters.

The valuation reflects the critical role milking liners play in the mechanical harvesting of milk, acting as the primary interface between the cow and the milking machine. Market growth is heavily influenced by material science innovations, particularly the adoption of advanced polymers like silicone and thermoplastic elastomers (TPEs) over traditional rubber. These modern materials offer extended lifecycles, superior hygiene properties, and improved comfort for the animals, leading to higher milk yields and reduced instances of mastitis. Investment in dairy infrastructure across developing economies also contributes significantly to this market trajectory.

Milking Liner Market introduction

Milking liners, often referred to as teat cups or inflation tubes, are the disposable, yet critical, components of the milking cluster responsible for extracting milk from dairy cows. They function by creating a pulsated vacuum environment around the teat, gently massaging and stimulating the milk flow. The market encompasses a diverse range of products categorized primarily by material—including traditional natural rubber, synthetic rubber, silicone, and thermoplastic elastomers (TPEs)—and by design geometry, such as round, triangular, and square profiles. The fundamental application of milking liners is universal across all types of mechanized dairy operations, from small family farms utilizing bucket milkers to vast industrial dairy facilities employing robotic milking systems.

The primary benefit derived from high-quality milking liners includes improved animal welfare by minimizing teat damage and reducing the risk of mastitis, a costly bacterial infection. Furthermore, efficient liners optimize milking speed and completeness, thereby increasing overall farm productivity and reducing labor time per cow. Driving factors for market expansion are centered around increasing global demand for dairy products, technological advancements leading to automated milking systems (AMS), and stringent regulatory standards concerning milk hygiene and animal welfare, which necessitate the frequent replacement of liners to prevent bacterial buildup and ensure operational consistency. These factors collectively cement the milking liner as a non-negotiable consumable within the modern dairy industry value chain.

Milking Liner Market Executive Summary

The Milking Liner Market exhibits robust business trends dominated by the shift from commodity natural rubber liners to premium materials, specifically silicone and TPEs, driven by their enhanced durability and hygienic superiority, despite higher initial costs. Strategic acquisitions and vertical integration amongst leading dairy equipment manufacturers are common business strategies aimed at controlling the supply chain and ensuring compatibility with proprietary milking systems. Furthermore, a key trend involves the development of specialized liners optimized for specific cow breeds or stages of lactation, offering customized milking solutions to maximize yield and teat health.

Regionally, the market is highly dynamic. North America and Europe maintain maturity, characterized by high adoption rates of robotic milking and premium liners, focusing heavily on replacement cycles driven by strict hygiene protocols. Conversely, the Asia Pacific (APAC) region, particularly India and China, is emerging as the fastest-growing market, driven by rapid industrialization of dairy farming, increasing herd sizes, and government initiatives promoting mechanized milking over traditional methods. Latin America is also contributing significantly, fueled by large-scale commercial dairy production in countries like Brazil and Argentina.

Segment trends reveal that the silicone material segment is poised for the fastest growth, offering superior longevity and chemical resistance compared to rubber. Geometrically, triangular and square liners are gaining traction over traditional round designs, attributed to their improved ability to manage pressure and provide a more uniform, gentler massage action on the teat end. End-user analysis highlights that large industrial farms (over 500 cows) remain the dominant revenue generator due to their sheer volume requirements and readiness to invest in advanced, high-efficiency equipment necessary for optimizing large-scale operations.

AI Impact Analysis on Milking Liner Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Milking Liner Market frequently revolve around predictive maintenance, optimization of liner replacement cycles, and the integration of smart sensor technology within the milking cluster. Common concerns include the cost-effectiveness of integrating AI in what is essentially a consumable component, the accuracy of data collection regarding teat health and liner degradation, and how AI can personalize milking parameters based on individual animal needs. Users are keenly interested in leveraging AI to move beyond scheduled maintenance, seeking solutions that can predict liner failure or efficiency loss before it impacts milk quality or cow health, thereby maximizing uptime and minimizing operational risk.

AI's primary influence is indirect, stemming from its role in optimizing the overall milking process, which dictates liner performance and replacement strategy. AI-driven vision systems and predictive analytics platforms are increasingly used to monitor teat condition and milk flow dynamics. By analyzing data collected from sensors integrated into the milking system—though often not directly in the liner itself, but in the cluster—AI algorithms can determine the optimal vacuum level, pulsation rate, and importantly, signal when a liner’s physical characteristics (like elasticity or inner surface condition) begin to deviate from optimal performance metrics. This data-driven decision-making extends the effective service life of expensive silicone or TPE liners while maintaining rigorous hygiene standards, transforming liner management from a fixed schedule task to a condition-based predictive process. This shift enhances farm profitability and overall herd health management.

- AI drives predictive maintenance for optimal liner replacement, minimizing unexpected failures.

- Machine learning algorithms analyze milk flow data and teat health indicators to suggest tailored pulsation settings, extending liner life.

- AI integration supports smart milking systems, optimizing vacuum pressure management and reducing wear and tear on the liner material.

- Enhanced data analysis capabilities enable manufacturers to design next-generation liners with improved durability and ergonomic profiles based on real-world usage patterns.

DRO & Impact Forces Of Milking Liner Market

The dynamics of the Milking Liner Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. A primary driver is the accelerating trend toward dairy farm automation, particularly the widespread adoption of Robotic Milking Systems (RMS) and Automated Milking Systems (AMS), which require highly consistent, high-performance liners compatible with precise machine operation. Furthermore, increasing global awareness and regulation concerning animal welfare place significant pressure on farmers to utilize liners that minimize stress and teat damage, boosting demand for premium materials like silicone and TPEs over cheaper, traditional rubber alternatives. The non-negotiable nature of liner replacement—mandated typically every 2,500 to 3,000 milkings—ensures a perpetual replacement market, forming a foundational driver of demand.

However, the market faces significant restraints. The initial high capital investment required for implementing sophisticated milking systems, especially in emerging economies, can impede the uptake of premium liners. Price sensitivity among small and medium-sized dairy operations often leads to the extended use of liners beyond their recommended lifespan or the selection of lower-cost, less durable materials, compromising herd health and long-term efficiency. Furthermore, the variability in cow breeds, teat sizes, and farm management practices across different geographical regions necessitates a wide array of specialized liners, complicating inventory management and standardization for both manufacturers and farmers. The lack of standardized global protocols for liner material testing and replacement intervals also creates market friction.

Opportunities for growth are concentrated in material innovation and geographical expansion. The development of antimicrobial liners and smart liners embedded with RFID or other sensor technology represents a significant opportunity to add value and justify higher pricing. Geographically, untapped potential lies in expanding mechanized milking adoption across large, rapidly modernizing dairy industries in Asian and African countries. Furthermore, strategic collaborations between liner manufacturers and AMS providers to create optimized, integrated milking solutions offer avenues for market penetration. The continuous push toward maximizing operational efficiency and improving hygiene standards provides a sustained tailwind for advanced, feature-rich milking liner products.

Segmentation Analysis

The Milking Liner Market is primarily segmented based on material type, design profile (geometry), and end-user application, reflecting the diverse requirements of the global dairy industry. Material composition is the most critical differentiator, directly influencing liner lifespan, hygiene characteristics, and cost. Design profile segmentation addresses the varying anatomical needs of different cattle breeds and the optimization required for specific milking system types (e.g., parlor vs. rotary). End-user analysis categorizes demand based on farm size and operational scale, highlighting the distinct purchasing power and preference for automation levels between large industrial farms and smaller, cooperative-based operations. Understanding these segments is vital for manufacturers to tailor product development and market penetration strategies, ensuring compatibility and compliance with region-specific dairy farming practices.

The key segments reveal a trend toward specialization. While traditional rubber remains dominant in emerging and price-sensitive markets, the rapid growth in developed dairy regions is concentrated in silicone and TPE segments due to their superior chemical inertness, extended durability, and reduced risk of cracking, which harbors bacteria. Geometric segmentation shows growing adoption of non-circular profiles, as triangular and square liners are ergonomically superior in providing an even massage and reducing pressure variation, improving blood circulation in the teat and promoting healthier udder condition. This nuanced segmentation reflects the industry's shift from a generic consumable item to a sophisticated, specialized piece of dairy technology integral to maximizing animal performance and milk quality.

- By Material Type:

- Natural Rubber (NR)

- Synthetic Rubber (SR)

- Silicone

- Thermoplastic Elastomers (TPE)

- By Design Profile (Geometry):

- Round/Circular Liners

- Triangular Liners

- Square Liners

- Other Specialty Designs (e.g., oval)

- By End-User Application:

- Small Farms (Less than 100 cows)

- Medium Farms (100–500 cows)

- Large Industrial Farms (More than 500 cows)

- By Milking System Type:

- Conventional Milking Parlors

- Rotary Systems

- Automated Milking Systems (AMS)/Robotic Milking

- By Sales Channel:

- Direct Sales (Manufacturer to Farm)

- Distributor/Dealer Networks

- Online Retail

Value Chain Analysis For Milking Liner Market

The Milking Liner Market value chain commences with upstream analysis, focusing on the procurement and processing of raw materials. This stage involves key suppliers of polymers, including natural rubber latex, synthetic compounds (like butyl rubber), high-grade silicone polymers, and TPE granules. Quality control and material purity at this stage are paramount, as they directly dictate the liner’s performance metrics such as elasticity, chemical resistance to cleaning agents, and overall lifespan. Manufacturers often establish long-term relationships with specialized chemical and rubber compounders to ensure a steady supply of high-specification materials compliant with food contact and dairy hygiene regulations. Fluctuations in commodity prices, particularly for crude oil derivatives used in synthetic rubbers and TPEs, represent a critical upstream risk factor influencing manufacturing costs.

The midstream involves manufacturing and fabrication, where companies mold, cure, and finish the liners. This stage is capital-intensive, requiring specialized injection molding or compression molding equipment, especially for complex geometries like triangular and square liners. Most major dairy equipment providers either produce liners in-house to maintain strict quality control and system compatibility or utilize specialized contract manufacturers capable of high-volume, precision production. Direct distribution channels involve the manufacturer selling directly to large industrial dairy farms or key accounts, offering integrated equipment and consumable packages, which ensures prompt technical support and efficient inventory management.

Downstream analysis focuses on the distribution and end-user adoption. The primary route to market is through an extensive global network of authorized distributors, dealers, and agricultural equipment retailers, who provide localized sales, technical service, and educational support to smaller and medium-sized farms. Indirect channels, primarily specialized dairy supply retailers and burgeoning e-commerce platforms, cater to the replacement market by offering various brands and material types directly to farmers. The crucial downstream element is the service provided by the dealer network, often including maintenance contracts and regular farm visits, which drive the consistent replacement cycle necessary for market volume and profitability. The efficacy of the liner relies heavily on proper installation and consistent maintenance procedures executed at the end-user level.

Milking Liner Market Potential Customers

Potential customers for milking liners span the entire spectrum of the global dairy industry, fundamentally comprising any operation utilizing mechanical milking equipment. The primary end-users are commercial dairy farms, which range vastly in scale and operational complexity. Large industrial farms (typically housing over 500 cows) represent the most valuable customer segment. These operations prioritize performance, durability (often opting for expensive silicone/TPE liners), system compatibility with automated and rotary parlors, and bulk purchasing power. Their purchasing decisions are driven by total cost of ownership (TCO), efficiency gains, and minimizing risks associated with mastitis outbreaks, necessitating the purchase of tens of thousands of replacement liners annually.

Medium-sized dairy farms (100–500 cows) form the largest customer base by volume of individual operations. These farms often balance cost considerations with the need for reliable equipment. They are frequent users of mid-range synthetic rubber or TPE liners and typically purchase through local distributors. Decision-making is often influenced by local dealer recommendations and perceived immediate cost savings, although there is a growing awareness of the long-term benefits of premium liners. Small farms (under 100 cows) or specialized niche dairy operations (e.g., goat or sheep dairy) constitute a smaller, yet significant, segment often requiring specialized, low-volume liners and utilizing simpler bucket or pipeline systems, where longevity and ease of installation are key considerations.

Beyond traditional bovine dairy, there is a specialized segment comprising farms milking goats and sheep, which require smaller, uniquely shaped liners designed for their specific anatomy. Institutional customers, such as agricultural research centers and veterinary teaching hospitals, also serve as potential customers, utilizing liners for research and demonstration purposes. Overall, the market centers on optimizing operational performance; therefore, any entity focused on maximizing milk yield and maintaining high standards of animal health and hygiene is a primary target customer for advanced milking liner solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 520.5 Million |

| Market Forecast in 2033 | USD 775.3 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DeLaval, GEA Group, BouMatic, Interpuls S.p.A., Fullwood Packo, Waikato Milking Systems, Dairymaster, Coburn Company, Siliconform, Milkrite | InterPuls, Conewango Products, Skellerup Rubber Services, Agco Corporation (through GSI), Lely, Read Industrial. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Milking Liner Market Key Technology Landscape

The Milking Liner Market technology landscape is characterized by continuous advancements focused on material science and integrated monitoring systems to maximize herd health and milking efficiency. A primary technological focus is on developing advanced polymers, moving beyond traditional rubber toward high-grade medical or food-grade silicone and specialized thermoplastic elastomers (TPEs). These modern materials offer enhanced longevity, reducing the frequency of replacements, superior resistance to aggressive caustic cleaning chemicals, and, crucially, reduced absorption of fat and microorganisms, thereby maintaining a cleaner milking environment. Innovations in TPE manufacturing allow for dual-hardness materials, where the mouthpiece and barrel sections can be optimized for softness and durability respectively, tailoring the liner to provide a more physiologically suitable milking experience, which is a major technological differentiator.

Another significant technological advancement involves liner design and geometry optimization. Computational Fluid Dynamics (CFD) and Finite Element Analysis (FEA) are routinely used by manufacturers to model the forces exerted on the teat end during pulsation, leading to the proliferation of non-circular profiles like triangular and square liners. These designs are engineered to ensure uniform pressure distribution and more effective rest phases, which improves blood flow to the teat. Furthermore, the concept of "Smart Liners" is emerging, involving the integration of micro-sensors (often passive RFID tags or simple conductivity sensors) that allow for automated tracking of liner usage cycles, ensuring farmers adhere to recommended replacement intervals and providing crucial data points for predictive maintenance algorithms integrated into the overall milking system software.

The integration of liners with Automated Milking Systems (AMS), particularly robotic milkers, is forcing technological standardization. Liners used in these environments must be perfectly consistent in size, elasticity, and tolerance to withstand the repetitive and precise movements of robotic arms and ensure seamless attachment without human intervention. The technology emphasizes materials that retain their shape and elastic properties consistently across tens of thousands of cycles. This shift pushes manufacturers towards highly standardized, computer-controlled production processes (e.g., high-pressure injection molding) to eliminate variability, reinforcing the technological gap between commodity liners and premium, system-specific solutions.

Regional Highlights

- North America: This region, dominated by the United States and Canada, represents a mature but highly lucrative market for milking liners. The market is characterized by large commercial dairy operations, high adoption rates of cutting-edge technology including robotic milking, and strict adherence to animal welfare and milk quality standards (e.g., Pasteurized Milk Ordinance protocols). Demand is strongly concentrated in the premium segment (Silicone and TPE), driven by replacement cycles and the ability of advanced liners to support high throughput and reduce somatic cell counts. Technological compatibility with major robotic systems is a key purchasing factor. The focus here is less on volume growth in cow numbers and more on optimizing productivity per cow, leading to sustained demand for specialized, high-performance consumables.

- Europe: Western European countries like Germany, France, and the Netherlands lead the European market, which is defined by strong regulatory frameworks concerning environmental impact and animal welfare. Europe is a global leader in AMS adoption, creating consistent demand for high-specification liners compatible with automated systems from companies like DeLaval and GEA. Eastern Europe is experiencing modernization, leading to conversion from traditional methods to mechanized milking, offering moderate growth opportunities for mid-range and premium synthetic rubber liners. The regional trend heavily favors liners that contribute to excellent udder health management, driven by economic incentives and consumer expectations regarding ethical dairy farming.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, primarily fueled by the rapid expansion and modernization of the dairy sectors in India and China. While India's market remains heavily fragmented, with a high usage of traditional methods, governmental focus on boosting dairy productivity is driving investment in mechanized parlors, creating massive future potential for entry-level and mid-range synthetic rubber liners. China is establishing large, industrial-scale dairy operations mirroring Western models, which demand high-volume procurement of quality TPE and silicone liners. Market growth is heavily dependent on infrastructure investment, cold chain development, and rising consumer demand for processed milk products across the region.

- Latin America: This region, particularly Brazil, Argentina, and Mexico, possesses extensive commercial beef and dairy production capabilities. The market is driven by large, export-oriented farms focusing on maximizing efficiency and minimizing operational costs. While cost sensitivity remains a factor, the professionalization of the dairy supply chain pushes demand towards durable, standardized synthetic rubber and TPE liners. Seasonal variations and environmental factors necessitate robust liner materials capable of withstanding varied conditions and cleaning protocols. Investment in new parlor construction provides consistent opportunities for initial equipment installation and subsequent liner replacement contracts.

- Middle East and Africa (MEA): The MEA market is small but growing, dominated by highly advanced, large-scale dairy projects in resource-constrained countries like Saudi Arabia and the UAE, which rely heavily on imported technology and premium, high-efficiency equipment. These operations favor the highest quality silicone liners due to their tolerance to high temperatures and aggressive cleaning regimes necessary for maintaining hygiene in arid environments. Africa presents nascent opportunities, primarily through development projects aimed at improving smallholder farm efficiency, potentially creating demand for standardized, cost-effective synthetic liners in the long term.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Milking Liner Market.- DeLaval

- GEA Group

- BouMatic

- Interpuls S.p.A.

- Fullwood Packo

- Waikato Milking Systems

- Dairymaster

- Coburn Company

- Siliconform

- Milkrite | InterPuls

- Conewango Products

- Skellerup Rubber Services

- Agco Corporation (through GSI)

- Lely

- Read Industrial

- J.F. Agroeurope ApS

- Daviesway

- Tudagricola S.L.

- Ambrosia Industries

- Rubber & Plastic Innovations, Inc.

Frequently Asked Questions

Analyze common user questions about the Milking Liner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the recommended replacement frequency for milking liners?

The standard replacement interval for most milking liners, regardless of material, is approximately 2,500 milkings or every six months, whichever comes first. Silicone and high-grade TPE liners may offer extended lifespans (up to 5,000 milkings) but adhering to a strict, scheduled replacement is critical for maintaining vacuum stability, preventing bacterial buildup, and ensuring optimal cow udder health.

How do silicone and TPE liners compare to traditional rubber liners?

Silicone and Thermoplastic Elastomers (TPEs) are premium materials offering superior resistance to fat absorption and harsh chemicals, leading to extended durability (often twice that of rubber) and better hygiene. Traditional rubber is cost-effective but degrades faster, leading to surface cracking that harbors bacteria. Premium materials justify their higher cost through reduced maintenance, improved milk quality, and better animal comfort.

Which milking liner design profile (round, triangular, square) is considered most effective?

While traditional round liners are common, triangular and square profiles are increasingly favored due to their ability to provide a more uniform and gentler massage action during the resting phase. This improved massage minimizes congestion in the teat tissue, promoting better blood circulation and overall udder health, which directly contributes to lowering somatic cell counts and mastitis incidence.

What impact does milking liner quality have on milk somatic cell count (SCC)?

Milking liner quality directly impacts SCC. Worn, cracked, or improperly fitted liners cause teat damage, inconsistent vacuum levels, and potential bacterial cross-contamination, all of which elevate the cow's stress response and SCC. Utilizing high-quality, frequently replaced liners is a non-negotiable step in maintaining low SCC and achieving premium milk pricing.

Are smart milking liners (sensor-enabled) becoming standard in the industry?

Smart liners, often integrated with passive identification or wear sensors, are not yet standard but are a rapidly growing technological niche, particularly within large industrial farms utilizing robotic milking systems. These technologies allow for automated tracking of usage, ensuring timely replacement based on condition rather than fixed schedules, thereby optimizing efficiency and hygiene protocols within sophisticated AMS setups.

What are the key drivers for market growth in the Asia Pacific region?

The primary drivers in the APAC region are government initiatives aimed at modernizing dairy infrastructure, increasing per capita consumption of processed dairy products, and the consolidation of small, traditional farms into larger, mechanized operations. This rapid industrialization creates massive, scalable demand for durable and standardized milking consumables.

How does the volatility of raw material prices affect the Milking Liner Market?

Volatility in the price of crude oil derivatives significantly impacts the cost of synthetic rubber and TPEs, increasing manufacturing expenses for synthetic liners. Conversely, fluctuations in natural rubber commodities, driven by environmental and geopolitical factors, affect the pricing of traditional liners. Manufacturers often employ hedging strategies and long-term contracts to mitigate these input cost risks.

What role does digitalization play in the management of milking liners?

Digitalization plays a crucial role through farm management software that integrates with milking systems. This software tracks liner replacement schedules, monitors milk flow data associated with specific clusters, and uses predictive analytics (often AI-enhanced) to signal maintenance requirements, optimizing inventory and operational efficiency far beyond manual tracking methods.

Which end-user segment generates the highest revenue in the Milking Liner Market?

The Large Industrial Farms segment (operations with over 500 cows) generates the highest revenue. This is due to the sheer volume of liners required, their preference for higher-cost, premium materials (silicone/TPE) necessary for continuous, high-speed operation, and their readiness to adopt system-specific, specialized liners compatible with high-end robotic and rotary parlors.

What regulatory standards primarily influence milking liner design and material?

Milking liner design and material selection are heavily influenced by stringent regulations regarding food contact materials and dairy hygiene, such as those set by the FDA (Food and Drug Administration) in the US and equivalent bodies globally. These standards mandate non-toxic materials, chemical resistance, and ease of cleaning, directly impacting the adoption rate of materials like food-grade silicone over general-purpose rubbers.

How has the rise of Automated Milking Systems (AMS) affected liner requirements?

AMS has necessitated highly precise, dimensionally stable liners. Robotic systems demand perfect consistency in liner geometry and elasticity to ensure reliable, unassisted attachment and detachment. This requirement has significantly boosted the adoption of custom-engineered TPE and silicone liners that maintain their physical properties rigorously throughout their service life.

What is the key technological differentiation between current milking liner products?

The key technological differentiation lies in material compound formulation (e.g., specialized TPEs with antimicrobial properties or enhanced resistance to chemical erosion) and advanced geometric profiling (triangular/square designs optimized for pulsation dynamics). This focus on material and design aims to reduce vacuum fluctuation and improve teat end condition.

Do liners designed for specific cow breeds exist, and how are they developed?

Yes, specialized liners exist, particularly for breeds known for unique teat shapes or sizes. These are often developed using 3D scanning technology and Computational Fluid Dynamics (CFD) modeling to analyze teat kinematics across various breeds (e.g., Holstein vs. Jersey). This research informs liner design to ensure optimal fit and performance, minimizing stress across diverse herd genetics.

What challenges do manufacturers face in the Milking Liner Market?

Manufacturers face challenges related to intense pricing pressure from commodity rubber suppliers, ensuring global regulatory compliance across varied geographical hygiene standards, managing intellectual property related to proprietary geometries and compounds, and navigating compatibility issues across diverse competitor milking system platforms.

How does upstream material quality influence the longevity of a milking liner?

Upstream material quality is critically important. Imperfections or inconsistencies in the polymer compound, such as incorrect curing levels in rubber or suboptimal TPE density, lead to premature degradation, loss of elasticity, surface cracking, and increased absorption of milk fat, all of which drastically reduce the liner’s effective lifespan and compromise hygiene standards before the recommended replacement interval is met.

What are the environmental considerations in the disposal of used milking liners?

Disposal poses an environmental challenge as many liners are derived from synthetic materials (rubber, silicone, TPE) that are not easily biodegradable. The industry is exploring opportunities in liner recycling programs, especially for TPE materials, and developing biodegradable or sustainably sourced rubber compounds to minimize landfill waste and adhere to growing corporate sustainability goals.

What role do distributors and dealer networks play in the market value chain?

Distributors and dealer networks are crucial indirect channels. They provide essential localized services, including technical installation support, inventory stocking tailored to regional demand, and farmer education on proper usage and replacement schedules. They act as the primary interface between manufacturers and the vast network of small and medium-sized dairy operations.

How does the rising cost of labor globally affect the demand for specific liner types?

Rising labor costs incentivize farms to invest in high-durability, premium liners (Silicone/TPE) that require less frequent replacement and minimize milking failures. This reduces labor hours spent on maintenance and troubleshooting, driving demand toward products that offer maximum uptime and efficiency, justifying the higher initial consumable expenditure.

What is the current trend regarding the adoption of antimicrobial features in milking liners?

The incorporation of antimicrobial or bacteriostatic additives into liner materials (often silver ions or specific polymer treatments) is a strong emerging trend. While increasing the production cost, these features are highly sought after in regions with high mastitis risk, as they provide an added layer of defense against pathogen colonization on the liner surface.

Beyond dairy cows, what are the niche applications for milking liners?

Niche applications include specialized liners designed for the mechanized milking of sheep and goats. These liners are significantly smaller and require different geometry and pulsation characteristics tailored to smaller teat structures. This segment, while small in volume, demands highly specialized, custom-manufactured solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager